Last Updated on September 2, 2022 by Chin Yi Xuan

Okay, if you are here, you are most likely keen to find out if Flex (previously FRANK), a high-interest savings account from OCBC, is suitable for you.

Right of the bat, if you are still indecisive, I’d say – go open an account!

Table of Contents

Frank by OCBC Main Features/Highlights

- Save Pot & Spend Pot feature: Adjust your money accordingly when you want to save or spend.

- Earn interest up to 1.8% per annum for money saved on Save Pot + 0.3% per annum for money in Spend Pot.

- No typical FD lock-in period & withdrawal penalty. Minimum account balance & initial deposit of RM20 (extremely low barrier of entry).

- No forex mark-up while spending foreign currencies online (just like BigPay)

- Debit card & online banking function. Withdraw money at no extra charges from any ATM by OCBC (Malaysia, SG, Indonesia, HK & Macau)

- Capital is protected by PIDM up to RM250,000.

- Account Opening Reward: Get an RM20 additional cash reward in your account when you sign up using my referral code 3AFMJA, and deposit a minimum of RM20 in your account within 15 days from sign up!

Save Pot & Spend Pot – How Do They Work?

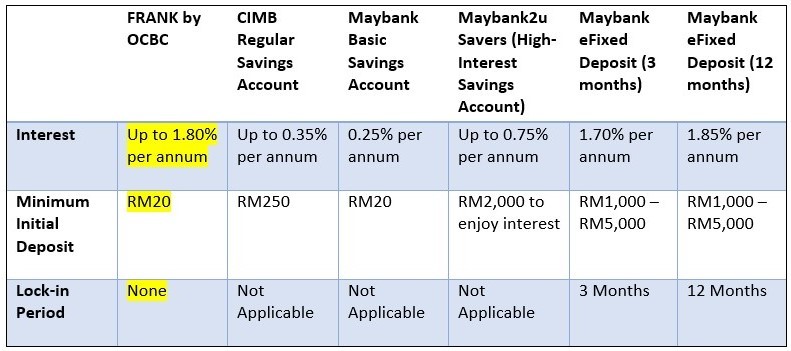

Here’s a table that’ll give you a clear idea of why FRANK is such a unique offering in the market now:

Obviously, the main thing that attracted me to open a FRANK account is the FD-like interest that OCBC offers (1.80% at this moment) – without the restrictions imposed by typical FD products.

How do they work, actually? Pretty simple, to be honest.

Just think of the Save Pot and Spend Pot as 2 piggybanks for different purposes.

