Last Updated on May 2, 2022 by Chin Yi Xuan

In Part 1 of my Amanah Saham article, I talked about what is Amanah Saham and a brief overview of the benefits and risks of investing in Amanah Saham’s Fixed Price Funds.

For Part 2, let’s zoom in a little and have an in-depth look into the 6 Amanah Saham’s Fixed Price Funds that everyone is talking about:

Table of Contents

(A) Before we start, a little recap…

Amanah Saham’s Fixed Price Funds are funds of which its fundamental value is fixed at RM1/unit regardless of the market condition. These funds are famous due to their 0% sales fees, a track record of bringing in consistent return, and its nature that serves as an excellent capital preservation investment option. More about this in Part 1.

As mentioned, there are 6 Fixed Priced Funds by Amanah Saham, namely:

|

Bumiputera-Only |

Open to all Malaysians |

| Amanah Saham Bumiputera (ASB) | Amanah Saham Malaysia (ASM) |

| Amanah Saham Bumiputera 2 (ASB 2) | Amanah Saham Malaysia 2 – Wawasan (ASM 2) |

| Amanah Saham Bumiputera 3 – Didik (ASB 3) | Amanah Saham Malaysia 3 – 1 Malaysia (ASM 3) |

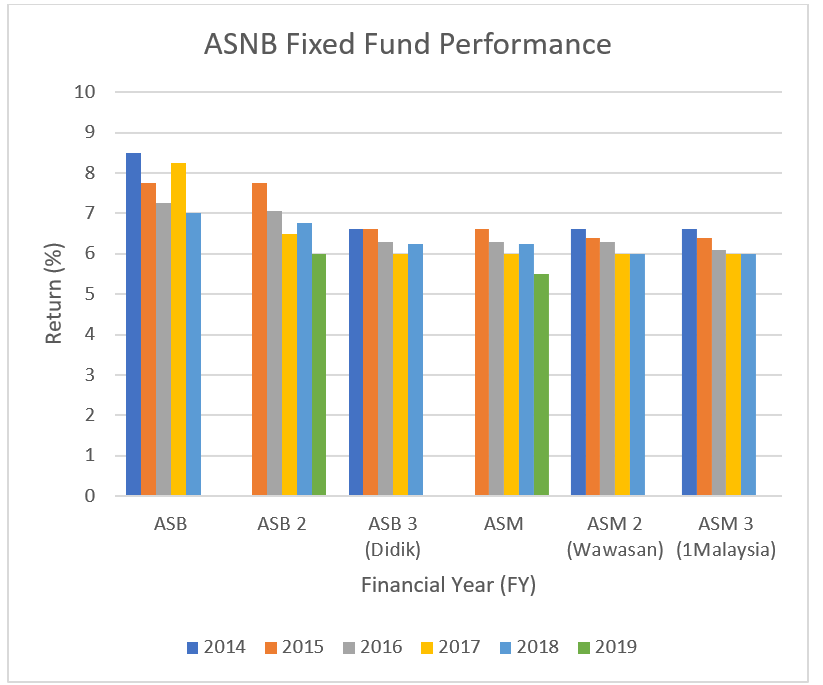

(B) Summary of each Funds’ return (%) over the past 5 Financial Years (FY)

As you can see from below, each fund has been reasonably consistent in their performance, albeit some funds’ return has slid down for a little – in line with the overall market performance.

