Last Updated on April 8, 2023 by Chin Yi Xuan

Since the end of last year (2019), I have been able to work with my first ever licensed financial planner to improve my overall finances.

Now that it’s the end of the year, and I would like to give you all an update on how this decision has impacted my financial life in 2020.

p

Table of Contents

What exactly is a Licensed Financial Planner?

No kidding, the word ‘financial planner’ has been abused in so many ways to mislead everyday people like ourselves.

The thing is, not everyone can legally call themselves a financial planner. And there is actually a big difference between a licensed financial planner and an insurance agent.

So, what is a licensed financial planner, and who is qualified to be called a licensed financial planner?

Essentially, a licensed financial planner has more in-depth qualifications, namely:

- Capital Market Service Representative License, issued by Securities Commission (SC): Having this license allows a financial planner to conduct licensed financial planning in Malaysia – as such, be called a ‘financial planner’.

o - Financial Adviser Representative (FAR) License, issued by Bank Negara Malaysia (BNM): Having this license allows a financial planner to recommend insurance products from any insurance company.

On the other hand, the qualification of most insurance agents would stop at the Pre-Contract Examination for Insurance Agents (PCEIA) and Certificate Examination in Investment-linked Life Insurance (CEILI) papers. These are the papers that insurance agents have to take in order to start offering insurance solutions for one particular insurance company.

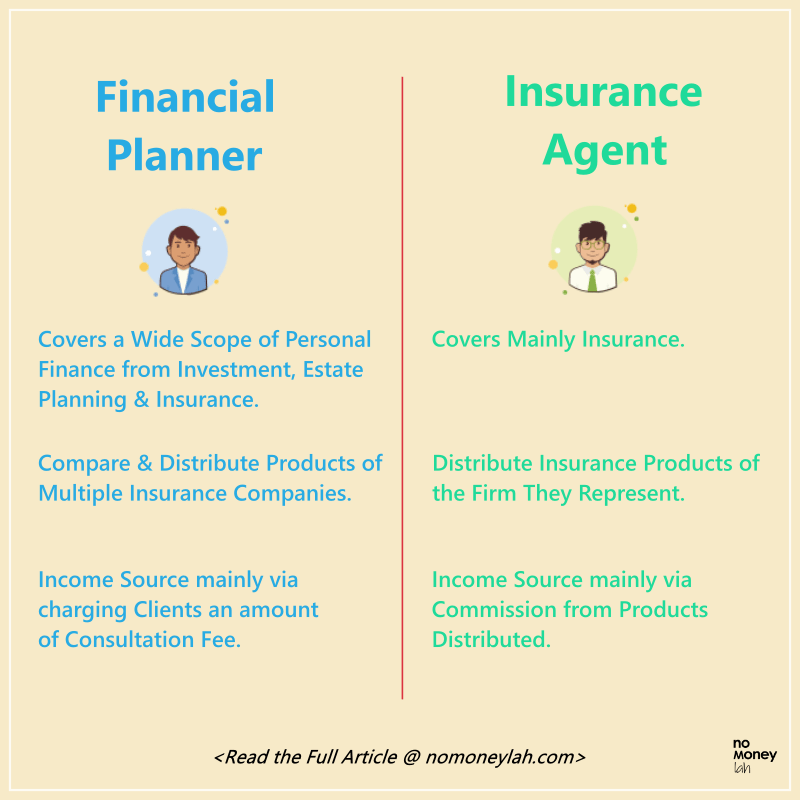

All of these qualification differences effectively separate a licensed financial planner and an insurance agent:

- A licensed financial planner can cover comprehensive aspects of personal finance from insurance, investment, budgeting, asset management, taxation, and estate planning. An insurance agent can only cover insurance.

