Last Updated on April 17, 2023 by Chin Yi Xuan

A stock screener is usually used by investors to help filter through hundreds of stocks, in order to identify the ones that fit into their predetermined criteria.

In this article, I’ll be sharing how you can create your own powerful Bursa stock screener, alongside 3 ideas to get you started.

For this, I’ll be using the built-in stock screener from Rakuten Trade’s web platform. There are many screeners out there, but Rakuten Trade’s screener is certainly one of the most comprehensive & customizable screeners that I’ve ever come across – plus it’s free to all Rakuten Trade users so that’s a no-brainer.

If you are looking to open a stock investing account, or want to experience Rakuten Trade’s powerful stock screener, definitely check out my detailed account-opening guide HERE.

Table of Contents

Features & Highlights of Rakuten Trade Stock Screener

- Powered by Thomson Reuters, a global company that provides insights and information to professionals of various fields, including the stock market.

- Highly customizable & comprehensive filtering criteria from Stock Types, Companies’ Scale, Financials, Estimates & Technicals.

- Real-Time: Financial filters (eg. P/E Ratio) that consider stock price into calculation are updated on an hourly basis. Technical filters (eg. MACD, RSI) are also updated hourly. This could be helpful to investors/traders are involved with real-time decision-making.

Read Also: 4 underrated features on Rakuten Trade that can help you make better investment decisions!

Rakuten Trade Stock Screener Interface & Guide

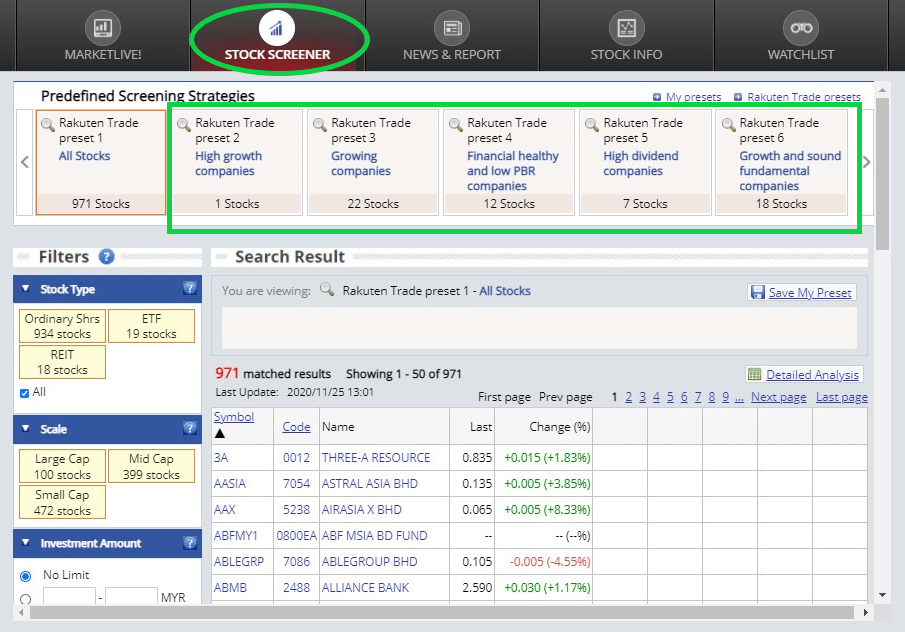

Rakuten Trade Stock Screener is easily accessible to every Rakuten Trade’s investor. Once you are a Rakuten Trade user, simply login to your Rakuten Trade account or register for a new Rakuten Trade account and you’ll be able to spot it right away (refer to screenshot below).

