Last Updated on April 30, 2023 by Chin Yi Xuan

If you are looking for a better savings alternative to Fixed Deposit (FD), Versa Cash from Versa is an excellent cash management solution that I reviewed last year.

Since then, Versa Cash has been my go-to app to store my savings.

This year, Versa has introduced Versa Invest – the latest investment solution designed to beat the market!

What do I mean by beating the market – or rather, how? In this review, let’s find out more about Versa Invest!

p

Table of Contents

What is Versa Invest + Safety of funds

Versa Invest is a new investment solution within the Versa app that offers users diverse access to top funds globally with just a single investment.

Versa Invest is a partnership between Versa and Affin Hwang Asset Management (AM). In other words, all Versa Invest portfolios are designed & managed by the fund managers from Affin Hwang AM.

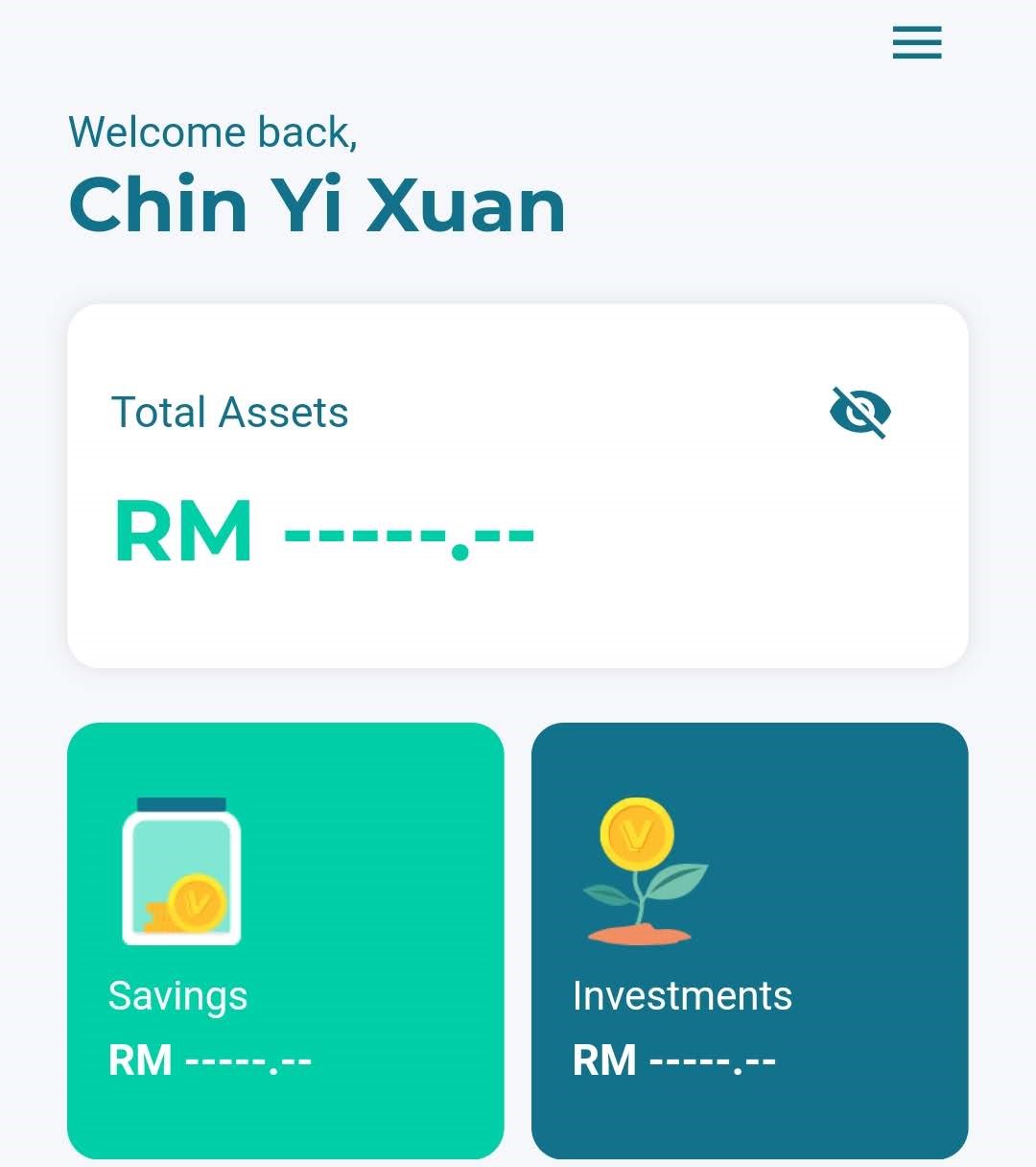

As a result, you can manage both your savings (via Versa Cash) and investments (via Versa Invest) in just a single app within Versa.

Regulation & Safety of funds

As a company that provides financial services, Versa is regulated by the Securities Commission of Malaysia. This ensures that Versa operates under the guideline of the authority.

Meanwhile, your funds are held in a separate trust account in CIMB Commerce Trustee Bhd. for Versa Invest. This protects you from the unlikely event that Versa goes bankrupt, as customers’ funds are unmingled with Versa.

For the most updated product & regulation info, please visit Versa Invest and Versa Cash‘s product pages.

Highlights of Versa Invest

#1 Versa Invest is designed to beat the market

In my opinion, the main highlight of Versa Invest is that it is positioned to ‘beat the market’.

How so? What makes Versa Invest different from all the existing robo-advisors?

To start with, Versa Invest’s portfolios are designed to be actively managed.

Meaning, depending on market conditions, Versa Invest (through Affin Hwang AM) can deploy users’ money in a combination of active and passive global funds.