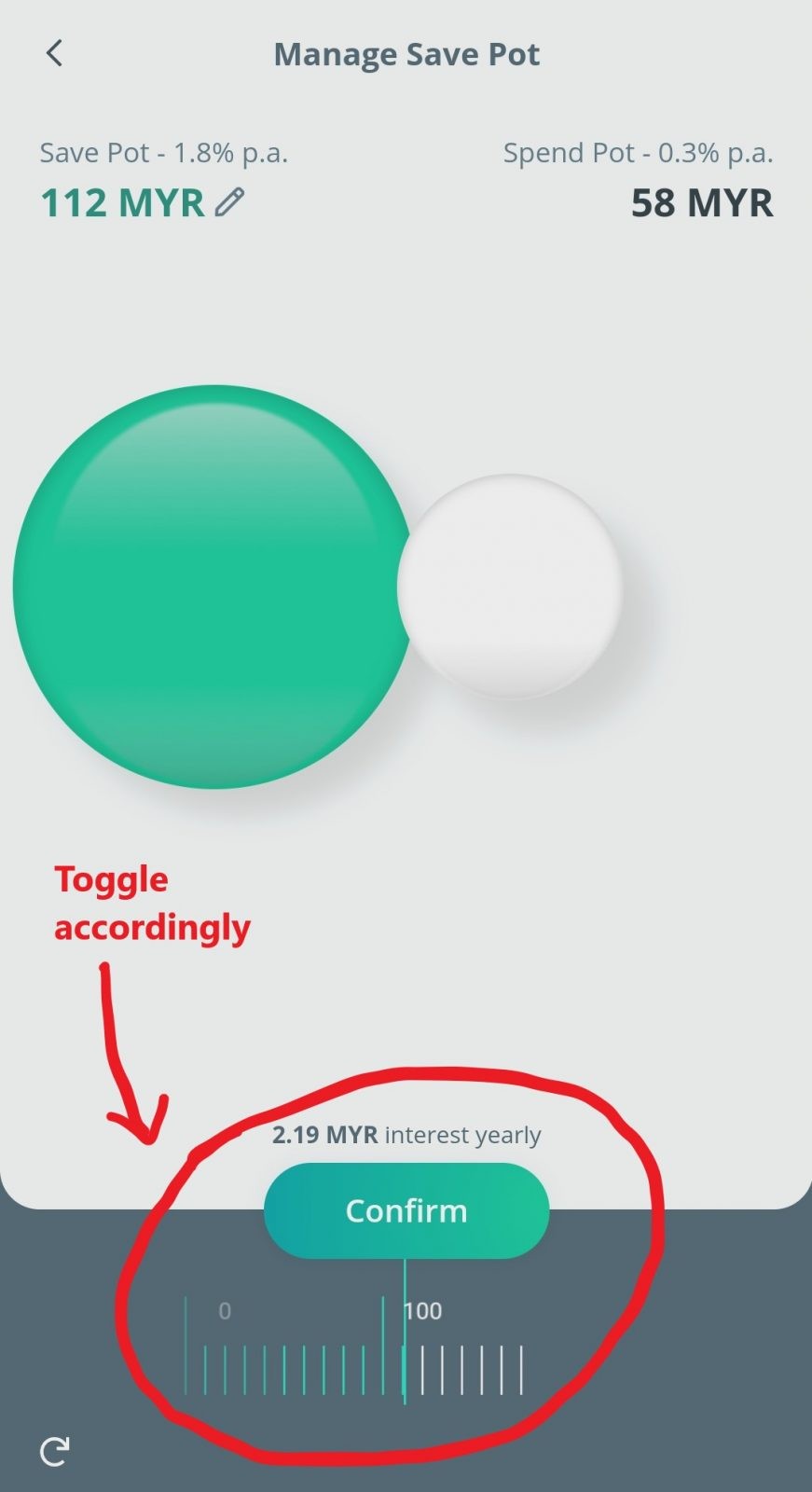

Essentially, in the OCBC mobile app, you are able to toggle your deposits between the money you want to save (a.k.a. the Save Pot), and the ones you are ready to spend (a.k.a. the Spend Pot).

The main difference between the Save Pot and Spend Pot is:

- You’ll earn 1.80% interest for money saved in the Save Pot, BUT you cannot withdraw or spend the money in it until you toggle/allocate them to the Spend Pot.

- You can spend the money in the Spend Pot, BUT you’ll only earn 0.30% of interest for the money in it. (p.s. You can toggle/relocate the unused money back to Save Pot to enjoy higher interest.)

