Last Updated on January 17, 2023 by Chin Yi Xuan

In this post, you’ll see my monthly dividend income updates for 2022.

My goal is to invest a portion of my funds to build a RM1,000/month passive income portfolio (and eventually RM4,000/month).

Through this journal, you’ll see my progress month by month – and I wish you will find inspiration to start your dividend investing journey too! Let’s go!

Related Post: If you like reading my journey, I’m sure you’ll like the posts below as well:

- The Freedom Fund: My whole dividend investing portfolio!

- Dividend+: Learn how to build a low-maintenance dividend portfolio!

If you enjoy following my dividend investing journey and would like to learn more, subscribe to my FREE newsletter and I’ll be sending you the most updated content every week!

p

Table of Contents

December 2022 Dividend Income Update

We are at the final dividend income update of 2022!

As a whole, I received RM224.58 in December 2022, which is a decent increase over RM39.92 last year!

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

| Axis REIT | 5106 | RM61.64 | RM61.64 |

| Syfe REIT+ | SGD11.57 | RM38.07 | |

| Harvest Brand Leaders Plus Income ETF | HBF | CAD4.59 | RM14.92 |

| Harvest Tech Achievers Growth & Income ETF | HTA | CAD4.93 | RM16.02 |

| Purpose Bitcoin Yield ETF | BTCY | CAD1.79 | RM6.37 |

| Purpose Ether Yield ETF | ETHY | CAD1.96 | RM6.37 |

| Harvest Tech Achievers Growth & Income ETF (USD) | HTA.U | USD6.21 | RM27.32 |

| Schwab US Dividend Equity ETF | SCHD | USD10.83 | RM47.65 |

| SPDR S&P US Dividend Aristocrats UCITS ETF | UDVD | USD1.54 | RM6.78 |

| Total Dividends Received | RM224.58 |

[Note] Rotate your screen if you cannot view the full table in portrait mode. Dividends are considered received as per dividend ex-date.

Exchange Rate:

- USD1 = RM4.40

- SGD1 = RM3.29

- CAD1 = RM3.25

- HKD1 = RM0.56

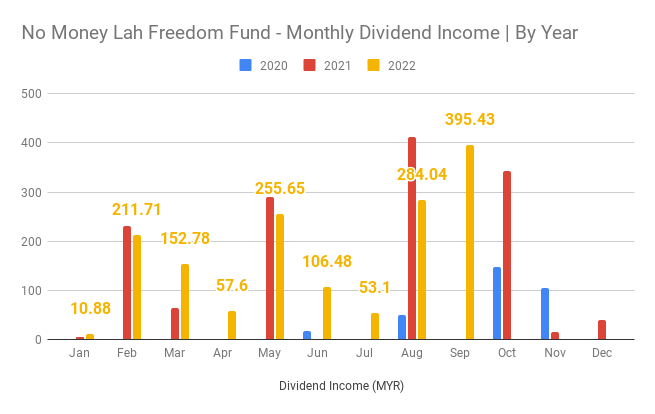

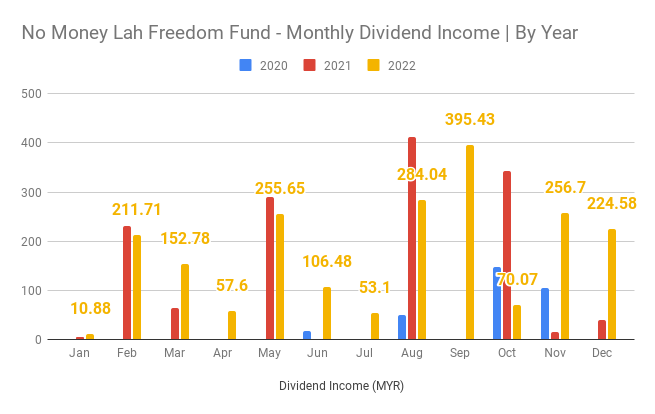

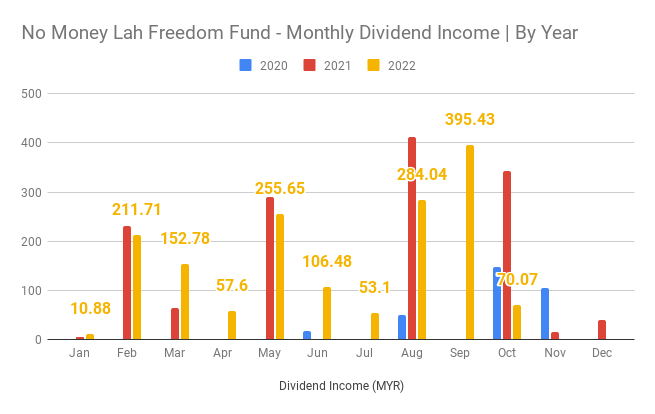

Dividend breakdown by month & year:

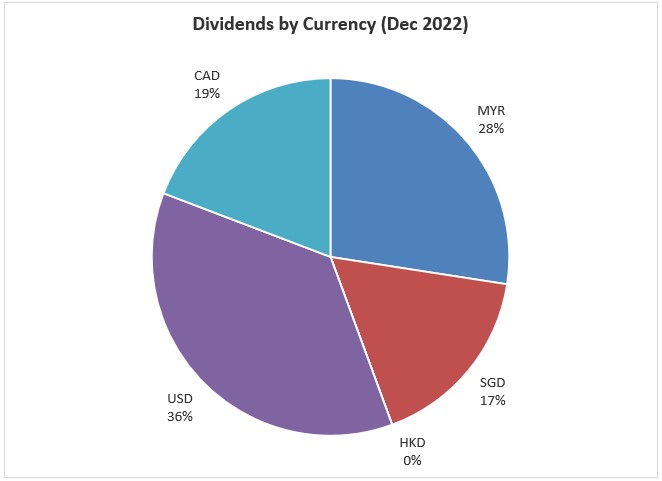

Dividend breakdown by currency:

Dec 2022 Wrap-Up + Thoughts:

Time flies and we are ending the year already!

Personally, I am happy with my progress in 2022. Income automation is a key revelation in my investing journey and I am glad that I am building toward it via the Freedom Fund.

In the new year, I will continue to build on the Freedom Fund, and let’s hope 2023 will be a good year for us all!

- Dividend Income (Dec): RM224.58

- Dividend Income (2022): RM2063.46

November 2022 Dividend Income Update

Time flies and we are almost coming to the end of 2022! With this, let’s check out my November 2022 dividend income update!

As a whole, I received RM256.70 in November 2022, which is a decent increase over RM15.09 last year! Key contributions come from the final dividend payment from my REIT investments for the year.

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

| Atrium REIT | 5130 | RM31.64 | RM31.64 |

| Axis REIT | 5106 | RM72.97 | RM72.97 |

| IGB REIT | 5227 | RM57.17 | RM57.17 |

| Syfe REIT+ | SGD4.89 | RM15.89 | |

| Harvest Brand Leaders Plus Income ETF | HBF | CAD4.59 | RM15.28 |

| Harvest Tech Achievers Growth & Income ETF | HTA | CAD4.93 | RM16.42 |

| Purpose Bitcoin Yield ETF | BTCY | CAD1.96 | RM6.53 |

| Purpose Ether Yield ETF | ETHY | CAD1.96 | RM6.53 |

| Harvest Tech Achievers Growth & Income ETF (USD) | HTA.U | USD4.76 | RM21.32 |

| Fidelity US Quality Income UCITS ETF | FUSD | USD2.89 | RM12.95 |

| Total Dividends Received | RM256.70 |

[Note] Rotate your screen if you cannot view the full table in portrait mode. Dividends are considered received as per dividend ex-date.

Exchange Rate:

- USD1 = RM4.48

- SGD1 = RM3.25

- CAD1 = RM3.33

- HKD1 = RM0.57

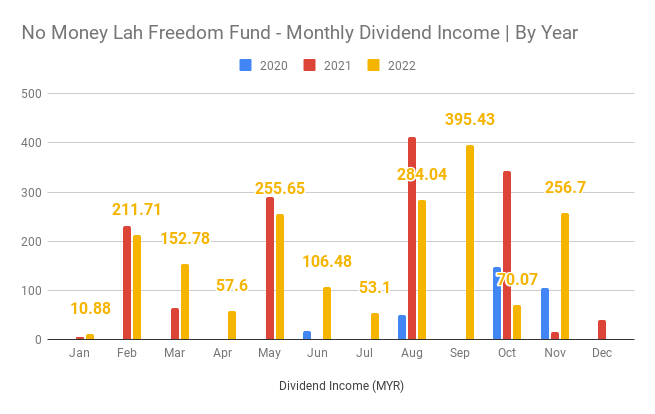

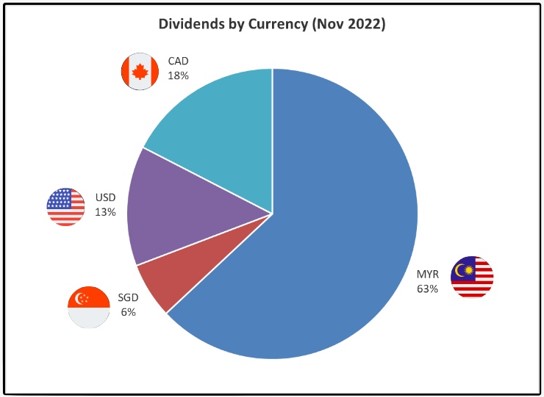

Dividend breakdown by month & year:

Dividend breakdown by currency:

New additions:

Added to my existing holdings as I seek to increase my exposure in the US stock market.

- SCHD: One of my favorite dividend ETFs to buy & hold long-term. Managed to add more units of SCHD prior to price pushing back to near all-time high this month. With a solid history of dividend increments every year for the past 10 years, SCHD is a no-brainer for long-term dividend investors. Check out my newly released SCHD review HERE.

- HTA.U: Added to HTA.U for the attractive yield in USD as tech still looks very attractive to me.

You can check out my latest Freedom Fund portfolio HERE.

Nov 2022 Wrap-Up + Thoughts:

Personally, I am pretty happy with my progress in 2022. I continue to build my portfolio despite the market selldown and fears & noise in the market.

- Dividend Income (Nov): RM256.70

- Dividend Income (2022): RM1853.21

October 2022 Dividend Income Update

October 2022 dividend income update is back!

This month’s dividend is slightly toned down as I’ve received my many quarterly payouts last month. As always, the goal is to continue building the dividend portfolio – focus on the long-term game and process!

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

| Syfe REIT+ | SGD0.56 | RM1.86 | |

| Harvest Brand Leaders Plus Income ETF | HBF | CAD4.59 | RM15.88 |

| Harvest Tech Achievers Growth & Income ETF | HTA | CAD4.93 | RM17.06 |

| Purpose Bitcoin Yield ETF | BTCY | CAD2.68 | RM9.27 |

| Purpose Ether Yield ETF | ETHY | CAD2.52 | RM8.72 |

| Harvest Tech Achievers Growth & Income ETF (USD) | HTA.U | USD3.66 | RM17.28 |

| Total Dividends Received | RM70.07 |

[Note] Rotate your screen if you cannot view the full table in portrait mode. Dividends are considered received as per dividend ex-date.

Exchange Rate:

- USD1 = RM4.72

- SGD1 = RM3.33

- CAD1 = RM3.46

- HKD1 = RM0.60

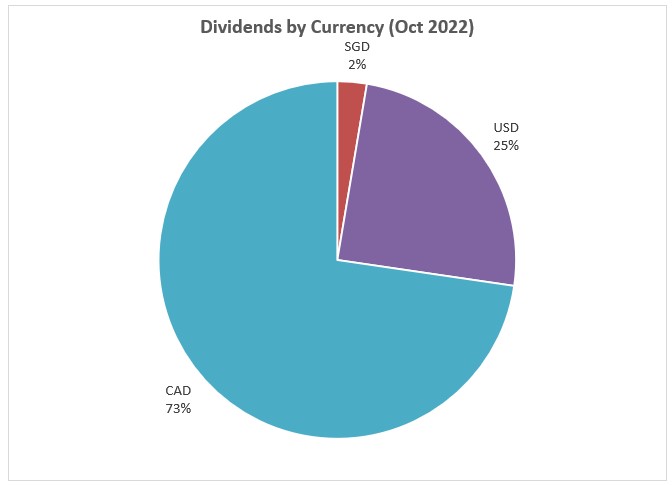

Dividend breakdown by month & year:

Dividend breakdown by currency:

New additions:

Added to my existing holdings as I seek to increase my exposure in the US stock market.

- SCHD: Despite having to incur a 30% dividend withholding tax (WHT) for all US-domiciled ETFs, SCHD got really attractive in line with market selldown – hitting a yield of over 3% in October. Combined with a solid history of dividend increments every year, SCHD is a no-brainer for long-term dividend investors.

You can check out my latest Freedom Fund portfolio HERE.

