Gong Xi Fa Cai! Gong Hey Fat Choy!

Happy Chinese New Year everyone – may this new year showers you with health and wealth!

If you are like me, you know that growing up, we do not get to keep our angpau money. Instead, our angpaus are being kept and managed by our parents.

The good thing? It prevented us (the child) from spending on unnecessary stuff. On the flip side, it made a lot of us pretty bad angpau money ‘managers’ upon growing up.

If that’s the case for you, here are some solid suggestions (which I personally do) on how to best make use of your angpau money!

Table of Contents

#1 Invest them! (Starting from RM0)

Getting your angpau invested is definitely one of the best and most direct ways to start a prosperous new year!

If you are new to investing and/or have no extra time to manage your money, be sure to check out StashAway to help manage your investments, hassle-free!

Essentially, StashAway is a smart wealth management platform that helps you manage your investments via algorithms in accordance with your risk appetite and economic condition – think of it as an (often cheaper) alternative to mutual funds.

Personally, I have been using StashAway to manage my passive investment portfolio and have no problem recommending it to people due to its reliability (regulated by Securities Commission) & lower fees than typical mutual funds.

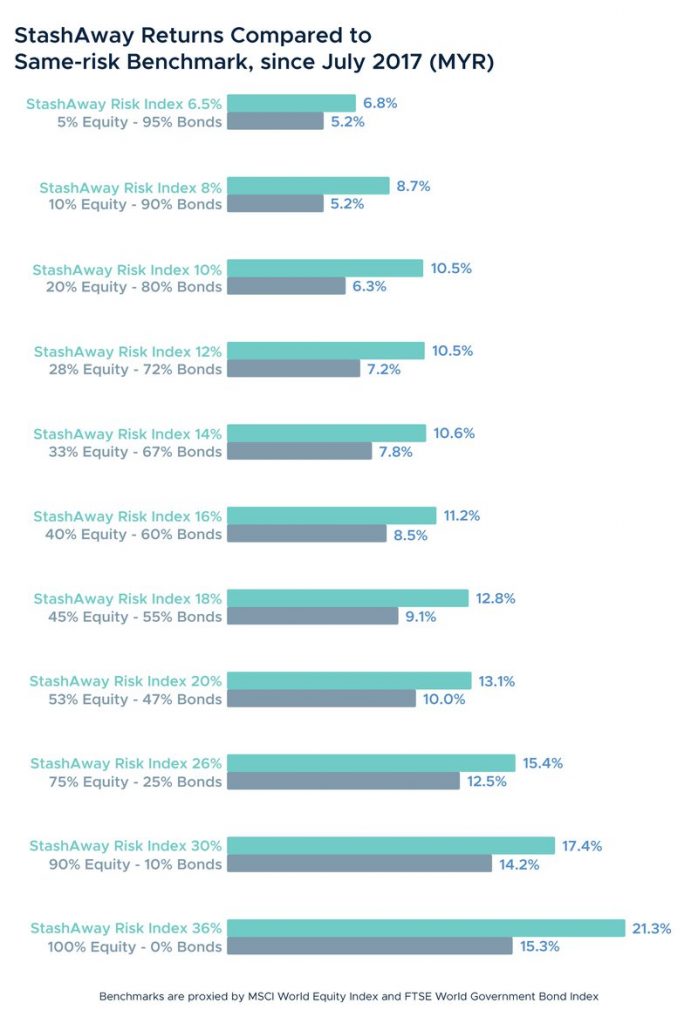

In terms of returns, StashAway managed to give a return of around 10% for my combined aggressive portfolios in 2019 – a very respectable return by all means. Check out StashAway’s 2-year performance in the photo below.

Alternatively, there are other similar wealth management services like Wahed (Promo Code to get FREE RM40 bonus when you deposit a min. of RM100: YIXCHI1) and MyTheo (Promo Code to get 3 months FREE management fee: CHINYXWD49) of which I will be covering in the future.

If you are keen to try out StashAway, be sure to click HERE to get an exclusive 50% OFF your StashAway fees – AND no worries on how much you get for your angpau as you can get started with any amount at all!

