Last Updated on April 11, 2024 by Chin Yi Xuan

If you are investing for consistent dividend income, Singapore REITs (S-REITs) offer an investment option that you should not miss.

In this post, let’s explore S-REITs, and why it is such a great choice, especially for investors looking to build a stable dividend income portfolio!

RELATED POSTS:

- How to build your first $1,000/month passive income with REITs

- In-depth investing guide: S-REIT ETFs

- Introduction to Real Estate Investment Trusts (REITs)

- 5 things I look for when I invest in REITs

p

Table of Contents

What is S-REIT?

Singapore Real Estate Investment Trusts (S-REITs) are listed companies in Singapore that own and/or manage local and global properties such as malls, hotels, warehouses, data centres, and more.

Through rental income from these properties, S-REITs generate yield for investors looking for consistent dividend income.

S-REITs are an important part of the Singapore stock market. With 43 listed REITs and a total market cap of around S$110 billion, S-REITs make up around 13% of the whole Singapore stock exchange.

Effectively, this makes the REIT industry in Singapore the largest REIT market in Asia (excluding Japan) and is increasingly becoming an international REIT hub.

4 reasons why I invest in S-REITs

#1 Earn attractive dividend yield at low volatility

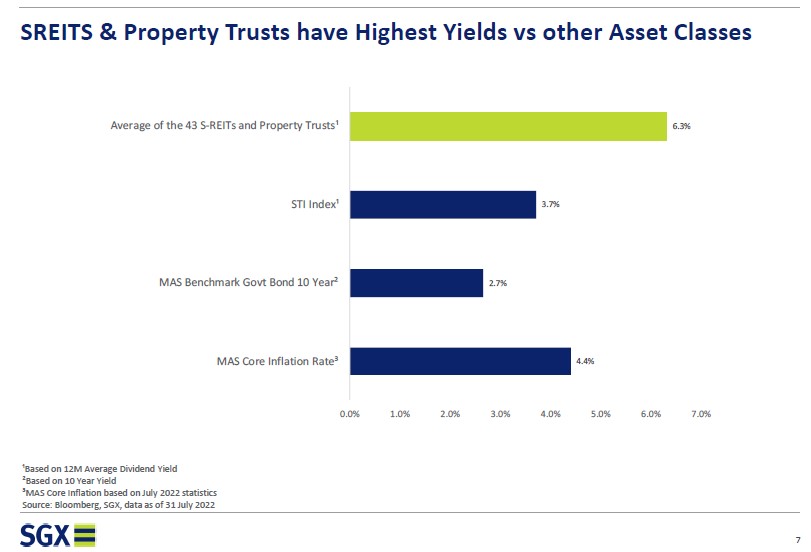

Generally, one of the main reasons why S-REITs are favoured by investors is due to its higher-than-average dividend yield.

Based on the latest 12-month yield (as of July 2022), S-REITs generate an average dividend yield of 6.3% – which is higher than Singapore’s key Straits Times Index (STI) and government bond respectively.

