Last Updated on April 11, 2024 by Chin Yi Xuan

Inflation is hitting us hard in life.

If you have been spending on everyday goods, I’m sure you’d have noticed that things are getting (a lot) more expensive.

As an example, in January, the average price of chicken in Malaysia rose by 13.6% from RM8.40/kg to RM9.54/kg compared to a year before. Furthermore, eggs and milk prices also went up by 13.5% and 3% respectively not too long ago.

Heck, my favorite chicken rice now costs 50 cents more.

Unfortunately, this is not an illusion.

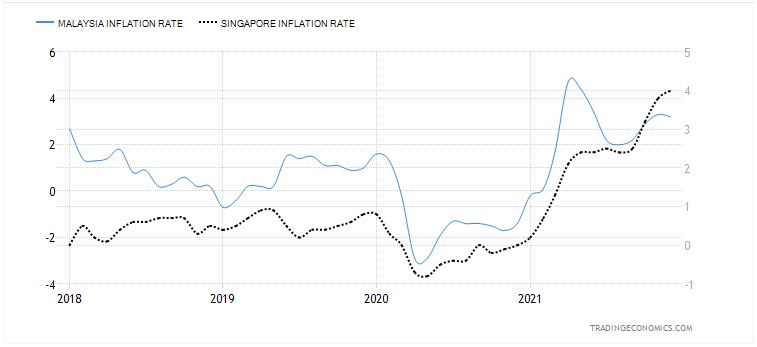

- In Malaysia and Singapore, we are experiencing the highest inflation in 4 years since 2018.

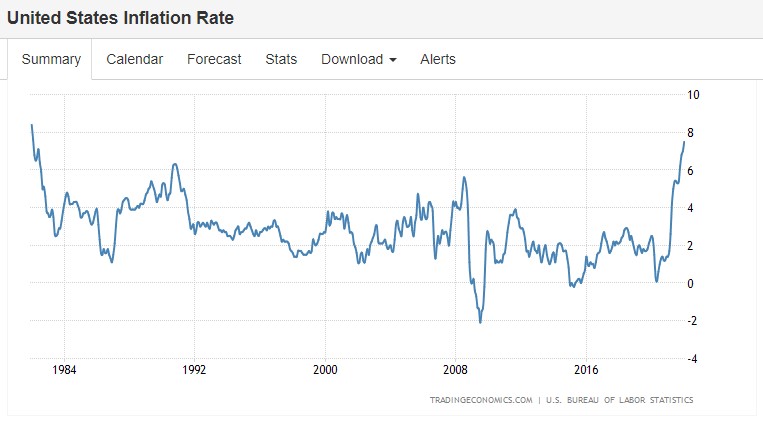

- Even crazier, the US recorded an inflation rate of 7.5%, the highest since 1982.

Isn’t this mad, given how our income hasn’t been able to keep up with inflation at all?

For sure, inflation will erode the value of our cash. So, the BIG question now is: how should we invest during periods of high inflation?

Let’s dive into the data – I am confident you’ll find it useful!

p

Table of Contents

A note before we start

Before we start, do note that I’ll be using data from the US because:

- The US is the largest market in the world, anything big that happens in the US creates ripples globally. These data will give us a good representation of what to expect.

- It is very hard to gather long-term data on various asset classes in Malaysia… so yeah.

Which asset classes perform best during inflation?

