Last Updated on May 1, 2022 by Chin Yi Xuan

ASNB unit trust funds are funds that are managed by Amanah Saham National Berhad (ASNB), a wholly-owned subsidiary company of Permodalan Nasional Berhad (PNB). It was established on 22 May 1979 to manage the Funds launched by PNB.

In short, ASNB is a unit trust management company with decades of experience.

p

Table of Contents

ASNB Fixed Price Fund & Variable Price Funds

As of the time of writing, there are a total of 16 funds offered by ASNB. Of all, there are 6 Fixed Price Funds and 10 Variable Price Funds:

p

| Fixed Price Funds | Variable Price Funds |

|---|---|

| Amanah Saham Bumiputera (ASB) | Amanah Saham Nasional (ASN) |

| Amanah Saham Bumiputera 2 (ASB 2) | ASN Equity 2 |

| Amanah Saham Bumiputera 3 - Didik (ASB 3 Didik) | ASN Equity 3* |

| Amanah Saham Malaysia (ASM)* | ASN Equity 5* |

| Amanah Saham Malaysia 2 – Wawasan (ASM 2 Wawasan)* | ASN Equity Global* |

| Amanah Saham Malaysia 3 (ASM 3)* | ASN Imbang 1* |

| ASN Imbang 2* | |

| ASN Imbang 3 Global* | |

| ASN Sara 1* | |

| ASN Sara 2* |

Differences between ASNB Fixed Price Funds and Variable Price Funds

p

| ASNB Fixed Price Funds | ASNB Variable Price Funds | |

|---|---|---|

| Value | Fixed @ RM1/unit | Varies according to the Net Asset Value (NAV) |

| Sales Charge | 0% | 1.75% - 5% |

| Return | Annual dividend payout | Annual dividend payout & capital gain (ie. Selling Price > Buying Price) |

Essentially, Variable Price Funds are similar to other unit trusts in the market.

As the name suggests, Variable Price Funds are funds that will fluctuate in value in accordance with market movement.

This also indicates that there’s a potential for higher gains and losses. That said, do remember that past performance is not indicative of future performance.

In terms of fees, Variable Price Funds have a sales charge between 1.75% to 5%, depending on the channel of purchase.

On the other hand, ASNB’s Fixed Price Funds are more unique.

For one, the value of the funds is fixed at RM1/unit no matter the market condition. In addition, there is also no sales charge (yes, 0%) for all 6 Fixed Price Funds.

Benefits of ASNB Fixed Price Funds

In the past, I have been receiving many requests to cover ASNB Fixed Price Funds. In this section, let’s explore the benefits of these funds as they are seriously one-of-a-kind.

Personally, I am genuinely happy to see that out of the 6 Fixed Price Funds, 3 (ASM, ASM 2, ASM 3) are actually open to all Malaysians, and I am delighted for good reasons:

#1 ASNB Fixed Price Funds’ Unit value is fixed at RM1/unit

Currently, all ASNB Fixed Price Funds are sold at RM1/unit.

This is a unique and convenient feature of Fixed Price Funds as you can plan your purchase without worrying about sudden price swings.

p

#2 ASNB Fixed Price Funds pay decent dividends

ASNB Fixed Price Funds are well-accepted by fellow Malaysians for good reasons. One of them is because they are able to deliver decent dividends over the long term.

As an example, for the financial year (FY) 2020, all Fixed Price Funds were able to deliver dividends of 4% and above despite the challenging market condition.

| Fixed Price Fund | Distribution Per Unit (sen) - FY2020 | Dividend Yield - FY2020 |

|---|---|---|

| Amanah Saham Bumiputera (ASB) | 5.00 (including bonuses) | 5% |

| Amanah Saham Bumiputera 2 (ASB 2) | 4.75 | 4.75% |

| Amanah Saham Bumiputera 3 - Didik (ASB 3 Didik) | 4.25 | 4.25% |

| Amanah Saham Malaysia (ASM) | 4.25 | 4.25% |

| Amanah Saham Malaysia 2 – Wawasan (ASM 2 Wawasan) | 4.00 | 4.00% |

| Amanah Saham Malaysia 3 (ASM 3) | 4.00 | 4.00% |

p

#3 Dividends earned is not taxable

In other words, you do not have to worry about tax filing.

p

#4 ASNB Fixed Price Funds have no sales charge

Another highlight feature of Fixed Price Funds is there is no sales charge. Meaning, you do not have to pay any sales fee if you purchase new units.

