Last Updated on October 17, 2022 by Chin Yi Xuan

So, I’ve decided to create my own will at 28.

The idea of dying is a scary one – but it’s the only certain thing in life.

In this post, let’s explore will writing in Malaysia:

How does a will work? Is will-writing complicated? How much does it cost? What do you need to know while looking to create your own will?

Let’s find out!

p

Table of Contents

Useful terms used in will-writing:

- Estate: Property and assets of a person after he/she passes away

- Executor: The person that you appoint legally to execute your will

What is a will?

A will is a legal document where you decide what happens to your assets (or ‘estate’) once you pass away.

Essentially, through a will, you get to legally appoint someone as an executor of your will to ensure that your assets go to the appropriate people.

“Haiya, I don’t own a lot of things so I do not need a will.”

“I am still young so I do not need a will yet.”

Regardless of how many assets you own or your age, a will is still an important document to own. This makes sure that your assets get distributed smoothly to the people you care for after you pass away.

In Malaysia, there are 2 types of will: Wasiat for Muslims and Will for non-Muslims. For this post, I will focus namely on my research and personal experience on will-writing as a non-Muslim. Feel free to find out more about Wasiat HERE.

Why I write my will at 28 (+ when you should write a will)

From the surface (or from movies & dramas), writing a will seems to be done by the super-rich people with a lot to pass down.

In fact, writing a will is such a taboo in Asian families. I recalled a story where my grandparents (when my grandfather was still alive) were actually angry when the topic of will-writing is being raised in the family.

Ironically, writing a will isn’t so much for the people that write it. It’s for the people that they care – where they do not have to go through sh*t in order to distribute the assets of the deceased (more on this in the next section).

Personally, I am by no means super rich. But I am lucky to have accumulated some assets from my working years so far.

Hence, it’s only responsible that I have my own will so my family does not need to go through the trouble (mentally + legally) to get my assets if I die one day.

So, when should you write a will?

Just like investment & retirement planning, writing a will is part of personal finance. It is an aspect that you should not ignore – not for yourself, but for the people that you care for.

As such, the best time to write a will is when you start to own assets like cash, stocks, properties, business, and so on.

More so, you should seriously consider creating a will if you have a family that depends on you.

Why is a will important? (+ what if we die without a will)

A will is important because it acts as a legal document that determines how your assets get distributed.

Without a will, a combination of all of the scenarios may happen after your demise:

#1 Family members fighting over the inheritance of your assets

A legal will help avoid any potential family feuds or drama upon your demise.

