Last Updated on May 1, 2022 by Chin Yi Xuan

In Part 1 of my Amanah Saham article, I covered an overview of Amanah Saham investing and the benefits and risks of putting your money in Amanah Saham. For Part 2, we took an in-depth look into all 6 Fixed Price Funds by Amanah Saham (eg. Their stellar return).

p

Table of Contents

(1) Account Opening Process

Opening an ASNB account is relatively straightforward. You can either visit any of the ASNB’s branches or its agents to open your ASNB account – be sure to bring along minimum cash of RM10 for initial investment!

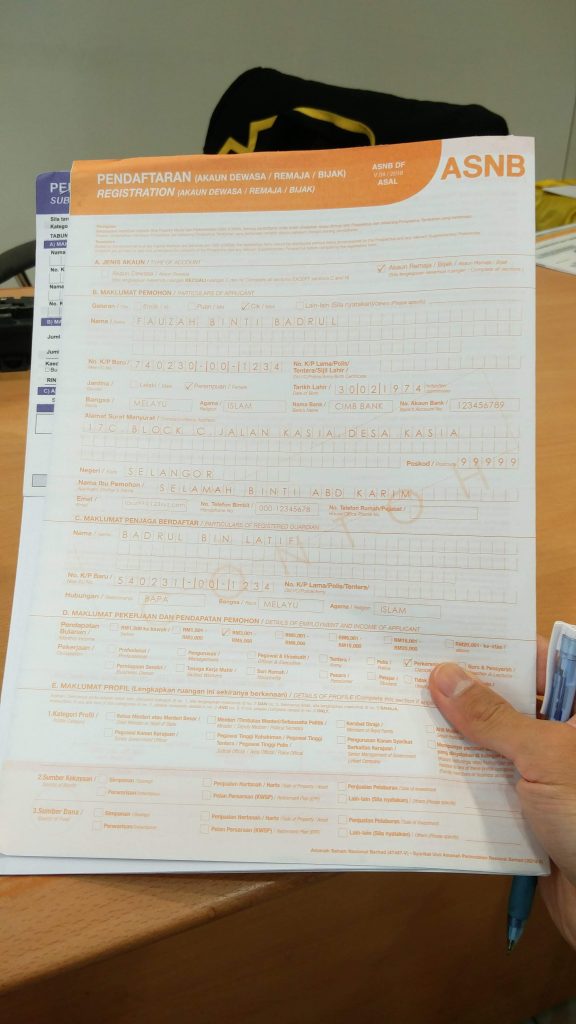

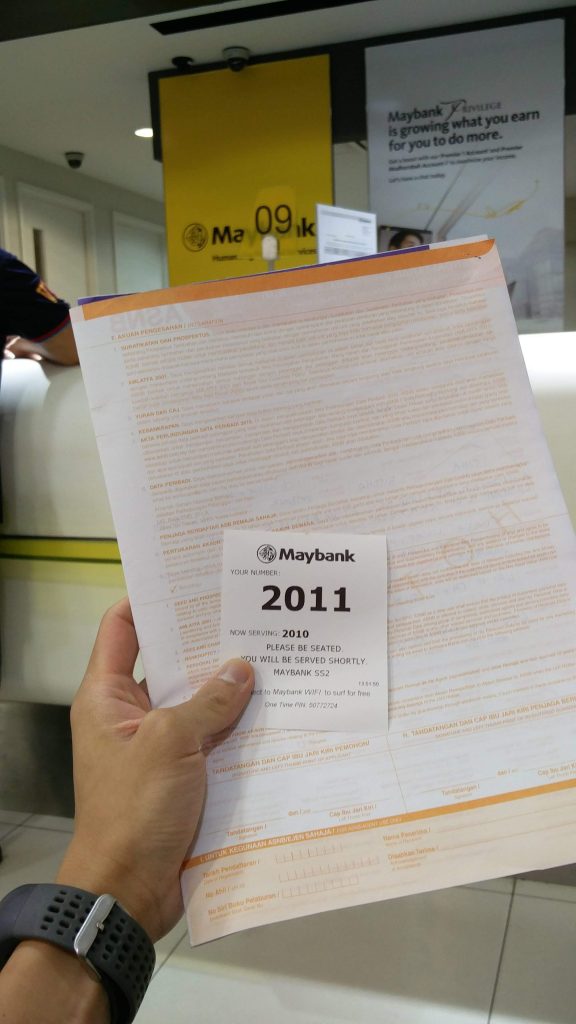

For myself, I went to one of the Maybank branches nearby to apply for my ASNB account. While the process is straightforward, there are quite a number of declaration and Know-Your-Customer (KYC) forms to fill up. (Note: Individual below 18 years old will need to have his/her guardian’s details filled up as well)

