Last Updated on May 2, 2022 by Chin Yi Xuan

Look, you are now a working adult with a decent monthly income. However, no matter what you how hard you work every month, your money in the bank doesn’t seem to grow much, at least not at the extent you desire.

They (the society) says that you got to have a house by 30, and you are looking to marry the girl of your life by the age as well. Damn, what about the expenses with having kids after that?

Where will all this money come from?

You see, many of us know the importance of money. However, only a few know how to manage money.

Coincidentally, the people that know how to manage money are the ones are financially better off in life. Heck, they may not even earn as much as you every month, but they are wealthier than you in the end.

Why is it so?

One of the reason is that they have clear and precise financial goals, and they work towards it with commitment and discipline no matter their current financial condition.

If you want to make the most out of your hard-earned money, here are 4 ultimate financial goals in life that you got to strive to achieve:

Table of Contents

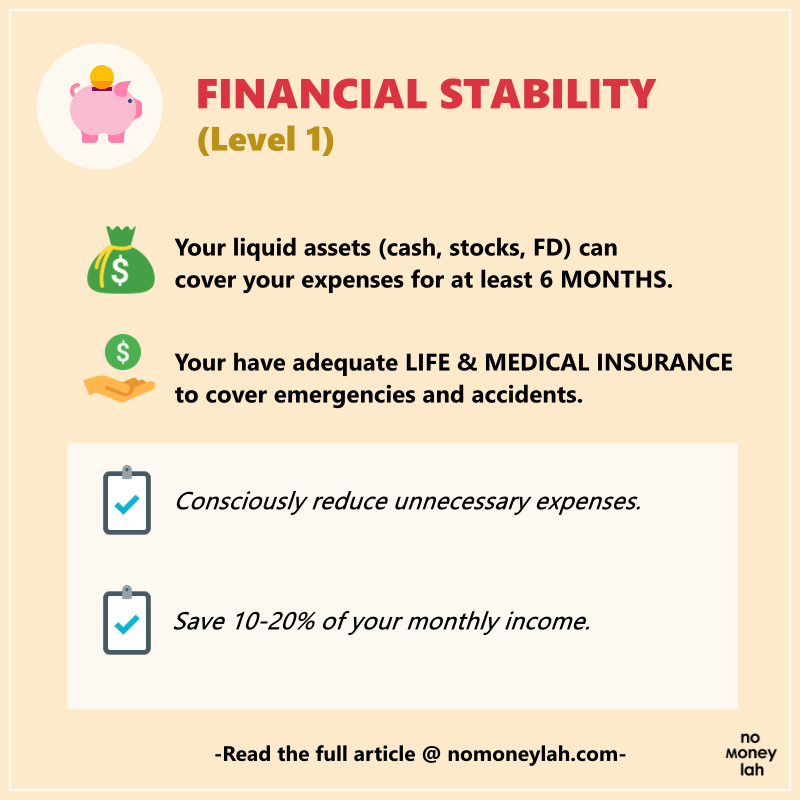

Level 1: Financial Stability

To achieve any sort of financial successes in life, you must first aim to achieve Financial Stability.

Essentially, you have attained Financial Stability when:

- Your existing liquid assets* are 6 times your monthly expenses, and,

- You have life and hospitalization insurance to cover you and/or your family’s expenses should anything happen to you.

In short, attaining Financial Stability will give you peace of mind knowing that your current lifestyle is in good hands should unexpected events such as retrenchment and accidents happen to you.

How to achieve Financial Stability?

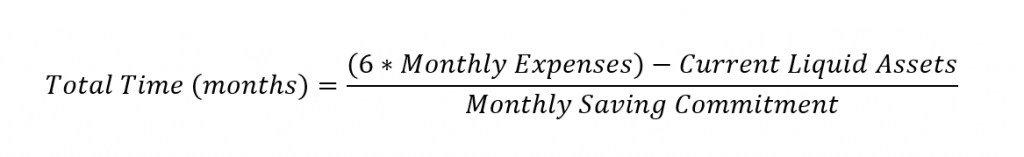

Step 1: Identify your current monthly expenses.

Step 2: Identify your current status of liquid assets.

Step 3: Identify the total liquid assets needed to cover your monthly expenses for 6 months. (6 x Monthly Expenses – Current Liquid Assets)

Step 4: Commit to save at least 10% – 20% of your net income every month to fill up the differences.

Step 5: Identify how long you will take to achieve Financial Stability given your saving commitment:

Step 6: Last but not least, make sure you have enough insurance coverage for you and your family members!

*Liquid assets are things such as cash or assets that can be readily converted into cash. (eg. Fixed Deposit, Stocks, Unit Trusts)

p

Level 2: Financial Security

Financial Security is the level of wealth where you have attained income-generating assets and investments to generate passive income enough to cover your most basic expenses.

At this level, you can stop working and still live a very basic lifestyle. It also means that if you continue to work, all your active income will go towards building other income streams and investments and this will further compound your overall asset value.

A list of basic expenses is:

- Personal/family expenses (eg. Food, groceries)

- House and car loans

- Transportation (eg. Petrol, Touch & Go)

- Utilities (eg. Water and electricity bill, phone bill)

- Credit card interest repayment

- Insurance premium

How to achieve Financial Security?