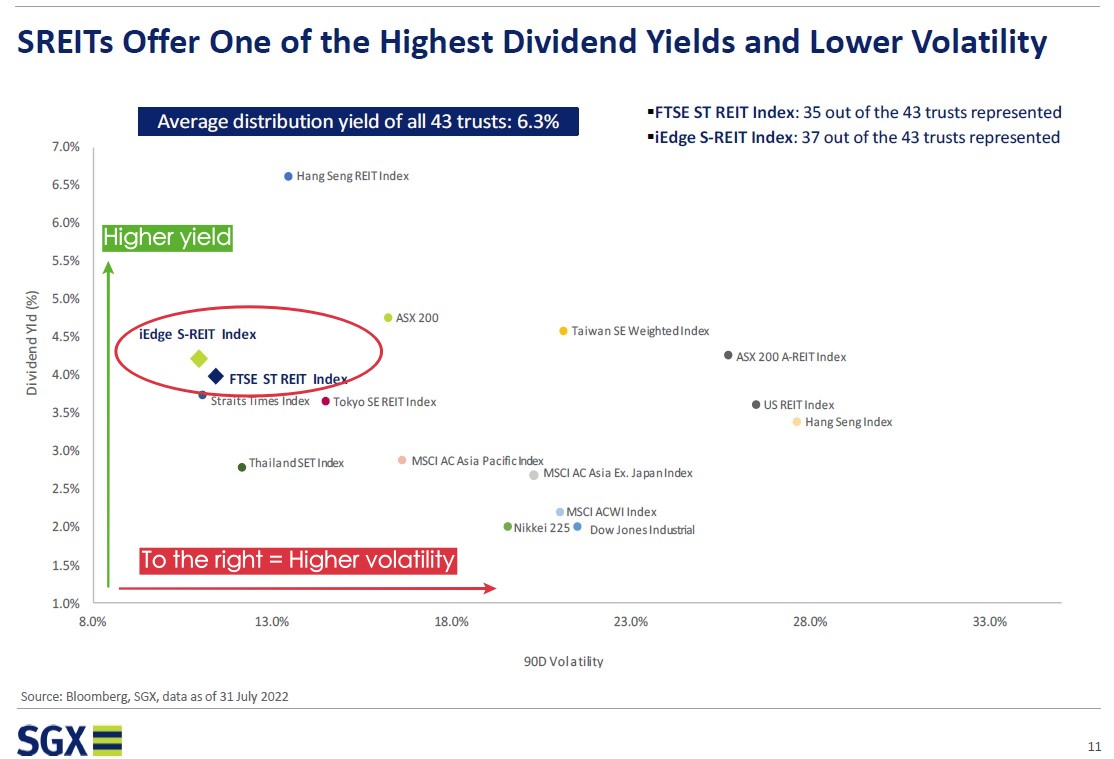

In addition, investors are able to enjoy these attractive dividend yields at relatively low volatility.

When compared to major global markets, both S-REIT indices (which represent the performance of S-REITs) have been able to produce competitive yield at significantly lower volatility:

#2 Grow your passive income in SGD

Investing in S-REITs is also a great way for investors to grow a dividend income stream in SGD.

From RM2.25 to RM3.20, MYR has lost value against the SGD in the past decade. As such, investing in S-REITs can be an attractive move, especially for dividend investors looking to protect themselves against a weakening currency.

#3 Competitive overall growth

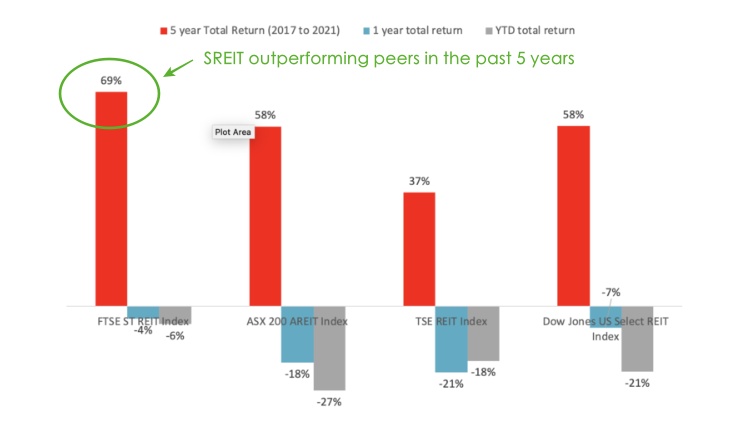

In addition to dividend yield, S-REITs have been producing a decent long-term total return relative to other REIT markets globally.

From the comparison below, the FTSE ST REIT Index (which reflects the average performance of S-REITs) delivered a 5-year total return of 69% (2017 – 2021). This means it outperformed key REIT markets from Australia (ASX), Japan (TSE), and the US.

