Last Updated on May 17, 2022 by Chin Yi Xuan

It has not been a good time if you are investing in 2022.

As of Friday (13/5), the US stock market (ie. The S&P500 index) is down by over 16% from all-time highs. Meanwhile, the tech-focused Nasdaq 100 index is down by about 25% from its high.

Personally, my growth-focused Exchange-Traded Fund (ETF) portfolio dropped over 14% in the past 3 months.

In addition, a portion of my dividend-focused ETFs in the Freedom Fund has shed about 14% in value so far:

Seeing my investments down to this extent is not pleasant, but it is not the end of the world either.

Seeing my investments down to this extent is not pleasant, but it is not the end of the world either.

In this post, I want to share with you several important insights on the stock market – and hopefully, this will boost your confidence to stay the course in this long game!

If you like this post, consider subscribing to my FREE weekly newsletter where I’ll share all things I learn about personal finance & investment with you!

p

Table of Contents

#1 A bear market is not forever

Technically, a bear market is described as a market dropping over 20% from the all-time high.

While we are not there yet for the S&P500 index, I think we are close enough for me to call a bear market right now.

I can’t tell for sure how long a bear market will last – but they do come to an end eventually. Let’s take a look at the history:

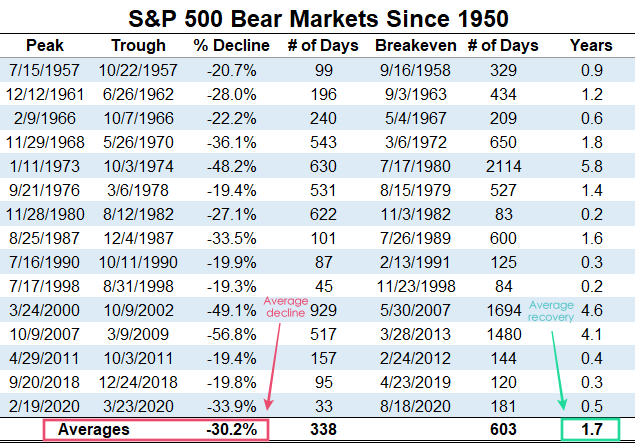

Over the 15 bear markets in the past, the average decline was about 30%, where the market generally took under a year to reach the bottom.

The recovery from the bottom? On average, a little more than 1 ½ year.

- That said, the last 3 bears recovered relatively quickly.

- 8 out of the 15 bears recovered within a year.

- The worst bears were in 1973-1974, 2000-2002, and 2007-2009 which all took more than 4 years to recover.

I’m not certain how this one will play out – but as you can see, the market always recovers.

#2 Win by staying invested for the long term

For the last 95 years (1926 – Feb 2022), the US stock market (S&P500 index) has produced an average of 10 – 11% annually.

In fact, there has never been a 20-year period in the market where it is down on a nominal basis:

In other words, if you have a long-term time horizon, you are almost certainly going to see gains with your investments.

In other words, if you have a long-term time horizon, you are almost certainly going to see gains with your investments.

#3 Why does the market go up in the long run?

Why does the stock market go up in the long run?

One of the biggest reasons is because the economy grows and companies earn more money.

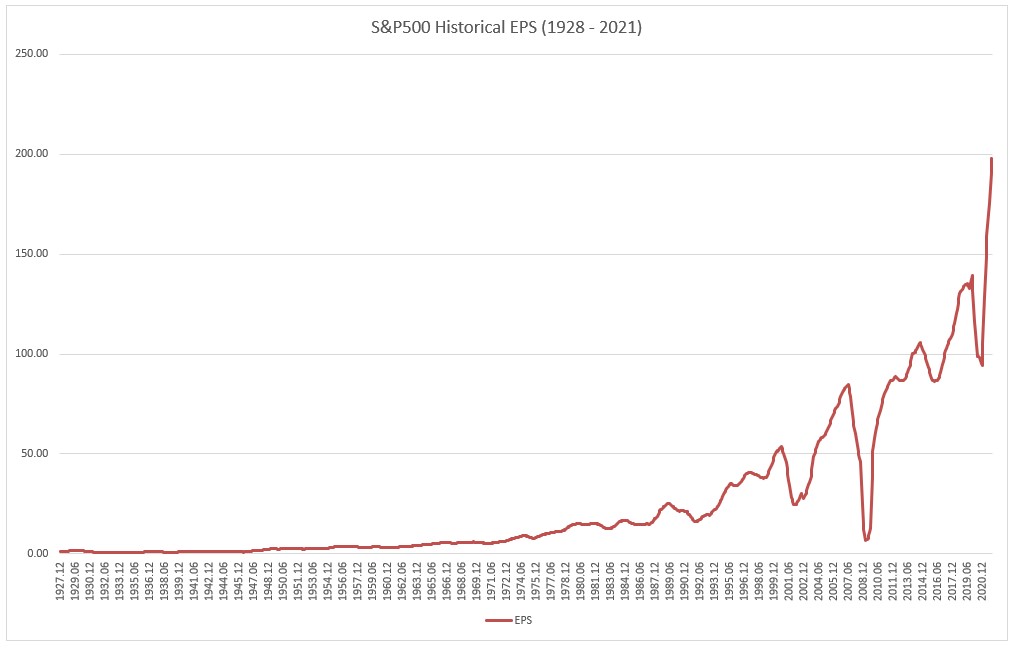

In the 1920s, the earnings per share (EPS) for the S&P 500 was $1.11 while companies paid out $0.78 per share in dividends.

By the end of 2021, those numbers were $197.87 and $60.40 respectively.

Simply put, over the past 90+ years, earnings on the US stock market have grown by 6% annually, while dividends have grown 5% per year.

When you invest in the stock market, you are investing your money in assets that produce income on your behalf. This means you get to participate in the growth and innovations that come with it.

My Bear Market Survival Guide

If you are feeling miserable from this bear market, hopefully what you’ve read so far can give you a big picture perspective on your investing journey.

Below are 3 things that I’m personally practicing in this bear market:

#1 Stick to a long-term investment routine

Having an investment routine helps especially in times of chaos.

Since I cannot predict when a bear market will end, I will continue sticking to my investment routine (ie. Dollar Cost Average X amount monthly) knowing that I will be buying income-producing assets at a discount.

Remember, the market favors those who stay on course in the long run.

#2 Never invest the money you need in order to gain something you want

This is so important:

Avoid investing in such a way that your ability to put food on the table depends on the returns of your investments in the coming month:

- We cannot tell when a bear market will end.

- A new low can go lower!

- A bear market may lead to a recession – don’t use the money you saved up for rainy days to invest!

#3 I will not let my investment performance affect how I look at myself

Your life is not defined by your investments. Neither is net worth because it is a poor definition of success in life.

Reflect and find meaning in your life outside of your portfolio. Eating and living healthier is a good place to start.

Useful Resources & Guide

- How to invest in the S&P500 index as a non-US resident.

- ETF investing guide – getting started!

- Learn dividend investing

Disclaimers

This post is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

Related Posts

January 13, 2022

Malaysian’s Guide to Invest in ETF

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

I like this part ‘Your life is not defined by your investments. Neither is net worth because it is a poor definition of success in life. Reflect and find meaning in your life outside of your portfolio’. Sagacious.

Hi Puva,

Thanks for your kind words and I’m glad that this post found its way to you!

Hopefully this post is helpful! 🙂

Regards,

Yi Xuan