Some of these funds include global funds from Vanguard, Blackrock, and Affin Hwang’s very own funds.

In other words, Versa Invest has the flexibility & diversity to invest in active funds when they are well-positioned to beat the market, while shifting to passive funds (eg. The S&P500 ETF) when the market favors them.

This investing approach separates Versa Invest from other robo-advisors in the market that generally only invest in passively managed ETFs.

#2 Gain exposure to premium funds at an affordable fee

Another benefit of investing in Versa Invest compared to typical unit trust is its relatively low fees to gain exposure to premium global funds.

As a user, you do not pay any fees to Versa while investing via Versa Invest. Instead, you only pay fees to fund managers:

You do not need to fork additional money to pay for these fees as they are charged on your invested amount (or Net Asset Value, NAV) monthly.

What’s amazing is unlike other unit trusts, there are no sales and withdrawal fees. This means all your investments are 100% invested to maximize your returns.

| Annual Management Fee | 1% per annum |

| Sales Charge | 0% |

| Redemption Fee | 0% |

| Trustee Fee | 0.04% per annum |

#3 Low barrier of entry to premium funds globally

Unlike conventional unit trust with a high barrier of entry from RM1,000 to RM10,000, Versa Invest makes it easy for users to gain exposure to premium global funds.

In this case, the minimum investment amount for Versa Invest is just RM100. This makes it easy to invest in a diversified global portfolio even if you are starting with a small capital.

#4 Hedge against currency fluctuation

Worried about currency fluctuation while investing globally?

To reduce currency risk, Versa Invest uses derivatives such as forward contracts & swaps to manage fluctuations in the exchange rate.

In other words, you can invest with peace of mind knowing that you have minimal exposure to currency fluctuations!

3 Different Versa Invest portfolios

There are 3 portfolios within Versa Invest for users of different risk preferences.

