Last Updated on May 1, 2022 by Chin Yi Xuan

In this month’s Invest in China Series, we are going to look at the STAR 50 Index.

With the US-China trade tension ongoing, the STAR 50 Index is certainly one of the most interesting and challenging article for me to write.

That said, I am sure this is an article that tech investors and enthusiasts will find insightful and enjoy reading – so let’s jump straight into the topic, shall we?

p

Table of Contents

Highlights of the STAR 50 Index:

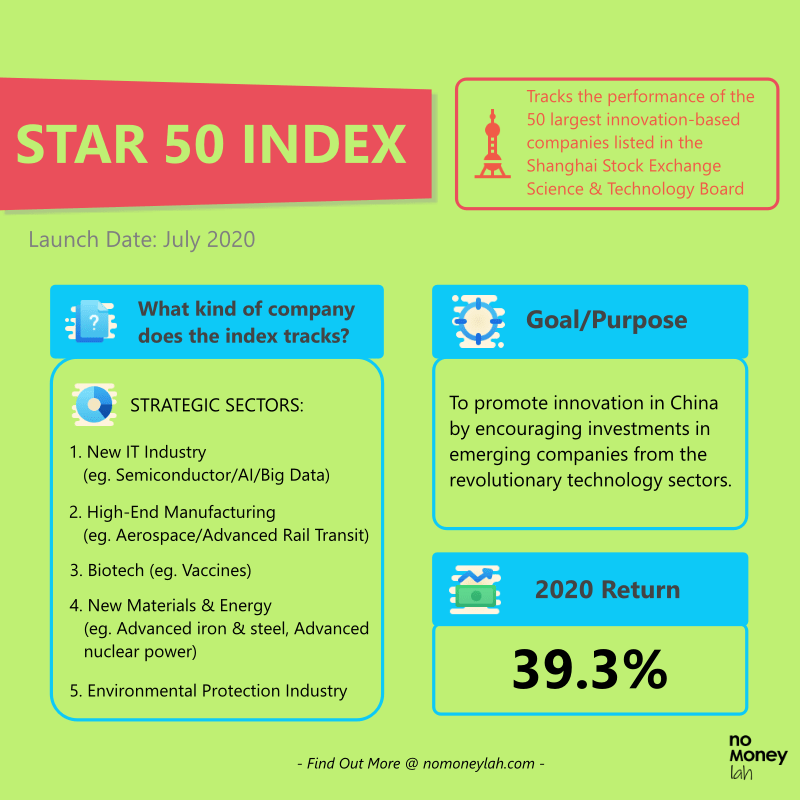

- The Shanghai Stock Exchange Science and Technology Innovation Board 50 Index (STAR 50 Index) tracks the performance of the 50 largest innovation-based companies (measured by market cap) that are listed in the Shanghai Stock Exchange Science & Technology Innovation Board (STAR Market).

p - The STAR 50 index is newly launched in July 2020. Of which, China’s home-grown information tech companies make up the majority of the index component (eg. Semiconductor companies). That said, the index also hosts companies from a diverse range of new-gen. industries including biomedicine, new energy, advanced equipment manufacturing & environmental protection.

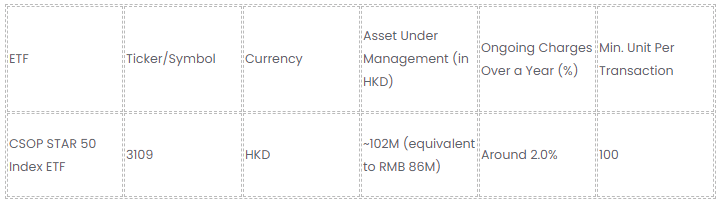

p - One cannot invest directly at the index. Instead, we can do so via ETFs that track the index – such as the CSOP STAR 50 Index ETF (ticker: 3109).

p

What goes into the STAR 50 Index?

The STAR 50 Index is established with the goal to promote innovation in China by encouraging investments in emerging companies from the new technology sectors. As such, it is highly perceived as China’s equivalent of the US’s Nasdaq 100 Index.

