Last Updated on August 2, 2023 by Chin Yi Xuan

Fixed Deposit, or FD, has always been people’s go-to way to save or deposit extra cash. The problem is, it locks your money in for a long period of time, or requires a high initial deposit to start with.

In this article, let’s look into StashAway Simple, a great alternative to FD. Personally, I’ve been using StashAway Simple since mid-2020, and in this post, let’s explore if StashAway Simple is for you!

Table of Contents

Highlights of StashAway Simple

StashAway Simple (or ‘Simple’) is a cash management offering from robo-advisor StashAway. It provides users competitive returns like FD, but without the troublesome restrictions:

- Regulated: StashAway Simple is regulated by the Securities Commission (SC) of Malaysia.

- Competitive Return: Through Simple, users can earn up to 3.8% interest per annum, which is comparable to the rates of Fixed Deposit (FD).

- Low Risk: The underlying fund of Simple is the Eastspring Investment Islamic Income Fund. It is a Shariah-compliant fund that invests in very low-risk money market funds.

- Flexible & Low Barrier of Entry: Malaysians aged 18 and above can start saving or investing via Simple. There is no minimum on how much you need to save with Simple. Withdraw anytime without being charged penalty fees.

How does StashAway Simple work?

So, how exactly is Simple able to deliver returns that are on-par with FD?

All of this is possible because Simple invests users’ cash into money market funds (MMF).

MMFs are funds that invest in Fixed Deposits and highly liquid, short-term cash equivalent instruments called Money Market Instruments.

Essentially, Money Market Instruments are short-term debts issued by banks in order to accumulate short-term cash-pile to make up for the shortfall in their daily deposit reserve.

Simply put, MMFs are lending money to banks when they buy these Money Market Instruments. These instruments are relatively low-risk as they are backed by banks. Moreover, they are highly liquid with short maturity periods.

Through regular redemption of matured Money Market Instruments, it allows MMF to provide a similar rate to FDs without having to lock up users’ capital.

For Simple, the underlying MMF that they invest in is the Eastspring Investment Islamic Income Fund, which is a Shariah-compliant money market fund.

In short, through Simple, you can earn a similar rate to FD through low-risk MMF without having to lock up your funds, unlike conventional FDs.

It is a great choice if you are looking for a competitive and flexible alternative to FDs.

Is StashAway Simple safe to use?

When it comes to regulation, Simple is regulated by the Securities Commission (SC) of Malaysia. This ensures that Simple is always operating in Malaysia as per the guideline from the local authority.

As for the safety of funds, your funds in Simple are held by a third party (trustee), which is Deutsche Trustees Malaysia Bhd.

In other words, your deposits to Simple are separate from StashAway’s company finances. As such, this ensures no deposits can be used for fraudulent purposes and you will always have full access and claim to them no matter what happens to StashAway.

StashAway Simple Performance, Fees & Charges

StashAway Simple does not charge any platform or service fee to users. That said, the underlying MMF, Eastspring Investment Islamic Income Fund, does charge reasonable annual fees, as shown below:

- Annual Management Fee: -0.25%

- Annual Trustee Fee: -0.04%

- Annual Projected Return AFTER fees & rebate: 3.8%

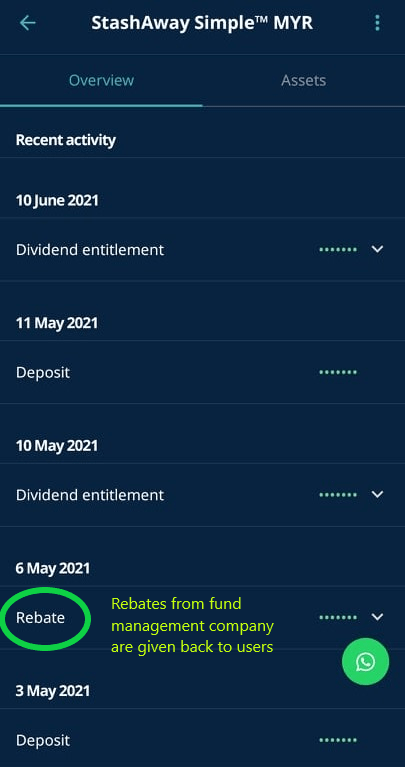

A thing worth noting is that StashAway does get fee rebate from Eastspring, likely due to the size of capital that StashAway Simple can channel to the fund (p.s. just my opinion).

As such, when Eastspring rebates StashAway, they’ll re-distribute this full rebate to users.

Next question: Are there any fees when you withdraw your funds from StashAway Simple?

Unlike FDs, there are no charges when you withdraw your funds from StashAway. Withdrawals are expected to be reflected within 3-4 business days.

4 things I like about StashAway Simple

#1 Returns on par with conventional Fixed Deposits (FDs)

Through Simple, returns are compounded daily and interest payout is made every month, which is re-invested into user’s fund.

