Last Updated on May 2, 2022 by Chin Yi Xuan

An emergency fund is one of the least discussed topics in personal finance. Yet, it is the most crucial aspect of our financial life that will save us in times of unexpected crisis, if prepared well.

In spite of Covid-19, if you are still earning an income, you should really consider to start building the foundation of your financials via an emergency fund.

Typically, most people would opt for Fixed Deposit (FD) to build their emergency fund. That said, if there is a better alternative in town, would you be interested to learn more?

Table of Contents

What is an Emergency Fund?

An emergency fund is essentially the money that you allocate on the side in case of unexpected financial emergencies like unemployment or a loss of income.

As a minimum, one should aim to build a 3 to 6 months’ worth of emergency fund (ie. 3 – 6x Your Monthly Expenses).

Now, it is crucial for us to understand the mechanism around an emergency fund:

It is not about growing the fund like what we do with investing. Rather, with an emergency fund, we are trying to preserve the value of your emergency fund so it doesn’t lose its value with time.

p

Where to Place Your Emergency Fund: Money Market Fund

Money Market Funds are funds that invest in low-risk assets such as government securities, treasury bills, commercial bonds, and other highly liquid securities.

This means that unlike stock market investments that are generally volatile, the low-risk assets in a Money Market Fund is relatively stable & consistent.

Reason being, most assets under a Money Market Fund have a maturity date where it almost always ensures a return.

Normally, most assets under a Money Market Fund matures in 1 year or less. This ensures the liquidity of funds that allow you to buy and sell relatively easily.

Money Market Fund vs Fixed Deposit (FD)

(1) Competitive Return

Money Market Funds generally pays a return of 3.0 – 3.5% annually. On the other hand, FD rates have been hovering in an average of 2%.

(2) Better Liquidity

Money Market Fund is generally more liquid than FD. This means that there is no lock-in period and you can deposit and withdraw whenever you want.

(3) Lower Barrier of Entry

Not only that, a Money Market Fund also has a relatively low barrier of entry compared to FD. This means that you can start investing in Money Market Funds from as low as RM10 and still enjoy the returns.

In comparison, there is a relatively high cap for FD deposits that ranges from RM10,000 to RM100,000.

What are the Risks of Investing in Money Market Funds?

Investing in a Money Market Fund is not without its risks, although it is quite minimal relative to the stock market.

(a) Interest Rate Risk

Interest rate risk refers to the impact of interest rate changes on the valuation of fixed income securities.

Essentially, when interest rates rise, fixed income asset prices generally decline. This may lower the market value of the Fund’s investment in fixed income securities, which will affect the net asset value (NAV) of the Fund.

The opposite may apply when interest rates fall.

(b) Credit/Default Risk

Credit/Default risk refers to the ability of issuers of fixed income assets (eg. a company’s bond) to make timely payment of interest or profit.

This means that if the issuer faces any challenges to make payment, it may impact the value as well as the liquidity of the fixed income assets of a Fund.

To manage the risks involved, a Money Market Fund will normally opt for high graded bonds and securities. This means that the chance of default will be relatively low and hence ensure peace of mind.

All in all, Money Market Fund’s investment in low-risk assets ensured it’s stability, making it a great FD alternative to build your emergency fund.

That said, please be reminded that it is NOT a capital and return guaranteed vehicle as there are still some risks involved in it.

