Last Updated on May 1, 2022 by Chin Yi Xuan

In this month’s Invest in China Series, we are going to look at the ChiNext Index.

With the world going through significant shifts, such as the Covid-19 pandemic to the rise of electric vehicles, innovative businesses play a crucial role in saving mankind and making human life better.

If innovation is your thing, then this article will be one that you’d want to read – so let’s get going!

p

Table of Contents

Highlights of the ChiNext Index:

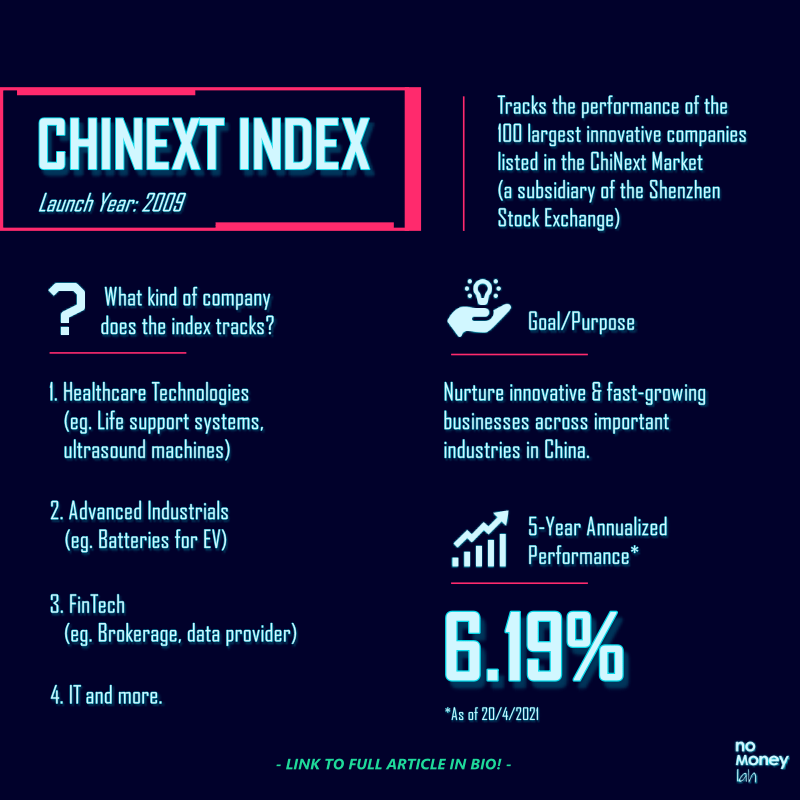

- The ChiNext Index tracks the top 100 innovative & fast-growing companies (measured by market cap) listed on the ChiNext Market, which is a subsidiary of the Shenzhen Stock Exchange.

p - The ChiNext index started trading in 2009. The index hosts innovative companies from a diverse range of industries including healthcare, IT, and industrial businesses.