Oct 2022 Wrap-Up + Thoughts:

- Dividend Income (Oct): RM70.07

- Dividend Income (2022): RM1633.39

“The man who can do the average thing when everyone else around him is losing his mind.”

September 2022 Dividend Income Update

We are back with September 2022 dividend income update! *DRUM ROLLS*

Despite the market being in the red this month, I actually received my highest dividend income for 2022 (so far) of RM395.43 ($86)!

The highest contribution comes from the bi-annual distribution of 3110, a dividend ETF from Hong Kong. This is followed by dividend income from Syfe REIT+, my go-to way to invest in Singapore REIT.

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

| Syfe REIT+ | SGD24.86 | RM80.55 | |

| Maybank | 1155 | RM56.28 | RM56.28 |

| Global X Hang Seng High Dividend Yield ETF | 3110 | HKD300 | RM177 |

| Harvest Brand Leaders Plus Income ETF | HBF | CAD4.59 | RM15.38 |

| Harvest Tech Achievers Growth & Income ETF | HTA | CAD4.93 | RM16.52 |

| Purpose Bitcoin Yield ETF | BTCY | CAD2.68 | RM8.98 |

| Purpose Ether Yield ETF | ETHY | CAD2.52 | RM8.44 |

| Harvest Tech Achievers Growth & Income ETF (USD) | HTA.U | USD3.66 | RM16.98 |

| Schwab US Dividend Equity ETF | SCHD | USD1.78 | RM8.26 |

| SPDR S&P US Dividend Aristocrats UCITS ETF | UDVD | USD1.52 | RM7.05 |

| Total Dividends Received | RM395.43 |

[Note] Rotate your screen if you cannot view the full table in portrait mode. Dividends are considered received as per dividend ex-date.

Exchange Rate:

- USD1 = RM4.64

- SGD1 = RM3.24

- CAD1 = RM3.35

- HKD1 = RM0.59

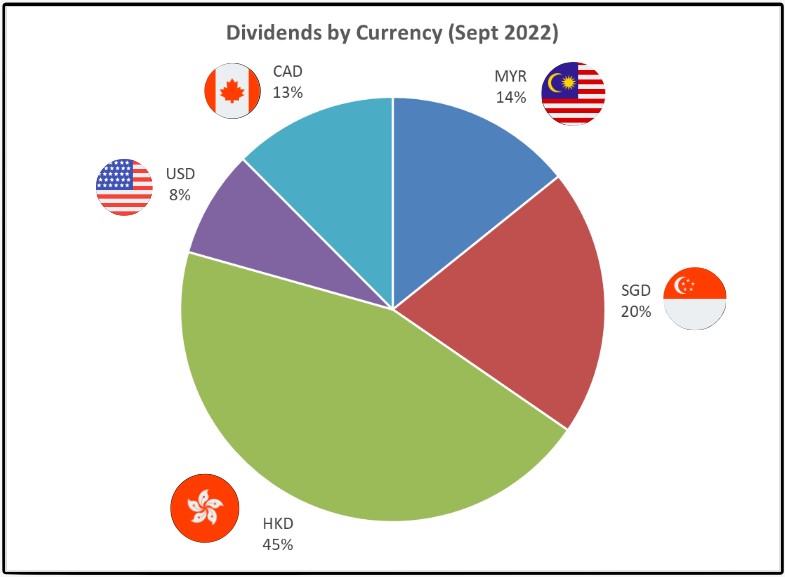

Dividend breakdown by month & year:

Dividend breakdown by currency:

New additions:

Nothing fancy in September. Added to my existing holdings as I seek to increase my exposure in the US stock market.

- HTA.U: Now generating a yield of over 10% with a track record of stable dividend payout.

- FUSD: Track record of growing dividends in the past 3 years.

- Syfe REIT+: Automated monthly investment.

You can check out my latest Freedom Fund portfolio HERE.

Sept 2022 Wrap-Up + Thoughts

- Dividend Income (Sept): RM395.43

- Dividend Income (2022): RM1539.58

One of my biggest decisions in 2022 is when I finally decided to commit to dividend investing.

Why so?

Due to certain family issues this year, I’ve come to realize that cashflow is crucial.

As such, I aim to automate my income so, in 15 to 20 years, I have the choice to focus on what’s important in life without having to worry about actively working for income.

Knowing the context behind WHY I go for dividend investing helps massively because I’ll not be affected by short-term market swings, and other people’s opinions on dividend investing.