#2 You don’t get to decide on the inheritance of your assets

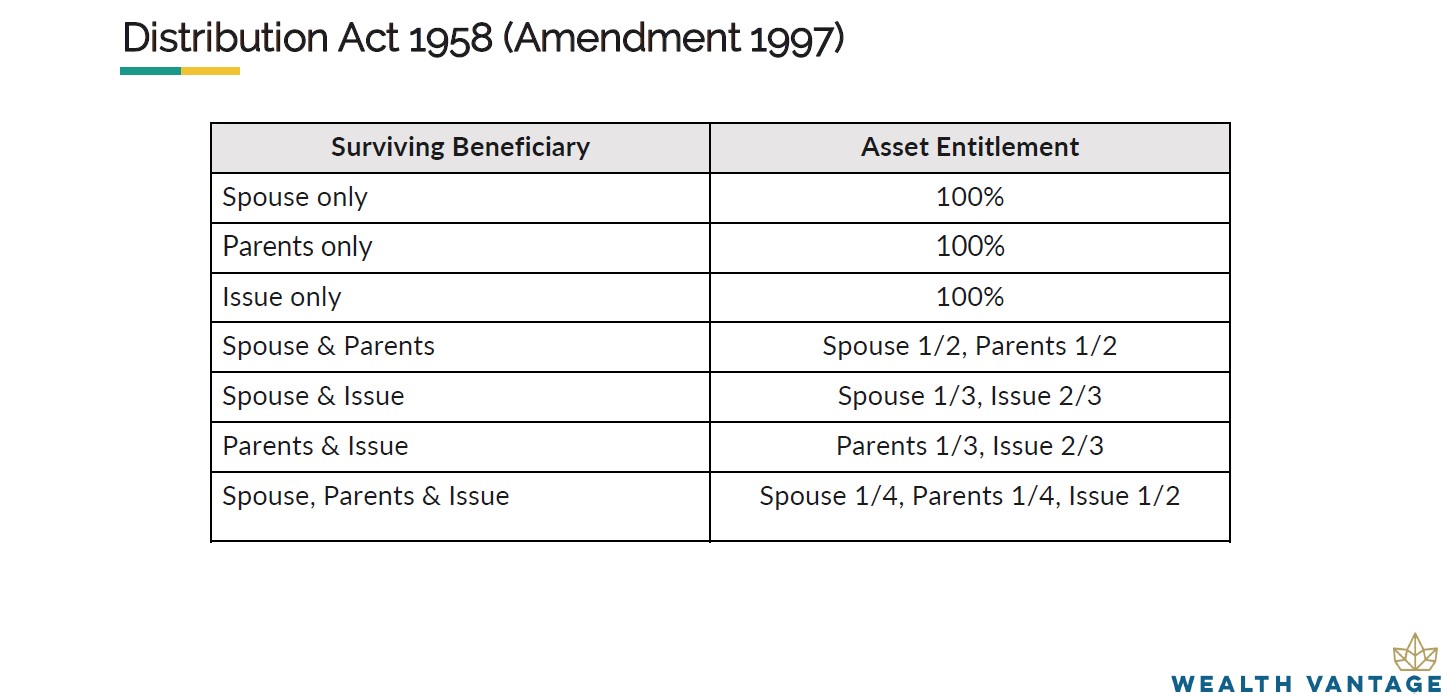

If you die without a will, your assets will be distributed according to the Distribution Act 1958 (refer to the table below). This means you will never get a say on how your assets get distributed.

#3 It will take a LONG time for your assets to be distributed to the people you care

Without a will, it may take years for your assets to be distributed due to all the additional legal procedures involved. This will be a problem especially if you are the breadwinner of your family and your dependents are not able to access your assets.

Where to write a will?

Method #1: Write a will on your own for free (not recommended)

You do not need special qualifications to write a legally-binding will on your own.

The Malaysian Wills Act 1959 has very simple requirements for a legal will. Namely, it must be signed by you and two witnesses who cannot be beneficiaries. However, unless you have extremely simple wishes, it may not be easy to clearly list all the ways you may want to distribute your assets.

You can also write a will for free via the templates provided on sites such as Tokio Marine. Again, this is more suited if you have a very simple requirement.

Also, bear in mind the legal technicalities that your executor will need to go through to execute your will. In addition, this method does not provide you with the facility to store your will.

Method #2: Write your will via will-writing services

Will can also be created via will writing services. This is a good choice if you plan to create a more detailed will. Many will-writing companies will also guide you through the will-writing process.

In addition, will-writing services usually come with the option to appoint a professional will executor and custody to secure your will at additional charges.

Examples of will writing services in Malaysia are:

- Rockwills

- Maybank Trustee Berhad

- CIMB Trustee Berhad

- Amanah Raya Trustee

To be honest, I have no idea which will-writing service is the best for my needs. Price is one consideration, but the quality of service is also crucial. Hence, I moved on to Method #3 when I plan to write my will.

Method #3: Will writing guidance from Personal Financial Planner

With so many will-writing services available, which is the best for you? How can you create a will that meets your needs, yet fulfills your budget?

If you need non-bias guidance in estate planning (including will writing), engaging a financial planner can be highly helpful.

Personally, I’ve gotten guidance from my financial planner from WealthVantage Advisory, Stev when it comes to creating my will. The benefits of creating my will with the guidance of my financial planner include:

- Unlike agents, financial planners are not attached to a single will-writing company. Hence, they can help clients to search for the most suitable will-writing service that best serves the needs of clients.

- Financial planners are also licensed in estate planning, which includes will-writing. This means they have all the knowledge to guide clients through the will creation process.