That said, some funds such as ASB 2 and ASM 3 have full discretion to charge a 1% sales fee – just saying.

p

#5 On-The-Spot Redemption

You can withdraw your investments and get your money immediately (either via cash/cheque/bank transfer).

On the other hand, online redemptions of up to RM1,000 a month are now available via myASNB portal and myASNB app.

What you need to know + Risks of investing in ASNB Funds

One thing that we have to keep in mind is that there are no investments that are 100% risk-free. Here are what you need to know before investing in ASNB Funds:

#1 Market Risks and Interest Rate Risk

The returns & performance of both ASNB Variable and Fixed Price Funds are subject to the fluctuation of the market and interest rate.

Specifically for Fixed Price Funds, while the unit value remains fixed at RM1/unit, dividend payout may fluctuate in accordance with the funds’ exposure to market movements and interest rate.

p

#2 Your Capital is not Protected by PIDM

Just like any instruments with exposure to the capital market, your money is not protected by Perbadanan Insurans Deposit Malaysia (PIDM) if ASNB goes bankrupt.

p

#3 Availability of Funds

For ASM Funds, there is a quota capped to non-bumi. When the quota is fully filled, you may have a hard time trying to buy the funds (unless someone lets go of their units).

p

#4 Withdrawal Limits

Online redemptions via myASNB portal and myASNB app are available, but are only up to RM1,000 a month.

Any withdrawal of funds with value above RM1,000 must be made over the counter at ASNB’s branches and agents.

How to open an ASNB account & invest in ASNB Funds

Opening an ASNB account used to be something that has to be done physically via ASNB branches or agents (eg. Most banks).

Just introduced in 2021, new ASNB accounts can be opened digitally via the myASNB app! Here’s how you can open your ASNB account via myASNB app:

-

Step 1: Download & install the myASNB app

-

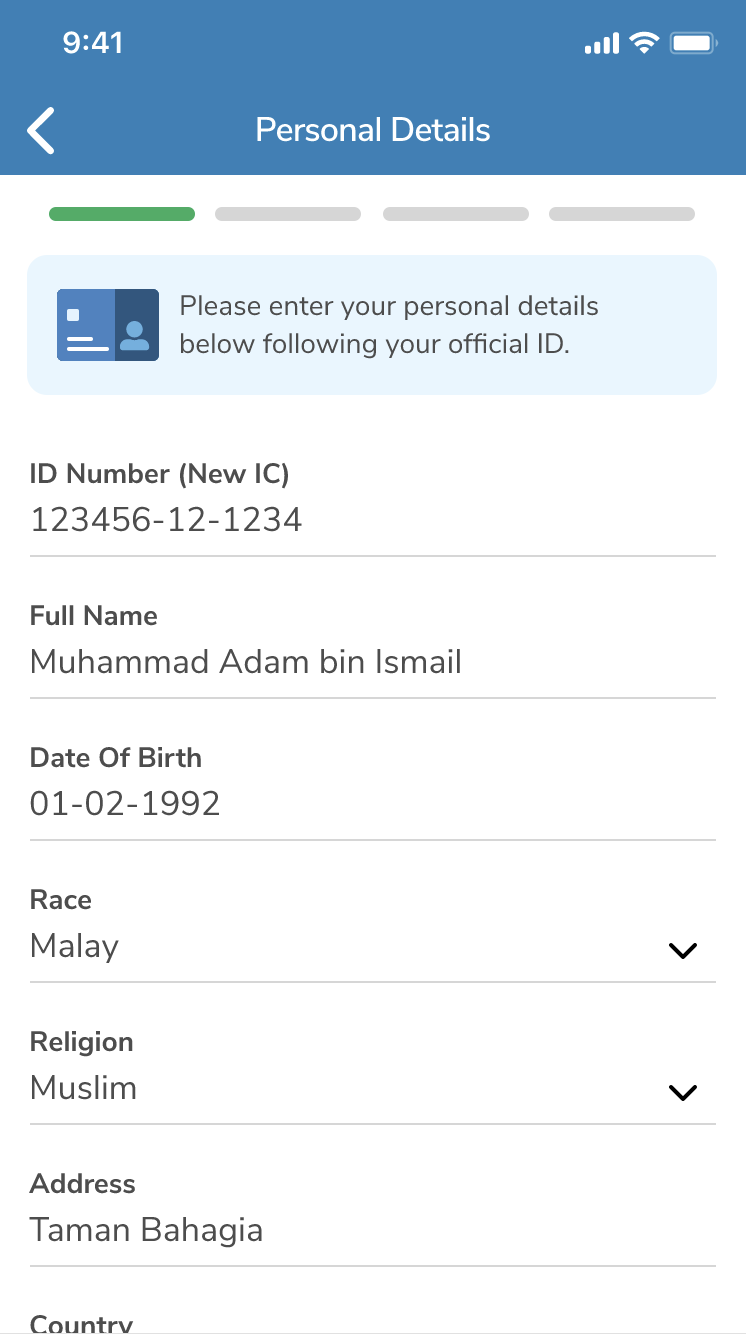

Step 2: Register for your ASNB account by keying in your personal details.

[Note: If you are unable to get your OTP while trying to register for the myASNB app, consider contacting the customer service number for ASNB at 03 – 7730 8899 or email them at [email protected] where they’ll assist you on the matter.]