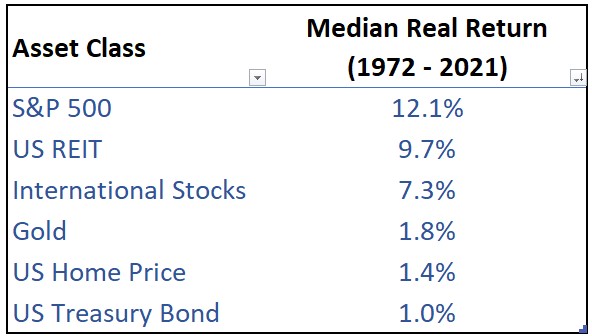

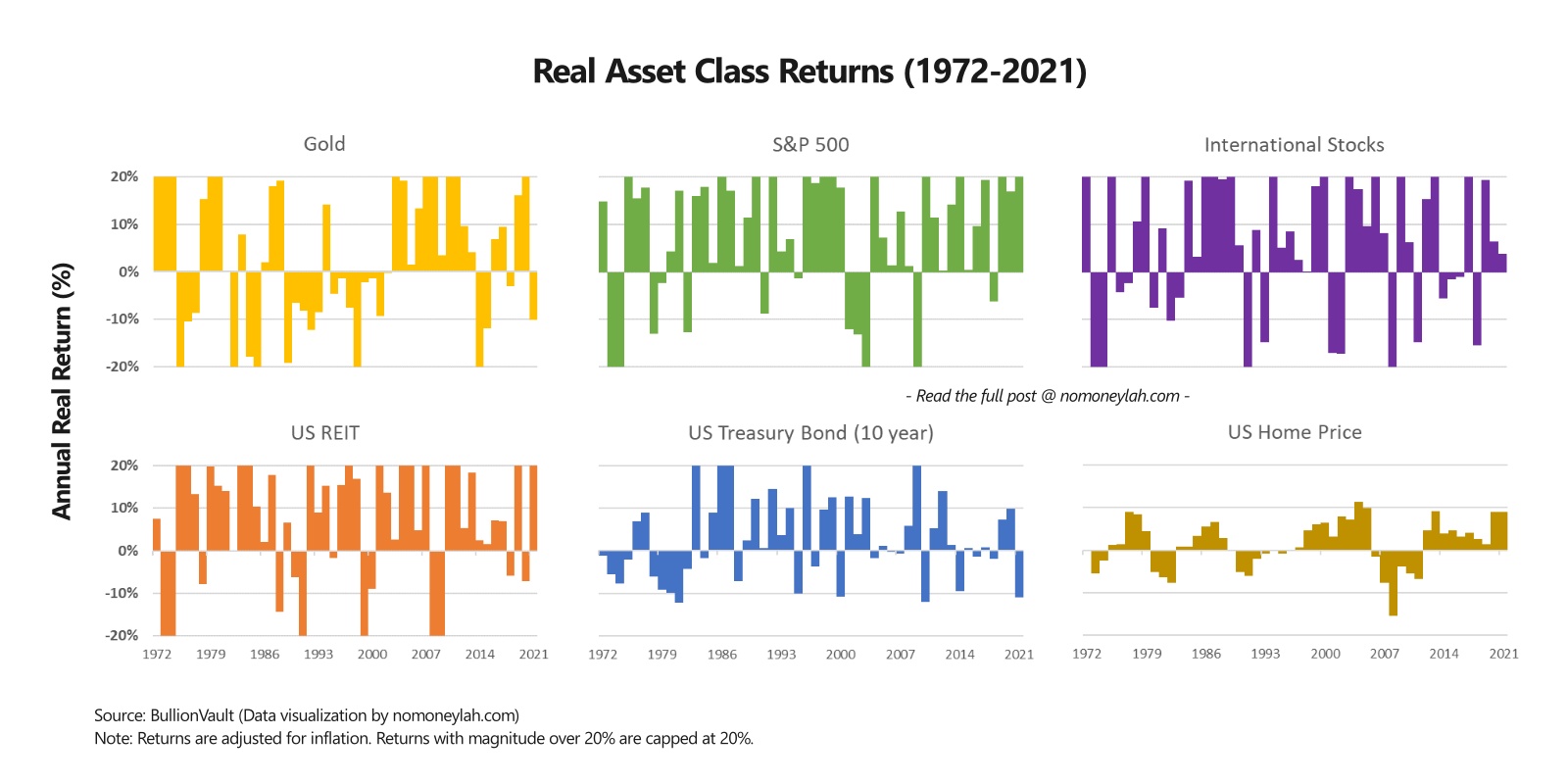

To begin, let’s look at the inflation-adjusted (‘real’) annual returns of 6 different asset classes from 1972 to 2021.