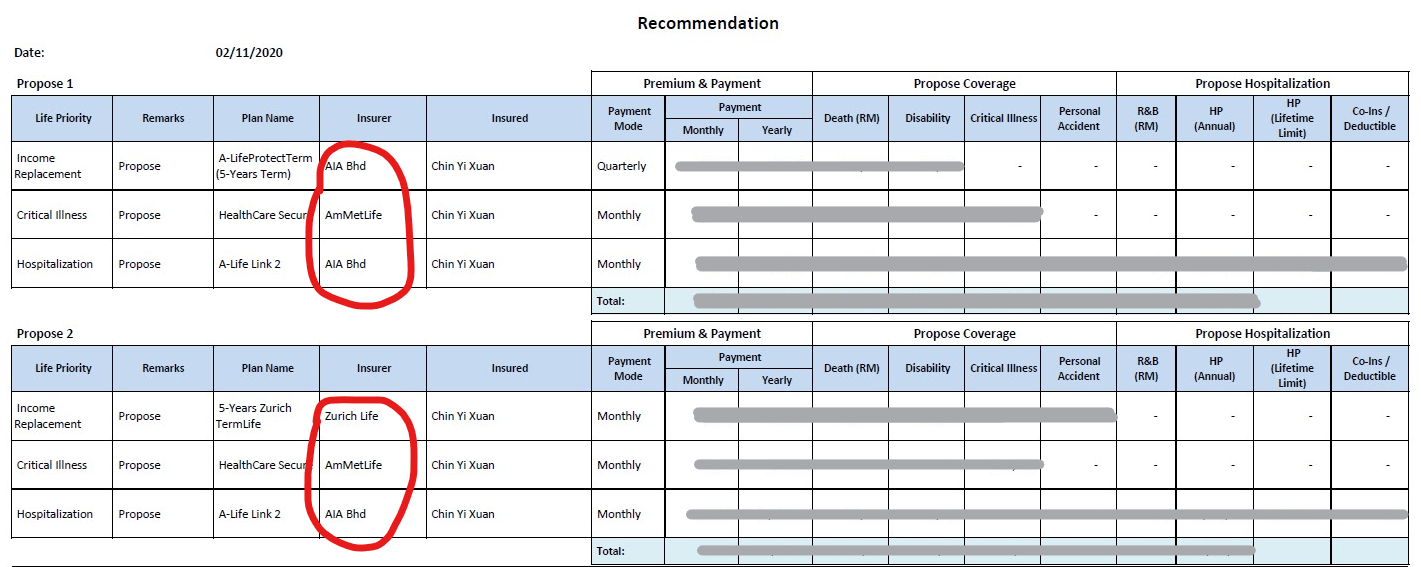

p - A licensed financial planner can recommend insurance solutions from different insurance companies – truly representing the client & ensuring minimal conflict of interest. An insurance agent can only offer the solutions from the company that he/she represents.

p - A licensed financial planner earns mainly from the consultation fee that they charge to their client. An insurance agent earns from the commission of the insurance solutions sold.

Added together, working with a licensed financial planner ensures that the service provided is fully in the interest of the clients and no one else. That said, there is no one-size-fits-all solution when it comes to financial planning. One should go for the best-suited services by considering what’s best for him/her under their personal needs.

p

Alright, so how has working with a financial planner improved my finances?

