Last Updated on May 1, 2022 by Chin Yi Xuan

Have you ever tried to send money overseas? If yes, you’d know that it was a slow and painfully expensive experience.

No more such headache, as Ripple aims to improve our existing financial system especially when it comes to global payments & transactions.

In this article, I want to explore Ripple and its cryptocurrency XRP – how exactly it could improve our current financial system, and what do you need to know before investing in it?

p

Table of Contents

Highlights of Ripple (XRP):

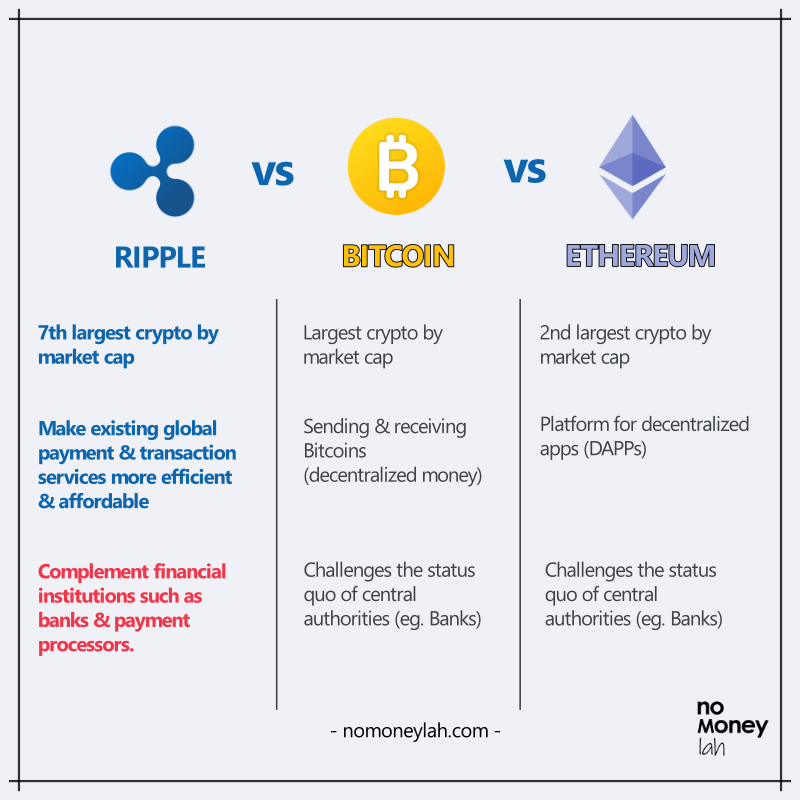

- Ripple was created in 2012 by Ripple Labs, a US-based tech company. XRP (crypto issued by Ripple Labs) is the 7th largest cryptocurrency by market cap, worth more than $41 billion in value.

p - Solid use case: Ripple aims to make existing global payment & transfer more efficient compared to intermediary solutions like Swift and Western Union. XRP is the cryptocurrency that involves in the transfer of money between different currencies across the Ripple Network.

p - Unlike Bitcoin and Ethereum that challenge the status quo of central authorities (eg. Banks), Ripple is created to serve the financial institutions by making the existing services better.

NOTE: Before you proceed, it is best that you have a basic understanding of Bitcoin and Ethereum first. This will make learning about Ripple much, much easier. Check out my post on Bitcoin HERE, and Ethereum’s post HERE – both conveyed in simple-to-understand English.

p

International Money Transfer is, well… Sucks

Transferring money abroad using different currencies is slow and expensive.

As an example, let’s say you are sending RM1,000 in New Zealand Dollar (NZD) to your brother in New Zealand.

There are 3 issues with our existing banking solutions like Swift or Western Union:

- Expensive FX Spread: A conversion fee will incur due to the bid-ask spread between MYR and NZD. (Similar to the experience when we exchange for foreign currencies at money-changers)

p - Inefficient system: Behind the scene, NZD may not be a currency that most banks keep in their reserves. Since USD is a commonly used currency globally, banks would normally convert your MYR to USD, which will need to be converted back into NZD prior to reaching your brother’s bank account.

p - Expensive Intermediary Bank Fees: One issue with our banking system is most banks do not have a direct line with each other. Hence, in order to transfer money from one bank to another, it’ll have to go through several intermediary banks searching for common network connection in order to clear a path for the transfer (think of transitional flight to countries like the US).

p

As such, expensive intermediary banking fees will incur.

