Last Updated on May 1, 2022 by Chin Yi Xuan

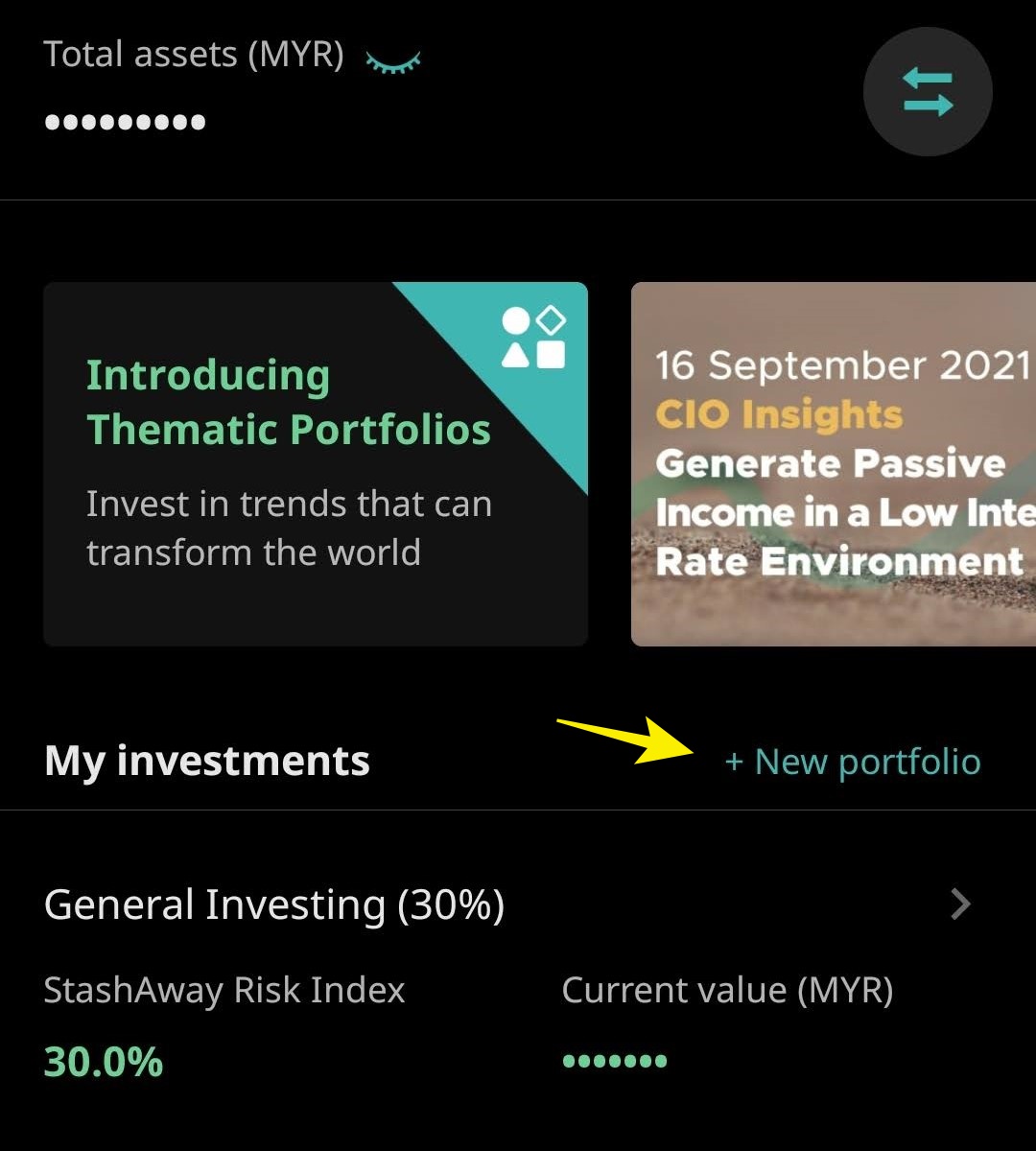

StashAway has just launched their thematic portfolios and it’s certainly refreshing to see this from them!

But what exactly are in the thematic portfolios, and should you invest in them?

In this overview, let’s explore StashAway’s thematic portfolios, and see if this is something that you should be using!

READ: StashAway Review – A robo-advisor that you can depend on

p

Table of Contents

StashAway Thematic Portfolios Overview

A thematic portfolio allows you to invest in Exchange-Traded Funds (ETFs) within a specific niche area (ie. Theme). Usually, these portfolios focus on niches that have promising growth.

