Last Updated on June 11, 2022 by Chin Yi Xuan

Financial scams are getting out of control these days.

We hear worrying cases such as scam calls pretending to be from government agencies or banks, and worse, people’s hard-earned money is stolen from their banks without even receiving an OTP.

In this guide, let’s find out what you should do immediately in the unfortunate event that you become a scam victim. I’ve also included 1 final method if you’ve tried everything and nothing works.

If you find this post useful, consider subscribing to my FREE weekly personal finance & investing newsletter! I’d really appreciate it if you can share this post with your family and friends too!

Useful guides:

- Guide: What to do if scammers stole money from your credit/debit card

- Guide: 12 practical ways to protect yourself from financial scams

p

Table of Contents

What to do if you find out that you got scammed?

In the unfortunate event that you fell for a scam, here are 4 things you should do IMMEDIATELY:

Step 1: Remember, it is NOT the time to blame yourself!

Stay composed and proceed to the steps below as provided by Bank Negara Malaysia (BNM).

Step 2: Call your bank’s 24-hour fraud line and report the incident immediately.

Request for your card/bank account to be halted to avoid further unauthorized transactions.

Please find the 24-hour fraud hotline for Malaysia banks below. You can also Google for your bank’s most updated hotline:

- Maybank: +603 5891 4744

- CIMB Bank: +603 6204 7788

- Public Bank: +603 2177 3555

- HSBC Bank: +603 8321 5400

- OCBC Bank: +03 8317 5200

- UOB Bank: +03 2612 8121

- Ambank: +03 2178 8888

- Citibank: Can’t find a dedicated fraud hotline (or it is really not obvious lol). You can try contacting Citibank HERE.

- Standard Chartered Bank: Call the number on the back of your bank card or on your bank statement.

Banks are given a maximum of 60 days to investigate a dispute.

Step 3: Contact the following numbers (Malaysia):

- The Commercial Crime Investigation Department (CCID) Scam Response Centre at 03-2610 1559/1599

- BNMTELELINK at 1-300-88-5465

These organizations will facilitate immediate measures for CCID to coordinate with BNM and banks to help protect affected accounts.

Step 4: Lodge a police report to facilitate the investigation.

Can you get your money back if they are stolen/scammed from your bank account?

At this point, you’ve done everything you can. Since banks are given 60 days to investigate your case, the only thing you can do is wait.

Whether you are able to get a refund is highly dependent on the investigation process of your bank, and if they’d categorize your case as an ‘unauthorized transaction’.

Like it or not, you’ll really need a boost of luck at this stage.

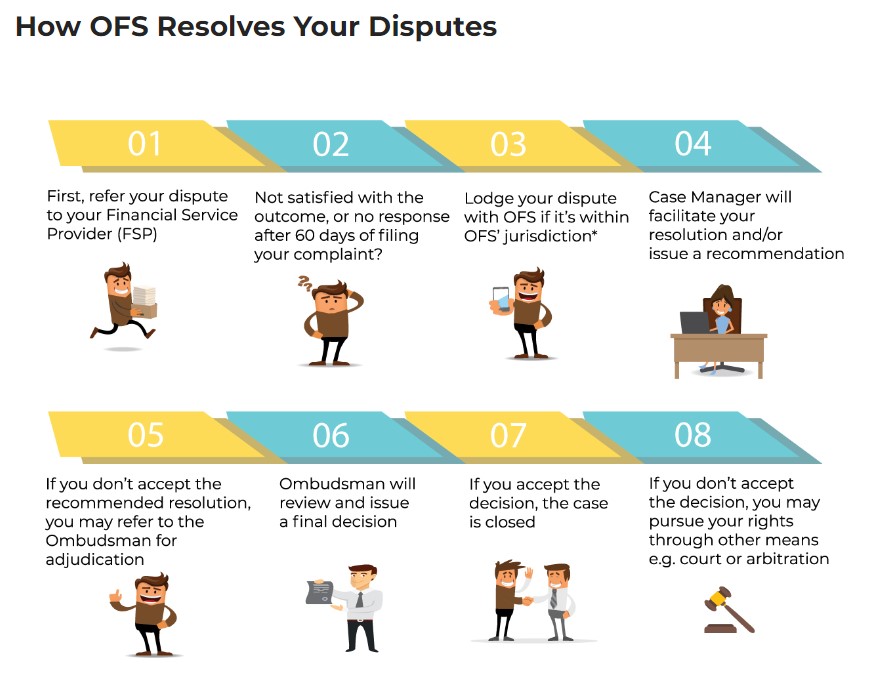

That said, if you are unhappy with the final investigation result, you can file a dispute with the Ombudsman for Financial Services (OFS).

One Final Step: What is Ombudsman for Financial Services (OFS) and how it can help you

OFS is a special non-profit organization approved by BNM to provide dispute resolution between consumers/businesses and financial services.

OFS is a special non-profit organization approved by BNM to provide dispute resolution between consumers/businesses and financial services.

If you’ve tried everything and nothing works, OFS is where you should go to. The mandate of OFS is to resolve disputes via facts/evidence without taking sides.

The jurisdiction of OFS:

OFS accepts disputes which involve monetary losses that fall within the following limits:

- Up to RM250,000 for banking products and insurance claims.

- Up to RM10,000 for motor 3rd party property damage insurance/takaful claims.

- Up to RM25,000 for cases involving unauthorized transactions through channels such as internet & mobile banking, ATM, or unauthorized cheques.

Check out the infographics below on how OFS resolves a dispute. For more info, check out OFS official site HERE.

Financial Scam FAQs:

Q1: Will Perbadanan Insurans Deposit Malaysia (PIDM) protect my money from scams?

A: No. PIDM only protects consumers in the case where their members (eg. banks) go bankrupt. They do not provide coverage from scams.

Q2: Will I be able to get a refund if my money is stolen from my bank?

A: It is highly dependent on your bank’s investigation on your case, so I can’t give you’re a sure answer. Do your best to provide all the info you have to assist the investigation.

Q3: What should I do if I am not happy with the final investigation result from my bank?

A: Lodge a report to Ombudsman for Financial Services (OFS). OFS is established to help resolve disputes between consumers/businesses and financial services. Check out the prior section of this article for more info.

Verdict: We need more robinhoods against scammers.

Truthfully, seeing all the news of people falling to scams left me helpless and frustrated.

There are so many people losing their hard-earned savings to scammers everyday, yet our banks and regulators are WAYYY too slow and passive in handling the matter.

If your money has been unfortunately stolen by scammers while reading this, please know that this is not the end of the world. Remember, there are always people that love you – they’ll help you get through this together.

If there’s any comfort in this, there are ethical hackers cum Youtubers like Scammer Payback and Scambaiter that are returning the ‘favor’ to the scammers – letting them taste their own medicine. We certainly need more people like them.

I hope this guide is helpful and lastly, screw the scammers, and may they die in pain.

If you find this post useful, consider subscribing to my FREE weekly personal finance & investing newsletter!

Disclaimers

This guide is produced with my own best effort and research.

Always refer to the official guideline from your bank and official Bank Negara Malaysia (or your respective central banks for my fellow foreign readers) for the latest scam prevention info.

Related Posts

September 6, 2020

3 Ideas About Money & Consistency

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.