As a result, by the time your RM1,000 (denominated in NZD) reaches your brother, it may be (much) less than RM1,000 in value due to all the fees. Worse, he may need to wait several days before he receives the transfer.

This is where Ripple comes in. Ripple aims to decentralize our current global payment system and make it more efficient and affordable.

p

How exactly does Ripple work?

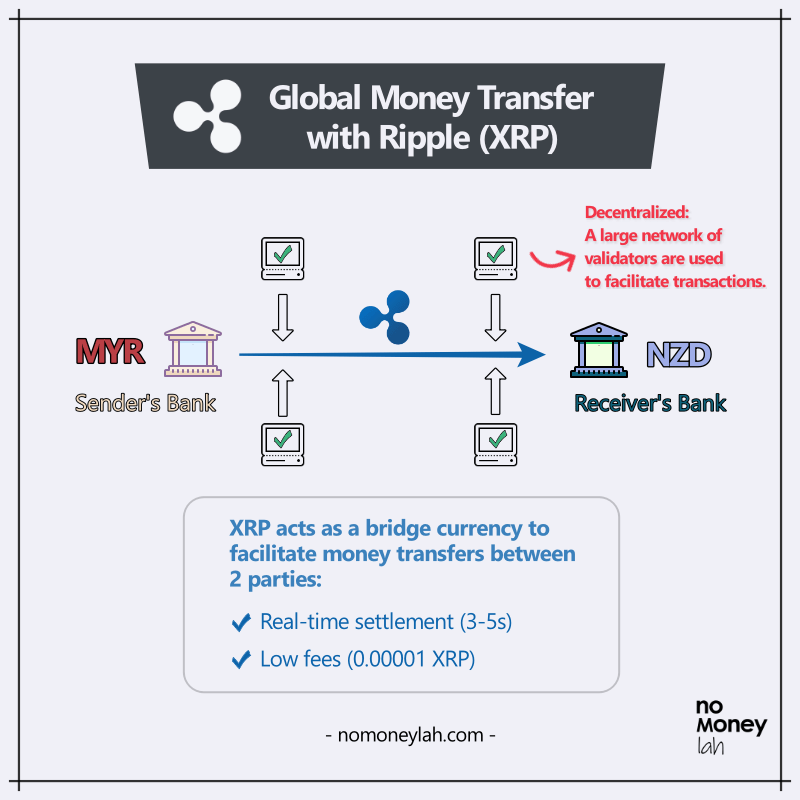

Ripple works through a consensus protocol that contains a network of validators. Validators are a network of computers across the globe that facilitate transactions and maintains an ownership record of who owns what. Anyone can run a validator but Ripple also offers a default list of trusted validators.

The way a transaction in the Ripple network works is any transaction must have more than 80% approval (>80%) from the validators in order to go through.

p

What you need to know about XRP

Alright, so where does the XRP cryptocurrency come into the picture?

XRP is a cryptocurrency issued by Ripple. It is a cryptocurrency that involves in the transfer of money between different currencies across the Ripple Network. In short, XRP is what we are going to invest in when someone says he/she is investing in Ripple.

So, let’s go back to our example where your bank would like to move your RM1,000 (in NZD) to your brother in New Zealand:

Instead of going through complicated banking network, banks can instead become a ‘Gateway’, and conduct the transfer in XRP via the Ripple Network.

In this case, XRP is sort of like the ‘Joker’ card in card games: not the scary character, but the card that can be any other card. Meaning, if you want to exchange RM to NZD, it can be RM with RM and NZD with NZD.

As a result, XRP transactions on the Ripple Network are able to achieve 3 significant benefits:

- Real-time settlement: XRP are able to settle transactions between 3-5 seconds instead of 3-5 business days.

p - Efficient: XRP is able to do about 1,500 transactions/second with the potential to match Visa’s capability of 65,000/s. In comparison, this is much more effective than Ethereum (~20/s) and Bitcoin (4-5/s).

p - Low fees: The transaction cost on Ripple is 0.00001 XRP, which is around 0.85 USD at the time of writing. This is much lower compared to conventional international transfer solutions.

p

How is XRP different from Bitcoin?

Firstly, the main role of Ripple (and its cryptocurrency XRP) is to complement existing financial institutions such as banks and payment processors. This is done by decentralizing payment solutions and making them more efficient. On the other hand, Bitcoin focuses on overhauling traditional fiat money, and as a result, removing central authorities altogether from the picture.