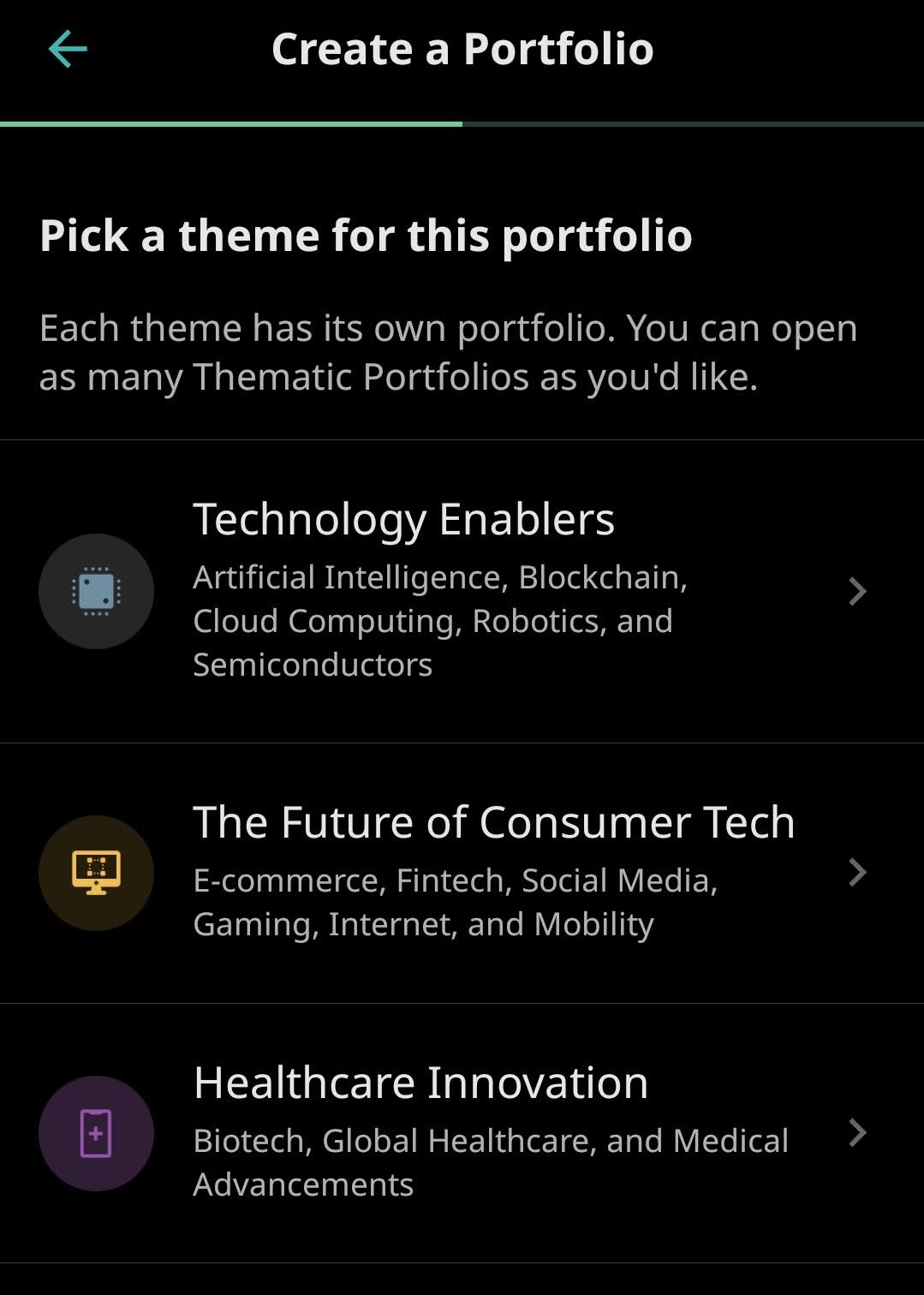

Within StashAway Thematic Portfolios, there are 3 key themes to choose from:

Theme #1: Technology Enablers

The Technology Enablers portfolio focuses mainly on the behind-the-scene tech that powers the rapidly growing tech sector, such as:

- AI

- Blockchain

- Cloud Computing

- Robotics

- Semiconductors

Why this is exciting:

While we do not experience them directly, but technologies such as AI and semiconductors power our everyday life. Not only that, they are here to stay and grow. As an example, the global AI industry is estimated to grow at 35% annually from 2021 – 2026.