- Since my financial planner, Stev, has been working with me on all aspects of my finances, he’ll have a clearer idea of my financial situation (eg. My goals, assets, liabilities). This makes it much easier for us to work on the will creation.

Through Stev’s guidance, I’ve decided to create my will via Rockwills.

We are in the midst of getting my will done so I’ll update this article as it goes!

[FREE PERK] Get a FREE financial consultation session today and see how a financial planner can add value to your financial journey – including will-writing! Scroll till the end of this article for more info!

Will-writing process (UPDATED: My overall experience now that I am done!)

In this section, let’s explore the step-by-step process of will creation. Under the Wills Act in Malaysia, anyone with the basic requirement below can write a valid will:

- At least 18 years old at the time of writing the will.

- In a sound mind.

- A will that is produced in writing and signed.

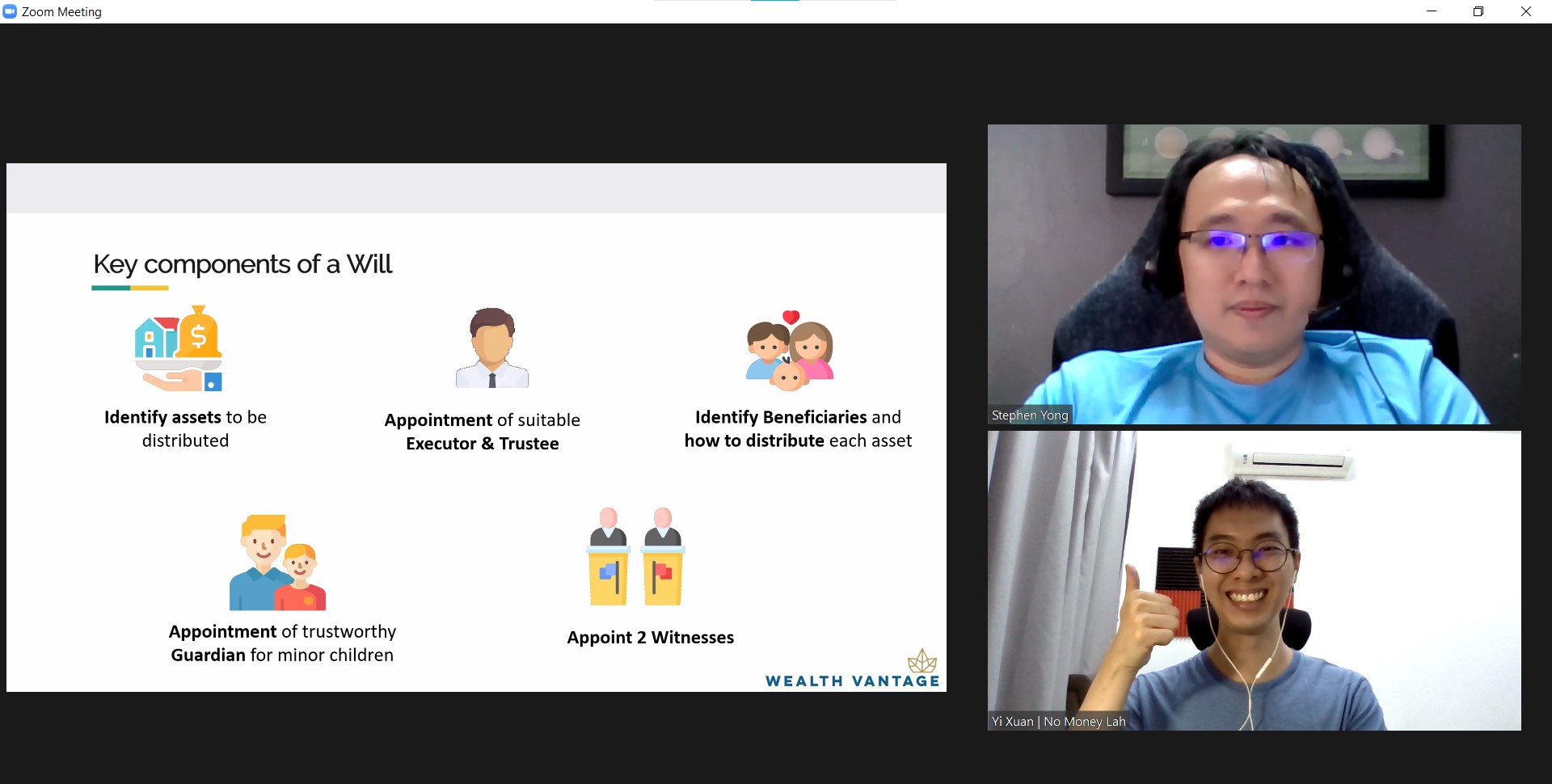

Step 1: Identify assets to be distributed and your beneficiaries

Firstly, identify the assets that you own. Assets can be things like:

- Movable assets: money, stocks, PRS, and EPF.

- Immovable assets: properties or land.

- Alternate assets like cryptocurrencies.

In the meantime, you should also consider how you wish for the assets to be distributed. Identify your beneficiaries and collect their names & IC numbers.

[Side note] Since cryptocurrencies like Bitcoin don’t leave a trail, it is best to include instructions on how to access them in your will.

Step 2: Appoint your executor

Next, appoint a legal executor of your will. An executor’s role is to make sure that your will is carried out accordingly.

An executor is anyone that is 18 years old or older. You can appoint up to 4 executors, though that is not necessary.

Specifically, an executor will need to:

- Identify and locate your will

- Apply for grant of probate from the court. When a person is granted the grant of probate, he/she is legally allowed to administer your assets upon your death.

- Identify the list of your assets.

- Pay off any of your debts/liabilities & taxes.

- Distribute assets as per your will

Throughout this process, your executor will also take the role of a trustee. Essentially, a trustee is responsible to hold your assets (and keeping a proper record & account of them) on behalf of your beneficiaries until the distribution is completed.