3 Money Market Funds Options

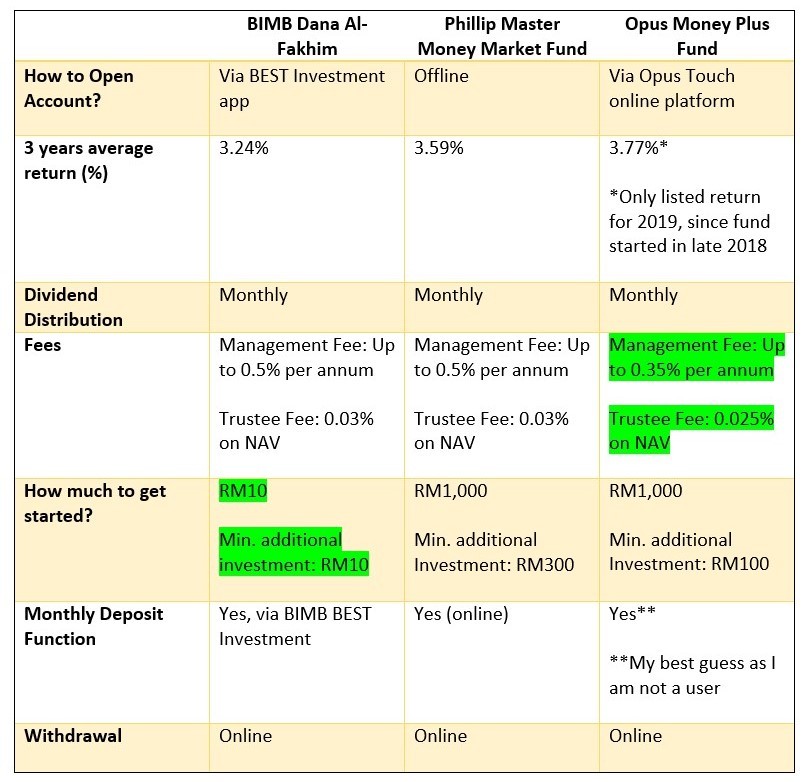

There are many money market options out there, varying in fees and deposit amount. For the options below, I am going to share with you 3 options out there which is suitable for most people.

The first money market fund that I think is a great option for most people is the BIMB Dana Al-Fakhim (Money Market Fund) via BEST Investment App.

Its low barrier of entry of just RM10 is the reason why I would recommend this to most people that are looking to build their emergency fund via money market.

To start, just go ahead and install the BEST Investment app on your phone (select Do It Yourself –> BIMB Dana Al-Fakhim), and start contributing to your emergency fund.

Install BEST Investment app HERE.

The reason why I feature Opus Money Plus Fund is due to its overall fee structure that is lower than other money market options out there.

Typically, most money market funds have a management fee of up to 0.5%/annum. In contrast, Opus Money Plus Fund features a maximum management fee of 0.35%/annum.

The final option that I am featuring here is Phillip Capital Money Market Fund.

The reason for this feature is because I am personally having my emergency fund parked with them.

That said, when it comes to ease of access, Phillip Capital is the least friendly one as it requires applicants to still fill up physical forms to open an account.

4. StashAway Simple (Updated 15/6/2020)

Newly launched in June 2020, StashAway Simple comes into the scene as a reliable alternative to Fixed Deposit (FD).

For an in-depth review of StashAway Simple, click HERE.

Money Market Funds Comparison

No Money Lah’s Verdict

Hopefully this article gave you a good idea on how to get started to build your emergency fund!

Do you have any other suggestions on where to place your money for an emergency? Share with me below! 🙂

p.s. Already have an emergency fund in place? Wanna kickstart your investing journey for a new (& consistent) income stream?

Scroll below for more info!

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

I have been building my emergency funds in high-interest paying saving accounts.

For example:

1. Maybank M2U Savers (earns 3% interest)

2. Standard Chartered Priviledge $avers Account (can unlock and earn up to 6% interest, by tiers)

3. OCBC (can unlock and earn 4% interest, with few conditions)

I have just started with the first 2 accounts a month back, and they pay me interest by the end of the month. It was quite lucrative.

Any suggestions/ advices on this?

Hey Gin Ann!

Yeah I think these are some good options too given that you can fulfill the terms and conditions of the tiered system of these savings account.

The reason why I do not include these options into my article is that sometimes the conditions needed for people to unlock the yield are not for everyone – it really depends on your lifestyle and spending habit.

That said, if you can fulfill the conditions – definitely give them a go! 🙂

Yi Xuan

Hi Yi Xuan, will you be including Stashaway SImple into the Money Market Funds Comparison chart above? THanks!! 🙂

Hey Sarah!

That’s actually a great idea! I will update the comparison table asap! 🙂

Regards,

Yi Xuan

Yi Xuan,

For BIMB Dana Al-Fakhim, how u compare invest using BEST app and FSMOne?

Hi Khai!

The thing with BEST invest app is you can start with as low as RM10, while you’ll need at least RM1,000 to start with FSMOne.

Hope this helps!

Yi Xuan

I don’t recommend Opus Asset at all! The site is terrible built, if the site is bad, think wise on what will happen to your money!!

When I registered there is no way to undo/edit the investment profile i select, and it force me to invest in income fund on my first investment.

You can’t even change your mind or select another fund (even on the same category) until you place money with them, this is BS!

You will be stuck at FPX/boost invest payment!!

Hey Alvin!

Thank you so much for the feedback and I am not aware of this since I am not a user.

Will add your feedback on the article asap.

Regards,

Yi Xuan