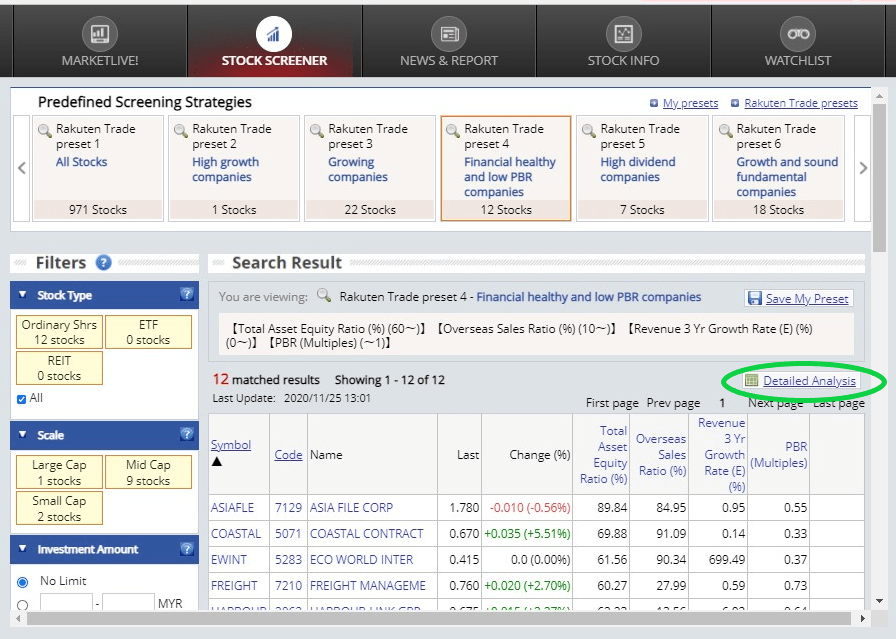

One awesome thing about this screener is that it also comes with several presets (eg. High Growth Companies, High Dividend Companies) where you can filter through stocks right away – neat stuff for fellow investors!

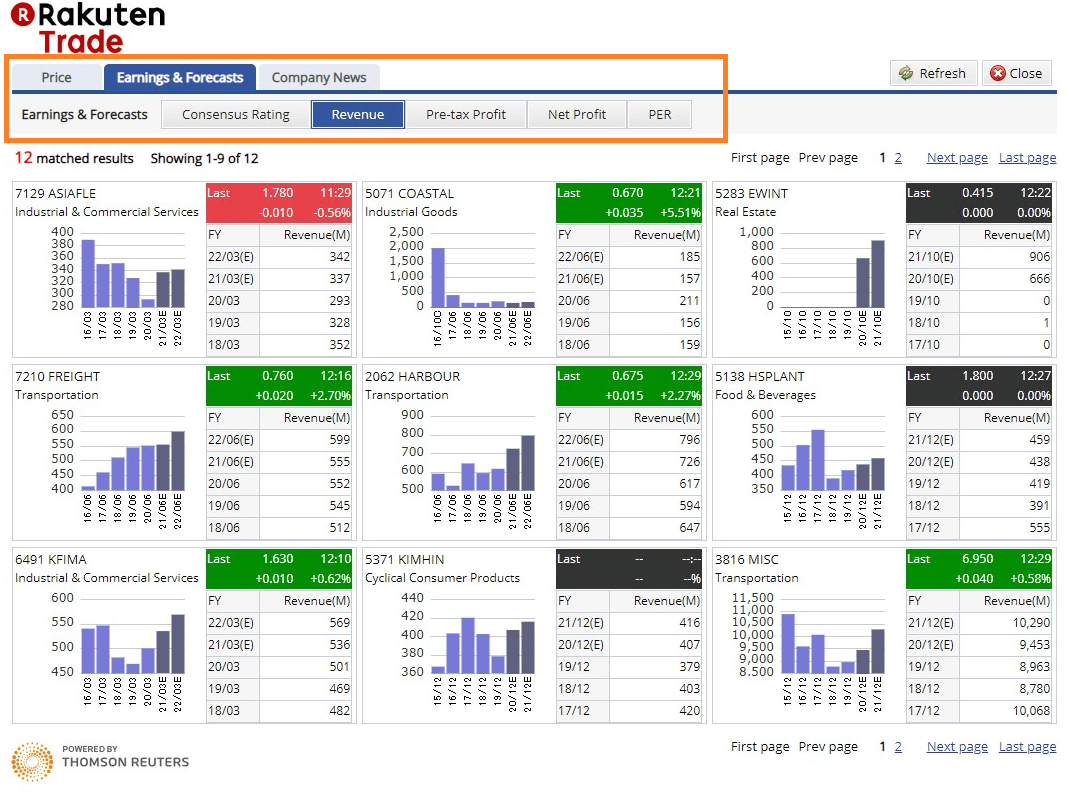

In addition, every filter also comes with the ‘Detailed Analysis’ feature. Clicking on this feature allows you to compare all filtered stocks from various perspectives (eg. Consensus Rating on earnings & forecasts, Forecasts on Revenue and Profit, Company news, and more)

Read also: Check this out before opening your stock investing account!