Good to consider:

Now that you understand the role of an executor, it might not be a good choice to appoint your family members or best friend as an executor.

Why?

Because dealing with the work of an executor is a real burden when you consider that the people close to you would be grieving when you pass away. Furthermore, the work can be complex, and not everyone has such expertise to handle the tasks.

As such, it might be a better choice to appoint a professional executor from a will-writing company (eg. Rockwills) as they have the expertise needed to deal with the workload of an executor.

[Side Note] For completion’s sake, an executor can also be the beneficiary of your will. However, as mentioned above, it might not be a good choice to appoint someone close to you as an executor due to emotional and expertise reasons.

Step 3: Appointment of guardian

If you have children under 18, you will have to appoint a guardian for them. This person will take care of your children in the unfortunate event that both you can your spouse pass away until they turn 21 years old.

If you don’t appoint a guardian, it will be up to the court to name someone that they think is appropriate.

Step 4: Create your will + Appoint 2 witnesses

Now that you gathered all the information needed, you can proceed to create your will through online will-writing services or a trust company (eg. Rockwills).

If you engage a financial planner like myself, they will provide you with an unbiased opinion on which will-writing company to go with.

Once your will is created, you will have to sign the will in the presence of 2 witnesses. A witness must be anyone 18 years old and above who is NOT your spouse or beneficiary.

[Side Note] From my understanding, due to the pandemic, this process of will-signing with witnesses around does not need to happen in a physical setting and it can happen virtually.

Step 5: Keep your will in a safe place

That it! Now that your will is created and signed, keep your will in a safe and secured place. Also, you should let your appointed executor know where you place the will.

Normally, if you go with any will-writing services (eg. Rockwills, Maybank Trustee), you’ll be given the option to store your will safely under the custody of the company. I’d recommend doing so, as you’ll ensure that your will is safe from being damaged or tampered.