In other words, the index offers an easier path for investors to get exposure to China’s home-grown innovative companies, especially crucial competitive technologies like semiconductor manufacturers.

That said, not all tech companies in the STAR market can become part of the elite STAR 50 Index.

To qualify, a company has to be in the top 50 in terms of market cap to become part of the STAR 50 Index. Also, the index is adjusted and rebalanced on a quarterly basis to ensure the relevance of the index.

p

STAR 50 Index Performance

Since the STAR 50 index is a newly launched index in 2020, there are not many details on its exact performance (yet).

That said, in 2020, the index recorded a 39.30% return.

p

The Story of Chips, Semiconductors and the STAR 50 Index

Our discussion around the STAR 50 Index cannot continue without an interesting dive into semiconductors (or chips) and the ongoing US-China trade tension.

Semiconductors, or chips are a crucial part powering many transformative technologies around our daily lives, from computers, smartphones, automobiles, medical equipment, and more.

Despite this, semiconductors represent a rare area where China is dependent on the rest of the world – rather than the other way around.

China is the world’s largest consumer of semiconductors. In 2019, the value of China’s semiconductor import is over USD300 billion and it was China’s largest import item. In comparison, China supplies just 30% of its chips demand domestically.

With the ongoing US tech sanctions towards China, the Chinese government has stepped up their effort to become self-sufficient when it comes to key innovative solutions, such as semiconductors. In fact, China aims to increase its self-reliance on domestic chip production to 70% from 30% in 2019.

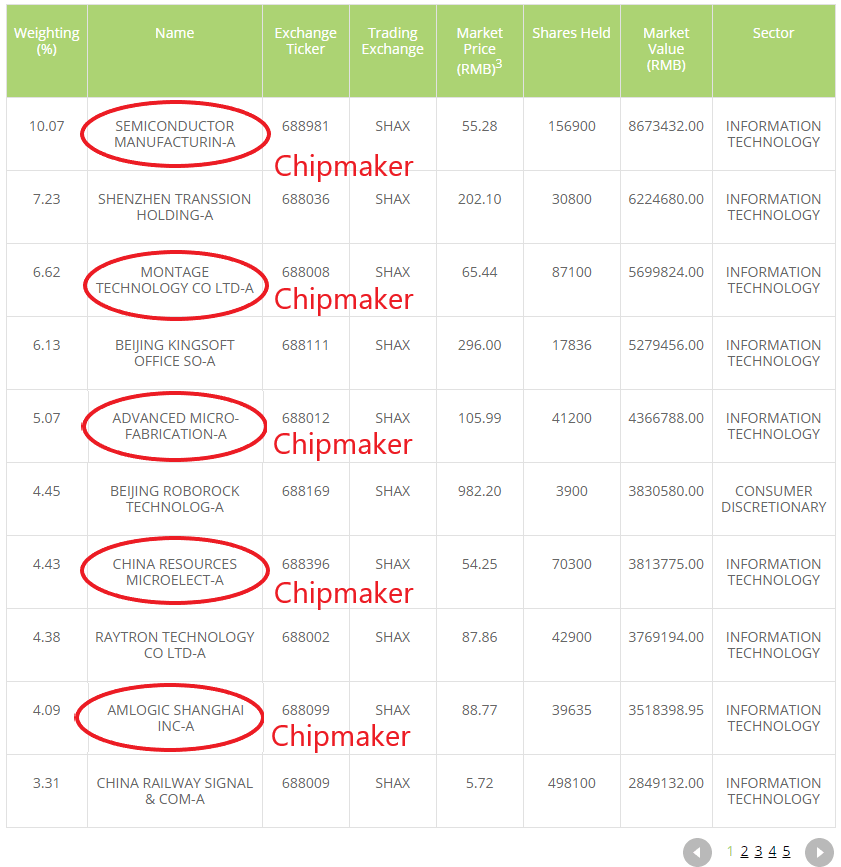

As such, the STAR market is China’s initiative to encourage investments into home-grown tech companies. Not surprisingly, many of the top components of the STAR 50 index is made up of semiconductor companies.

p

The Challenges of China’s Plan to become Technologically Self-Sufficient

Well, China can simply produce anything if they wish for it, right? That was my initial assumption.

