Last Updated on May 2, 2022 by Chin Yi Xuan

Let’s say you were given an option to choose between taking RM3 million (RM3,000,000) in cash this very instant and a single cent (RM0.01) that doubles in value every day for 31 days, which option would you choose?

p

Table of Contents

The Incredible Story of a Compounding Penny

When I first encountered this question in a book, picking RM3 million seemed like a no-brainer. After all, how would a single cent make any difference in my bank account?

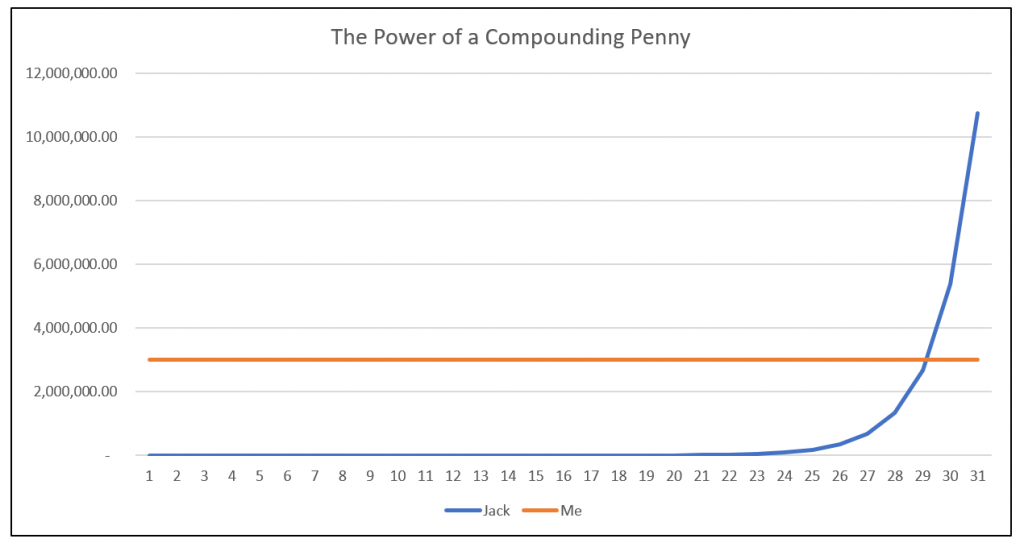

Now, let’s say I eventually chose to take RM3 million in cash, and my friend, Jack, chose the latter:

p

Day-5: I would feel sorry for Jack because he only has 16 cents (RM0.16) compared to my gigantic RM3 million.

Day-10: I would be laughing at Jack because he only managed to accumulate RM5.12 in his pocket.

Day-20: With only 11 days left, Jack has only RM5,243 with him compared to my RM3 million. In that instant, it is easy to dismiss and conclude that Jack has made a poor decision in life.

However, it is not until the final days of the 31-days bet that we finally witness the magic of a doubling cent.

Day-29: Jack has managed to accumulate RM2.7 million. Close enough, but still lesser than my RM3 million.

Then, by Day-30, Jack finally surpassed me and accumulated RM5.3 million on hand. Finally, on Day-31, Jack won the month-long bet by making RM10.7 million (vs my RM3 million) merely from a single cent that doubles in value.

p

This would have put me into shame and regret with my decision, but more importantly, we see why being consistent over time is so crucial.

p

How did Warren Buffett Become So Rich?

It may seem crazy how a single cent that doubles in value can grow into such extend given consistency and time.

This is the Power of Compounding Effect. It is the idea that given time, with the consistency in effort (eg. Investments, Habits), the payoff will eventually compound and return to us in an exponential rate (as seen in the previous chart).