To ensure that you can visualize the performance of these assets, I’ve capped all returns at 20% (-20%):

Here are several key takeaways from the chart above:

- Firstly, you may notice is certain assets are more volatile (Gold, S&P500, International Stocks, REITs) than others (US Treasury Bond, US home price).

- Moreover, asset classes with higher volatility tend to achieve higher real returns compared to assets with low volatility. You can observe this clearer in the table below, where I summarize the median real return of all 6 asset classes from 1972 to 2021:

- As you can see, equities (S&P500, International stocks) and REITs come in top, followed by gold, and ending with US Treasury Bond, and US home prices.

The interesting thing about this table is gold. Despite the huge volatility of gold (big swings up & down), it produced a subpar real return. Even if we use average real return (instead of median), gold still failed to outperform equities and REITs. In other words, this tends to go against the assumption that gold is a superior hedge against inflation.

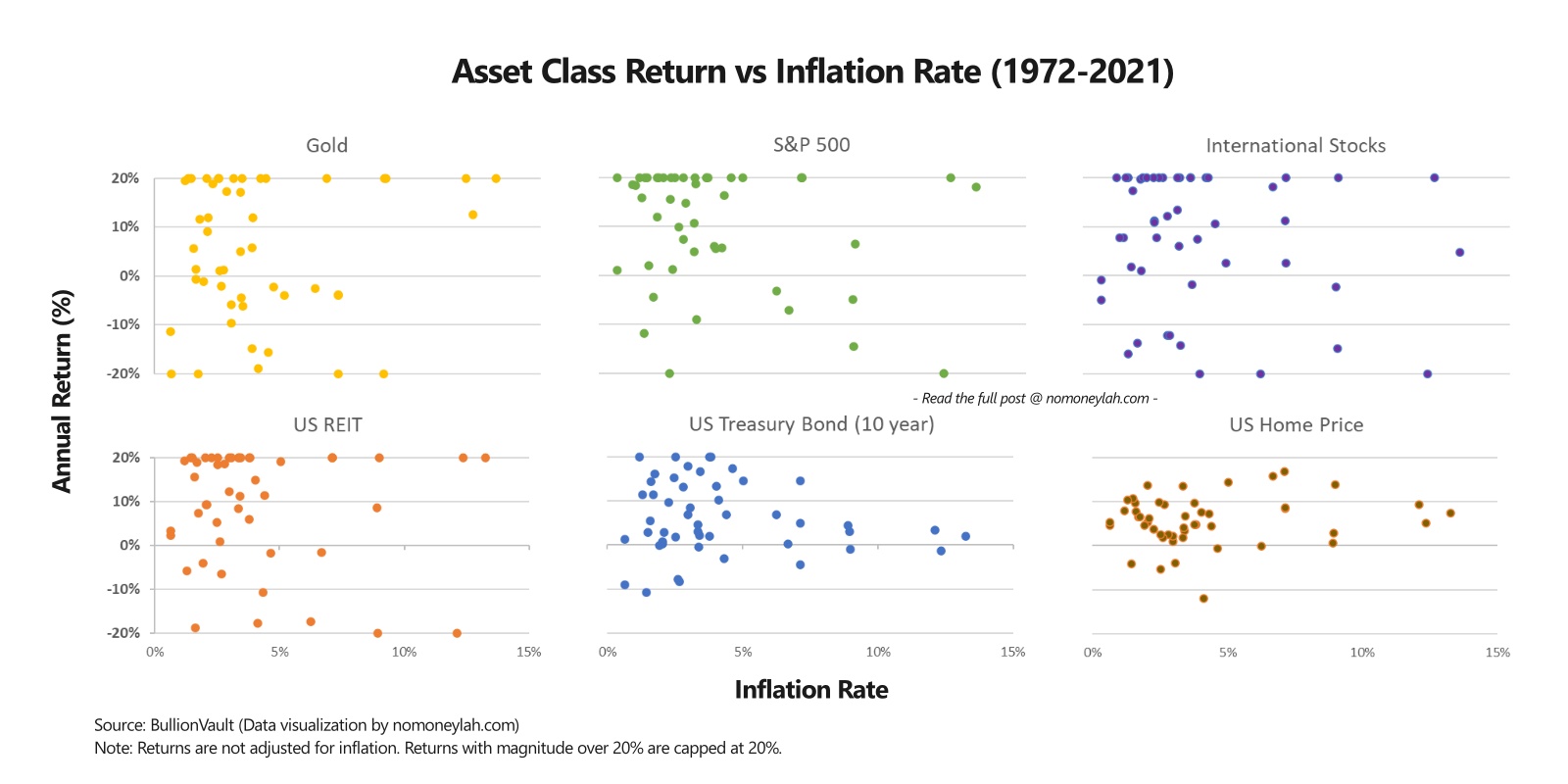

To dive further, I plot the non-inflation-adjusted returns of all 6 asset classes against the inflation rate from 1972 to 2021:

As you can see, the assets that performed the best against inflation (especially when it is higher), are also those that tend to be more volatile (S&P500, International stocks, REITs, gold).

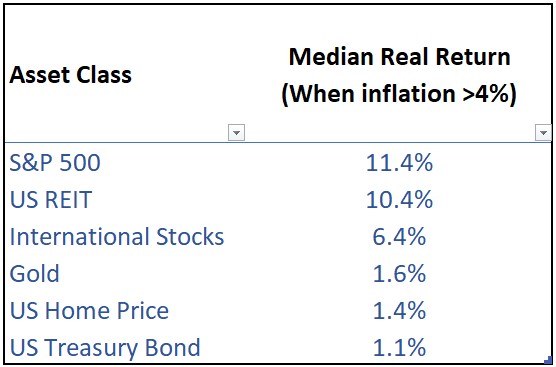

That said, volatility is just part of the story here. Reason being, if we filter the returns to only include years where inflation exceeds 4% (1973 to 1982, 1985, 1988 to 1991, 2008, 2021), gold still fails to impress:

In other words, gold might not be a superior inflation hedge as many assumed it’d be.

What should an investor do during high inflation?

So, what should most investors do when inflation is rising?

According to data: Buy equities, REITs, or physical real estate.

From what we’ve seen so far, we can interpret that equities (S&P500, International stocks), and real estate (REITs, housing) tend to preserve their value, even during periods of high inflation.

- In a way, this makes sense because these equities, REITs, and real estate are all based on monetary payments made to businesses or landowners. Hence, when payments go up during inflation, the value of these assets should go up as well.

- Generally, businesses are able to preserve their value during inflation as they can pass on inflation (through higher prices) to customers (that’s us, lol). This may not be true for all businesses, but inflation isn’t as scary for stocks as you might have thought it’d be.

- As for investment in physical properties, if your mortgage is FIXED instead of floating, then you are in a good place to be a debtor during high inflation periods.

- Why? Because with inflation, the value of your fixed payment (eg. RM2000/month) will shrink in real terms (a.k.a. when adjusted for inflation) with time. Again, FIXED mortgage payment, not floating.

In comparison, assets that offer fixed payments to investors (eg. Bonds) tend to underperform during high inflation periods.

- With inflation, the value of each fixed payment eroded, which impact the overall value of bonds as well.

Is Crypto a good hedge against inflation?

