[UPDATE 28/8/2019: Since my writing, StashAway has managed to raise USD12 million in Series B funding, and managed to deliver a 4% – 11% annual return since 2017]

—

Let’s get right into the topic:

We can now employ the service of a robo-advisor to invest on behalf for us in Malaysia, legally.

With the advancement of algorithms and data technology, there has been a rise of ‘robo-advisors’ designed to invest for the mass market consumers since the past few years around the region. In short, we can now depend on algorithm systems to help invest our money.

In this article, we are going to look into the particulars of a robo-advisor, and I’ll also share my thoughts on StashAway, Malaysia’s first robo-advisor platform.

But first thing first…

Table of Contents

What is a robo-advisor & how does it work?

In its simplest form, robo-advisor is built on a system of algorithms and data to invest on behalf of customers.

Imagine Jarvis, the AI for Ironman, but specifically tailored to manage money and investment for retail investors like us (albeit not as advanced as Jarvis la).

In reality, how a robo-advisor work is simple. Simply put, robo-advisors will help you invest your money into different assets (normally via Exchange Traded Funds, ETFs*) based on your investment goals and risk preferences.

If this sounds too simple for you, it really is that simple.

The core idea of robo-advisors is to make investment simple and accessible to everyone. Normally, all you have to do is to identify your investment goals and how much risk you can take to get started. Then, just sit back, relax, and let the algorithms do the work for you!

*ETF is a marketable security that you can invest in where it tracks the performance of a group of securities such as stocks, commodities, and bond. (eg. FBMKLCI-EA is the ETF that tracks the performance of our very own Kuala Lumpur Composite Index, KLCI).

Enter StashAway, Malaysia’s first robo-advisor platform

p

First launched in July 2017 in Singapore, StashAway is the first robo-advisor platform that follows through with the momentum and entered the Malaysian market late last year.

As the first robo-advisor in Malaysia, I am very intrigued to find out what it is all about. So, without further ado, let’s dive straight into it!

How does StashAway invest your money?

This is the first question that came to my mind when I was told about robo-advisor. So it goes without saying that I have to get this answered right off the bat.

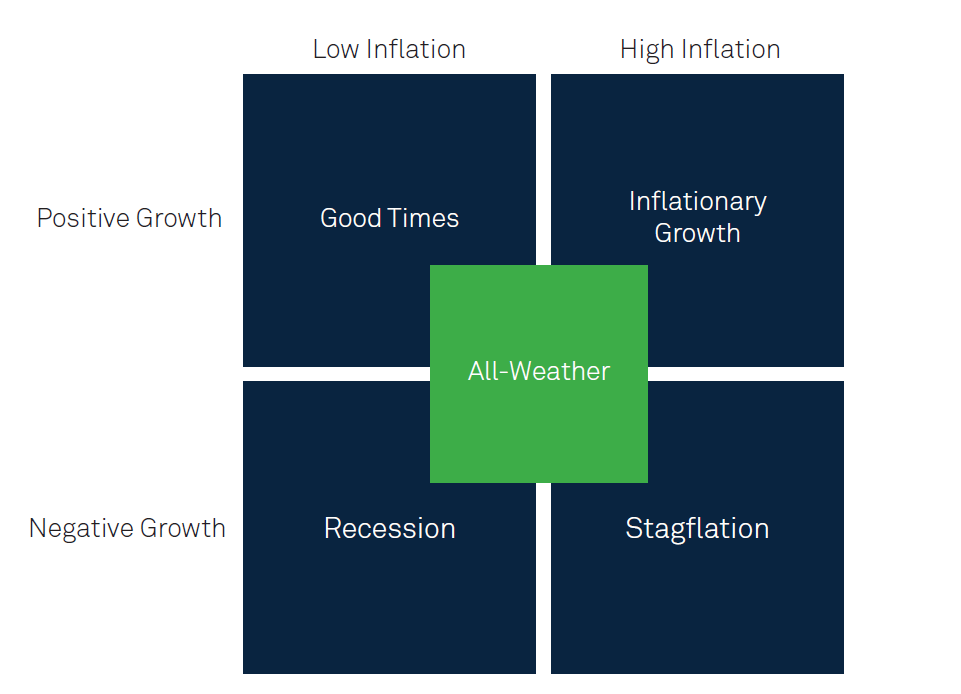

The framework that powers all the all the investment decisions behind StashAway is called the Economic Regime-based Asset Allocation (ERAA).

Essentially, ERAA is a set of algorithms that make all the investment decisions for you by considering 2 important factors, among all:

Ensuring constant customers’ risk exposure throughout different economic conditions, and

Optimizing customers’ returns under different economic conditions.

Under ERAA, your money will be invested into various Exchange Traded Funds (ETFs) in accordance with your risk appetite and investing goals. Not only that, the algorithms will also allocate the investments according to the economic condition at any moment.

If that’s not enough, ERAA will also track macroeconomics news and move your investments towards more defensive asset should the algorithm detects potential market crashes.

In short, StashAway’s ERAA framework is designed to ensure long term wealth creation within customers’ risk preference.

My StashAway Experience

To further my understanding about StashAway, I went on to try out the app itself. In general, I like the interface and the overall application process.

In essence, you get to select your investment goals and risk appetite. Then, StashAway will recommend an asset allocation for you. (eg. If you opt for a more conservative risk exposure, your investments will be focused towards Treasury Bond ETFs, which are relatively less volatile in nature)

Note that while you have the flexibility to readjust your risk appetite during the process, you cannot control the proportion of asset allocation that is suggested by StashAway. (eg. If StashAway suggests 15% weightage on Treasury Bond ETF, you cannot change the weightage to 10%)

Once you are done with the initial settings, you can transfer money to the fund and choose to set up a monthly transfer if you want to invest your savings monthly into the fund.