How to Customize Your Own Stock Screener?

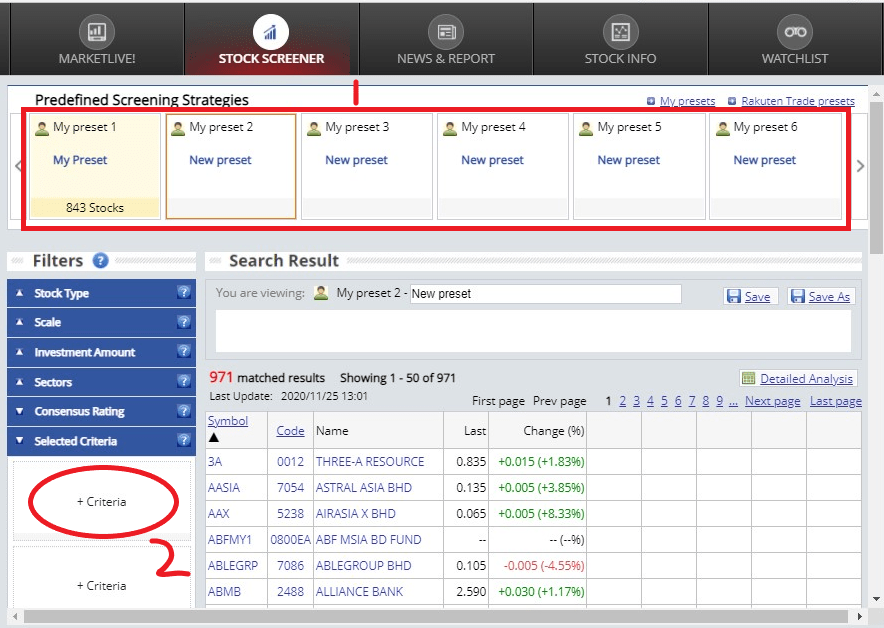

Now, perhaps you have some specific filtering criteria in mind, and you want to find out if there are any companies that fulfill these conditions.

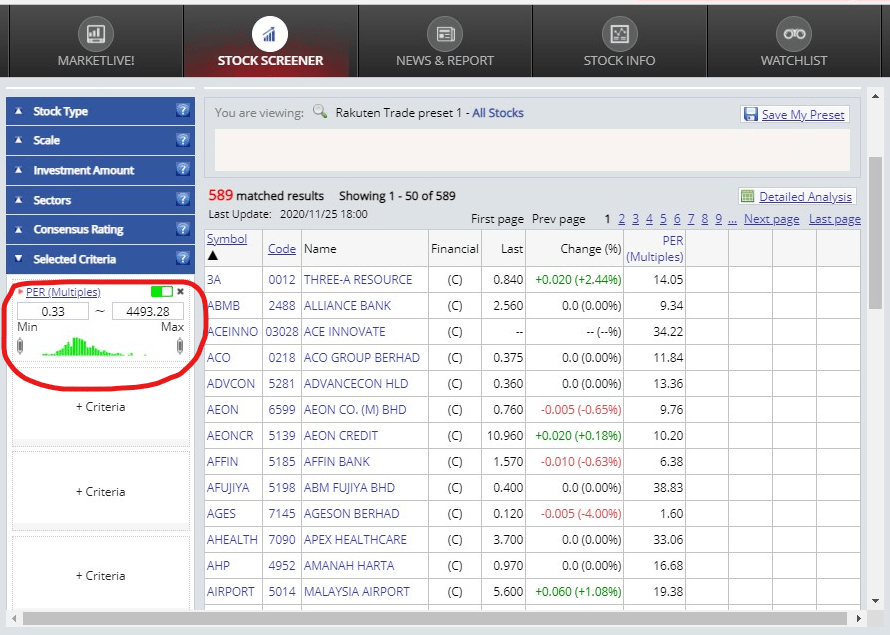

Step 1: To start customizing your own stock screener, simply click on any ‘My Preset’ section, then click ‘+ Criteria’ (refer to the screenshot below).

