Last Updated on May 19, 2023 by Chin Yi Xuan

Rakuten Trade is my main stockbroker when it comes to investing in local stocks due to it being one of the lowest-priced commission brokers in town.

For quite some time now, I have been receiving emails and various questions under my stockbroker and Rakuten Trade articles about the platform. Since the questions are quite commonly seen, I thought why not compile them in one article to address them.

Please note that this is not an exhaustive list. Hence, if you do not find the answer to your questions in this article, feel free to leave a comment at the end of this article and I will update the list of questions accordingly!

Anyways, have a good read!

READ: Rakuten Trade Long-Term User Review: 5 Reasons Why it is My Preferred Stock Broker!

Table of Contents

“What to do if I forgot my Trading Pin?”

Please login to the members’ page via www.rakutentrade.my/login and then click “Settings”, select “change trading pin” and proceed accordingly.

‘Order amount exceeded trade limit’ issue

To address extraordinary market volatility in the equity market, Rakuten Trade has implemented a market order mechanism (price band) that will prevent trades to exceed customer’s available trading limits. The cost of trading will be calculated at 30% higher than the current market price.

*Price band percentages will be 30% above the market price, as such customer trading limit should have a minimum of RM138.50 in order to purchase 1 board lot of 100 units of shares.

“Can I transfer my shares from other brokerage accounts to Rakuten Trade?”

Yes, you can.

To initiate a share transfer from another broker to Rakuten Trade, you will have to reach out to the broker where your shares are currently deposited in to fill up the shares transfer form. The shares will be reflected in your Rakuten Trade account upon successful transfer from the previous broker.

What are the Charges?

It’ll be RM10.00 per stock charged by Bursa Malaysia Depository regardless of quantity.

How long will the transfer take?

If the instruction is received before 10:00am, the transfer will be done on the same business day. If the instruction is received after 10:00am, the transfer will be done by the next business day.

Note: This is subject to when the transfer is accepted and acknowledged by Bursa Malaysia Depository.

“Can buy foreign-listed shares with my Rakuten Trade account?”

No

Potential RT Platform issue/System Down Issue

Since MCO started, the market condition as attracted a huge influx of retail investors into the marketplace. This resulted in an increase in brokerage account activations across the board regardless of brokers.

Indeed, I have heard feedback from people about system down issues on various brokers including Rakuten Trade. Hence, I have reached out to Rakuten Trade in hope to get some clarification on their approach to resolve the sudden influx of investors.