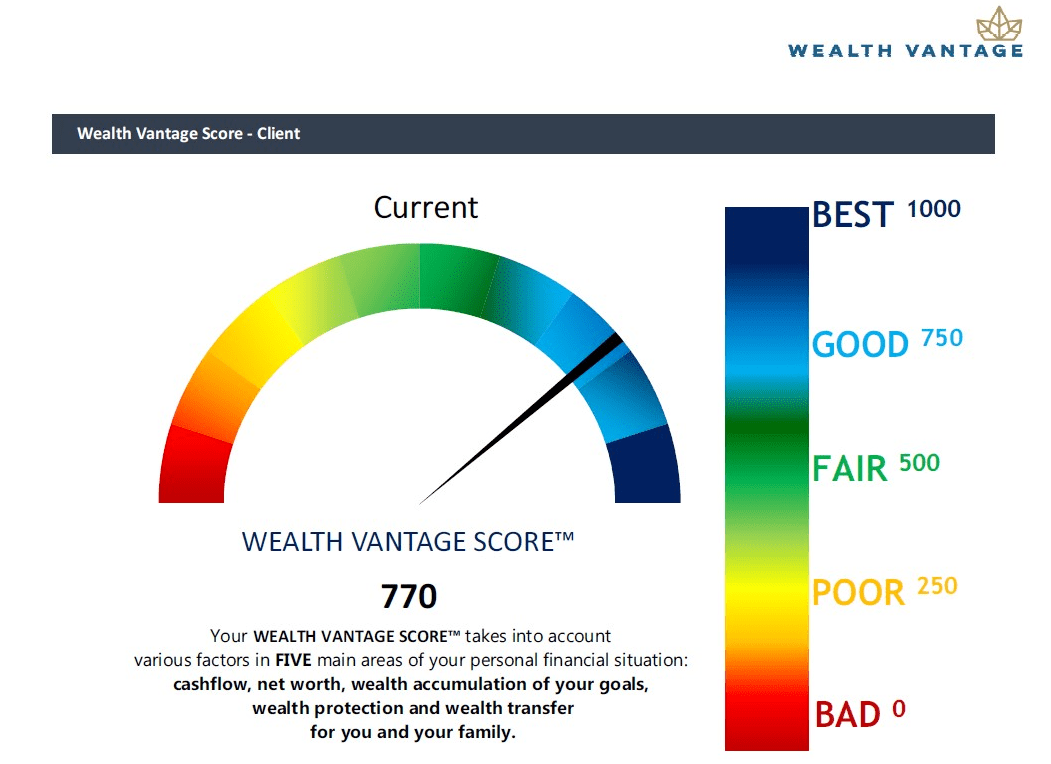

During the financial planning process with my financial planner last year, I was given a score to represent the overall state of my finances.

Last year, I got a score of 602 (borderline of ‘Good’). This score is a combination of my personal finances like cashflow, net worth, and other wealth accumulation factors. Since then, my financial planner, Stev recommended several action steps for me to improve my finances, such as:

- Establishing my emergency fund in money market fund.

- Optimizing my monthly contribution to EPF as a self-employed.

- Optimizing my proportion of cashflow to investment.

Fast forward to 2020, even with the pandemic hitting hard, I’ve managed to lift my overall financial score from 602 (borderline of ‘Good’) to 770 (‘Good’)! This means that my cashflow, net worth, and other wealth indicators improved in 2020 despite the whole Covid-19 crisis – not too shabby!

With the combination of working hard (correction: I worked like mad) and the guidance from my financial planner throughout the year, I managed to 2x my monthly income in 2020 while optimizing every penny of my hard-earned money to work for me.

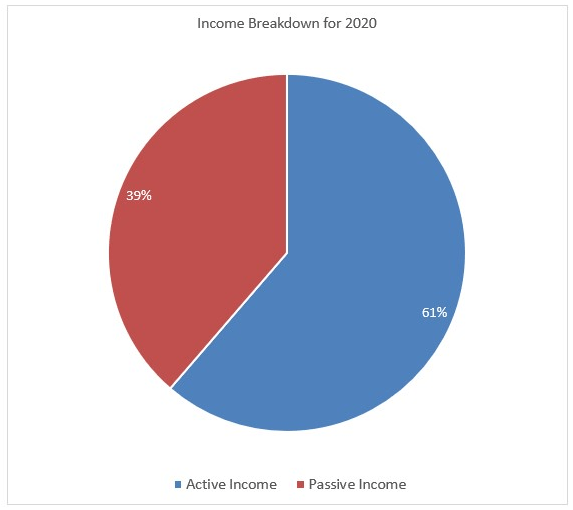

Just for personal sharing, below is my income breakdown composition for 2020:

One achievement that I am quite satisfied with is that my passive income makes up nearly 40% of my overall income. These are monthly passive income that requires relatively less effort & commitment from my end, which consists of dividends, affiliates, and more.

