Last Updated on May 2, 2022 by Chin Yi Xuan

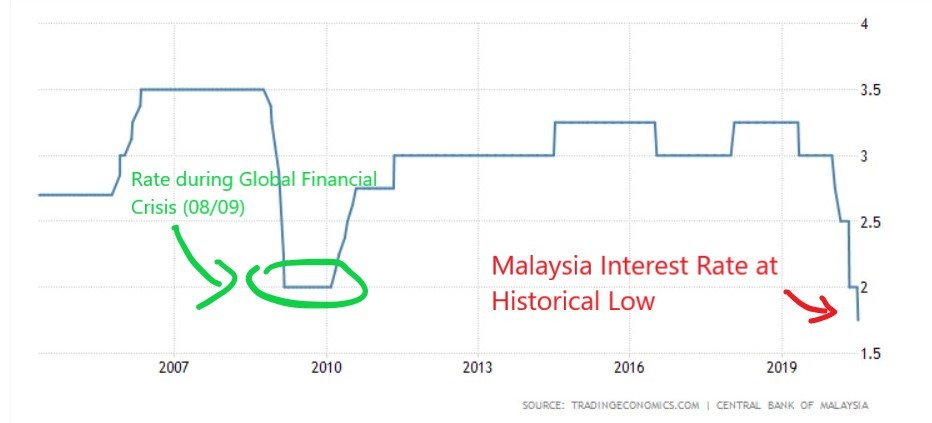

Since the Covid-19 pandemic started earlier this year, central banks across the world have been lowering interest rate in hope to spur the economy with increased consumption & borrowings.

On the flip side, under a low interest rate environment, the yield of conventional financial vehicles like Fixed Deposit (FD) are affected negatively.

In fact, Bank Negara Malaysia (BNM) has just announced the lowering of interest rate from 2% to 1.75% this month (July), which is never seen even during the Global Financial Crisis in 2008/09.

Simply put, savers suffer in this historically low interest rate environment.

Table of Contents

The question is obvious:

Is there anywhere we can place or save our money in this low interest rate environment?

Let’s find out together.

Firstly, Our Goals & Criteria:

What I intend to achieve with this article is to share what I think are suitable alternatives to FD for most people to place their money.

The main goal here is to seek options that can allow most people to PRESERVE the value of their wealth.

Hence, please approach this article from a wealth & value preservation mindset, NOT from an investment mindset.

Since we are talking about potential FD alternatives here, there are a few criteria that I consider while planning for this article:

- #1 The majority exposure of these financial vehicles must be limited to low-risk asset classes.

- #2 Ideally, we’ll want to have a low barrier of entry to these options. Meaning, we can start even with a small amount of capital.

- #3 A flexible deposit & withdrawal feature would be a plus point.

- #4 No troublesome tiering conditions where I must spend up to some amount or swipe my card X times a month to be eligible for the yield. (too mafan)

Now, a huge disclaimer (confirm people will mention): NONE of the options mentioned below are insured by PIDM and NONE of them have guaranteed yield or return. So if that’s your thing, this article is not for you.

With that in mind, let’s start!

1. Money Market Funds

Money Market Funds are mutual funds that typically invest in cash equivalent short-term debt instruments with short maturity (normally around 1 – 2 years, sometimes even shorter).

In other words, Money Market Funds place your money in instruments like government treasuries, corporate, and bank securities. Also, Money Market Funds’ managers typically attempt to keep the price of the funds fixed (ie. RM1/unit), so only the yield will fluctuate.

In nature, Money Market Funds are considered lowest in risk within the fixed income asset classes as the short maturity (a.k.a. expiry) of the instruments invested lower the risk of default and reduce exposure to long-term risk in the market.

Generally, yields are paid out in the form of dividends either monthly or quarterly.

Personally, I have most of my money placed with BIMB Dana Al-Fakhim (via BIMB’s BEST Invest) and Phillip Capital Money Market Fund for non-investment related purposes.

Average Past Return: Around 3 – 4%/annum

Pros:

+ Higher return than FD;

+ Low barrier of entry (RM10 for BEST Invest);

+ No lock-in period (deposit & withdraw anytime).

Cons:

– Funds’ return can be impacted by low-interest rate, albeit they are still better than FD.

– Minimal amount of management & trustee fees will incur.

