Last Updated on March 7, 2024 by Chin Yi Xuan

Are you looking for a (simple) investment that has proven itself over the past few decades?

How about one that makes money 76% of the time over the past 30 years?

The S&P500 index is perhaps one of the best testaments for simple, yet practical investment that has withstood the test of time (AND financial crises, AND Covid-19).

But what exactly is the S&P500, and how can you (as a non-US resident) invest in the S&P500 index?

In this post, let’s explore how you can invest in the S&P500, and the things that you need to know before investing in it!

Before this, here are some related posts that you may want to read:

- Interactive Brokers (IBKR review): Invest in the global market including Ireland-domiciled ETF!

- Malaysians’ guide to ETF investing

- Are you a dividend investor? Here are the best dividend-paying ETFs in Malaysia!

p

Table of Contents

What is the S&P500 Index?

The S&P500 index is a stock market index that has been tracking the performance of the top 500 largest US-listed companies since 1957.

Just like how the KLCI and STI are used to measure the performance of the Malaysian and Singapore stock markets respectively, the S&P500 is commonly used as a proxy to the US stock market.

In fact, since the US stock market is so dominant, the S&P500 is sometimes considered as THE stock market.

So, what are the key companies within the S&P500 index?

Apple, Microsoft, Amazon, Meta (formerly Facebook), Alphabet, Berkshire Hathaway, and JP Morgan – just to name a few.

Essentially, by investing in the S&P500, you’ll get exposure to the finest companies in the US stock market.

But is there more to the S&P500? In the section below, let me show you some surprisingly impressive feats about the S&P500 index!

Time-tested Performance: Why invest in S&P500

In 2020, Warren Buffett stated that “for most people, the best thing to do is to own the S&P 500 index.”

Personally, I think there are solid reasons to this statement. Here are 2 indications of why the S&P500 is a great long-term investment:

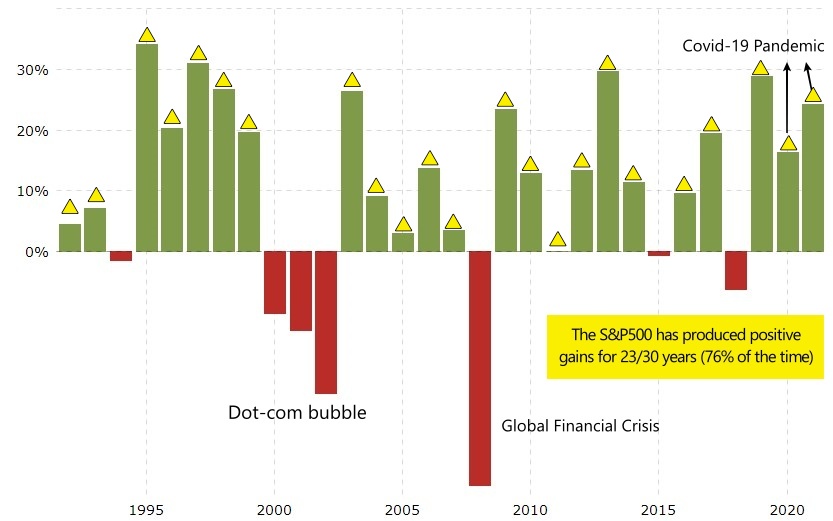

#1 The S&P500 produced gains 76% of the time over the past 30 years.

Over the past 3 decades (1992-2021), the S&P500 has ended up higher in 23 out of 30 years. This makes up to gains 76% of the time*!

That, ladies & gentlemen, is just you investing your money passively without having to manage them at all! Not sure ’bout you, but I think that’s a fantastic deal relative to the effort required!

*Important: Past performance is NOT indicative of future performance.