(C) Deep Dive into all 6 Fixed Price Funds

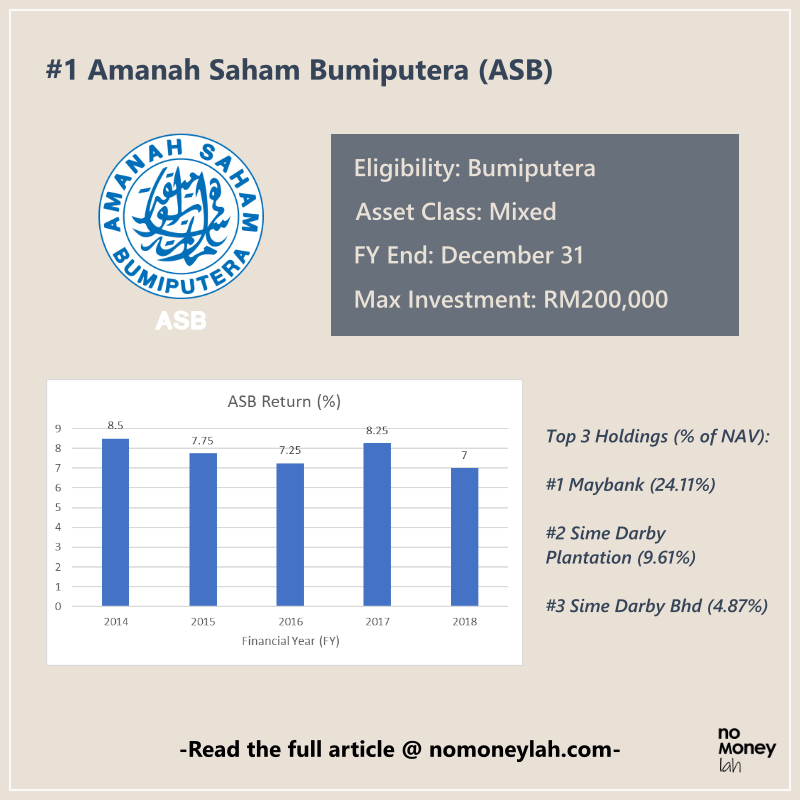

#1 Amanah Saham Bumiputera (ASB)

Established in 2nd January 1990, ASB is the first Fixed Price Fund by Amanah Saham. In terms eligibility, ASB is only open to Bumiputera, with a maximum investment of RM200,000.

ASB is a fund with a mixed portfolio of assets such as equities (73.56%) and other capital market instruments such as fixed income securities and bonds (26.44%). With more than half of its total capital invested in equities, it is important to find out which sector ASB has been investing in:

|

Top 3 Sectors (FY 2018) |

Top 3 Holdings (FY 2018) |

| Financial (27.55%) | Maybank (24.11%) |

| Services (21.01%) | Sime Darby Plantation (9.61%) |

| Plantation & Agriculture (11.58%) | Sime Darby Bhd (4.87%) |

What we can tell from above is that ASB is pretty heavily invested in the financial sector of the country, namely Maybank, and rightfully so as banks generally give out a decent dividend.

#2 Amanah Saham Bumiputera 2 (ASB 2)

ASB 2, which is also a Bumiputera-only fund, was launched in 2014 with a maximum investment of RM200,000.

In terms of the nature of the fund, ASB 2 is also managing a mixed asset of equities (81.96%) and some other instruments from the capital market (18.04%). What makes ASB 2 stands out among other Fixed Price Fund is that ASB 2 is the ONLY fund with more than 80% of its capital invested in equities.

|

Top 3 Sectors (FY 2019) |

Top 3 Holdings (FY 2019) |

| Financial (25.93%) | Maybank (9.93%) |

| Industrial (11.5%) | CIMB (6.03%) |

| Utilities (10.19%) | TNB (5.91%) |

Without surprises, ASB 2 is also heavily invested in the financial sector.