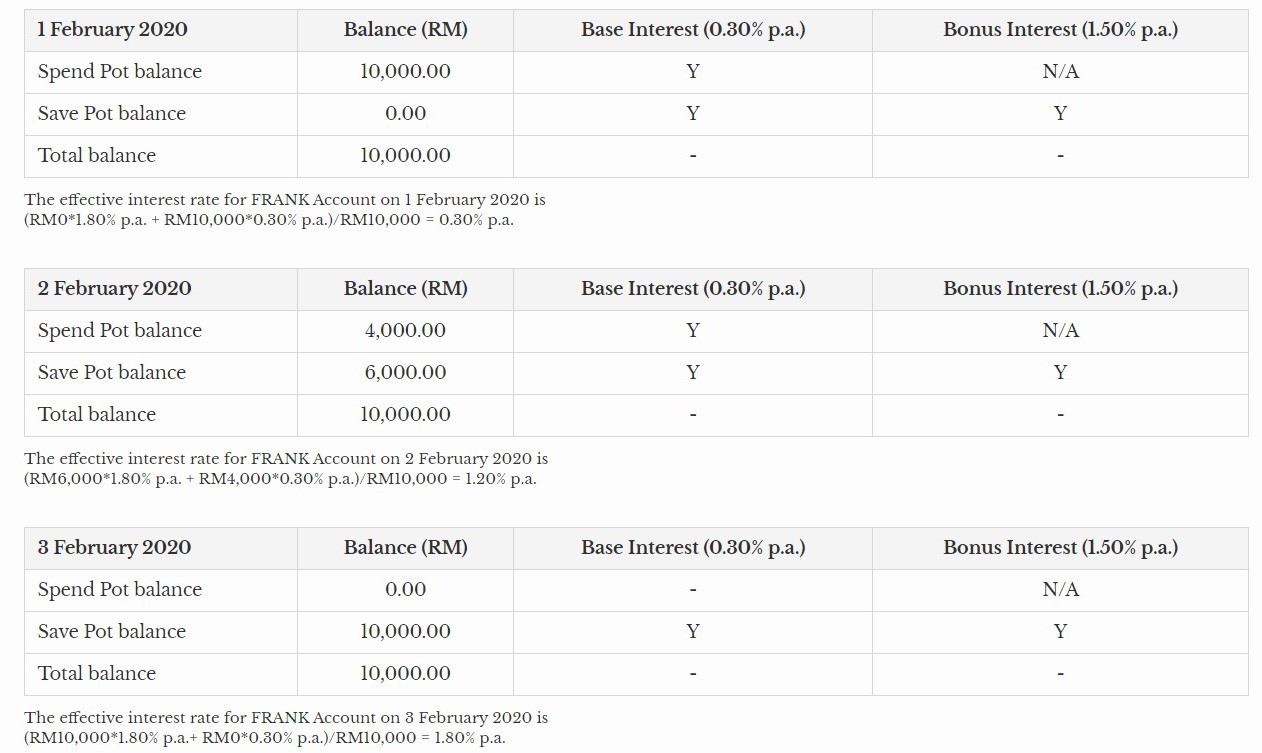

One thing that you need to bear in mind is that the interest is accrued daily based on the day-end balance (normally at 9pm) of your account, and will be paid out every month end.

Simply put, what this means is that the interest in either of your pots is calculated daily based on the balance in each pot by 9pm daily, as shown below:

Personally, I think this Save Pot & Spend Pot idea is brilliant. This is because it’ll make users think twice before spending impulsively as they may lose the extra interest earned with their savings.

Who is this for?

As you have read above, FRANK is a truly unique offering from OCBC. By offering FD-like interest and the convenience of a typical savings account, FRANK is a must-get for:

a. Students (18 y/o & above) and adults that are looking for high-interest savings account with truly competitive interest rate.

b. People that are held back by conventional Fixed Deposit (FD) restrictions (eg. High deposit requirement, long lock-in period, withdrawal penalty), and are looking for a Fixed Deposit (FD) alternative.

c. People that transact in foreign currencies a lot, and travelers looking for a BigPay alternative.

d. People that are looking to manage their personal finances better.

