Last Updated on April 17, 2023 by Chin Yi Xuan

Imagine investing in a country where the everyday people are spending almost 2x as much compared to the everyday people in the US.

How can you benefit from this massive spending power and growth?

In this post, let’s talk about how you can invest in China through 3 Malaysia-listed ETFs (TradePlus S&P New China Tracker, VP-DJ Shariah China A-Shares 100 ETF, Principal FTSE China 50 ETF) and their respective performances!

Before this, here are some related posts that you may want to read:

- What is ETF, and Malaysian’s Guide to ETF investing!

- Best Dividend-Paying ETFs in Malaysia for CONSISTENT Passive Income!

- All you need to know on how to open a stock investing account in Malaysia!

p

Table of Contents

Context: China growing middle class (and massive spending power)

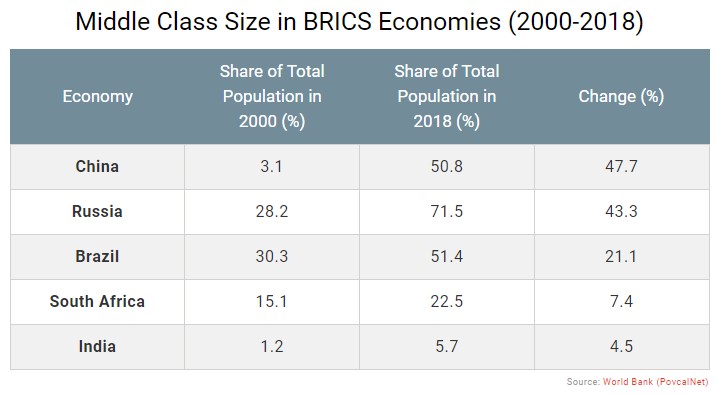

China is a country with a huge population. Of all, the Chinese middle class makes up half (50.8%) of China’s population.

Before you continue, I want you to take a moment, and guess how massive is the Chinese middle class.

Done?

As of 2016, there is about 730 million middle class in China. For the record, that’s about 697x the whole Malaysian population!

Now, a random middle-class Chinese may not be able to spend much. But with 730 million of them (again, 697x the whole Malaysia), this creates a HUGE consumption power, and business opportunities.

In 2020, China’s middle class recorded consumption of $7.3 trillion (12 zeros, you’re welcome), which is almost double what the US’s middle class has spent.

Here’s one more thing you need to know: China’s middle class is expected to keep growing, and reach about 1.2 billion in 2027!

So, how can you ride and invest in the growth of this huge consumption powerhouse?

Let’s find out with our very own Malaysia-listed China ETFs!

ETF #1 TradePlus S&P New China Tracker (CHINAETF-MYR)

TradePlus S&P New China Tracker (or CHINAETF-MYR) is a Malaysia-listed ETF that provides investors exposure to Chinese companies (listed in HK and US) within the consumption and service-orientated industries.

- CHINAETF-MYR (Stock Code: 0829EA) was listed and started trading in Bursa Malaysia in 2019.

- Underlying index: CHINAETF-MYR tracks the S&P New China Sectors Ex A-Shares Index through full replication strategy to ensure minimal tracking error.

- Annual Fees: 0.59% of Net Asset Value (NAV)

- Annual Management Fee: 0.50%

- Annual Trustee Fee: 0.04%

- Index License Fee: 0.05%

Sector exposure of TradePlus S&P New China Tracker

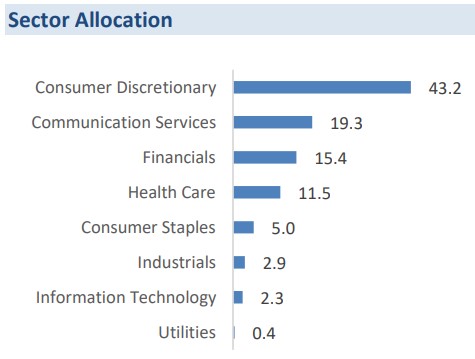

Essentially, investing in CHINAETF-MYR provides investors exposure to Chinese businesses that grow on increasing consumer spending.

