Last Updated on May 2, 2022 by Chin Yi Xuan

In this post, I will address one issue: How to protect ourselves from a market downturn. But firstly, a little bit of context:

Look, I know the country’s state of economy is not in a good shape right now.

Table of Contents

But seriously, how bad are we at the moment?

Looking back at the KLCI index, we’ve been enjoying strong growth since the end of 2016 towards the peak of 1896.03 points in April 2018. That was right before our election in 509. As such, we enjoyed a whopping 17% growth for more than a year!

That said, weakened investor confidence after 509, coupled with trade war and other internal and external geopolitical uncertainties have impacted our market heavily. This is especially true among the construction and tech sector.

A simple chart analysis (purple circle) in October will show that we are indeed heading towards a market downturn (or bear market), at least for a medium to long-term period. In simple word, a general sign of a market shifting towards a downward trend can be observed when the 200MA (black line) crossed above the 150MA (yellow line) and 50MA (green line), and all 3 of them are sloping down.

Some facts on bear market:

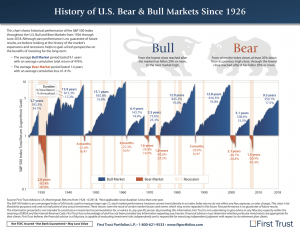

- In the U.S., an average Bear Market lasted for a period of 1.4 years, with an average cumulative loss of 41%.

- This will be followed by the Bull Market which on average, lasted for 9.1 years with an average cumulative return of 476%.

In short, for months to come, there is a need to brace ourselves for any punches from the local and global economy before the eventual rebound.

Here are 3 practical ways to protect ourselves in the event of a market downturn:

(1) Diversification of Income Streams

In any period of downturn, there will be unavoidable lay-offs.

Unfortunately, the good old time of working one stable job forever is now obsolete. Anyone and everyone is replaceable in a bad market condition and changing political landscape (read: our infrastructure projects after 509).

The safest bet is not to expect your boss (and government) to be loyal to you during the bad times.

Hence, it is important to start diversifying our income streams. In other words, we should not just depend on our current job as the only source of money.

Instead, spend your free time (and potentially time you would waste in social media anyway) to generate side income through existing passion and skills (eg. Piano, Photography, Marketing). Look around, the demand for your skill and passion is everywhere!

Also, it is equally important to learn to invest (not just relying on your mutual fund agent!) as another stream of income via capital appreciation (the profit when the price rises from the price you bought) and dividend income. It always feels safer when you are fully in control with your investments!

(2) Rational Investing*

In a market downturn, even the best stock investor loses money. But what differentiates these investors and layman is their discipline to admit to their losses and sell off their holdings.

In a bear market, low prices could go even lower. This is true even for fundamentally sound companies.

Hence, it is important to protect yourself by being rational during a market downturn. Grab your profit, even if it is lesser than what you’ve wished for. Stop losses if necessary, even if it hurts your ego while doing so.

Essentially, it is crucial to make decisions rationally during a market downturn.

*The key to making rational investment decisions in a market downturn is to know what you are doing! If you are not familiar with the stock market, it is wise to stay out from the market during a downturn. (Even better, follow No Money Lah on Facebook to keep yourself updated!)

(3) Manage Your Debt and Expenses!

Just like any businesses, we will be in trouble if we do not manage our debt and expenses properly in the time of a market downturn.

Hence, cut down on unnecessary expenses. Track your daily and monthly expenses, cut off the fats. Cancel the Astro and Hypp TV subscriptions already if you don’t even watch them anymore!

Also, don’t take on debt that you cannot handle or would suffocate yourself to service. It is fine to not have a beautiful car or gorgeous house now. Everyone’s pace in life is different, so are yours.

No Money Lah’s Verdict

Unfortunately, we are slowly stepping into the spiral of downturn as you read this. This economic downturn might last for a few months, or if it got worse, years.

Just like how spring and summer will always follow after a cold winter, fingers crossed that we will see a change of season in the market soon. However, we are not in place to decide when this winter will end.

What we have the ability to control, though, is to prepare ourselves to face any situation to come in the market and the economy.

I wish all of us the best!

Interested in learning to make informed investment decisions regardless of market condition?

No Money Lah organizes investing workshops and gatherings for individuals and communities that are keen to learn.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.