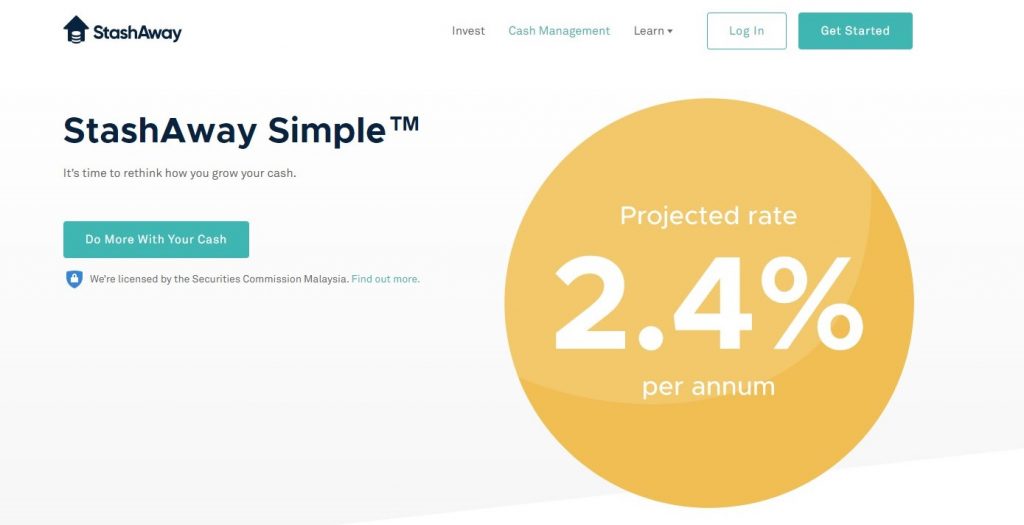

2. StashAway Simple

StashAway Simple is a cash management service from robo-advisor StashAway.

Essentially, StashAway Simple is also invested in Money Market Fund. However, I think it deserves its own place in this article due to its unique value proposition as shown below:

Historical Return: Between 3.6 – 3.7%/annum (data taken from the historical performance of Eastspring Investments Islamic Income Fund*)

Projected Return: About 2.4%/annum (this is an estimated potential return and SHOULD NOT be compared to the historical returns of other funds)

Pros:

+ Lower fee structure compared to typical Money Market Funds (~0.165% vs ~0.5%/annum). There’s no management fee from StashAway though there’s a minor fee charged by the underlying fund manager.

+ Zero barrier of entry. You can literally start using StashAway Simple at any amount you want.

+ No lock-in period (deposit & withdraw anytime).

Cons:

– The cons listed under Money Market Funds.

*The underlying fund of StashAway Simple is Eastspring Investments Islamic Income Fund that invests in Islamic debt instruments offered by financial institutions. You can find out more about the fund HERE.

3. Bond Funds

Bond Funds are mutual funds that mainly invest in bonds (okay haha what am I doing here).

Essentially, when we invest in a bond fund, the money collected from investors will be pooled together to buy various bonds (ie. debts from governments and corporations) with different yields & maturities.

Unlike Money Market Fund where the unit price is typically fixed, the value of Bond Fund units generally fluctuates inversely with interest rate.

In short, this means that the lower the interest rate, the higher the value of the bonds invested in a Bond Fund, which may lead to an increase in the value of the Bond Fund.

However, the opposite can also be true, where an increase in interest rate (which will definitely happen in the future) will lead to a drop in the value of bonds.

Return: Around 3-8%/annum, depending on the type of Bond Fund you invest in.

