Last Updated on May 2, 2022 by Chin Yi Xuan

TradePlus by Affin Hwang Asset Management has recently listed their highly anticipated Leveraged & Inverse ETF (FANG+ 2x Leveraged, FANG+ Inverse, HSCEI 2x Leveraged, HSCEI Inverse) on Bursa – the first in Malaysia.

Essentially, this means that local traders now have the opportunity to be exposed to the foreign market (US Tech sector & Hong Kong’s listed Chinese companies) via local platform. In addition, local traders also have more versatility when it comes to trading the market – with the advantage of leveraging and the ability to profit with inverse ETF when the market goes south.

That said, are these ETF products for you? Let’s find out:

Table of Contents

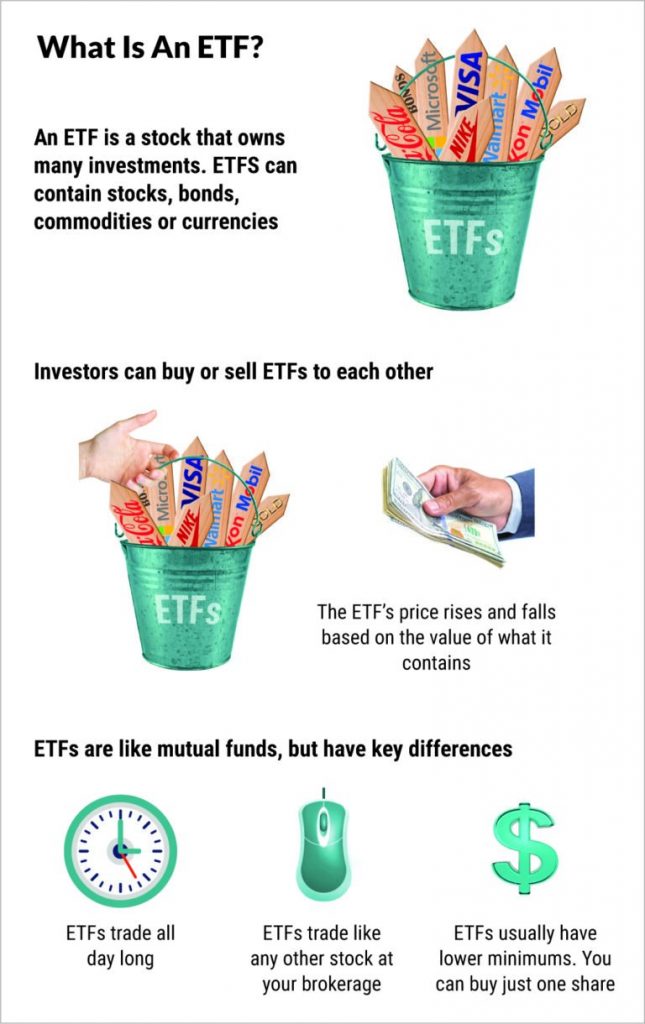

First of all, what is an ETF?

Exchange-Traded Fund, or ETF, is a fund that tracks a collective of specific securities that is traded on stock exchanges.

Simply put, instead of a single stock, look at ETF as a basket of stocks that are being sold in the stock market – tracking the collective performance of stocks within the basket.

So…What are the newly listed Leveraged and Inverse ETFs?

