Last Updated on January 10, 2024 by Chin Yi Xuan

Rakuten Trade has been my go-to broker to invest in the stock market for more than 4 years now.

As a long-term user, I have both good and to-be-improved experiences with the platform.

In this Rakuten Trade review, let’s learn more about this platform and whether they are the stock investing platform for you!

Before you proceed, here are some related posts that you might find useful:

Table of Contents

How I use Rakuten Trade

Personally, I use Rakuten Trade mainly for long-term investing. Meaning, I invest in stocks and hold them for years UNLESS there is a shift in business nature or fundamentals. This also means that:

- I do not actively trade in and out of the market.

- Also, I certainly do not need to be on the screen/app at 9am when the market opens in an attempt to get the ‘best’ stock entry price

- Plus, I definitely do not participate when the market is crazy over any particular stock – I invest in what I know best instead of following the herd.

Putting this ahead is CRUCIAL because this review is purely based on my personal experience and usage.

Depending on your participation in the market, you may find your experience differs from mine.

That said, if you are in for investing in quality companies for the long-term, I think this review will give you solid insights on Rakuten Trade as a stock investing platform.

Rakuten Trade Feature Highlights

- Rakuten Trade is a joint venture between Malaysia’s Kenanga Investment Bank Bhd. and Japan’s Rakuten Securities Inc. Established in 2017, Rakuten Trade is under the regulation of the Securities Commission (SC) of Malaysia and holds the Capital Markets Services License (CMSL) to deal with listed securities and provide investment advice

- Rakuten Trade offers a full online investing experience. From registration to funding/withdrawal, every process is done online at our convenience. Plus, get your account approved within 3 days (sometimes earlier). This is much more efficient compared to certain brokers that require weeks to approve an account.

- Rakuten Trade offers one of the most competitive commission rates in Malaysia. In other words, Rakuten Trade is a fee-friendly option, especially for new investors who are starting with a small capital – more below.

- Rakuten Trade offers users access to the US stock market and Hong Kong stock market at a highly affordable commission!

6 things I like about Rakuten Trade

#1 Competitive Fees for Malaysia & US Stock Market

Rakuten Trade offers one of the most competitive rates in the local brokerage scene, be it for Malaysia, the US, or Hong Kong stock market.

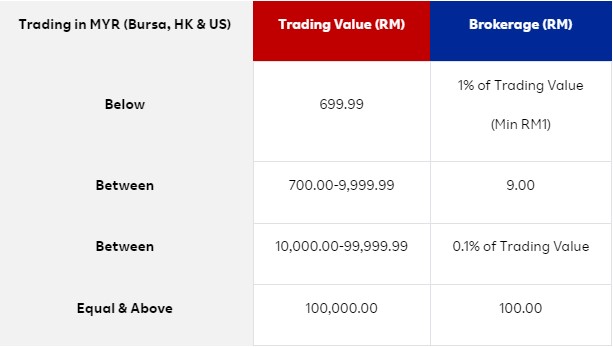

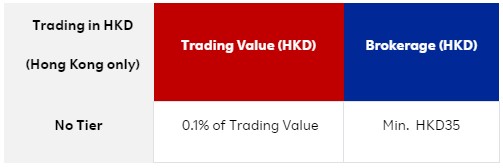

(a) Rakuten Trade Brokerage Fee for MYR trading (Bursa Malaysia, US, and HK stock market):

(b) Rakuten Trade Brokerage Fee for USD trading (US stock market):

(c) Rakuten Trade Brokerage Fee for HKD trading (HK stock market):

However, while looking for a broker, there are more things to consider than commissions alone. Let’s explore the additional value-added strengths that I like about Rakuten Trade in the next few points below.

RELATED READ: Rakuten US Stock Trading Review

#2 Nominee CDS Account = No Manual Paperwork Needed (+ FREE CDS Fee!)

Everyone has to open a Central Depository System (CDS) account while applying for a stock investing account. Most brokers make it part of the whole registration process already, so don’t worry too much.

What you need to know though, is that there are 2 types of CDS accounts: Nominee and Direct CDS account. In this case, Rakuten Trade is a Nominee CDS. The good things that come with this are:

- No need to manage the paperwork on corporate actions like rights issue and dividend reinvestment program (DRP). Everything about corporate action is handled by Rakuten Trade on behalf of the users, which is awesome because my time is too precious for (more) paperwork.

