Last Updated on May 2, 2022 by Chin Yi Xuan

Private Retirement Scheme (PRS) is introduced as an additional retirement investment scheme (aside from EPF) to better prep Malaysians for retirement.

On top of that, the government has introduced the PRS Youth Incentive, a one-off RM1000 top-up for young adults between age 20 – 30 if he or she invests a minimum of RM1,000 into a PRS account.

In simple terms, you would have made of 100% return out of your initial investment with this incentive. With that in mind, the period of the incentive will be ending by 31st December 2018. Hence, it is the last window of opportunity for us to enjoy the incentive.

Note: This week, instead of my writing, I would like to pass the stage to my buddy, Varian Soong. He is currently a Credit Analyst in MCIS Insurance and he’ll share 3 simple hacks that you can use to identify the fund that suits you the best! The floor is yours, Varian!

—

Hi fellow readers of No Money Lah! Here are 3 simple (and important hacks) that you can use to identify the most suitable PRS fund for yourself!

To start, PRS is somewhat a combination of EPF and unit trust.

Just like any investment, PRS does not guarantee return on your principal. This simply means that your final withdrawal amount will base purely on the fund’s performance. Hence, it is crucial for you to choose the fund that suits your age, lifestyle and risk appetite.

Another thing to note is you can only do a full withdrawal once you reach the age of 55 (or pre-withdrawal with a fee).

In the present, there are 8 PRS Providers in Malaysia, each with its own unique style of fund:

- Affin Hwang Asset Management

- AIA

- AmInvest

- CIMB-Principal

- Kenanga Investors

- Manulife Asset Management

- Public Mutual

- RHB Asset Management

In general, each provider offers three general categories of fund, which are conservative (mostly fixed-income assets like bonds and deposits), balanced (balanced proportion of fixed Income assets and equity) and aggressive (high proportion of equity).

Depending on your risk appetite and your target return, you can choose the fund that suits you the most. Some funds even invest overseas if you are looking into that.

Table of Contents

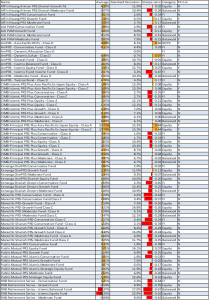

List of PRS Funds in Malaysia

Below is a list of PRS funds that you can choose to invest in when you open a PRS account, along with some useful benchmarks to guide you in your decision-making process:

(1) Average Annual Return*

The Average in the table refers to the average annual return you would get in a year.

Similar to any form of investments, PRS funds’ performance fluctuates with time. At times, it may go above the average return and below it or even negative occasionally. That said, if you hold it long enough, say until 55 years old, your average return should reflect the number.

Let’s say you opt for the fund with highest average return (CIMB-Principal PRS Plus Asia Pacific Ex Japan Equity – Class A). At 10.7% (and at age 24), your RM2,000 initial investment could be compounded to RM46,810 when you are 55! That is enough to buy yourself a new Myvi with CASH!

*Refers to the geometric means of annualized return which has incorporated compounding effect in it. I used ‘average’ for layman description.

(2) Standard Deviation

Next, the Standard Deviation reflects how risky the fund of your choice is.

Take the earlier example, the fund has a standard deviation of 15.3%. This means that your yearly return can sometimes fluctuate to up to 26% or down to a loss of -4.6%. Like the saying goes, high risk high return.

(3) Sharpe Ratio

Finally, let’s look into the last and most important benchmark, the Sharpe Ratio. The Sharpe Ratio is one of the most widely used benchmark to evaluate a fund’s performance.

In general, a positive number shows that capability of the fund to generate money for you. A negative number shows the fund took too much risk than the return could justify. This means that the higher the magnitude, the more reliable the ratio is.

Referring to the example, the fund is shown to have a Sharpe Ratio of 0.44. In other words, the fund is generating a solid return and not simply gambling our money away.

Conclusion

Not to mislead you, the example given is merely for convenience sake. Ultimately, you have the say on which fund that would suit your risk appetite.

For example, the AmPRS – Dynamic Sukuk – Class D is a safer investment as it offers an average return of 4.6%, which is more than the return from fixed deposit (FD).

An important note that the data used are from the period of 2013-2018 (annualized) and some are lesser than that. It means that the calculation would have some error as more data is needed to have a reliable measurement (minimum of 30 years). Therefore, take the number as a general guide and not an absolute deciding factor for your investment.

Back to you, Yi Xuan!

—

No Money Lah’s Verdict

To be frank, I’ve never looked into PRS in detail and I was shocked when I realized that there are so many funds available for us to invest in!

For a young fresh graduate, if I were to invest in a PRS fund, I would opt for AmPRS – Asia Pacific REITs – Class D given its decent Sharpe Ratio and average return, plus a Standard Deviation that is still rather low compared to other performing funds.

Now that you have a clear idea on how to find your choice of PRS fund, which fund would you choose to invest in? Let me know in the comment section below! (remember to open a PRS account by end of this year to enjoy the youth incentive!)

—

About the contributor:

Varian Soong is an Economics graduate from University of Malaya. Being one of the brightest of his batch, he came in as the 1st runner-up in 2017 CFA Institute Research Challenge. Also, he has completed CFA Level 1 professional paper prior to his graduation. He is now pursuing his professional career as a Credit Analyst in MCIS Insurance.

Connect with him on LinkedIn here.

Related Posts

October 14, 2018

5 Simple Social & Networking Hacks for Introverts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

1. “However, unlike unit trust, PRS does not guarantee return on your principal.” I think unit trust also does not guarantee return.

2. The return for Average Annual Return is annualised return or merely divided by number of years? If it is the latter then it’s inappropriate to use it for compound interest calculation.

Hi Zen!

Thank you so much for your feedback!

1. I’ve made the necessary changes to the mistake thank you!

2. It is actually the geometric means of annualized return which has incorporated compounding effect in it. Varian has used ‘average’ for layman description.

Thank you so much for reading, and appreciate your feedback!

Cheers,

Yi Xuan

hi Guys,

Really good info for the PRS newbies like me. Even i think not to late for me to invest more even though i’m not in the list of Youth category. 🙂

Happy invest all!

Indeed you are right! Never too late to start investing!

Cheers!

Hi, this article is really useful for me!!!

May I know how to get the latest list of the PRS Fund which shows the benchmark as mentioned above?

Thank you.

Hi Yee!

You can find more details of the funds at https://my.morningstar.com/ap/main/default.aspx.

(Refer to the list in this article to see which funds are PRS funds)

Cheers,

Yi Xuan