Apparently, I was wrong.

Challenge #1: Technological Gap

The semiconductors business is a highly complex and advanced industry. As such, progresses in semiconductor manufacturing requires skills and expertise which cannot be developed overnight.

This is where mainland China is falling behind their competitors, such as Taiwan Semiconductor Manufacturing Company (TSMC) from Taiwan and Samsung (Korea).

When TMSC and Samsung began investing in semiconductor production in the late 1970s, China had just emerged from their decade-long Cultural Revolution that deterred scientific progress. As a result, even after multiple reforms, China still lacked the engineering skills to make an innovative breakthrough in the industry.

China’s real problem lies in its ability to manufacture high-end semiconductors. While TSMC has been able to produce high-end 5 nanometers (nm) semiconductors, China’s largest chipmaker – Semiconductor Manufacturing International Corporation (SMIC) has only recently gotten the technology to mass-produce 14nm semiconductors (p.s. the smaller the better).

In other words, China’s semiconductor manufacturer is (still) at least 5 years behind the industry leaders.

p

Challenge #2: Talent Gap

To become self-sufficient when it comes to semiconductors, the Chinese Semiconductor Industry Association estimates that China will need to close a talent gap of around 300,000 engineers.

This is not a gap that can be filled instantly regardless of how aggressive China is keen to make this happen.

p

The Potential & Opportunities of Investing in the STAR 50 Index

As a whole, the STAR market is one of China’s main initiatives to push for progress and self-reliance in innovation and technology.

While it is certainly an uphill battle for the businesses, but there are several notable opportunities that we can look into as an investor:

Short-Term: Global Semiconductor Shortages

Since the breakout of the Covid-19 pandemic, there has been a surge in global demand for consumer electronics. In return, the demand for semiconductors also spiked in tandem with the trend.

Despite that, not all the demand requires the latest and most high-end chips. Many of the demands can be fulfilled by mid to low-end chips.

Meaning, this is something that STAR 50-listed Chinese semiconductors companies like SMIC can step in and benefit from the global chip shortages.

p

Medium to Long Term: Innovations from the Higher Value Chain

Aside from conventional semiconductors and chips, the STAR 50 index is also a hub for innovative businesses that produce future-proof solutions.

Such an example is the listed companies in the index that specializes in artificial intelligence (AI) chips – a new innovation field with fewer established incumbents.

Cambricon Technologies Corp. is the first listed AI chip-maker in the Chinese stock market. It is the company that produces chips that are powering servers for Alibaba and the latest generation of Huawei’s latest AI-enabled smartphones.

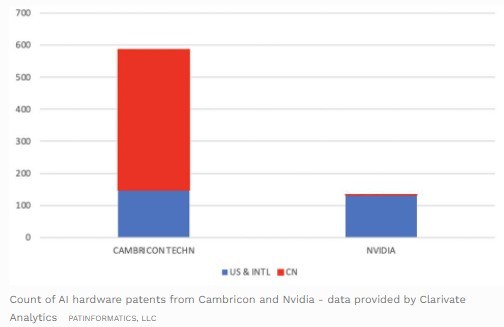

If that’s not impressive yet, Cambricon also has one of the largest portfolios of patents in the field, when compared to its largest US competitor – Nvidia.

