Last Updated on January 26, 2023 by Chin Yi Xuan

Gold is an asset that has been universally recognized as a store of wealth since ancient times. Despite not being a legal tender form of exchange (read: currency) these days, gold is still widely accumulated by the society and countries alike.

In this article, let’s look at some interesting (and lesser-known) facts about gold, WHY invest in them, and HOW to invest in gold as a Malaysian.

Table of Contents

What Makes Gold So Attractive?

(1) Gold is uniquely beautiful

Gold is stunning on its own. As such, gold’s shinny and elegant nature make it an attractive choice for jewelry and life accessories alike.

(2) Gold is scarce

Gold is a type of commodity. This means it is a rare metal and the amount of gold available to mankind is limited.

Not only that, the mining process of gold is also painstaking and expensive, making gold an even more valuable asset to own.

(3) Gold is durable and useful

Gold does not decay or rust – and it is almost indestructible. All the gold ever mined is still around in one form or another.

In addition, gold is a good reflector of light and an excellent electric conductor. This contributes to the extensive usage of gold in electronics such as circuits, dental fillings and more.

(4) Gold is homogeneous

One pure gram of gold is similar in value to the next gram. This makes it easy for people to ascertain gold’s value and utilizing it in trade and commerce.

Having understood the characteristics of gold, it is useful for us to understand WHERE gold is being supplied and HOW gold is being used in the world.

p

Supply & Demand of Gold

Have you ever wonder how is gold being supplied all around the world?

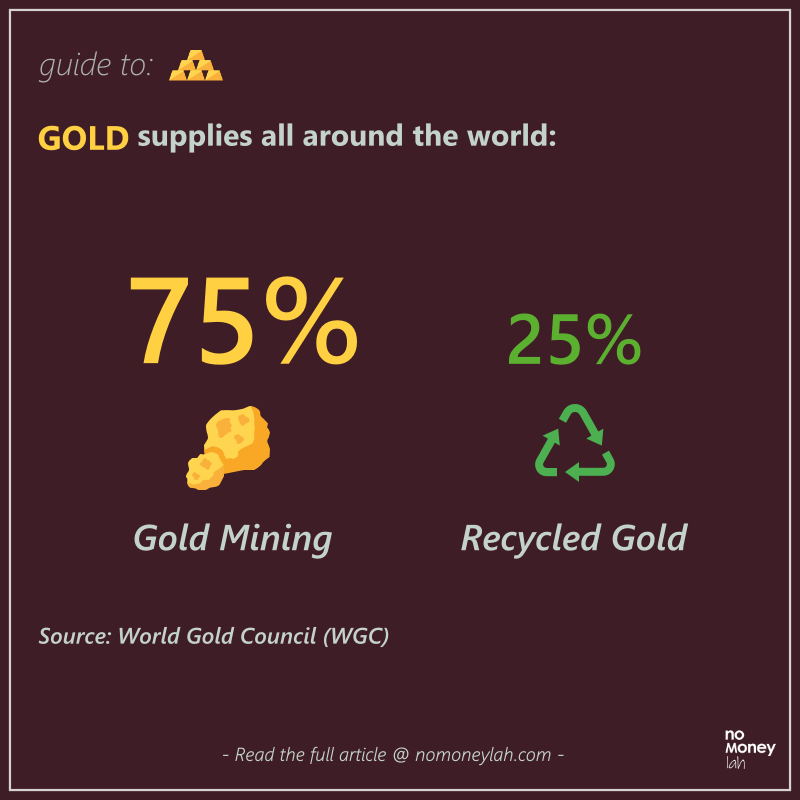

According to the World Gold Council (WGC), around 75% of the world’s gold demand is contributed by gold mining. Unlike paper money which can be printed with relative ease, the only known way to produced gold is to mine them.

That said, gold that is mined is usually not enough to meet the demand for gold. Hence, the remaining 25% of gold demand is met by the recycling of gold. These recycled gold supplies come mainly from jewelry (~90%) and gold extracted from technological hardware.

p

If that’s the case, WHO is buying gold around the world?