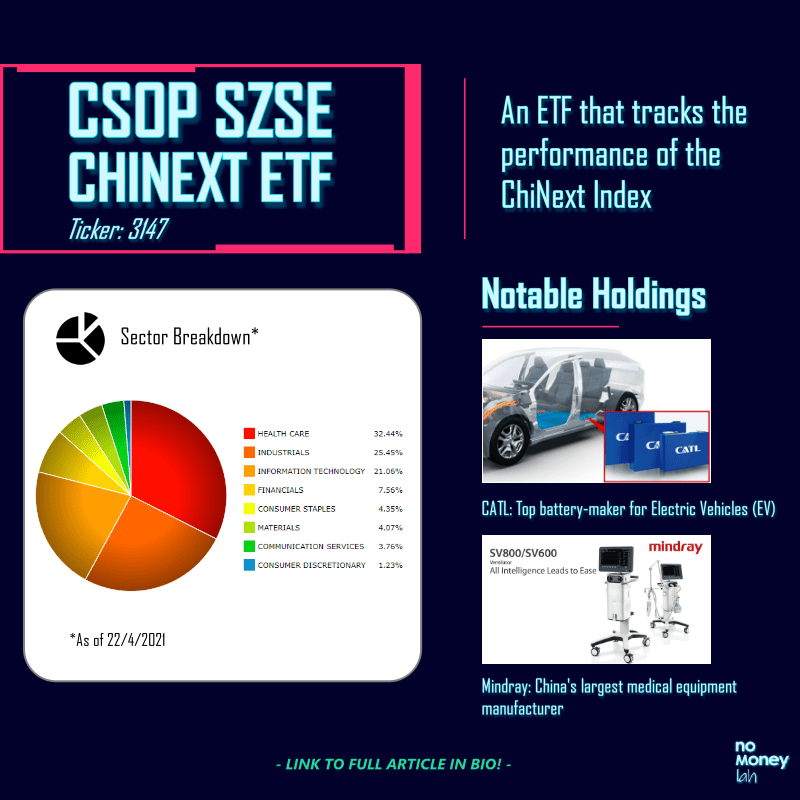

p - One cannot invest directly at the index. Instead, we can do so via ETFs that track the index – such as the CSOP SZSE ChiNext ETF (ticker: 3147).

p

What goes into the ChiNext Index?

The ChiNext index is established to attract innovative and fast-growing businesses, especially high-tech firms. As such, it is also perceived as China’s equivalent of the US’s Nasdaq 100 Index.

In other words, the ChiNext index offers investors a simple way to invest in China’s home-grown innovative companies. This is because the index hosts future-proof companies that produce the ever-important healthcare technologies, to battery suppliers of electric vehicles (EV).

That said, not every company in the ChiNext Market can become part of the elite ChiNext Index.

To become part of the index, a company has to be in the top 100 in terms of market cap. Also, the index is adjusted and rebalanced on a semi-annual basis to ensure the relevance of the index.

p

ChiNext Index Performance

As of 20/4/2021, the ChiNext Index recorded a 5-year annualized return of 6.19%.

A 5-year 6.19% annualized return means that money invested 5 years ago in the index has grown by 6.19% every year.

p

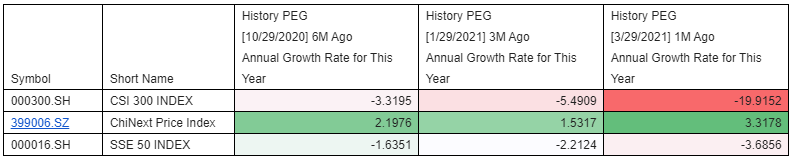

In terms of Price/Earnings-to-Growth ratio (PEG ratio), the ChiNext Index has been recording a positive PEG ratio for the annual growth rate for 2021. Compared to the negative PEG ratio of major Chinese indices like the CSI 300 Index and Shanghai SE (SSE) 50 Index, a positive PEG ratio of the ChiNext index would likely indicate a positive growth anticipation for 2021.