Through CHINAETF-MYR, you’ll mainly gain exposure to companies from the consumer discretionary (43%), communication services (19%), and financial sector (15%).

Given the growth of China’s middle class, the CHINAETF-MYR can be an attractive opportunity for investors looking to ride on the growing consumer market.

Notable companies/holdings of TradePlus S&P New China Tracker

As of August 2021, the top 10 holdings of CHINAETF-MYR include companies such as AIA Group, Tencent, Alibaba, and Meituan Dianping.

Performance of TradePlus S&P New China Tracker

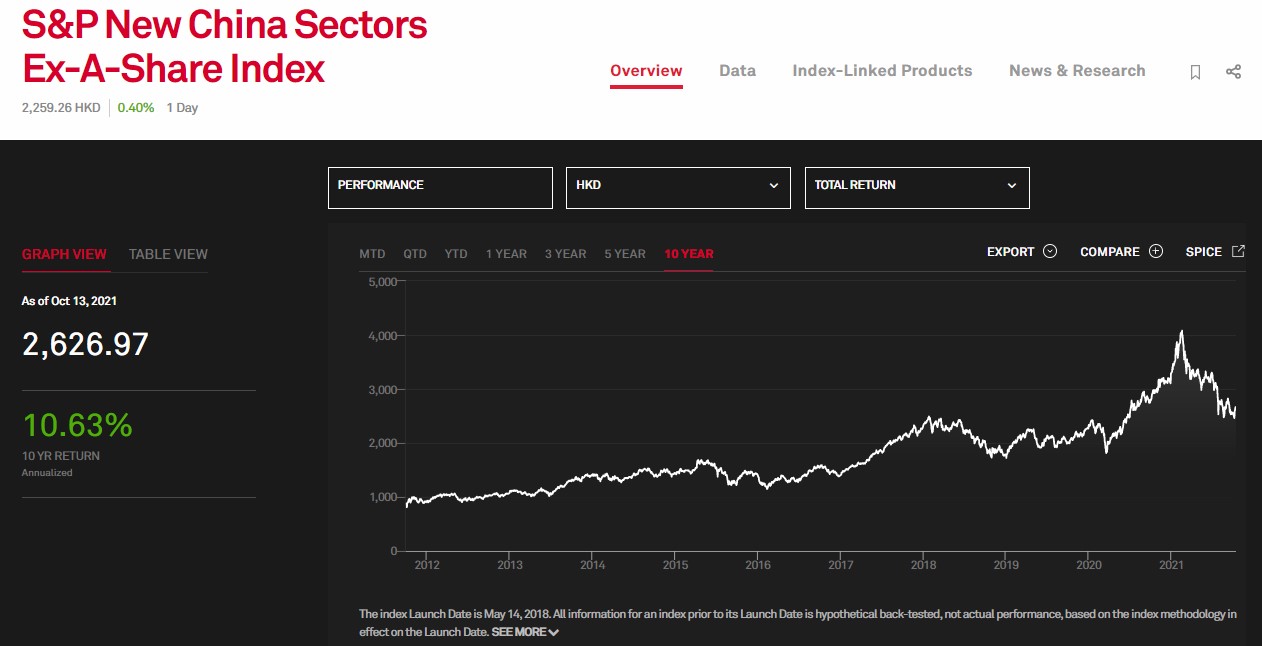

Since CHINAETF-MYR is listed in 2019, there is very limited historical data on the past performance of the ETF.

That said, the back-tested performance of the S&P New China Sectors Ex A-Shares Index (ie. The underlying index of CHINAETF-MYR) can be a good reference for us:

Over a 10-year period (2011 – 2021), the S&P New China Sectors Ex A-Shares Index has grown by roughly 200%, translating to an annualized return of 10.63%.