In addition, unlike Bitcoin, XRP coins cannot be mined. Meaning, unlike the miners in the Bitcoin network, the validators on the Ripple Network will not be rewarded when validating a transaction. This is because XRP runs on a very different consensus mechanism compared to Bitcoin (p.s. complex topic – you can read about them HERE if you are interested).

From these, XRP actually does not compete with Bitcoin or ETH (at least not directly). Instead, it competes with existing payment and remittance solutions like Swift or Western Union, and newer technologies like Wise.

p

4 things you need to consider BEFORE investing in XRP

#1 Is XRP centralized?

Whether Ripple is actually centralized in nature has long been a topic of debate. To understand this, you need to know the distribution of the XRP coins:

At the very start, a total of 100 billion XRP coins were created (or pre-mined) by Ripple Labs and no additional coins can be created anymore. Initially, 80 billion XRP went to Ripple Labs and 20 billion XRP were distributed among the founders. Over time, the 80 billion XRP that Ripple Labs own is slowly being released to the public.

As of June 2021, about 46 billion XRP is in public circulation. That said, it is obvious that most XRPs are still under the control of Ripple Labs.

With this in mind, Ripple Labs, without doubt, has heavy influence over the Ripple Network and XRP. When there is a figure/organization that has implicit influence over the system, it is up to investors to decide how ‘decentralize’ XRP is over the likes of Bitcoin and Ethereum.

p

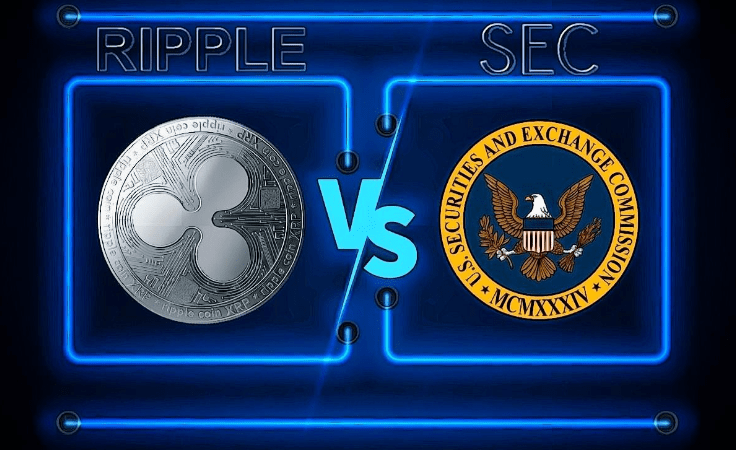

#2 XRP vs SEC Lawsuit

Since late 2020, Ripple has been fighting a lawsuit with the US’s Securities & Exchange Commission (SEC). Reason being, SEC alleged that XRP is actually not a currency and instead, a security like stocks. In essence, the SEC wants to have jurisdiction over XRP due to the nature of how XRP works.

As a result, XRP has since been delisted from major crypto exchanges such as Coinbase. The lawsuit is still going on as of the time of writing but there are signs that Ripple may be winning the case (though we can never tell the absolute outcome).

If you are interested, you can read more about the lawsuit HERE.

With that said, Ripple’s lawsuit with SEC is certainly something that you need to take into consideration before investing. This could either be a main determent, OR a huge opportunity to invest in XRP.

