Last Updated on May 2, 2022 by Chin Yi Xuan

YTL REIT is a Malaysian REIT that stands on its very own niche in the industry. In this article, I am going to present an in-depth analysis of YTL REIT and share my thoughts on this company as an investment.

Table of Contents

1. Background

YTL REIT is a Malaysia REIT that runs purely on hotel and hospitality-related assets. As such, it is a pure hospitality REIT in Malaysia that owns iconic investment assets such as JW Marriott Hotel Kuala Lumpur and The Majestic Hotel Kuala Lumpur, among many.

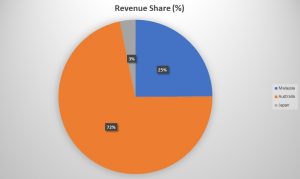

YTL REIT is also one of the few Malaysian REITs that owns a diverse portfolio of assets in foreign countries. As of the latest financial year ended 2018 (FY2018), YTL REIT’s Australia portfolio has been contributing near to 72% of total revenue, followed by 24.9% from their Malaysia portfolio and 3.3% from their Japan portfolio.

2. Portfolio Breakdown

(1) Malaysia Portfolio

In Malaysia, YTL REIT owns 10 hotel and hospitality assets. The company leases them out on a fixed lease basis to ensure income stability. As such, these assets are: JW Marriott Hotel KL, The Majestic Hotel KL, The Ritz-Carlton KL Hotel, The Ritz-Carlton KL Suite, Vistana KL, Vistana Penang, Vistana Kuantan, Pangkor Laut Resort, Tanjong Jara Resort, and the Cameron Highland Resort.

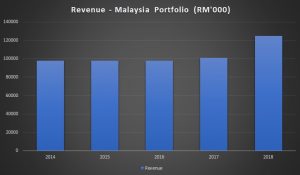

The question is, how did their Malaysian portfolio perform over the years?

Pretty consistent, actually. In fact, revenue for the past 4 financial years (2014 – 2017) has been rising steadily. In FY2018, there is a significant increase in revenue as YTL REIT has completed the acquisition for The Majestic Hotel KL and it provided a boost of income to the company.

(2) Japan Portfolio

YTL REIT owns Hilton Niseko Village located in Hokkaido, Japan. Like its Malaysian portfolio, it operates under a fixed lease basis to ensure a stable return for the company.

Over the past 5 financial years, the company’s business in Japan has produced steadily rising revenue for the company thanks to Hilton Niseko Village’s reputation as one of the most well-known ski resorts in Japan.

On 14th August 2018, a proposed acquisition is announced by YTL REIT for the acquisition of The Green Leaf Niseko Village for 6.0 billion Yen (equivalent to RM222.5 million, based on an exchange rate of 100 Yen : RM3.7078)

Upon completion of the Proposed Acquisition, it will be leased out for a lease period of 30 years, with an option granted to the vendor to renew the lease for a further term of 30 years.

With an initial annual rental payment for 315 million Yen for the first 5 years with a step-up provision of 5% every 5 years, this will ensure an increase in revenue contribution to the company from its Japanese portfolio.

(3) Australia Portfolio

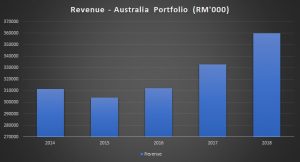

Unlike the investment assets from Malaysia and Japan, YTL REIT profits directly from the operation of their investment assets in Australia.

With the likes of Sydney Harbour Marriott, Brisbane Marriott and Melbourne Marriott, YTL REIT has been enjoying stable and consistent revenue growth for the past few financial years.

Occupancy rate is an important benchmark for real estate operation and performance. In FY2018, Sydney Harbour Marriott has enjoyed an average occupancy rate of 89.31% while Melbourne Marriott followed closely at an average of 87.09% and Brisbane Marriott at 85.06%.

3. Overall Financial Performance & Debt Status

Thanks to the steady performance of its portfolios, YTL REIT has registered a healthy revenue growth for the past 5 financial years.

For FY2018, YTL REIT recorded a gearing ratio at 37%, which is a respectable number among Malaysian REITs. This translates to a healthy borrowing status within the company.

4. Dividend Yield

Distribution per unit (DPU) for the past 5 financial years for investors was at its highest in FY2014 (8.46 sen) and remained between 7.8 sen to 8.08 sen for the following financial years.

For FY2018, YTL REIT paid a DPU of 7.868 sen, which translates to a Dividend Yield of 6.84% (base on the closing price of the last day of FY2018). This put the yield of YTL REIT well above famous Malaysian REITs such as SunREIT and IGB REIT.

5. Income Visibility

For a big chunk of its business (Malaysia & Japan portfolios), YTL REIT obtains its profit from leasing its investment assets to various operators and collect a fixed lease. This mitigates the fluctuation of potential low seasons in its hotel businesses and ensures a stable income flow for the company.

Below is a compilation of the lease details of YTL REIT’s investment assets:

The table above shown a healthy lease expiry period, and this ensures stability in income source at least for the next 5 financial years.

6. Current Valuation

At a closing price of RM1.24/unit (5th October 2018), YTL REIT is close to its 52-Weeks high of RM1.28/unit. That being said, YTL REIT still has a space for potential upside as it is well below its Net Asset Value Per Unit (NAVPU) of RM1.595/unit.

7. Potential Risks

One of the major risk that YTL REIT may face is interest rate risk. With a 20% to 80% fixed-floating debt interest structure, YTL REIT is exposed to the risk of potential interest hikes in the economy. A hike in interest rate will increase the operating expenses of the business and impact its earnings.

Another risk faced by YTL REIT in its business is forex risk. With near to 72% of revenue contribution from its Australian business, any fluctuation in foreign exchange between the Malaysian Ringgit and the Aussie Dollar will impact their earnings as well.

No Money Lah’s Verdict

I’ve long looked into YTL REIT as one of the better REIT investment for passive income purpose in Malaysia.

Its track record in income stability and manageable gearing (despite running a seasonality inclined hotel business), coupled with a decent dividend yield in comparison to the other Malaysian REITs make YTL REIT a good REIT to invest in for capital appreciation and passive dividend income.

p.s. This article is purely a review of the company’s fundamental status and DOES NOT serve as a buy recommendation.

Always wanted to learn to invest but do not know where to start? No Money Lah provides personal coaching sessions and investing workshops for individuals, organizations, and communities to learn practical investing techniques and knowledge!

Related Posts

October 1, 2018

How Can You Make The Best Out of The Last 90 Days of 2018?

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Great effort yi xuan! Loving the clean UI. In regards to the name of your webpage, do enlighten us readers on how young adults should budget/earn/invest (Fresh grads) to finally move away from ‘no money la’

Cheers

Thanks Wilson!

Will come out with more money/personal finance related articles along the way in order to do so! Hopefully one day all of us would be able to move away from being No Money Lah to No Problem Lah haha!

Cheers,

Yi Xuan