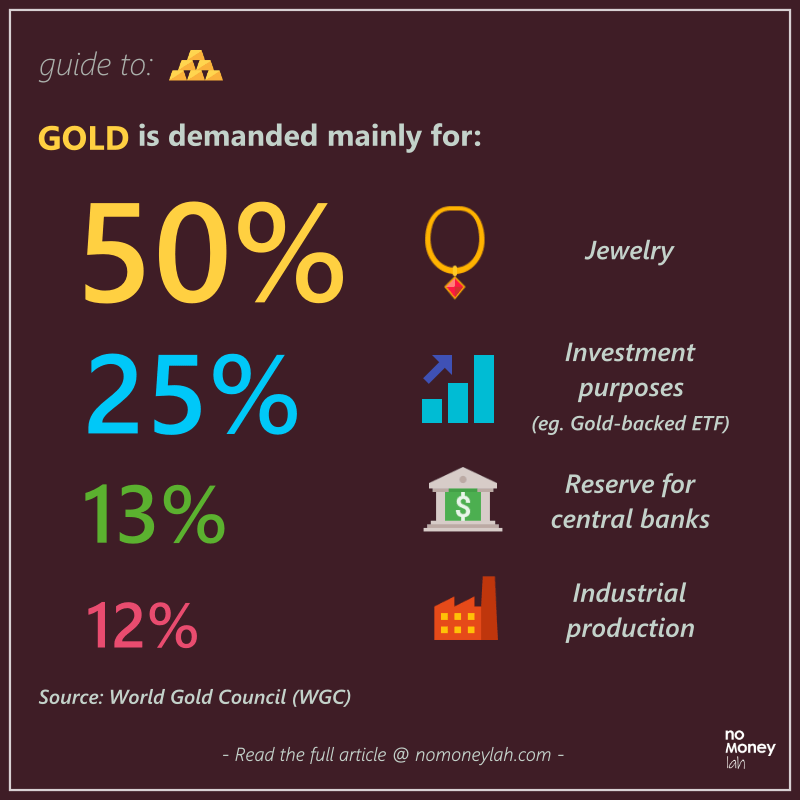

There has been 4 main use of gold worldwide.

The first use of gold, which takes up around 50% of the total demand, comes from (you’ve guessed it) – jewelry.

This is followed by investment-related purposes (eg. Gold-backed ETFs), which contribute to around 25% of total gold demand. In addition, gold is also accumulated by central banks all around the world. This takes up around 13% of total gold demand.

Lastly, gold usage for industrial production takes up the rest of the demand.

p

Which country holds the most gold?

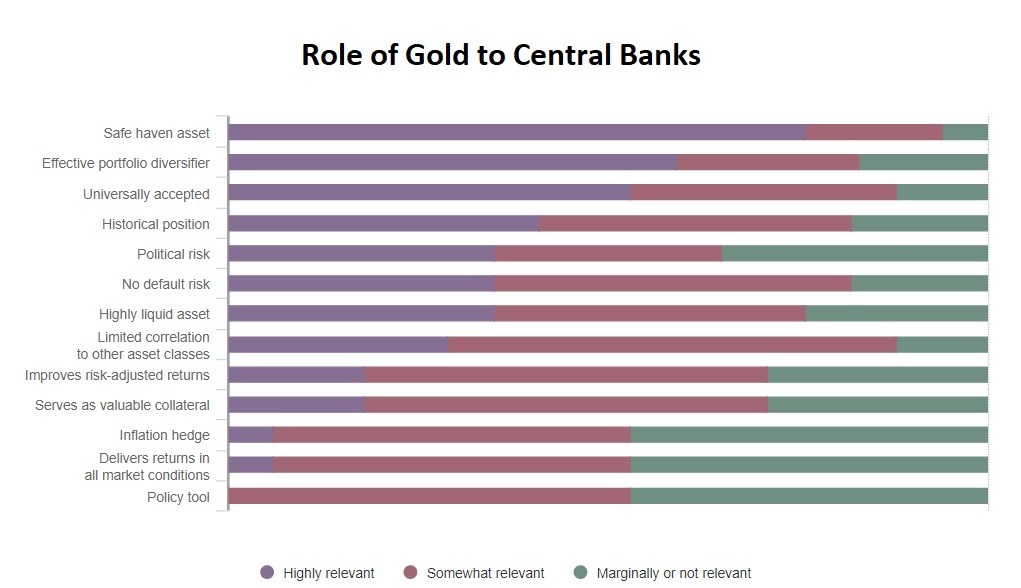

Now, as mentioned, gold is highly accumulated by the central banks of many countries. Gold is being held as part of a nation’s reserves, mainly due to gold’s nature as a safe haven asset and an effective diversification of their portfolio.

p

With that in mind, let’s make a smart guess before you proceed – which are the countries that hold the most gold?

