Last Updated on May 2, 2022 by Chin Yi Xuan

Have you ever been in a situation, where you were looking at a stock that you think you should buy, yet did not pull the trigger and ended up regretting your inaction?

How about the times when you think you should get out of an investment, yet too clouded by emotions to do so and ended up taking a huge loss?

When I first started in the market, I faced the similar problem over and over again. Not only it was frustrating, the huge emotional swings involved were also extremely tiring.

As times went by, I have learned an important, yet hugely overlooked mental skill by many that have since helped me improve my investing and trading performance alike.

Table of Contents

What is the If/Then Mindset?

If/Then mindset is a simple, yet critical mental skill that is hugely overlooked by new investors and traders in the market.

In essence, the If/Then mindset is a mental simulation of the possible outcomes given a particular set of scenarios, and the actions that you will take should any of these outcomes happen:

“If A happens, I will do X. If B happens, I will do Y.”

Okay, So How Will the If/Then Mindset Improve My Investing Performance?

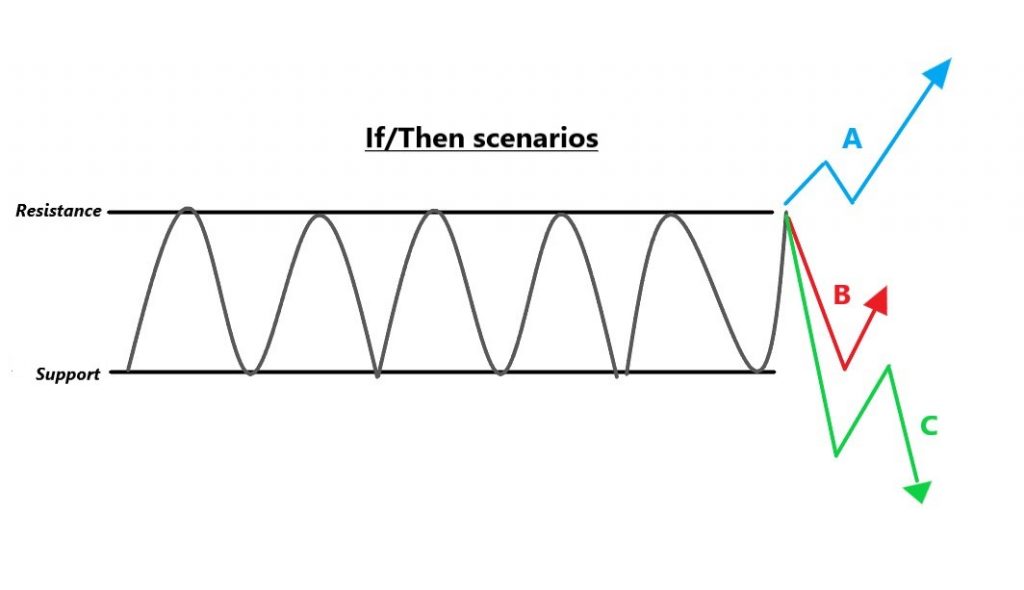

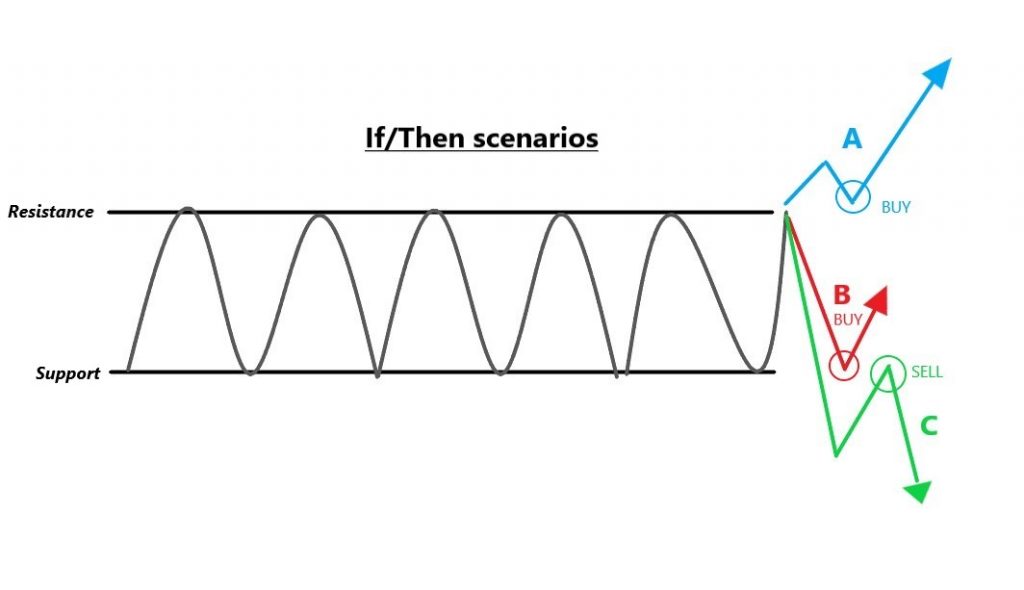

Let’s look at a simple ranging chart pattern, and how the If/Then mindset could help improve your performance:

What we are looking above is a stock price in a ranging (or zig-zag) pattern. For an inexperienced investor or trader, it is easy to conclude that there is no trend going on with this particular stock and hence no ‘excitement’ in the price.

However, using the If/Then mindset, one could easily simulate the potential price movements of the stock (scenarios A, B, C). With that, various interesting opportunities could be identified prior to any price movement at all.

As an example, if scenario A happens, then one could buy at the pullback upon a small retracement. However, should scenario B happen, then one could look to buy at the support level. That said, if scenario C plays out, then one could look to sell upon a mini retracement.

Benefits of If/Then mindset

Believe it or not, there are many benefits if you are able to build up your If/Then mental skill:

(1) Early Anticipation of Price Movement

Training your If/Then mental skill will help you to anticipate price movement effectively.

We can never predict with absolute certainty where the price of a stock will move. However, we can use the If/Then mindset to anticipate the different possibilities of price movement, and devise our actions should any of the scenarios play out.

p

(2) Reduce Mental Stress & Emotions in Decision-Making

