Last Updated on May 2, 2022 by Chin Yi Xuan

Retirement supposed to be a phase in life where we finally put down our burden in life and start enjoying life, right?

However, according to EPF, 70% of members who withdraw their savings at age 55 use up their savings in less than a decade after retiring.

Simply put, for most people, having a good retirement life seems to be a huge challenge.

The challenge, though, is to figure out ways for us all to retire comfortably in the norm of the rising cost of living and stagnant wage growth.

Now, to be fair, for you to better prepare for your retirement, you probably should contribute more to EPF.

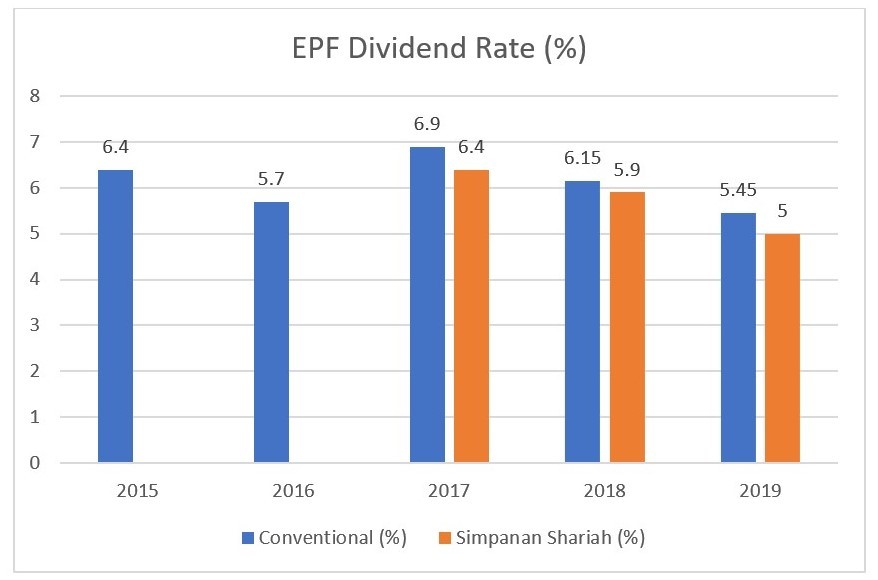

Considering that is done, is there any other way for you to diversify & grow your EPF savings beyond the boundaries of returns that you are getting from EPF themselves?

(Yes, there is a way – share this with your parents too!)

Table of Contents

EPF Members Investment Scheme (MIS)

EPF MIS is an initiative by EPF to allow eligible members (eligibility details below) to invest in EPF-approved unit trust funds in order to allow members to diversify and potentially grow their retirement savings.

There are essentially 2 ways for a qualified EPF member to take advantage of the MIS initiative.

One of them is via a Fund Management Institution (FMI) agent that’ll conduct face-to-face advice while aiding members with fund selection & document submission.

On the other hand, the alternative way is via EPF’s latest i-Invest online platform.

Introducing EPF i-Invest

EPF i-Invest is an initiative introduced by EPF in August 2019 to allow fellow EPF members to diversify their EPF savings into EPF-approved unit trusts under the Members Investment Scheme (MIS) – all at the convenience of our very own devices.

Under EPF i-Invest, eligible members can diversify up to 30% of the amount in excess of the basic savings in Account 1 into EPF-approved unit trust funds.

Simply put, we now have more flexibility over where their EPF funds are being invested.

Source: EPF

Okay, Which Fund Manager Should I Use? (hint: Principal Asset Management Berhad)

As of now, there are 10 financial management institutions that you can choose from to invest via EPF i-Invest.

Of all, Principal Asset Management Berhad (“Principal”) is an established fund manager that has been running award-winning funds since 1994.

One of the highlights of investing your EPF funds with Principal EPF i-Invest is that there will be no sales charge (a.k.a. 0% sales charge!*).

Simply put, you can save up on your upfront fee to invest in EPF-approved unit trusts!

But personally, I think the biggest opportunity here is the chance for members to DIY their EPF investments (ie. research, buy & sell anytime) all at the convenience of their devices.

EPF-Approved Funds from Principal Asset Management

As of the time of writing, there are 30 EPF-approved funds (both conventional & shariah-compliant) that are being offered by Principal for members to invest via EPF i-Invest.

I can’t go through every single one of them, but these are 5 highlighted funds by Principal Asset Management that you can check out.

- Principal Greater China Equity Fund | 7-year Annualized Return (31/12/2012 – 2019): 13.56%

- Principal Global Titans Fund | 7-year Annualized Return (31/12/2012 – 2019): 12.59%

- Principal Asia Pacific Dynamic Income Fund | 7-year Annualized Return (31/12/2012 – 2019): 11.87%

- Principal Asia Titans Fund | 7-year Annualized Return (31/12/2012 – 2019): 10.56%

- Principal Islamic Asia Pacific Dynamic Equity Fund | 7-year Annualized Return (31/12/2012 – 2019): 7.35%

Source: Principal

Are You Eligible to Invest Your EPF Fund using EPF i-Invest?

For one to take advantage of the investment using EPF i-Invest, you’ll have to be:

- A Malaysian, OR a Permanent Resident (PR), OR a Non-Malaysian that is registered as EPF Member before 1 August 1998

- Have sufficient savings with the EPF (more below)

How would we know if we have sufficient savings with EPF?