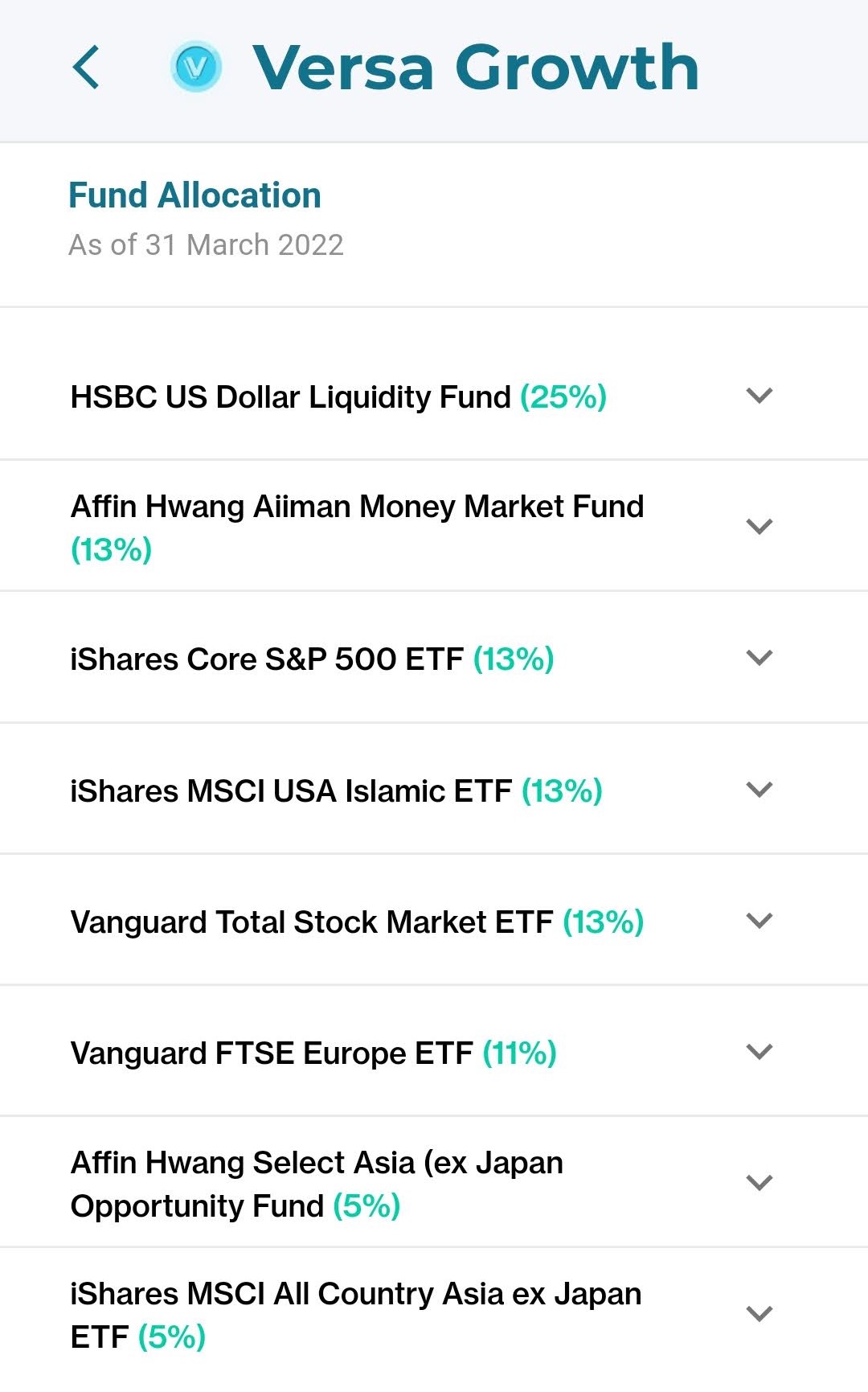

i. Versa Growth

Versa Growth is crafted for higher returns over the long term – suitable if you have a higher risk tolerance.

For time being, Versa Growth’s portfolio is mainly made up of equities (60%), followed by bonds (38%), and cash (2%).

Through Versa’s back-tested data, Versa Growth recorded an average annual return of 15.7% over the past 3 years.

For your reference, I compare the returns between the stock market (S&P500) relative to Versa Growth from 2019 to 2021 in the table below:

| Returns | S&P 500 (Total return) | Versa Growth (Back-tested return) |

| 2021 | 28.71% | 77% |

| 2020 | 18.40% | 56.3% |

| 2019 | 31.49% | 14.5% |

Feel free to find out more about Versa Growth HERE.