In other words, on average, your capital would have increased by 10.63% every year if you invested in the S&P New China Sectors Ex A-Shares Index since 2011.

ETF #2 VP-DJ Shariah China A-Shares 100 ETF (0838EA)

The VP-DJ Shariah China A-Shares 100 ETF is a Malaysia-listed ETF that provides exposure to the top 100 largest & most liquid Shariah-compliant shares that are listed in China.

- VP-DJ Shariah China A-Shares 100 ETF (Stock Code: 0838EA) was listed and started trading in Bursa Malaysia in 2021.

- Underlying index: 0838EA tracks Dow Jones Islamic Market (DJIM) China A-Shares 100 Index through full replication strategy to ensure minimal tracking error.

- Annual Fees: 0.70% of Net Asset Value (NAV)

- Annual Management Fee: 0.60%

- Annual Trustee Fee: 0.06%

- Index License Fee: 0.04%

Investing in China A-Shares

Unlike TradePlus S&P New China Tracker which invests in Chinese shares listed in HK and US, the VP-DJ Shariah China A-Shares 100 ETF invests directly in Chinese stocks listed in the Shanghai and Shenzhen Stock Exchange (a.k.a. A-shares).

Generally, investing in China A-Shares reflects exposure to Chinese companies that are less well-known globally, and usually more domestically focused in their business.

While China A-shares may not be as popular, the benefits can be interesting to certain investors.

As an example, A-shares tend to experience a smaller impact from global risks (eg. Geopolitical, global pandemic) as most businesses generate revenues domestically.

With that in mind, China A-shares ETFs can be a good diversification vehicle for investors with exposure, especially in the US market.

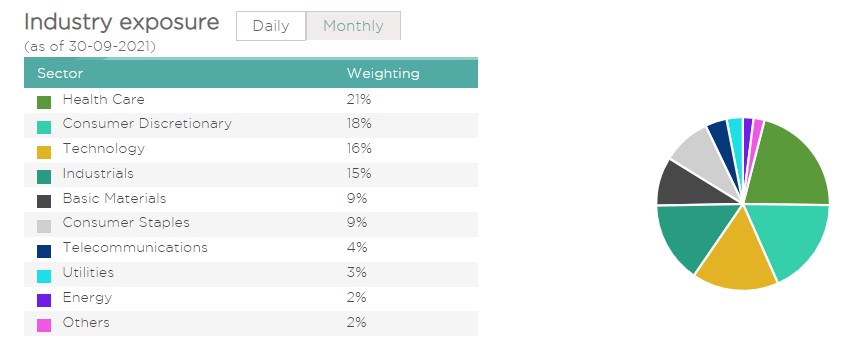

Sector Exposure of VP-DJ Shariah China A-Shares 100 ETF

As a whole, 0838EA has a balanced and diversified exposure to sectors such as healthcare (21%), consumer discretionary (18%), technology (16%), and industrials (15%).

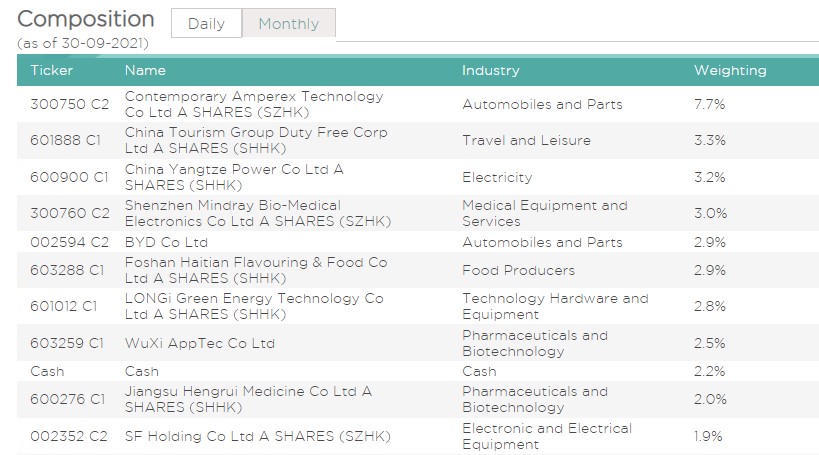

Notable Companies/Holdings of VP-DJ Shariah China A-Shares 100 ETF

Investing in China A-shares can be unfamiliar to most investors as most companies are not as well-known globally. I’ll do a brief introduction to some of the notable companies in this ETF:

As of September 2021, the top 10 holdings of 0838EA include companies such as:

- Contemporary Amperex Technology Co. (CATL): CATL is one of the dominant battery manufacturers in the EV industry, with association with big names like Toyota, Volkswagen, Volvo, and more.

- China Tourism Group Duty Free Corp.: A Chinese company involved in travel agencies and duty-free businesses.

- China Yangtze Power Co. (CYPC): CYPC is involved in the businesses of hydropower generation, power distribution & sales, and overseas power plants operation & management. With a total installed capacity of 45.495 GW, the company is the largest listed electric power company in China and the largest listed hydropower company globally.

- Shenzhen Mindray Bio-Medical Electronics Co.: Mindray is China’s largest medical equipment manufacturer, with a presence around the world. It is a company that makes medical equipment such as patient-monitoring and life-support systems and ultrasound machines.

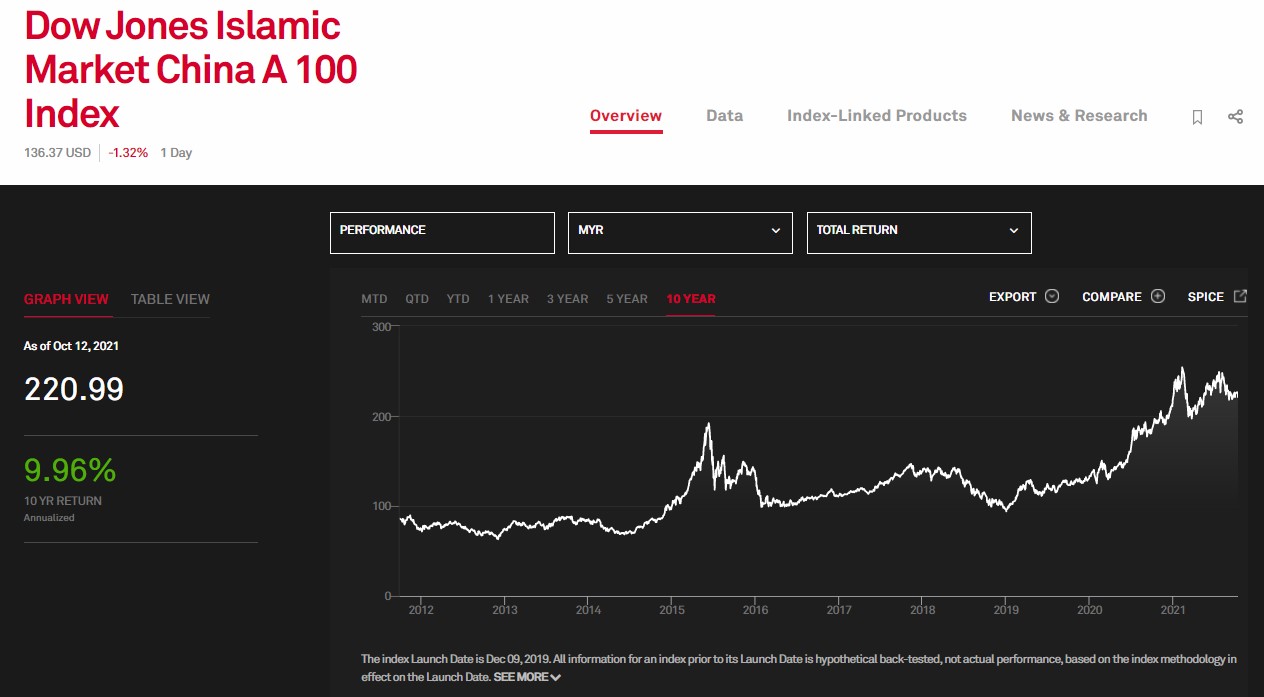

Performance of VP-DJ Shariah China A-Shares 100 ETF

Since 0838EA is listed in 2021, there is very limited historical data on the past performance of the ETF.