- While other brokers that offer Nominee CDS account charges a fee to handle corporate action for users, BUT specifically for Rakuten Trade, there are no additional charges on handling corporate action – yes, FREE.

- FREE CDS account opening: Typically, there is an RM10 fee imposed on opening a CDS account. However, Rakuten Trade has been waiving this fee for users too!

All being said, many have the concern that under a Nominee CDS, their share ownership is placed under a trustee instead of directly under their own name (this is done to avoid fraud).

For me, I think this is not a matter to be concerned with because (1) Rakuten Trade is regulated heavily by the SC and (2) in the event that the company does go bankrupt, our capital is protected as it is placed with a trustee instead of with Rakuten Trade.

READ: Direct and Nominee CDS, what’s the difference, and how to choose?

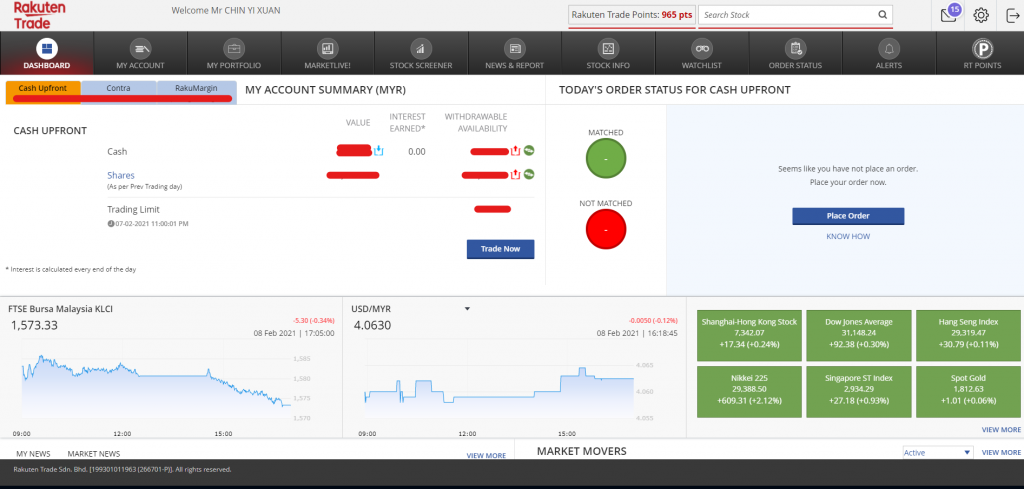

#3 Clean, Functional & User-Friendly Platform

Being a fully online broker, Rakuten Trade provides investors with a modern and clean trading experience. Personally, I have used several brokers in the past, and have seen the interface of other brokers.

There are 2 problems with many of these brokers:

- Obsolete design/complicated user interface like they are from the early 2000s. Beginners are overwhelmed with poor layouts and simply can’t find what they want to do easily.

- Non-functional – certain platforms are barebone (different from minimalist) without value-added features like stock screeners and so on.

In this regard, Rakuten Trade struck a decent balance between user experience and functionality. Its web platform is simple to navigate with solid value-added features like stock screeners and price alerts.

Coming from using several brokers in the past, I am sure new users will appreciate and be able to familiarize themselves with Rakuten Trade with little to no issue.