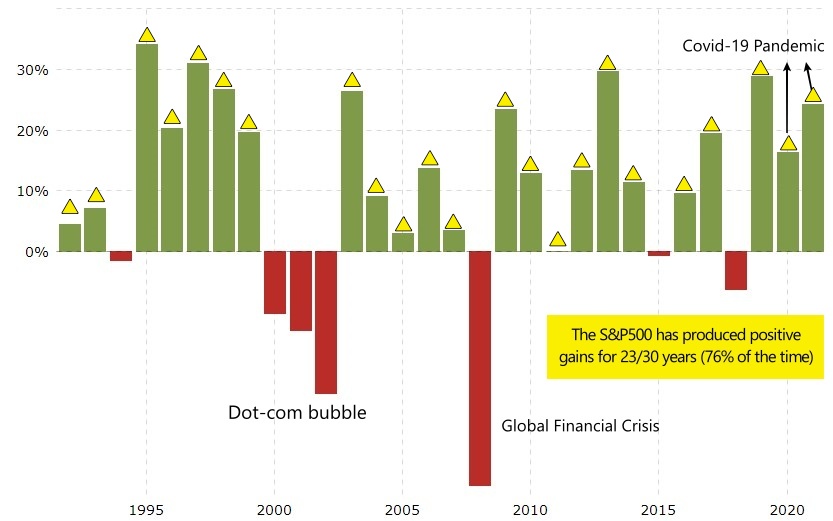

#2 The S&P500 has grown by 1019%* over the past 30 years.

This translates to an 8.38% in annualized return (ie. 8.38% yearly COMPOUNDED return over the past 3 decades!)

*1992 to 2021

Now, if #1 and #2 aren’t good enough, consider this:

Over the past 3 decades, the S&P500 has survived the dot-com bubble (2000), global financial crisis (2008), the Covid-19 pandemic crisis (2020), many other smaller crises – and STILL grown by 1019%!

In other words, the S&P500 has not just overcome the biggest financial and health crises of the past decades, but still managed to thrive coming out of them.

If you are looking for a simple AND reliable way to grow your wealth, I am pretty sure the time and crises-tested S&P500 could find its place in your portfolio.

How to invest in S&P500 Index as a non-US resident

As an investor, we cannot invest directly in the S&P500 index.