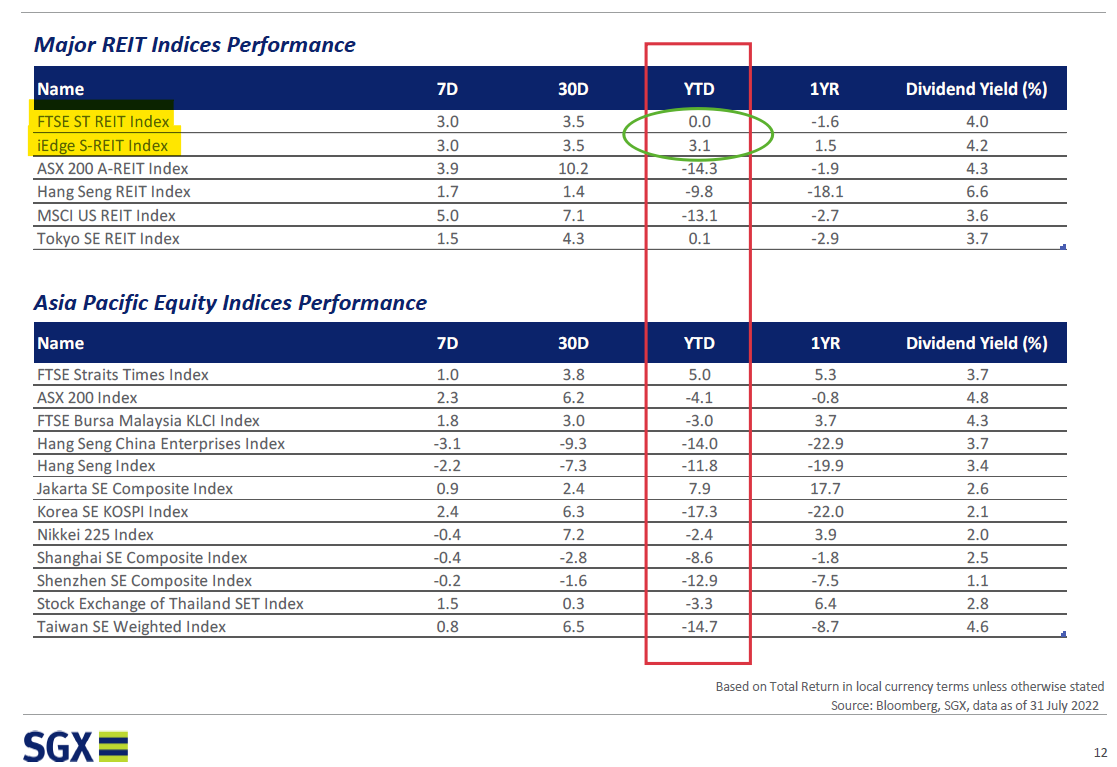

In a challenging 2022, S-REITs continued to display low volatility compared to other markets:

#4 Global exposure to quality real estate & sector diversification

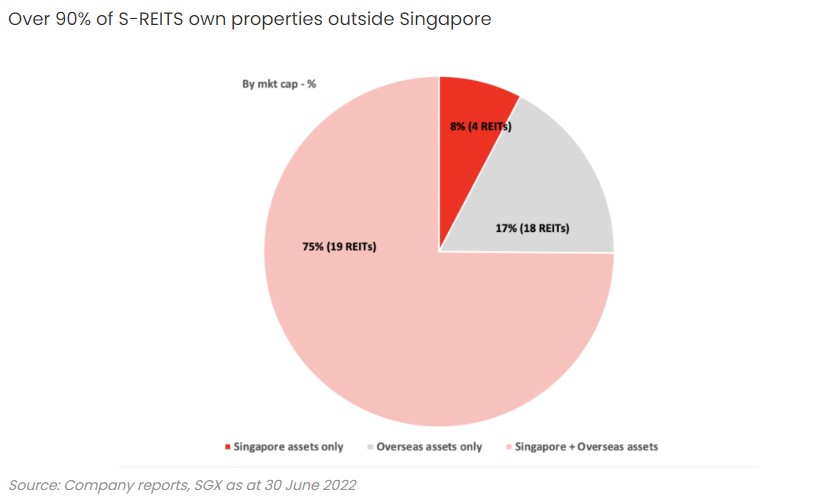

The S-REIT market also allows investors to have a very respectable exposure to the global real estate scene.

To be precise, over 85% of S-REITs own and/or manage properties outside Singapore.

