Last Updated on April 8, 2023 by Chin Yi Xuan

Back in October, I had the opportunity to work with my very own Personal Financial Planner to get my financials planned for the new year of 2020 – and I would like to share my experience with you today.

Now, it should be noted that I do have the habit of keeping track of my daily expenses. Plus, I do monthly reviews on my overall financial status and investments.

This means that I actually have a decent understanding of my personal financial state. That being said, why did I opt to work with a Personal Financial Planner?

The reason is simple: because I have a personal financial goal in mind, and I would like to seek professional opinion on how I can achieve my goal.

Read also: How my finances improved with the help of my financial planner in 2020!

Table of Contents

What is a Personal Financial Planner, really?

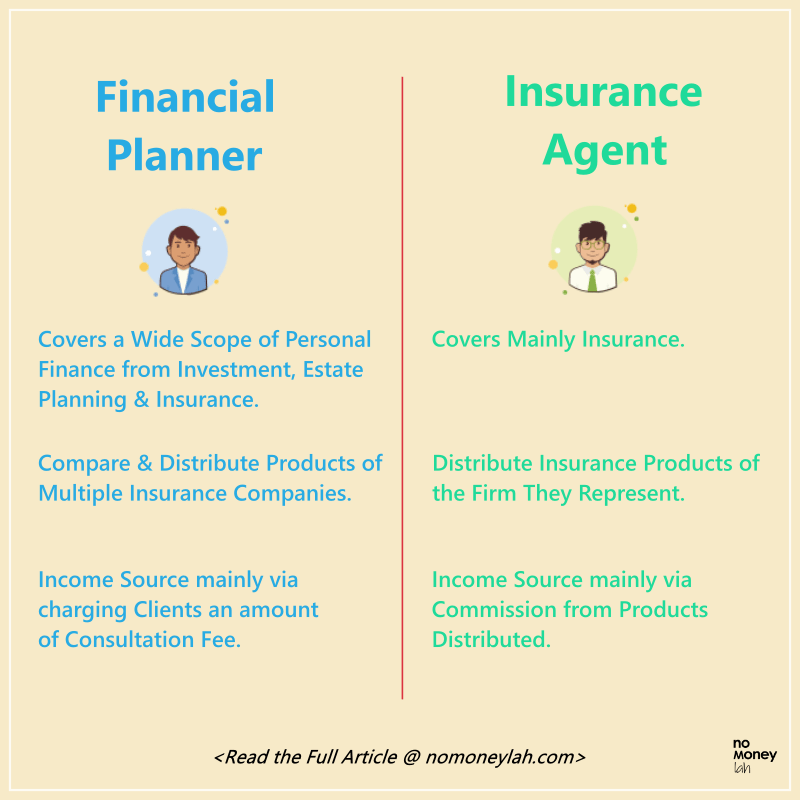

The best way to explain what a Personal Financial Planner is to compare one to an insurance agent.

Essentially, a Personal Financial Planner covers a wider aspect of personal finance aside from insurance. In addition, financial planners are usually brokers to multiple insurance companies which means that they are able to compare and filter for the best solution (from more than one insurance company) for their clients.

A crucial difference, though, is that Financial Planners earn mainly through charging their clients a consultation fee, while insurance agents earn mainly through the commission of the insurance solutions sold.

Added together, working with a Personal Financial Planner ensures minimal conflict of interest in their services as they are only accountable to their clients and no one else.

That said, there is no one-size-fits-all solution when it comes to financial planning. One should go for the best-suited services by considering what’s best for him/her under their personal circumstances.

What is it like to Work with a Personal Financial Planner? (My Experience)

Generally, a financial planning package (or service) is separated into 3 modes, namely:

- Comprehensive Financial Health Check (FHC) [RM300]: You’ll go through a comprehensive fact-finding process with your financial planner. Then, you’ll be presented with an analysis and report of your overall financial state with recommendations for improvement.

p - 1-year Modular Financial Planning (MFP) [RM 1,500]: You’ll get everything from the Comprehensive Financial Health Check above. PLUS, you can choose to focus on EITHER Investment/Insurance/Estate Planning and your financial planner will support you in the implementation for 1 full year.

p - 1-year full financial planning (FFP) [RM 3,000]: You’ll get everything from the Comprehensive Financial Health Check. PLUS, your financial planner will support you in the implementation of ALL aspects of your personal finances (Investment + Insurance + Estate Planning) for 1 full year.

Now, it is also important to note that both packages of financial planning also include an in-depth analysis of one’s cash flow status and financial health check. This is extremely crucial in helping us to understand our current financial strength for future planning.