All of this combined, through its underlying Eastspring Investment Islamic Income Fund, Simple projects about 3.8% return per annum (after fees) for users.

#2 Flexible & low barrier of entry

There are 2 things that I absolutely love with Simple:

- Low barrier of entry: There is no minimum amount to start using Simple. Meaning, you can start investing or saving with Simple with any amount you want.

- Flexible: There are no charges to open a StashAway Simple account. In addition, you can withdraw your funds anytime and there are no fees on withdrawal.

Combined, both these features make a compelling edge against typical FDs.

Reason being, FDs usually have higher minimum deposits & they tend to lock in users for a period of time (and charge a penalty for early withdrawals).

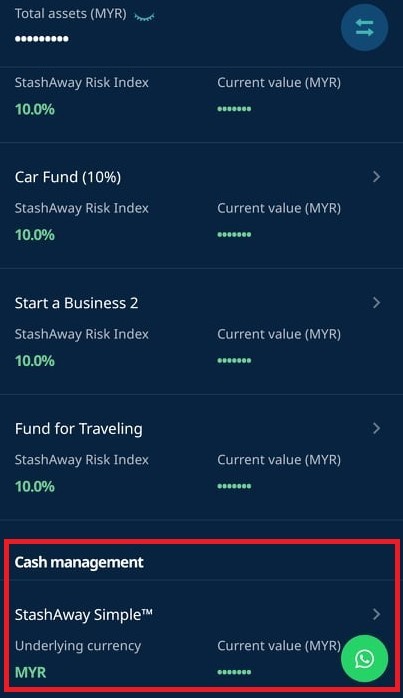

#3 Integration with StashAway main investment ecosystem

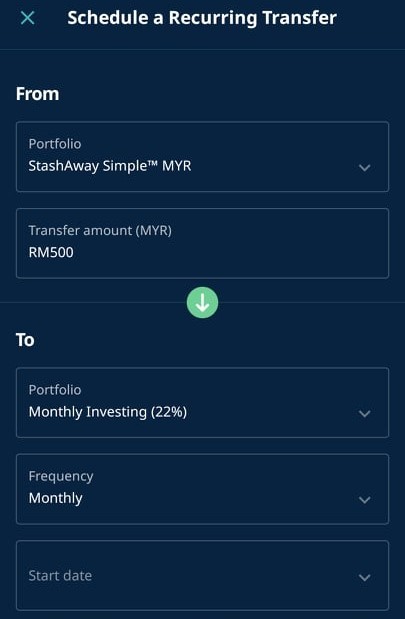

Another reason why I enjoy using StashAway is its seamless savings (StashAway Simple) and investment (StashAway) integration.

So, let’s say you have RM50,000 in cash and would like to invest them. However, you do not want to invest the whole RM50,000 at once and would like to spread it over time (dollar-cost average).

Through StashAway app, you can place your funds in Simple (low-risk + earn stable interest), then automate a weekly or monthly transfer from Simple to your main StashAway investment portfolio.

I think this is a brilliant feature from StashAway, which makes it the most versatile robo-advisor at the moment.

#4 Intuitive user experience

As an app catered for the general public, StashAway is really simple to use.

Even if you need any help, StashAway’s customer support is one of the best I’ve ever experienced when it comes to financial products.

Risks + What you need to know before investing in StashAway Simple

In this part, let’s explore 3 things that you need to be aware of while investing your money with Simple:

1. Market risk

While being a relatively stable instrument, investing in Money Market Fund (MMF) via Simple still presents exposure to market risk.

One such risk is the fluctuation in interest rate. For instance, if Bank Negara Malaysia (BNM) increases interest rate, MMF is likely going to generate higher returns. On the other hand, if BNM reduces interest rate, it’ll also affect the returns of MMF as a result.

2. Not protected by PIDM

While investing in Simple, it is important to remember that your funds deposited on StashAway are not protected by Perbadanan Insurans Deposit Malaysia (PIDM).

PIDM is an organization that protects deposits kept in banks and financial institutions that are a member of PIDM. Conventional bank FDs are usually protected by PIDM.

Improvement: 2 Improvements Needed for StashAway Simple

Having been a Simple user since its launch, I think there are 2 improvements needed for Simple to compete with competitors like Versa:

1. Automatic scheduled transfer

One thing that puzzled me with StashAway is, I can schedule a routine transfer to my normal StashAway investment portfolio from my bank account, but I cannot do so for Simple.

I think having the convenience for users to automate their deposits every week/month into Simple should be a fundamental feature.

While I enjoy using Simple, I think this improvement will make StashAway a more solid financial app.

2. Withdrawal speed

StashAway Simple has a 3-4 business days withdrawal speed. While this is reasonable, it falls behind competitors like Versa that has a 1-2 business days withdrawal.