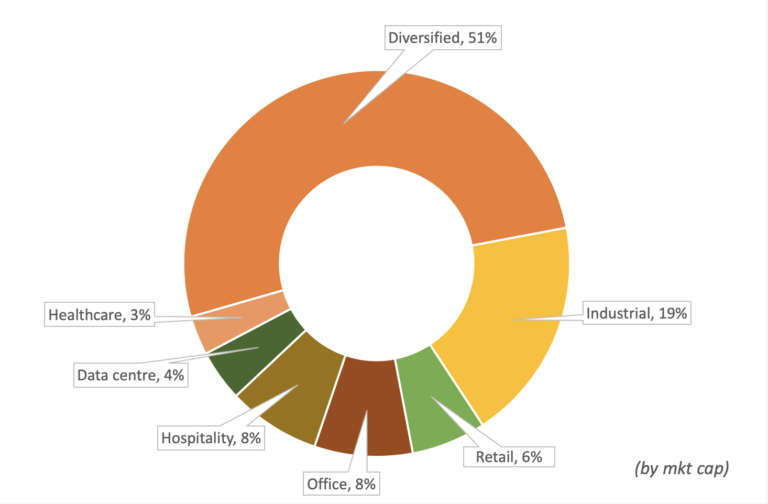

In addition, within the S-REIT industry itself, there are REITs that focus on various business sectors. As an example:

- Retail REITs: Mapletree Pan-Asia Commercial Trust (SGX: N2IU) owns Vivocity, the biggest mall in Singapore; CapitaLand China Trust (SGX: AU8U) mainly owns malls in Tier 1 cities in China (eg. Beijing).

- Specialized REITs: Keppel DC REIT (SGX: AJBU) owns data centers around the globe.

- Office REITs: Manulife US Trust (SGX: BT0U) owns office buildings in the US.

- Industrial REITs: Ascendas REIT (SGX: A17U) owns logistics and industrial properties in Singapore, UK, Australia, and more.

- Aside from that, there are also Healthcare, Hospitality, Residential and Diversified REITs as well. For more details on different S-REITs, click HERE.

All in all, as an international REIT hub, S-REITs allow investors exposure to quality global real estate, with the option to diversify their REIT investments across different sectors – neat!

READ MORE: 6 different REITs and their pros & cons

How to invest + Best performing S-REITs & S-REIT ETFs

There are 2 main ways you can invest in S-REITs:

Method 1: Invest in individual S-REITs

The first way to invest in S-REITs is by investing directly in individual S-REITs listed on the Singapore stock exchange (SGX).

Below are the best-performing S-REITs based on the 3-year annualized total return for your reference (Source: SGX, as of August 2022):