-

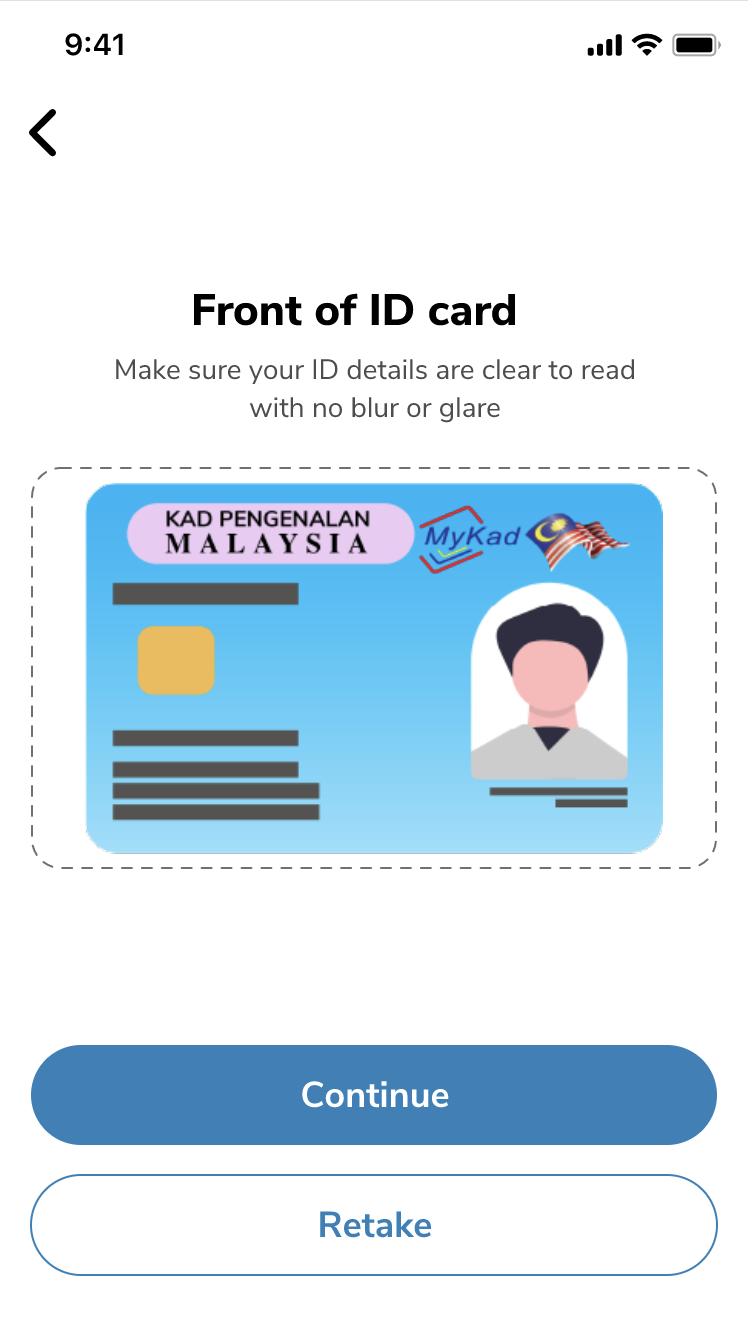

Step 3: Take a photo of your IC and complete the video selfies for verification purposes.

-

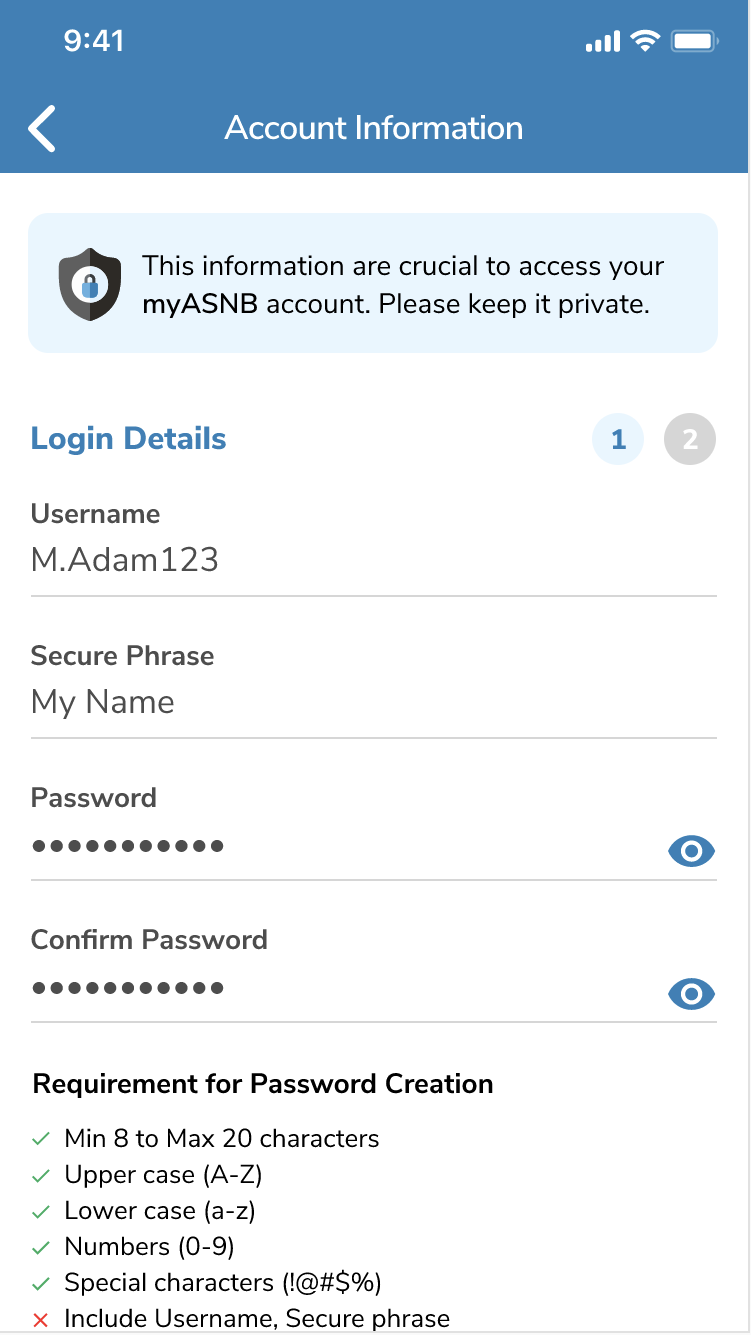

Step 4: Setup your username & password.