For friends who are reading this, I encourage you to figure out your investment goal/direction. Knowing your WHY will help you filter out a lot of noise and stay consistent in your journey.

August 2022 Dividend Income Update

Hey hey! Despite heavy market sell-off, we are back with the dividend update for August! In August, I received RM284.04 in dividend income!

The dividend in August is the highest of the year so far since I got my quarterly payout from my REIT holdings alongside monthly dividend payout from my ETFs.

As for new addition, I’ve added the USD version of Harvest Tech Achievers Growth & Income ETF (HTA.U) as I’d like to focus on more dividends in USD moving forward.

You can check out my latest Freedom Fund portfolio HERE.

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

| Syfe REIT+ | SGD12.37 | RM39.71 | |

| Atrium REIT | 5130 | RM38.48 | RM38.48 |

| Axis REIT | 5106 | RM75.84 | RM75.84 |

| IGB REIT | 5227 | RM57.38 | RM57.38 |

| Harvest Brand Leaders Plus Income ETF | HBF | CAD4.59 | RM15.74 |

| Harvest Tech Achievers Growth & Income ETF | HTA | CAD4.93 | RM16.91 |

| Purpose Bitcoin Yield ETF | BTCY | CAD3.4 | RM11.66 |

| Purpose Ether Yield ETF | ETHY | CAD2.99 | RM10.26 |

| Harvest Tech Achievers Growth & Income ETF (USD) | HTA.U | USD2.21 | RM9.88 |

| Fidelity US Quality Income UCITS ETF | FUSD | USD1.83 | RM8.18 |

| Total Dividends Received | RM284.04 |

[Note] Rotate your screen if you cannot view the full table in portrait mode. Dividends are considered received as per dividend ex-date.

Exchange Rate:

- USD1 = RM4.47

- SGD1 = RM3.21

- CAD1 = RM3.43

- HKD1 = RM0.57

August 2022 Wrap-Up

- Dividend Income (August): RM284.04

- Dividend Income (2022): RM1150.05

July 2022 Dividend Income Update

We are back with the dividend update for July! In July, I received RM53.10 in dividend income!

July closed on a positive note after months of bearish sentiment. That said, I don’t think the market is clearly bullish yet. Inflation is still high and interest rate hikes have not proved effective in pushing inflation down.

For the month, I’ve added more units of HTA, alongside 2 Ireland-domiciled dividend growth ETFs – FUSD and UDVD to the Freedom Fund. These ETFs:

- Provide exposure to the US market at a lower dividend withholding tax (WHT) at 15% instead of 30% from typical US-listed equities.

- They also have a history of growing dividends and should serve as a great long-term holding to the portfolio.

An interesting note on FX rate. So far in 2022, our beloved MYR has:

- Dropped more than 4% against SGD.

- Lost close to 5% against CAD.

- Lost over 6% in value against USD.

If any, investors should absolutely consider diversifying their income into different major currencies (eg. SGD, CAD, USD) to hedge against a weak MYR. A dividend portfolio with foreign exposure is certainly the easiest way to do so.

You can check out my latest Freedom Fund portfolio HERE.

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

| Harvest Brand Leaders Plus Income ETF | HBF | CAD4.59 | RM15.97 |

| Harvest Tech Achievers Growth & Income ETF | HTA | CAD4.93 | RM17.16 |

| Purpose Bitcoin Yield ETF | BTCY | CAD3.4 | RM11.83 |

| Purpose Ether Yield ETF | ETHY | CAD2.34 | RM8.14 |

| Total Dividends Received | RM53.10 |

[Note] Rotate your screen if you cannot view the full table in portrait mode. Dividends are considered received as per dividend ex-date.

Exchange Rate:

- USD1 = RM4.45

- SGD1 = RM3.22

- CAD1 = RM3.48

- HKD1 = RM0.57

July 2022 Wrap-Up

- Dividend Income (July): RM53.10

- Dividend Income (2022): RM869.50

June 2022 Dividend Income Update

We are back with the dividend update for June! In June, I received RM97.96 (update: RM106.48) in dividend income!

June was a pretty tough month for the market as a whole. We’ve entered a bear market, inflation is hitting hard across the globe, and measures to raise interest rate did not seem to be effective in cooling things down.

I was quite busy with some research and work in June, so I did not do anything crazy other than adding additional 2 units of SCHD.

