Last Updated on May 2, 2022 by Chin Yi Xuan

Imagine waking up tomorrow, and going to work because you enjoy the things that you do, not because of the paycheck every month?

Alternatively, you could also retire altogether, and head over to the beach if you feel like doing so.

Regardless of which option you choose, it feels amazing! The freedom of choice, action, and time are indeed the best things that can happen to any working adults.

This is what achieving Financial Independence (FI) can do for you:

FI is a state where your side/passive income (eg. investments, side businesses, rental properties) covers more than your expenses, that you do not have to financially rely on a full-time career anymore.

In this post, let’s explore how much do we need to achieve FI, PLUS a more interesting question:

Which is more helpful to achieve FI? Increasing your income OR reducing your expenses? (You’d be surprised!)

Table of Contents

Part 1: How Much Do You Need to Achieve FI?

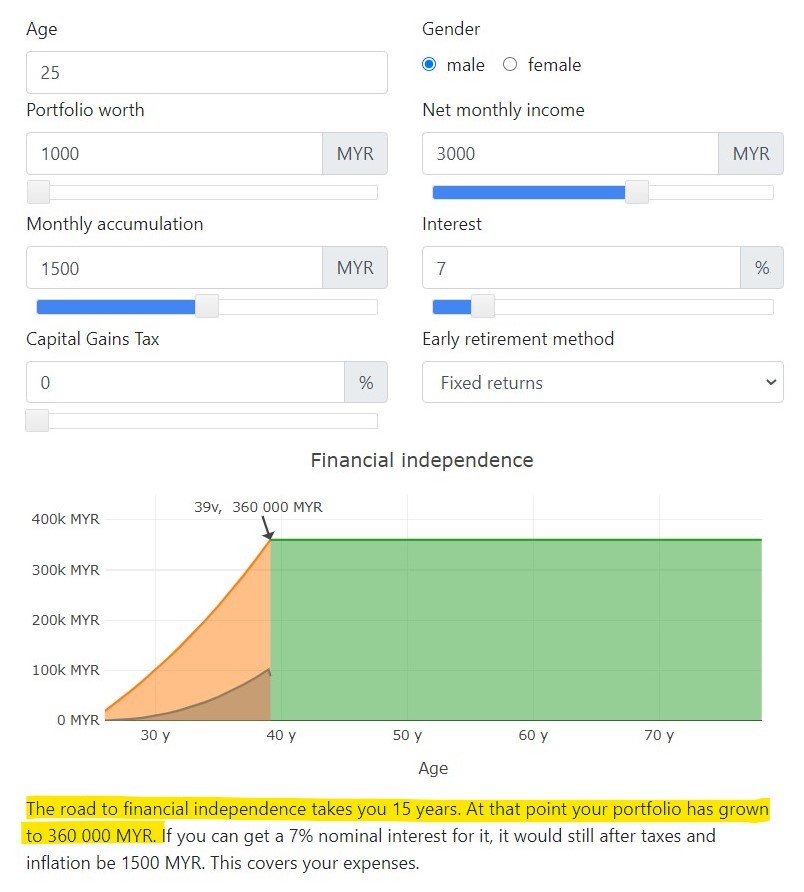

To calculate this, we’ll use a Financial Independence calculator HERE with several assumptions for this case study named Jake:

- Age: 25 y/o single male

- Starting capital to invest: RM1,000

- Net monthly income: RM3,000 (assuming no income growth for simplification)

- Average monthly expenses: RM1,500 (50% of income)

- Monthly allocation to invest: RM1,500

- Average annual return: 7%

- Retirement style: Fixed returns

- Inflation at 2%

Now, keying in all the numbers into the FI calculator, Jake will be able to achieve FI (and retire if he wishes to do so) at 39 y/o with RM 360,000 worth of investments. Then, Jake can sit back and receive his 7% return every year, which would be enough to cover his expenses (inflation-adjusted).

Hey, of course, I understand that this is a rather simplified example with some variables that could change as Jake’s life progresses (eg. Potential income growth with career progression, potential expenses increase due to starting a family). However, for anyone looking to gauge your FI journey, I think this calculator serves its purpose.

But wait, we are not even at the most interesting part of this discussion YET – read on:

Part 2: Increasing Your Income vs Reducing Your Expenses – which is more helpful?

Now, before you proceed, I want you to do a quick guess on your own:

Which one do you think is more helpful to achieve FI?

