Last Updated on May 2, 2022 by Chin Yi Xuan

As a kid, two of my most visited shopping malls are Mid Valley and Sunway Pyramid. While both are without doubt huge malls, an experience stood out the most while I visited these malls every time as a kid: it was pretty damn hard to look for a parking space!

Wouldn’t it be amazing if you can own part of these crowd-magnet malls, or get a share out of their profit?

Well, in a way, you can!

Today, I would like to talk about Real Estate Investment Trust (REIT), a personal favorite subject of mine.

Table of Contents

(1) What are REITs?

Real Estate Investment Trusts (REITs) are companies that own and/or operate real estate. Publicly listed REITs are traded just like any stocks listed in the stock market, making it very easy to invest in REITs.

Some of the more well-known real estates that are part of Malaysia REITs portfolio include Sunway Pyramid (SunREIT), Mid Valley (IGB REIT), The Gardens (IGB REIT), KPJ Hospitals and Specialist Centers (Al-Aqar REIT), Pavilion (PavREIT), JW Marriott hotel (YTL REIT) and more.

In short, REITs are great investment instrument for those who wish to own or profit from popular and profitable real estates – where others spend and consume on these places, you profit from them.

(2) How do REITs make money?

To recap, REITs are companies that own and/or operate real estate. When it comes to real estate, it is not hard to understand the underlying business model of REITs – a.k.a. How do REITs make money?

Mainly, REITs make money through rental income from the real estates that they own and/or operate.

As an example, IGB REIT’s income is derived from the rental collected from its tenants for both Mid Valley and The Gardens Mall.

(3) Why Invest in REITs? – the Pros of REIT Investment

REITs are especially well-received among people longing for long-term investment for some of the reasons below:

a. High proportion of Income Distribution

In order to be qualified as a REIT, companies are required to pay out at least 90% of its net income as dividend to their investors.

Which lead me to my second point…

b. Attractive Dividend Yield – making it a great passive income stream

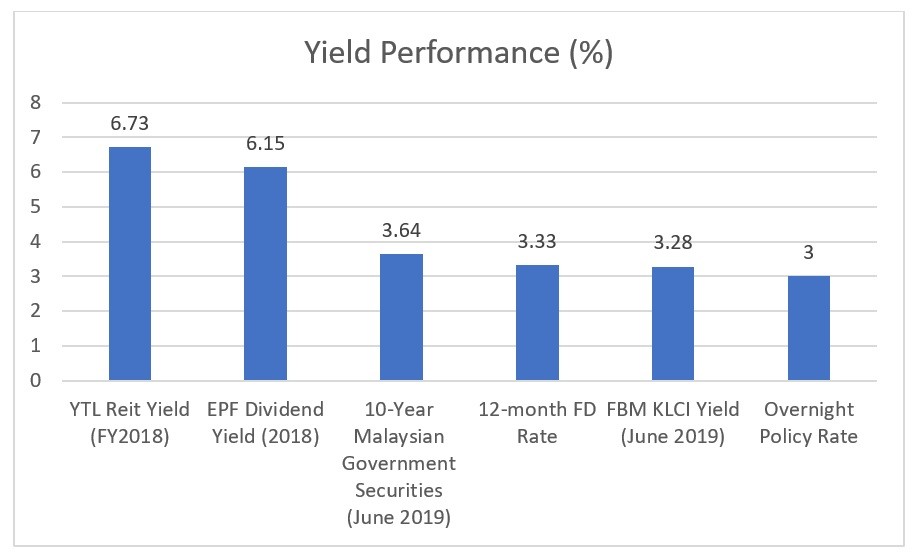

Due to the dividend payout nature of REITs, dividend yield from REITs is generally better than typical stocks dividend in the market.