Theme #2: The Future of Consumer Tech

With The Future of Consumer Tech portfolio, you’ll get exposure to the industries with huge growth potential, such as:

- E-commerce

- Fintech

- Gaming

- Internet

- Mobility tech

- Social media

Why this is exciting:

Let’s just say this – we are only going to become more reliant on things like E-commerce and social media in the future. And this means a huge growth potential for these businesses.

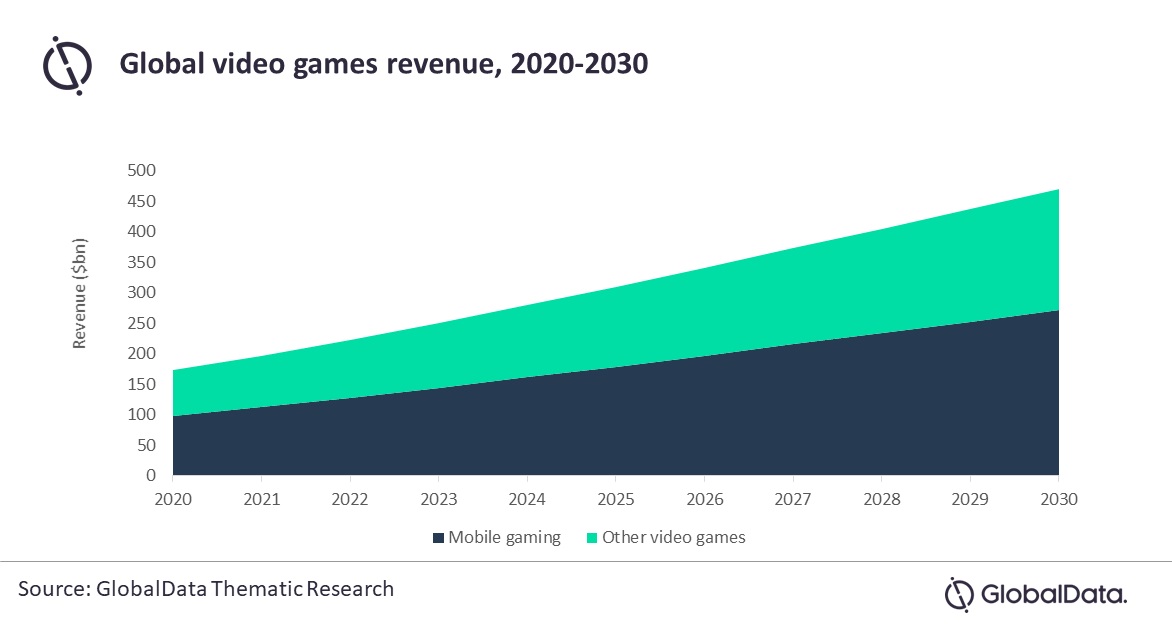

On the other hand, the mobile gaming industry is also estimated to be worth $272 billion by 2030, with a CAGR of 11% per year.

Theme #3: Healthcare Innovation

Through Healthcare Innovation portfolio, you get to invest in the ever-important future of the healthcare industry:

- Biotech

- Genomics

- Medical Devices

- Pharmaceuticals

Why this is exciting:

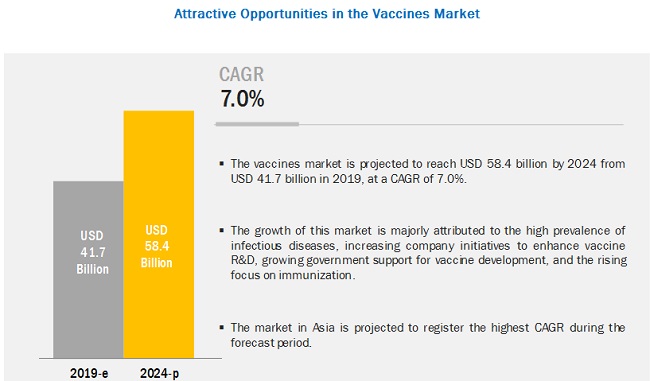

With an increasing population globally, medical innovation is a must against issues like aging, diseases, and yes – pandemics.

From SARS to Covid-19, it signals that humans may have to face pandemics again and again in the future. In fact, the global vaccines market is projected to grow to $58.4 billion by 2024 from $41.7 billion in 2019, with a CAGR of 7.0% per year.

READ: Malaysian’s Guide to invest in ETF

How StashAway Thematic Portfolio Works

It’s easy to get started with StashAway Thematic Portfolios:

Step 1: Firstly, update your StashAway app so you can see the new thematic portfolio feature.