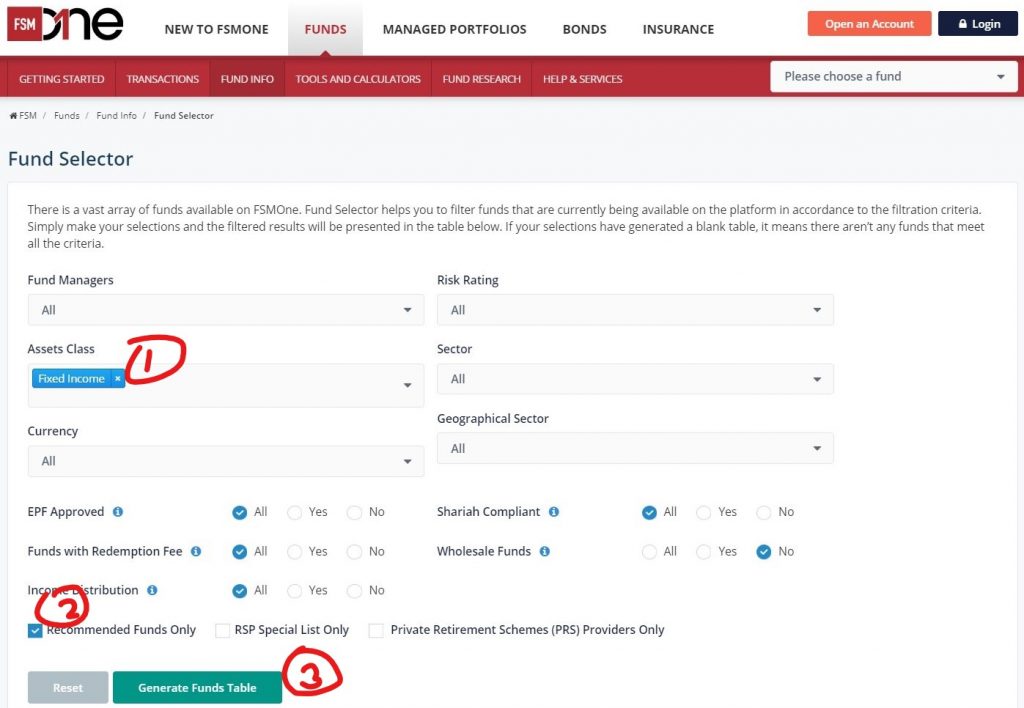

How to buy: Fund SuperMart (FSM)

Under FSM’s fund selector, select ‘Fixed Income’ under Assets Class. Then, if you want to filter your selections further, tick ‘Recommended Funds Only’ and click ‘Generate Funds Table’.

You’ll see a list of FSM’s recommended fixed income Bond and Sukuk Funds, and you can dive deeper into the particulars of the funds.

Note: Let me know in the comment section below if you want me to write more about Bond Funds!

Pros:

+ Lower interest rate generally increases the value of bonds within a Bond Fund.

Cons:

– The opposite of pros can also be true.

– Higher min. investment of RM1,000 for most bond funds.

– Typical management & trustee fees apply.

p.s. In terms of risk, Money Market Funds are considered to be less risky compared to Bond Funds, but it also offers a lower yield in return.