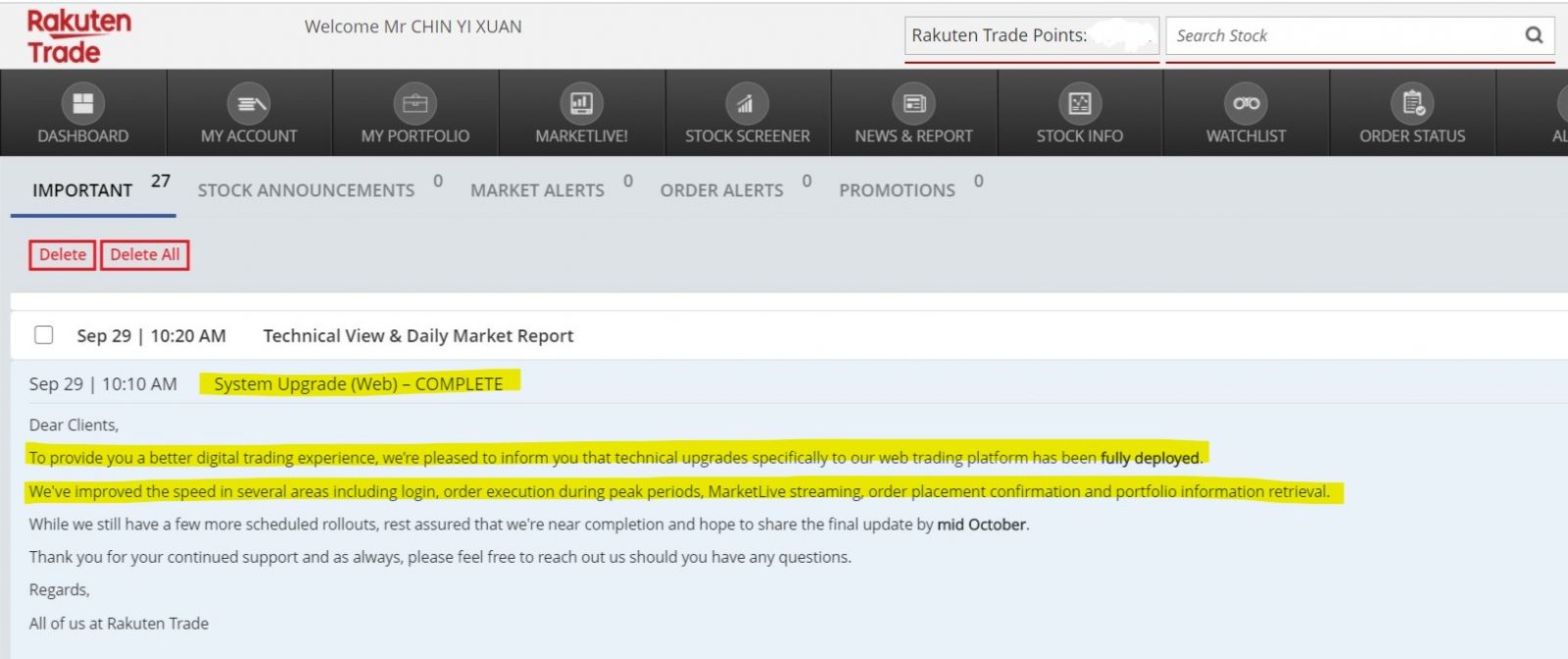

As per my knowledge, Rakuten Trade acknowledges and is mindful of the issue. In return, they are currently pushing updates to the platform in phase in order to improve the overall user experience.

Update October 2020: As per October 2020, Rakuten Trade has completed the deployment of updates to their platform which includes login and execution speed during peak hours. This means that there should be lesser glitches moving forward and a generally smoother experience. Personally, I’ve tried executing orders during peak hours and it has worked well for me. That said, should you face any issues feel free to share with me in the comment section below!

“Do I have to open an extra CDS account in order to use my Rakuten Trade account?”

First of all, if you are not a Rakuten Trade user prior to this, you will need to open a CDS account specifically for Rakuten Trade (just like when you open a new brokerage account with anyone else as well).

But worry not, as your CDS account will be opened for you when you apply for a Rakuten Trade account.

“What are the differences between Cash Upfront, Contra & RakuMargin accounts?”

Cash Upfront:

Works like a debit card. The limit of how much you can invest is based on the amount you have in your account.

I would suggest most people, especially new investors to stick with a Cash Upfront account unless you have extensive knowledge and understanding of how a Contra or Margin account works and the risks involved.

Contra:

Works like a charge card. You can have a trading limit of up to 5x the money and existing share value that you have in your Contra account (limit differs from the type of shares and warrant expiry period we plan to buy).

That said, you will have to fully settle your transaction within 2 days. Failure to fulfill the settlement will cause force selling to an account from the 3rd day onwards.

Suitable for experienced active investors & day-traders.

RakuMargin Account:

Works like a credit card. Essentially, you are given a credit facility to invest in shares.

The margin of financing of a RakuMargin account is 180%. Simply put, this means that in order to secure an RM10,000 credit facility, you will need to have collateral (ie. existing cash and shares value) of RM18,000 in your RakuMargin account.

The main difference between a RakuMargin and a Contra account:

RakuMargin: There’s no fixed settlement period for RakuMargin account, but there’s an interest of 6.8%/annum on your outstanding balance (ie. Shares financed by margin, Losses from shares financed by margin).

Contra Account: Fixed settlement date of T+2. Meaning, you will have to settle your transaction within 2 days.