p

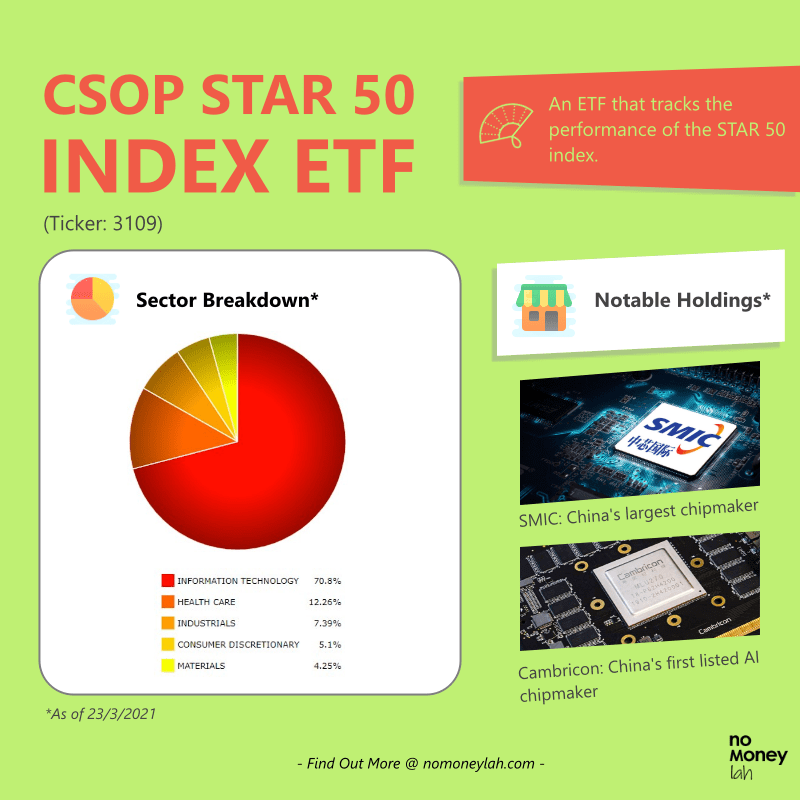

CSOP STAR 50 Index ETF: Your Gateway to Invest in the STAR 50 Index

An index is not something that one can invest in directly. Instead, investors can invest in Exchange Traded Funds (ETFs) that track the performance of the index.

One such ETF is the CSOP STAR 50 Index ETF. This is an ETF that tracks the performance of the STAR 50 Index, where investors can invest even with small capital.

To track the STAR 50 Index, the ETF adopt a combination of physical representative sampling and synthetic representative sampling strategy.

p

Notable Holdings of the CSOP STAR 50 Index ETF

In this section, I’ll be sharing with you some notable companies in the CSOP STAR 50 Index ETF that caught my eyes. Note that they may not be the top component companies of the ETF at the moment, but their potential is huge nevertheless:

#1 Semiconductor Manufacturing International Corporation (SMIC)

SMIC is China’s largest semiconductor manufacturer. It is also the largest weighting (10.05%) in the ETF as of 22nd March 2021.

As mention in the previous section, SMIC’s semiconductor technology may not be the leading chipmaker in the world. However, thjat does not mean there’s no progress made. Recently, SMIC has acquired the infrastructure to mass-produce 14nm semiconductors, closing the gap between SMIC and the world’s leading manufacturers.

In addition, SMIC is in a good position to benefit from the global shortage of semiconductors caused by a rise in demand for consumer electronics due to Covid-19.

Aside from that, being China’s top semiconductor manufacturer, SMIC also enjoys various support & funding from the government in order to become technologically self-sufficient.

In the recent announcement, SMIC is building a new factory worth $2.35 billion with support and funding from the government.

#2 Cambricon Technologies Corp.

Cambricon is a state-backed AI chip manufacturer that is also part of the STAR 50 index.

Optimized for deep learning capabilities, Cambricon chips are used in the likes of Huawei’s smartphone products and also powering Alibaba’s servers.

AI chip is a new frontier of the semiconductor industry of which China is focusing on to build their edge against global competitors.

p

What You Need to Know + Risks of Investing in the STAR 50 Index

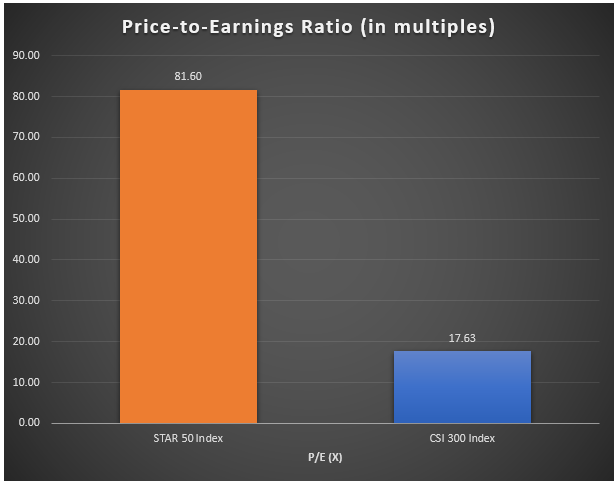

#1 Higher than Average Valuation

Since the companies in this index are generally growth companies, you should note that the index tends to trade at a higher valuation.