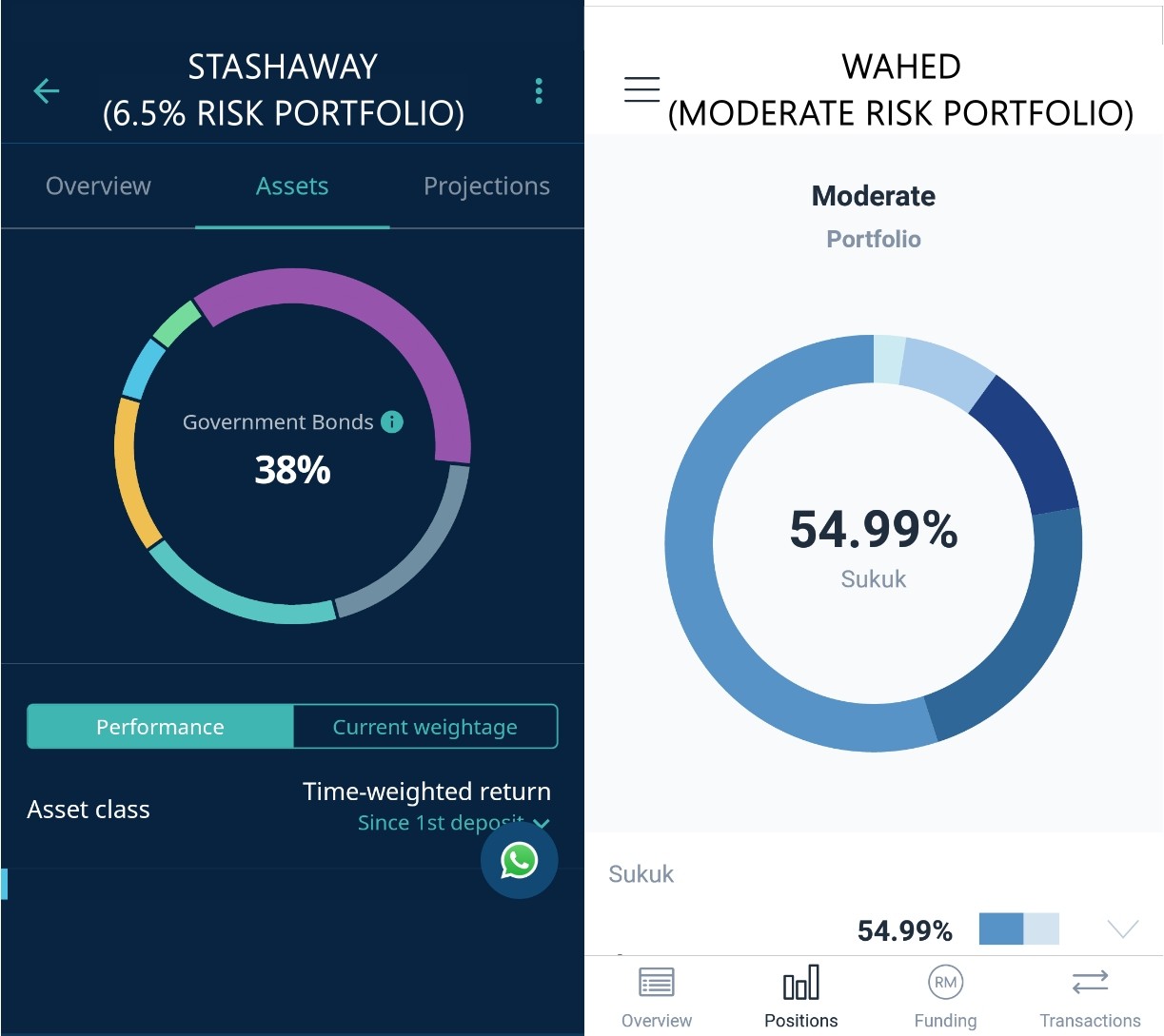

4. Low to Medium Risk Portfolio on Robo-Advisors (eg. StashAway, Wahed, MyTheo)

If you are looking for something more diverse, putting your money in low to medium risk portfolio on Robo-Advisor platforms like StashAway, Wahed or MyTheo may be a good option.

Typically, in a low to medium risk portfolio, robo-advisor platforms will allocate the majority of the funds towards bonds and money market instruments, alongside a minimal allocation to equities and commodities.

In short, a low to medium risk robo-advisor portfolio will give you a good bond-focused allocation, with a dose of exposure to asset classes like equities and commodities.

Pros:

+ Potentially higher returns due to exposure to the equity market.

+ Low barrier of entry

+ No lock-in period (deposit & withdraw anytime)

Cons:

– Potentially higher volatility and risk due to exposure to the equity market.

p.s. Use my: StashAway Referral Code and get 50% off your management fees for 6 months, Wahed Referral Code (Code: YIXCHI1) and get RM10 bonus fund and MyTheo Referral Code and get 100% off your management fees for 3 months!

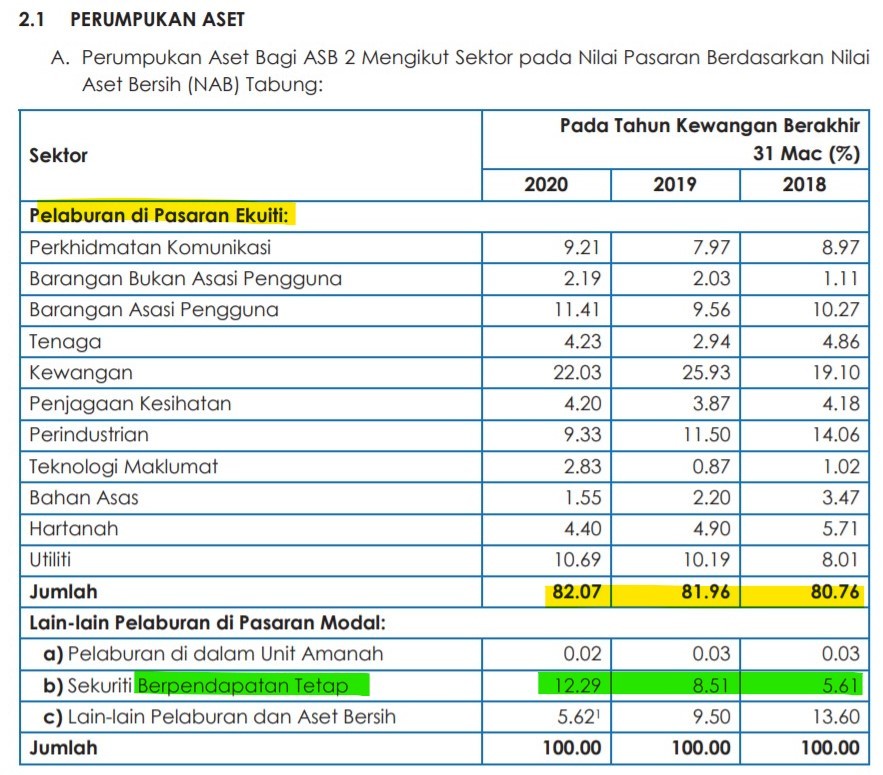

But hey, What About Amanah Saham Fixed Price Funds?

