Last Updated on April 8, 2023 by Chin Yi Xuan

For 2 years, I’ve been engaging a licensed financial planner to advise me on my personal finances.

Personally, it has been a fruitful journey as my finances have improved significantly compared to where I was 2 years ago.

But what is a licensed financial planner? How exactly does a financial planner help in your finances?

In this post, I’d actually like to share my financial planning journey with you in 2021. Doing so, I think you’ll have a taste of what I’ve learned, and perhaps, find out if you need a financial planner (or not).

OK, let’s get started!

p

Table of Contents

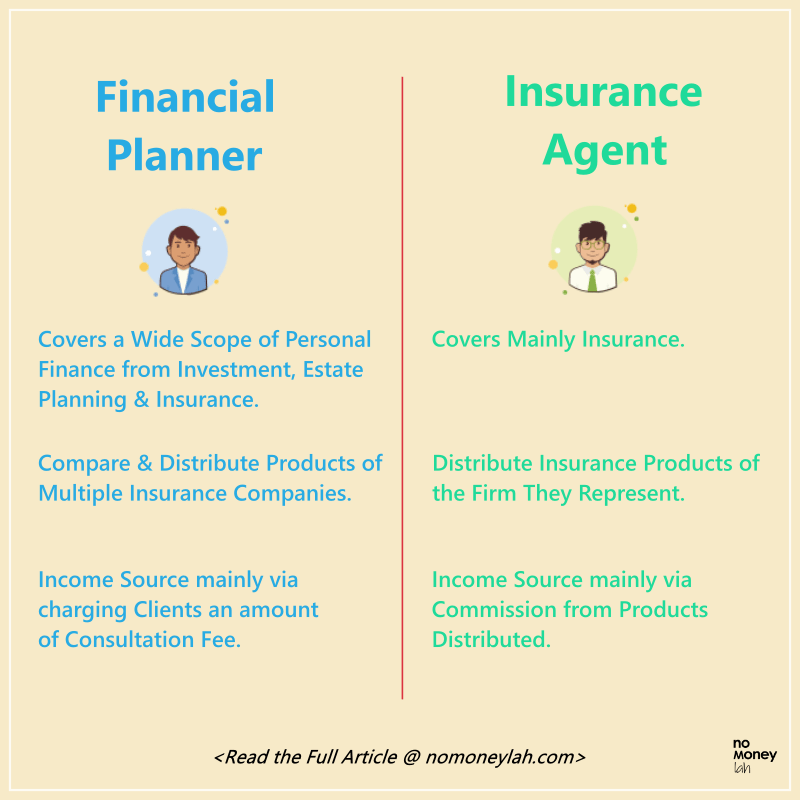

Quick recap: What is a financial planner

So, what is a licensed financial planner, and who is qualified to be called a licensed financial planner?

Essentially, a licensed financial planner has in-depth qualifications, namely:

- Capital Market Service Representative License, issued by the Securities Commission (SC): To conduct licensed financial planning in Malaysia – as such, be called a ‘financial planner’.

- Financial Adviser Representative (FAR) License, issued by Bank Negara Malaysia (BNM): Allows a financial planner to recommend insurance products from any insurance company.

On the other hand, the qualification of most insurance agents would stop at the Pre-Contract Examination for Insurance Agents (PCEIA) & Certificate Examination in Investment-linked Life Insurance (CEILI) papers. These are the papers that insurance agents have to take in order to start offering insurance solutions for one particular insurance company.

In essence, a financial planner offers a complete service in all aspects of personal finance relative to an insurance agent.

How it works

Personally, I have been working with my financial planners – Stev and Catherine from Wealth Vantage Advisory (WVA) for 2 years now. WVA is a licensed financial advisory firm in Malaysia.