READ:How to buy your first stock on Rakuten Trade

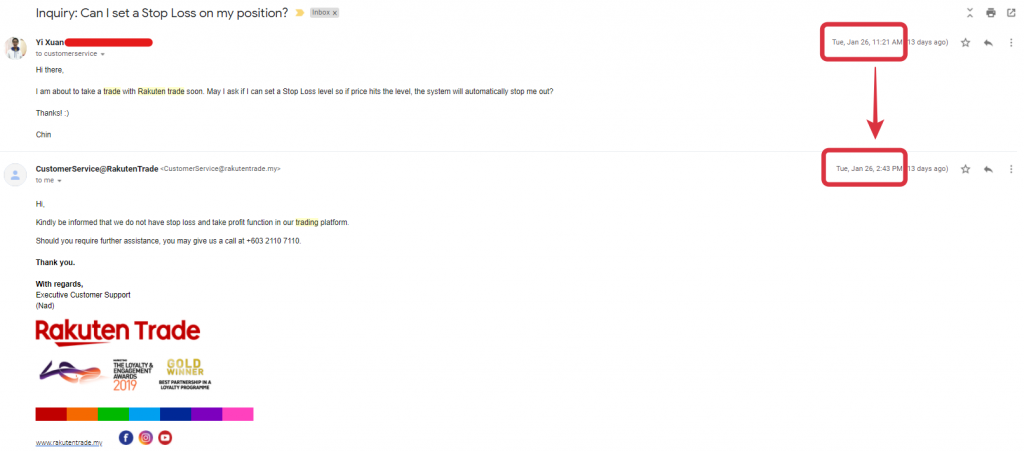

#4 Quick Response from Customer Service

Any company that tries to go digital today MUST have proper online customer service in place.

Generally, there are 3 ways a user can reach out for help: Facebook Chat, Email ([email protected]), and a Hotline.

With the exception of Hotline, I have reached out to Rakuten Trade with questions on several occasions in the past. Generally, the response from the Customer Service team is quick and I usually get my questions addressed.

#5 Solid Value-Adding Features (eg. Powerful Stock Screener, earn interest on idle cash)

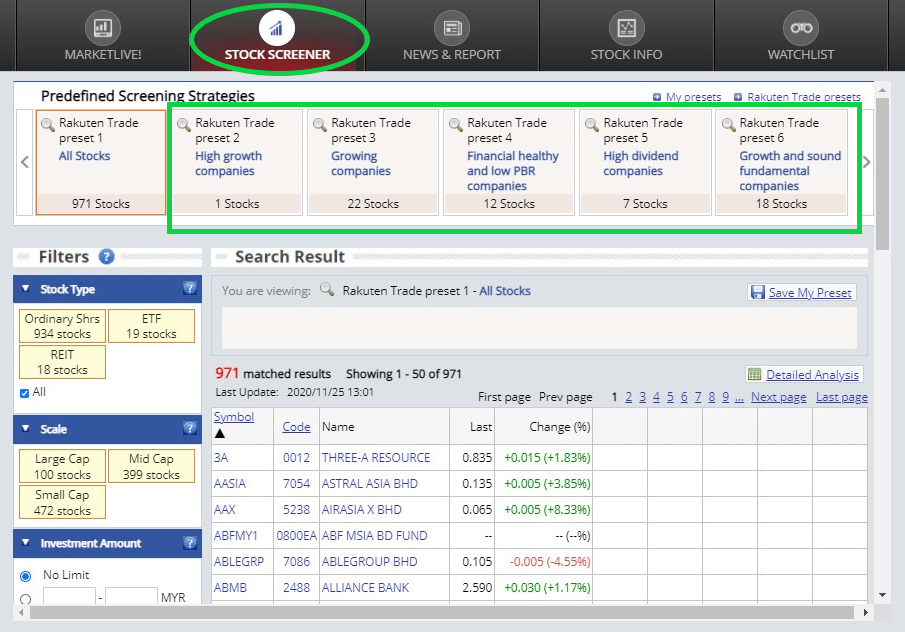

There are several features in Rakuten Trade that make investing a fruitful process for users. Namely, Rakuten Trade’s built-in stock screener is one of the most comprehensive FREE screeners around.

Powered by Thomson Reuters, there are many parameters that you can set up to filter for stocks. For new investors, this is certainly an awesome feature to have to reduce the time needed to research for stocks.

READ: How to build your own reliable Bursa stock screener.

And do you know with Rakuten Trade, you actually earn a 1.50% annual interest on the cash balance in your account?

I was not aware of this when I first used Rakuten Trade and was pleasantly surprised when I received interest on my cash balance.

READ: 4 Underrated Features on Rakuten Trade

#6 Fractional Trading for the US market

Starting May 2023, Rakuten Trade launched its Fractional Share Trading for US stocks and ETFs. This makes it more capital-friendly for Malaysians to own US stocks.

READ MORE: Rakuten Trade Fractional Share Trading review

Should You Open a Rakuten Trade Account? (+ How to open one?)

All in all, Rakuten Trade has been my go-to broker while investing in the stock market, and I have no problem recommending Rakuten Trade to:

- New investors with small capital that are looking to get started in the Malaysia & US stock market thanks to Rakuten Trade’s beginner-friendly commission.