That said, I’ve probably made a mistake with buying SCHD from the start due to dividend withholding tax reasons (where non-US residents are taxed 30% of their dividend income) – which makes the long-term prospect of this US dividend ETF less attractive.

Will decide what I’d do with this soon but it’s a good lesson nevertheless. You can check out my latest Freedom Fund portfolio HERE.

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

| Syfe REIT+ | SGD14.59 | RM46.10 | |

| Harvest Brand Leaders Plus Income ETF | HBF | CAD4.59 | RM15.70 |

| Harvest Tech Achievers Growth & Income ETF | HTA | CAD4.25 | RM14.54 |

| Purpose Bitcoin Yield ETF | BTCY | CAD3.4 | RM11.63 |

| Purpose Ether Yield ETF | ETHY | CAD2.34 | RM8.00 |

| Schwab US Dividend Equity ETF | SCHD | USD1.97 | RM8.69 |

| Total Dividends Received | RM104.66 |

[Note] Rotate your screen if you cannot view the full table in portrait mode. Dividends are considered received as per dividend ex-date.

Exchange Rate:

- USD1 = RM4.41

- SGD1 = RM3.16

- CAD1 = RM3.42

- HKD1 = RM0.56

June 2022 Wrap-Up

- Dividend Income (June): RM106.48

- Dividend Income (2022): RM804.17

May 2022 Dividend Income Update

In May, I received RM255.65 in dividend income!

May is generally a nice month for dividends as quarterly distributions from REITs come in.

While MYR weakened against other currencies, dividends from foreign currencies also increased in MYR terms.

If you live in Malaysia, it is important to expand your income streams into stronger currencies (eg. USD, SGD) and dividend investing is a great way to go.

Took the chance to add SCHD, a US-listed ETF into the Freedom Fund as well.

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

| Syfe REIT+ | SGD3.99 | RM12.73 | |

| Atrium REIT | 5130 | RM37.62 | RM37.62 |

| Axis REIT | 5106 | RM71.65 | RM71.65 |

| IGB REIT | 5227 | RM37.62 | RM37.62 |

| Harvest Brand Leaders Plus Income ETF | HBF | CAD4.59 | RM15.79 |

| Harvest Tech Achievers Growth & Income ETF | HTA | CAD4.25 | RM14.62 |

| Purpose Bitcoin Yield ETF | BTCY | CAD6.38 | RM21.95 |

| Purpose Ether Yield ETF | ETHY | CAD6.55 | RM22.53 |

| Total Dividends Received | RM255.65 |

[Note] Rotate your screen if you cannot view the full table in portrait mode. Dividends are considered received as per dividend ex-date.

Exchange Rate:

- USD1 = RM4.38

- SGD1 = RM3.19

- CAD1 = RM3.44

- HKD1 = RM0.56

May 2022 Wrap-Up

- Dividend Income (May): RM255.65

- Dividend Income (2022): RM708.12

April 2022 Dividend Income Update

In April, I received RM73.32 in dividend income!

April is generally a slow month despite many REITs announcing their earnings. Reason being, the dividend ex-date for my MREIT holdings (Atrium REIT, Axis REIT, IGB REIT) is happening in May.

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

| Syfe REIT+ | SGD0.33 | RM1.04 | |

| Harvest Brand Leaders Plus Income ETF | HBF | CAD4.08 | RM13.87 |

| Harvest Tech Achievers Growth & Income ETF | HTA | CAD4.25 | RM14.45 |

| Purpose Bitcoin Yield ETF | BTCY | CAD6.38 | RM21.69 |

| Purpose Ether Yield ETF | ETHY | CAD6.55 | RM22.27 |

| Total Dividends Received | RM73.32 |

[Note] Rotate your screen if you cannot view the full table in portrait mode. Dividends are considered received as per dividend ex-date.

Exchange Rate:

- SGD1=RM3.15

- CAD1=RM3.40

- HKD1=RM0.54

April 2022 Wrap-Up

- Dividend Income (April): RM73.32

- Dividend Income (2022): RM448.69

March 2022 Dividend Income Update

This month, I received RM152.78 in dividend income!

I revamped my dividend portfolio by adding in new dividend-paying stocks & ETFs (3110). Unique Covered Call ETFs (HBF, HTA, BTCY, ETHY) that pay monthly dividends were also added.

As a whole, this month’s dividend income is a fantastic 142.7% increase over March 2021 (RM62.94). That’s RM71.84 more dividend income than last March – not a lot by absolute means, but progress is progress!