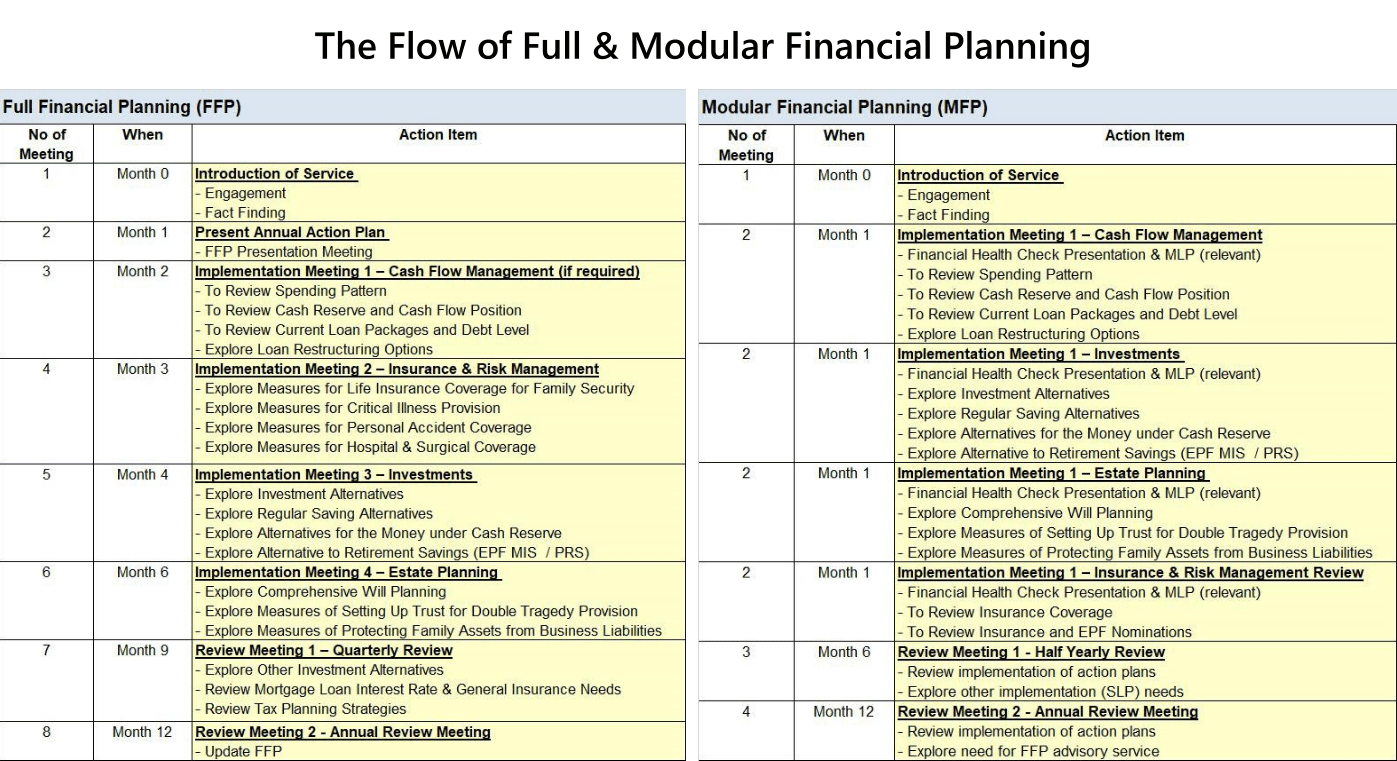

Engaging a financial planner is a process that involves 3 key stages: Fact-finding, Implementation, and Follow-Up Review Meetings. I’ll explain more about each process in the following section.

Depending on your needs, there are 3 ways you can work with a licensed financial planner from WVA, namely:

- Comprehensive Financial Health Check (FHC): You’ll go through a comprehensive fact-finding process with your financial planner. Then, you’ll be presented with analysis and report of your overall financial state with recommendations for improvement.

- Modular Financial Planning (MFP): You’ll get everything from the FHC above. PLUS, you can choose to focus on EITHER Investment/Insurance/Estate Planning and your financial planner will support you in the implementation for 1 full year.

- Full Financial Planning (FFP): You’ll get everything from the FHC. PLUS, your financial planner will support you in the implementation of ALL aspects of your personal finances (Investment + Insurance + Estate Planning) for 1 full year.

For me, I’ve opted for the MFP package (investment) back in 2020. You can read about my journey and takeaways HERE.

As for 2021, I have opted for the FFP package. This is where my financial planner, Stev and Catherine guided me in all aspects of my finances (investment, insurance, estate planning).

My financial planning journey in 2021

Engagement/Fact-Finding phase (October 2020):

My FFP journey actually started back in October 2020 as I do my 2021 financial planning with Stev and Catherine.

This is where I discuss my goals, and update my latest financial details such as my existing insurance coverage, financial commitments, financial figures with my financial planner.

[Useful Tip]: Back when I engaged Stev and Catherine for the first time, I felt a little uncomfortable sharing my financial figures with them. But they have been very professional and treated my information with utmost privacy.

