Last Updated on April 11, 2024 by Chin Yi Xuan

Having a reliable passive income in life is the financial goal of many people (including myself).

However, most passive income streams require a conscious effort to maintain. Rarely do we see passive income that is completely, well, passive.

One of those rare exceptions is dividends from investing. In my opinion, dividends are the closest thing to pure passive income that you can get in life.

Once your money is invested in companies that pay dividends, they work for you while you are sleeping, eating, and exercising. And you get paid income in the form of dividends – how amazing is that?

In this post, I want to explore the idea of making $1,000/month* of passive income in the form of dividends, via Real Estate Investment Trusts (REITs). (*In our respective home currency)

Is it possible to make $1,000 in passive income from dividends via REITs? How much do we need? How long will it take?

p

Table of Contents

Quick introduction to dividends & REIT

A dividend is a form of return that companies agree to distribute to their shareholders. Here are some things you need to know about dividends:

- Dividends are not compulsory. Certain companies pay dividends while some companies can choose not to do so.

- Dividends are generally paid either monthly, quarterly, semi-annually, or annually (depending on a company’s distribution policy).

- There are 2 ways to look at dividends: Distribution Per Unit (DPU), and Dividend Yield (DY).

- Distribution Per Unit (DPU) refers to the absolute amount per share that is being paid to shareholders. So, if you own 5000 shares of a REIT that pays a DPU of $0.05, then you’ll get a total dividend of $250 (5000 shares*$0.05/unit).

- Dividend Yield (DY) refers to the percentage (%) of DPU relative to the price of the share (DY = (DPU/Price)*100). So, let’s say a REIT pays a DPU of $0.05 and the share price is $1.00/unit, then the dividend yield would be 5% [($0.05/$1.00)*100]

When it comes to dividends, REITs can be a good choice:

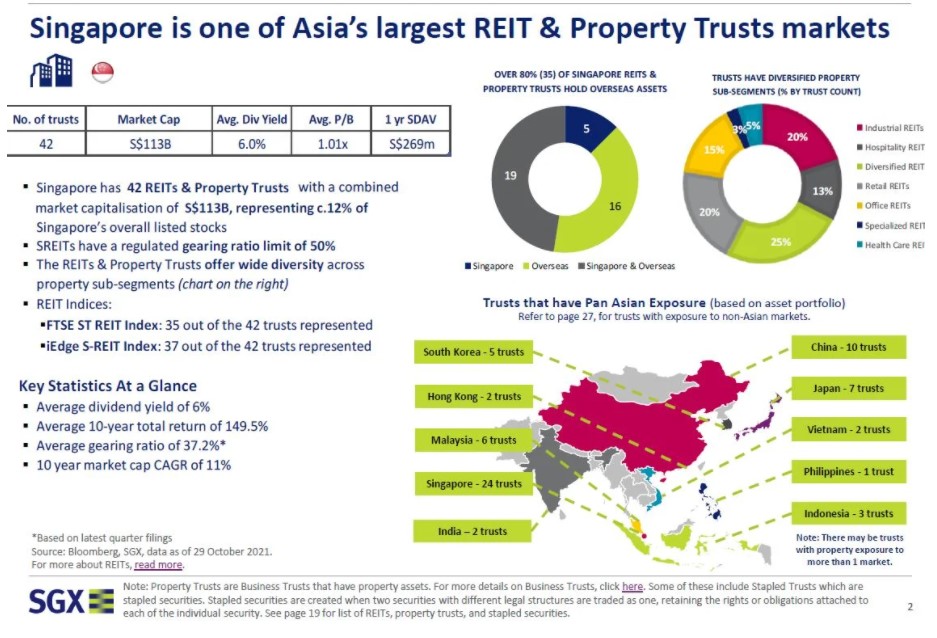

- REITs are unique companies in the stock market that allow investors to earn dividends by investing in income-generating properties.

- These properties can range from shopping centers, offices, factories, warehouses, data centers and more!

- REITs usually pay at least 90% of their income back to shareholders in the form of dividends. By investing in REITs, we are able to receive stable and (usually) higher-than-average dividends on a regular basis.

- There are 2 main ways to invest in REITs. One is to invest in individual REITs, and the other is to invest in REIT Exchange-Traded Funds (ETFs).

RELATED POST: 5 Singapore REIT ETFs to invest in for consistent dividends!

Expectation Setting: Why $1,000?

Now, before we proceed, it’ll be helpful to know that dividend investing is a long journey – especially if we start off with small capital.

The reality is that dividend investing is capital intensive. For most people, it’s not something that can be achieved overnight.

However, in my opinion, a $1,000/month dividend is a realistic milestone target. With the power of compounding (more on this later), most people can achieve a respectable dividend income in life.