That said, the back-tested performance of the Dow Jones Islamic Market (DJIM) China A-Shares 100 Index (ie. The underlying index of 0838EA) can be a good reference for us:

Over a 10-year period (2011 – 2021), the DJIM China A-Shares 100 Index has grown by roughly 157%, translating to an annualized return of 9.96% per year.

In other words, on average, your capital would have increased by 9.96% every year if you invested in the DJIM China A-Shares 100 Index since 2011.

ETF #3 Principal FTSE China 50 ETF (CIMBC25)

Listed in 2010, the Principal FTSE China 50 ETF (or CIMBC25) is the longest Malaysia-listed ETF with China exposure.

- CIMBC25 (Stock Code: 0823EA) tracks the FTSE China 50 Index either via full replication strategy or representative sampling strategy.

- Through CIMBC25, investors get exposure to the 50 largest and most liquid Chinese stocks listed in Hong Kong.

- Annual Fees: 0.72% of Net Asset Value (NAV)

- Annual Management Fee: 0.60%

- Annual Trustee Fee: 0.08%

- Index License Fee: 0.04%

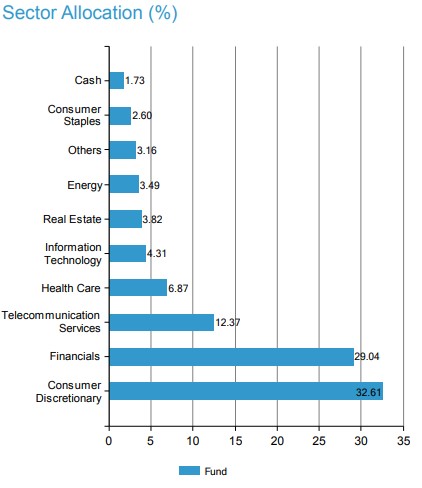

Sector Exposure of Principal FTSE China 50 ETF

Investors that invest in CIMBC25 gain exposure to 3 main sectors, namely Consumer Discretionary (33%), Financials (29%), and Telecommunication Services (12%).

In many ways, there is a huge resemblance between investing in CIMBC25 relative to TradePlus S&P New China Tracker that we discussed earlier. In short, both ETFs focus on sectors that is highly dependent on consumerism.

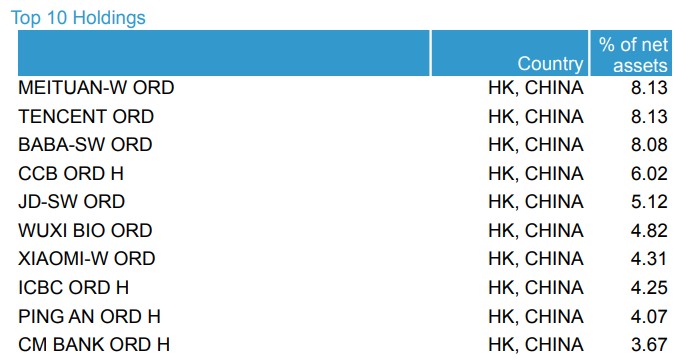

Notable Holdings/Companies of Principal FTSE China 50 ETF

CIMBC25 allows investors to gain exposure to the big names in China. As of August 2021, the top 10 companies held by the ETF includes Alibaba, Tencent, Meituan Dianping, Xiaomi, and more:

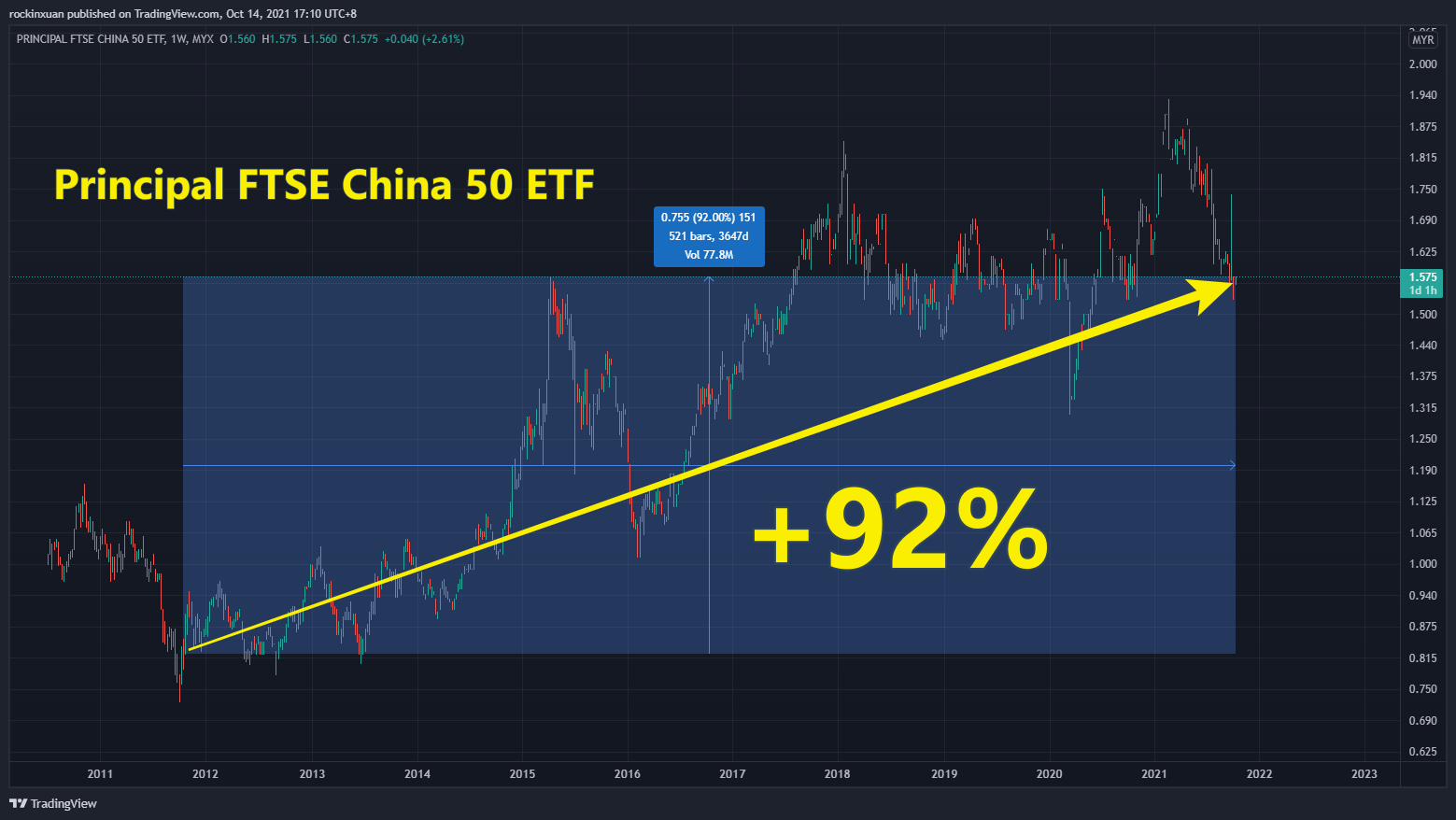

Performance of Principal FTSE China 50 ETF

Unlike the previous ETFs in this article, CIMBC25 is listed in 2010, which means we have enough historical data on the past performance of the ETF.

