Last Updated on May 1, 2022 by Chin Yi Xuan

SecureMas by Lonpac Insurance is an affordable Personal Accident (PA) insurance for elderly adults. In this review, let’s cover the benefits and highlights of the SecureMas PA insurance, and who is it for.

p

Table of Contents

Highlights: SecureMas PA protection by Lonpac Insurance

- Low-Cost High Cover Solution for the Senior Citizens.

p - The only Personal Accident coverage in the market with high living benefits at an affordable price. (From RM22.50/month for dad/mom or RM35.40 for both parents)

p - Includes medical expenses reimbursement, hospital income, disability benefit, and accidental death benefit.

p - Extension to cover dengue fever, food poisoning cases, and many more.

p

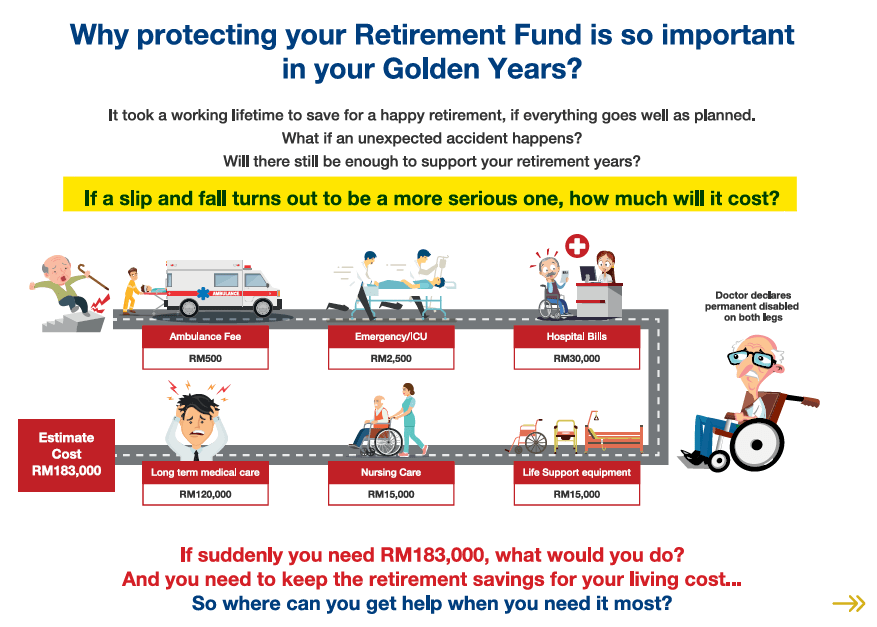

The Problems Faced by Senior Citizens:

If your parents are in their retirement age, chances are it will be very expensive to get them covered if they are underinsured. This is tricky, because as at our parents age, they are also extremely prone to accidents such as falling at home or injury while doing leisure sports – which the treatments can be financially demanding.

p

The Benefits of SecureMas PA Insurance

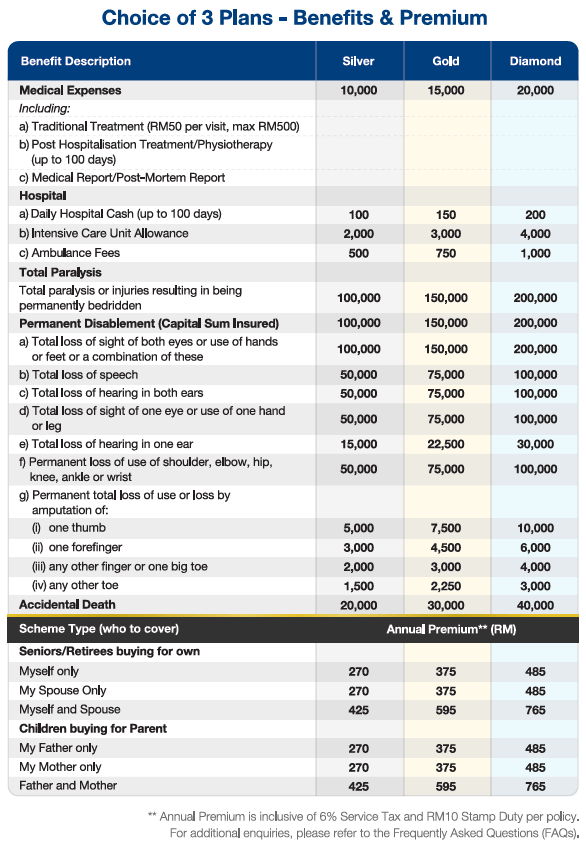

SecureMas by LonPac Insurance is a personal accident (PA) insurance that not only reimburses your parents’ medical and hospitalization expenses but also provides hospital income, disability benefit, and accidental death benefit, should they are involved in an unfortunate accident.

One great feature about SecureMas is their price: Starting at RM270/YEAR per parent (RM22.50/month) or RM425/YEAR for both parents (RM35.40/month), you can get your parents insured against accident at NO yearly price increment. This means that what you pay is the same throughout the whole coverage period regardless of the age of your parents.

Different from other PA in the market, SecureMas offers high medical and hospitalization expenses reimbursement if (fingers crossed) your parents are involved in a fall-down accident, food poisoning, dengue fever etc.

