Last Updated on May 1, 2022 by Chin Yi Xuan

Gold has always been a great asset as a store of value. In fact, this precious commodity has always been part of my portfolio as a diversification tool to offset volatilities in my portfolio.

The question is, is there a way for you to buy & own gold even with a small capital, and without having to worry about the safety of your gold?

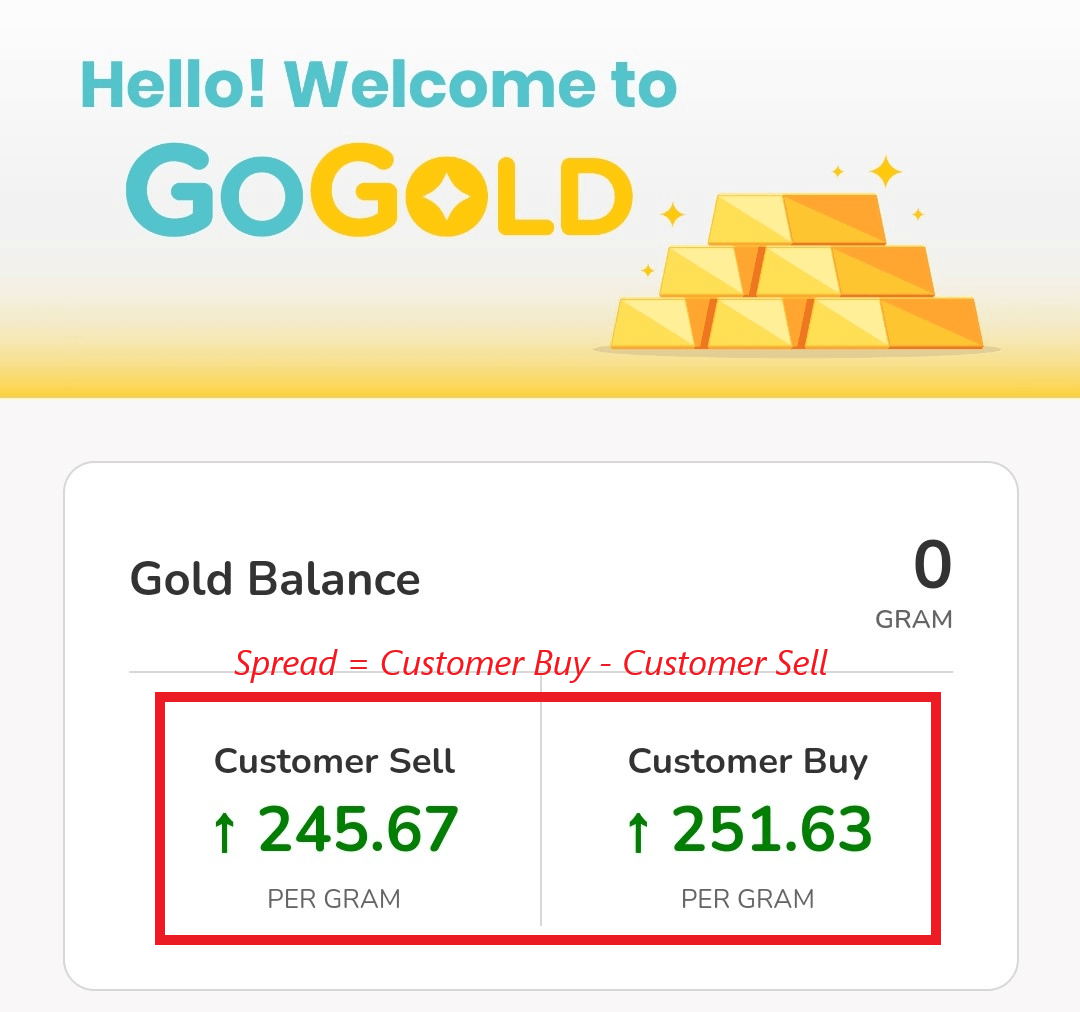

In this post, let me introduce you to GoGold. GoGold is in partnership with ACE Capital Growth. Through GoGold, now anyone can start owning gold from just RM5!

p

Table of Contents

5 GoGold with GoPayz Features

There are 5 main features that make GoGold your go-to platform if you are keen to own gold:

#1 Low barrier of entry

With GoGold, you can start owning gold from as low as RM5. In comparison, most platforms out there only sell gold in grams, kilograms or ounces.