Personally, I opted for a modular financial planning package from Wealth Vantage Advisory (WVA), specifically in investment as I want to explore how I can best optimize my cash on hand to achieve my financial goal.

The Flow of Working of a Personal Financial Planner (Step-by-Step)

Personally, I find working with my Personal Financial Planners from Wealth Vantage Advisory (Stev & Catherine) really simple and straightforward (to be honest, I thought it was going to be a complicated process initially).

Step 1: First Engagement

It all starts with an initial meetup in October in Stev’s office after signing up for my financial planning package.

The objective of this meetup is to do some fact-finding, expectation, and goal-setting. Along with the meeting, I also sent in my personal financial details required to my Personal Financial Planner.

Now, it should be noted that not everyone is equally comfortable sharing their personal financial details, even with a professionally trained Personal Financial Planner. I, for one, resonate with this very much as I felt vulnerable when I was asked to do so.

However, Stev and Catherine’s professionalism towards their work eventually made me really feel safe for doing so. Furthermore, the existence of legal paperwork in this financial planning process also ensures the privacy of our personal data.

Behind the Scene…

So, what happened after I submitted the details required by my Personal Financial Planner?

In WVA, they have a team of certified & professionally-trained financial planners to analyze my financials and put up detailed action-steps to help me achieve my goals.

Knowing this gives me peace of mind knowing that not just one, but a team of experts is working behind the scene to produce a solid financial plan that’s in my best interest.

Step 2: Implementation Meeting (1 month after first engagement)

About one month after our first meeting (October), I met up with Stev again for our first implementation meeting in November.

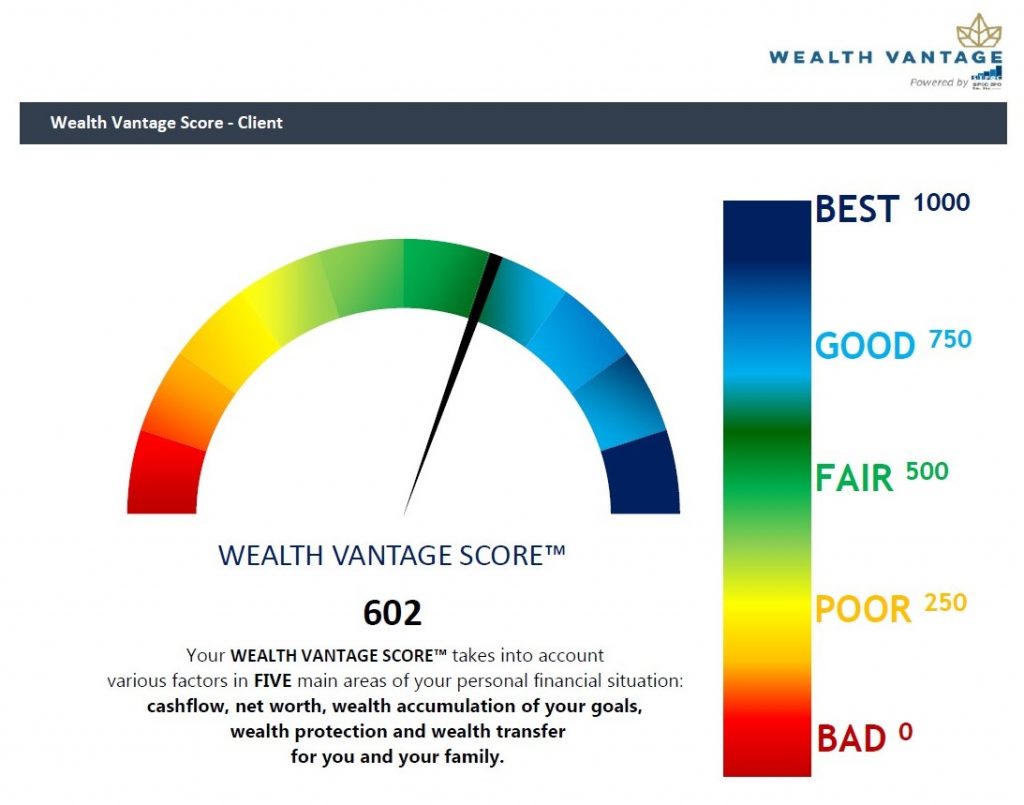

By now, my financial plan is prepared and Stev essentially, in detail, went through my (1) current financial health and (2) investments’ strengths and weaknesses with me.

The meeting was really an eye-opener as I have never been exposed to such detailed financial data of myself.