[Important] Past returns and back-tested data are NOT indicative of future returns.

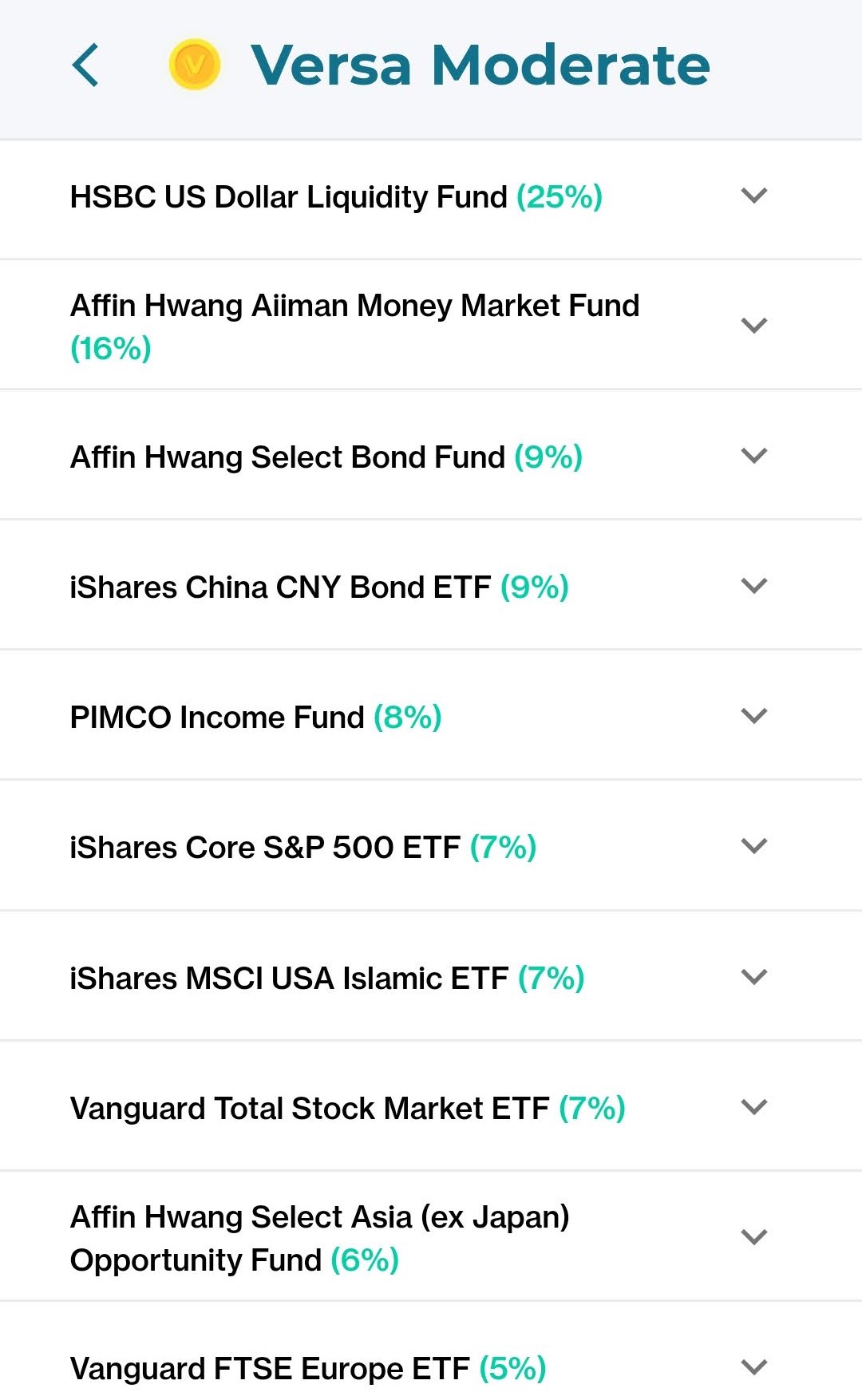

ii. Versa Moderate

Versa Moderate is designed for users looking for a more stable growth with smaller swings. It is suitable if you desire a more stable (hence less aggressive) returns on your investments.