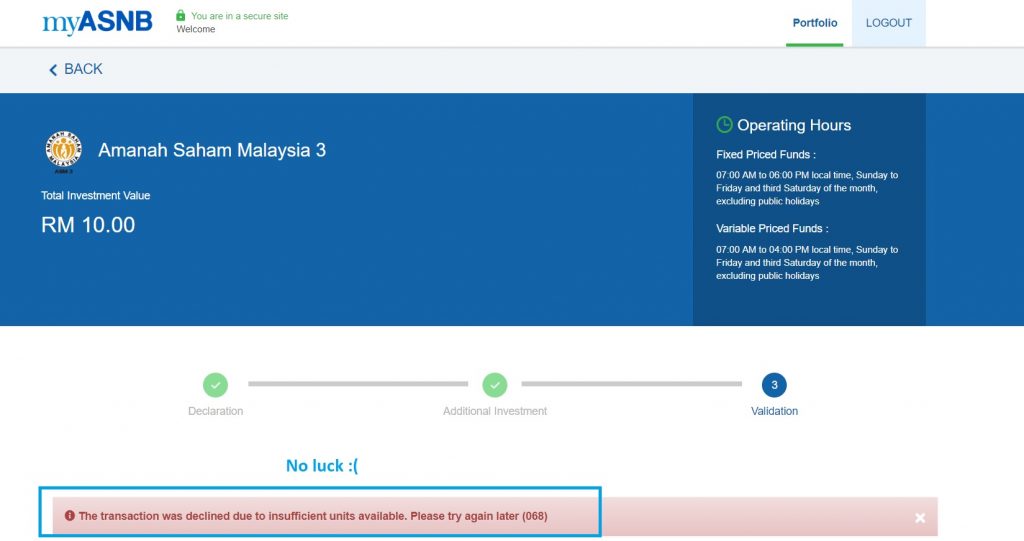

From my experience, the account opening process at the counter took quite a bit of time, due to some lengthy account activation procedures – so be sure to allocate about 40 minutes for everything! For my initial investment, I only managed to open my ASNB account (ASM 3 – 1 Malaysia) with RM10. As there were no extra units available (minimum RM100 additional investment), I could not buy more units 🙁

(2) Buying Additional Units & Managing Your Investments via myASNB Platform!

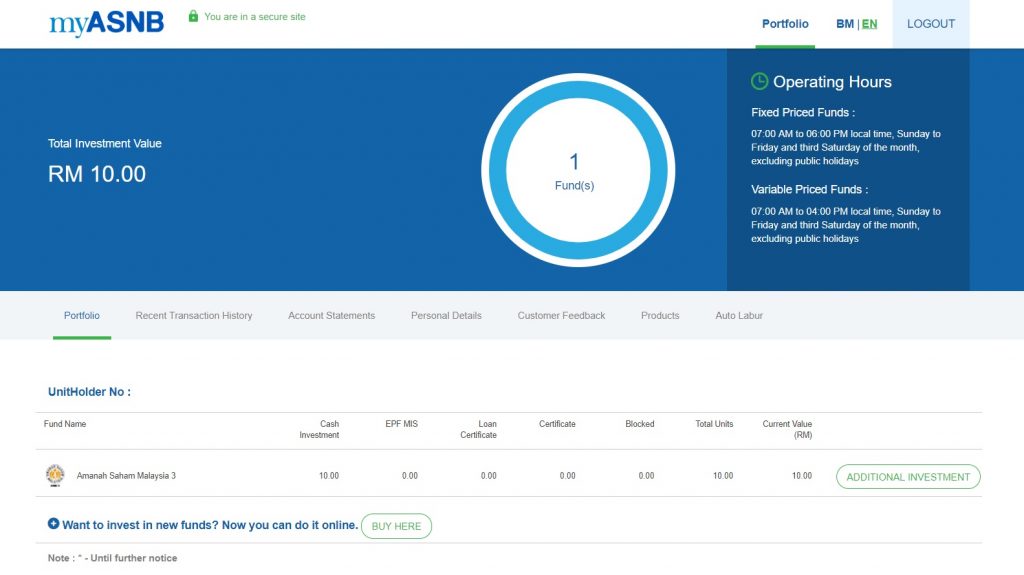

myASNB is a platform by ASNB where you can manage your portfolio and purchase additional units of the fund without going to the counter. Although I did not manage to buy additional units when I register for my ASNB account, I can still try to buy it via the myASNB platform and app.