If you are new to StashAway, download StashAway using my referral link HERE and get an exclusive 50% off your fees for the first RM100,000 invested for 6 months!

Step 2: Select ‘+ New Portfolio’ and choose ‘Thematic Investing’

Step 3: Select the theme that you are keen to invest in.

One good thing is you can open more than one thematic portfolio within StashAway.

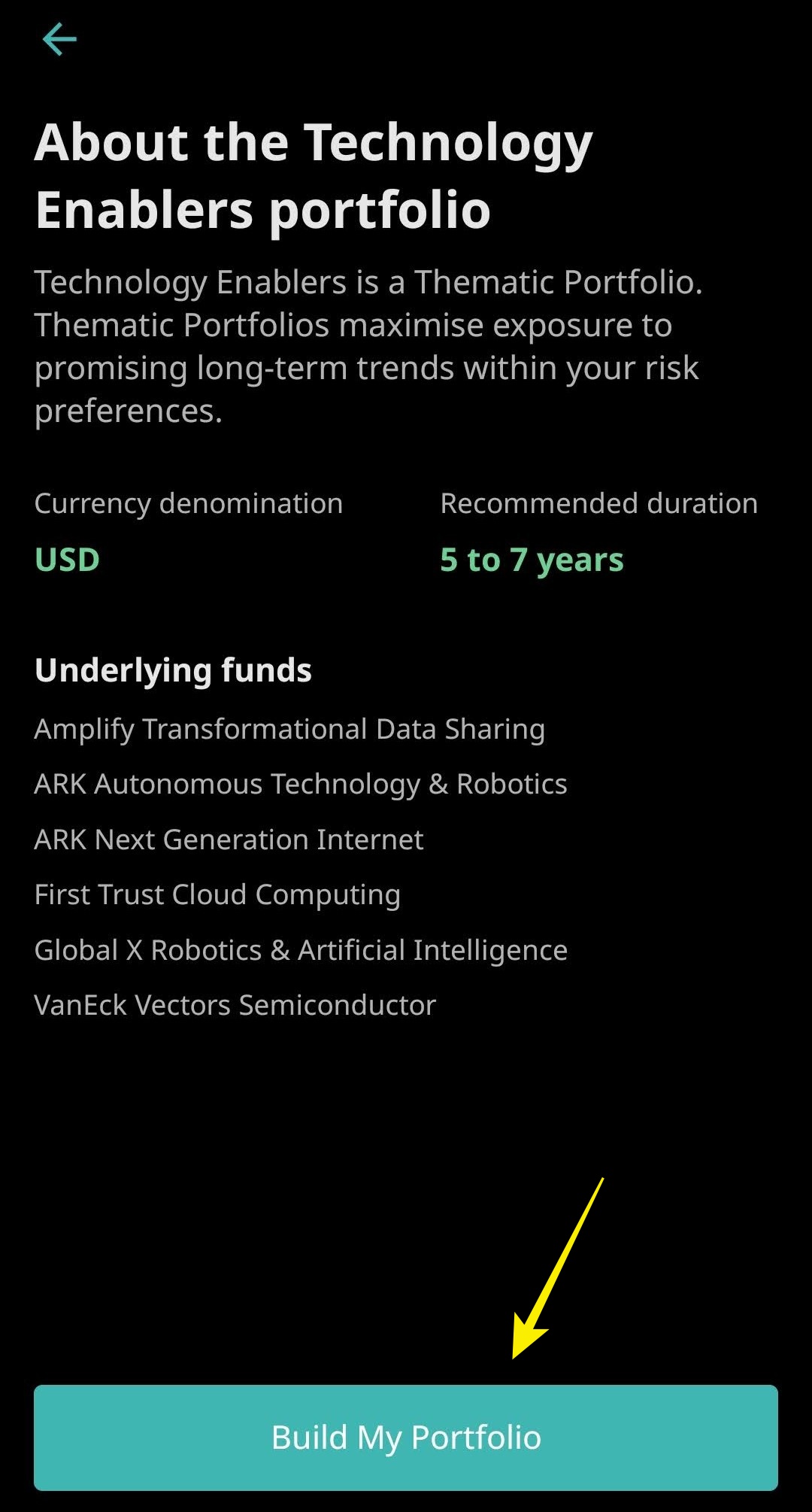

Step 4: Select ‘Build My Portfolio’

You’ll be able to see the underlying ETFs within the thematic portfolio. The ETFs within StashAway thematic portfolios are chosen based on 3 criteria:

- Tracking error: How well does an ETF tracks its underlying asset class

- Cost: Total expense ratio

- Liquidity: How easy it is to redeem and invest into the fund

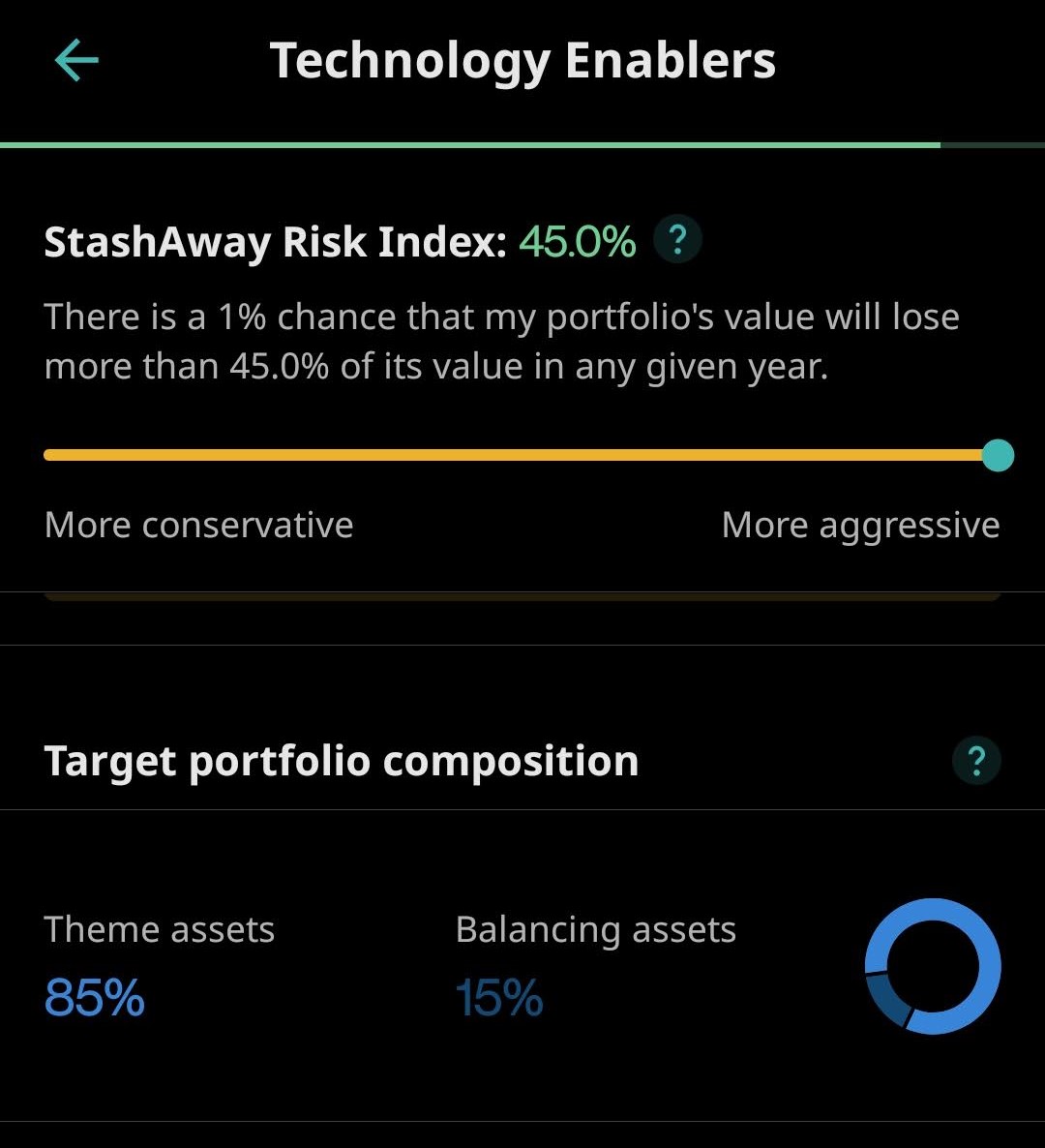

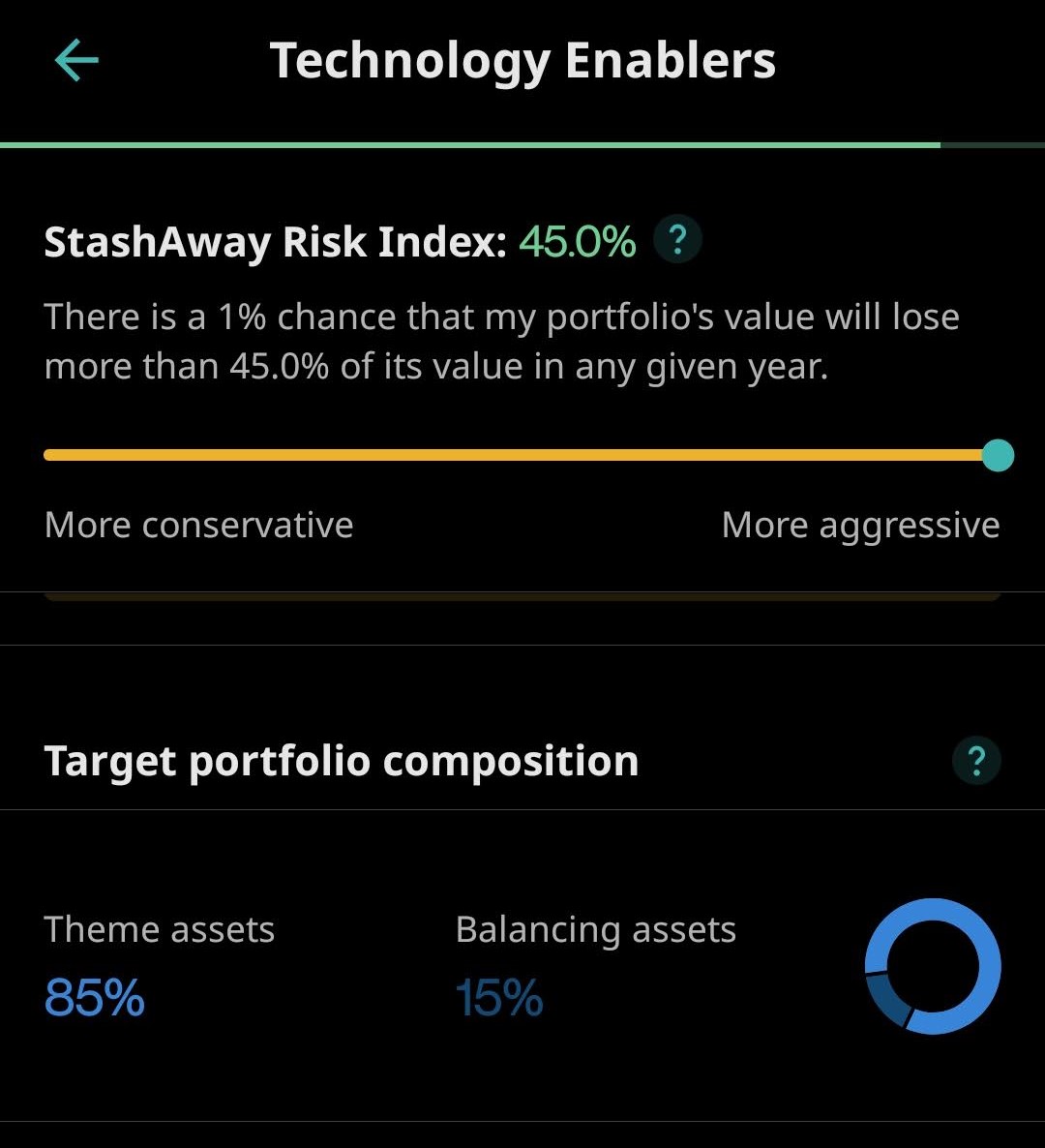

Step 5: Select your risk category (IMPORTANT)

StashAway thematic portfolio works with a combination of the underlying theme assets and ‘balancing assets’.

- Theme assets refer to the ETFs that expose you to the theme that you have chosen (ie. Technology Enablers, Consumer Tech, Healthcare Innovation)

- Meanwhile, balancing assets are low-risk assets like bonds and cash to accommodate potential volatility from the underlying theme assets.

For thematic portfolio, you can select the risk category between 20% to 45% StashAway Risk Index (SRI):

- The higher the risk category, the more exposure you’ll get on the underlying theme assets (and less on ‘balancing assets’).

- On the other hand, the lower the risk category, the less exposure on to the underlying theme assets (and more on ‘balancing assets’).

Let’s say you select the most aggressive 45% StashAway Risk Index (SRI) for your thematic portfolio. This means you have a 1% probability of losing more than 45% of the value of your portfolio.