By simulating the possible outcomes prior to price movement, an investor could plan ahead of what could be done should different scenarios play out.

This might look like a simple thing, yet it is extremely helpful in reducing any form of emotional bias (eg. Fear of losing, Ego) and mental stress in comparison to the times when you have to make an immediate investment decision on your feet.

p

(3) Improve Consistency in Investing Performance

As you make progress in developing your If/Then mental skill, you can expect consistency in your performance.

Reason being, a strong If/Then mental skill will provide you with a consistent execution process (eg. If A happens, then I will do X) by filtering out a lot of unnecessary biases involved.

We can never predict with 100% certainty what will happen, but we can always anticipate the possible outcomes and respond accordingly.

How to Apply If/Then Mindset in Investing & Trading

By now, it should be obvious that If/Then mindset is a mental skill that is applied prior to making any investment decisions.

As such, most application of the If/Then mindset should be done during the preparation phase of your investing workflow:

If you are a fundamental investor (read: Value Investing), your If/Then mindset could be “I will only invest in a company IF it has a consistent profit growth over a 5-year period”.

If you are a technical trader, your If/Then mindset could be applied in a way “IF price movement A happens, THEN I will do X”.

In short, practice and apply the If/Then mindset BEFORE you have to make any investment or trading decision live.

p

No Money Lah’s Verdict:

If/Then mindset is a mental skill that is crucial for an investor or trader’s development to perform better and more consistent in the market.

That said, many tend to undermine the practice of this skill as it seems to be simple. However, ask yourself: How many times have you ever go through the If/Then thought process before making an investment decision?

If any, the If/Then mindset does not require one to be right at predicting the direction of a price. Rather, it trains a person’s mind to anticipate and be open to different possibilities of outcome and respond accordingly.

Personally, I think this is an important skill to develop, and one that I strive to improve on a daily basis.

I certainly hope you do, too.

Read my articles on REIT Investing HERE.

Every now and then, I organize sharing sessions to share insights on how I invest in the market. Book your slot for my upcoming session HERE!

Related Posts

October 24, 2019

Why Are You Still Suck with Investing after Paying Thousands for Courses?

Have you ever attended any of those…

November 28, 2018

4 Key Differences Between Investing in REIT and Rental Property

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.