Some investors may think an extra $1,000 is too little.

But remember this: the extra $1,000 is close to passive. Plus, an additional $1,000/month means an extra $12,000/year! For many, it could mean better quality groceries, better meals, a new phone – and certainly more choices in life.

Execution: How to start & how long will it take?

To begin, let’s assume we are starting exactly from nothing. Here’s what we are doing to do:

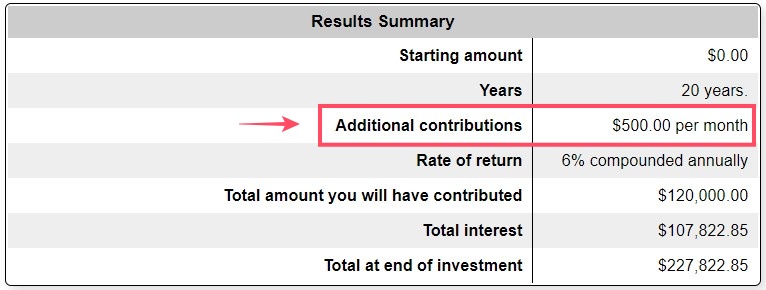

- Contribute $500 monthly into REITs. Investors can decide to either invest in individual REITs, or in REIT ETFs that track the performance of a diversified REIT portfolio.

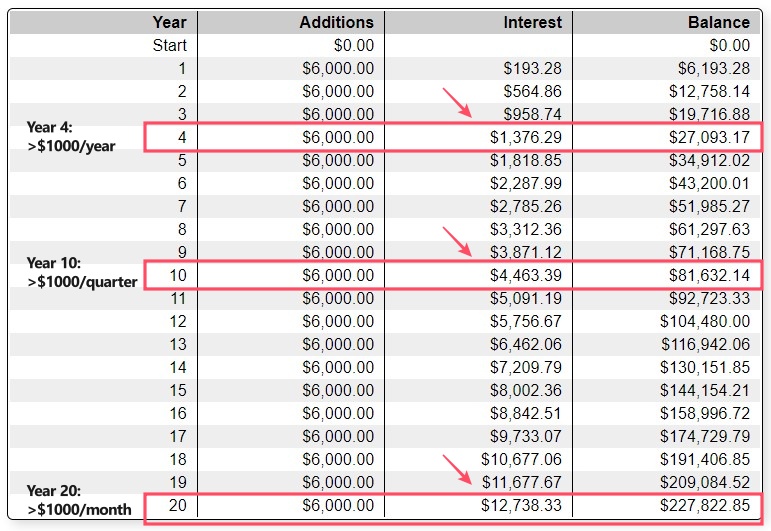

- We’ll assume an annual dividend yield of 6%. This is realistic, and is in line with Singapore REIT’s average dividend yield.

Compound our return: All dividends received are reinvested into our REIT portfolio until we reach $12,000 in yearly dividends (ie. $1,000/month).

Compound our return: All dividends received are reinvested into our REIT portfolio until we reach $12,000 in yearly dividends (ie. $1,000/month).- NOTE: The calculations below are hypothetical and can deviate from real-life performance. In addition, the calculations below do not take into account of potential capital growth, which may impact actual real-life performance.

So, given a 6% annual yield, how long will it take for us to reach a total of $12,000 in yearly dividends?

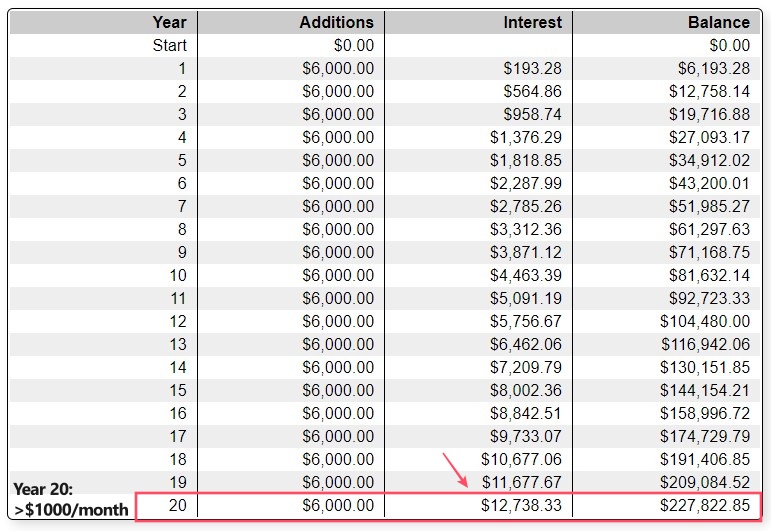

From the table below, it will take 20 years before we reach more than $12,000 in yearly dividends. Another insight that we can extract from this is that we’ll need about $200,000 in capital to achieve such a feat.