Step 2: Select your filtering criteria from the list, then adjust the min/max value accordingly.

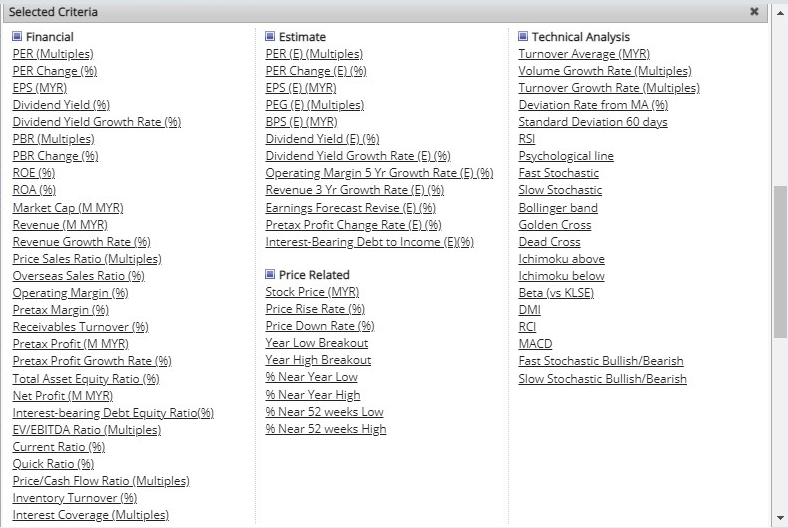

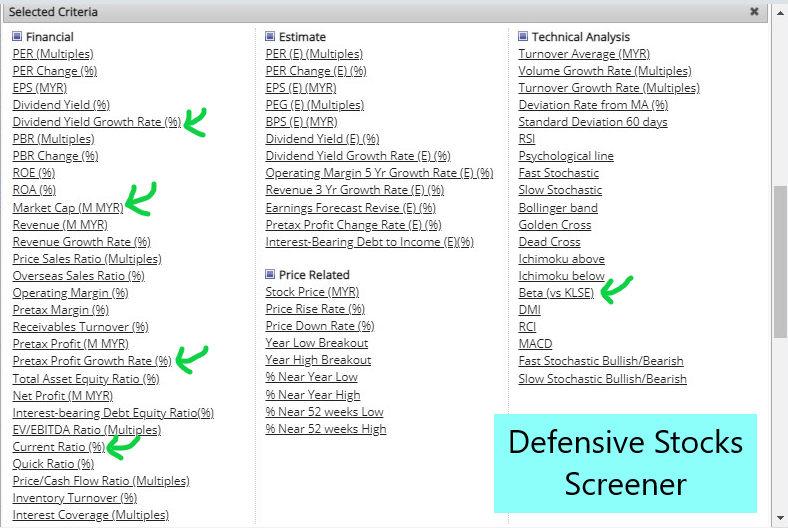

Filtering criteria:

- 1. Financials: Allow you to specify the companies that fulfill certain financial-related criteria (eg. PE Ratio, Market Cap, Revenue Growth)

- 2. Estimate: Allow you to specify companies with their future financial capability according to analysts’ estimates or forecasts.

- 3. Price Related: Allow you to filter stocks base on the price level of the stocks.

- 4. Technical Analysis: Allow you to filter for stocks that fulfill certain conditions via technical indicators.

Step 3: Rakuten Trade Stock Screener allows up to 5 customizable criteria. Once you are done, save your filter by clicking ‘Save My Preset’.

3 Stock Screener Ideas for Different Investing Style

If you are a little overwhelmed on which filtering criteria to choose, or simply looking for some ideas, keep reading.