Let’s explore:

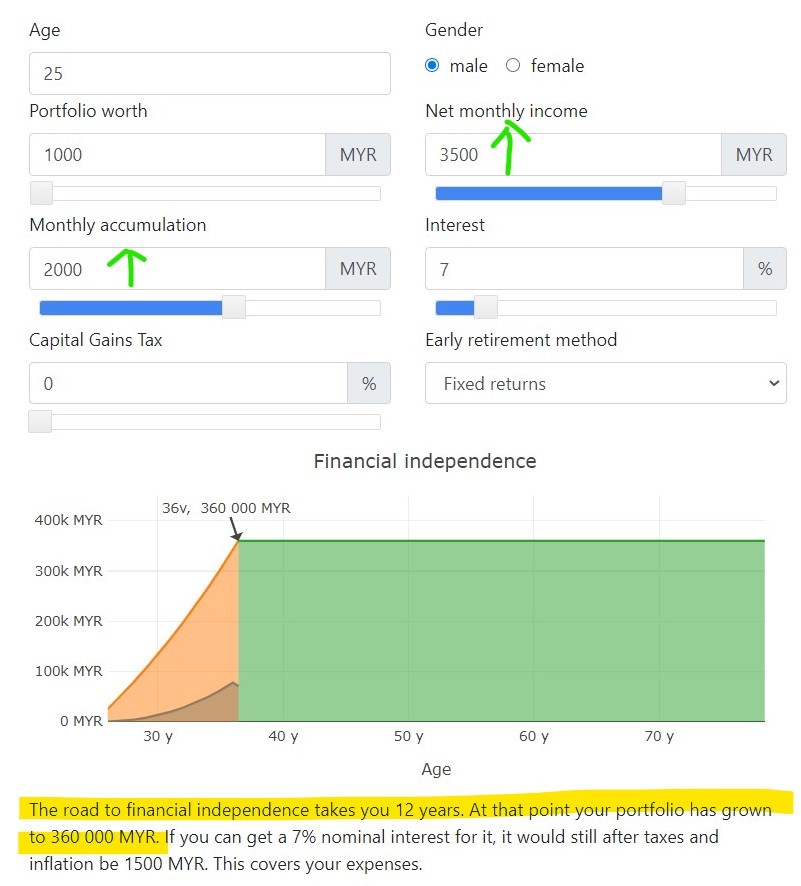

a. Increasing Income by RM500 (while still spending RM1,500/month) allows Jake to retire 3 years earlier.

- Age: 25 y/o single male

- Starting capital to invest: RM1,000

- Net monthly income: RM3,500 (initially RM3,000)

- Average monthly expenses: RM1,500 (43% of income)

- Monthly allocation to invest: RM2,000 (initially RM1,500)

- Average annual return: 7%

- Retirement style: Fixed returns

- Inflation at 2%

In the scenario above, Jake will be able to retire by 36 y/o (compared to the initial 39 y/o), with RM360,000 worth of investment assets.

To be frank, an RM500 increment in income is not super hard to achieve. This could be done by either striving for increment in his full-time job or using his downtime during the weekend to coach basketball or run an online store.

Not too shabby!