-

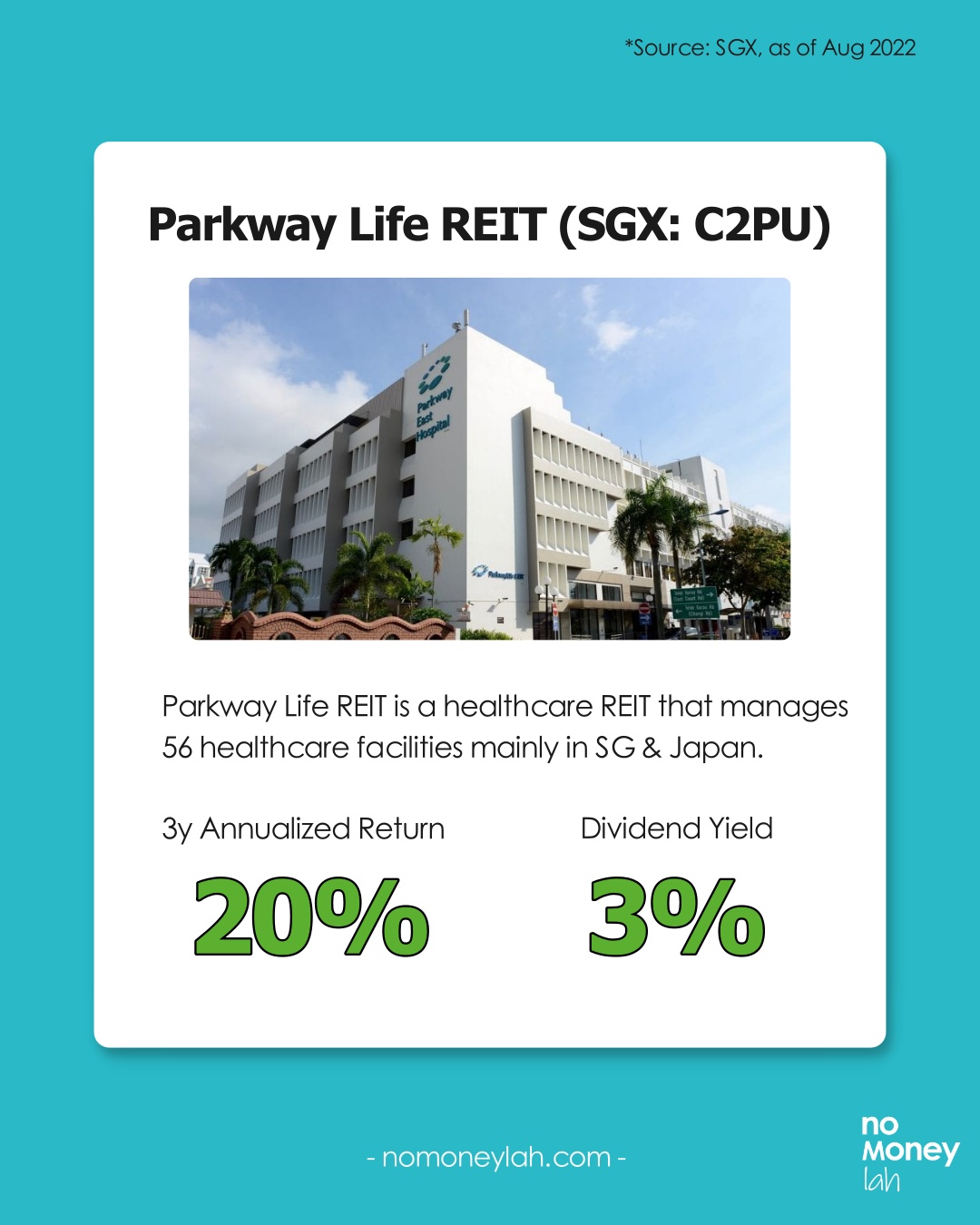

Parkway Life REIT (SGX: C2PU)

-

- 3y Annualized Return: 20%

- Dividend Yield: 3.0%

- Parkway Life REIT is a healthcare S-REIT that owns & manages 56 healthcare facilities (eg. hospitals & nursing homes) mainly in Singapore & Japan.