- Investors that are looking to save time on paperwork and skip the handling fees for corporate action such as dividends and rights issue.

- Investors who are looking to open an account and manage their stock portfolio fully online during this pandemic.

- Investors who are looking for a modern, user-friendly stock trading platform without compromising on features.

If you fall into any one (or more) of these categories, check out my step-by-step guide to open your Rakuten Trade account online!

🎁 Rakuten Trade Referral Link for New Users

If you are keen to open a Rakuten Trade account, consider using my referral link below! For that, you’ll get:

- 1000 Rakuten Trade (RT) points worth RM10 to offset your brokerage fee.

- + 1000 RT points when you deposit an initial deposit of RM500 or more.

- + 1 RT point for each RM10 share value when you transfer your shares from other brokers to Rakuten Trade.

- + 2800 RT points worth RM28 when you activate foreign share trading (US & HK market) feature (p.s. Promo ending 30/6/2024, and will revert to 1288 RT points thereafter).

- Free 0.01 unit of Nvidia share (NASDAQ: NVDA) when you activate foreign share trading (US & HK market) feature and make your first buy trade on the US market during the campaign period (Campaign Period: 1/4 – 20/4/2024, T&C applies)

Aside from that, Rakuten Trade users get +1 RT point for every RM1 brokerage paid! Click HERE for the full T&C on RT points.

Open A Rakuten Trade Account Today!

Related Post: Guide – How to activate US stock trading on Rakuten Trade

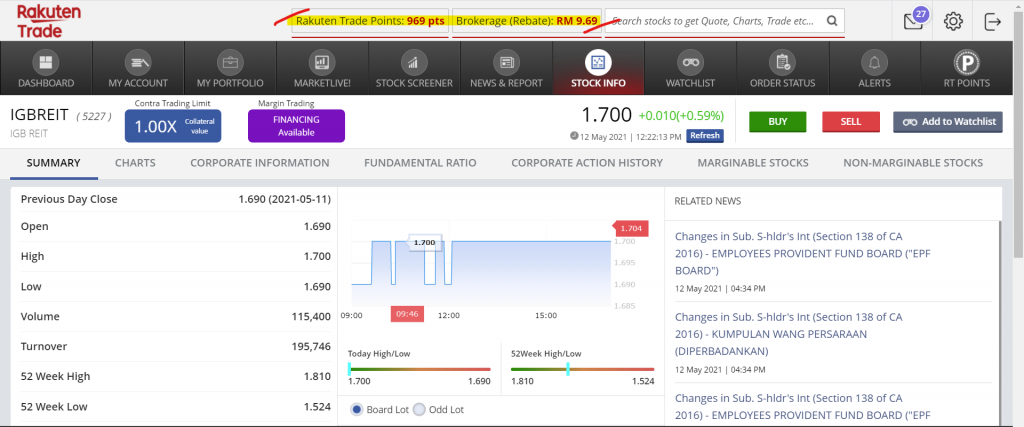

How can you use these RT points?

These RT points are amazing, as they can be converted into brokerage rebates, Air Asia rewards, Boost stars, and Bonuslink points which are redeemable for rewards.

p.s. Click HERE for the full T&C of your account opening reward.

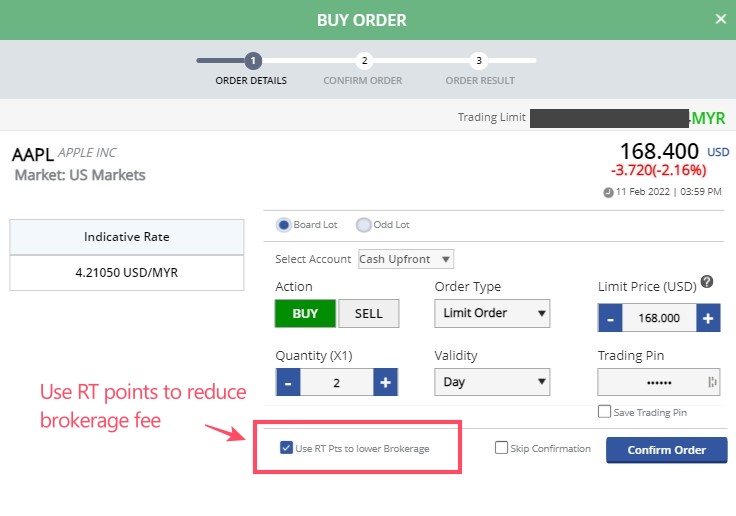

Awesome Feature: Use your RT Points as Brokerage Fee Rebate!

