Last Updated on May 2, 2022 by Chin Yi Xuan

If you are looking to invest in Real Estate Investment Trusts (REITs), this will be extremely insightful to you.

In this post, I want to dive deep into the topic of how REITs make money, and why it is CRUCIAL for you to know this as a REIT investor.

Table of Contents

3 Types of Income Streams for REITs

On the surface, most people know that REITs make money through rental that they collect from their tenants.

While this is true, knowing just this contributes little to nothing to an investment decision (side note: knowing that we must eat to beat hunger doesn’t mean we know WHAT to eat to be healthier, right?).

On the other hand, it’d be an amazing piece of information if we are able to go deep into understanding how a REIT makes money:

#1 Rental Income (short-term rental)

Rental income is the first kind of income that most REITs investors are familiar with.

Essentially, rental income is derived from rents collected from tenants under short-term rental (normally around 1-3 years).

This is most commonly seen among REITs in the retail space (eg. IGB REIT – Mid Valley, The Gardens, KIP REIT – KIP Malls) & sometimes among offices and hospitality REITs as well.

#2 Contract Revenue (long-term fixed lease)

However, not all REITs do their business via a short-term rental model.

For some REITs, a short-term rental is simply not viable. Imagine a REIT that manages hospitals having to renew their contract with the hospital operator (a.k.a. tenant) every year, or the operator would have to find another place to continue the business – that just doesn’t make any business sense.

Hence, for these REITs, a long-term fixed lease contract is adopted in their business model.

In short, this means that instead of signing a 1-2 year short-term rental, REITs will sign a multi-year long (usually 3-20 years) tenancy deal with their tenants.

Under a long-term fixed lease contract, REITs are paid an agreeable amount of rent from the tenant throughout the tenancy period regardless of the occupancy of the property.

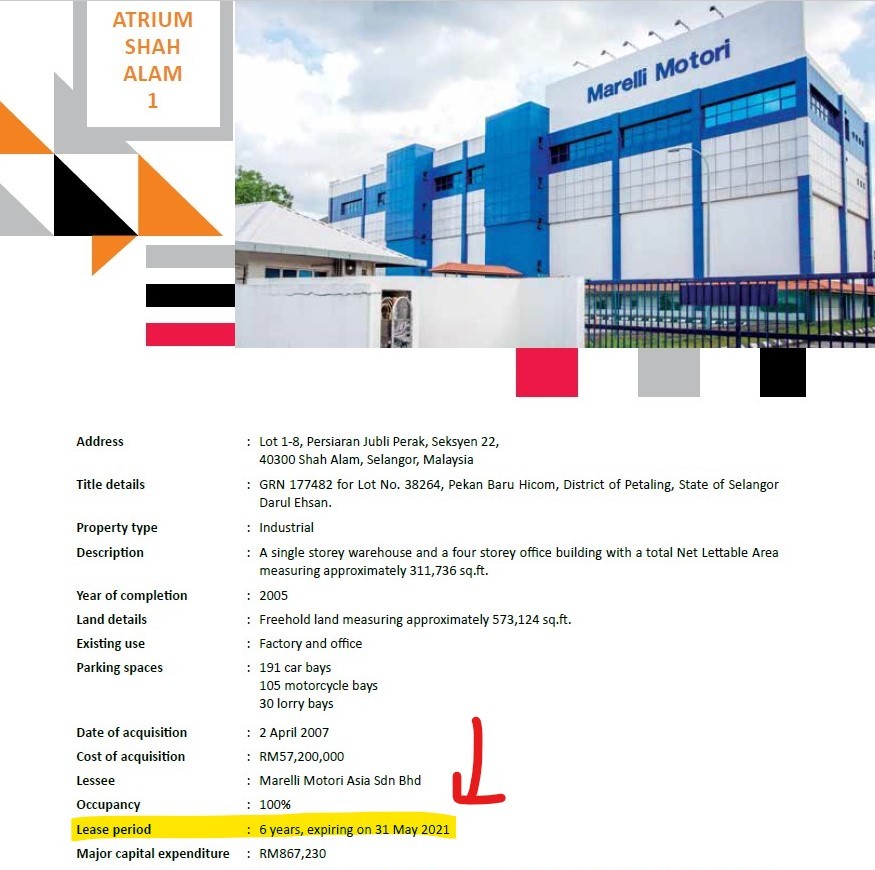

This is most seen in healthcare REITs (Al-Aqar REIT), industrial (eg. Atrium REIT), office & hospitality REIT (eg. YTL REIT).

—

Side note: Rental Income and Contract Revenue are NOT mutually exclusive for a REIT.

Meaning, a REIT can have income from short-term rentals AND from long-term leases. A good example is YTL REIT of which its revenue is dependent on the occupancy rate (short-term stay) of its Australian hotels, while also enjoying the long-term lease income from its Malaysia & Japan hotels.