In this section, I’ll be sharing with you 3 stock screener ideas that can help you get started. Simply choose the ones that suit your investing style the most:

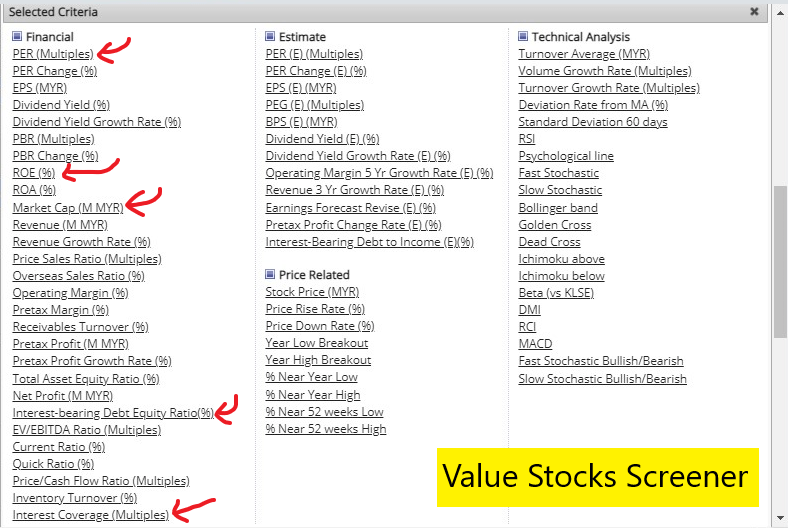

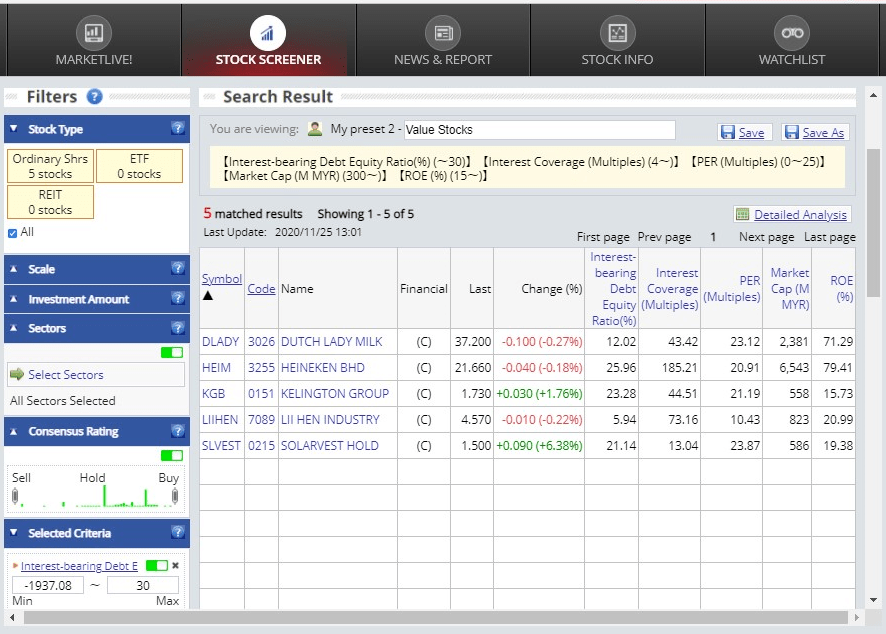

i. Value Stocks Screener

Value stocks screener allows investors to filter for stocks that are relatively undervalued, while having a strong potential upside in the future.

Criteria:

- Market Cap: Min. RM300 million [companies with respectable size]

- Interest-bearing Debt Equity Ratio (%): Max. 30% [ensure healthy leverage]

- Return of Equity (ROE %): Min. 15% [ensure business generates income for the company]

- PE Ratio (PER Multiples): Max. 25x [avoid relatively overpriced companies]

- Interest Coverage (Multiples): Min. 4x [reduce risk of bankruptcy due to loan interests]