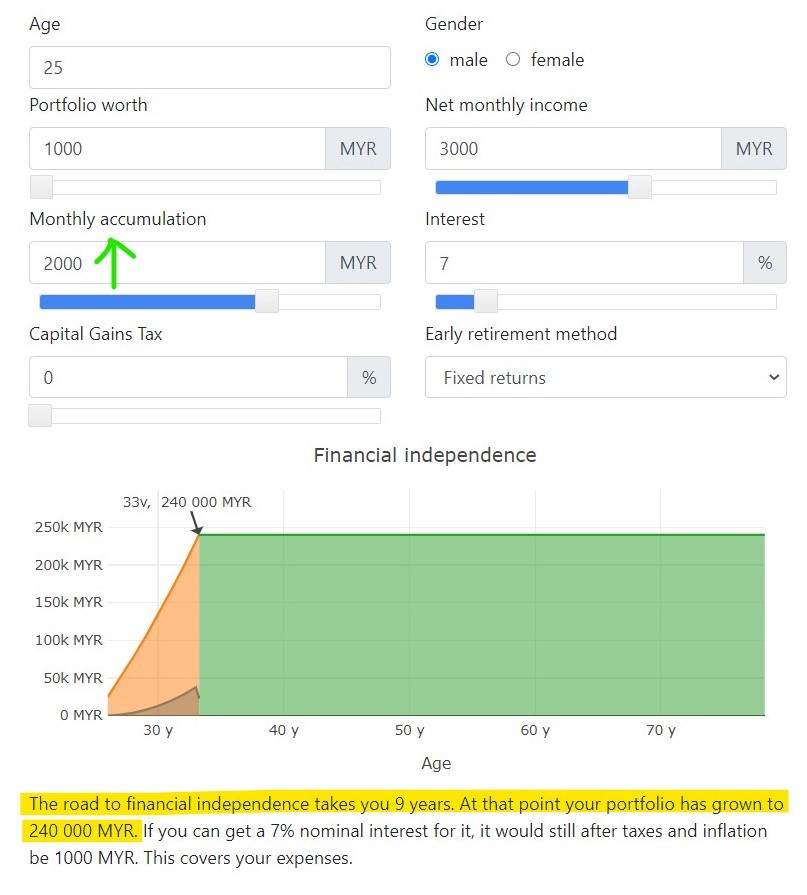

b. Reducing Expenses by RM500 (while still earning RM3,000/month) allows Jake to retire 6 years earlier.

- Age: 25 y/o single male

- Starting capital to invest: RM1,000

- Net monthly income: RM3,000 (stays the same with initial assumption)

- Average monthly expenses: RM1,000 (33% of income)

- Monthly allocation to invest: RM2,000 (initially RM1,500)

- Average annual return: 7%

- Retirement style: Fixed returns

- Inflation at 2%

In the scenario above, Jake could retire by 33 y/o (compared to the initial 39 y/o), with RM 240,000 worth of investment assets.

More surprisingly, compare this to the scenario above (increment in income of RM500), Jake could actually achieve FI (and retire if he wants) 3 years earlier!

Part 3: Lessons & Takeaways

The discovery above is quite refreshing to me, because my initial assumption was that an increment in income would always be more helpful than managing expenses.

Now, of course I did include some assumptions here:

- For both scenarios, income and expenses improve in the same proportion (ie. RM500).

- Whatever extra amount that’s earned/saved is invested.

Regardless, I think these case studies gave me 3 important takeaways, of which I’ll share them below:

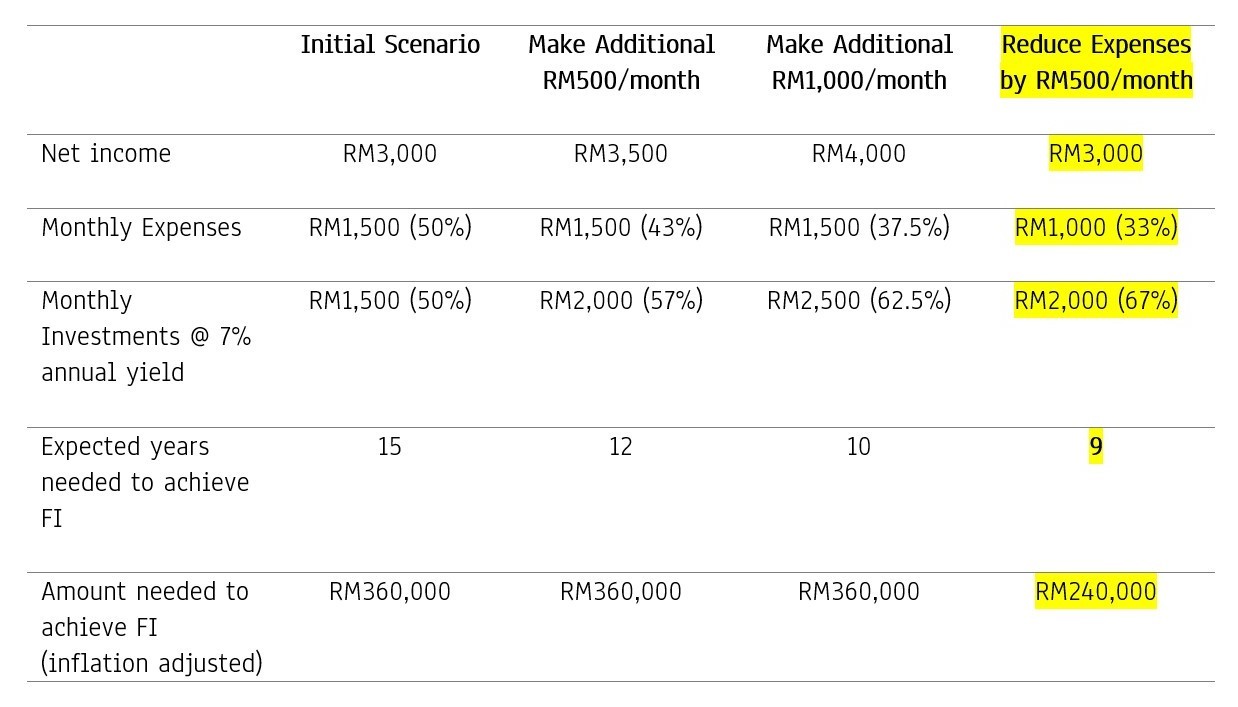

Lesson #1: If you are keen to pursue FI, manage your expenses FIRST.

Managing your expenses is CRUCIAL. Reason being, how much you need to spend to live on DIRECTLY determines how fast you can achieve FI.

Mathematically speaking, your expenses have more impact over how much you earn when it comes to how long it’ll take for you to achieve FI (refer photo below).

Yes, I agree with the fact that attempting to cut down RM500 in expenses is NOT going to be easy for most people.

That said, the key here is not about the absolute amount we manage to cut, BUT rather, the conscious effort to reduce unnecessary expenses in life.

If you have never look into your expenses before, you’d be surprised to find many expenses in life that could be cut down without having to sacrifice your overall happiness and fulfillment.

The best example is to bring along your bottled water while having lunch and skip that RM3 drink order. Just by adjusting this minor spending habit in life, you’d have an extra RM90 (RM3*30 days) to save/invest every month (equivalent to RM1,080/year) – pretty neat!

In short, if you are serious towards your long-term financial goals, try striking small wins by identifying & reducing all the minor & unimportant expenses in life.

Lesson #2: Increasing your income is also IMPORTANT.

Of course, there are only so many unnecessary expenses that you can cut in your life.

The next obvious step is to increase your earning power.

In the long run, the effort to increase income would be way easier compared to reducing expenses. Reason being, there is no upside to how much more you can make while there is a limit of how you can cut in terms of expenses.

In other words, unlike the scenarios above, you can definitely make more than RM500/month via a side hustle or a passion project.