p

#3 XRP is Volatile

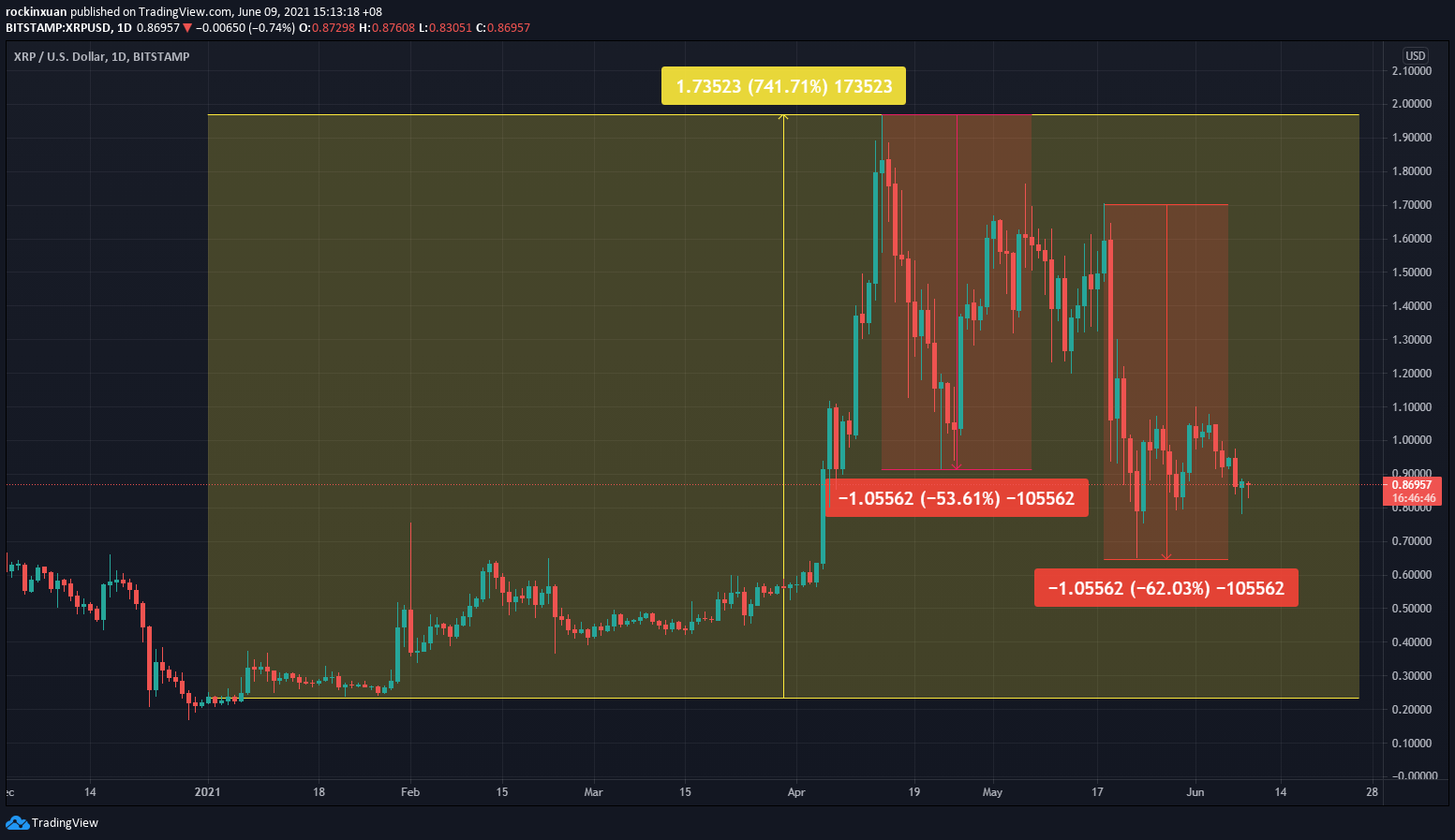

The crypto world has never been shy of volatility and XRP is no exception for that.

In fact, due to the existing lawsuit with SEC, XRP’s price has been very volatile in 2021. From a >700% increase to 2021’s peak, to 2 major huge selldowns (> -50%) so far, you truly need to understand your risk appetite before investing in XRP.