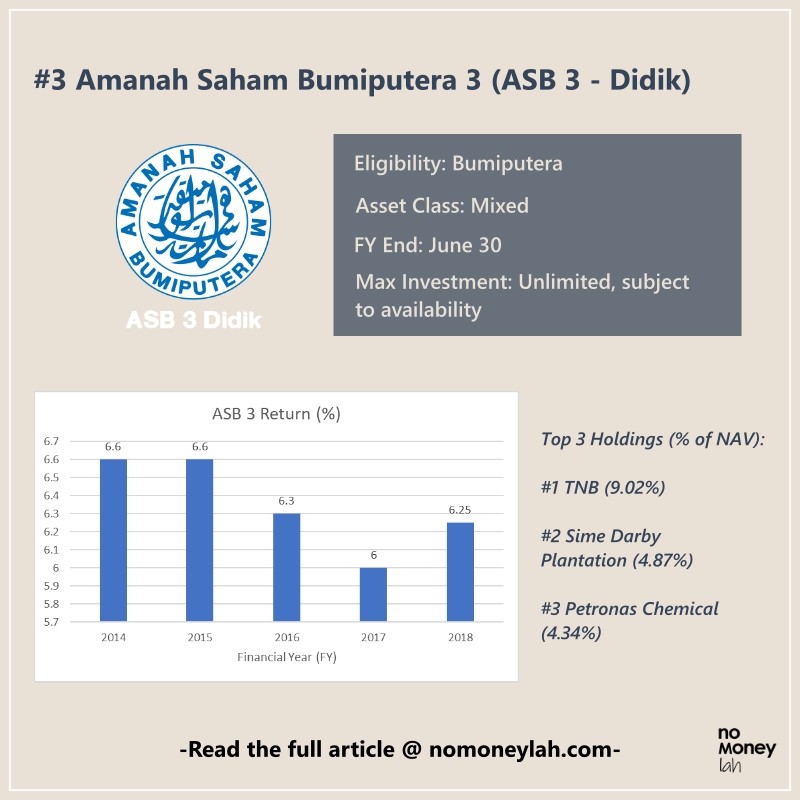

#3 Amanah Saham Bumiputera 3 – Didik (ASB 3)

Another Bumiputera-only fund, what makes ASB 3 different from ASB and ASB 2 is that there is no cap to the maximum investment of each person but instead is subjected to the availability of units.

Similar to ASB and ASB 2, ASB 3 handles a mixed portfolio of assets, with 76.11% on equities and 23.89% on other capital market instruments.

|

Top 3 Sectors (2Q FY 2019) |

Top 3 Holdings (2Q FY 2019) |

| Services & Trade (30.6%) | TNB (9.02%) |

| Plantation (12.31%) | Sime Darby Plantation (4.87%) |

| Industrial (6.74%) | Petronas Chemical (4.34%) |

Unlike the funds before, ASB 3 focused its capital mainly on services & trade sector.

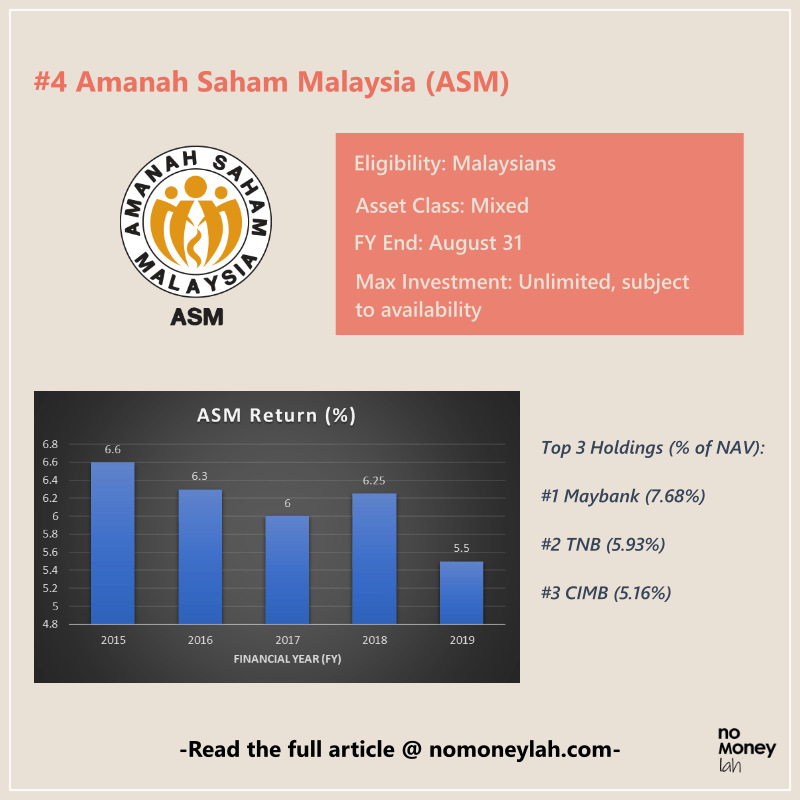

#4 Amanah Saham Malaysia (ASM)

ASM was launched in 20th April 2000, and it is one of the Fixed Price Fund in Amanah Saham that is open to all Malaysians. It has no cap when it comes to maximum investment, yet it depends on the availability of units for purchase.

As a fund that manages a mixed asset class, ASM has a 73.08% breakdown in equities and 26.92% in other market instruments.

|

Top 3 Sectors (FY 2019) |

Top 3 Holdings (FY 2019) |

| Financial (20.78%) | Maybank (7.68%) |

| Services (10.29%) | TNB (5.93%) |

| Utilities (9.59%) | CIMB (5.16%) |

Just like most of the Fixed Price Funds, ASM places a big emphasis of its funds into the financial sector, with Maybank and CIMB being 2 of its largest holdings for the 2019 Financial Year. One thing to note is that ASM is the only fund that performed less than 6% return (5.5%) in its latest financial year – the first to slip under 6% among all 6 funds.