Read Also: How is it like to work with a financial planner?

p

What I’ve Learned After Engaging a Financial Planner for 1 Year

For sure, people can certainly DIY their own finances. However, I’ve learned and benefitted a ton from my experience working alongside the guidance of a financial planner. Here’s a summary of the things I’ve learned/benefitted from the process:

#1 Perspective & Optimization

As a person, there is only so much we can learn from our own lenses when it comes to our personal wealth.

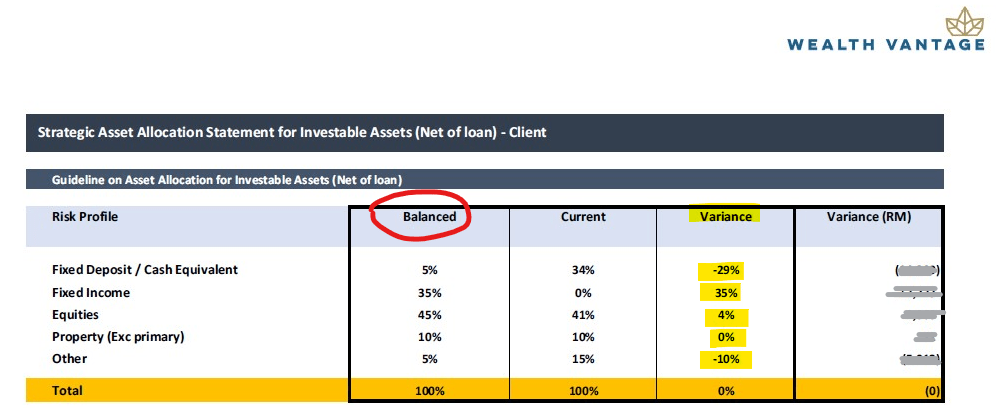

As an example, I was actually quite content with how I allocate my assets. However, upon in-depth review by my financial planner, we’ve discovered that my allocation is not well-optimized. In return, I was recommended a better allocation according to my risk profile.

In addition, I am also grateful that I got the zero-bias analysis I need when it comes to insurance. As a personal finance enthusiast, I still find insurance extremely complicated to study on my own as there is simply no well-organized info online.