I think this is a space that StashAway can improve on as well.

READ: Versa Review: A Great Alternative to Fixed Deposits (FD)!

Eligibility + is StashAway Simple for you?

The minimum age required to open an account with StashAway is 18 years old. Meaning, even young Malaysian adults can start building good financial habits by saving/investing from their phones – neat!

That said, is StashAway Simple for you?

To answer this question, it is best to first know what Simple is NOT:

- Simple does not invest in stocks/equities (ie. Higher risk assets). Hence, do not expect mutual fund-like returns.

- Simple does not guarantee returns. Even though it invests in low-risk MMF, returns are still subjected to market fluctuation.

Hence, in my opinion, Simple is great for:

- People looking for a flexible alternative to FD & typical savings account.

- People looking to save for a specific goal (eg. house, car, wedding)

- People with additional cash and want to save it for the short-term

- People with a stash of cash looking to invest, but would like to spread the investment across time. (StashAway & StashAway Simple is perfect for this)

StashAway Simple or Versa or KDI save?

In terms of offering, StashAway Simple’s closest competitor is certainly KDI Save and Versa. Both offer users flexible and low barrier access to MMF that pays competitive FD-like rates.

I think this comparison deserves a full article on its own so I’ll attach a link here (it’s up!) when I come out with a comparison article real soon!

Personally, I use StashAway Simple, Versa, and KDI Save to save for different purposes and I am happy with them as an alternative to FD (I think you will, too!).

READ: The Ultimate FD-Killer Showdown: StashAway Simple vs Versa vs KDI Save vs TNG GOinvest!

StashAway Referral Link & Code: P-NOMONEYLAH-MY

No Money Lah is working with StashAway to bring new users an exclusive 50% off your fees for the first RM100,000 invested for 6 months.

Since it is Simple is free to use, this deal is applicable if you eventually use StashAway robo-advisor portfolio to invest.

To be eligible for this deal, sign up for your StashAway account through my referral link HERE (or apply code ‘P-NOMONEYLAH-MY‘). (or HERE if you are from Singapore)

No Money Lah’s Verdict: Simple is the New Breakthrough

With the rise of innovations in the financial solution space, it is refreshing to keep seeing new, innovative products from robo-advisor platforms like StashAway.

In many ways, in the financial services industry, Simple is indeed the new breakthrough that consumers need. With Simple, everyday consumers can enjoy returns on par with FD without the typical restrictions.

Personally, I have always enjoyed using StashAway, and I highly suggest you to check it out too!

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Hi Yi Xuan, I’m a fan of yours since I read your post about ASNB back in last year, and one thing I noticed about your super informative posts is your writing is so much Malaysian, that absolutely makes reading a breeze! Well, to brief a bit about my question, I came to this post after reading your writeup about OCBC’s ‘Frank’. Part of my interest revolves around low-risk financial products with high flexibility, and hence I got to know about this StashAway Simple from you as well. Not to take anything for granted, but the competitive ‘rebate’ by the fund manager is undeniably good. The benefits described in their official webpage also seems real promising and attractive. Now, before making the decision, what do you think about putting our savings in StashAway Simple versus through other platforms like FSMOne or maybe their own (Eastspring) website (not sure if this works, plz pardon my ignorance in this regard xD)?

Hey Tale!

Thanks for reaching out and really appreciate your support and kind words! Awesome people like yourself is my biggest motivation to keep writing 🙂

Let’s talk specifically about Simple vs EastSpring themselves. The underlying product of Simple is also an EastSpring product. As such, technically, there is no difference between you investing in Simple or the similar product on EastSpring.

However, I do understand that there is a minimum amount needed for you to deposit when you invest directly in EastSpring but there is no such limit in Simple.

I guess ultimately it really depends on how you value the flexibility of Simple. If there is no such concern, anything is fine imo 🙂

Yi Xuan

Great Insight on this topic, One question, is the annual 3% return include the fees or is it excluding the fees?

Hi buddy!

This 3% promo is net of fees. 🙂

Regards,

Yi Xuan

Hi Yi Xuan, recently, StashAway Simple had switching their underlying fund from Eastspring to AmIncome. What’s your opinion toward this issue?

It will be very great if you are willing to do a comparison study between the ex-fund (Eastspring) and the current fund (AmIncome), especially in terms of their performance.

Thanks.

Thanks for the question! 🙂

I’ll be working on a detailed update for this switch soon but in terms of performance, it’s still anticipated to maintain at 2.4%.

Regards,

Yi Xuan

I’ve just updated this review with details on the new AmIncome Fund, check it out! 🙂

Regards,

Yi Xuan

is this campaign for malaysians only?

Hi ZM!

Yes this campaign is for Msians only at the moment. But I believe StashAway SG has also raised their rates for Simple recently as well!

Regards,

Yi Xuan