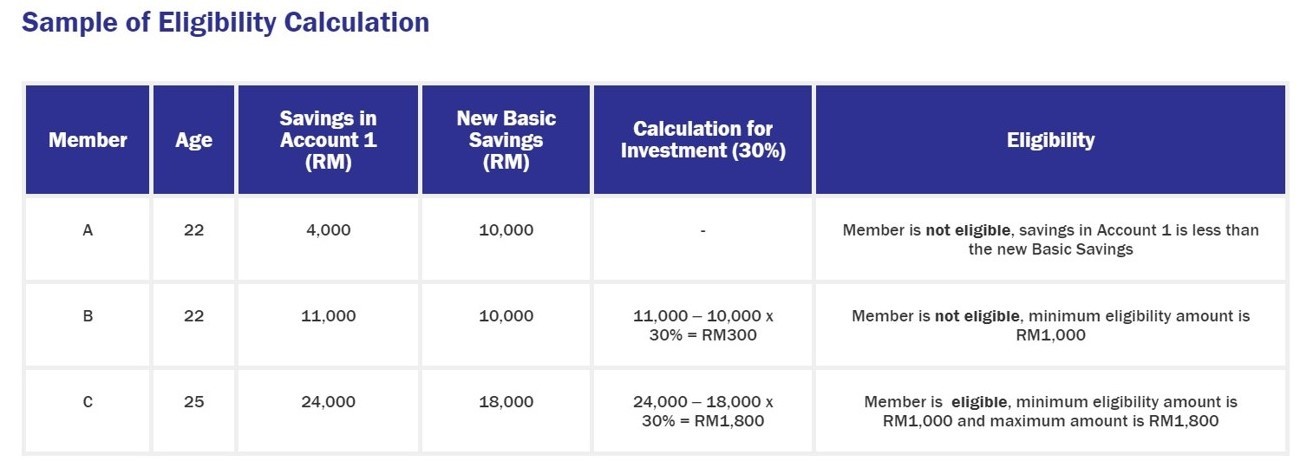

Essentially, for an EPF member to be considered to have ‘sufficient’ savings to invest via EPF i-Invest, one will have to have an excess of savings in Akaun 1, beyond the basic savings amount set by EPF according to a member’s age.

Then, a member will be able to use 30% out of the excess savings (minimum RM1,000) in Akaun 1 to invest in unit trusts through EPF i-Invest.

Below is a sample of eligibility calculation:

To get more information on EPF’s basic savings requirement, check out the link HERE. Otherwise, you can also view, at a glance, the amount that you are eligible to invest by logging in to EPF i-Invest.

How to Invest via EPF i-Invest?

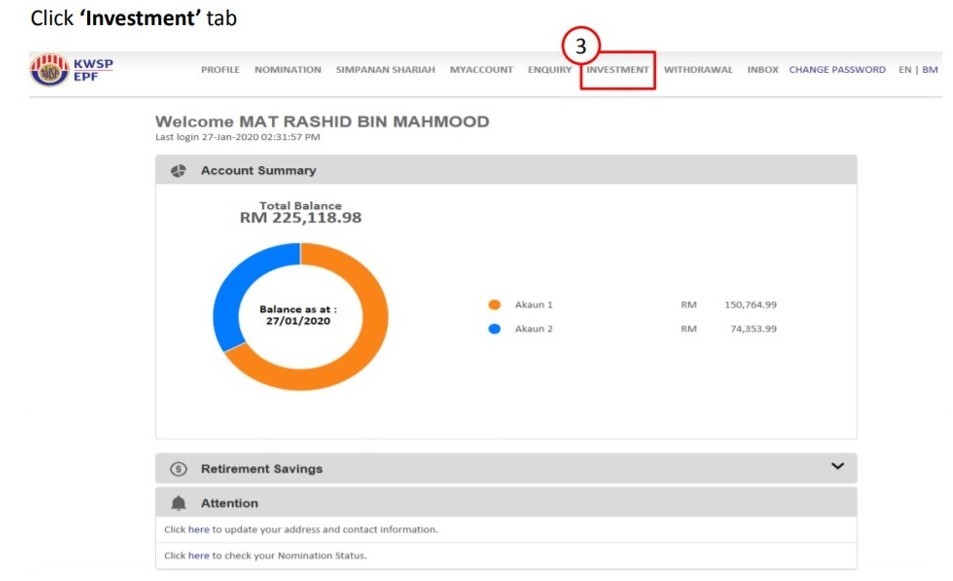

EPF i-Invest is essentially a feature under EPF’s digital platform – EPF i-Akaun.

Hence, to get started to invest with Principal Asset Management via EPF i-Invest, an EPF member will first have to get an EPF i-Akaun.

If you (or your parents) do not have one, be sure to head over to your nearest EPF office to open your account.

Once you are done with that, just follow these 4 simple steps:

Step 1: Login to Your EPF i-Akaun

Step 2: In the main menu, click ‘Investment’, then select ‘Transaction’, followed by ‘Buy’.

Step 3: Select “Principal Asset Management Bhd” as your Financial Management Institution (FMI) and choose your preferred fund.

Step 4: Checkout with “Principal Asset Management Bhd” and complete your transaction.

Principal EPF i-Invest New Investor Promo (yay!)

Principal is now rewarding new EPF i-Invest’s investors with a special reward!

From 10/9/2020 to 31/12/2020, receive RM50 Touch ‘n Go eWallet reload pin when you start investing with Principal through EPF i-Invest.

Terms & conditions apply. You may refer to the T&C here.

No Money Lah’s Verdict

With technology enabling innovation in the financial industry, I am happy to see that we have more flexibility to use our retirement savings in EPF to gain access to different investment solutions to diversify and grow our savings – all at the convenience of our fingertips via EPF i-Invest!

Now, are you or any of your family members eligible to invest using EPF i-Invest?

Be sure to check it out, and start growing your retirement fund today!

Disclaimer: Investment involves risk. As a general rule, you should only trade in financial products that you are familiar with and understand the risk associated with them. Click HERE to find out the specific risk and details of the funds mentioned in this article.

p.s. This article is kindly sponsored by Principal Asset Management.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.