Versa Moderate portfolio is mainly made up of bonds (67%), followed by equities (32%), and cash (1%).

In Versa’s back-tested data, Versa Moderate recorded an average annual return of 9.1% over the past 3 years.

For your reference, I compare the returns between the stock market (S&P500) relative to Versa Moderate from 2019 to 2021 in the table below:

| Returns | S&P 500 (Total return) | Versa Moderate (Back-tested return) |

| 2021 | 28.71% | 41.3% |

| 2020 | 18.40% | 26% |

| 2019 | 31.49% | 11.3% |

Feel free to find out more about Versa Moderate HERE.

[Important] Past returns and back-tested data are NOT indicative of future returns.

iii. Versa Conservative

Versa Conservative, I believe, is for users with a smaller tolerance for up and down swings. As of this writing, it has not been launched – I’ll be sure to update this section when it is up!

My personal thoughts on Versa Invest

#1 I love the ease to save and invest within the Versa app itself

I think the beauty of innovative financial products is their ability to make users’ financial life easier and seamless.

Through the Versa app, users can save and get rates on par with FD with Versa Cash, while investing for higher returns via Versa Invest.

If you are looking to manage your savings and investments in a place, Versa is a great choice.

And did I mention that I really enjoy the user interface (UI) of the Versa app?

Point of improvement: I hope to see Versa integrate an auto-debit feature where I can automate my investments from Versa Cash to Versa Invest on a periodic (eg. monthly) basis.

#2 Can Versa Invest outperform the market in the long run?

Personally, I think it is fresh and bold that Versa Invest is introduced as an investment solution positioned to beat the market.

It shows that the team behind Versa must be confident in Versa Invest to deliver massive value to users. Indeed, the back-tested data from 2019 – 2021 has shown that Versa Invest did outperform the market.

However, can the outperformance be replicated in reality – over a long-term horizon?

I think only time can tell if Versa Invest can withstand the test of time and the market.

Things you need to know + Risk of investing via Versa Invest

Here are 2 things you need to know before you start using Versa Invest:

- Versa Invest is not Shariah-compliant.

- Similar to any form of investment, expect market volatility while investing via Versa Invest.

If you are okay with larger swings in your portfolio, Versa Growth is a good choice.

Meanwhile, if you cannot withstand large swings in your portfolio, it’s best to try out the Versa Moderate portfolio instead.

That said, don’t worry as you’ll go through a risk assessment process during registration where you answer a few simple questions – and Versa will suggest the best portfolio for you!

Exclusive Versa Invest & Versa Cash Promo Code: VERSANML4

In collaboration with Versa, No Money Lah is bringing an exclusive deal for new users that are keen to start saving or investing with Versa!

Use my dedicated Versa referral code – VERSANML4, and you will get RM10 credited into your account* when you successfully make a minimum deposit of RM100 or more. That’s an instant 10% return on your investment.

Open Your Versa Account HERE.

Sign Up for a Versa account today!

How to start investing via Versa Invest?

- New Versa Users: Install the Versa app at Google Playstore or Apple Appstore and create an account.