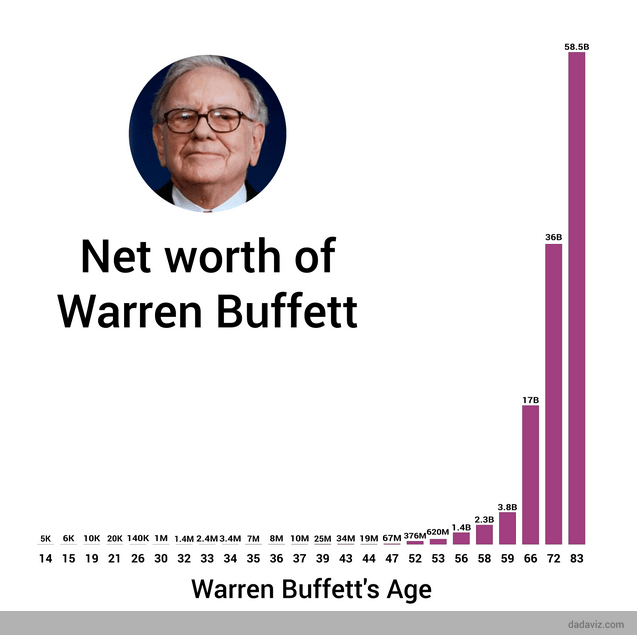

Warren Buffett, one of the richest figure in the world, built his wealth mainly via interest from the companies that he invested in. At age 56, his net worth was $1.4 billion. If this looks like a lot to you, his wealth grew more than 1000% to $17 billion by the age of 66!

If you observe the image below carefully, you will realize that the vast majority Warren Buffett’s fortune is acquired later in life. In fact, it is the power of compounding that triggered such an exploding growth, very much alike with the story of the Compounding Penny above.

p

Great. So What Does That Mean for You and Me?

(1) Positive behaviors and habits, no matter how small they are, given time, will become a formidable push of success via Compounding Effect:

Hence, start now.

You may not see the immediate effect of jogging 2km daily, but you will be surprised by how healthy your life will become if done consistently.

You may not become financially free right after learning new investing knowledge, but you will be surprised by how continuous learning will lead you to your goals if done consistently.

You may not become rich instantly after investing, but you will be surprised by how an RM1,000 investment into the right company can grow by more than 470% in 30 years (at a conservative 6% dividend return a year) if you have the patience to let your wealth grow via Compounding Effect.

Again, start now.

p

(2) The idea behind Compounding Effect is simple and powerful. And it can work both ways:

You could either take control and work consistently towards your life and financial goals from now on, OR you could choose to do, well, nothing.

Taking charge of your life with consistent life and money habits may not be the most comfortable option at the beginning (well, isn’t that always the case with making changes in life?). But given time, persistence and the right strategies, your path to success is only a matter of time:

A matter of time before momentum takes off and the power of compounding effect starts rewarding you with exponential returns.

On the contrary, sticking with your current life and financial status with no intention to improve may be the best option at the moment. After all, we ain’t have time for this, right?

But if you choose to do so, just do not regret with the fact that mediocrity will always be part of your life. Period.

The Conversation Between 2 of the Richest Men on Earth

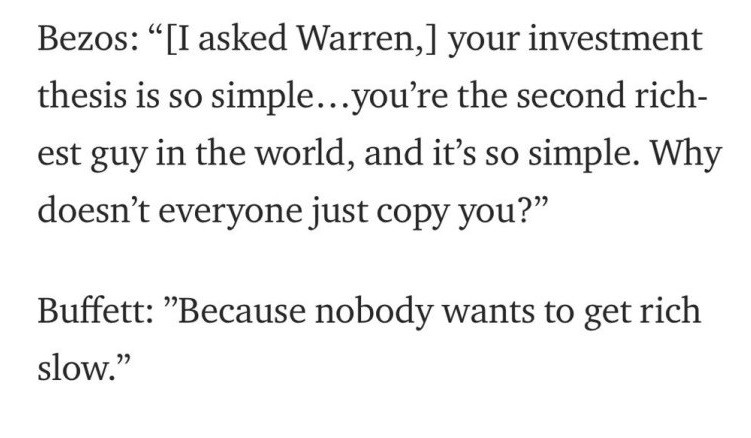

Jeff Bezos once had a conversation with Warren Buffett, and I think this conversation would bring a very on-point end to this article. The conversation went on like this:

Now that you understand the Art of Getting Rich, here are 4 Financial Goals in life and how to achieve them!

Learn how I build PASSIVE INCOME in the stock market with MINIMAL RISK!

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Was this an idea that come from the book “Compounding effect?” If so, I gotta read it right now. lol

Hey Stanley!

Yes it is haha! This article is inspired by the book 🙂

Yi Xuan