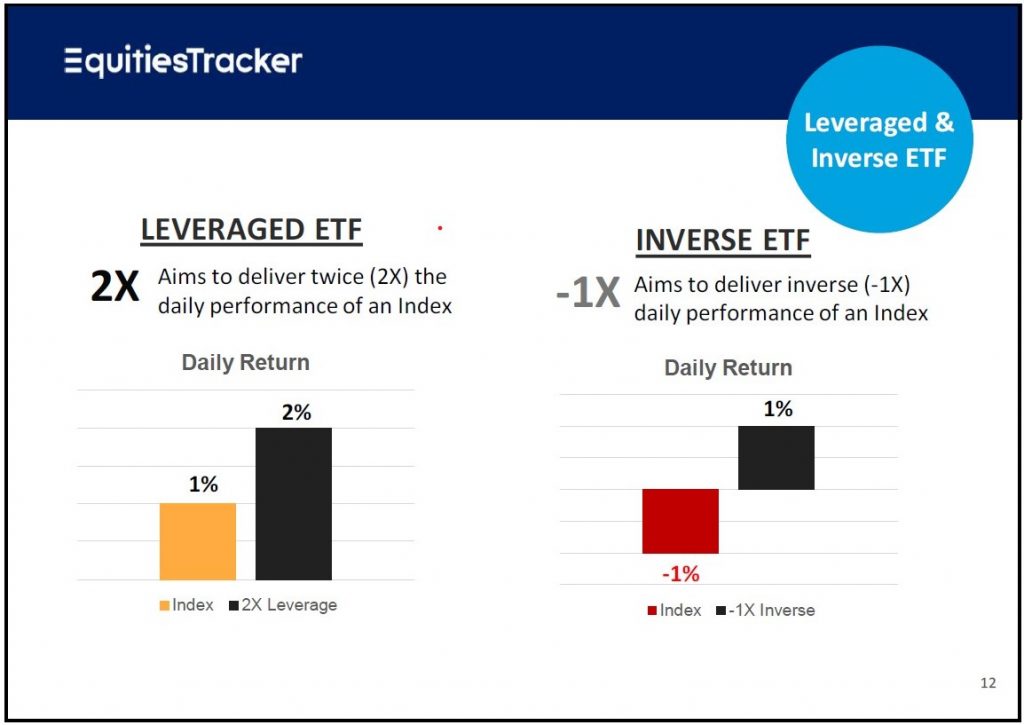

For a typical ETF or stock investment, you earn 1% when the investment moves up by 1%.

Technical details (boring stuffs) aside, the newly listed FANG+ and HSCEI 2x Leveraged ETF allows one to double his or her return when the trade moves in one’s favor. Generally, it means that when the ETF moves up by 1%, your return would be 2%, which is twice (2x) the price movement.

On the other hand, the newly listed FANG+ and HSCEI Inverse ETF would allow a trader to profit when the price of the ETF goes down instead. Simply put, think of it as you are buying an Inverse ETF with the outlook that the price of the ETF is going to drop.