One of the good thing with StashAway is that there is no lock-up period. This means that you can choose to withdraw your investments at any time.

As a whole, I had a decent experience while checking out the app.

My Rant with StashAway and the Risk Involved.

(1) ERAA Framework not independently verifiable

This is my biggest and only rant with StashAway.

As mentioned above, the ERAA framework is able to recognize different economic conditions and allocate customers’ investments accordingly (they call it ‘Reoptimization’). By doing so, StashAway claims to be able to reduce the impact of a financial crisis.

All these explanations are backed by a whitepaper with backtesting charts that showed how the ERAA framework is able to perform better in relative to the S&P 500 Index and 60-40 Stock-Bond allocation strategy during the 2008 financial crisis.

However, the fact that StashAway’s ERAA framework and software is not released to the public means there is no way I can verify how true their claim is.

In short, this means that without any available tools to backtest StashAway’s claims, we will not only be investing our money with StashAway, but also our faith on the effectiveness of the framework to deliver its promises during the next crisis.

p

(2) Risk: Past performance does not reflect the future

Even if StashAway’s performance did outperform the S&P 500 index during the 2008 financial crisis in backtesting, this does not mean it will perform the same for the upcoming crises.

Reason being, every crisis is unique on its own and is triggered by different factors. Hence, what worked for StashAway’s framework in the past may not necessarily work in the future crises.

While I feel this is not something that StashAway can fully control, I think it is necessary for readers to understand that in any investment, past performance does not guarantee future performance.

What I Like About StashAway

But wait, let me clarify: I do not hate StashAway. In fact, in many aspects, I kinda like it a lot:

(1) StashAway is regulated by the Securities Commission (SC)

While checking out StashAway, what really gives me a peace of mind is to know that they are regulated by the SC.

This means that they have to go through the grueling procedures and paperwork to prove to the authority that they have the necessary consumer’s protection framework in place to ensure customers’ interest is covered in the case of events such as bankruptcy.

It is also worth noting that StashAway is just a party that manage your fund. This means that the actual assets (the ETFs) do not belong to them and are owned by StashAway’s broker, Saxo, where you are recognized as the rightful owner of the ETFs.

In short, StashAway is a legit business that helps you make investment decisions with your money and all your asset investments belong to you.

p

(2) Easy to use and low barrier of entry at just RM1

Another reason to like StashAway is that of how pleasant it is to use the app. Not only you have a feeling that you are in control of customizing your investments (of course to a certain extent only), but the overall experience just trumps in terms of user-friendliness.

Moreover, StashAway’s low barrier of entry at just RM1 means that anyone can afford to get their robo-advisor experience at a ridiculously low price. This is in stark contrast of conventional unit trusts that have the minimum initial investment of RM1,000.

Simply put, at just RM1, you get to kickstart your robo-investing journey with an intuitive user experience.

p

(3) Relatively low fees compared to Unit Trusts

When it comes to competition, robo-advisors such as StashAway compete head-to-head with conventional financial advisors and unit trusts.

In this case, what makes StashAway so appealing is its low fees relative to the fees charged by its direct competitors.

As an example, unit trusts will usually charge a sales fees of 5% (or more) and an average 1% annual fee for professional fund management. In comparison, StashAway charges no sales fees and an annual fee between 0.2% – 0.8%.

In the long term, a small savings in terms of fees make up to a lot of differences in terms of your return.

p

(4) Good Customer support

While you may expect robo-advisor like StashAway to cut corners on human interaction, but I’ve found their customer support to be quite decent.

One of my encounters with StashAway’s customer support is how quick they are to follow-up with you. Since I’ve just moved to a new place, I have yet to change my house address on my IC. Upon noticing the difference in the address in my application and IC, they have been very quick and helpful in assisting me on the issue via Whatsapp.

Hence, a plus point for StashAway!

No Money Lah’s Verdict

As a whole, I think the rise of robo-advisor such as StashAway does provide another good investment option for the public to build wealth on their hard-earned money.

The question now is this: Is robo-advisor for you?

If you have no prior experience with investing and are considering whether to invest passively via unit trust or robo-advisor, definitely check out robo-advisor due to its low barrier of entry and relatively low cost involved.

On the other hand, if you are a DIY investor that are more comfortable with managing your own investments (provided that you know what you are doing), a robo-advisor may not be for you as its annual fees is still a considerable cost for you as a DIY investor (you don’t pay yourself management fees when you do your own homework, right?).

Ultimately, it really boils down to your own preference and lifestyle.

For me, I think having control on my own investment is essential to achieving my financial goals. However, I have no problem recommending robo-advisor to those who are looking for alternative investment vehicles other than unit trusts.

If you are interested to check out StashAway, be sure to click below to get an exclusive 50% off the management fees for the first RM100,000 invested for 6 months.

p

Meanwhile, if you are keen to learn more about robo-advisor businesses around, do check out some other robo-advisors in Malaysia: Wahed (Promo Code for a FREE $10 Bonus: YIXCHI1) and MyTheo (Click HERE to claim Your FREE 3-months Referral Fee).

Note: This post may contain affilliate links that afford No Money Lah a small amount of commission should you sign up through the links.

Last Updated on May 2, 2022 by Chin Yi Xuan

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.