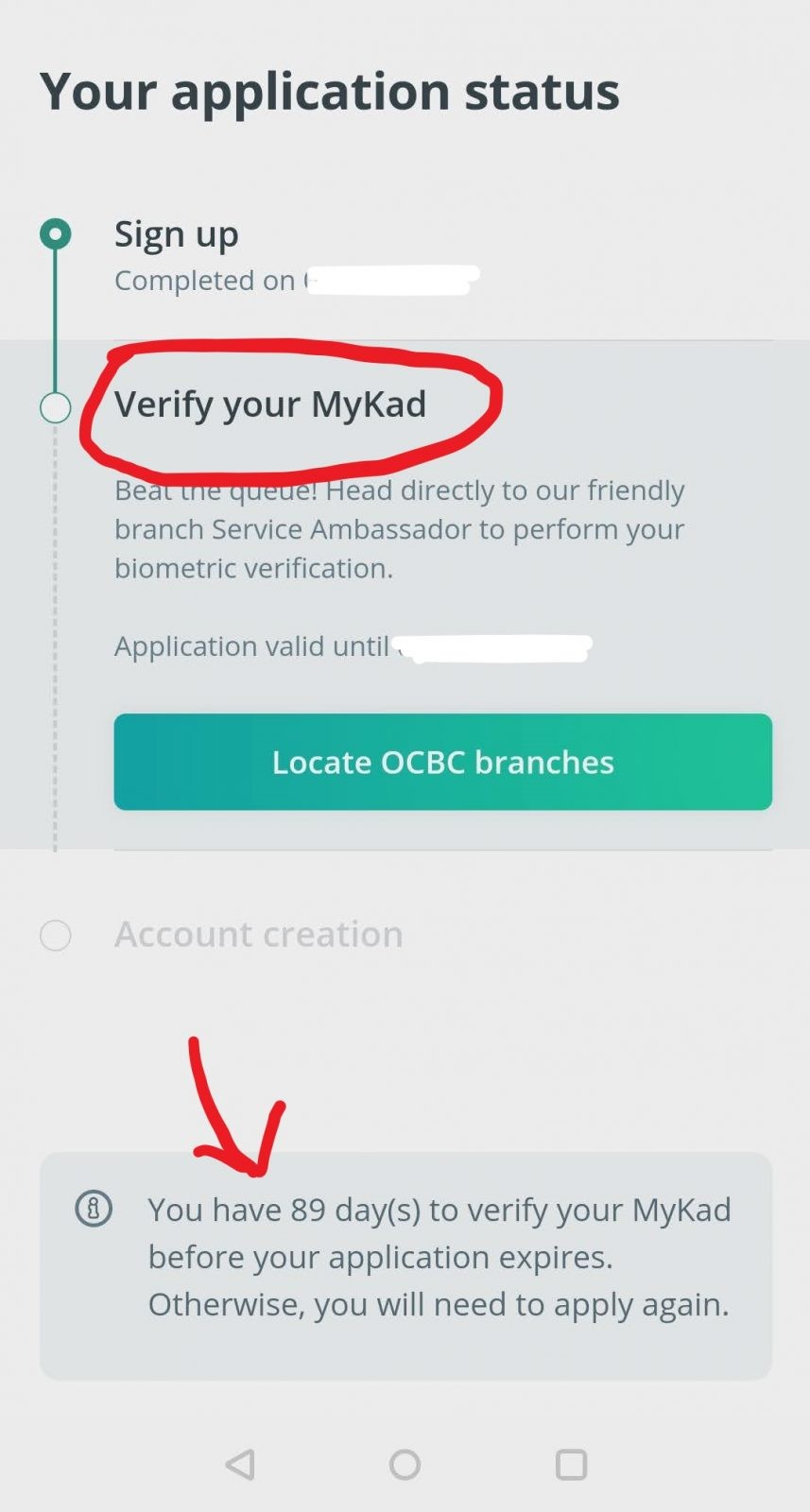

How to Open a FRANK Account?