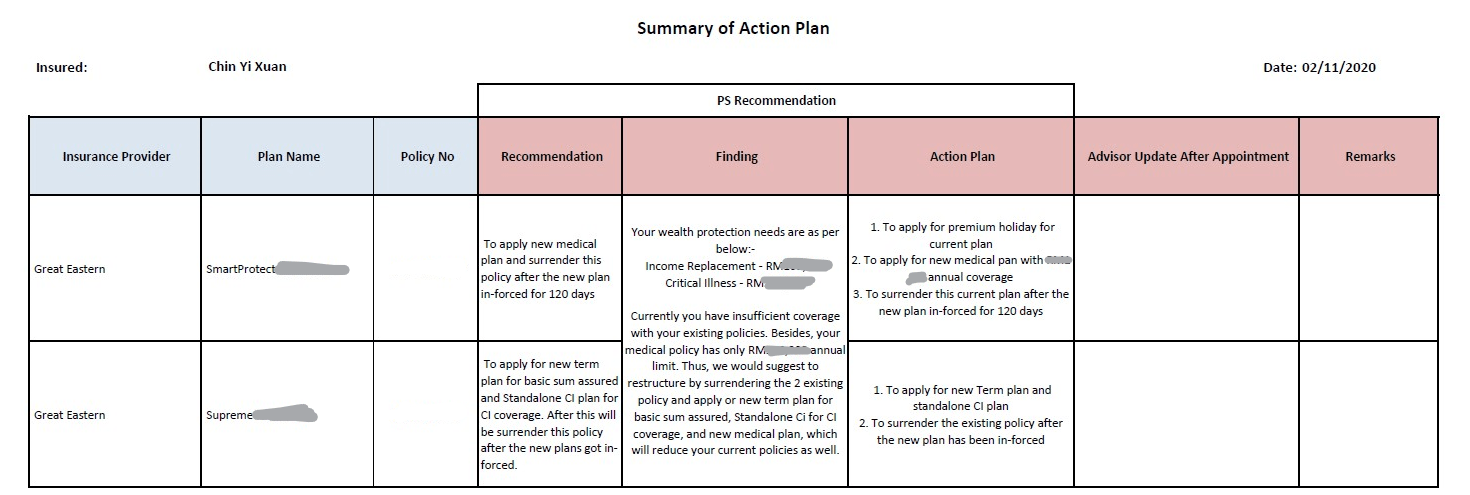

As such, I’ve always assumed that I have the best and appropriate coverage until Stev, my financial planner informed me otherwise.

It turns out that I can actually get MORE protection by paying even LESS than what I am paying presently. This is done by getting the best solutions from multiple insurance companies, plus a combination of term products (usually more affordable) and conventional investment-linked protection.

Seriously, how would I know this if I do not have a financial planner to guide me on this?

#2 Financial Accountability & Mindfulness

Another good thing about having a financial planner is that it creates a sense of mindfulness & accountability on my own finances.

Having a clear action plan devised by my financial planner, I am always aware of what to do about my finances in 2020. All of these combined, I know that I’d always be on track towards my financial milestones in this journey.

#3 Getting personal finance questions addressed by Licensed Professionals

Lastly, having a financial planner is like having access to a reliable personal finance encyclopedia.

When it comes to complex money or any personal finance related questions (eg. taxes, insurance), I am always grateful that my financial planner is just a message or email away.

Instead of searching the internet for scattered pieces of incomplete info, I can get my questions addressed by a licensed professional super fast – neat!

p

The Flow: How is it like working with a financial planner? (and charges)