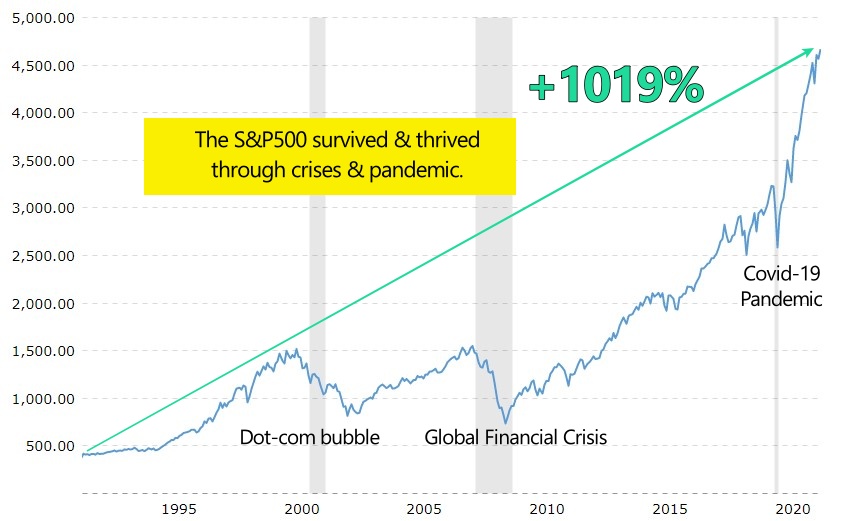

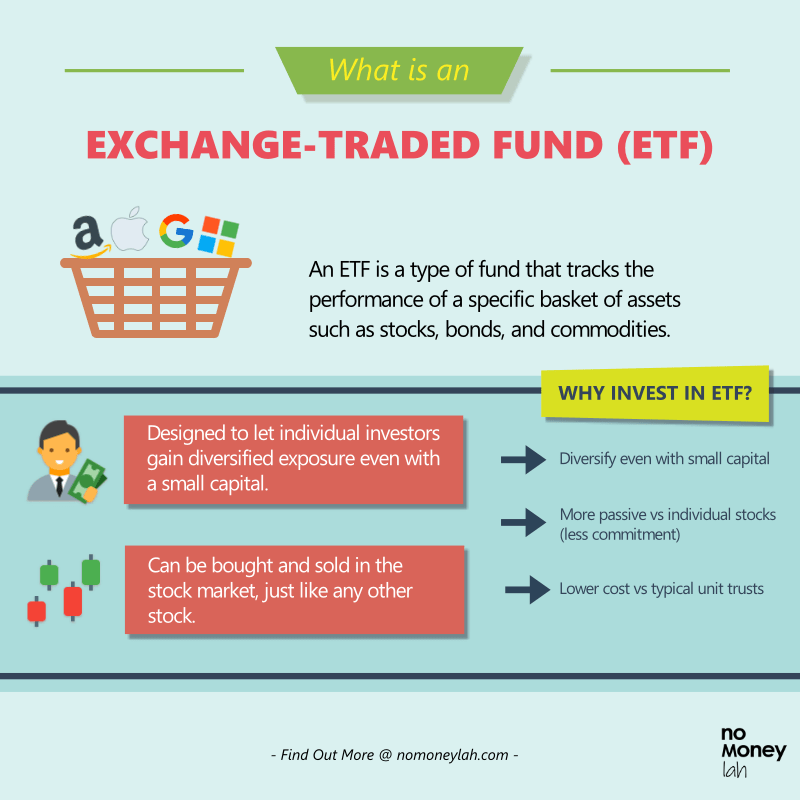

Instead, the easiest way to invest in the S&P500 index is through investing in the S&P500 Exchange-Traded Funds (ETFs).

An ETF is an instrument that mirrors the performance of an underlying index. Similar to stocks, ETFs are also traded in the stock market.

In other words, you can buy/sell ETFs just like how you buy or sell stocks.

Before we proceed, as a non-US resident, it is not viable for us to invest in US-listed ETFs for the long-term due to tax reasons. More on why and what you can do about it in the following section.

RELATED READ: Guide to ETF Investing

Withholding & estate tax for investing in the US stock market

In the US, there are many popular S&P500 ETFs, such as:

- SPDR S&P 500 ETF (ticker: SPY)

- iShares Core S&P 500 ETF (IVV)

- Vanguard S&P 500 ETF (VOO)

These ETFs are especially popular among US investors as they track the performance of the S&P500 index closely.

However, it is not recommended for non-US residents (eg. investors from Malaysia or Singapore) to invest long-term in the US-listed S&P500 ETFs (eg. VOO, SPY, IVV).

Why?

-

Withholding Tax on Dividends

As countries without tax treaty with the US, non-US residents investing in the US stock market are taxed 30% on dividends received.

So, let’s say you received $100 in dividends, you’ll only end up getting $70 due to withholding tax.

This is certainly not ideal if we invest in US-listed stocks or ETFs that pay out dividends.

Check the list of countries with tax treaty with the US HERE.

-

Estate tax

There is also a 40% estate tax in the US for foreign investors.

So, let’s say I pass away with $1 million worth of stocks, $400k will go to the US government, and only $600k will be received by my appointed nominee.

Ireland-Domiciled ETFs: The best S&P500 ETFs for non-US residents

Well, does that mean we are not able to invest in the S&P500 after all?

Not exactly. There are ways to go around this:

The easiest way for non-US investors (eg. Malaysians, Singaporeans) to invest in the S&P500 index is through Ireland-Domiciled ETFs.

Why?

Because Ireland-Domiciled ETFs benefit from the US-Ireland tax treaty of only 15% withholding tax on dividends. This is significantly lesser compared to the 30% withholding tax of US-listed ETFs.

(a) How many Ireland -Domiciled S&P500 ETFs are there?