p

ChiNext Index vs STAR 50 Index vs Hang Seng TECH Index

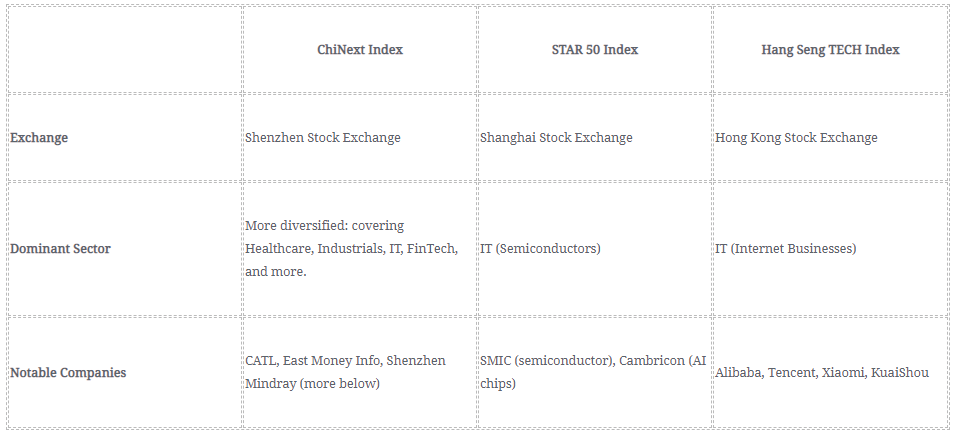

In this ‘Invest in China’ series, I have covered 3 China tech & innovation-focused indices, namely the ChiNext Index, STAR 50 Index, and the Hang Seng TECH Index.

The question is, what are the differences between all these 3 indices?

Essentially, there are 2 main elements that differentiate the ChiNext, STAR 50 and Hang Seng TECH Index from each other:

Firstly, all three indices host companies that are listed in different stock exchanges – ShenZhen (ChiNext), Shanghai (STAR 50), and Hong Kong (Hang Seng TECH).

Secondly, each index has its own theme by hosting innovative companies from different niche, as shown in the table below:

READ MORE: Hang Seng TECH Index Review, STAR 50 Index Review

p

CSOP SZSE ChiNext ETF: Your Gateway to Invest in the ChiNext Index

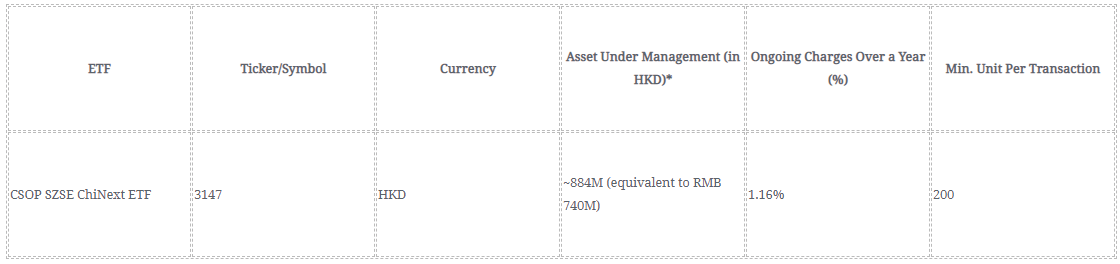

An index is not something that one can invest in directly. Instead, investors can invest in Exchange Traded Funds (ETFs) that track the performance of the index.

One such ETF is the CSOP SZSE ChiNext ETF. This is an ETF that tracks the performance of the ChiNext Index, where investors can invest even with small capital.

To track the ChiNext Index, the ETF adopts a combination of physical representative sampling and synthetic representative sampling strategy.

p

p

Notable Holdings of the CSOP SZSE ChiNext ETF

In this section, I’ll be sharing with you some notable companies in the CSOP SZSE ChiNext ETF that caught my eyes:

#1 Contemporary Amperex Technology Co. Ltd (CATL)

We all know that the electric vehicle (EV) business is a huge thing and with massive growth potential.

Behind the scene, CATL is one of the dominant battery manufacturers in the EV industry, with association with big names like Toyota, Volkswagen, Volvo, and more. According to UBS, the demand for battery cell supply to meet the increasing growth of the EV industry will tighten in 2021 and there’d be a global shortage by 2025.

In other words, this means that the EV industry is rapidly growing. CATL, being an incumbent battery manufacturer is at a significant cost advantage to grow alongside the demand.

p

#2 East Money Information Co. Ltd

East Money Information is a Chinese online financial company that offers various online financial services such as brokerage service, investments in unit trusts & bonds, paid datafeed, and more.

Think of East Money Information like Rakuten Trade and Fund Supermart, but in steroid. In fact, the company is so huge that in 2020, its growth in share price made the company more valuable than notable bank, Credit Suisse.

p

#3 ShenZhen Mindray Bio-Medical Electronics

Mindray is China’s largest medical equipment manufacturer, with a presence around the world.

