Last Updated on May 2, 2022 by Chin Yi Xuan

Bitcoin and cryptocurrencies have been picking up steam in recent months. This leads to a problem: I’ve noticed that people would jump on the bandwagon without truly understanding what they are doing.

So, what is cryptocurrency exactly? How do they work and why should you consider investing (and not investing) in them? Is cryptocurrency legal in Malaysia? How to invest in Bitcoin in Malaysia?

In this article, let’s cover all these questions so you are better informed and hopefully able to make a better investment decision:

p

Table of Contents

Disclaimer: My Personal Experience with Bitcoin, Cryptocurrencies & Blockchain

Personally, I’ve started to research and presented topics on Bitcoin & crypto in assignments & student forums way back in early 2017, when I was still a university student. This was a time when Bitcoin & cryptocurrencies were still alien to most Malaysians.

Before graduation, I have also interned in an insurance technology startup where I was involved in developing blockchain solution for insurance (p.s. it was eventually put on hold as we were (and still are) way ahead of our time for the dinosaur-age insurance industry)

Nevertheless, I am not by any means an expert with cryptocurrency and blockchain (the technology behind Bitcoin).

Given how fast the cryptocurrency space has evolved since I parted ways with any of these, I have to redo my research and update my knowledge as I prepare for this article.

The point is, having involved in this space not just as an investor, but one working on a (potential) viable solution, I hope I can give you a different perspective into the cryptocurrency space – and hence make better investment decisions.

With that, let’s start!

The BIG Picture: How well do you know about money?

The topic of bitcoin or cryptocurrency cannot start without a talk on money. Yep, how well do you know money?

Money, as we know today, is a medium of exchange for products and services that we use everyday. As an example, if I want to buy a Happy Meal, I’d pay for it using cash.

In other words, money is a store of value. But have you ever asked yourself: who decides that a banknote of RM1 is worth RM1, and a banknote of RM100 is worth RM100 and so on? What determines the value of money as we know it today???

Over human history, one thing that human commonly used for transactions is gold. Everyone recognizes gold and hence there is a general consensus of value around gold.

Then, because it is hard to bring gold around, humans eventually moved on to paper cash as a proxy to gold. This part is CRITICAL to our discussion because each paper cash WAS essentially backed by gold. (ie. People can redeem gold using their paper cash)

This gold-backed paper cash relationship ended in the 1970s, when the then-US president (Nixon) scrapped this relationship altogether. Since then, the governments and central banks decide the value of money.

Why is this important? Glad you asked.

This is because as we end the relationship between paper cash and gold, humans essentially entrust the value of money from someTHING (gold) to someONE (the government & central banks).

The impact? An almost-absolute power given to the government and central banks to manipulate the supply and value of money around the world by printing money – causing INFLATION.

