Last Updated on May 2, 2022 by Chin Yi Xuan

In this article, I will explain whether it’s a good idea (or not) to settle your PTPTN loan for 20% off by the end of 2018.

The short answer is: yes, and well, no. Depending on your perspective towards money, one’s answer may differ from one to another.

It is pretty simple, and let me explain why:

(1) The Savers Mindset

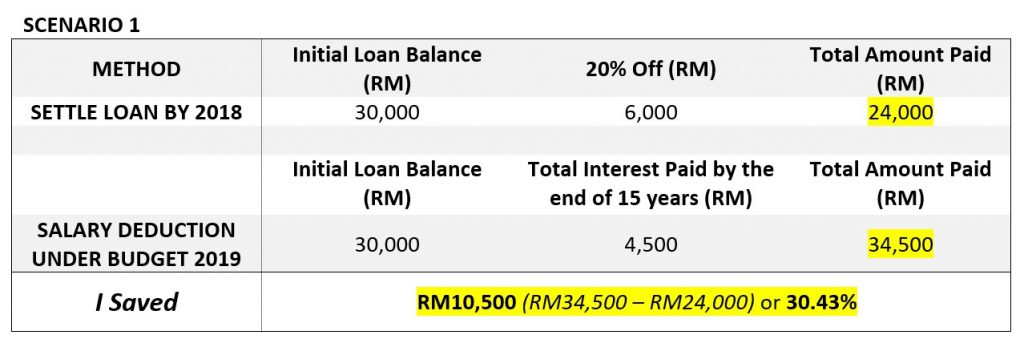

Let’s say I owe PTPTN a total of RM30,000, payable at a period of 15 years (180 months) at a fixed interest rate of 1%.

Compared to servicing my loan in the given period, if I were to settle the loan one-off by 2018, I would get a nice savings of RM10,500, or 30.43% lesser. Refer to the table below for more information:

Hence, with such a big difference in the amount paid, paying off my PTPTN fully before the end of 2018 is actually a pretty good idea.

But what if I tell you that there is an even better alternative? You will resonate well with this alternative if you have the…

(2) The Investor Mindset

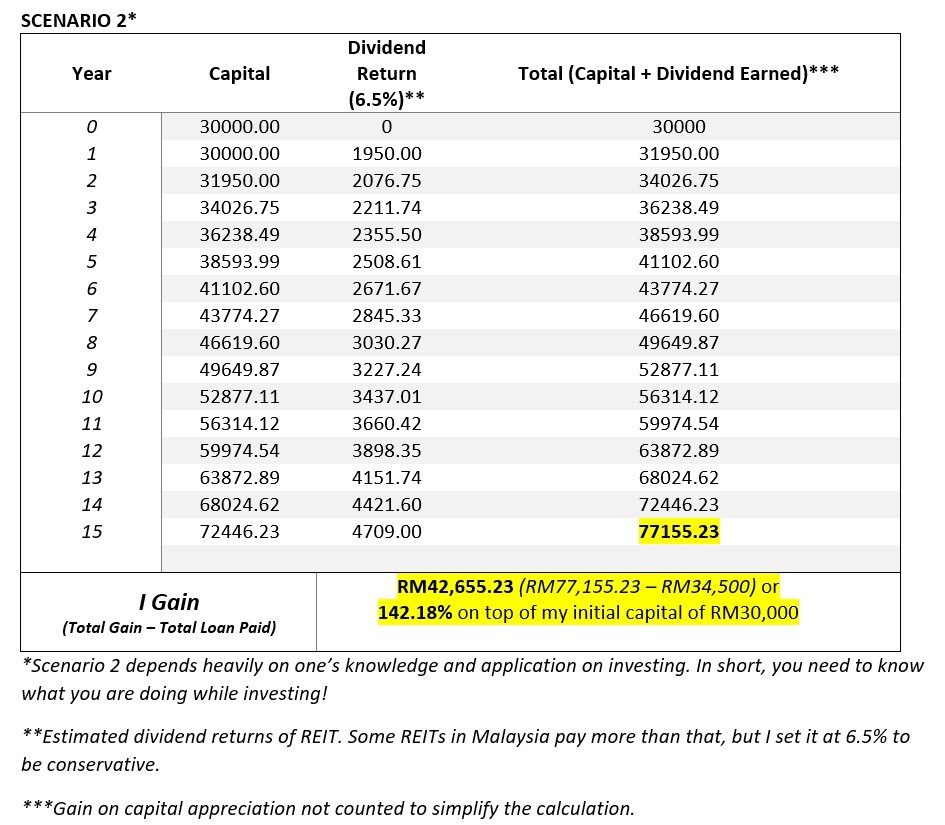

Let’s say I have RM30,000 and I am considering to pay-off my PTPTN loan or to invest the RM30,000 to earn a better return.

This time, I’ve chosen to service my loan through salary deduction as proposed under Budget 2019 and instead, invest the RM30,000 into the stock market, particularly REIT (due to its price stability), with a relatively stable interest return (dividend) of 6.5% annually.

By reinvesting all my interest returns, I would have a projected gain of more than 140% on my initial capital by the end of the 15th year (yes, even after factoring in the total payment for my PTPTN loan)! More details in the table below:

In simple terms, this means that by investing my initial RM30,000 into REITs, I would have paid off my PTPTN loan (RM34,500), and still have an additional RM42,655.23 by the end of the 15th year!

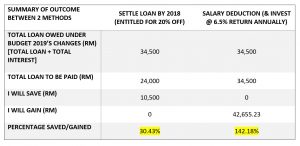

Below is a table of comparison between both scenarios:

No Money Lah’s Verdict

While there is no one right way to pay-off our PTPTN loan, I believe that there is definitely a better way to service the loan. I believe that this article has explained clearly the difference of outcome between one with a Saver’s Mindset or one with an Investor’s Mindset.

With this, I hope this article will help clear off the questions that you have in your mind, and I hope you can share this article with the friend that could benefit from it!

Do you have any personal experiences or tips on PTPTN that you would like to share? Let me know by leaving a comment at the very end of this article!

I cannot wait to hear from you!

—

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Thank you bro! It really convincing enough to clear my mind whether to clear my loan in one shot or servicing my loan! 😇

You’re welcome Mike 🙂