Looking at the chart, the CIMBC25 ETF has grown by 92% over the past 10 years (2011 – 2021). This translates to an annualized return of 6.64% per year.

In other words, on average, your capital would have increased by 6.64% every year if you invested in the FTSE China 50 ETF since 2011.

Which Malaysia-listed China ETF is the best?

So, which Malaysia-listed China ETF should you invest in if you are keen to ride on the huge potential of the China market?

Personally, I think there is no absolute ‘best’ ETF in this case. Rather, it is finding the ‘right’ ETF as per your investing goals and needs:

- If you are looking to invest in China for the first time, the TradePlus S&P New China Tracker (CHINAETF-MYR) or Principal FTSE China 50 ETF (CIMBC25) can be a good start.

Both ETFs have similar resemblance where they have huge exposure to consumer-heavy industries (ie. Consumer Discretionary, Financials).

In addition, both ETFs are holding companies that most of us are familiar with, such as Alibaba, Tencent, and JD.com.

When it comes to annual fees, TradePlus S&P New China Tracker (0.59%) is slightly lower compared to Principal FTSE China 50 ETF (0.72%).

As for past performance, TradePlus S&P New China Tracker* displayed a better return (+200%) relative to Principal FTSE China 50 ETF (+92%) over the past 10 years (2011 – 2021).

That said, it should be noted that past performance is not indicative of future returns.

[*Backtested results of the underlying index]

- If you have a deeper understanding of the domestic Chinese business environment, and/or looking for a relatively low-correlation diversification from a US-heavy portfolio, the VP-DJ Shariah China A-Shares 100 ETF can be a decent choice with exposure to China A-shares.

How to invest in Malaysia-listed ETFs?

Investing in ETF is similar to buying/selling stocks. You can invest in Malaysia-listed ETFs via stock brokers that allow access to the Bursa Malaysia stock market, such as Rakuten Trade.

Rakuten Trade Referral Link for New Users

If you are keen to open a Rakuten Trade account, consider using my referral link below! For that, you’ll get:

- 1000 Rakuten Trade (RT) points worth RM10 to offset your brokerage fee.

- + 150 RT points when you deposit a min. of RM1,000 within 5 days.

- + 1000 RT points when you transfer your shares from other brokers to Rakuten Trade.

- + 1x brokerage fee rebate when you place your 1st trade within 30 days after your account is activated.

Aside from that, Rakuten Trade users get +1 RT point for every RM1 brokerage paid! Click HERE for the full T&C on RT points.

Open a Rakuten Trade Account Today!

No Money Lah’s Verdict

So, there you have it – a detailed overview of Malaysia-listed China ETFs!

Personally, I think China is definitely going to grow in the coming future, despite regulatory risks from the Chinese government.

Moreover, I think this is where China ETFs shine compared to individual companies, as ETFs can help in reducing company-specific risk.

Regardless, what do you think? Will you allocate certain portion of your capital for exposure in China?

Feel free to share with me in the comment section below!

Disclaimers

This article is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

This post may contain affiliate links that afford No Money Lah a small amount of commission (and help support the blog) should you sign up through my referral link.

Related Posts

January 14, 2022

ETF: Best Dividend-Paying ETFs in Malaysia

January 13, 2022

Malaysian’s Guide to Invest in ETF

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Hi Yi Xuan, thanks for your sharing about China ETFs in Malaysia. Just want to know more, did these 3 ETFs provide any dividends so far? I’m looking for a more consistent dividend ETFs from China

Hi KF,

Glad that u find the article helpful!

TradePlus S&P New China Tracker paid about 2.48% in yield as of Dec 2021.

VP-DJ Shariah China A-Shares 100 ETF paid about 1.3% in yield as of March 2022.

There was no distribution for Principal FTSE China 50 ETF last year.

Else, if you can consider non-Msia listed China ETF, 3110 ETF listed in HK from GlobalX is a good choice too.

Regards,

Yi Xuan