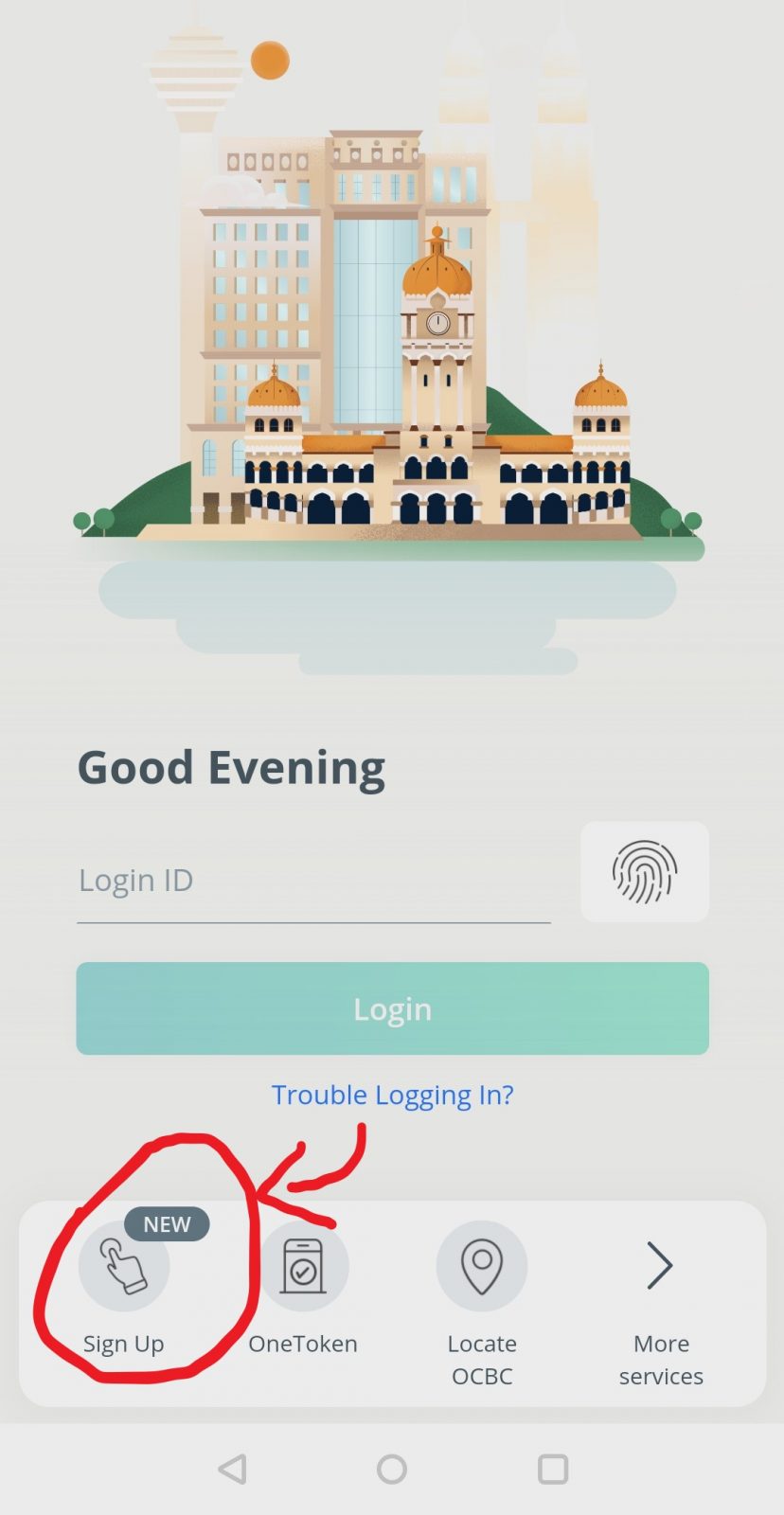

Step 1: Install the OCBC Malaysia Online Banking app HERE. Upon starting the app, click the ‘Sign Up’ button at the bottom left corner.

Step 2: Follow the steps to sign up for FRANK.

Step 3: Visit your nearby OCBC branch within 90 days to verify your identity & activate your account.

Step 4: Activate your debit card & online banking HERE after you are done with Step 3 (alternatively, you can also get the service agent in the branch to help you out too).

Step 5: Deposit a minimum of RM20 within 90 days to fulfill the minimum account opening balance.

Close Competitors

Having creating content in the personal finance space for about 2 years now, I can only identify 2 close (but not similar) competitors to FRANK, namely:

1. StashAway Simple

StashAway Simple is a money management offering from my favorite robo-advisor StashAway.

Essentially, StashAway Simple invests your money in extremely low-risk money market funds for FREE (ie. StashAway does not charge management fees for this), which will in turn give you relatively higher returns compared to conventional Fixed Deposits.