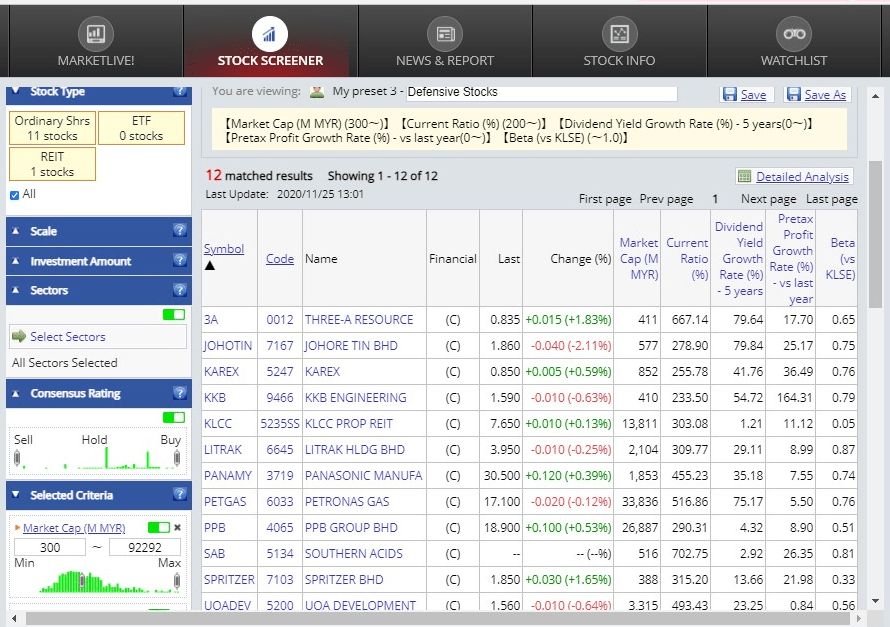

ii. Defensive Stocks Screener

Defensive stocks screener allows you to filter for stocks with a relatively stable business model and hence less volatile in nature.

Criteria:

- Market Cap: Min. RM300 million [companies with respectable size]

- Current Ratio (%): Min. 200% [companies with healthy liquid assets over liabilities]

- Dividend Yield Growth Rate (%) [5 years]: Min. 0% [companies with dividend growth]

- Pre-Tax Profit Growth Rate (%) [vs last year]: Min. 0% [companies with profit growth]

- Beta: Max 1.0 [companies that are equal/less volatile compared to the main index]

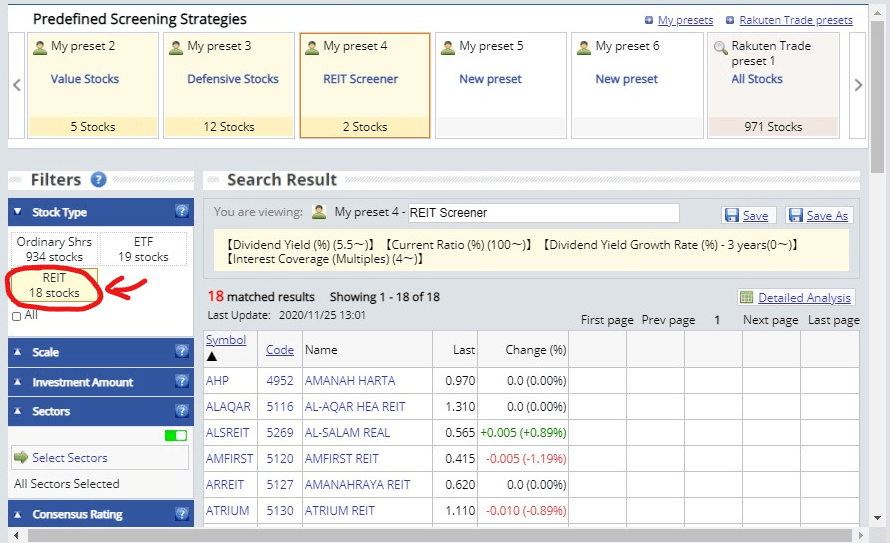

iii. REITs Screener

This REITs Screener enables you to filter for stocks that are financially balanced short & long-term, while returning a decent dividend yield.

Firstly, under ‘Stock Type’, unselect ‘Ordinary Shares’ and ‘ETF’. This means any criteria chosen will only be filtering for REITs.

Criteria:

- Dividend Yield (%): Min. 5.5% [REITs that pay respectable dividends]

- Dividend Yield Growth Rate (%) [3 years]: Min. 0% [REITs with dividend growth]

- Current Ratio (%): Min. 100% [companies with healthy liquid assets over liabilities]

- Interest Coverage (Multiples): Min. 4x [reduce risk of bankruptcy due to loan interests]

READ: Important Caveats Before Using a Stock Screener

There are several caveats that I want to clarify before you proceed:

Firstly, stocks filtered from a stock screener DOES NOT mean it is worth investing in right away. Filtering is just an initial phase of your research, and more thorough research needs to be done to ensure it fits into your investing strategy.