-

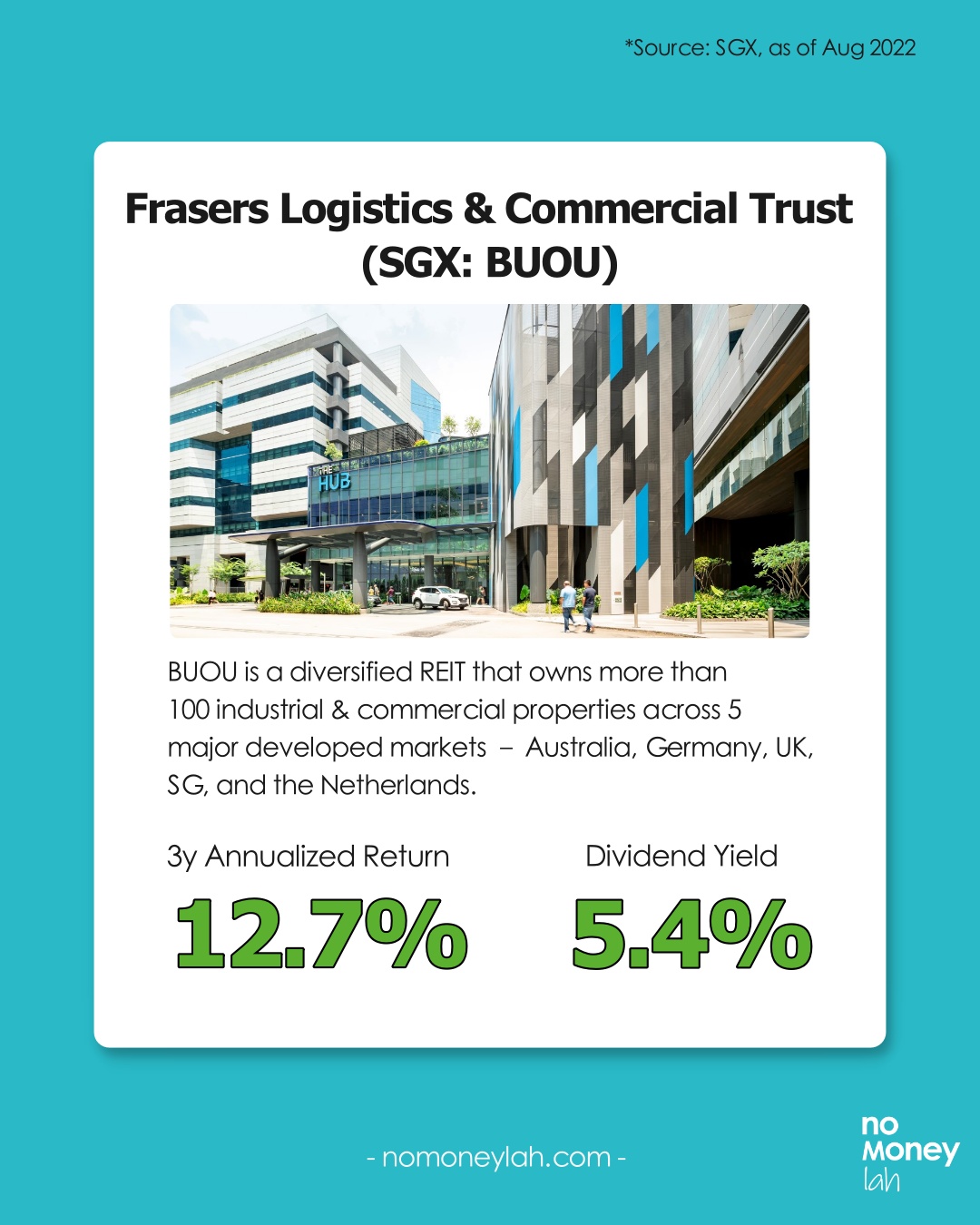

Frasers Logistics & Commercial Trust (SGX: BUOU)

- 3y Annualized Return: 12.7%

- Dividend Yield: 5.4%

- Frasers Logistics & Commercial Trust is a diversified S-REIT that owns more than 100 industrial & commercial properties (e.g. Warehouses, factories, offices) across five major developed markets – Australia, Germany, the United Kingdom, Singapore, and the Netherlands.