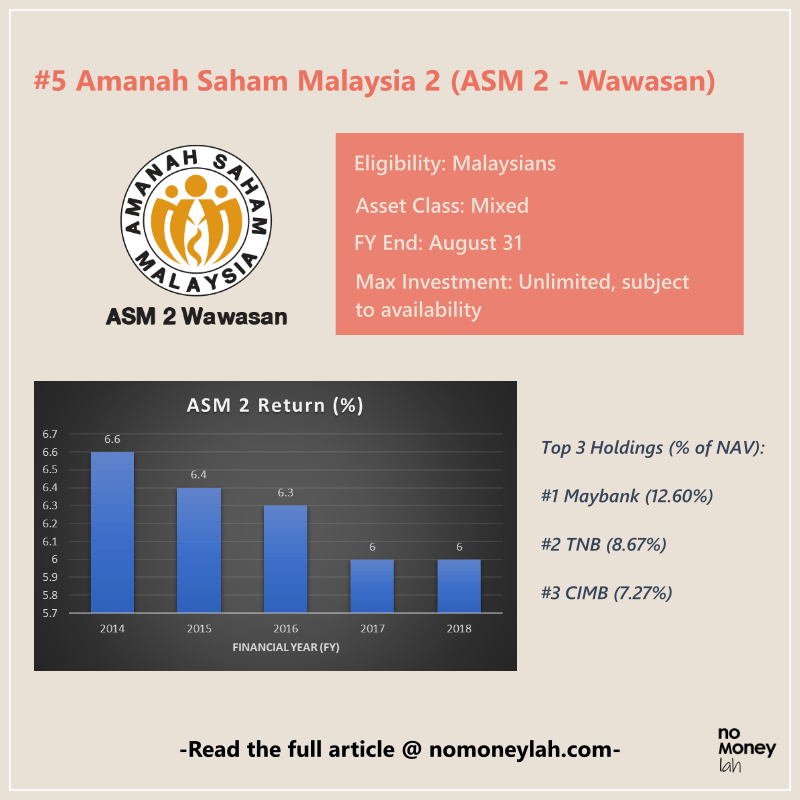

#5 Amanah Saham Malaysia 2 – Wawasan (ASM 2)

Launched in August 1996, ASM 2 is the first Fixed Price fund that is open to all Malaysians public to buy. Just like ASM, ASM 2 has no cap to its maximum investment, yet to purchase you got to depend on the availability of units of the fund.

In terms of asset breakdown, ASM 2 manages 79.39% of equities and 20.61% of other market instruments – making it the 2nd largest equity holding among all 6 funds (the 1st being ASB 2).

|

Top 3 Sectors (FY 2019) |

Top 3 Holdings (FY 2019) |

| Financial (27.85%) | Maybank (12.60%) |

| Services (23.83%) | TNB (8.67%) |

| Plantation (10.12%) | CIMB (7.27%) |

In terms of sector breakdown, ASM 2 is both heavily invested in the financial and services sector, hence any form of performance fluctuation in these sectors would definitely affect the performance of ASM 2.