In general, Malaysian REITs yield a decent 5% – 7% dividend on a yearly basis. Aside from that, should investors time their entry point properly, they are also able to enjoy growth from capital appreciation as well. (eg. Buy at RM1.00/unit. A price rise to RM1.20 will make up to 20% capital growth for investors)

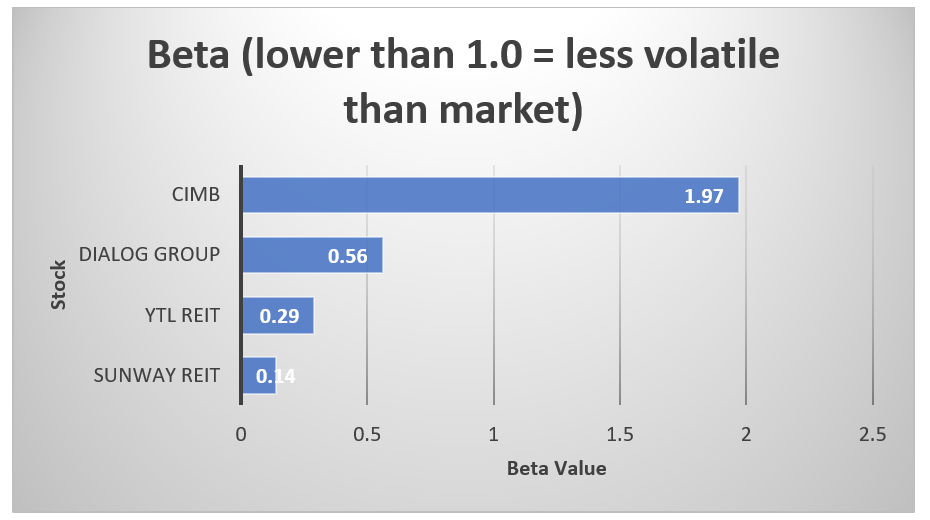

c. Relatively less risky than typical stock investments

REIT investment is also relatively less risky compared to typical stock investments due to most REIT’s business model that lock in tenants for at least 1 – 3 years, ensuring a relatively stable income stream for REITs.

(4) Cons & Risks of Investing in REITs

a. Less capital growth opportunity

Due to its nature of being more stable in relative to typical stock investments, REITs growth in revenue and profit is often predictable, making it less exciting for short-term speculators and traders to speculate the REIT sector.

In other words, REITs growth are more likely supported by its fundamental business growth – making REITs an answer for those who seek long-term investment opportunities, but not so much for short-term speculators and traders.

b. Exposure to Market Fluctuation

Unlike conventional real estate investment, publicly listed REITs are also constantly exposed to a certain degree of market fluctuation due to its nature of being listed in the stock market.

Meaning, regardless of the fundamental stability of a REIT business, REITs are still prone to a certain degree of price fluctuation in the market.

c. Change in Portfolios’ Fundamental

Similar to conventional real estate investment, REITs also have the risk of having a strong income-producing real estate turning otherwise due to changes in market demand or fundamentals.

As an example, Sungei Wang Plaza (CMMT) and Subang Parade (Hektar REIT) used to be the to-go malls in the 90s, yet the rise of more attractive malls eventually replaced their glory.

(5) How to Invest in REITs?

There are both private (Alpha REIT) and public-listed REITs (eg. SunREIT, IGB REIT, Axis REIT, YTL REIT) in Malaysia.

Generally, the easiest and most common way for one to invest in REITs is through the stock market, as there is where one can find publicly-listed REITs to invest in.

No Money Lah’s Verdict

Personally, I find REIT investment relatively simple to understand and work around, due to its business model that is (most of the time) straightforward.

In a way, REITs allow retail investors to invest in a portfolio of income-generating real estates, while enjoying the convenience of participation of the stock market. (eg. Buy and sell as instantly as you please, unlike conventional real estate/property transactions)

With that in mind, I believe that there is no harm to have REITs in your investment portfolio.

In the coming posts, I will dive into the different type of REITs and an overview of REITs in Malaysia, so stay tuned!

Do you invest in REITs? If you do, what REITs have you been investing lately? Would love to hear from you!

p.s. REITs are my personal favorite when it comes to long-term investment due to its decent dividend and simple-to-understand business model.

Related Posts

January 23, 2022

[Sponsored Post] What is ASNB and How to Invest in It?

January 25, 2019

How to Invest Using a Robo Advisor in Malaysia

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.