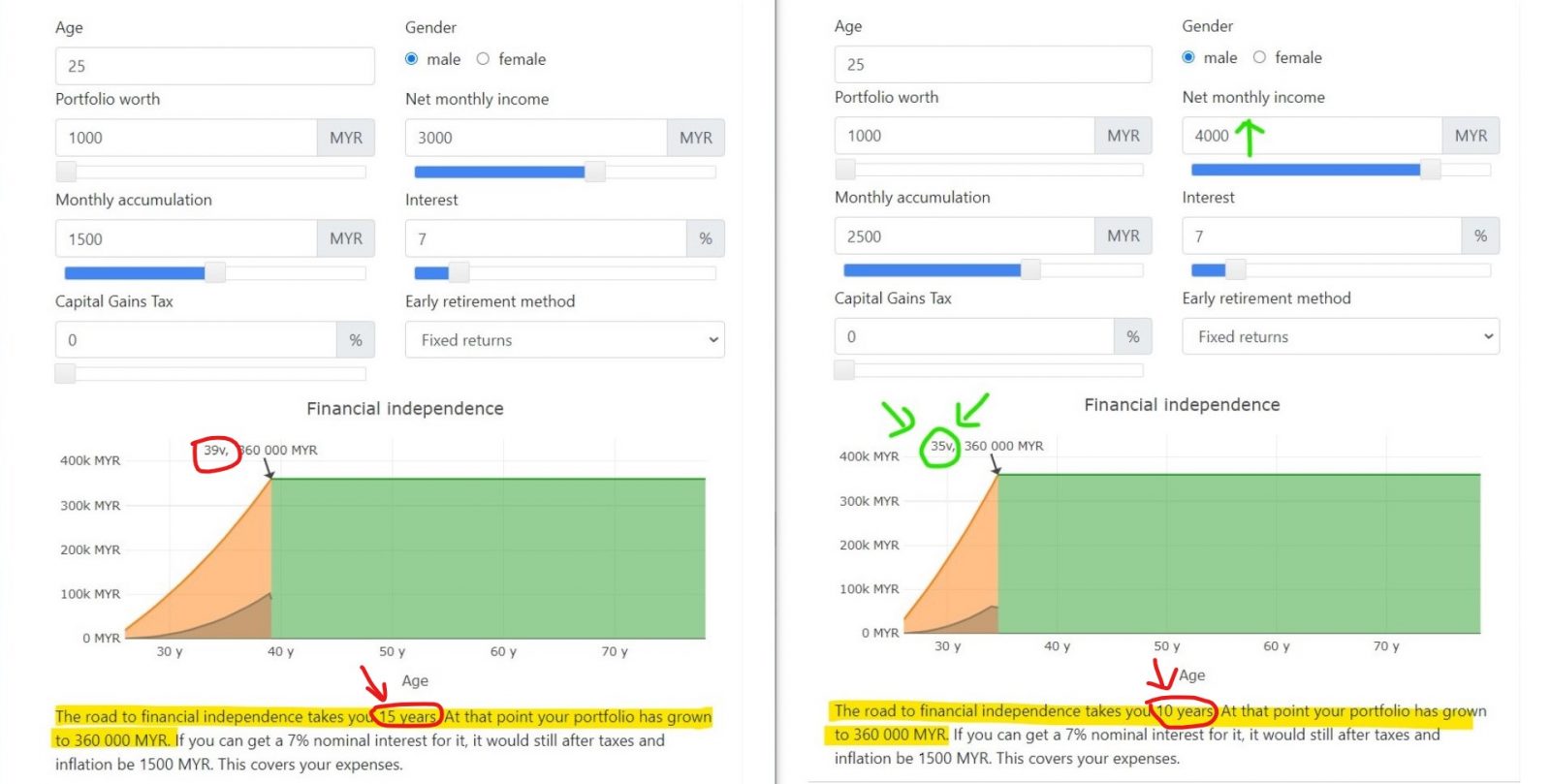

Using our original case study above, if Jake can make an additional RM1,000 a month instead of RM500 (while still spending RM1,500/month), his journey to achieve FI is shortened from 15 years to 10 years.

The key here is all about your willingness to invest the extra time to work on your hustle.

Lesson #3: FI = 90%*(Habits + Consistency) + 10%*(Strategies)

This last takeaway is perhaps the most underrated, yet important point that I’ve learned:

Achieving any financial goals is 90% habits & consistency and 10% strategies:

Most people have access to free content about personal finance techniques via the internet. Most people know that adding unique value in their workplace leads to higher pay. Most people know that building a side hustle will increase their income.

But not everyone is willing to put in the work and practice to improve their financial lives.

Knowledge is one thing. Execution is another.

No Money Lah’s Verdict:

So, are you surprised to find that managing expenses are actually more helpful to achieve FI? (under some reasonable assumptions, of course)

Personally, I was pleasantly surprised, and this proves that I have much to learn when it comes to personal finances – adulting is indeed a life-long journey.

So that’s it for this week’s post! Did you learn or find some new inspirations from this article? Feel free to share with me at the comment section below! 🙂

Till next week!

Disclaimer: This post is written for sharing purposes and should not be taken as advice to make any form of financial decision. Please consult a licensed financial planner before making any important financial decisions.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Yes Yi Xuan. I agree with you. By increasing income alone does not guarantee FI in the long-run.

In fact, control our own expenses should be the ultimate goal of FI.

I think this is the problem for the young generation, where they keep on thinking about how to increase their income but not how to reduce their expenses (all my relatives think how to earn more, but they are not cutting unnecessary expenses).

By the way, this is a great piece. Looking forward to your posts on this issue in the future!

Hey Tien Ming!

Haha thanks for the comment bro! Just like what you said, it is crucial to find a balance between managing expenses and increasing income. Both are important and viable depending on which stage of financial life we live. 🙂

Great writing 👍🏻 Get some useful tips from your article 🤓 increasing the income and reducing the expenses can run at the same time. So that we can achieve our financial freedom goals quickly and efficiently.

Hi hi!

That’s very true! Both can definitely run at the same time and it is all about being mindful and consistent in our effort.

good article! i always be a silent reader in the group and on your article but for this one you really enlighten me. thank you bro.

Thank you so much for being an awesome reader Afiq!

So happy that this article finds its way to you and enlighten your journey! 🙂

Yi Xuan