-

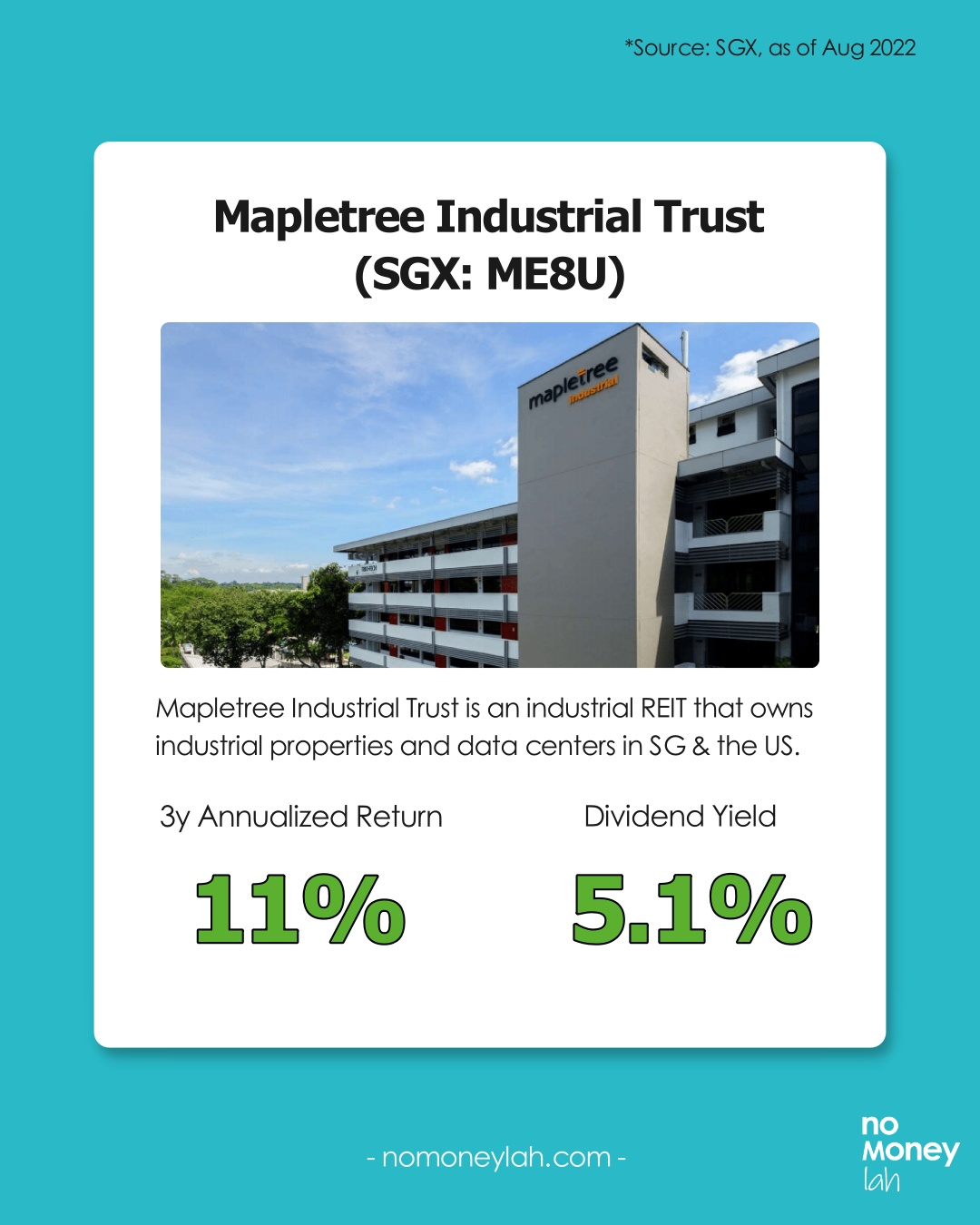

Mapletree Industrial Trust (SGX: ME8U)

- 3y Annualized Return: 11%

- Dividend Yield: 5.1%

- Mapletree Industrial Trust is an industrial S-REIT that owns industrial properties and data centres in Singapore & the US.

Method 2: Invest in REIT ETFs listed in Singapore

The 2nd way to invest in S-REIT is by investing in REIT Exchange-Traded Funds (ETFs) listed on the Singapore stock exchange (SGX).

S-REIT ETFs allow investors to gain exposure to a basket of Singapore and/or global REITs.

An S-REIT ETF is a great choice for investors that seek diversified REIT exposure and do not want the hassle of managing a portfolio of individual REITs.

Below are 5 SREIT ETFs listed on the SGX (Source: SGX, as of August 2022).

For your reference, I’ve also covered all S-REIT ETFs in detail in a separate post, which you can check out below:

LEARN MORE: How to choose the best S-REIT ETFs for dividend income!

-

Phillip SGX APAC Dividend Leaders REIT ETF (SGD: BYJ | USD: BYI)

12-Month Dividend Yield: 3.47%

The Phillip SGX APAC Dividend Leaders REIT ETF is an ETF that tracks the iEdge APAC ex Japan Dividend Leaders REIT Index.

It reflects the 30 highest dividend-paying REITs in the Asia Pacific.

-

NikkoAM-StraitsTrading Asia Ex Japan REIT ETF (SGD: CFA | USD: COI)

12-Month Dividend Yield: 4.74%

NikkoAM-StraitsTrading Asia Ex Japan REIT ETF is an ETF that tracks the FTSE EPRA Nareit Asia ex Japan REITs 10% Capped Index.

It tracks the performance of qualifying REITs from China, Hong Kong, India, Indonesia, Malaysia, Pakistan, the Philippines, Singapore, South Korea, Taiwan, and Thailand.