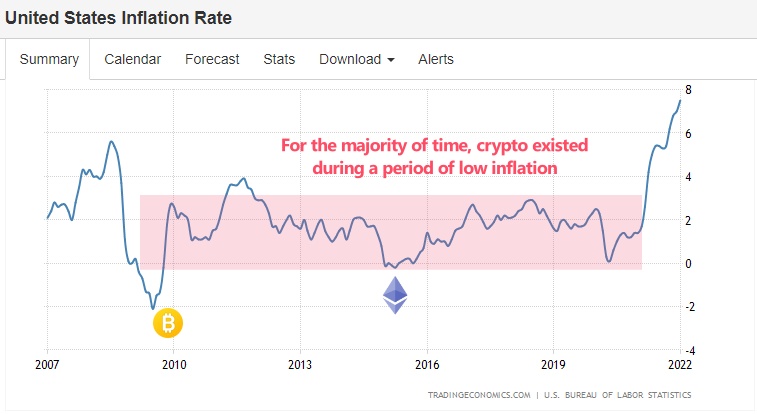

So, are cryptocurrencies like Bitcoin, Ether (ETH), and Ripple (XRP) good hedge against inflation?

To be honest, we have no clue due to a lack of data. Since cryptocurrencies only existed mainly during times of low inflation (2009 onwards), it is hard to tell what they will do now that inflation is on the rise.

Since there is no historical reference on crypto, a good gauge for a crypto investor to ask is: Does the crypto provides value to the owners? If you think it provides value (yet it is still undervalued), and such value continues to rise, then it may have a chance to outperform inflation.

Verdict: The One Thing that Always Outperforms Inflation

Regardless of stocks, real estate, gold, or crypto, there is one thing that will always protect your wealth against inflation – own things that provide value to humans.

If you own things that people want, no matter what’s happening in the world, the assets you own will likely retain their value (and even better, grow in value).

Hence, the question that you should focus on and ask is: are you owning assets that provide value to people?

If you find this post insightful, consider subscribing to my FREE newsletter.

Useful Resources

If you find this post insightful, here are several useful resources to get you going:

- Guide: How to invest in the S&P500

- Guide: How to invest in Singapore REIT ETF for consistent dividends

- Guide: How to make $1,000/month in passive income via REIT investing

This post is sponsored by ProsperUs by CGS-CIMB.

Check out my full review on ProsperUs by CGS-CIMB HERE on how you can start your investment journey.

ProsperUs by CGS-CIMB is a regulated broker from Singapore that gives investors access to 30+ exchanges in more than 8 countries. (US, Hong Kong, China, Japan, UK, Singapore, Malaysia, Europe, and more!)

In addition, ProsperUs offers multiple instruments from stocks, ETFs, futures, options, Forex, and CFDs. This is great for investors looking to diversify across different asset classes.

Exclusive ProsperUs Referral Code – MONEY20

If you are thinking to give ProsperUs a try, here’s something exclusive to No Money Lah readers – you will not find this anywhere else!

From today till 30/6/2024, key in my exclusive promo code ‘MONEY20’ while you register, and get FREE cash credits up to SGD100 when you open a ProsperUs account:

Tier Initial funding within 30 days of account set up Trades Executed Cash Credits

1 Minimum SGD500 – SGD2,999 Minimum 3 trades executed SGD10

2 Minimum SGD3,000 – SGD14,999 Minimum 3 trades executed SGD20 (Deposit SGD3000 or more), OR

SGD20 + SGD30 (Deposit SGD3000 or more + Min. trades fulfilled)

3 SGD15,000 or more

Minimum 3 trades executed SGD20 (Deposit SGD3000 or more), OR

SGD20 + SGD100 (Deposit SGD15,000 or more + Min. trades fulfilled)

Click HERE to view the full T&C of this referral reward.

Open a ProsperUs Account Today!

Disclaimers

The assets mentioned in this post are represented by:

- US Stock Market: The S&P500 index

- Bonds: US 10-year Treasury Bond

- International Stocks: MSCI EAFE (Europe, African, Far East) Index

- REIT: FTSE NaREIT All REITs total return index

- US Home Price: S&P/Case-Shiller Home Price Series

- Gold

This article is brought to you in collaboration with ProsperUs by CGS-CIMB.

This post is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

This post may contain promo code(s) that afford No Money Lah a small amount of commission (and help support the blog) should you sign up through my referral link.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.