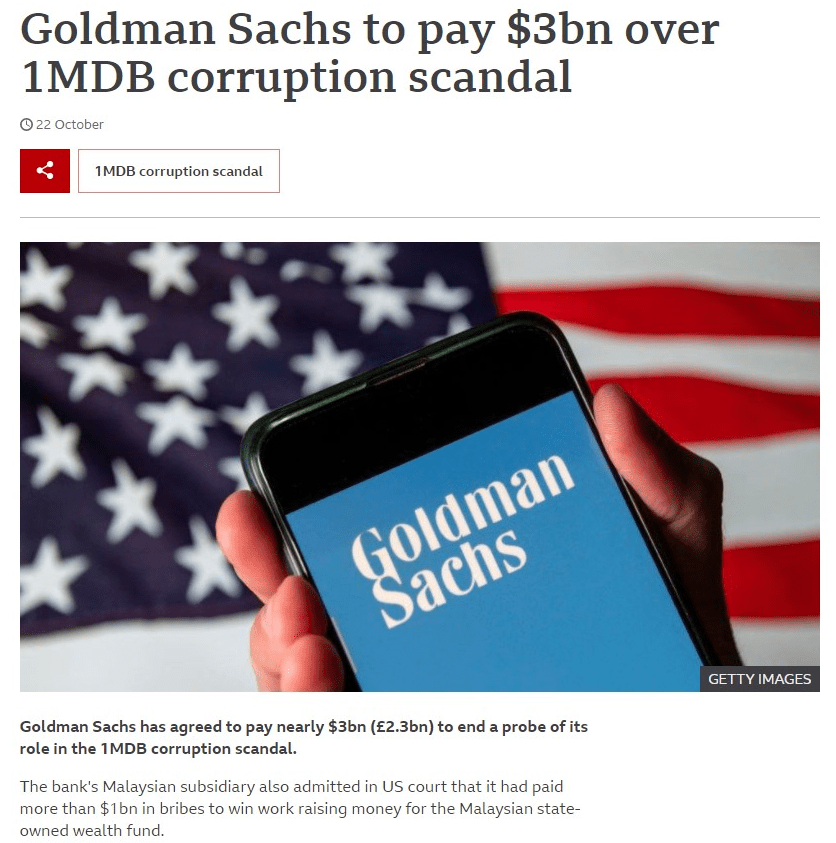

Not only that, because of how the monetary system is centralized, there is a huge chance for white-collar crimes like corruption, internal frauds, and forgeries to happen.

The Potential Solution? Enter Bitcoin

As the people’s trust towards the centralized monetary system gets weaker, cryptocurrencies like Bitcoin enter the scene as a potential solution to the flaws of this existing system.

Bitcoin at its core, is a transparent ledger without a central authority, created by an anonymous party (or person) call Satoshi Nakamoto back in 2009.

Now, to help you understand the concept above better, let’s compare Bitcoin to our conventional centralized banking system:

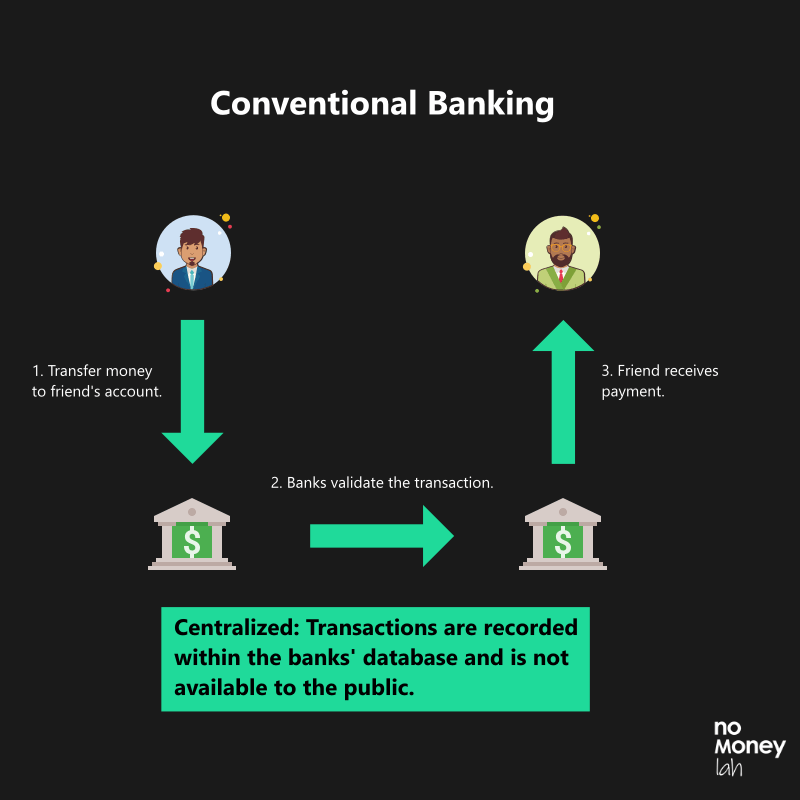

Conventional banking happens in a closed and centralized manner.

If we were to transact through banks today (eg. Sending money to my friend’s Maybank account via my own CIMB account), the transaction record (1) needs to be approved by the banks involved, AND (2) is NOT transparent as it is being kept in the central computer of the banks.