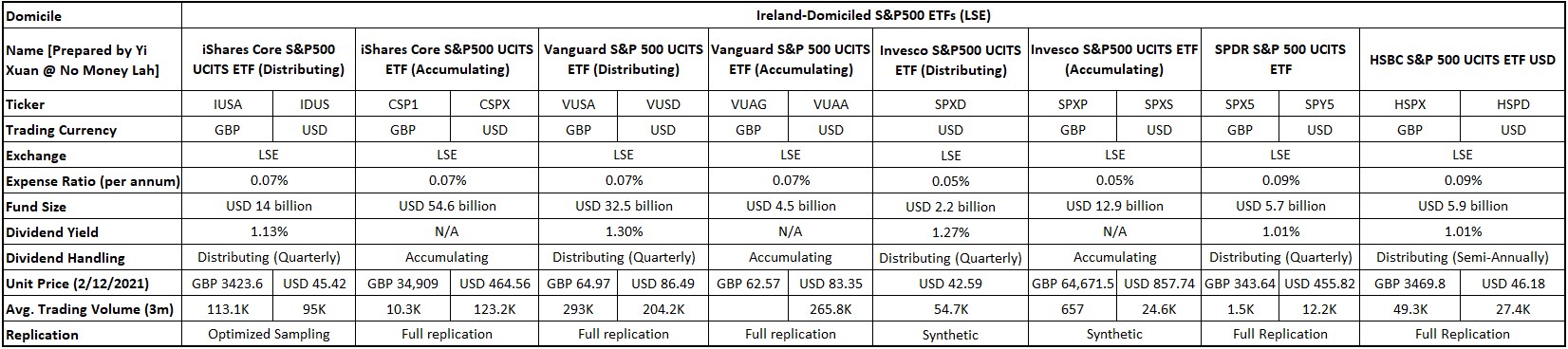

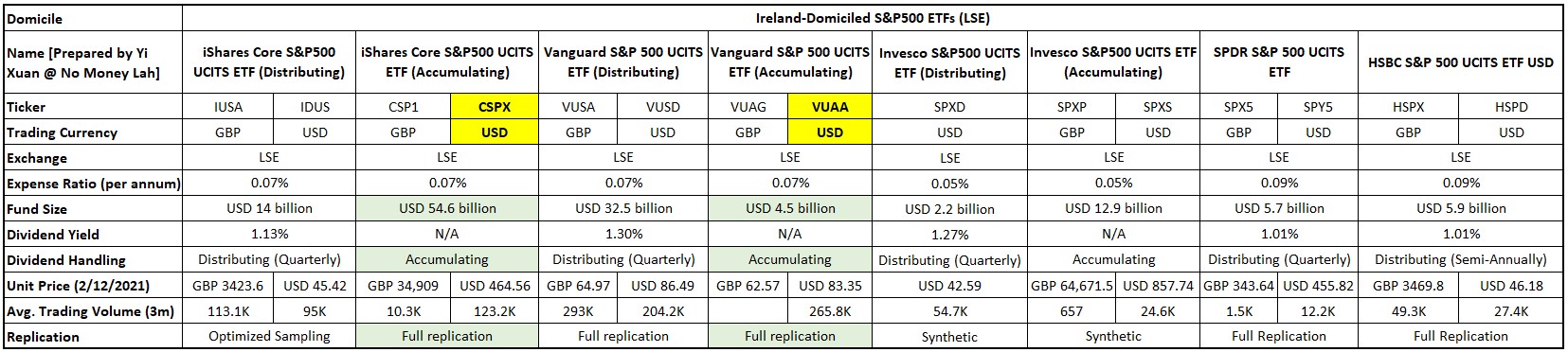

The following are 8 Ireland-Domiciled S&P500 ETFs are ETFs listed in the London Stock Exchange (LSE) that tracks the S&P500 index.

Don’t worry, let me simplify this table and tell you which S&P500 ETFs are the best among all:

In the table above, there 6 things that you need to pay attention to:

(1) Trading Currency:

Most ETFs can be bought either in GBP or USD. Personally, I’d go for USD-denominated ETFs as USD is still the go-to global currency.

(2) Expense Ratio:

ETF providers charge a small annual management fee for their ETFs. In this case, all ETFs have a very low expense ratio so the difference is negligible.

(3) Fund Size:

In general, an ETF with a larger size fund size is a good indicator of the ETF’s durability as well as its popularity. Larger ETFs can also make use of economies of scale to lower their costs.

So, ETFs like CSP1 and CSPX are the obvious winner here. That said, other ETFs are also fairly respectable in size (billions) so you’ll be in good place regardless of which S&P500 ETF you select.

(4) Dividend Handling:

There are 2 approaches on how these ETFs manage dividends:

- Distributing: Your dividends are redistributed to you.

- Accumulating: Your dividends are reinvested automatically.

Choosing to invest in either ETF is your personal preference. Personally, I’d go for Accumulating ETFs as I want my dividends to be re-invested automatically, so I can compound my returns more efficiently.

(5) Unit Price:

Some ETFs are larger in terms of per unit share price. As an example, CSPX is USD 400+/share while VUAA is USD 80+/share.