Market Transaction Hour

1st Session

Pre-opening: 8:30am

Opening and continuous trading: 9:00am

Closing: 12:30pm

2nd Session

Pre-Opening: 2:00pm

Opening and continuous trading: 2:30pm

Pre-closing: 4:45pm

Trading at last: 4:50pm

Closing: 5:00pm

“Does Rakuten Trade has an automatic Stop Loss Function?”

Yes, it is possible to set a stop loss on Rakuten Trade. After you bought a stock, you can add a sell stop or sell limit order which will act as your stop loss if price were to drop below the set price level.

Click HERE for more info on Rakuten Trade’s Stop orders.

“Why I can’t view my Rakuten Trade CDS account on Bursa Anywhere?”

Bursa Anywhere is an app launched by Bursa to allow users to consolidate and facilitate their CDS accounts.

That said, this is only applicable to direct CDS accounts. Since Rakuten Trade is a nominee CDS account, it is not viewable on Bursa Anywhere.

“What to do if I want to attend the AGM of the company that I invest in?”

To attend AGM/EGM, simply email your request to Customer Service ([email protected]) ten (10) working days before the AGM/EGM

“How long will it take for me to receive my dividends?”

Your dividend(s) will be credited into your Rakuten Trade account in at least five (5) working days after the official payment date.

“My cash balance is not immediately updated for withdrawal upon selling my shares, why ah?”

As per Rakuten Trade’s explanation:

However, your cash withdrawal available still need T+2 to reflect.

Do note that, if you keep trading (buy & sell) after that, it will take your previous order T+2 trading limit which means it will lower your withdrawal limit.

Below is the scenario to provide a better explanation to you:

- 3 Aug Sold Stock A RM1,000: Should be reflected on 5 Aug (T+2)

- 4 Aug Purchase Stock B RM600, Sell Stock B on 4 Aug RM800. Should be reflected on 6 Aug (T+2)

On 5 Aug, your cash withdrawal for stock A will be RM400 (after minus stock B RM600).

On 6 Aug, your cash withdrawal for stock B will be RM800.

All of these scenarios are based on RM0.00 withdrawal limit as default.

Have more questions about Rakuten Trade?

This article is not an exhaustive list, but it comprises of the common questions that are asked by my readers for the past few months.

That said, if you have any other questions that are not in this article, feel free to leave a comment below and I will do my best to help you out! 🙂

Disclaimer: The content of this article is written purely based on my personal research and experience, and is NOT an official document from Rakuten Trade. I’ll do my best to keep the content of this article relevant but for the most updated support and solution, please reach out to Rakuten Trade’s official support team.