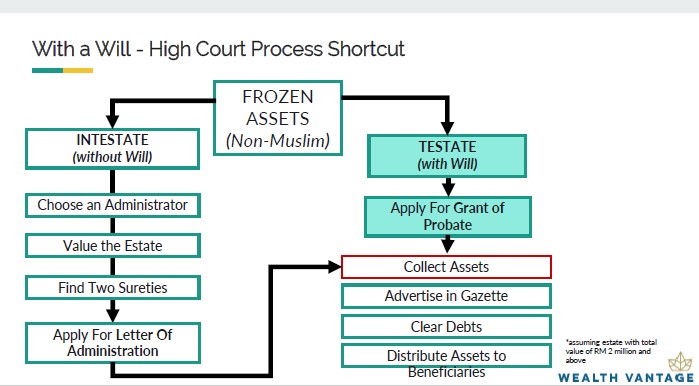

What happens after you die with a legal will?

Curious about how a will is executed in the event of your death? Here’s how:

When you pass away, your assets will be frozen. With a legal will, the executor of the will then has to go on with the following steps:

- Identify and locate your will

- Apply for a grant of probate from the court. When a person is granted the grant of probate, he/she is legally allowed to administer the assets of the deceased. This is the key to speeding up the process of asset distribution to your beneficiaries.

- Identify the list of your assets.

- Advertise in Gazette (ie. Posting on newspaper/social media)

- Pay off any of your debts/liabilities & taxes.

- Distribute assets as per your will

As you can see, if you die without a will, there will be no legal executor to apply for grant of probate. This results in a long and tedious process in an effort to get your assets distributed.