-

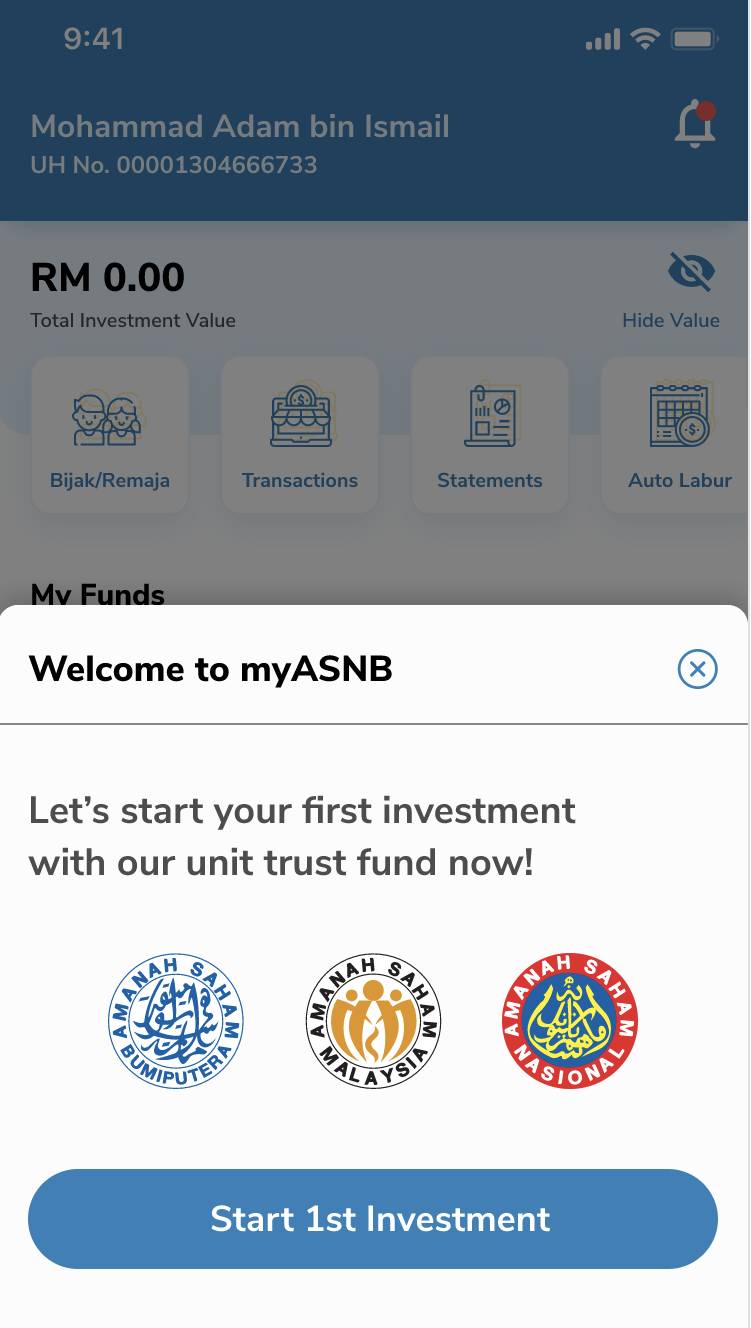

Step 5: You are done! Now, proceed to buy your first ASNB units.