p

#4 Ripple’s Adoption

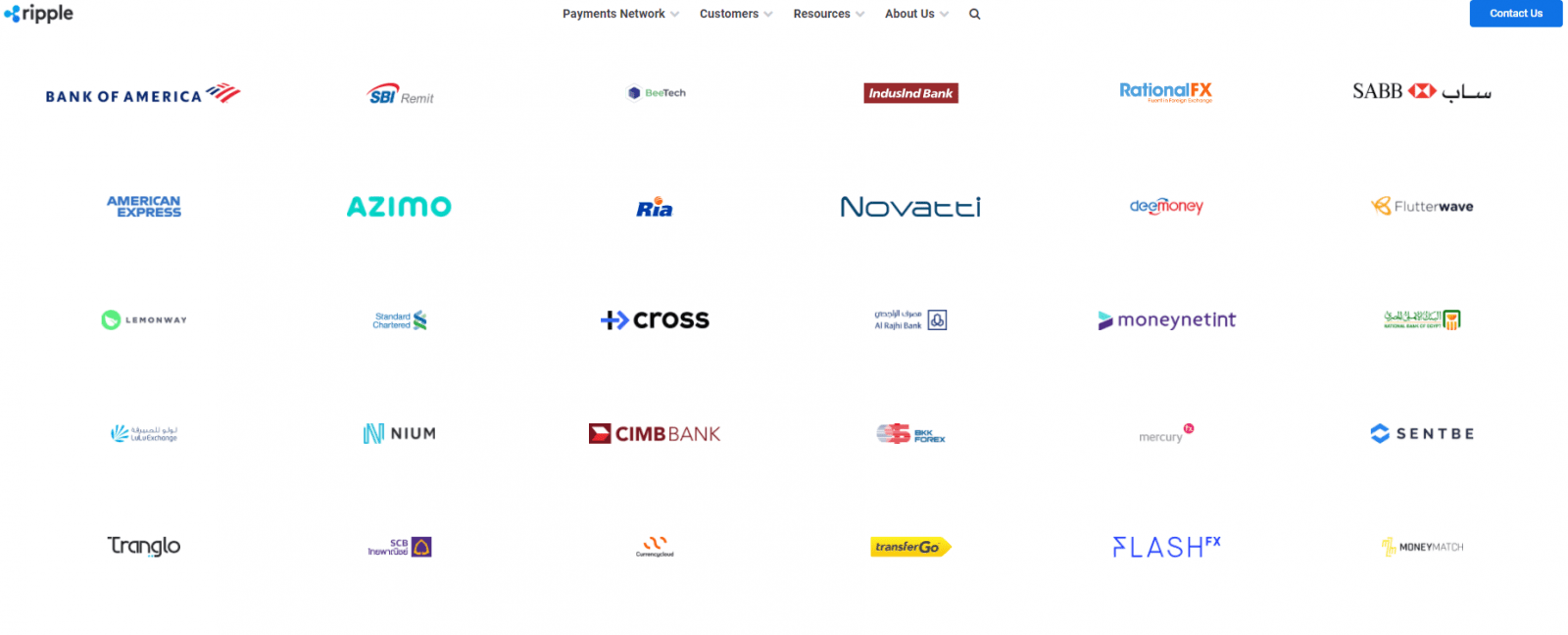

A glance over Ripple’s website, you’ll be able to see a list of Ripple’s customers with the likes of Bank of America, American Express, and CIMB Bank.

You can also check out many case studies that Ripple has over its website HERE. One notable company working with Ripple is MoneyMatch, which provide SMEs & individuals in Malaysia an alternative to the high transfer fees and FX rates compared to conventional banking solution.

p

My Personal Thoughts + Should You invest in XRP?

In my opinion, what Ripple can offer is truly unique among the crypto world. Instead of challenging the status quo of central authorities (eg. Banks) like Bitcoin and Ethereum, Ripple looks to serve financial institutions by integrating & improving the existing financial solutions.

As such, despite the current lawsuit with SEC right now, I do think Ripple has the most solid use case RELATIVE to our current financial system when compared to many other cryptocurrencies out there.

That said, we can never tell with certainty if our ‘current’ financial system will still be relevant in the far future. With that, if you are keen to invest in XRP, you should answer these 3 questions:

- Do you believe that Ripple will improve our financial system for the better?

- Are you confident that, with time, more and more financial institutions are going to adopt Ripple?

- Are you comfortable with short-term volatile swings?

p

How to invest in XRP in Malaysia?

The next question: How can you invest in XRP and cryptocurrencies in Malaysia?

Presently, there are 3 cryptocurrency exchanges that are approved by Securities Commission (SC) to operate digital asset exchanges. This means that these are 3 regulated exchanges where Malaysians can buy and trade Ripple and other cryptocurrencies.