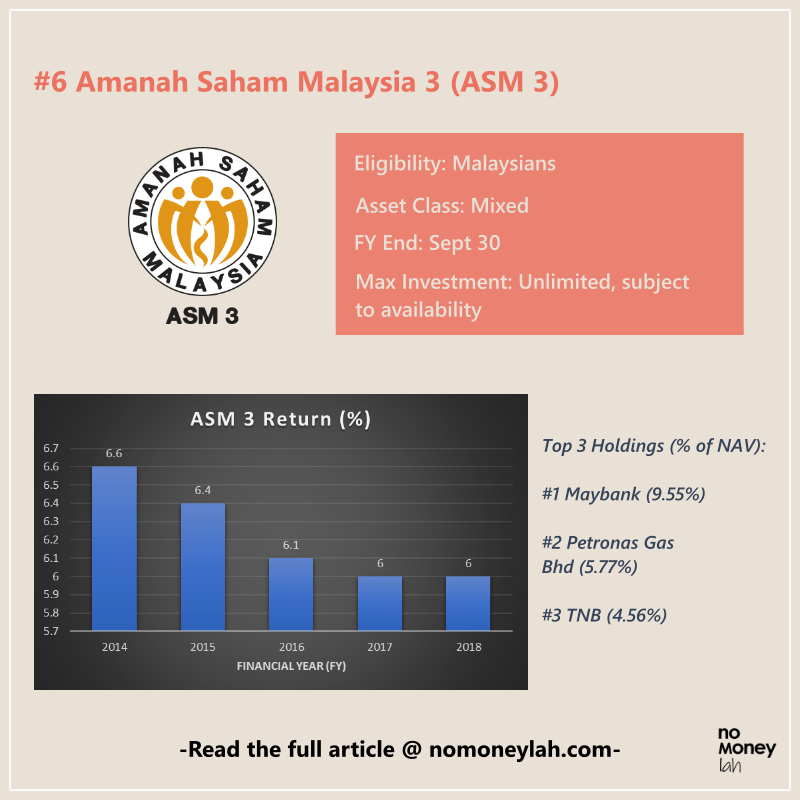

#6 Amanah Saham Malaysia 3 – 1 Malaysia (ASM 3)

Being the latest addition of all-Malaysians Fixed Price Fund (2009), ASM 3 also has no cap to its maximum investment.

Just like all other Fixed Price Funds, ASM 3 manages 73.5% of equities and 26.5% of other capital market instruments in its portfolio.

|

Top 3 Sectors (FY 2018) |

Top 3 Holdings (FY 2018) |

| Services & Trade (22.88%) | Maybank (9.55%) |

| Financial (21.36%) | Petronas Gas Bhd (5.77%) |

| Industrial (7.27%) | TNB (4.56%) |

For ASM 3, Services & Trade sector is one of the main holdings of its entire equity portfolio, followed closely by investments in the Financial sector.

(D) Sector & Company Specific Risks

From the fund description above, it is not hard to spot that there are a lot of similarities between all 6 funds, namely:

Most of the funds either have a big and/or heavily invested in the financial and (some in the) services sector. This means that any news or fundamental changes in these sectors’ performance will affect the return of these Fixed Price Funds.

Of all, interest rate fluctuation is no doubt one of the major risks of banks (financial sector), as any changes in interest rate will impact the revenue of the banks.

Aside from that, there are companies that will always be in the podium of Top 3 Holdings of these funds, such as Maybank and TNB. While these are very reliable blue-chip stocks, any company-specific news could also affect the return of the Fixed Price Funds. (especially ASB and ASM 2 that have a huge holding of Maybank shares)

(E) So…Which Fund Should I Pick?

Firstly, from a pure return perspective, I personally think that any of the funds are okay as they have been giving pretty consistent return throughout the past 5 Financial Years (FY). That said, ASB is likely the favorite as it has been giving not only consistent, but also the highest return among all 6 Fixed Price Funds available.

However, your available options really depend on, well, your race. If you are a non-Bumi (like me), your options are mainly ASM, ASM 2 and ASM 3.

Another catch of these Fixed Price Funds is they are really, really hard to buy. In short, what you WANT to buy may not be what you COULD buy. Reason being, for each fund, a quota is allocated specifically to each race and once the quota is used up, you can only purchase the units if someone else is selling their holdings.

Essentially, you got to have some luck and keep trying if you want to buy into any of these funds (more on this in Part 3).

No Money Lah’s Verdict

So here you go, the in-depth view into all 6 Amanah Saham’s Fixed Price Funds! These are, in every means, some of the best long-term investment options available to Malaysians if you can get your hand on them.

In Part 3 (the final part of this Amanah Saham series), I will share my experience and personal thoughts on Amanah Saham investment with you – so stay tuned and subscribe if you haven’t already!

Do SHARE this article out with your friends and family if you find it useful, would ya’? 🙂

If you have yet to check out Part 1 of my Amanah Saham investing, be sure to check it out HERE!

Disclaimer: The accuracy of this content is based on the best effort by myself and at the time of writing. I do not guarantee the validity of this content as details and performance of ASNB and its funds will change over time. This article is also not a buy/sell recommendation. Please seek professional financial planner’s advice on this matter.

Related Posts

April 20, 2023

StashAway Simple Review: The Fixed Deposit (FD) Killer?

January 23, 2022

[Sponsored Post] What is ASNB and How to Invest in It?

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.