-

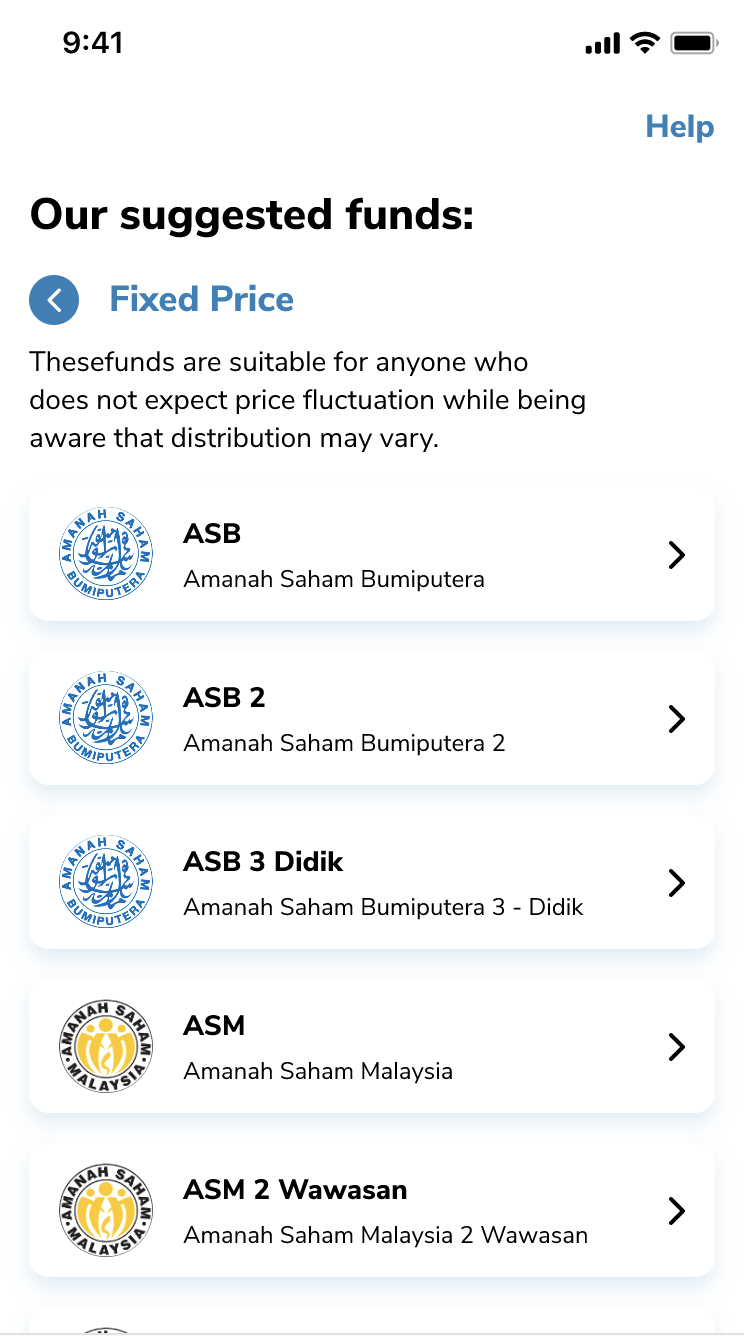

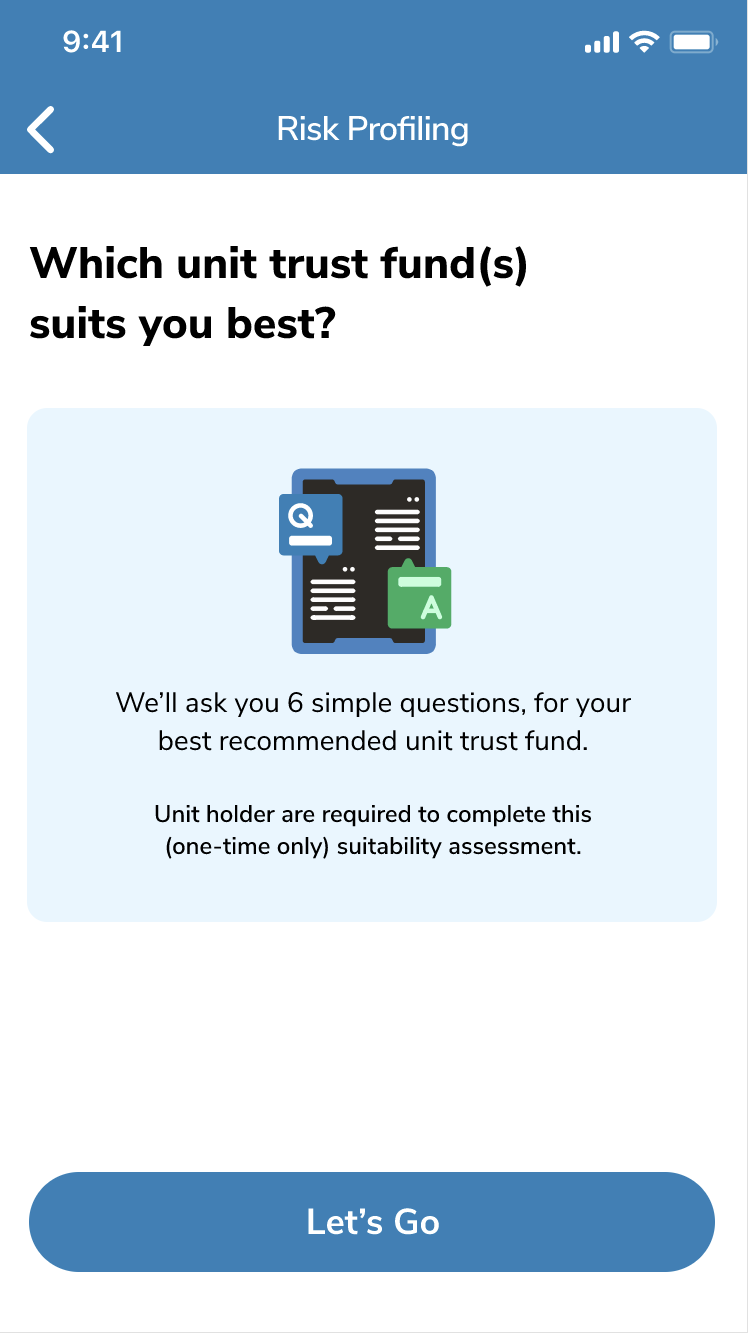

Step 6: As a first-time user, you are required to complete a one-time-only risk assessment.

Doing so, ASNB will suggest funds according to your risk profile.

-

Step 7: Make an initial investment of RM10.00 via FPX online banking or selected e-wallets.