Secondly, stocks that are left out of your filter DOES NOT mean it is not worth investing in. Not all criteria are suited to be used in every stock. As an example, a 25x PE Ratio may be undervalued to a stock from industry A but a similar multiple could be expensive to another stock from industry B.

Apply a bit of critical thinking and take your filters with a pinch of salt.

Lastly, all my stock screening criteria are just for reference purposes. Feel free to tweak the criteria according to what you feel logical and makes sense to you.

No Money Lah’s Verdict

So here you go: How you can build your own powerful stock screener and 3 ideas to get you started!

In my opinion, Rakuten Trade Stock Screener is highly underrated as it is certainly more powerful and customizable than many free screeners on the internet.

If you are looking for investing ideas or direction in your stock-picking journey, hopefully this has been helpful to you!

Do you have other ideas/filtering criteria to be added to a stock screener? Feel free to share with me in the comment section below!

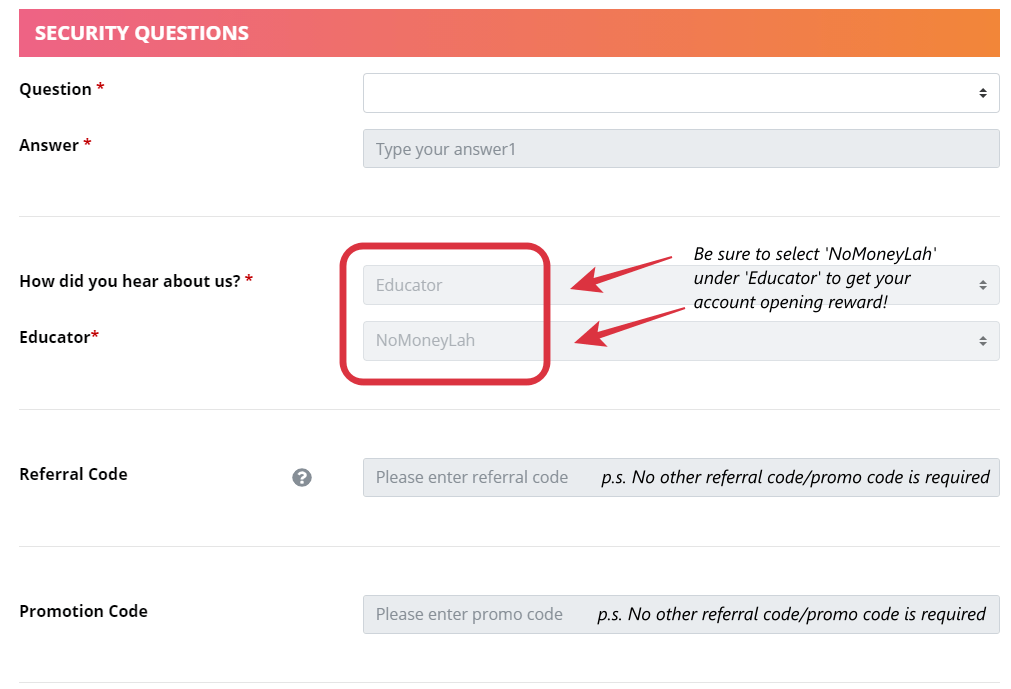

Rakuten Trade Referral Link for New Users

If you are keen to open a Rakuten Trade account, consider using my referral link below! For that, you’ll get:

- 1000 Rakuten Trade (RT) points worth RM10 to offset your brokerage fee.

- + 150 RT points when you deposit a min. of RM1,000 within 5 days.

- + 1000 RT points when you transfer your shares from other brokers to Rakuten Trade.

- + 1x brokerage fee rebate when you place your 1st trade within 30 days after your account is activated.

Aside from that, Rakuten Trade users get +1 RT point for every RM1 brokerage paid! Click HERE for the full T&C on RT points.

Open a Rakuten Trade Account Today!

Open A Rakuten Trade Account Today!

Disclaimer: This post contains affiliate links, which afford No Money Lah a small referral (and in return, support this blog) if you sign up for an account using my referral link.

Related Posts

September 6, 2020

3 Ideas About Money & Consistency

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.