Now, some of you may have Amanah Saham Fixed Price Funds in mind, but there is ONE key reason why I’ll not include them in this discussion:

Reason: High exposure to equities (risky asset class)

One of the criteria that I mentioned earlier in this article is that the options must have the majority of its exposure in low-risk assets.

As such, Amanah Saham Fixed Price Funds (ASB, ASB2, ASB3, ASM, ASM2, ASM3) do not fulfill the criteria as the majority of these funds are parked with equities.

This simply means that the actual risk involved while putting our money in ASB is actually higher and hence in my opinion NOT a suitable choice for wealth preservation purposes.

No Money Lah’s Verdict: Explore Your Options in this Low-Interest Rate Environment

With the low interest rate environment that we are living in right now, it is crucial for us to explore alternatives beyond FD to preserve the value of our hard-earned money.

Be it for emergency or savings, I think the options mentioned in this article will be suitable for most people to get started.

Have you start placing your money with any of the options mentioned above? Did I forget to mention any other options in this article?

Let me know in the comment section below – can’t wait to hear from you!

Disclaimer: This article is produced for informational purposes only and SHOULD NOT be viewed as a buy/sell advice. Please seek financial professionals before making a financial decision.

Related Posts

August 14, 2020

How I Customize My Own Savings Routine (that actually works)

May 20, 2020

How to Build Your Emergency Fund?

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Hi,

How about invest/diversify/preserve hard earned cash in comodities like Gold and Silver?

Hi Khai!

That is also a choice, but commodities at its core are actually quite volatile.

I’ve written about it more in detail in the article below:

https://nomoneylah.com/2019/11/26/gold-stable-investment/

Have a good read! 🙂

Yi Xuan

hi! Mind to share more about bond funds? (how to choose etc). Prices are increasing rapidity due to the announcement of lower interest rate recently. It is still a good time to buy? Thanks

Hi Angeline!

I’ll work on a detailed bond fund article soon!

In general, I feel like a good mix of bond funds and money market fund will be very helpful to balance out the risk in the long term.

Yi Xuan

Hi! When will you be writing more on bond funds? In the current climate, I am interested in low risk bond funds. Are Islamic bond funds safer? Ie no capital loss

Hi MB,

Working on it haha – good things take time 😛

Bonds are generally a safer asset but there is no guarantee of capital gain/loss.

You can try out the sukuk fund from BEST Invest by BIMB.

Yi Xuan

Which investment app allows me to invest in REIT portfolio?

Hi Ram!

You can invest in REITs using brokers like Rakuten Trade. You can find out more below:

https://nomoneylah.com/2019/06/25/first-trade/

Yi Xuan

Hi Yi Xuan, I’m currently working in Singapore and intend to open stashaway account but not sure should I open Msia AC or SG AC… can u advise which one gives a better return base on past performance?

Hey Chris!

Thanks for reaching out!

Personally I am on Malaysia’s account and I do not have enough info on SG’s account to advise you which is better.

My suggestion is to look at where you’d be in a few years’ time – MY or SG?

If you’d be coming back to MY soon then it makes sense to open a MY account as it is much easier to manage once you are back.

Yi Xuan

Hi Yi Xuan,

What’s the difference between Stashaway and MyTheo which are robo-advisor that invest in ETFs. If I have to choose, which is the better one?

Thank you!

Hi Min!

Theoretically, they work similarly to each other (ie. using programmed algorithms to invest in mainly ETFs on your behalf).

That said, having use both for a while now, I’d say go with StashAway if you need to choose one. The overall experience, performance has been better on StashAway imo.

However, I’ll also recommend that you try both and decide for yourself after some time.

p.s. If you are looking for a referral code for both, check out this page for them:

https://nomoneylah.com/recommendations/

Any ques just let me know! 🙂

Yi Xuan