This means that for a bank transaction to happen, it needs to be validated by the banks (centralized). As the record is recorded in a centralized manner (ie. Not transparent to outsiders), the whole process is easily exposed to hacking and any transactional record can be potentially manipulated without being noticed by outsiders.

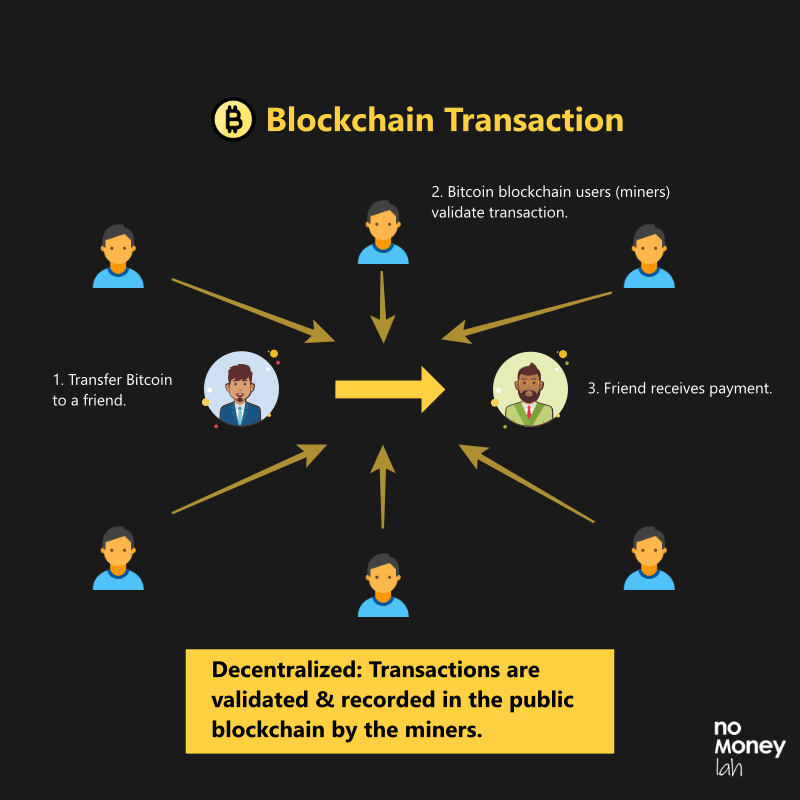

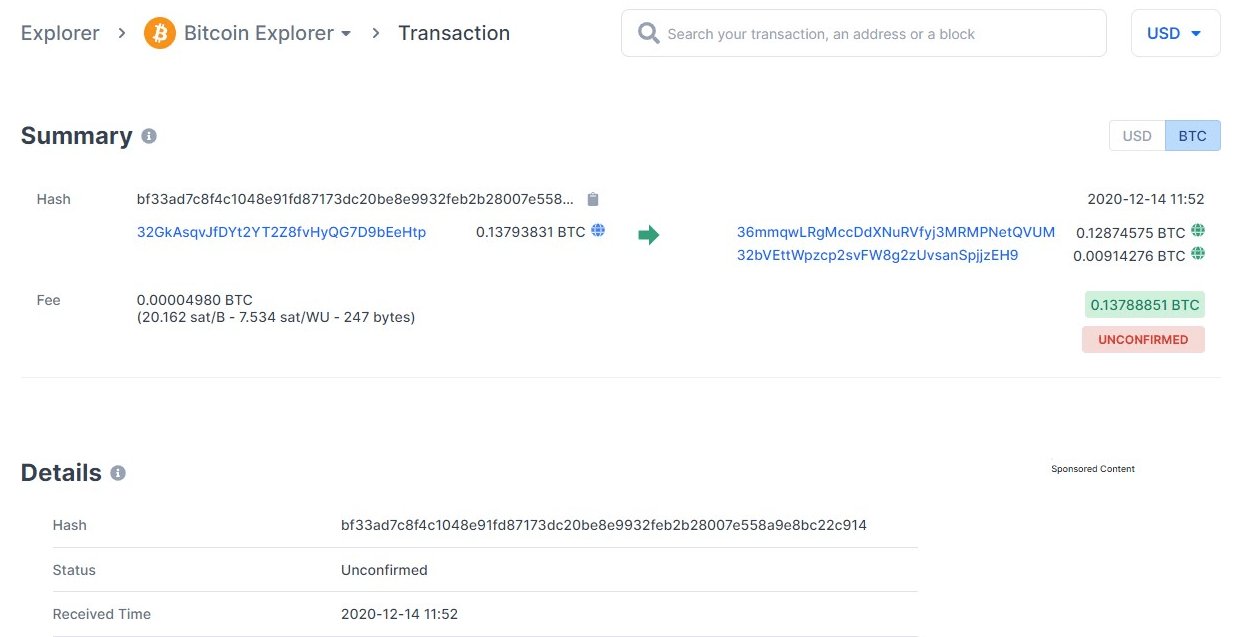

In contrast, transactions via Bitcoin happen in a transparent and decentralized ledger, called the Blockchain. This means that in a Bitcoin blockchain, (1) all transactions are trackable and (2) need to be approved by the computers participating in the Bitcoin blockchain (a.k.a. the miners).

Simply put, any transaction via Bitcoin is decentralized and transparent. In order for hackers to hack through a transaction, they’ll need to target thousands of computers in the blockchain network at the same time which is almost impossible to execute.

The Advantages of Bitcoin

Bitcoin presents many direct advantages to our present centralized monetary system:

#1 For one, because Bitcoin is decentralized by nature, you and you alone have access to your Bitcoins.

No one (ie. The government or banks) can have access to your Bitcoins, hence do not have the right to freeze your account or confiscate your holdings.

#2 Secondly, due to its decentralized nature, Bitcoin eliminates the middlemen (erhem… Banks) when it comes to transactions.

This effectively lower down the cost of transaction compared to traditional wired and telegraphic transfer. Also, this eliminates crimes like banking frauds and corruption altogether.

Put it another way, Bitcoin and its underlying technology Blockchain literally removed the fragile trust issue that people have towards the existing banking system.

#3 Lastly, Bitcoin opens up transactional capability to all people around the world that do not have access to conventional banking facilities due to where they live.

These are people that are underbanked. With Bitcoin, they can now transact with each other with just a smartphone without additional permission.

The Risks/Downside of Bitcoin

The ideals behind Bitcoin as a replacement for our existing form of transaction is amazing. However, there are several issues that investors may have to be aware of about Bitcoin:

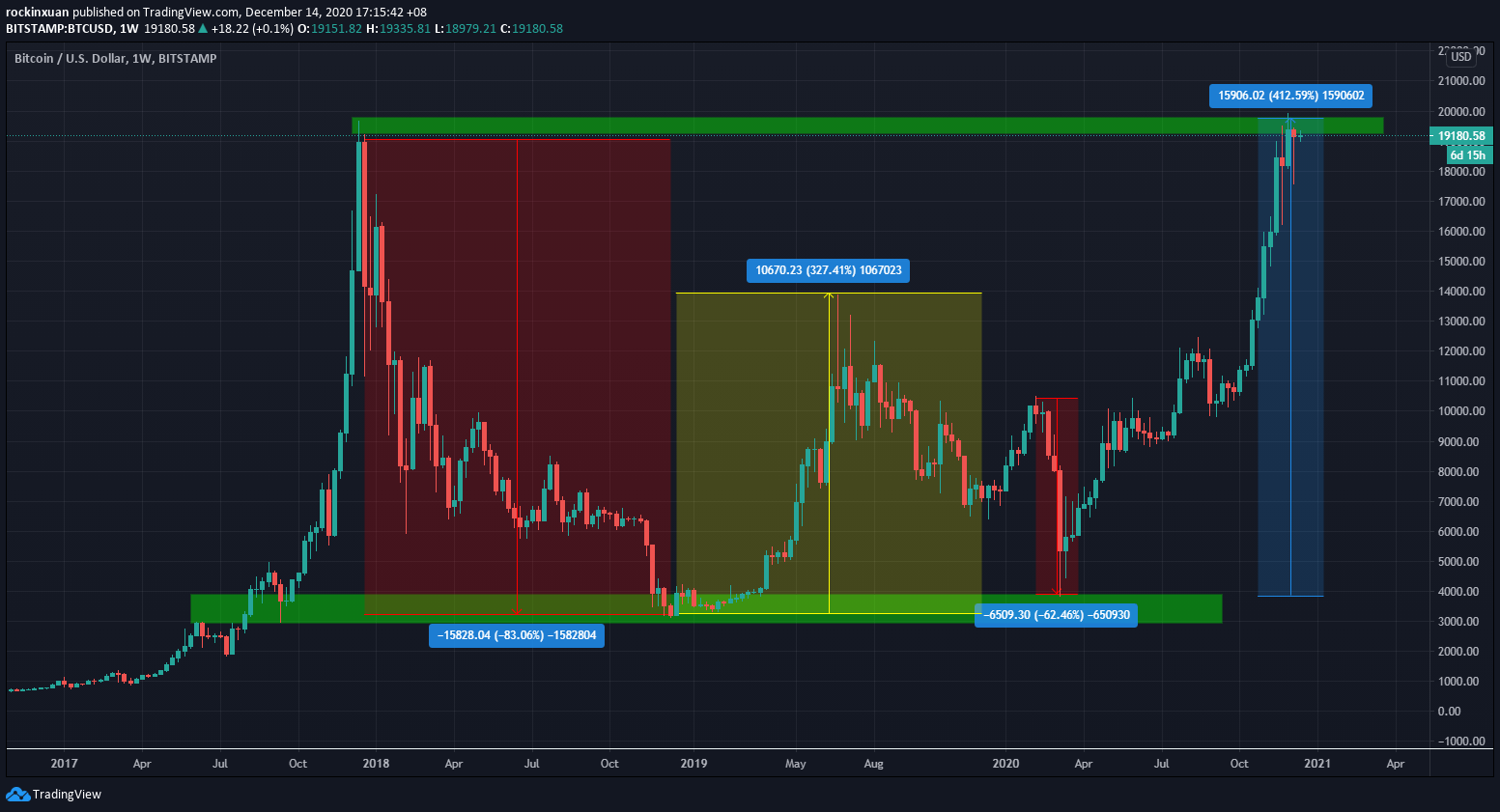

1. Volatility of Bitcoin and cryptocurrencies

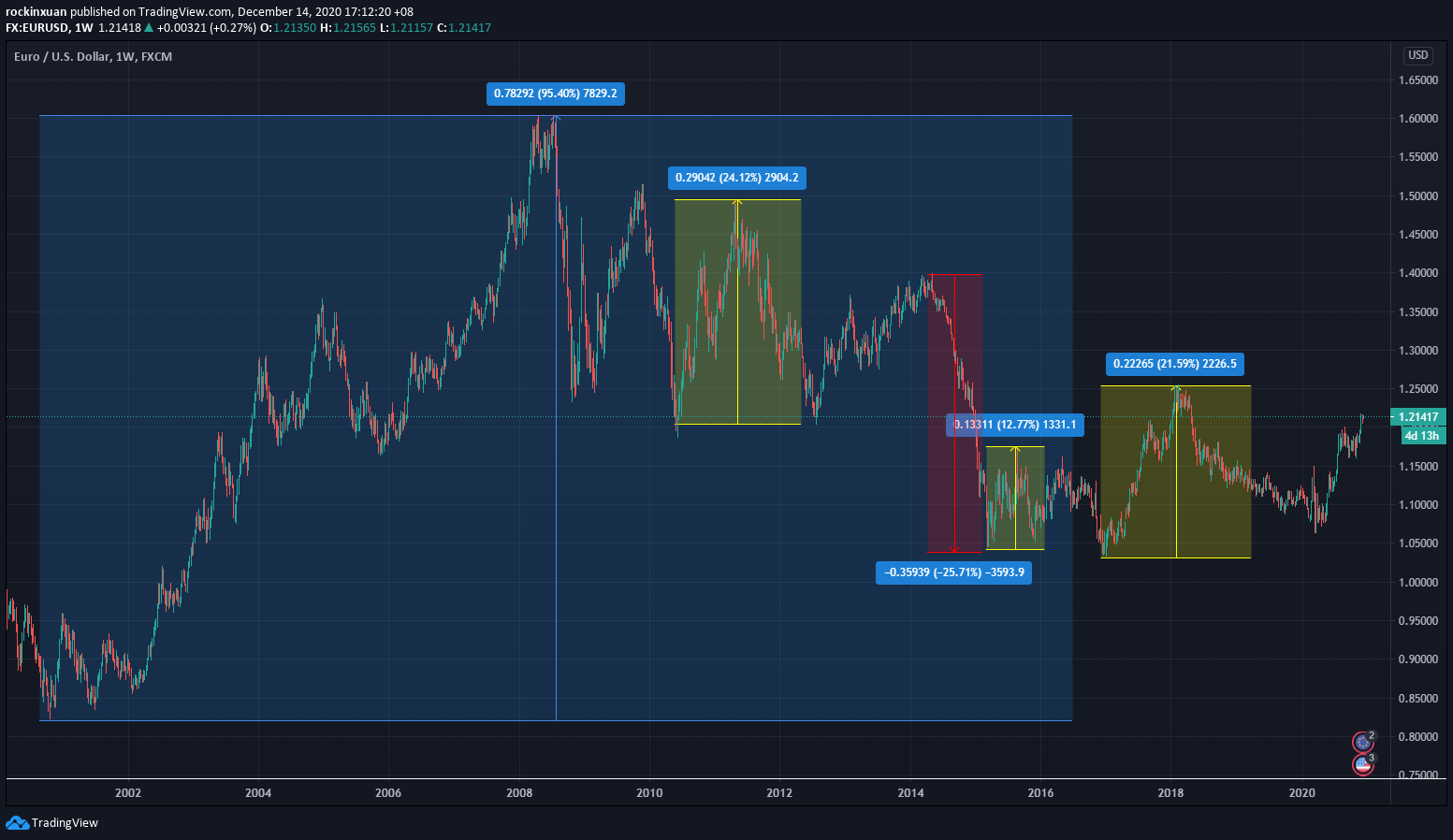

As of today, Bitcoin’s market cap (Market Cap = Total Bitcoin in circulation * Price) is around $350 billion. Relative to things like the gold market (~$3 trillion), Bitcoin is a much smaller market.

This means that Bitcoin is more easily affected by everyday’s fluctuation in buying and selling – just like how a rock can cause bigger ripples in a small pond than the large sea.

As a result, Bitcoin’s volatility makes it extremely hard to become a stable medium of exchange like our existing currencies. Imagine that a burger cost X unit of Bitcoin today, then suddenly Bitcoin just does its thing (ie. Fluctuate like nobody’s business) – and you have to pay 2X the Bitcoin for the same burger the next day.

As such, Bitcoin’s volatility poses a challenge for its mainstream adoption and harder for most risk-averse investors to accept Bitcoin as part of their portfolio.

2. Using Bitcoin for Crimes(?)

Due to the anonymous nature of Bitcoin, the debate around how hackers and crime-lords use Bitcoin as a manner of ransom is common every now and then.

Again, I do not have much knowledge on crypto-crimes so here’s what’s I’ve found in my research:

Since all the transactions behind the Bitcoin blockchain can be traced, committing any form of ransom via Bitcoin is actually not that easy. In fact, in 2019, only $829 million in bitcoin has been spent on the dark web. This is a mere 0.5% of all bitcoin transactions for the year.

Does this mean that Bitcoin can be cleared off its reputation as a ransom-heaven for criminals?

Not really. In this interview piece by the Wall Street Journal, it mentioned how criminals can (still) use Bitcoin as a manner to get off the radar despite the transactions being traceable in the blockchain network.