Step 6: Review & confirm your portfolio

Once you have confirmed your portfolio, you are good to start funding and investing with your thematic portfolio.

Is StashAway Thematic Portfolio for you?

Regardless of which theme you go for, you should be aware that all the themes are by nature, high in risk (and potential growth).

Meaning, you should expect higher volatility and swings in these thematic portfolios compared to your usual StashAway portfolios.

As such, for most people, the thematic portfolio should not be your main investment, but rather a complement to your existing portfolio for potentially higher returns in the long-term.

I recommend the StashAway Thematic Portfolio to investors with a longer-term bullish view on a specific niche industry, and would like to gain exposure in the industry.

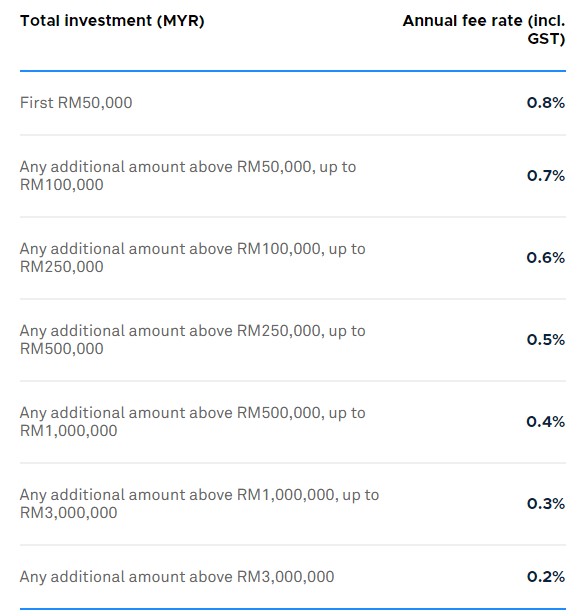

Fees of StashAway Thematic Portfolios

When it comes to fees, StashAway’s fees for their thematic portfolios are the same as their usual portfolio. The more you invest, the lower the annual fees.

That said, you’ll also have to account for the expense ratio of the underlying ETFs. An ETF expense ratio is an additional fee charged NOT by StashAway, but by the underlying ETF fund manager.

As an example, the expense ratio charged by ETF manager is about 0.2% per annum for StashAway’s usual portfolios.

However, for thematic portfolios, the average expense ratio for the ETF is about 0.52% per annum (according to StashAway).

So, let’s say your total investment in StashAway is less than RM50,000, then the annual fees would be:

- StashAway usual portfolios: 0.8% (StashAway annual fees) + ~0.2% (ETF expense ratio)

- StashAway thematic portfolios: 0.8% + ~0.52% (ETF expense ratio)

In short, investing in StashAway thematic portfolio is slightly more expensive, as the ETFs of a niche theme tend to have a higher expense ratio by nature.

Depending on your conviction on the potential growth of a thematic portfolio, this slight increase in expenses can be worthwhile (or not).

StashAway Thematic Portfolio vs Syfe Select Themes

StashAway is Malaysia’s first robo-advisor that released thematic portfolios for users.

That said, Syfe (a StashAway’s competitor in SG) has also released their version of thematic portfolios called Syfe Select Themes – a couple weeks earlier than StashAway.

Syfe Select Themes offer slightly more themes to choose from, such as ESG & Clean Energy, China Growth, and Global Income focusing on high yield bonds.