Implementation – Financial Report Presentation + Cashflow & Investment (December 2020):

Before the end of 2020, I was presented with my full financial report. This is a 20+ pages financial report that gives me an overview of my financial state in 2020 as well as action plans for 2021.

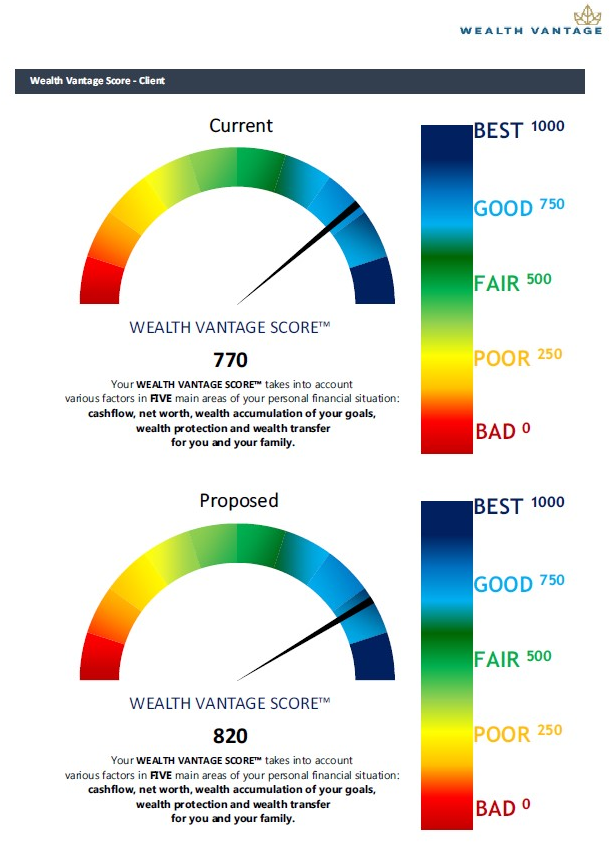

I am also shown my Wealth Vantage Score, a visual gauge of my financial state, and target progress for the year: With the details provided during our engagement session, Stev and Catherine are aware of my financial context. Hence, they are able to provide advice/action plans that are customized to my situation. Several key implementations that I have to make for 2021 include:

With the details provided during our engagement session, Stev and Catherine are aware of my financial context. Hence, they are able to provide advice/action plans that are customized to my situation. Several key implementations that I have to make for 2021 include:

- Investment: Rebalance investment assets to more equities (I was too heavy on REITs)