Let’s use SecureMas’ Diamond plan as an example: The Diamond plan offers up to RM20,000 limit for each parent for each hospitalization with an unlimited annual limit:

For example, within one year cycle:

- January: Suffered bone fracture due to falling down – can claim medical bill up to RM20,000 limit

- June: Caught dengue fever – can claim medical bill up to RM20,000 limit

- December: Fell down again – can claim medical bill up to RM20,000 limit

p

Eligibility & Other Special Features:

- Entry age up to 70 (Last age to apply is 70 year-old)

- Accepts people with high blood pressure/hypertension and mild diabetes not requiring insulin (at no extra charges)

- No medical check-up required.

- May renew up to 100 years old and premium does not increase with age

If you are keen to get your parents protected, definitely check out the video below:

p

How to Buy/Enquire?

SecureMas is a financial protection product directed at the underinsured parents’ market. An important thing to note is that currently, SecureMas is a pre-launched product only distributed by selected Lonpac Insurance authorized agencies. Hence, the information is not up on the official website yet (but I am notified that it will be up soon!).

All in all, if you are keen to find out more/apply for SecureMas PA insurance, get exclusive access by reaching out to Lonpac Insurance authorized agency via Whatsapp by clicking on the button below.

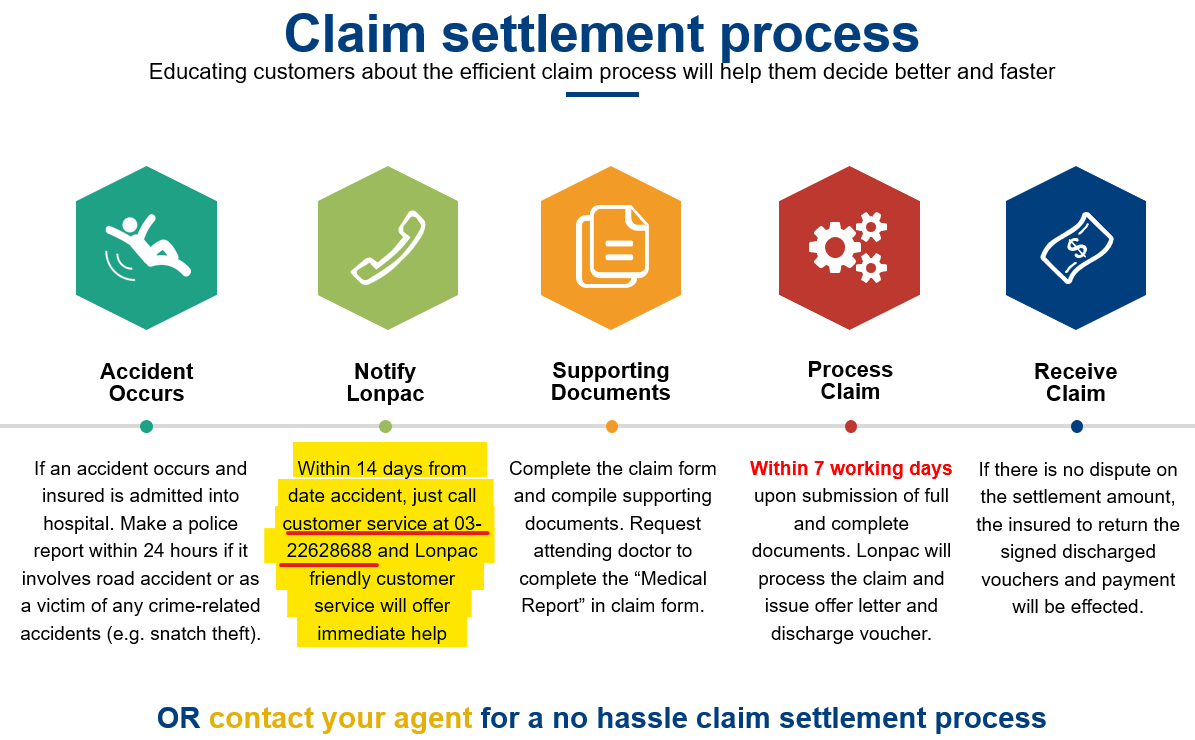

How to Claim?

I will never be comfortable with an insurance product without knowing their claim procedures, and I think you should be aware of that, too.

p

No Money Lah’s Verdict

So, I guess that’s it for this article! Personally, I think it is the responsibility of every young adult to find out the status of financial protection within his/her family. Let’s just say it is part of adulting. The bottom line is, don’t wait till it’s too late to build your financial defense line for you and your family members.

Note: SecureMas is a Personal Accident (PA) insurance that reimburses policyholders in the event of injury and/or death due to accident ONLY. It is not by any means a medical product, so there is no medical card involved. Meaning, you still have to pay for any medical expenses upfront, and your claim will come in as reimbursement upon document submissions following the claim process above.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Hi Yi Xuan,

Thanks for your informative post, which I read with great interest. You wrote that SecureMas offers medical and hospitalization expenses reimbursement in the event of dengue fever but in the leaflet that you included under “what is not covered?”, it specifically states disease, infection or parasites – dengue fever is an infectious disease – is it covered by SecureMas too in this case?

Cheers.

Hi Tong,

Thanks for your comment and glad that you find this article useful! Yes the product specifically mentions that it covers dengue so worry not as it is within the protection clause. Feel free to reach out to the authorized Lonpac agencies for more info via the button under ‘How to Apply’! 🙂

Regards,

Yi Xuan