In other words, GoGold gives users the flexibility to own gold regardless of how big or small their budget is. Personally, I think this is perfect for people that have a small capital but would like to own gold.

p

#2 Secure & Shariah compliant

GoGold ensures the gold that you purchase is genuine, safe, and secured. This is because GoGold is in partnership with ACE Capital Growth.

ACE Capital Growth is an established local & international gold bullion trader. Their parent company – ACE Innovate Asia Berhad is listed in the Bursa LEAP market.

In addition, your gold is also stored securely in a well-established security vault locally via Safeguard G4S, a leading provider of cash & security services in Malaysia.

GoGold is Shariah compliant, which makes it friendly for all Malaysians alike to buy digital gold via GoGold.

p

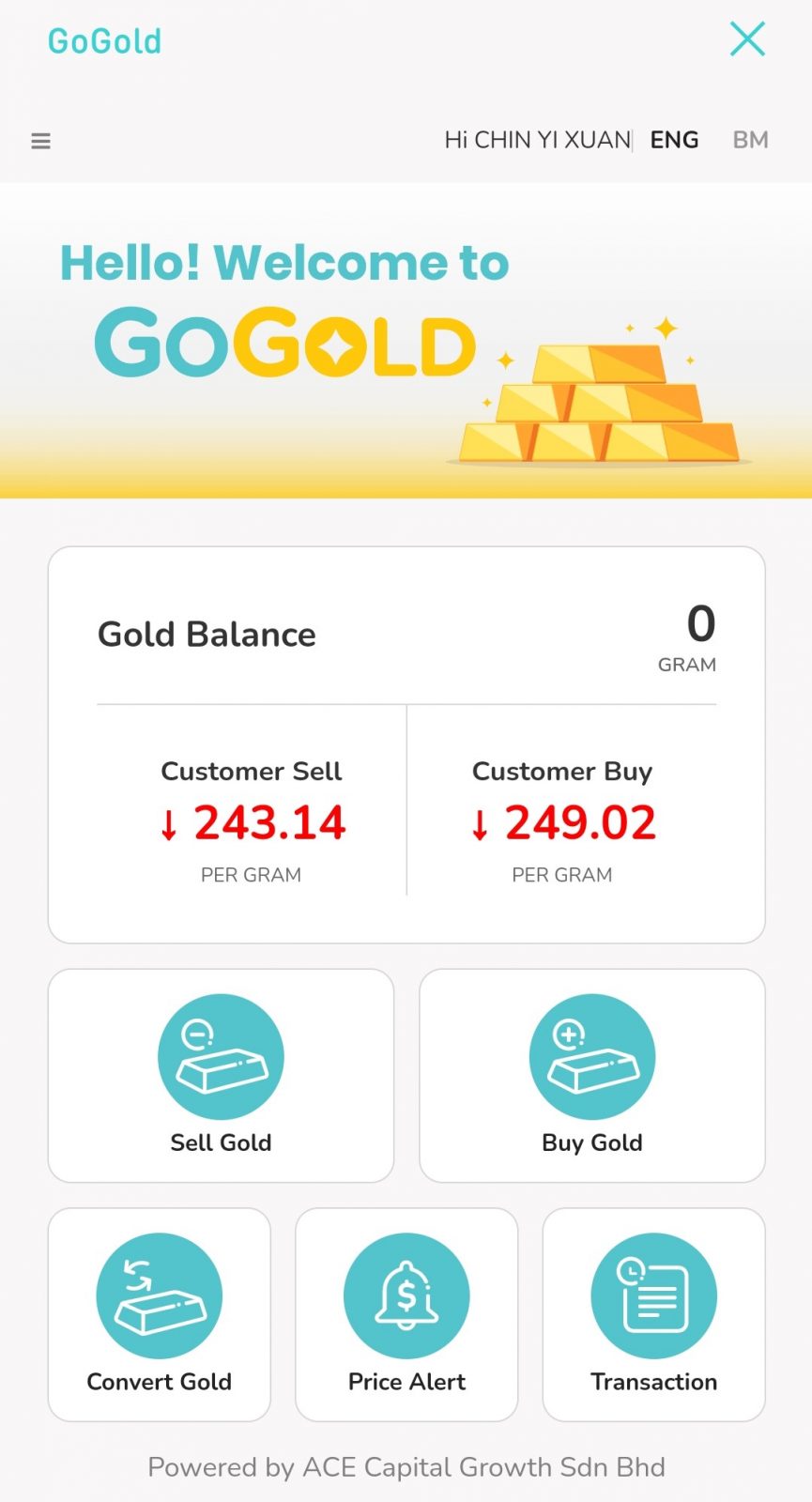

#3 Buy & sell gold within a single app

GoGold is neatly located within the GoPayz app. With its intuitive interface, GoGold provides users the convenience to buy and sell gold within the GoPayz app.

In other words, you can buy or sell your gold online, without having to visit physical bank branches or stores to do so.