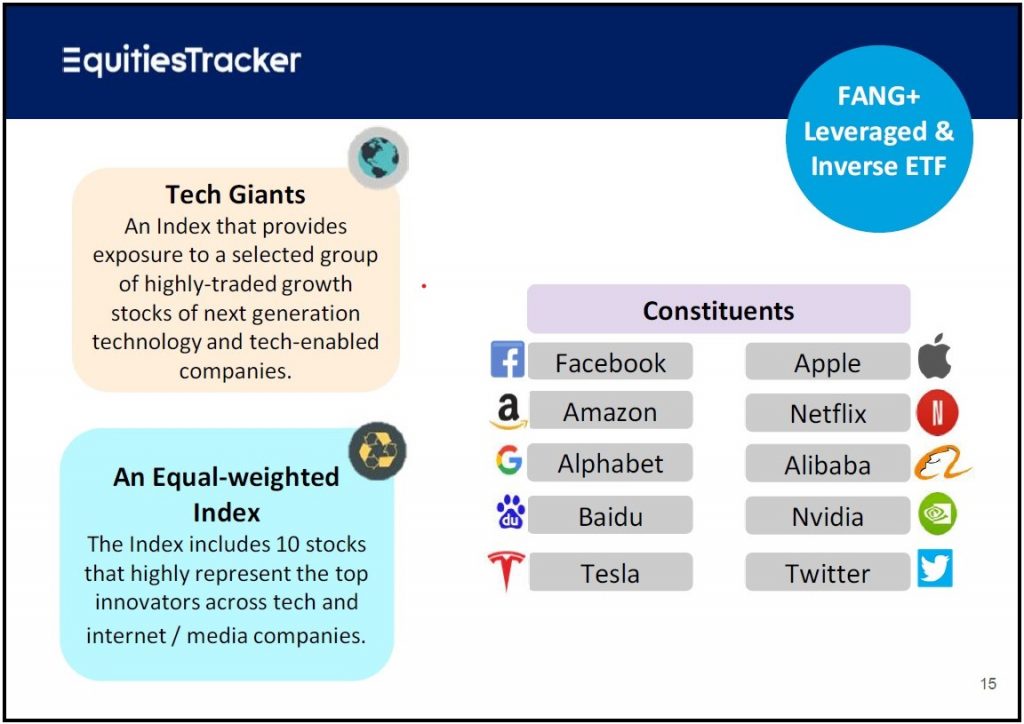

What are the stocks that the FANG+ and HSCEI ETFs track?

FANG+ 2x Leveraged & Inverse ETF tracks a basket of 10 US highly-renowned tech stocks, which is great if you have a specific trade idea on the US tech sector and is wondering how to trade the sector. (Interesting fact: FANG+ stands for Facebook, Amazon, Netflix, Google & Others)

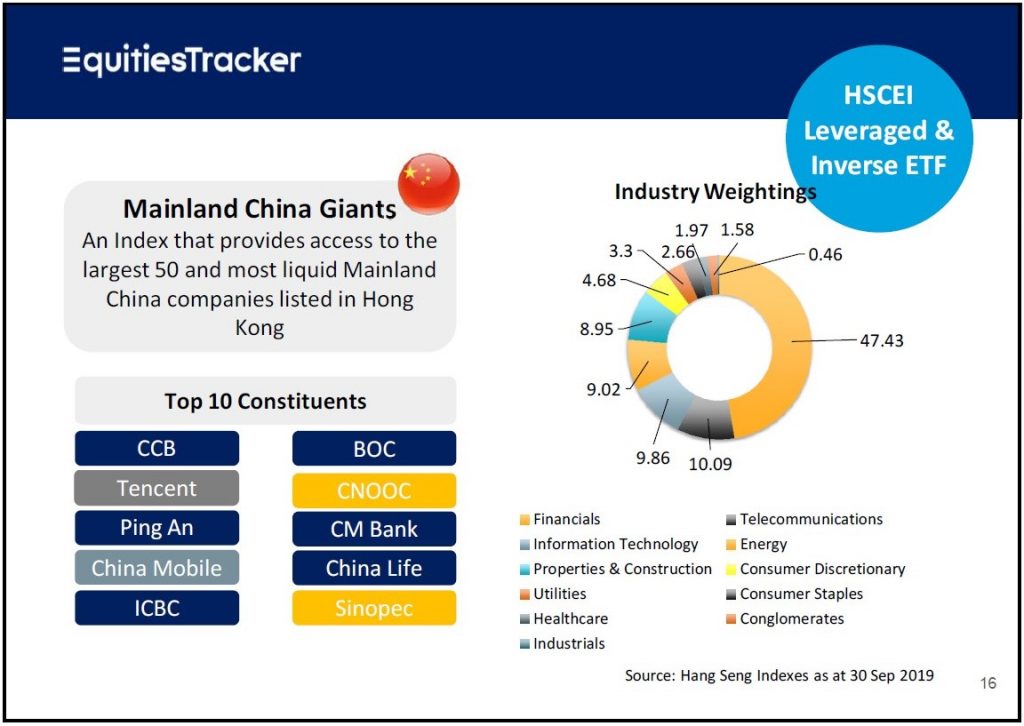

On the other hand, HSCEI 2x Leveraged & Inverse ETF tracks a basket of the 50 largest Chinese companies that are listed in the Hong Kong’s stock exchange. Some of the notable companies include Tencent (tahu Wechat?) and Ping An insurance.

HSCEI ETFs are a great choice for traders with trade ideas towards Chinese companies.