As of February 2021, the STAR 50 Index has a price-to-earnings (P/E) ratio of 81.60x. In comparison, China’s main CSI 300 index has a price-to-earnings (P/E) ratio of 17.63x during the same period.

In short, investors should be willing to pay a premium for investing in high-growth tech companies.

#2 Higher than Average Fluctuation

Companies listed on the STAR market are usually of emerging nature with a relatively smaller operating scale. As such, investors should expect bigger swings in both directions while investing in the index.

p

#3 Delisting Risk

Being an index that is made up of companies focusing on fast-moving technology & innovation, investors need to be aware of the risk of component companies being delisted when they become irrelevant or not in compliance to the STAR market’s listing conditions.

p

Who Should Invest in the STAR 50 Index?

All in all, the STAR 50 Index represents China’s ambition to become self-reliant and eventually, the world’s leading innovation hub.

From the opportunities and risks that entail, the STAR 50 Index is certainly NOT for everyone. New investors or investors with low risk tolerance should probably skip the STAR 50 Index, and maybe look into the Hang Seng TECH Index for Chinese tech-enabled internet businesses like Alibaba and Tencent.

That said, the STAR 50 Index can be a good investment option for:

- Opportunistic investors that are having a long-term view towards China’s innovation and technological development.

p - Investors looking to capitalize on China’s government-backed drive for technological independence.

p

My Recommended Broker to Invest in CSOP STAR 50 Index ETF (Ticker: 3109):

As you may have guessed by now, CSOP STAR 50 Index ETF is not listed locally. Instead, it is being traded in the Hong Kong stock exchange in Hong Kong Dollar (HKD).

As such, you’ll need a reliable stock broker with access to the Hong Kong stock exchange in order to invest in this ETF.

If you do not have a stock broker, I’d highly recommend Tiger Brokers to you. Tiger Brokers is my go-to regulated stock broker that provides all-in-one access to markets such as the US, Singapore, and Hong Kong stock market – all at a highly competitive fee.

Check out my full review on Tiger Brokers HERE.

ALSO READ: How to Invest in Your First Stock via Tiger Brokers

p

No Money Lah’s Verdict

So here you go! The CSOP STAR 50 Index ETF is certainly an interesting offering for investors that have a bullish view towards China’s intention to build a self-sufficient tech & innovation business ecosystem.

Tech investors, especially Chinese tech enthusiasts will be rejoiced to an easy and low capital way to invest in the Chinese tech companies. For those of you, I hope you find this article useful!

Personally, I had such a great time writing this article as I have always been interested to invest in the Chinese tech scene for a long time.

How ‘bout you? Do you have any questions on the STAR 50 Index? Feel free to let me know your thoughts & questions in the comment section below!

About CSOP Asset Management

I first discovered the STAR 50 Index through CSOP Asset Management (AM).

If you have been investing purely in the Malaysia or US market, it is likely that you have not heard of CSOP AM before. However, CSOP AM is huge in the China & Hong Kong market:

- Established in 2008, CSOP AM is the first offshore entity established by a regulated Chinese asset manager with Hong Kong’s Securities & Futures Commission (SFC) type 1 (dealing in securities), type 4 (advising on securities) and type 9 (asset management) licenses.

p - With this background, CSOP AM manages the biggest renminbi (RMB) equity & fixed income ETF listed in offshore China.

p - In late 2019, CSOP AM sets up their office in Singapore, with the goal to bring China’s gradually opening capital market to Southeast Asia’s investors (psst… that’s us).

In essence, through CSOP AM ETFs, foreign investors like you and me have the opportunity to gain exposure to China’s growing capital market.

Disclaimer

The purpose of this post is purely for sharing and should NEVER be taken as a buy/sell recommendation. Please do your own research AND/OR reach out to a licensed financial planner before making any investment decision.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.