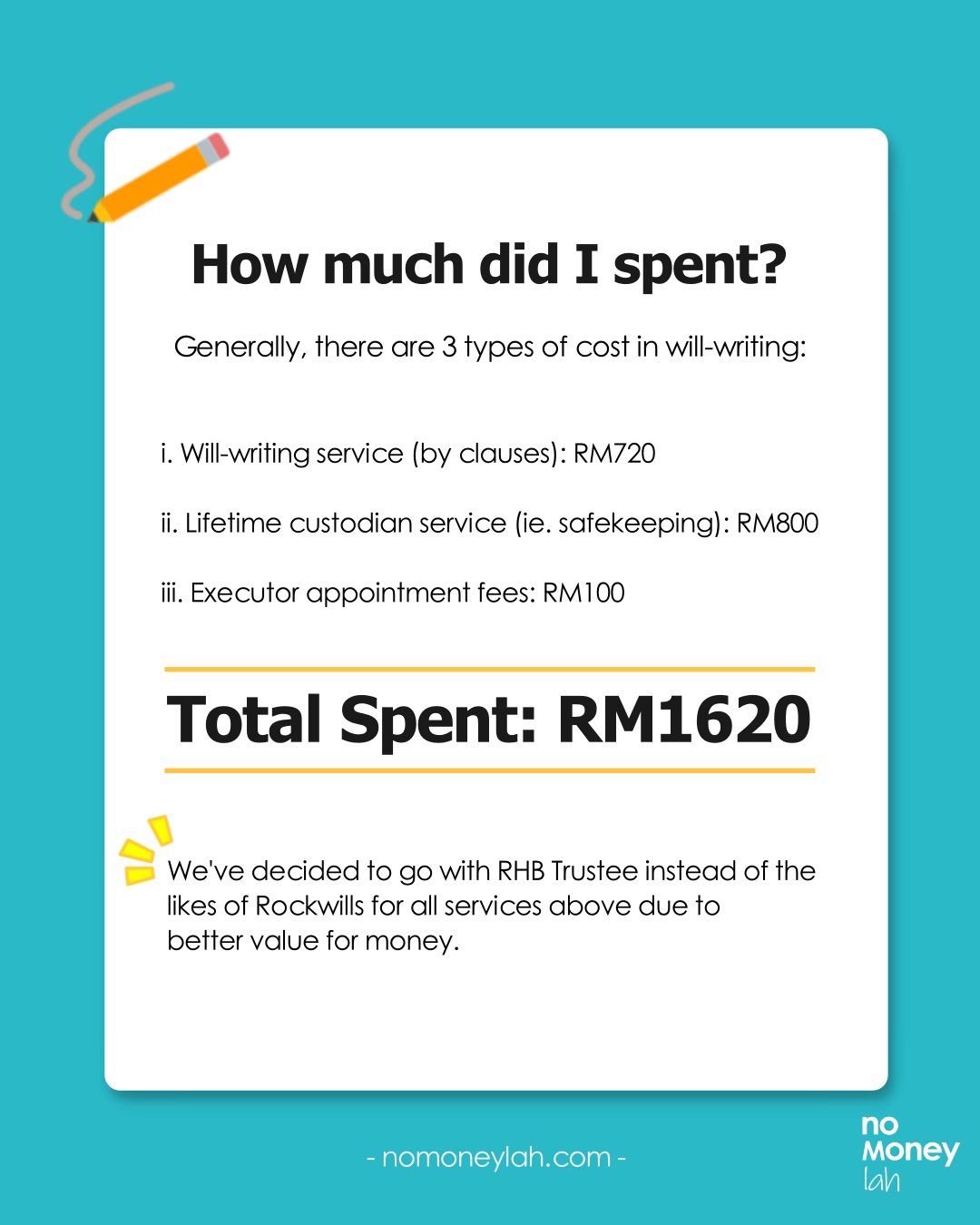

The cost of writing a will (UPDATED: How much did I spend?)

There is no one fixed cost for will-writing as everyone’s needs/wishes are different.

Below are a few elements that go into the cost of will-writing. Do note that this is a rough estimation based on my observation – please refer to the respective source for the most accurate pricing:

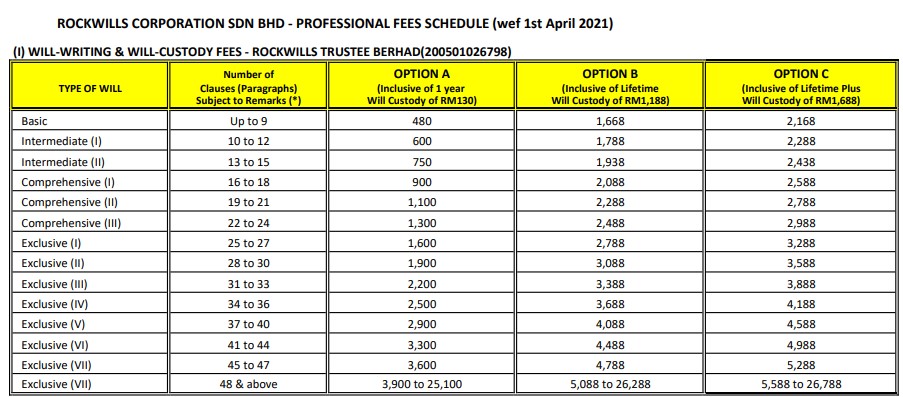

Cost #1: Creating a will

Creating a will is free if you use platforms like Tokio Marine or write your own will.

That said, I’d highly recommend that you consider going with will-writing services. Price usually starts at RM300+ via will-writing services depending on the number of clauses. Rockwills, for example, starts with a basic 9 clauses package. Then, the more clauses you have, the higher the cost.

Cost #2: Custody service to store a will

You can certainly skip this cost by keeping your will in a place where you feel safe (from being damaged or tampered).

Otherwise, will-writing services like Rockwills and Maybank Trustee would normally offer lifetime custody of your will at about RM900 – RM1000+.

Cost #3: Appointment of a professional will executor

You are free to select anyone as an executor.

However, due to the complex legal work that an executor needs to do, I’d highly recommend going with professional executors like the ones offered directly by will-writing companies.

Usually, it’s a one-time payment, starting from RM100+.

How much did I spend?

After taking into account all the costs above, I spent a total of RM1620 for my will.

Me and my financial planner, Stev decided to go with RHB Trustee instead of the likes of Rockwills due to better value for money.

Will-writing FAQs

Where should I keep my will?

Will-writing services would usually offer additional custody service for your will at an additional charge.

Otherwise, you should look for a safe place to store your will – make sure to let your executor knows where you are placing your will!

Can I change the details/clauses of my will?

Yes, you can change the details of your will anytime. That said, if you use will-writing service, there is usually a charge depending on how many clauses you are changing within the will.