- Tax: Contributing to PRS for tax relief

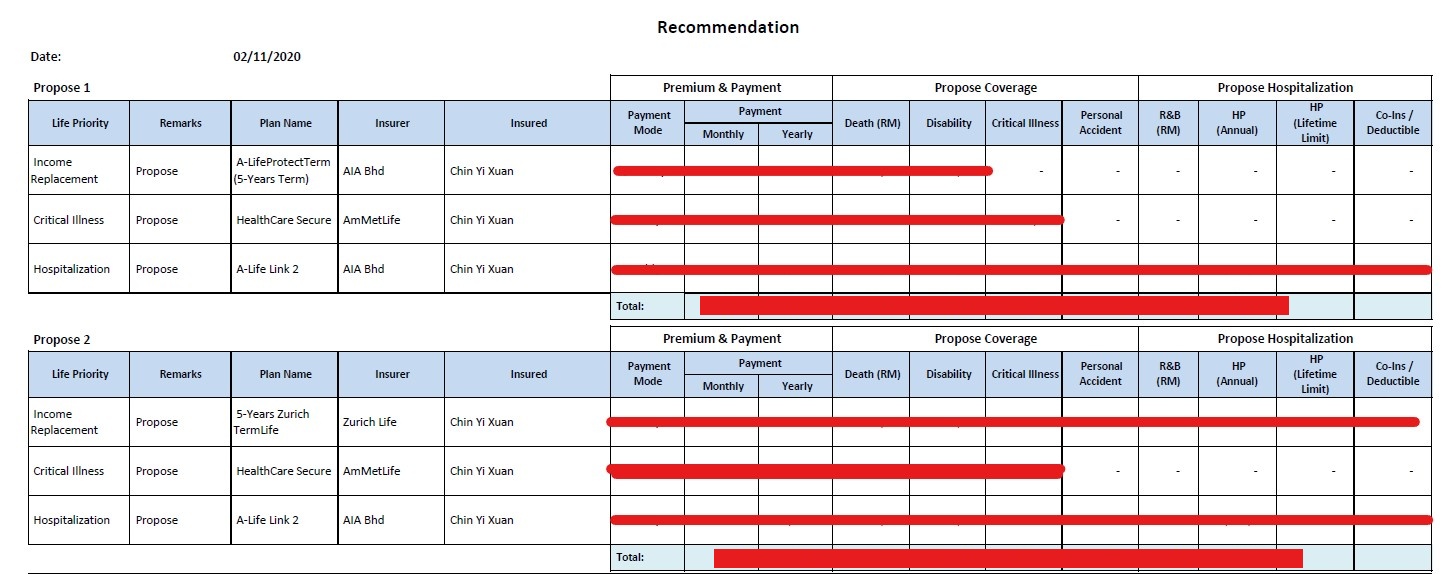

- Insurance: Patch insurance coverage shortfall: I was given several choices on the best insurance packages to choose from

- Cashflow & emergency fund: Streamlining emergency funds

Implementation – Insurance & Risk (March 2021):

This quarterly follow-up is mainly about insurance & risk management.

In the previous meetup, Stev has suggested a list of best-in-value insurance plans for my current phase in life:

I got to choose which insurance packages to go for. Ultimately, I opted for:

- Life: AIA A-Life Protect Term Life Insurance

- Medical: AIA A-Life Link 2 medical card

- Critical Illness: AmMet Life Healthcare Secure

All in all, my insurance coverage would cost me around RM3,600/year, translating to RM300/month. Given my life circumstances, I think this is a decent all-around insurance package.

Working with financial planners like Stev is a great thing, as they are not tied to a single insurance company. As such, they can recommend products from different insurance companies, ensuring the best-in-value coverage for clients.

Implementation – Estate Planning (June 2021):

This quarterly follow-up is mainly about estate management. Stev gave me an overview of estate management – will writing, trust establishment etc.

This session gave me an in-depth understanding of planning for the people that we care for upon our demise.

However, I was too caught up with work so I was unable to implement my estate planning in 2021.

Will definitely follow through with my estate planning implementation and will write about it in 2022.

Quarterly & Annual review (September & October 2021)

Towards the 4th quarter of the year, it’s time for an in-depth annual review. Several key highlights of our annual review include:

- Analyze growth and progress for 2021 – how much my net worth has grown.

- Anticipated changes in commitments in 2022, if any.

- Planning + goals for 2022 – Is my current financial routine (eg. Investments, insurance) matching up with my goals, and if any refinement is needed in 2022.

- Action plan for 2022:

- Stev guided me on tax optimization (eg. EPF & PRS contribution amount) in line with the newly released budget.

- Also advised me on shifting some of my current investment funds to better ones.

- EPF nomination (which I’ve been procrastinating on)

- Setting up a will and/or trust in 2022

My takeaways from engaging a licensed financial planner

-

A licensed financial planner gives you direction & clarity in all aspects of your finances

A financial planner can (and is qualified) to answer all your questions about money & finances.

- How can you maximize your tax reliefs in line with Budget 2022?

- How can you better organize your investments for inflation?

- How much % of crypto should you have in your portfolio (according to your risk preference)?

- How can you better plan for your first property purchase?

- And literally anything money-related.

In other words, a financial planner can tell you how exactly you can organize your money in the most efficient way.

In my time writing about personal finance, I noticed many people tend to just emphasize on investment. However, personal finance is more than investing.

There are things like insurance, estate planning, to making necessary adjustments to your overall finances as you transition to a different phase in life.

If you are looking for guidance for one or all aspects of your finances – certainly speak to a licensed financial planner!

p

-

What a licensed financial planner won’t do

A licensed financial planner should not be recommending products from only ONE company.

Since they are not tied to a single company, they are able to filter through the market and customize deals that suit you the best. This applies to insurance or investment products like unit trust.

In addition, a financial planner should not force you to buy/sign up for something that you are not comfortable with.

p

-

A good routine helps make the best use of your time with a financial planner

Having a good financial routine will help make each meeting with your financial planner more efficient.

As an example, I always track my finances every month (eg. Expenses, Assets, Liability). So, prior to a meeting with Stev, I’ll always update him with my latest figures. Moreover, if I have any questions, I’ll always take note of them ahead of our meeting.

Doing so, Stev is always kept up-to-date with my financials and hence, able to give me to most accurate guidance according to my life context.