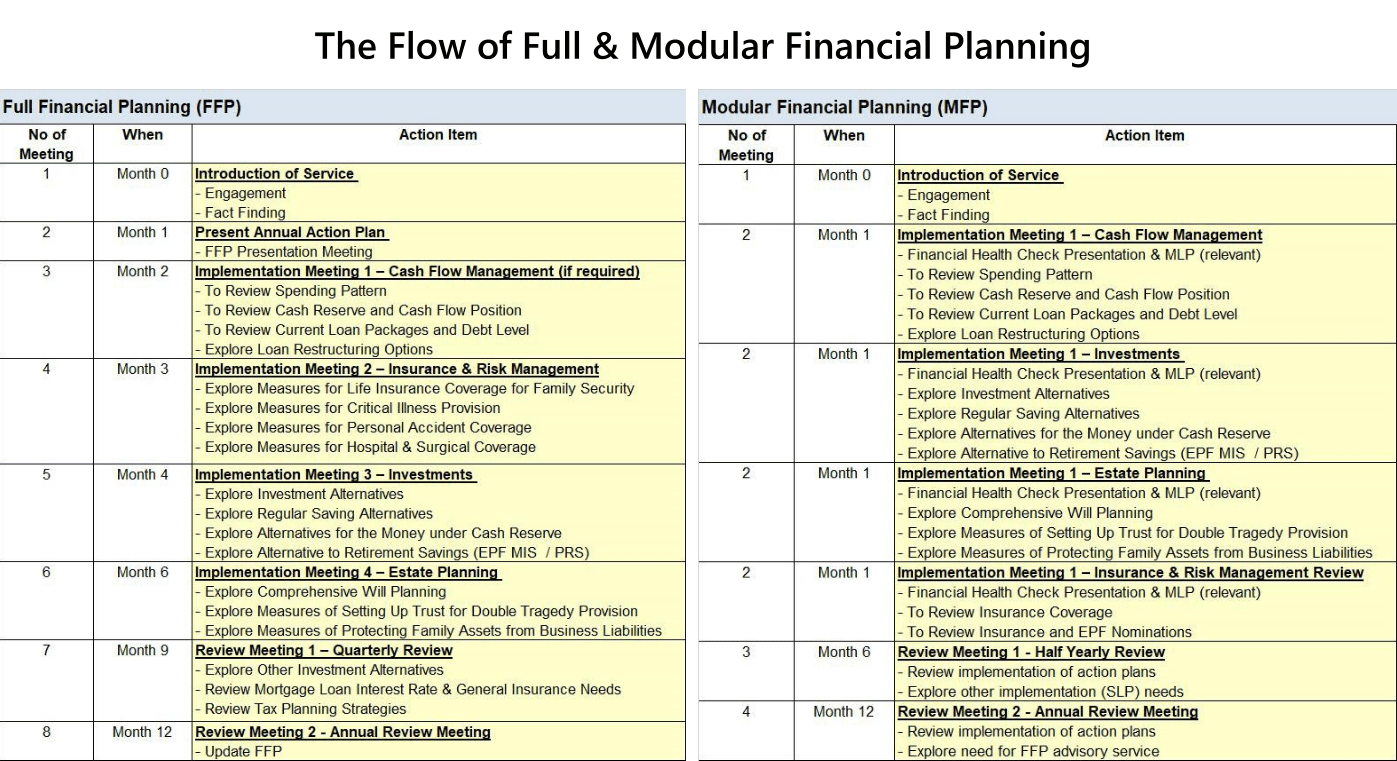

Engaging a financial planner is a simple process that involves several stages: Fact-finding, Implementation, and Follow-Up Review Meetings.

Do check out my detailed writing on the whole flow of engaging a financial planner HERE.

Personally, I have been working with my personal financial planners – Stev and Catherine from Wealth Vantage Advisory (WVA) for a year now. Depending on your needs, there are 3 ways you can work with a licensed financial planner from WVA, namely:

- Comprehensive Financial Health Check (FHC) [RM300]: You’ll go through a comprehensive fact-finding process with your financial planner. Then, you’ll be presented with an analysis and report of your overall financial state with recommendations for improvement.

p - 1-year Modular Financial Planning (MFP) [RM 1,500]: You’ll get everything from the Comprehensive Financial Health Check above. PLUS, you can choose to focus on EITHER Investment/Insurance/Estate Planning and your financial planner will support you in the implementation for 1 full year.

p - 1-year full financial planning (FFP) [RM 3,000]: You’ll get everything from the Comprehensive Financial Health Check. PLUS, your financial planner will support you in the implementation of ALL aspects of your personal finances (Investment + Insurance + Estate Planning) for 1 full year.

For me, I am on the MFP package (investment) in 2019 and opted for an FFP package in 2020.

p

Get Your First Financial Consultation Session Today – FREE OF CHARGE!

If you were to ask me, financial clarity & confidence are the biggest takeaways that I got after engaging a financial planner for a year. For every follow-up, I get clear actionable steps from Stev and Catherine to improve my finances. Knowing my overall financial health is improving with time boosted my confidence in pursuing my passion for blogging, investing, and trading.

For me, it is, without doubt, the best financial decision that I’ve made last year!

To be clear, I DO NOT want you to pay for a Financial Planner unless you are convinced that they are able to add value to you.

That said, I also want you to give yourself the chance (like what I did) to put your hard-earned money to the best use and achieve your financial goals in life.

Hence, I am working together with Wealth Vantage Advisory to bring a FREE Financial Consultation Session to all No Money Lah’s readers!

When you sign up for this FREE consultation session, you will learn more about your overall financial state. Not only that, you can gauge if a Financial Planner is going to add value in the pursuit of your financial goals – regardless, you are doing yourself a favor for the year to come!

You can sign up for your FREE financial consultation session HERE.

Disclaimer

This article is made possible through a collaboration with Wealth Vantage Advisory. Special thanks to Stev and the team for making this collaboration such an impactful one.

Wealth Vantage Advisory did not receive copy approval rights on this article – that means they are reading this article for the first time, right alongside you. 🙂

p.s. This post contains affiliate links, which afford No Money Lah a small referral if you sign up for any paid services.

Related Posts

December 31, 2021

My 2-year experience with a Licensed Financial Planner in Malaysia

August 14, 2020

How I Customize My Own Savings Routine (that actually works)

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.