Can a will become invalid?

You can revoke your own will whenever you wish. A will is revoked/become invalid when:

- A new will is written, whereas the old will is going to be revoked automatically.

- Alternatively, you can revoke a will without writing a new one by making a written statement in the presence of 2 witnesses.

- Marriage or remarriage. Divorce does not automatically revoke a will.

- A will is physically destroyed by you with the intent to revoke it. Do note that accidental destruction by a third party will not revoke a will.

- A non-Muslim who converts to Islam, his/her will becomes invalid. Reason being, estate distribution will automatically follow the Faraid distribution method.

Get Your First Financial Consultation Session Today – FREE OF CHARGE!

Personal finance is a huge topic. It includes investment, savings & retirement, insurance, and yes, estate planning like will-writing.

If you are planning to get guidance in all aspects of your personal finance, this is for you:

I am working together with Wealth Vantage Advisory to bring a FREE Financial Consultation Session to all No Money Lah’s readers!

When you sign up for this FREE consultation session, you will learn more about your overall financial state. Not only that, you can gauge if a Financial Planner is going to add value in the pursuit of your financial goals.

Regardless, it is 100% FREE and you have zero obligations to take up the service if it is not suitable for you. Plus, you are doing your finances a favor for the year to come!

You can sign up for your FREE financial consultation session by clicking on the button below.

Sign Up for Your FREE Consultation Session Here!

Disclaimers

This article is made possible through a collaboration with Wealth Vantage Advisory. Special thanks to Stev and the team for making this collaboration such an impactful one.

Wealth Vantage Advisory did not receive copy approval rights on this article – that means they are reading this article for the first time, right alongside you. 🙂

p.s. This post contains affiliate links, which afford No Money Lah a small referral if you sign up for any paid services.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Hey, Yi Xuan! Thank you for the insightful post. As a matter of fact, my friends and I were just talking about will writing yesterday and highlighted the importance of doing so. Very timely piece!

Hi Michelle!

Thanks and glad that this post found its way to you at the right time! Indeed writing a will is important, especially once we start to accumulate assets and have people dependant on us!

Regards,

Yi Xuan

Thank you for this .

It is good that you do this at a young age. I dont think most people will blog about this issue.

Even some people i know at 60 haven’t done this or even i tell them to, they never listen and drag and drag.

maybe they think it is a taboo. but anything can happen (Especially you see these days and all the netflix series about people dying all the time, haha) .

I am a foreigner with assets in here and i have done so (just in case) in both overseas and also malaysia.

Indeed will-writing is a taboo, especially among Asian families!

My grandparents actually got angry when we brought this up many years ago

Hopefully this mindset can improve with time + people getting more financially literate!

Hi Yi Xuan. Very interesting article. I don’t know why older people don’t like the idea of will and think you want to curse them to death if you pursue them to write a will. But a will only deals with when you die. But what about when you are incapacitated? If your love ones is incapacitated, how can you access the finance to finance their medical and care bills?

Hey Kam Yoong!

Thanks for reaching out and glad that this post found its way to you! I think for your context it’d be more on insurance coverage instead of will already. ie. Buy medical card to take care of medical cost and Personal Accident (for addidental cases) and/or critical illness (for cancer) protection to cover daily life expenses as income replacement.

Definitely consult with a financial planner on this matter!

Regards,

Yi Xuan

Hi. Yi Xuan. Thanks for the sharing. However may I know whether RHB Trustee

will impose 0.1% on total of assets value when they help you to run as executor to distribute your assets to the nominees?

Please advice. Thanks again.

Hi Rachel, yes i can verify that RHB Trustee will charge a fee ranging from 0.5% – 1.0%

Regards,

Yi Xuan

Hi Yi Xuan,

Do you mind PM me the contact details to your RHB Trustee representative? I tried leaving my details on their website but have not received any update after 3 week.

Thanks in advance!

Regards,

James

Hi James!

Thanks for reaching out! Just to understand, when you mention ‘their website’, which website are u referring to?

Regards,

Yi Xuan

Hi Yi Xuan,

From RHB Trustee website.

Regards,

James