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

| Maybank | 1155 | RM60.00 | RM60.00 |

| Syfe REIT+ | SGD5.46 | RM16.93 | |

| Global X Hang Seng High Dividend Yield ETF | 3110 | HKD22 | RM11.88 |

| Harvest Brand Leaders Plus Income ETF | HBF | CAD3.06 | RM10.28 |

| Harvest Tech Achievers Growth & Income ETF | HTA | CAD3.40 | RM11.42 |

| Purpose Bitcoin Yield ETF | BTCY | CAD5.74 | RM19.29 |

| Purpose Ether Yield ETF | ETHY | CAD6.84 | RM22.98 |

| Total Dividends Received | RM152.78 |

[Note] Rotate your screen if you cannot view the full table in portrait mode. Dividends are considered received as per dividend ex-date.

Exchange Rate:

- SGD1=RM3.10

- CAD1=RM3.36

- HKD1=RM0.54

March 2022 Wrap-Up

- Dividend Income (March): RM152.78

- Dividend Income (2022): RM375.37

March is when I decided to concentrate more funds to build up my passive income portfolio. Various incidents in my family led me to realize the importance of consistent cashflow – and dividend investing is one, if not the best way to build consistent cashflow.

I will continue to focus more funds to build this Freedom Fund so you’ll certainly see more growth down the line!

February 2022 Dividend Income Update

In February, I received RM211.71 in dividend income.

Since it’s Chinese New Year break, I took the chance to ‘slim down’ my REIT portfolio by letting go of all my individual Singapore REITs (SREITs) and several Malaysia REITs (KIP REIT, Sentral REIT). For Malaysia REITs, I only sold them off after ex-date so I am still eligible for the dividends.

I’ve been wanting to slim down my REIT portfolio as I have no capacity to manage individual REITs and now I finally got it done!

As a replacement, I transitioned to Syfe’s REIT+ portfolio, which is essentially something like a REIT ETF that tracks a basket of SREITs. I truly like the ease of automatic dividend-reinvestment without the hassle to deal with corporate actions (eg. rights issue, DRIP) etc!

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

| Atrium REIT | 5130 | RM82.62 | RM42.00 |

| Axis REIT | 5106 | RM12.16 | RM12.16 |

| IGB REIT | 5227 | RM50.81 | RM50.81 |

| KIP REIT | 5280 | RM17.59 | RM17.59 |

| Sentral REIT | 5123 | RM43.51 | RM43.51 |

| Syfe REIT+ | SGD1.62 | RM5.02 | |

| Total Dividends Received | RM211.71 |

[Note] Rotate your screen if you cannot view the full table in portrait mode. Dividends are considered received as per dividend ex-date.

Exchange Rate:

- SGD1=RM3.10

February 2022 Wrap-Up

- Dividend Income (February): RM211.71

- Dividend Income (2022): RM222.59

February is usually a high dividend month as most Malaysian REITs announce their Q4 dividends in late January with the following month as the ex-date. Now that I’ve sold many of my individual REITs, things may change a little moving forward.

January 2022 Dividend Income Update

As a REIT investor, January has been a relatively slow month for me. All in all, I received RM10.88 from Keppel DC REIT, a small Singapore REIT (SREIT) holding in my portfolio.

I’ve received my dividends from many of my Singapore REIT holdings late last year and most Malaysian REITs have yet to pass their dividend ex-date after their Q4 2021 earnings report – hence the quiet month.

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

| Keppel DC REIT | AJBU | SGD3.51 | RM10.88 |

| Total Dividends Received | RM10.88 |

[Note] Dividends are considered received as per dividend ex-date.

Exchange Rate:

- SGD1=RM3.10

January 2022 Wrap-Up

- Dividend Income (January): RM10.88

- Dividend Income (2022): RM10.88

Related Posts

November 12, 2020

Revealing My REIT Passive Income Portfolio!

May 20, 2020

How to Build Your Emergency Fund?

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Hi, how do you buy Syfe REIT+?

Hi Mabel,

You can install the Syfe app and open a Syfe REIT+ account easily! Check out my review on Syfe below:

https://nomoneylah.com/2021/09/10/syfe-review/

Regards,

Yi Xuan

Hi, why do you pick Canadian ETF, instead of, let’s say, U.S. one? Any advantage over the U.S. version? And where do you buy it?

I think it would be an interesting separate article as I think many are investing in either on U.S. or U.K. ETF.

Thanks!