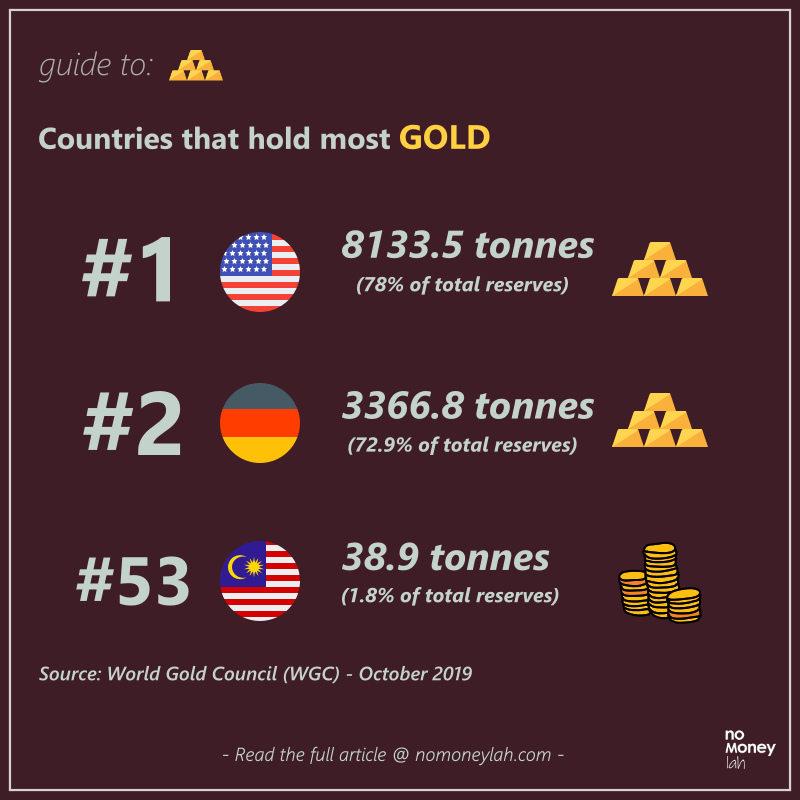

As of October 2019, the United States holds the most gold in its national reserves (8133.5 tonnes!) – which takes up near to 78% of the total reserves. The far second is Germany with a total gold reserve of 3366.8 tonnes, making up 72.9% of the country’s total reserves.

Countries like China and India have a gold reserve of 1942.4 tonnes and 618.2 tonnes respectively, making up less than 8% of these countries’ total reserves.

Back in Malaysia, we are placed at 53rd (out of 100 countries) when it comes to our total gold holdings. This translates to a total gold holding of 38.9 tonnes – which is 1.8% of Malaysia’s total reserves.

p

Why invest in gold?

(a) Hedge against the drop in interest rate & geopolitical uncertainties

With global powerhouses like the US reducing its interest rate, it is inevitable that there will be a drop in return (or yield) of major bonds in the market. This will cause the return of bonds less attractive in the eyes of investors.

Adding on to various geopolitical uncertainties, this makes gold especially appealing as a safe-haven asset for institutions and retail investors alike in search of protection against uncertainties.

p

(b) Portfolio Diversification

Gold is also an effective instrument for you to diversify your investment portfolio. This is because, for the past 10 years, gold has almost no correlation (0.04) with the stock market movement.

In short, this means that gold price is generally not affected by the ups and downs in the stock market, making it a good wealth diversification vehicle.

Useful link: S&P 500 vs Gold price movement for the past 10 years

p

How can Malaysians Invest in Gold?

#1 Physical Gold

Should you fancy physical gold bars and coins, you can also get them via sites like BuySilverMalaysia. That said, I personally feel that unless one has specific needs for physical gold, I do not recommend them due to safety and storage hassles.