p

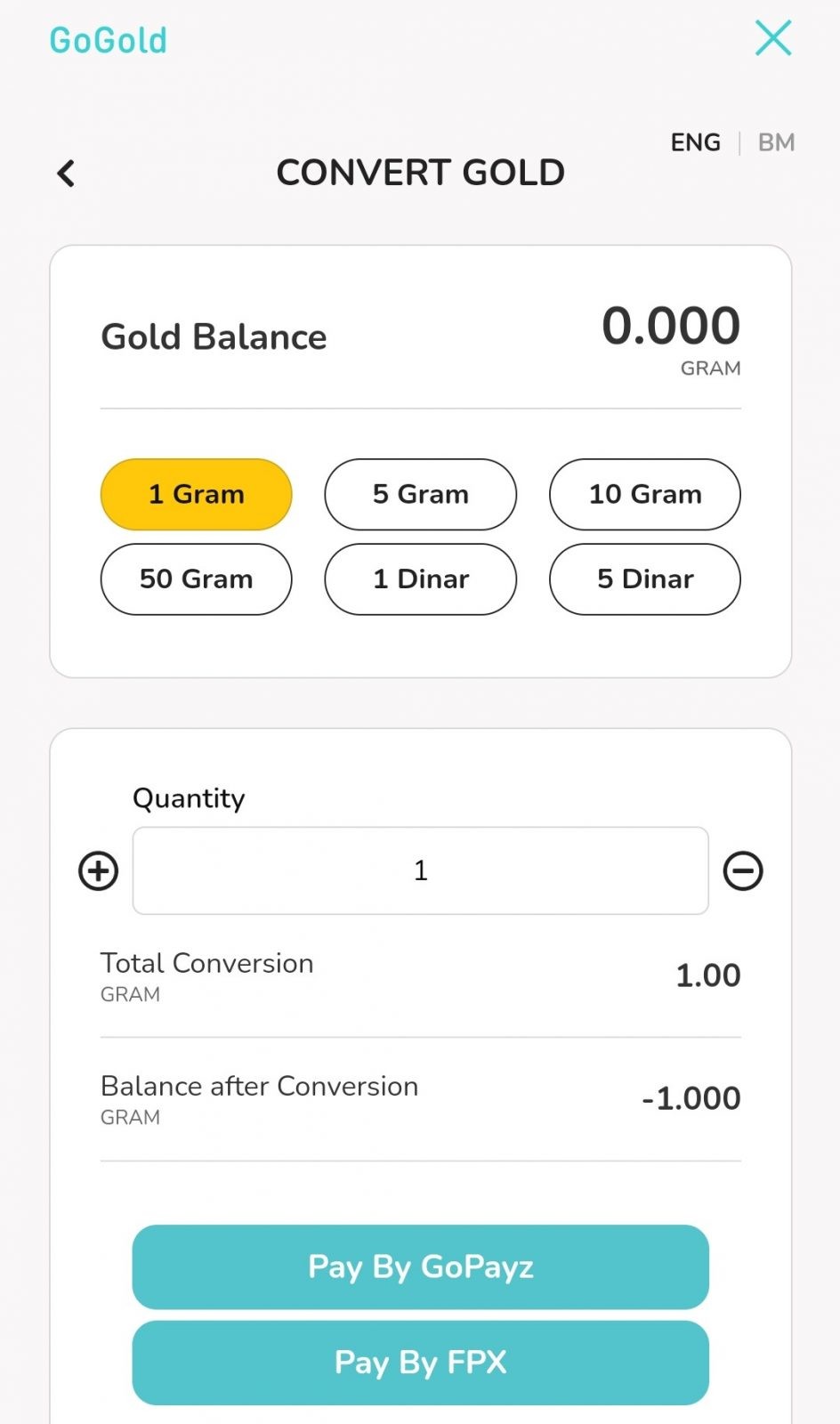

#4 Convert your digital gold into physical gold

An exciting feature for GoGold is it allows users to convert their digital gold into physical gold from as low as 1 gram.

2 things to know about converting your digital gold to physical gold:

- The fulfillment (or delivery) of the physical gold will take between 3 to 7 working days depending on where you are from.

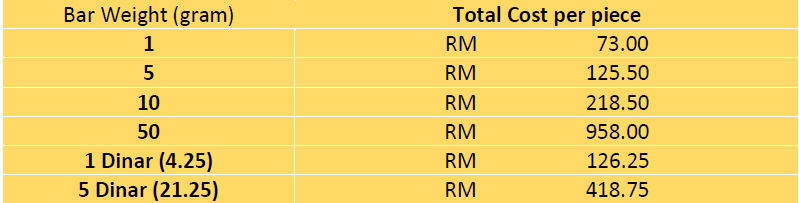

p - There’ll be a fulfillment fee for the conversion to physical gold. This fee includes courier and insurance charges for the physical gold fulfillment, as shown below.