Essentially, I was given an aerial view of my current financial status including the health of my cash flow, net worth, asset allocation, and more. With that, my financial plan also includes precise action steps in order for me to achieve my financial goals (more in ‘My Takeaways’ section).

What I really like about WVA’s Personal Financial Planning session is that although I opted for a modular financial planning package in investment, Stev and the team also helped me analyze my insurance plans.

With that, they also provided me with suggestions on how to optimize my insurance expenses by comparing my current package with the other solutions in the market – a nice touch indeed.

Behind the Scene…

Having a Personal Financial Planner is not just about giving you a plan and say bye-bye to each other.

In fact, the good thing about having a Personal Financial Planner is to assist and keep you accountable for the execution of your plan.

I find this very useful as it provided me with a push to get certain things that I’ve always wanted to do done after the meeting.

Step 3: Follow-Up Review Meetings

Review Meetings are done to keep track of the execution of one’s financial plan. Not only that, it is set up to see if there is any further implementation needed to achieve one’s financial goals.

For someone that is opting for a modular financial planning package like myself, Review Meetings are done on a half-yearly basis (twice in a year). For people that opt for a full financial planning package, Review Meetings are done once every quarter (4 times a year).

For sure, this is a great structure as you get all the accountability and support in getting your plans executed properly.

My Takeaways

An important takeaway for me in my financial planning session with Wealth Vantage Advisory comes in the form of my asset allocation. While I have been conscious of my financial status, I did not realize that I am not optimizing my assets to their full potential.

Namely, I have a relative sum of emergency cash reserves that could be put into Fixed Deposit (FD) alternative like Money Market Fund. Doing this will give me better returns on my cash reserves while still ensuring the liquidity of my cash (unlike FD).

In addition, I also like that the proposed action steps are precise and straightforward. In my case, the plan proposed a fixed % of cash allocated to the Money Market Fund. This is a sweet touch considering most people (okay, maybe it’s just me) are just too lazy to make decisions nowadays.

Not only that, going through a financial planning session also pushed me to rethink my approach towards my income stream. As in, how can I improve my active income flow while pursuing my goal to become a professional full-time trader?

This made me realized that sometimes all people need is a push and accountability to really do what it’s needed to achieve their financial goals – and engaging a Personal Financial Planner is no doubt a great way to do so.

Do You Really Need a Personal Financial Planner?

Now, I personally think that most people need a Personal Financial Planner more than they think.

Even for me that practice the habit of keeping my financials in check, I still found enormous value while engaging a Personal Financial Planner. The question is, do you need one?

If you are a young adult planning ahead for your wedding, family planning, and any other financial goals – go for it.

If you are a parent planning for your children’s future education and life – go for it.

If you are in your 30s, 40s or even 50s looking to retire earlier and/or manage your after-life asset allocation but not sure what to do – go for it.

Even more so, if you have a lot of savings in hand but have little to no clue on how to deal with them – GO FOR IT.

Getting a Personal Financial Planner will give you a clearer picture of your financial strengths and weaknesses – and support your journey towards achieving your financial goals.

Get Your First Financial Consultation Session Today – FREE OF CHARGE!

Before we continue, I think it is helpful for you to know that a 1-year Full Financial Planning package from WVA is priced at RM3,000. Meanwhile, the 1-year Modular Financial Planning package (Investment/Insurance/Estate Planning) is priced at RM1,000.

To be clear, I DO NOT want you to pay for a Personal Financial Planner unless you are convinced that they are able to add value to you.

That said, I also want you to give yourself the chance (like what I did) to make the best use out of your hard-earned money and achieve your financial goals in life.

Hence, I am working together with Wealth Vantage Advisory to bring a FREE session of Financial Consultation Session to all No Money Lah’s readers!

When you sign up for this FREE consultation session, you will learn more about your overall financial state. Not only that, you can gauge if a Financial Planner is going to add value in the pursuit of your financial goals – regardless, you are doing yourself a favor for the year to come!

Disclaimer

This article is made possible through a collaboration with Wealth Vantage Advisory. Special thanks to Stev and the team for making this collaboration such an impactful one.

Wealth Vantage Advisory did not receive copy approval rights on this article – that means they are reading this article for the first time, right alongside you.

p.s. This post contains affiliate links, which afford No Money Lah a small referral if you sign up for any paid services.

Related Posts

November 12, 2020

Revealing My REIT Passive Income Portfolio!

February 10, 2019

4 Ultimate Financial Goals in Life & How to Achieve Them

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.