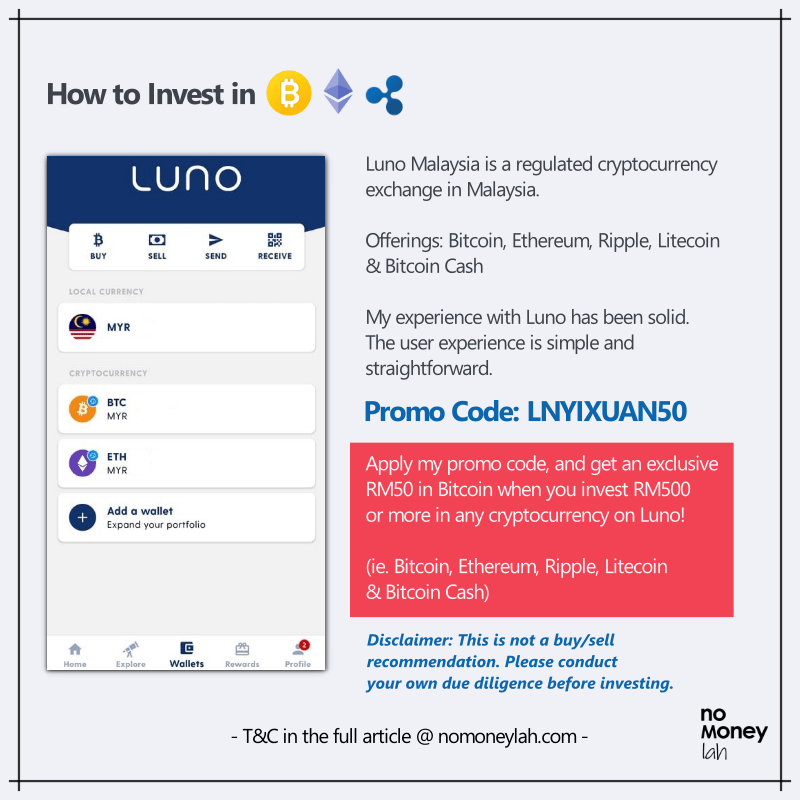

Personally, I have been using Luno, the largest of the 3 regulated exchanges since 2017 and I am more than happy to recommend Luno for investors looking to invest in cryptocurrencies safely.

I will work on a dedicated Luno review soon, but here’s a brief rundown of its features:

- Multiple Offerings: The biggest SC-regulated cryptocurrency exchange which offers Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and Ripple.

p - High Security: The majority of Luno’s customers’ cryptos are stored in a Deep Freeze storage – ie. A multi-signature wallet system, with private keys stored in different bank vaults. This means that no single person ever has access to more than one key, which translates to a high level of security of users’ cryptocurrency holdings.

p - Simple, user-friendly interface: Luno’s interface is exceptionally intuitive and simple to use. Every button and main functions are readily reachable and transacting ETH is straightforward.

p - PROMOTION: No Money Lah is now collaborating with Luno Malaysia to bring the best-in-town deal for new Luno users that are keen to invest in cryptocurrencies! Use my dedicated promo code – LNYIXUAN50, and you will get RM50 worth of Bitcoin when you invest RM500 or more in any cryptocurrencies (Bitcoin/Ethereum/Litecoin/Ripple/Bitcoin Cash). That’s an instant 10% return on your investment.

The full details of this promo can be accessed HERE. Please go through them so you are clear that you meet the criteria for this RM50 promo.

p

No Money Lah’s Verdict

So here you have it – Ripple explained in simple English for beginners! I hope you find this article simple to understand and insightful!

Ripple is such a unique crypto compared to Bitcoin and Ethereum and I have a great time working on this article. Do share this post with your friends if you find it useful – I’d really appreciate it!

So, now’s your turn:

What do you think about Ripple? Are you planning to invest in XRP? If yes, why? If no, why? Let me know your thoughts at the comment section below!

Looking forward to hear from you soon!

Luno Promo Code: LNYIXUAN50

In collaboration with Luno Malaysia, No Money Lah is bringing the best-in-town deal for new Luno users that are keen to invest in cryptocurrencies!

Use my dedicated promo code – LNYIXUAN50, and you will get RM50 worth of Bitcoin when you invest RM500 or more in any cryptocurrencies (Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and Ripple). That’s an instant 10% return on your investment.

The full details of this promo can be accessed HERE. Please go through them so you are clear that you meet the criteria for this RM50 promo.

Open Your Luno Account HERE.

Disclaimer: This article produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Information in this article is accurate as of the time of production. Please consult a licensed financial planner before making any investment decisions.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

How does the cost of the system stay cheap if the price of XRP goes up ? Or is it better to just buy stock in Ripple ? What is the max value of XRP?

Hi George!

Yeap that could be one of the concerns too if XRP gets more volatile. But as of the moment, it is still much more affordable than conventional money transfer.

Ripple Labs is not a publicly listed company so their shares are not something we can buy publicly. There is no cap for the XRP value.

Regards,

Yi Xuan