Twenty years is certainly a long time. But what if we can invest more on a regular basis?

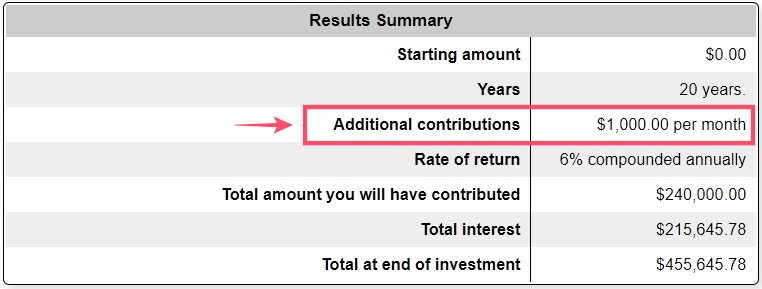

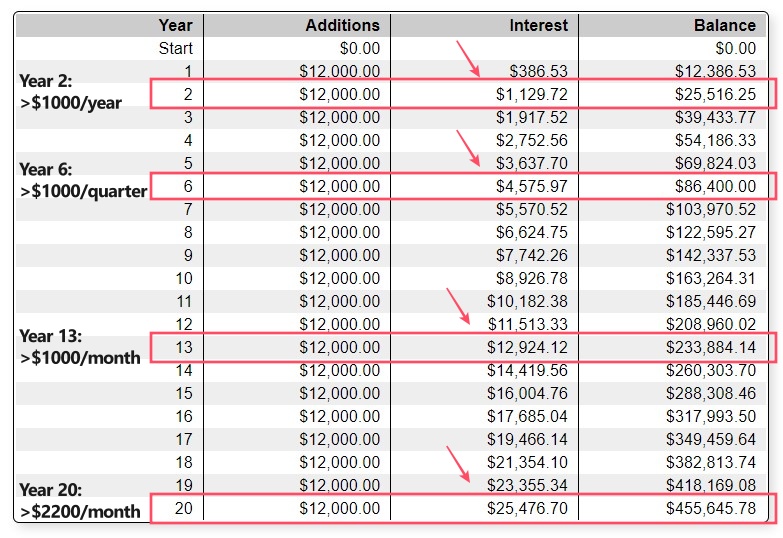

Below, let’s find out how long it’ll take for us to achieve $12,000 in yearly dividenda if we contribute $1,000/month instead of $500:

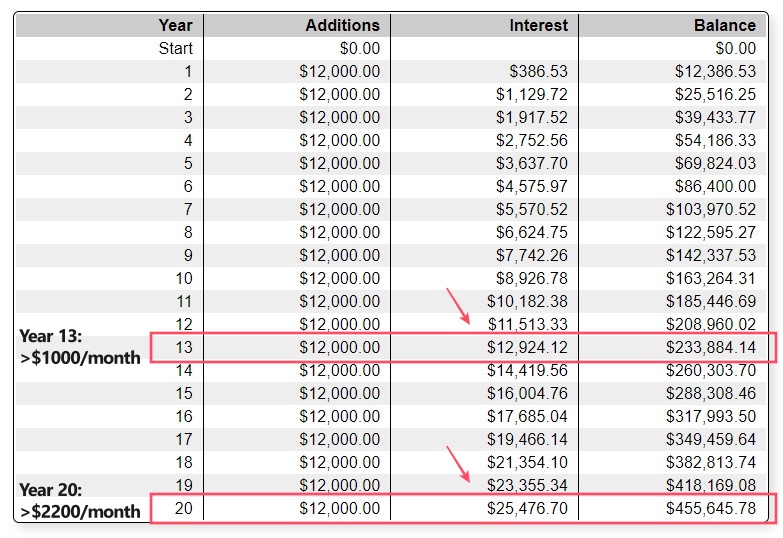

From the table below, with a $1,000 monthly contribution, it’ll take about 13 years for us to achieve more than $12,000 in yearly dividends.

By year 20, we’d be getting more than $25,000 in yearly dividends, which is more than $2,000/month!

Note: All tables/calculations are done using the Compound Interest Calculator from Bankrate.com

Lesson & Mindset: Aiming for small, achievable milestones

So, what are some key takeaways from this post?

- Capital is required to build a meaningful passive income via dividends. As an example, to achieve $12,000 in yearly dividends, a capital of about $200,000 is required at a 6% annual yield.

- That said, everyone can start building towards their desired dividend income even with small capital. Of course, the more capital we can contribute to our REIT portfolio, the faster we’ll be able to achieve our goals.