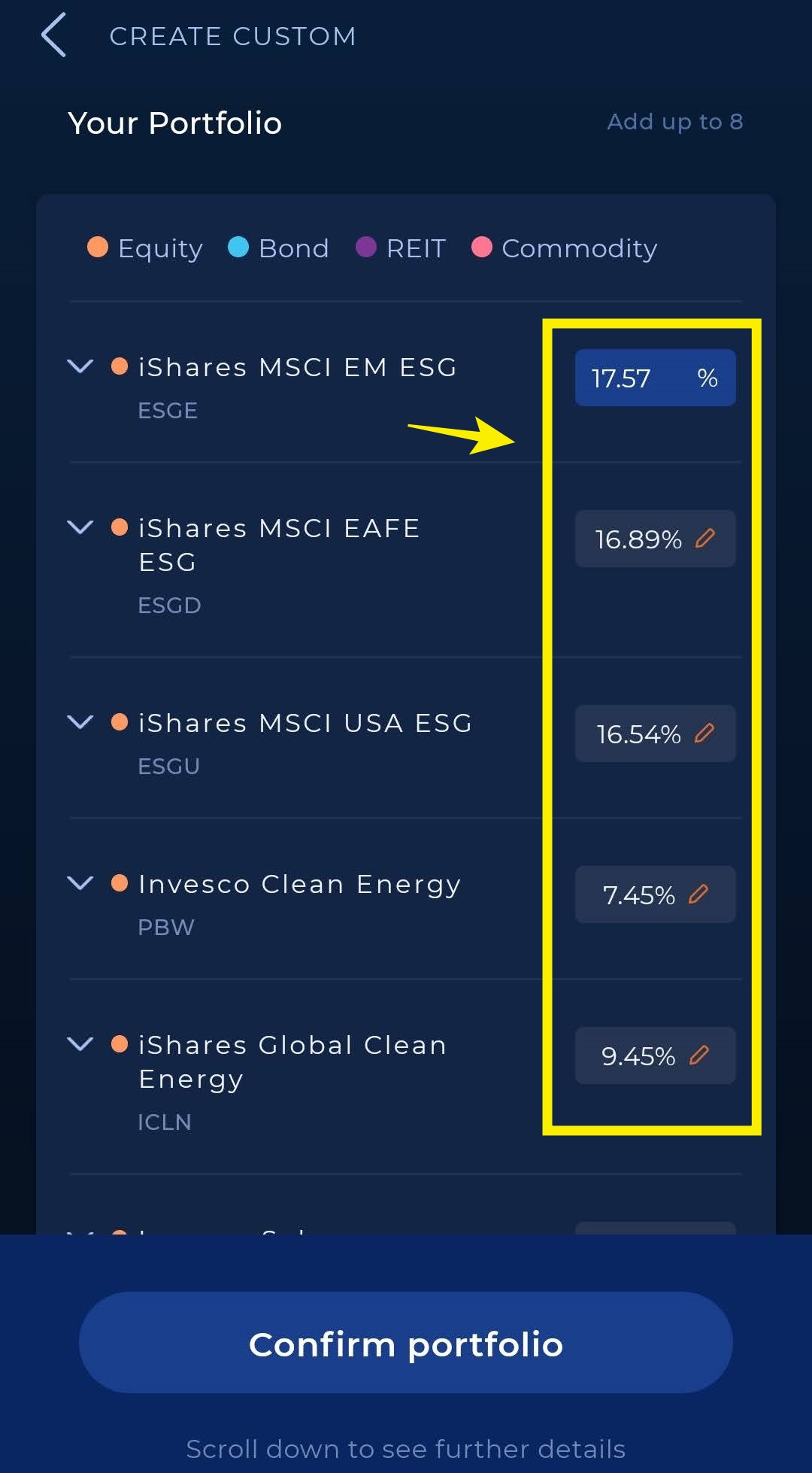

As for the implementation of the thematic portfolios, Syfe offers slightly better customizability compared to StashAway.

Through Syfe Select, if you do not like the default weightage of the ETF allocation, you are free to adjust the weightage accordingly.

Assuming a user knows what he/she is doing, this gives a huge space for Syfe’s users to have a bigger say on their thematic portfolio.

However, this flexibility can be a HUGE downside if a user is just mindlessly adjusting the weightage according to the current news and market performance.

On the other hand, StashAway allows users to adjust their risk index (SRI), which determines the % of ETF invested in thematic ETFs and balancing ETFs (cash & bonds).

StashAway’s customizability can be limiting for enthusiasts, but for everyday investors, it shouldn’t be an issue.

As a whole, both thematic portfolios from StashAway and Syfe are welcoming. Personally, I’d encourage you to explore both robo-advisors for yourself and find the right implementation that suits your investing preferences.

READ: Syfe robo-advisor review – the most customizable robo-advisor around!

StashAway Thematic Portfolio referral link + promo code

No Money Lah is working with StashAway to bring new users an exclusive 50% off your fees for the first RM100,000 invested for 6 months!

To be eligible for this deal, sign up for your StashAway account through my StashAway referral link via the button below. (or HERE if you are from Singapore)

Start Investing with StashAway Today!

No Money Lah’s Verdict

Personally, I think it’s welcoming to see StashAway launching their thematic portfolios.

These thematic portfolios are a great way for everyday investors to translate their conviction or opinion into reality, without going through the hassle to manage the investments themselves.

If you have a specific conviction in the future of tech or healthcare, I highly recommend for you to give StashAway’s thematic portfolios a try.

Start Investing with StashAway Today!

Disclaimer:

Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

This post may contain affiliate links that afford No Money Lah a small amount of commission (and help support the blog) should you sign up through my referral link.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.