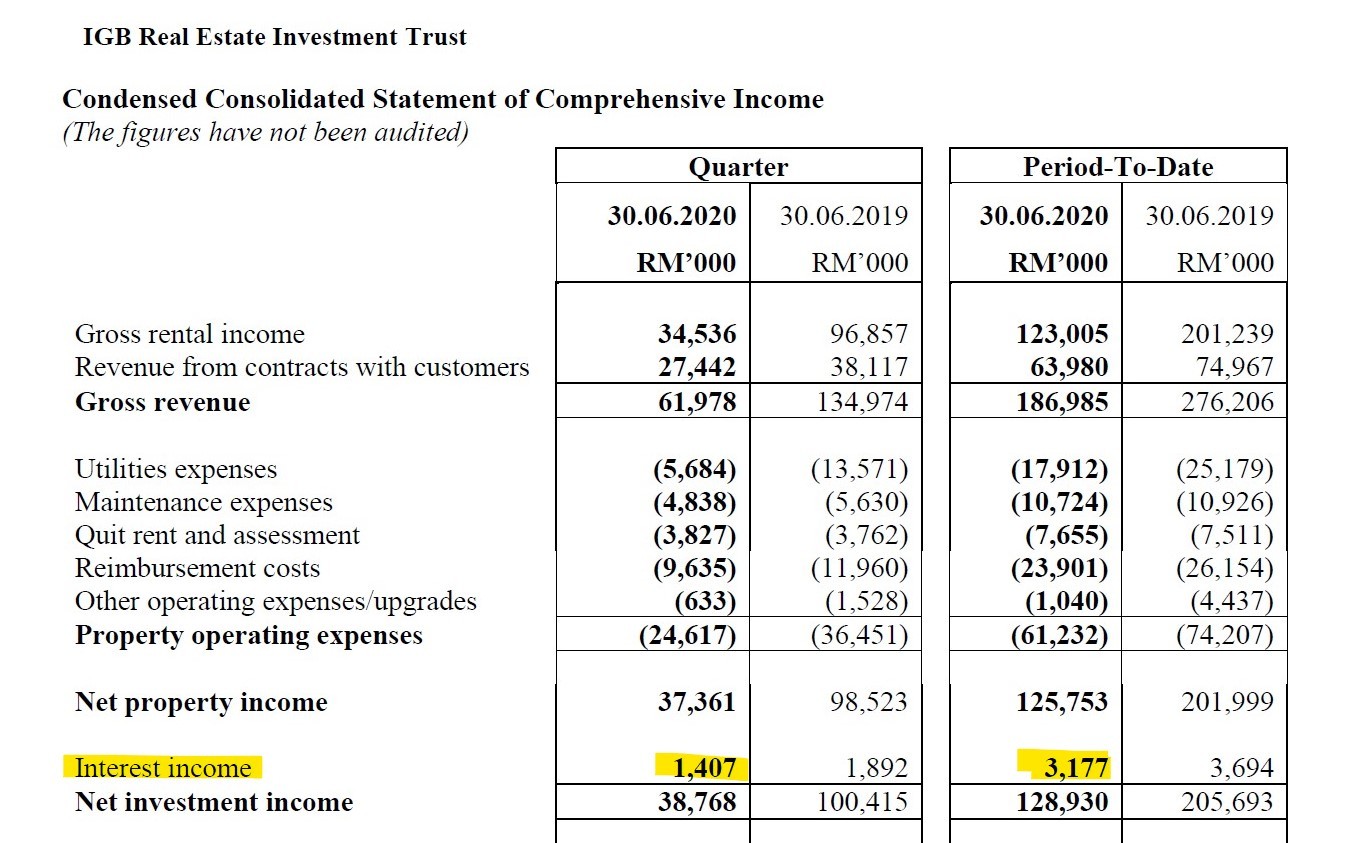

#3 Interest Income

The 3rd stream of income for REITs comes from the interest generated from the cash deposits in financial instruments like money market.

While this is a relatively small income stream for REITs, I thought I’d mention it for completion sake.

Pros & Cons of Different Rental Model

In this section, we are going to explore the benefits & risks involved with different REITs rental model.

#1 Rental Income (Short-term rental)

Pros:

+ Ability to be Nimble & Agile:

Short-term tenancy contracts mean REITs will be able to adapt their leasing strategy better to changing market demand & condition.

As an example, instead of leasing their mall space to non-essential businesses, retail REITs with short-term tenancy contracts can replace old tenants with the ones that supply daily essentials in order to adapt to the pandemic & improve their revenue.

+ Better Earning Potential:

Assuming a healthy & expanding market, REITs that adopt short-term rental models tend to be able to renew their tenancy contracts at an increasing rate.

The potential increase in rental is huge because the increment is usually not fixed & is (normally) decided on a yearly basis.

Cons:

– Challenges in Tenant Retention

Either a REIT that owns a sub-par property in a highly competitive environment (imo: Subang Parade, Sungei Wang), or simply a bad market condition (eg. Covid-19 Pandemic) will make it extremely challenging for REITs to retain their tenants.