It is a company that makes medical equipment such as patient-monitoring and life-support systems and ultrasound machines.

With the world living in pandemics and a society full of health concerns, Mindray is poised with a huge room to grow.

p

What You Need to Know + Risks of Investing in the ChiNext Index

#1 Higher than Average Fluctuation

The companies in the ChiNext market are made up of innovative or small/medium-sized enterprises. Many of them are usually in their early development stage with a smaller operating scale and shorter operating history.

As such, these businesses are usually subject to higher uncertainty and more fluctuations in their performance. Therefore, investors that are investing in the ChiNext index should expect bigger swings in the performance of the index.

p

#2 Delisting Risk

Being an index that is made up of companies in the fast-moving innovation industry, investors need to be aware of the risk of component companies being delisted when they become irrelevant or not in compliance to the ChiNext Index’s listing conditions.

p

Who Should Invest in the ChiNext Index?

Similar to the STAR 50 Index that I have reviewed, the ChiNext Index is certainly China’s initiative to nurture innovation via the capital market.

Accessing the opportunities and risks, the ChiNext Index is certainly NOT for everyone. New investors or investors with lower risk tolerance should probably skip the ChiNext Index, and perhaps look into the Hang Seng TECH Index for Chinese tech-enabled internet businesses like Alibaba and Tencent.

That said, the ChiNext Index can be a good investment option for:

- Opportunistic investors that are having a long-term view towards China’s innovative growth in ever-important industries like healthcare, industrial production, FinTech, and more.

p - Experienced investors with a good grasp on China’s growth & development.

p

My Recommended Broker to Invest in CSOP SZSE ChiNext ETF (Ticker: 3147):

As you may have guessed by now, CSOP SZSE ChiNext ETF is not listed locally. Instead, it is being traded in the Hong Kong stock exchange in Hong Kong Dollar (HKD).

As such, you’ll need a reliable stock broker with access to the Hong Kong stock exchange in order to invest in this ETF.

If you do not have a stock broker, I’d highly recommend Tiger Brokers to you. Tiger Brokers is my go-to regulated stock broker that provides all-in-one access to markets such as the US, Singapore, and Hong Kong stock market – all at a highly competitive fee.

Check out my full review on Tiger Brokers HERE.

ALSO READ: How to Invest in Your First Stock via Tiger Brokers

p

No Money Lah’s Verdict

All in all, the ChiNext Index is an interesting index that hosts China’s top innovative companies from various industries.

For investors looking to gain exposure to the potential of China’s innovation, the CSOP SZSE ChiNext ETF offers a great solution to invest in the ChiNext Index easily even with small capital.

Do you have any questions on the ChiNext Index? Feel free to let me know your thoughts & questions in the comment section below!

About CSOP Asset Management

I first discovered the ChiNext Index through CSOP Asset Management (AM).

If you have been investing purely in the Malaysia or US market, it is likely that you have not heard of CSOP AM before. However, CSOP AM is huge in the China & Hong Kong market:

Established in 2008, CSOP AM is the first offshore entity established by a regulated Chinese asset manager with Hong Kong’s Securities & Futures Commission (SFC) type 1 (dealing in securities), type 4 (advising on securities) and type 9 (asset management) licenses.

With this background, CSOP AM manages the biggest renminbi (RMB) equity & fixed income ETF listed in offshore China.

In late 2019, CSOP AM sets up their office in Singapore, with the goal to bring China’s gradually opening capital market to Southeast Asia’s investors (psst… that’s us).

In essence, through CSOP AM ETFs, foreign investors like you and me have the opportunity to gain exposure to China’s growing capital market.

Disclaimer

The purpose of this post is purely for sharing and should NEVER be taken as a buy/sell recommendation. Please do your own research AND/OR reach out to a licensed financial planner before making any investment decision.

Related Posts

January 13, 2022

Malaysian’s Guide to Invest in ETF

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.