In short, we live in a complex world and as long as humans exist, greed exists. This means that there’s no perfect system and there’ll be greedy humans that will always try to outsmart the system.

3. Hacking Incidents revolving around Bitcoin Exchanges

As a whole, hacking the Bitcoin blockchain itself is extremely hard due to the decentralized nature of the blockchain itself. Meaning, hackers would have to hack into thousands of computers within the bitcoin blockchain at the same time to do what they intended to do.

If that’s the case, why is the news of cryptocurrency hacking so common every now and then?

While Bitcoin blockchain on its own is designed to be hard to penetrate, BUT many exchanges that facilitate cryptocurrency trading are NOT. Security flaws that exist especially among unregulated crypto exchanges give hackers the opportunity to hack into the exchange to steal users’ cryptocurrency holdings.

A search on Google for ‘Bitcoin Hacking’ usually revolves around cryptocurrency exchanges being compromised, not so much of the Bitcoin blockchain itself being hacked.

Hence, it is crucial that you choose a well-regulated cryptocurrency platform with tight security features in place before investing – more below.

Should You Invest in Bitcoin?

Ultimately, it all comes back to a question – should you invest in Bitcoin, or any cryptocurrencies for that matter?

In my opinion, making this decision ultimately comes back to your faith and trust towards our current monetary & banking system:

- Are you confident that the existing governments and central banks are making monetary policies with the people’s benefit in mind?

. - Are you happy with how the value of your hard-earned money is today compared to 10, 20 years ago?

.

- Do you trust that the policymakers are going to preserve the value of your hard-earned money in the next 10, 20 years?

Once you have these questions answered for yourself, investing in Bitcoin for the long-term is actually not a very hard decision to make.

With the recent news of Paypal adopting Bitcoin transaction, and Singapore’s DBS Bank being the world’s first traditional banks to launch its cryptocurrency exchange, it is only rational to think that the cryptocurrency world is here to stay and disrupt.

Are Bitcoin and cryptocurrencies legal in Malaysia?

In Malaysia, the state of Bitcoin or cryptocurrencies is, to be frank, not exactly clear. I feel that Bank Negara Malaysia (BNM) has been vague in their stand towards cryptocurrencies.

This can be seen in their official announcements on cryptocurrencies (example HERE), where they stated that they want to promote ‘transparency among digital currency activities in Malaysia’, but ‘there will not be any elements of consumer protection or avenues for redress made available in the event of complaints or losses and damages incurred by any parties dealing in digital currencies.’

Translating to everyday human language, I think their tone reflects an obvious “If you want to invest, no problem. But if shit happens don’t come and kacau us.”

In short, in Malaysia, you bear the full risk if you want to invest in Bitcoin or other cryptocurrencies – so keep this in mind!

How to invest in Bitcoin as a Malaysian?

All in all, having seen both the upsides and risks of Bitcoin, I hope you now have an additional layer of clarity towards your investing decision.

The next question: How can you invest in Bitcoin and cryptocurrencies in Malaysia?

Presently, there are 3 cryptocurrency exchanges that are approved by Securities Commission (SC) to operate digital asset exchanges. This means that these are 3 regulated exchanges where Malaysians can buy and trade Bitcoin and other cryptocurrencies.

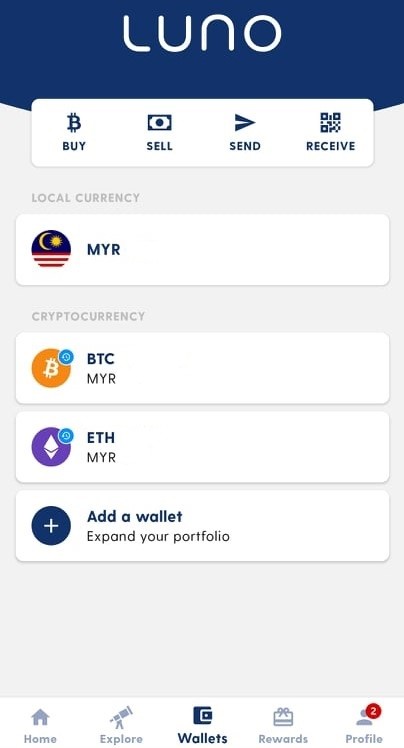

Personally, I have been using Luno, the largest of the 3 regulated exchanges since 2017 and I am more than happy to recommend Luno for investors looking to invest in cryptocurrencies safely.