Related Fees

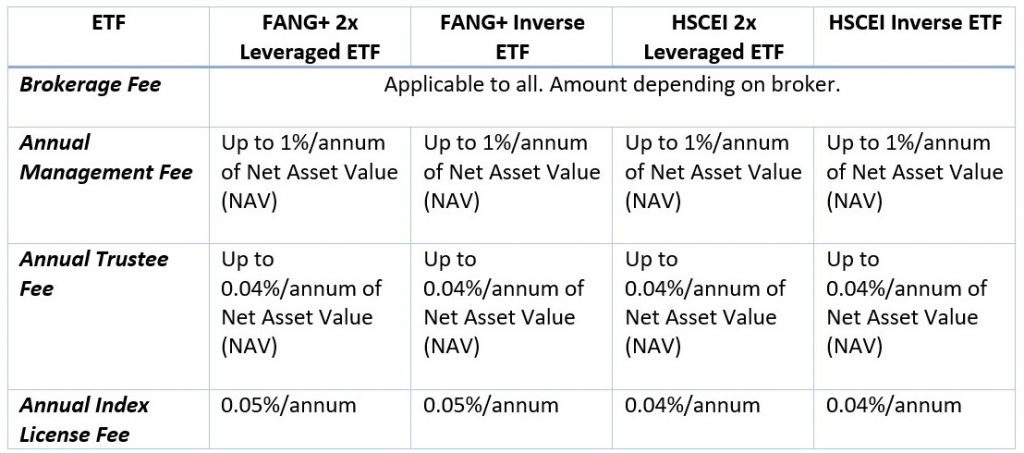

Just like investing in a stock market via your broker, you’ll be charged your normal brokerage fee when buying the FANG+ and HSCEI 2x Leveraged & Inverse ETF.

Also, certain annual charges will be imposed too, kind of like mutual funds.

Is it For You? (and the Risks Involved)

Now, it is super clear that these ETF products are very niche and is NOT for everyone. Even in the product page itself, it has been stated specifically that Leveraged and Inverse ETFs are more suited to be traded short term instead of long term investing.

In particular, 2x Leveraged ETFs, while could deliver 2x the return, could also deliver a loss that is twice as much to traders when a trade goes wrong – hence should be carefully approached.

That said, this product is superb specifically for experienced traders with large capital. As such, these are traders that would like to profit from their short-term view of the US tech sector or from the thriving HK-listed Chinese companies via leveraged and inverse products.

That aside, Leveraged & Inverse ETFs are NOT for people who:

- Have little to no experience in trading.

- Do not understand the risk of leverage.

- Have small capital (because your brokerage fees alone could screw you up)

How to Trade?

For traders that are interested to trade these newly listed ETF products, you can do so today via your Malaysian stockbrokers – just search for the respective ETF names/stock code and you will be able to start trading them!

FANG+ 2x Leveraged (E830EA), FANG+ Inverse (E831EA), HSCEI 2x Leveraged (E832EA), HSCEI Inverse (E833EA)

No Money Lah’s Verdict

In short, it is very interesting that we are starting to see more interesting investment alternatives that are coming up in the local scene. While clearly not designed for most everyday investors, TradePlus’ Leveraged & Inverse ETF products are definitely there to fulfill the niche for certain traders in the market that are looking to profit from their view of the foreign market.

For the general everyday investors though, my recommendation to check out the normal (and equally exciting) locally listed ETFs or stocks like REITs to invest for the longer term.

Side note: For the niche group of traders who are interested in the Leveraged & Inverse ETFs, I will be trading them for a bit – and will write about my experience real soon – so stay tuned!

Real Estate Investment Trusts (REITs) is one of my favorites to invest in the stock market, as they provide relatively stable dividends – hence making them a great passive income source.

Disclaimer: This article is written based on my best research as of the time of writing, and should not be considered as a buy/sell recommendation. Please do your own due diligence and/or seek professional advice when making your investment decision.

Related Posts

January 15, 2022

ETF: Best China ETFs in Malaysia!

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.