- It’s crucial that we reinvest our dividends. Letting our returns compound will make our dividend investing journey exponentially faster.

Now, while 13 or 20 years might seem to be a long journey, it is actually very realistic from the perspective of long-term investing. In this era, I think we are too ingrained in the idea of achieving something fast, that we forget the importance of growing our wealth step-by-step.

That said, it is helpful to break down our progress into small, achievable milestones, as shown below:

- Short-term milestone: $1,000 in yield per year

- Medium-term milestone: $1,000 in yield per quarter

- Long-term milestone: $1,000 in yield per month

By breaking down our goal into smaller milestones, it’ll make our investing journey much more meaningful. Below is the breakdown of each milestone using the same execution assumptions from the previous section:

(a) By investing $500/month, we can hit $1,000/year in dividend income by Year 4 and $1,000/quarter by Year 10.

(b) By investing $1,000/month, we can hit $1,000/year in dividend income by Year 2 and $1,000/quarter by Year 6.

The reward of compounding investment and patience?

A stream of reliable and passive income that requires almost no effort on our end – how awesome is that?

Resources: Want to learn more/invest in REITs & REIT ETFs?

There are 2 main ways to invest in REITs. One is to invest in individual REITs, and the other is to invest in REIT Exchange-Traded Funds (ETFs).

Both REITs and REIT ETFs are listed on the stock market and can be bought just like ordinary shares.

Useful resources:

- I’ve written an article on Singapore REIT ETFs, which I think you’ll find helpful. Check out my guide on Singapore REIT ETFs HERE.

- To start investing in REITs or REIT ETFs, you will need a reliable broker. Check out my full review of ProsperUs by CGS-CIMB HERE for more details.

- In addition, I’ve written multiple articles on REITs as well. Definitely check out my REIT articles HERE.

2 other REIT investing methods that I did not cover in this post

In this post, I’ve covered the simplest way to invest in REIT to build towards our dividend milestones:

By investing in REITs or REIT ETFs and re-investing the dividends, anyone can build towards a reliable passive dividend income to supplement their wealth.

Now, are there faster ways for you to achieve your dividend goals? Of course, there are!

Here are 2 other methods that I did not cover in this post:

#1 Taking margin financing to invest in REITs:

In simple terms, borrowing money to invest in REITs.

Just like taking a loan to buy physical properties, margin financing provides leverage to investors to own a bigger number of REITs with relatively small capital.

This can be a risky move as investors are exposed to the risk of margin call. Personally, I am not familiar with this approach and hence not able to write much about it.

#2 Covered Call Strategy:

This is an approach where investors can boost their dividend yield by selling call options on the stocks that they own to another investor.

That said, this approach involves options, which I personally have little knowledge of. I’ll study this further and cover this topic sometime in the future.

This post is sponsored by ProsperUs by CGS-CIMB.

Check out my full review on ProsperUs by CGS-CIMB HERE on how you can start your investment journey.

ProsperUs by CGS-CIMB is a regulated broker from Singapore that gives investors access to 30+ exchanges in more than 8 countries. (US, Hong Kong, China, Japan, UK, Singapore, Malaysia, Europe, and more!)

In addition, ProsperUs offers multiple instruments from stocks, ETFs, futures, options, Forex, and CFDs. This is great for investors looking to diversify across different asset classes.

Exclusive ProsperUs Referral Code – MONEY20

If you are thinking to give ProsperUs a try, here’s something exclusive to No Money Lah readers – you will not find this anywhere else!

From today till 30/6/2024, key in my exclusive promo code ‘MONEY20’ while you register, and get FREE cash credits up to SGD100 when you open a ProsperUs account:

Tier Initial funding within 30 days of account set up Trades Executed Cash Credits

1 Minimum SGD500 – SGD2,999 Minimum 3 trades executed SGD10

2 Minimum SGD3,000 – SGD14,999 Minimum 3 trades executed SGD20 (Deposit SGD3000 or more), OR

SGD20 + SGD30 (Deposit SGD3000 or more + Min. trades fulfilled)

3 SGD15,000 or more

Minimum 3 trades executed SGD20 (Deposit SGD3000 or more), OR

SGD20 + SGD100 (Deposit SGD15,000 or more + Min. trades fulfilled)

Click HERE to view the full T&C of this referral reward.

Open a ProsperUs Account Today!

Disclaimers

This article is brought to you in collaboration with ProsperUs by CGS-CIMB.

This post is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

This post may contain promo code(s) that afford No Money Lah a small amount of commission (and help support the blog) should you sign up through my referral link

Related Posts

November 12, 2020

Revealing My REIT Passive Income Portfolio!

August 18, 2019

5 MUST-KNOW Terminologies Before You Invest in REITs

Gearing refers to the leverage of a…

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.