If your investment capital is small, ETFs with smaller per unit price like VUAA would provide you more flexibility to invest in the S&P500.

(6) Trading Volume:

Here’s something that you may not know – the trading volume of an ETF has a minimal indication of the ETF’s liquidity.

Rather, it is the trading volume of the underlying component companies that truly affect the liquidity of an ETF (for S&P500 it’d be companies such as Apple, Microsoft etc.)

Hence, it’s okay to not put too much weightage into the trading volume of an ETF in our decision-making process.

(b) Which is the best Ireland-Domiciled S&P500 ETF?

Considering all the key factors, personally, I think CSPX or VUAA are the best Ireland-Domiciled S&P500 ETFs among all. Here are why:

- Both CSPX and VUAA are denominated in my preferred currency, USD.

- Both CSPX and VUAA have a very minimal expense ratio of 0.07%/annum.

- Both CSPX and VUAA will reinvest my dividends automatically (accumulating).

- Both CSPX and VUAA use a full replication approach. Meaning, I’ll get the most accurate representation of the S&P500 index when I invest in either of them.

- CSPX is the larger ETF compared to VUAA, but it has a larger per-unit price. This makes it less flexible to invest in it with a smaller capital.

- On the other hand, VUAA is a smaller ETF. However, it has a smaller per unit price, which is easier for investors to invest with a small capital.

Regardless, I think either ETFs are great for you to gain exposure in the S&P500 index.

Recommended broker to invest in Ireland-Domiciled S&P500 ETFs: Interactive Brokers (IBKR)

To invest in Ireland-Domiciled S&P500 ETF, you’ll need to have a broker with access to the exchange where the ETF is listed.

In this case, all the ETFs that we discussed are listed on the London Stock Exchange (LSE).

For this, I use Interactive Brokers (IBKR) to invest in Ireland-Domiciled S&P500 ETFs listed in the LSE. In fact, IBKR gives investors access to 150 markets in more than 33 countries! (US, Hong Kong, China, Japan, UK, Singapore, Europe, and more!)

In my opinion: IBKR is a no-brainer for investors looking to gain access to global markets at a low commission.

RELATED READ: Interactive Brokers Long-Term Review

Open an Interactive Brokers (IBKR) account today:

Click the image below to explore Interactive Brokers’ Low Commission:

No Money Lah’s Verdict

So, what do you think? Isn’t the S&P500 amazing, given how it has withstood the test of time and crises?

For me, I genuinely think that the S&P500 is a great long-term investment, be it as a standalone investment, or being part of a long-term investment portfolio.

Remember, if you want to invest in Ireland-Domiciled ETFs, be sure to check out Interactive Brokers for global market access at a competitive price!

Disclaimers

This article is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

This post may contain promo code(s) that afford No Money Lah a small amount of commission (and help support the blog) should you sign up through my referral link.

Promotional Relationship Disclosure:

This content is provided by a paid Influencer of Interactive Brokers. Influencer is not employed by, partnered with, or otherwise affiliated with Interactive Brokers in any additional fashion. This content represents the opinions of Influencer, which are not necessarily shared by Interactive Brokers. The experiences of the Influencer may not be representative of other customers, and nothing within this content is a guarantee of future performance or success.

None of the information contained herein constitutes a recommendation, promotion, offer, or solicitation of an offer by Interactive Brokers to buy, sell or hold any security, financial product or instrument or to engage in any specific investment strategy. Investment involves risks. Investors should obtain their own independent financial advice and understand the risks associated with investment products and services before making investment decisions. Risk disclosure statements can be found on the Interactive Brokers website.

Interactive Brokers is a FINRA registered broker and SIPC member, as well as a National Futures Association registered Futures Commission Merchant. Interactive Brokers provides execution and clearing services to its customers. For more information regarding Interactive Brokers or any Interactive Brokers products or services referred to in this video, please visit www.interactivebrokers.com.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Hi, I’m deciding between the 2 options that you whittled it down to in your article. What amount of money would you consider to be a small investment capital?

VUAA or CSPX are good. VUAA would allow you to invest in S&P500 with a relatively small amount since it’s unit price is smaller relative to CSPX.

Regards,

Yi Xuan