p

#5 Latest gold price notification & tight spread

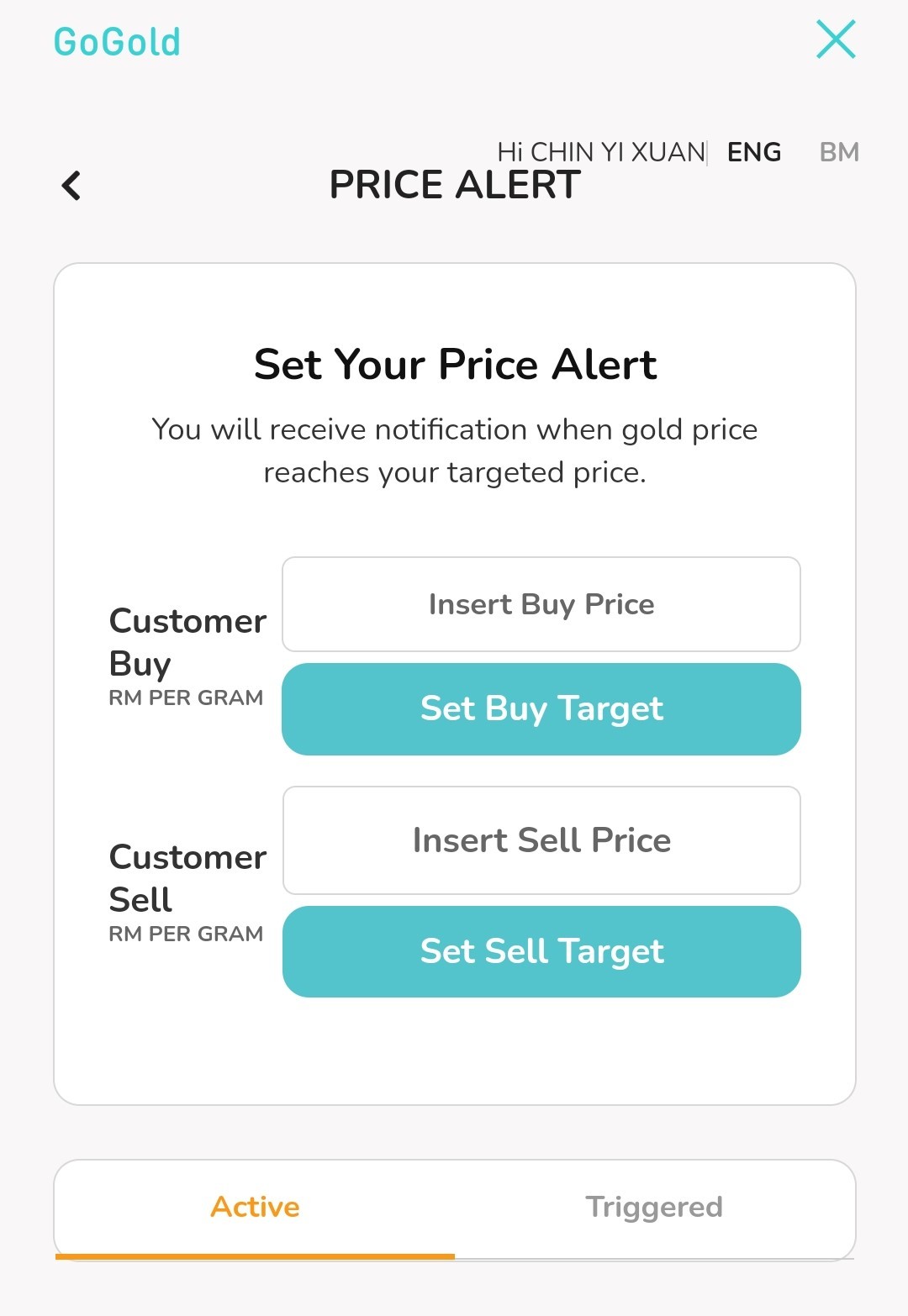

Within the GoGold interface, you can stay up-to-date with the latest gold price. In other words, you can monitor the price of gold live via GoGold, whereas other similar platforms usually have a delay when displaying the price.

In addition, you can also set alerts on prices so you are notified when the price of gold hits a particular level.

Furthermore, GoGold users get to experience one of the lowest price spreads. A spread is the difference between the buying and selling price of gold on the platform.

Through GoGold, users can enjoy tighter spreads compared to competitors!

GoGold with GoPayz Eligibility & Fees

GoGold is open for individuals age 18-year-old and above (Malaysians & non-Malaysians). This ensures that even young buyers are able to start owning gold.

There’ll be a small storage fee when you use GoGold to buy gold. This fee is to ensure that the gold that you own is safely stored within the vault.

In this case, the storage fee is 1.5% per year – calculated daily and charged monthly to your gold account balance, with a minimum charge of RM1.00 equivalent in gram per month.

GoGold with GoPayz Promotion – Buy & Get FREE Gold!

Until 21st September 2021, RM75,000 worth of FREE Digital GOLD awaits you when you register & buy gold with GoGold:

- First 5,000 users who register a GoGold account will get RM5 FREE digital gold.

Here’s how you can participate in this promotion:

Step 1: Download & sign up for GoPayz via Play Store, App store or Huawei AppGallery.