As a whole, I like the interface of myASNB platform and its app as they provide a clear and simple overview of my portfolio and they are really easy to navigate around. As for unit purchase, Amanah Saham’s Fixed Price Funds are open to purchasing from 7 am to 6 pm, Sunday to Friday and the third Saturday of the month, excluding public holidays.

(3) Everything about Amanah Saham investment is great, but there is one BIG catch…

As you may have guessed it: Getting your hand onto any of the Fixed Price Fund is extremely hard. With a minimum RM100 investment, it is most of the time, a matter of luck whether you can buy any of the funds even though you have an account.

Well, since Amanah Saham Fixed Price Funds are almost too good to be true, it makes a lot of sense that people would not sell their units once they get their hand on the funds. As of the time of the release of this article, I have been trying to purchase additional units of Fixed Price Fund via the myASNB app with no avail.

No Money Lah’s Verdict: Amanah Saham Fixed Price Funds – a game of luck?

Essentially, I retain my view on Amanah Saham’s Fixed Price Funds: these funds are indeed a great deal and, without doubt, one of the best long-term investment options for Malaysians.

That said, considering how hard it is to purchase additional Fixed Price Funds at the moment, I think you would either need to have a lot of commitment to try buying everyday on myASNB, or you could go find some alternative investment vehicles available in the market.

In short, researching about Amanah Saham has been an eye-opening and informative experience for myself, as I get to learn so much about one of the best investment options in the country.

Check out Part 1 and Part 2 of my Amanah Saham articles if you haven’t read them!

p.s. If you face the same problem buying Amanah Saham’s Fixed Price Funds, why not consider other investment options that are available in the market?

Investing in the sector of Real Estate Investment Trusts (REITs) is definitely one of my favorite long-term investment choices in the stock market, as REITs also give out competitive dividends and return. More details HERE.

Disclaimer: The accuracy of this content is based on the best effort by myself and at the time of writing. I do not guarantee the validity of this content as details and performance of ASNB and its funds will change over time. This article is also not a buy/sell recommendation. Please seek professional financial planner’s advice on this matter.

Related Posts

February 16, 2024

Guide: How to open a CIMB Singapore account for Malaysians

April 16, 2023

Guide: How to open a CDS & Stock Trading Account Online

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Does the RM10 to open an ASNB account also prone to the availability of units?

Hi Mary, nope. You can buy a RM10 unit for account opening regardless of availability.

The divident is getting lower each year.

Better invest in Bursa Malaysia stocks.

You can gain 5% to 70% each month with the correct knowldege and investment method.

Hi Kamal,

I would say every investment vehicle is catered for diff people according to their needs, risk profile, and knowledge level.

So while I acknowledge that the returns might be heading to the downside, but ASNB is still a good choice for many that do not have the necessary investing knowledge.

Yi xuan

Did you manage to get any units so far?

Hey Han Xiong!

No I have not been able to get any units thus far 🙁

Yi Xuan

I managed to get RM100K from myASNB.

Hey Margeret!

Mind sharing with me how you managed to accumulate so much? 🙂

Yi Xuan

Hello , I know this is late . I’ve ASNB 3 and my old ASNB that my mum opened for me . I’ve already capped out the 30k for ASNB 3 . Can I open a new Acc?

Hi Krish!

Now that you have maxed out your ASB3, I think you can start buying funds on other funds (eg. ASB, ASB2, ASM, ASM 2, ASM 3)

Read more: https://nomoneylah.com/2019/06/16/asnb-p2/

Hi Yi Xuan,

Is it anytime also can go to Maybank branch with my IC and RM10 to open an ASBN account ? Despite no release of unit from existing holder.

Thank you.

Hi Ben!

Yes you can do so. From my experience, they always have RM10 worth of units available for acc opening.

Regards,

Yi Xuan

Hi Chin , new to ur article and i love the content!

i have a question tho..

what does asnb actually trade? stocks,crypto or forex?

do i have to buy ‘units’ in order to receive dividends?

sorry for the noob question as i have little to no knowledge in investment

Hi Chinoy,

Thanks for your comment and glad that the article found its way to you!

1. ASNB Fixed Price Funds are invested mainly in stocks.

2. You have to own units of the funds in order to receive dividends.

Hope this helps!

Yi Xuan