Step 1: Identify your basic expenses (monthly) and multiply by 12 months to find out your basic expenses per year.

Step 2: Identify your current passive income per month. How much more do you need to fill in the balance to cover your basic expenses?

Step 3: Think of all the potential income streams and income-generating assets that could generate the passive income needed to cover your basic expenses.

Step 4: Execute and build those income streams and assets.

As an example, you could focus on building your passive income via intellectual properties (eg. Books, Courses) and investment in dividend-generating stocks (eg. REITs). As a rule of thumb, focus on building at least 3 – 5 streams of income-generating assets.

p

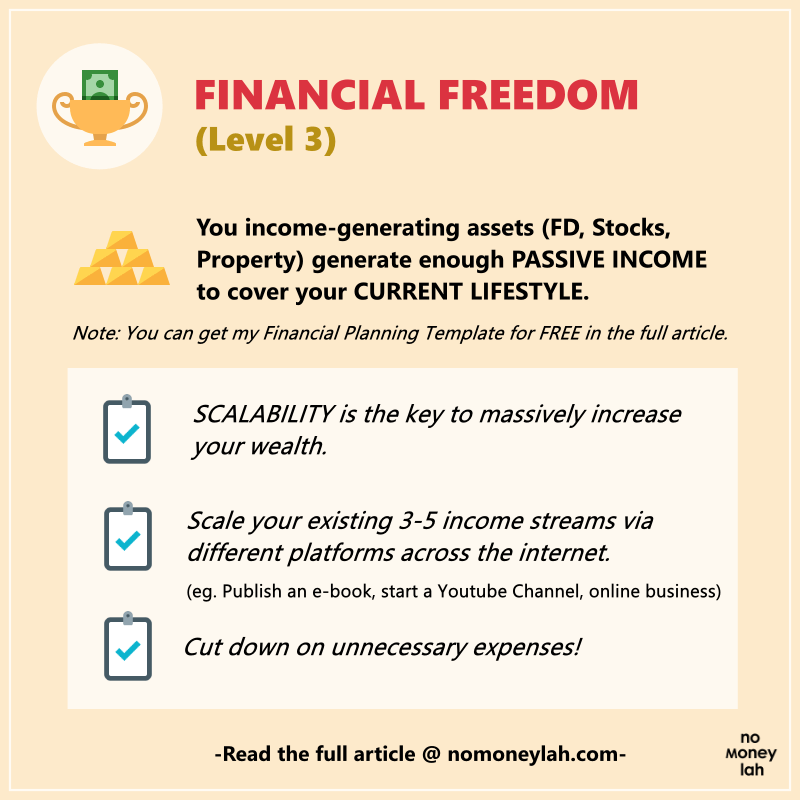

Level 3: Financial Freedom

You have achieved Financial Freedom when your level of passive income is able to sustain your current lifestyle. This may include things like going for vacation abroad once every year and a decent birthday meal for your loved ones a few times a year.

Achieving Financial Freedom is one of the most enlightening moment in life, as you continue working not because you have to, but because you choose to do so.

Again, depending on your lifestyle (how you spend), you may achieve Financial Freedom earlier or later than others. Hence, to achieve Financial Freedom, it is also essential for you to cut down unnecessary expenses.

How to achieve Financial Freedom?

Once you have built at least 3 – 5 income-generating assets and achieve Financial Security (Level 2), you have to learn how to scale them to influence more potential customers and increase your return.

As an example, if you have written a book, now you can write an e-book or online course to teach people your knowledge. Having your products online have a higher scalability factor that could reach out to more potential customers.

Likewise, you could start a YouTube channel or blog to reach out to more customers within your niche area.

p

Level 4: Financial Abundance

Financial Abundance is a level higher compared to Financial Freedom. It is a stage where your passive income is able to sustain your dream life. This is the level that is achieved by people such as Warren Buffett and Bill Gates.

How to achieve Financial Abundance?

As the popular saying goes: In general, every millionaire has an average of 7 income streams. Hence, it is essential for you to expand your income streams in order to achieve Financial Abundance.

Some of it may include investments into high-yield businesses and stocks, high scalability online business, investments into real estate, network marketing and more.

p

Financial Plan to Achieve Financial Security, Financial Freedom and Financial Abundance

An example below is a template that you can use to plan your financial goals.

Remember, while some income-generating assets do need certain capital to start, many can be started without much capital in hand. The most important thing is to just START and give your 101% in effort.

Also, do note that income-generating assets that produce passive income does domean that you got to sit there and wait for the money to flow in. In general, most passive income streams require your attention and utmost effort to build and sustain, especially during the early years.

p

No Money Lah’s Verdict

So here you go! To ensure financial success in life, here are 4 financial goals that you should strive to attain, stage by stage.

Before we part ways in this article, do understand that no one stage is easier to achieve that the other. Do not feel depressed if you haven’t achieved any of these goals yet (I myself is working towards Level 1 too!).

Rather, let’s devise plans and call-to-actions to make sure we commit and work towards these goals!

I wish you an amazing financial journey and I look forward to hear your financial success stories some day in the future!

Learn how I build PASSIVE INCOME in the stock market with MINIMAL RISK!

p.s. This post is inspired by Adam Khoo’s book ‘Secrets of Self-Made Millionaires’. You can get this book at any local bookstores near you.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.