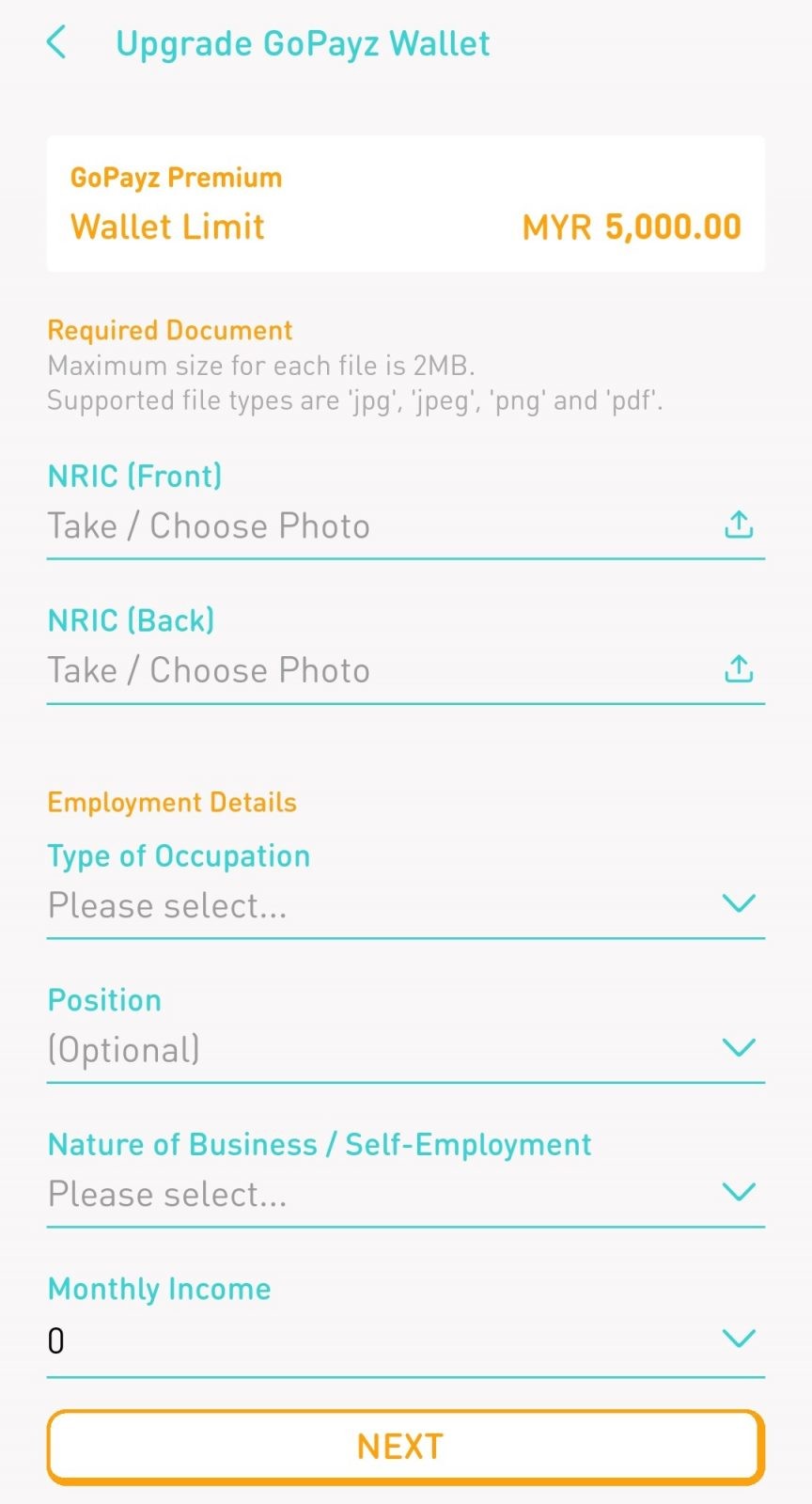

Step 2: Upgrade to GoPayz Premium Wallet once you have signed up for your account (“Wallet” > “Upgrade Wallet”). You are required to upload your IC and share your occupation & income details in order to verify your identity.