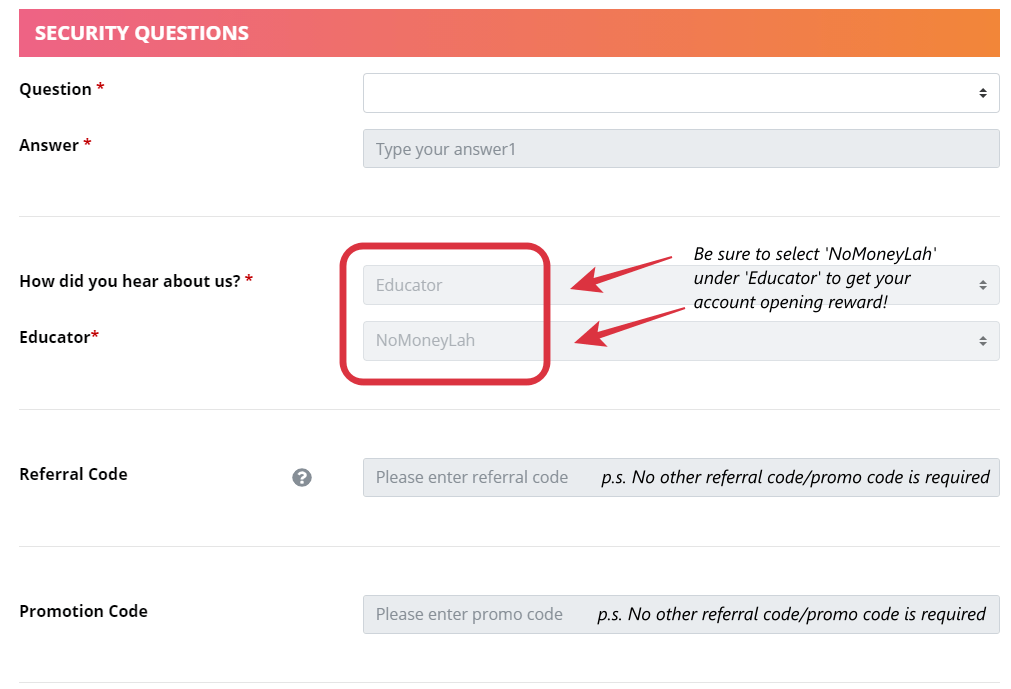

Rakuten Trade Referral Link for New Users

If you are keen to open a Rakuten Trade account, consider using my referral link below! For that, you’ll get:

- 1000 Rakuten Trade (RT) points worth RM10 to offset your brokerage fee.

- + 150 RT points when you deposit a min. of RM1,000 within 5 days.

- + 1000 RT points when you transfer your shares from other brokers to Rakuten Trade.

- + 1x brokerage fee rebate when you place your 1st trade within 30 days after your account is activated.

Aside from that, Rakuten Trade users get +1 RT point for every RM1 brokerage paid! Click HERE for the full T&C on RT points.

Open a Rakuten Trade Account Today!

Related Posts:

(1) Check this out before opening your stock trading account!

(2) How to make your first trade on Rakuten Trade?

(3) 4 Powerful Features on Rakuten Trade that’ll help you invest better!

(4) How to Build a Reliable Bursa Stock Screener via Rakuten Trade?

(5) NEW: Rakuten Trade Long-Term User Review: 5 Reasons Why it is My Preferred Stock Broker!

Disclaimer

The information stated above is based on my personal experience and for purpose of sharing such experience only. It is not intended as professional investment advice. Please contact Rakuten Trade for more information.

Related Posts

July 29, 2020

5 Things that I Look for When Investing in REITs!

January 3, 2024

How to Make Your First Trade on Rakuten Trade? (MY stocks)

April 16, 2023

Guide: How to open a CDS & Stock Trading Account Online

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Transfer share to sibling need to takes how many day?

Hi Von,

Generally, it should take around 48 hours.

Do reach out to RT’s support for more precise info: [email protected]

Regards,

Yi Xuan

HI YX,

If i queue buying a stock at a price below current market price

And then at the end of the day 5pm my queue is not fulfilled

Will i get charged for the transaction fees?

Hi Bryant!

Nope if your order is not filled you’ll not be charged.

Yi Xuan

Isn’t this supposed to be a financial website? You obviously don’t know what the f you’re talking about with the number of mistakes you got on here.

“Simply put, this means that in order to secure an RM10,000 credit facility, you will need to have collateral (ie. existing cash and shares value) of RM18,000 in your RakuMargin account.”

Are you stupid? Does this make sense to you? If I have to put in 18k to get 10k facility, why don’t I just use the 18k instead? Why am I reducing the value of my assets by almost half? If you don’t know shit, then stop posting shit. People who actually believe the shit you write are going to potentially incur monetary loss.

Hi there,

1. This is not a financial website. This is a personal blog where I share my personal experience and understanding of personal finance and investing. Of course, I make mistakes sometimes in my articles so feel free to point me out if I happen to make any mistakes in my article. 🙂

2. HOWEVER, in this context that you mentioned, there is NO PROBLEM to that statement and it is extracted directly from Rakuten Trade’s website as per their FAQ.

And not only that, it makes perfect sense: if you want to borrow RM10k, you’d need to have RM18k in cash value or share in your account – this is so the party that lends you the credit facility has his/her risk protected.