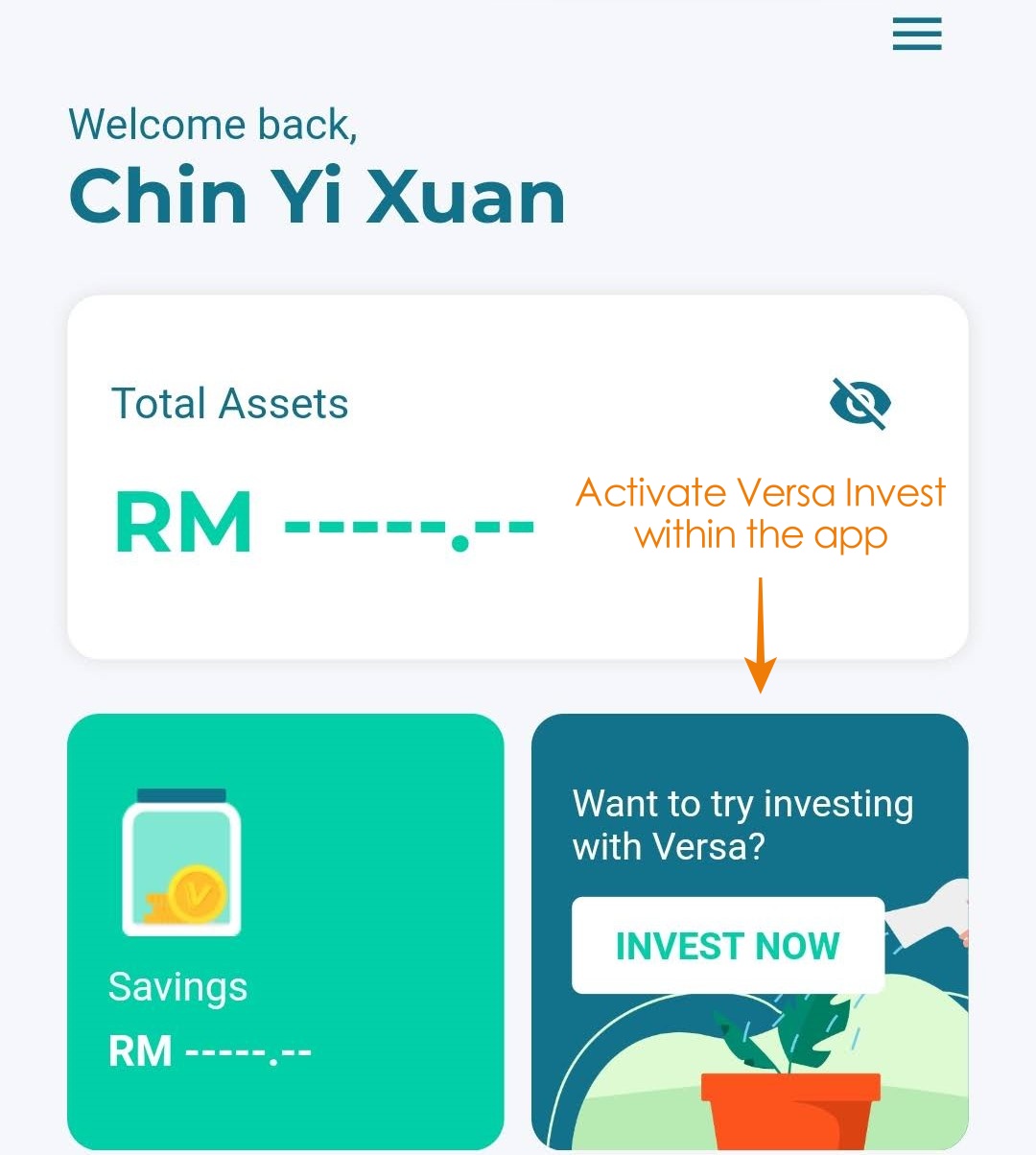

- Existing Versa Cash Users: Update your Versa app to the latest version. Then, activate the Versa Invest feature by clicking on the ‘Invest Now’ button in the app.

Sign Up for a Versa account today!

Side Note: Use Versa Cash as a low-risk alternative to Fixed Deposits (FD)!

Are you looking for a savings alternative to Fixed Deposits, or prefer a (very) low-risk approach to store your funds?

If that’s the case, you can consider using Versa Cash, which gives you a projected return of 2.50% annually!

Find out more about my review on Versa Cash HERE.

Disclaimers

This article is brought to you in collaboration with Versa. For the most updated info, please visit Versa Invest and Versa Cash‘s product page.

This post is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.