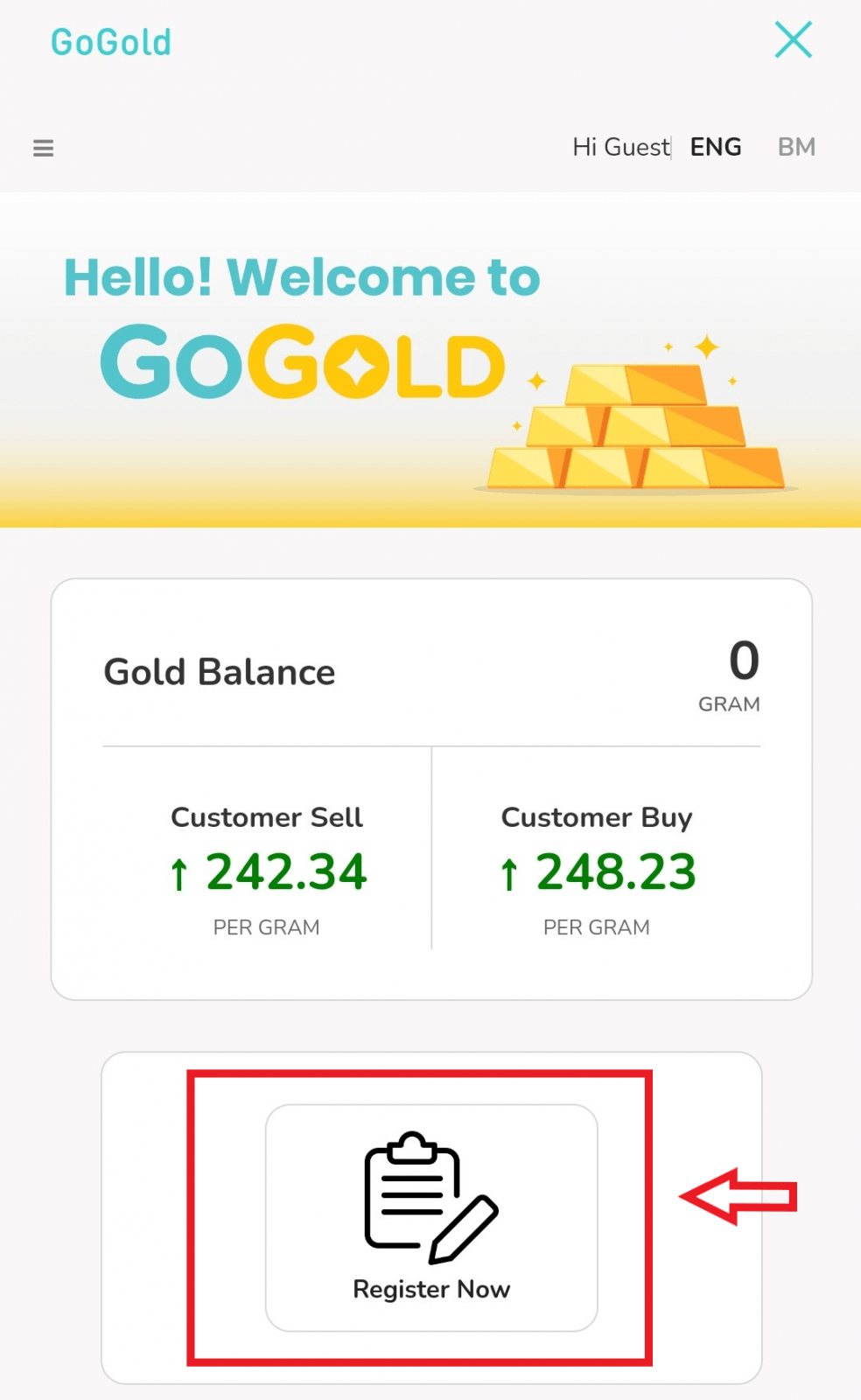

Step 3: Register for a GoGold account

- Launch the GoPayz app.