Not too long ago, Rakuten Trade released an exciting new feature: now you can convert your RT points as a discount to your brokerage fee!

In my opinion, this is the most practical use of the RT points for Rakuten Trade users. This is how it works:

Step 1: 1 RT Point = RM0.01 (ie. 100 RT points = RM1 Brokerage Fee.)

Step 2: Opt-in for brokerage rebate when you buy or sell shares on Rakuten Trade.

Step 3: Your brokerage rebate will be credited to your account by the end of the trading day (subject to your RT Point balance).

So let’s say you have 700 RT points (RM7), and the brokerage fee that you paid for a transaction is RM9. By the end of the trading day, Rakuten Trade will deposit RM7 back into your account, essentially offsetting the brokerage fee to just RM2.

You can find the full T&C here.

No Money Lah’s Verdict

So here you go – my long-term user review of Rakuten Trade!

For me, Rakuten Trade is a solid choice as it has the most balanced offering between value, functionalities, and rewards.

As the platform develops, I foresee Rakuten Trade will become even more user-friendly with time.

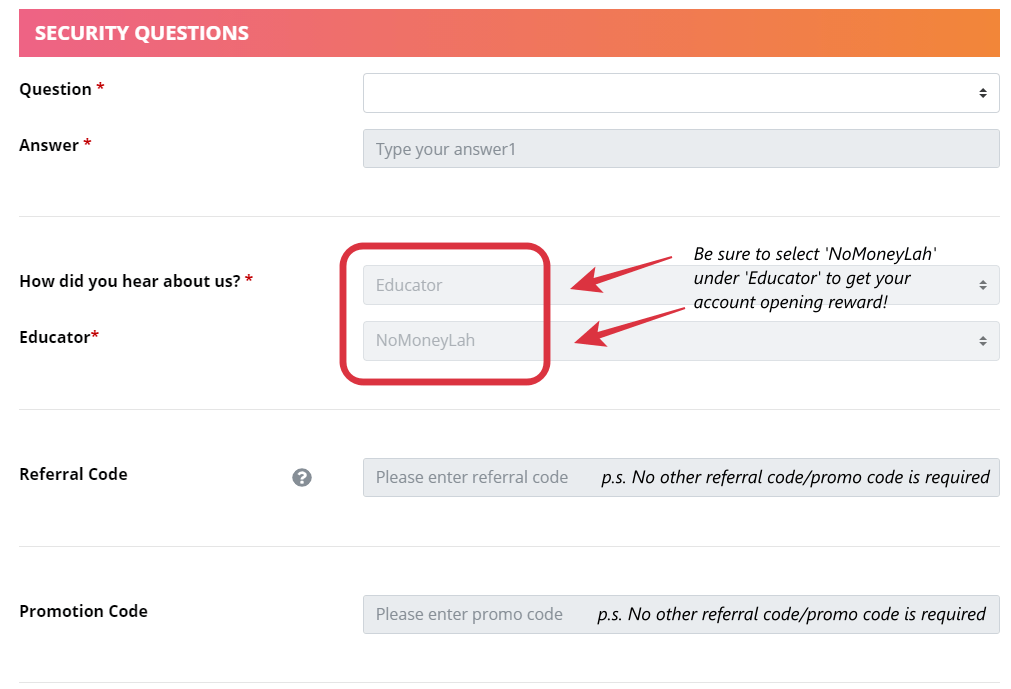

If you find this article useful, and would like to open your Rakuten Trade stock trading account, do consider using my referral link below to register for your account (or select ‘NoMoneyLah’ under ‘Educator’ when you register).

Open A Rakuten Trade Account Today!

Disclaimer:

This post contains affiliate links, which afford No Money Lah a small referral (and in return, support this blog) if you sign up for an account using my referral link. Rakuten Trade did not receive copy approval rights on this article – that means they are reading this article for the first time, right alongside you.

The information stated above is based on my personal experience and for purpose of sharing such experience only. It is not intended as professional investment advice. Please contact Rakuten Trade for more information.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.