The downside relative to FRANK as a savings solution: Withdrawal of funds from Simple will take time to be processed. Hence, FRANK may be a better choice to place the money that you could withdraw and spend whenever necessary.

I love StashAway Simple, and is personally using it as well. Check out my StashAway Simple Review HERE.

2. BIMB Dana Al-Fakhim from BEST Invest

BIMB Dana Al-Fakhim is also a money market fund from BEST Invest (a fund management app by Bank Islam).

In short, you can also expect the returns from this fund to generally beat the interest from conventional FD offerings.

The downside relative to FRANK as a savings solution:

– Withdrawal of funds from BEST Invest will also take time to be processed. Hence, FRANK may be a better choice to place the money that you could withdraw and spend whenever necessary.

– Also, typical fund management fees are applicable for BIMB Dana Al-Fakhim (rightfully so because it is still a fund)

I am also putting my savings in BIMB Dana Al-Fakhim. Check out my other writings on it HERE.

Ultimately, the reason why I say these are close competitors, but NOT similar, is because they exist for different purposes:

For me, StashAway Simple and BIMB Dana Al-Fakhim are great for savings for the longer term, while FRANK is awesome to place my money whenever I am in need of liquid cash as it also provides the convenience of debit card and online banking.

Sustainability Issue: Get Prepared for a Potential Brutal Issue from FRANK

FRANK by OCBC is truly a refreshing offering to see in the ever-boring realm of FD and savings account products.

However, I think there is a more important conversation for us to have on FRANK. For this, it is essential for us to understand how Fixed Deposits (FDs) works and why they even exist.

In short, products like FDs exist because banks need the liquidity or cash to give out as loans. As such, banks are willing to pay out interests for the money that are locked in FDs because, in return, they can loan the money out at a higher rate.

However, unlike conventional FDs, FRANK advertises an FD-like interest rate (1.80%), BUT without the conventional lock-in period and withdrawal penalty.

Using some common sense and logic, it is only natural for me to question the sustainability of this return (or interest) advertised by FRANK because it is, from my understanding, a loss-making endeavor.

Reason being, how can a bank deliver an FD-like interest rate without locking in clients’ money for a specific period of time (and thus lending them out as higher interest loans)?

Putting Malaysia’s interest rate fluctuation aside, I am quite biased that this advertised interest rate by FRANK will not stay for long and will soon be adjusted lower. That said, only time can tell and hopefully, I am wrong on this matter.

No Money Lah’s Verdict

All in all, at the point of writing this article, FRANK by OCBC is definitely a no-brainer for everyday consumers like you and me.

Although I question the sustainability of the advertised interest rate, but having to enjoy FD-like rates (for now) alongside the convenience of a savings account is truly fantastic.

In short, I think this is a brilliant financial offering for most people and I think you’ll certainly like what you are getting.

Are you planning to open a FRANK account after reading this article? Feel free to share with me in the comment section below!

Account Opening Reward – Open Your FRANK account today!

Good news!

Get an RM20 additional cash reward in your account when you sign up using my referral code 3AFMJA, and deposit a minimum of RM20 in your account within 15 days from sign up! (p.s. valid until 30/6/2021)

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

FRANK is certainly a very attractive choice to squeeze out that extra yield from spare cash. My only concern is, as you said, whether it’s a sustainable offering or not. It’s commendable that applying for an account is quite straightforward, I just don’t like the hassle of going to a physical branch to complete the last step. In fact that’s the main reason I haven’t opened any account with OCBC since I was eyeing their 360 account as well.

For people who don’t have a lot of spare cash lying around anyway, the extra bit of chump change probably might not be worth it.

Hi hi!

Thanks for your comment and I 100% relate to your concern on the physical branch opening requirement esp. in times like this.

I guess ultimately it is not for everyone, but for those who fit in to the targeted audience group, they would love the offering. 🙂

p.s. Love your blog btw!

Yi Xuan