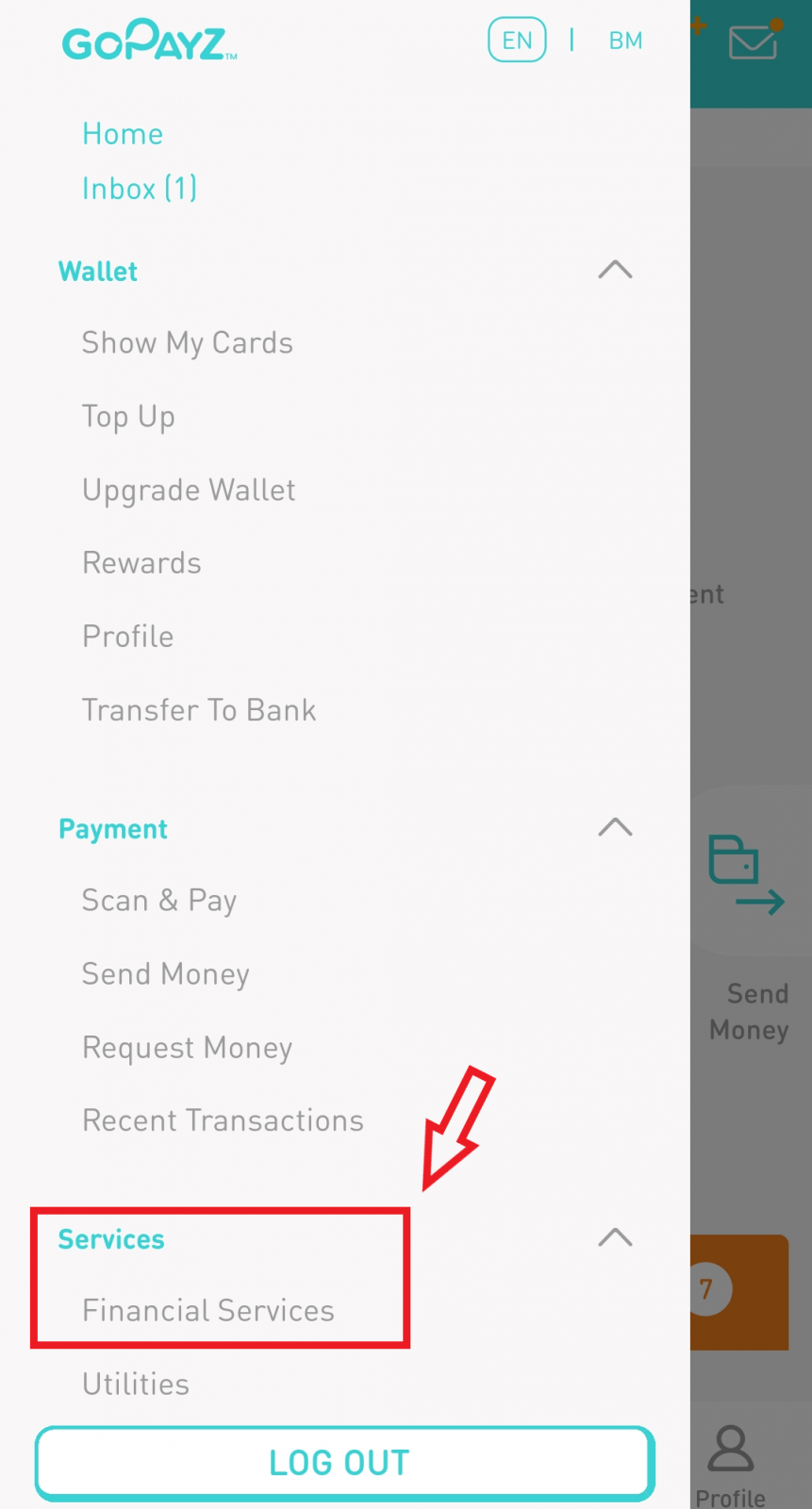

- Go to “Services” > “Financial Services” > “GoGold”.

Once you are done, buy a minimum of RM20 with GoGold and stand to win additional digital gold!

Check out the details of this promotion HERE.

No Money Lah’s Verdict

So here you have it – the new GoGold with GoPayz, where you can start owning gold from as low as RM5!

From how I see it, GoGold is a simple & easy way to start owning gold without having to worry about the safety of your gold. In other words, it’s a no-frills and convenient way to own this precious commodity.

Sign up with GoPayz and register your GoGold account today!

Disclaimers:

Buying & selling of gold involves market risk. Please conduct your own due diligence and/or consult a licensed financial planner before making any financial decisions.

The selling & buying of gold is not regulated by Bank Negara Malaysia (BNM), hence does not fall under the Banking and Financial Institutions Act 1989. However, ACE Capital Growth Sdn. Bhd. is required to comply under the practice of know-your-customer [KYC] and anti-money laundering.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.