#2 Gold-backed Exchange Traded Fund (ETF)

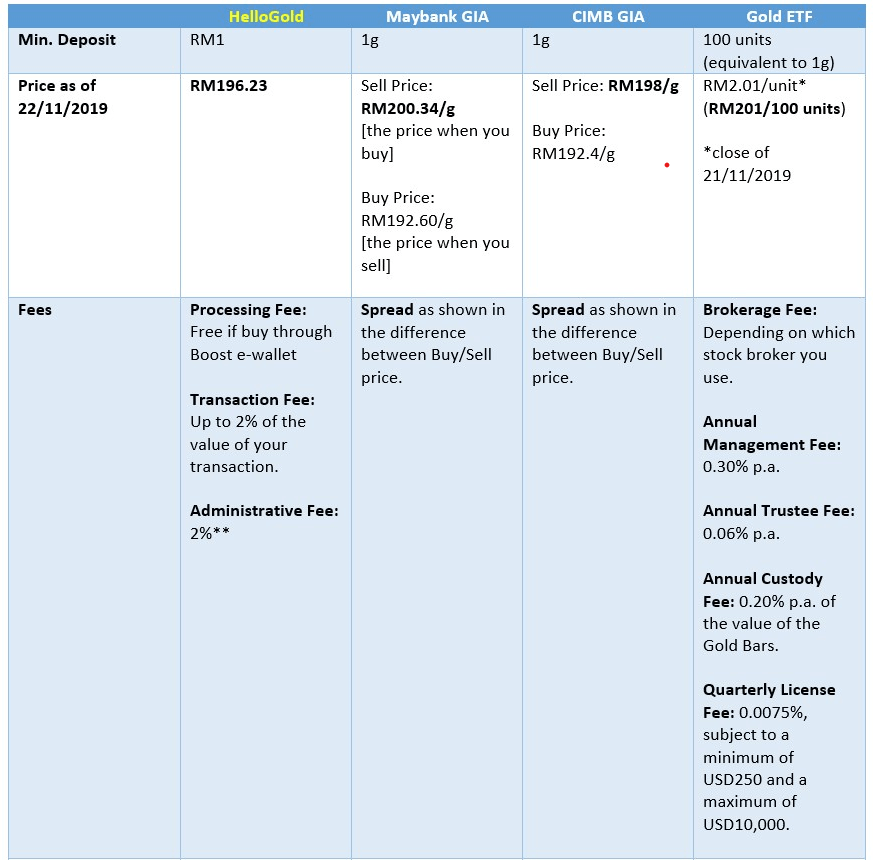

TradePlus Shariah Gold Tracker (Code: 0828EA) is Malaysia’s first shariah-compliant commodity ETF that tracks the performance of gold. Essentially, think of it as investing in a fund that goes up and down with the price movement of gold.

With some fees, you can invest in gold without having to take care of physical gold.

#3 Banks’ Gold Investment Accounts (GIA)

Alternatively, you can also purchase gold through banks’ gold investment account (eg. Maybank, CIMB). That said, GIAs usually charge a spread when you buy and sell gold.

Also, just a personal experience from using Maybank’s GIA: while I could purchase my gold online, I have to visit the counter should I wish to sell my gold holdings, which is a real hassle by today’s standard.

No Money Lah Verdict

With gold being an effective portfolio diversifier for your wealth, there is no doubt that one should accumulate gold as part of his or her portfolio.

However, the million-dollar question has yet to be answered: Is now a good time to buy gold?

In the next article, I will discuss about the price of gold and if it is a good time to invest in gold – Stay tuned!

Real Estate Investment Trusts (REITs) is one of my favorites to invest in, as they provide relatively stable dividends hence making them a great passive income source.

Click HERE to find out HOW you can pick and invest in quality REITs!

Disclaimer: This article is written based on my best research as of the time of writing, and should not be considered as a buy/sell recommendation. Please do your own due diligence and/or seek professional advice when making your investment decision.

Related Posts

April 10, 2019

5 Mistakes that I made in Stock Market Investment

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Nice article.

But then I found Hellogold’s fee are kind of high

2% for for admin fee per annum

2% for transaction fee

Sadly, these both fees may eat up the returns if ever the price goes up in future

Hi Ganaesan! Great to hear from you and happy to find that you like this article.

You are right, when it comes to fees, it coud be tricky to compare which platforms are better. Obviously bank’s GIAs charged a wide spread but it could be worthwhile if you just plan to put your money lump-sum there for the long-term (read: many years)

HelloGold, on the other hand, is more suitable for continuous purchase for the medium term (1-3 years) due to its fee structure.

Not to mention, it is also way more easy for people to get started with platform like HelloGold too – which is a plus point.

Here’s a link for additional read of fees: https://www.thebalance.com/average-daily-balance-finance-charge-calculation-960236