Essentially, think of your relationship with your financial planner like a student and coach. Let’s say you sign up for a guitar class but do not practice outside of the class. Every session, your coach will have to go through the basics again because you cannot recall what you’ve learned the previous week.

However, if you can prepare ahead by practicing, each class will be more fruitful and you’ll reap more benefit out of your time.

The idea is the same when you engage a financial planner. It takes two hands to clap.

The most helpful things in my time engaging a licensed financial planner

-

Insurance

As much as I like doing research on my own personal finances, insurance is one aspect that I have a hard time researching.

The jargon in insurance can be complex and this makes it hard for me to compare insurance products.

Guidance from a licensed financial planner is greatly helpful as they are not tied to a single insurance company. As such, they are able to customize the best insurance plan to fit the client’s needs.

-

Tax optimization

As a self-employed, tax is one of the personal finance topics that I need more guidance in.

With the help of a financial planner, I get to make the best out of the tax reliefs offered in each budget announcement.

-

Estate planning

Estate planning such as will writing is also a topic that I am not entirely familiar with. With the help from Stev, I get in-depth knowledge on what to do

Should you engage a financial planner?

In the past, I used to think I can handle my finances all by myself. And hey, it used to be alright.

But with time, there are many aspects of my life that require my attention:

- Managing my career as a self-employed.

- Taking up responsibilities in the family.

Over time, I realized that I cannot handle everything. Engaging a financial planner for the past 2 years has allowed me to use my time to focus on things that really matter to me.

Are you in a position in life where you have too much on your plate? In this case, a financial planner can be a massive help to keep your finances in place.

Moreover, I am confident that a financial planner will add massive value to you if:

- You have tried DIY your finances but still feel overwhelmed.

- You want to prepare your finances for the next phase in life (eg. marriage, retirement), but not sure how.

- You need help to organize your finances in place (investments, insurance, estate planning etc).

Yes, there are charges to engage a financial planner. But trust me, this will be an investment that’ll give you returns and peace of mind in multiple folds.

Verdict: Is a financial planner worth it?

In the past 2 years, I have received my financial planning package, complimentary from Wealth Vantage Advisory (WVA), a licensed financial advisory firm in Malaysia.

WVA offers 3 financial planning packages, namely:

- Comprehensive Financial Health Check (FHC): RM300

- Modular Financial Planning (MFP): RM1,500

- Full Financial Planning (FFP): RM3,000

Recap:

- FHC offers a comprehensive report on your financial state with action plans for improvement.

- MFP is essentially FHC + your financial planner will support you in the implementation in ONE aspect of your finance (insurance, investment, estate planning) for 1 full year.

- FFP is FHC + your financial planner will support you in the implementation of ALL aspects of your finance (insurance, investment, estate planning) for 1 full year.

Would I still sign up for a financial planner if I have to pay for the service?

For me, it is a solid yes.

The past 2 years have been life-changing as I dedicate my time and energy to build up my career as a self-employed. Without the guidance from Stev and Catherine in multiple aspects of my finances, I wouldn’t have the confidence to pursue my career wholeheartedly.

Yes, it is not the cheapest service in the world. But the value and professionalism that I gained from my financial planning journey have been one of the main reasons why I can pursue what’s important in life without having to hold back.

I am sure it’ll add massive value to many of you too.

More on my journey as I step into Year 3 of my financial planning journey. Talk soon!

Get Your First Financial Consultation Session Today – FREE OF CHARGE!

If you are keen to explore how a licensed financial planner can help with your finances, this is for you:

I am working together with Wealth Vantage Advisory to bring a FREE Financial Consultation Session to all No Money Lah’s readers!

When you sign up for this FREE consultation session, you will learn more about your overall financial state. Not only that, you can gauge if a Financial Planner is going to add value in the pursuit of your financial goals.

Regardless, it is 100% FREE and you have zero obligations to take up the service if it is not suitable for you. Plus, you are doing your finances a favor for the year to come!

You can sign up for your FREE financial consultation session by clicking on the button below.

Sign Up for Your FREE Consultation Session Here!

Disclaimers

This article is made possible through a collaboration with Wealth Vantage Advisory. Special thanks to Stev and the team for making this collaboration such an impactful one.

Wealth Vantage Advisory did not receive copy approval rights on this article – that means they are reading this article for the first time, right alongside you. 🙂

p.s. This post contains affiliate links, which afford No Money Lah a small referral if you sign up for any paid services.

Related Posts

October 16, 2022

My will-writing experience in Malaysia

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.