This is especially true to REITs that own real estate that are on a short-term rental basis.

#2 Contract Revenue (Long-term fixed lease)

Pros:

+ Secured & Predictable Rental Income:

REITs that are engaged in long-term lease contracts (~3 – 20 years) mean their income is usually stable & secured for a significant period of time.

This provides additional peace of mind to the investors as the income of these REITs are generally ensured for a long time.

Cons:

– Relatively boring growth potential

Long-term lease contracts means that rental increment is usually fixed (eg. 3% rental increment every 3 years for a 15 years tenancy deal).

In other words, the potential income growth of these REITs tends to be relatively limited compared to properties in short-term leases as they are not able to increase rent flexibly as per the market condition.

– Dependent Risk

Generally, it is more challenging for a REIT to replace a tenant that is engaged in a long-term lease contract.

As an example, it is easier to replace a small tenant in Sunway Pyramid compared to the whole hospital operator of KPJ Healthcare Centre.

Simply put, REITs with properties under long-term lease contracts have the risk of being overdependent to one of two tenants.

What Does All of These Mean to You?

Knowing how a REIT makes money is essential as it gives us a super important piece of puzzle in our decision-making process:

-

Short-term rental vs Long-term lease contracts

Understanding how a REIT generates income can help us in identifying the underlying opportunities, strengths & risks when investing in a REIT.

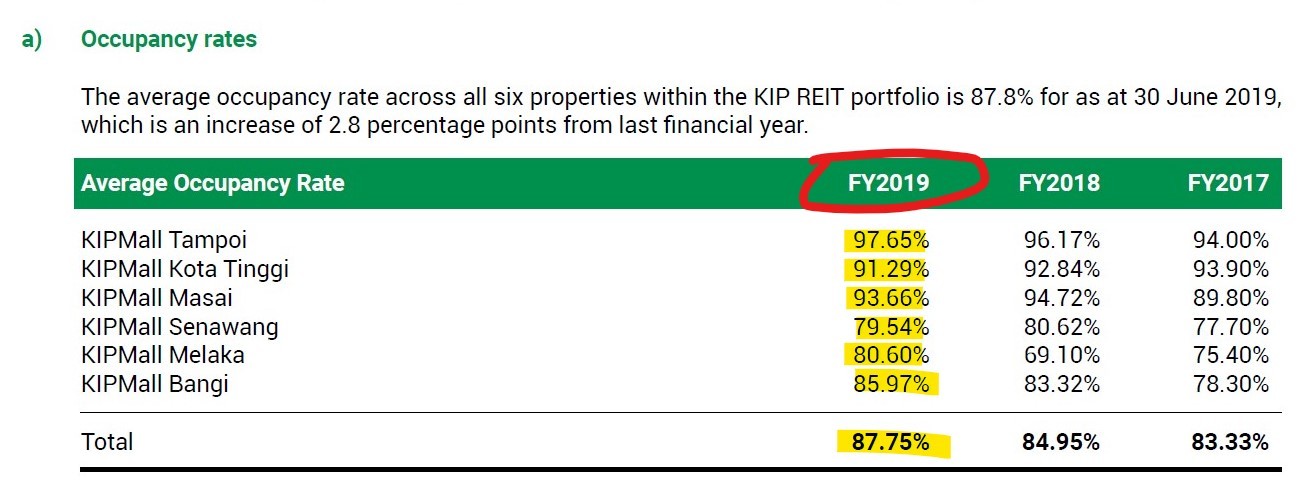

For REITs with properties engaged in a short-term rental, the occupancy rate is extremely crucial. If the property (eg. Mid Valley) is not occupied, this will directly affect the revenue of the REIT.

On the other hand, investors should focus on the lease expiry period of REITs with properties engaged in long-term lease contracts (a.k.a. how long before the lease contract expires?)

-

Which income model is better?

In short, there is no right or wrong answer to this.

However, asking ourselves the right questions before investing in REITs could be of great help to our decision-making process:

- Could REITs running on short-term rentals able to retain their tenants next year?

- Could REITs running on long-term leases able to find a new tenant after the current lease expires?

Combining the questions above with the current market condition & some foresight, you’ll be able to discover different opportunities, strengths & risks before investing in a REIT.

No Money Lah’s Verdict

Tenancy, regardless of a short-term rental or long-term lease, is the lifeline of REITs.

Hence, it is crucial for a REIT investor to find out & understand how REITs make money before investing in them.

Well, I hope this simple article has been helpful to you! Any questions, however big or small, just leave your comment below!

—

p.s. If you are keen to learn about REITs, you will be interested in my REIT investing sharing session. Find out more HERE.

Disclaimer: This post is written for sharing purposes and should not be taken as advice to make any form of financial decision. Please consult a licensed financial planner before making any important financial decisions.

Related Posts

August 18, 2019

5 MUST-KNOW Terminologies Before You Invest in REITs

Gearing refers to the leverage of a…

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.