-

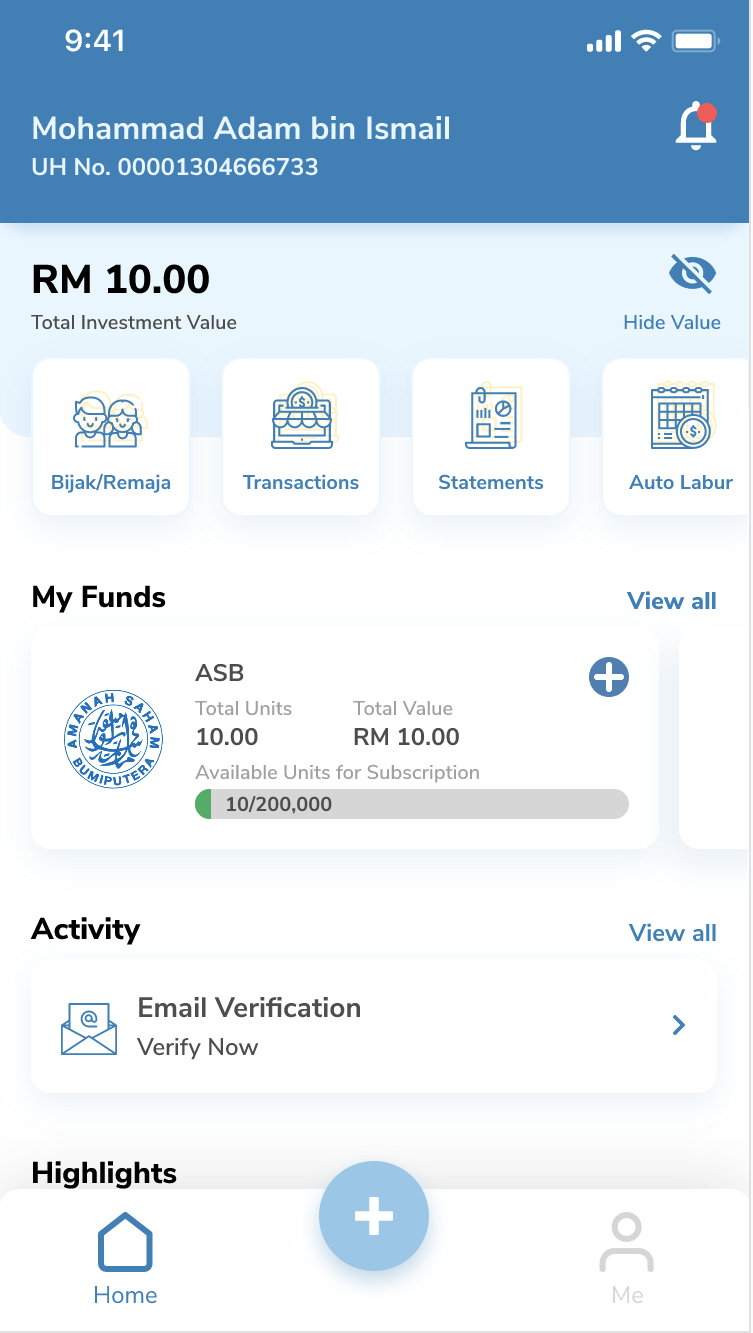

Step 8: Now, you have successfully purchased your first ASNB units!

Feel free to add on to your units via the myASNB portal and/or app, with a minimum additional investment of RM100.

If you need more details, check out the official ASNB webpage regarding mobile registration and onboarding HERE for instructions and FAQs.

There’s also a tutorial video available on ASNB’s YouTube channel HERE.

No Money Lah’s Verdict

In my opinion, ASNB has certainly built up the habit of consistent investing among fellow Malaysians.

Now that new users can open an ASNB account online, it makes it even more accessible for Malaysians to invest and grow their wealth.

Are you investing in ASNB funds at the moment? If not, are you looking to start investing in ASNB funds now that everything can be done online?

Feel free to let me know by leaving your thoughts in the comment section below!

Disclaimers:

This article is written in collaboration with ASNB.

Investing involves risks and past return is not indicative of future performance. Please seek a licensed financial planner before making important financial decisions.

The Replacement Master Prospectus of ASNB dated 1 February 2020, Prospectus of ASN Imbang (Mixed Asset Balanced) 3 Global dated 16 September 2020 and Prospectus of ASN Equity Global dated 1 September 2021, (“Prospectuses”), have been registered with the Securities Commission Malaysia.

Please read and understand the content of the Prospectuses together with the Product Highlights Sheets which are available at the ASNB website (www.asnb.com.my), branches, and agents. Unit will be issued upon receipt of the registration form referred to and accompanying the Prospectuses. Before investing, please consider the risk of investing as well as the fees and charges involved. Unit prices and distribution payable, if any, may go down as well as up. The past performance of a fund should not be taken as indicative of its future performance.

Disclaimer Statement on Advertisement of ASNB Products and Related Services: In accordance with the Guidelines on Advertising for Capital Market Products and Related Services, all advertisements and promotional materials produced by ASNB are reviewed by Compliance Department, Permodalan Nasional Berhad and do not require review from the Securities Commission Malaysia.

Related Posts

January 13, 2022

Malaysian’s Guide to Invest in ETF

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Any history of the company(ASNB) goes bankrupt?

Nope as far as I am concerned.

Regards,

Yi Xuan