#2 Spend on Books for even Bigger Return!

Nothing pays more dividends than acquiring new skills and knowledge.

If there is one thing that I can comfortably recommend anyone to spend on, books will top the list without a doubt.

Now, if you’ve been following me on social media, you’ll know that I am a huge book lover.

I enjoy reading books on personal growth, habits and money & investment – and here are 3 books that you should not miss in 2020:

(a) Mindset by Carol Dweck (Personal Development)

Mindset by Carol Dweck is a great book on personal growth that I am personally reading at the moment.

This book emphasizes the importance of having a growth mindset in personal life, sustainable leadership and long-lasting relationship – and the approach that you can apply to build this mindset.

Definitely check out this book if you are looking to make a significant breakthrough in 2020.

“True self-confidence is “the courage to be open—to welcome change and new ideas regardless of their source.” Real self-confidence is not reflected in a title, an expensive suit, a fancy car, or a series of acquisitions. It is reflected in your mindset: your readiness to grow.”

― Carol S. Dweck, Mindset: The New Psychology Of Success

p

(b) Atomic Habits by James Clear (Habit-Building)

Atomic Habits by James Clear is hands down, the best book on habits that I’ve read in 2019.

Essentially, this book rips off myths on conventional habit-building methods and introduces us to simple & scientifically proven hacks to build a good habit that lasts.

If you have problem building habits that last, this is THE book to go for.

“You should be far more concerned with your current trajectory than with your current results.”

― James Clear, Atomic Habits: An Easy & Proven Way to Build Good Habits & Break Bad Ones

p

(c) The Personal MBA by Josh Kaufman (Money, Personal Finance & Business)

The Personal MBA by Josh Kaufman will be my next read after I am done with Mindset.

The reason I am excited to read this book is that it covers a comprehensive aspect of personal finance and business – which I think would contain a whole lot of golden nuggets for me to discover.

Plus, you can now get this book at 41% OFF – which is really a great deal that I do not want you to miss out on.

“You can’t make positive discoveries that make your life better if you never try anything new.”

― Josh Kaufman, The Personal MBA: Master the Art of Business

#3 Optimize Your Financial Goals with a Professional Personal Financial Planner (BONUS: Free Consultation Session using my link below)

If you are looking to have a prosperous new year in 2020, you will definitely need a solid money plan on how to grow your wealth (like seriously).

This is even more important especially if you have a goal in mind that would need a big sum of money to accomplish in this new decade:

Planning to get married? Buying your first house or car? Looking to retire soon?

How about the plan for a trip to Japan, or the idea of changing your 3-year old smartphone this year?

If you have all these big (and small) financial goals in mind, and are still clueless about how to achieve them, engaging a Personal Financial Planner is the way to go.

Personally, I have worked alongside my very first Personal Financial Planner to get my 2020 financials planned with effective action steps – and I’ve learned so much about my finances.

Now, I DO NOT want you to pay for a Personal Financial Planner if you do not find value in their services.

For that, I am throwing in a FREE financial consultation session for you to find out for yourself (Click HERE to register) – I promise that it will be a time well-spent with great insights!

Verdict: The Best Return of Investment in Money Spent is When Your Grow Alongside Them.

One of my biggest satisfaction when it comes to money spent is to feel or know that I’ve learned something from the transaction.

As of the case for angpau money, it is even more meaningful to use them in ways that could elevate your wealth and/or growth to kickstart the year.

For me, that’s the best return ever.

Take care and have a great festive season! 🙂

Yi Xuan

Disclaimers:

(1) This post may contain affiliate links, which afford No Money Lah a commission if you make a purchase.

(2) Any investment related sharing in this article is purely my personal opinion and should not be taken as a buy/sell call. Please seek financial advice from a professional financial planner for this matter.

Last Updated on May 2, 2022 by Chin Yi Xuan

Related Posts

May 6, 2019

5 Money Mistakes to Avoid in Your 20s

January 30, 2019

The Malaysian’s Guide to CNY Angpau Rate (2019 Edition)

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.