You can certainly find the FAQ here: https://www.rakutentrade.my/faqs/account-opening-rakumargin/what-is-margin-of-financing-mof

3. Relax and please, watch your language. 🙂

Yi Xuan

Please calm down and think about the scenario provided by Chin:

Imagine you have RM18,000 is your cash trading account and you have used it up to purchase Share A. Your invested amount is RM 18,000. By having this margin facility limit of 180% maintenance ratio hence you will have another RM10,000 to trade or invest. Making your total invested amount to RM 28,000 (18,000 -your own cash + 10,000 – margin facility). It make absolutely perfect sense. Thanks to Chin’s effort in explaining.

Furthermore, it is absolutely disgrace to leave those harsh and ill meaning comment on someone else blog (make it even worse when you are not factually correct). Imagine you invite some guests to your house, and they don’t what they saw and starting to shit around your house. I believe a more civilize way of handling it if your guests doesn’t like what they saw, they could just leave your house peacefully.

Hi Harry,

Thank you so much for your kind words. Appreciate it 🙂

Regards,

Yi Xuan

Hi Yi Xuan,

Rakuten trade do not provide foreign trade platform. do you have any idea that which broker provide better foreign trade platform and minimum charges?

You know about nominees accounts are entitled to execute any corporates exercise? right issue, treasury share and etc.

Appreciate your replied.

Hi Chung,

Rakuten Trade provides access to local market, not overseas. Personally, I am using Tiger Brokers to invest overseas. You can check out my Tiger Brokers review here: https://nomoneylah.com/2020/10/30/tiger-brokers-review/

Yes nominee account have no issues with corporate actions like rights issue as well. I have written about how to deal with rights issue on both Rakuten Trade and Tiger Brokers below:

https://nomoneylah.com/2021/01/14/rights-issue/

Hope this helps!

Yi Xuan

Hi Yi Xuan,

i placed a sell order today and it was acknowledged by Rakuten. The order status shows “acknowledged” after stock market, I wish to cancel it but the cancel/amend button seems not working. Are we allowed to cancel order after market?

One additional thing, I noticed the share which i placed for selling will have share consolidation and ex-date is on coming Monday. Now, the open order still captured in my order status and not able to cancel/amend, would that be impacted to my selling open order on Monday ?

Looking forward to your reply.

Thanks,

Tan

Hi Tan,

I am guessing the reason why you are not able to cancel your order is because you tried to do so during the maintainence hour after market close, which is around 5 – 6/7pm every weekday. If you try it now, it should work.

Looking at your situation, I think aas long as your shares are still in yiur holding (ie. haven’t been sold), any corporate action will take place with the account of the shares.

Hope this helps! But please reach out to the customer support if you need a 100% confirmation. 🙂

Yi Xuan

if i cancel order, will i be impose any charges?

Hi Ash,

If you cancel your order before it is executed, there’ll be no fee for the cancellation.

Hope this helps!

Yi Xuan

Hi bro, wanna ask.. my current cash balance with current trading limit is not the same. I am using cash upfront account only not contra. Is it because the Purchase/Sold security settlement not yet fully transacted? So actually I can just refer to my trading limit to know how much balance of cash I still have on hand right? Thanks Yi Xuan

Hi Daniel,

Yes you are right your transaction needs a few days to be settled and be reflected. Meanwhile, you can trade by referring to your trading limit.

If you need further or more detailed clarification feel free to reach out to Rakuten Trade’s customer support as they’ll be able to help you better on this issue 🙂

Regards,

Yi Xuan

Hi

This is my first trade account. I was looking at some shares and there is no indication of minimum shares on the rakuten platform. If not mistaken, there is minimum shares required right to buy shares?

Hi AA,

The minimum units of share you need to buy is 100 units.

As an example, let’s say Company A is worth RM1.00/share. The minimum you need to buy is 100 units of shares, which make it a minimum of RM100 (RM1.00 * 100 shares).

Hope this helps!

Yi Xuan