I will work on a dedicated Luno review soon, but here’s a brief rundown of its features:

- Multiple Offerings: The biggest SC regulated cryptocurrency exchange which offers Bitcoin, Ethereum, Ripple, and Litecoin.

P - High Security: The majority of Luno’s customers’ cryptos are stored in a Deep Freeze storage – ie. A multi-signature wallet system, with private keys stored in different bank vaults. This means that no single person ever has access to more than one key, which translates to a high level of security of users’ cryptocurrency holdings.

P - Simple, user-friendly interface: Luno’s interface is extremely intuitive and simple to use. Every button and main functions are readily reachable and transacting Bitcoin is straightforward.

P - PROMOTION: No Money Lah is now collaborating with Luno Malaysia to bring the best-in-town deal for new Luno users that are keen to invest in Bitcoin! Use my dedicated promo code – LNYIXUAN50, and you will get RM50 worth of Bitcoin when you invest RM500 or more. That’s an instant 10% return on your investment.

P

The full details of this promo can be accessed HERE. Please go through them so you are clear that you meet the criteria for this RM50 promo.

No Money Lah’s Verdict

Personally, Bitcoin and Ethereum (another crypto) make up roughly 5 – 6% of my personal portfolio.

Having researched and worked on blockchain-related projects in my past student and work life, I am certain that cryptocurrencies are here to stay and disrupt. In particular, Bitcoin and Ethereum will be the forerunners of the cryptocurrency disruption due to them being the 2 cryptos with the largest market cap, and Ethereum being the backbone of decentralized finance (DeFi) development (more on Ethereum in future articles).

That said, I tried my best to reflect both the upsides and risks of Bitcoin & cryptocurrency in this article. As such, hopefully this article is able to give you a neutral overview of this topic and help you make a more informed investment decision!

Do you have any other questions on Bitcoin or cryptocurrency? If you are investing in this, what cryptocurrencies are you holding at this moment? Feel free to share with me in the comment section below! 🙂

Keen to Start Investing in Bitcoin and Cryptocurrencies?

In collaboration with Luno Malaysia, No Money Lah is bringing the best-in-town deal for new Luno users that are keen to invest in Bitcoin!

Use my dedicated promo code – LNYIXUAN50, and you will get RM50 worth of Bitcoin when you invest RM500 or more. That’s an instant 10% return on your investment.

The full details of this promo can be accessed HERE. Please go through them so you are clear that you meet the criteria for this RM50 promo.

Open Your Luno Account HERE.

Related Posts

August 14, 2020

How I Customize My Own Savings Routine (that actually works)

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

I vested btc, but still wondering is btc or crypto will favour more to the black market? corruption? or similar event that’s is not favour to the society/community? understand it is fight against the fiat but still.. seem it does favour to black market market shares? lol

Hi there,

Only around 0.5% of BTC transactions involved the dark web in 2019 and although there are certainly ways criminals can use BTC for their activities but it is fairly minimal. I’ve covered this part specifically in this article, definitely check it out here:

https://nomoneylah.com/2020/12/16/intro-to-bitcoin/#The_Risks/Downside_of_Bitcoin

Hope this clarifies things for you!

Yi Xuan

Hi, thanks for the info on bitcoin, just to clarify when open the Luno a/c, we are at level 0, so we can only use your promotion code when reach level 1 or above, it is correct or otherwise.

Hi Lee,

Yes, it is true. In order to make use of this promo code, you’d have to verify your mobile number and your basic personal details with Luno – that’s considered Level 1.

More details can be found here: https://www.luno.com/help/en/articles/11000019400

Any questions feel free to ask 🙂

Yi Xuan