-

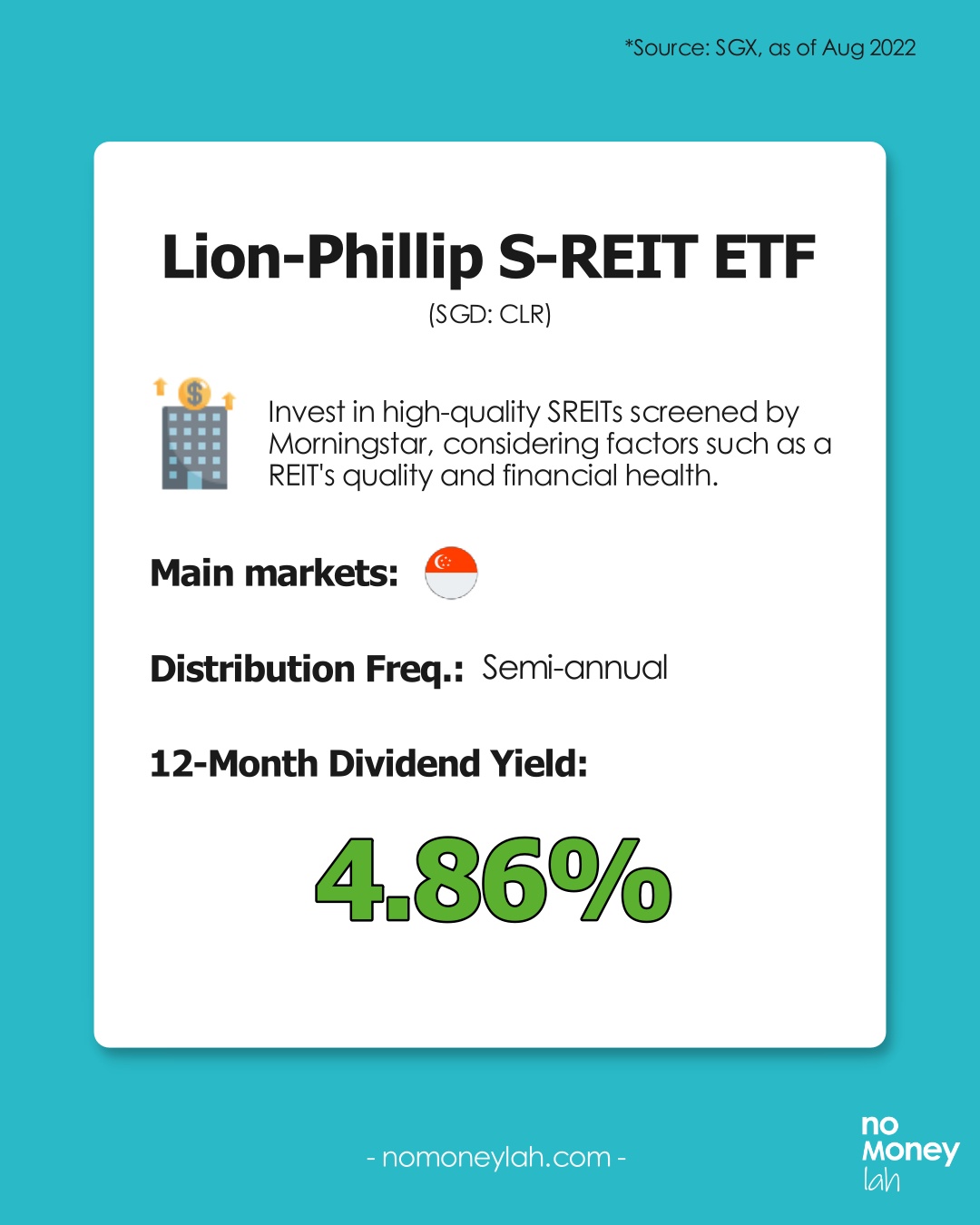

Lion-Phillip S-REIT ETF (SGD: CLR)

12-Month Dividend Yield: 4.86%

The Lion-Phillip S-REIT ETF is an ETF that tracks the Morningstar Singapore REIT Yield Focus Index.

It is an index that invests purely in high-quality Singapore REITs (S-REITs) screened by Morningstar.

-

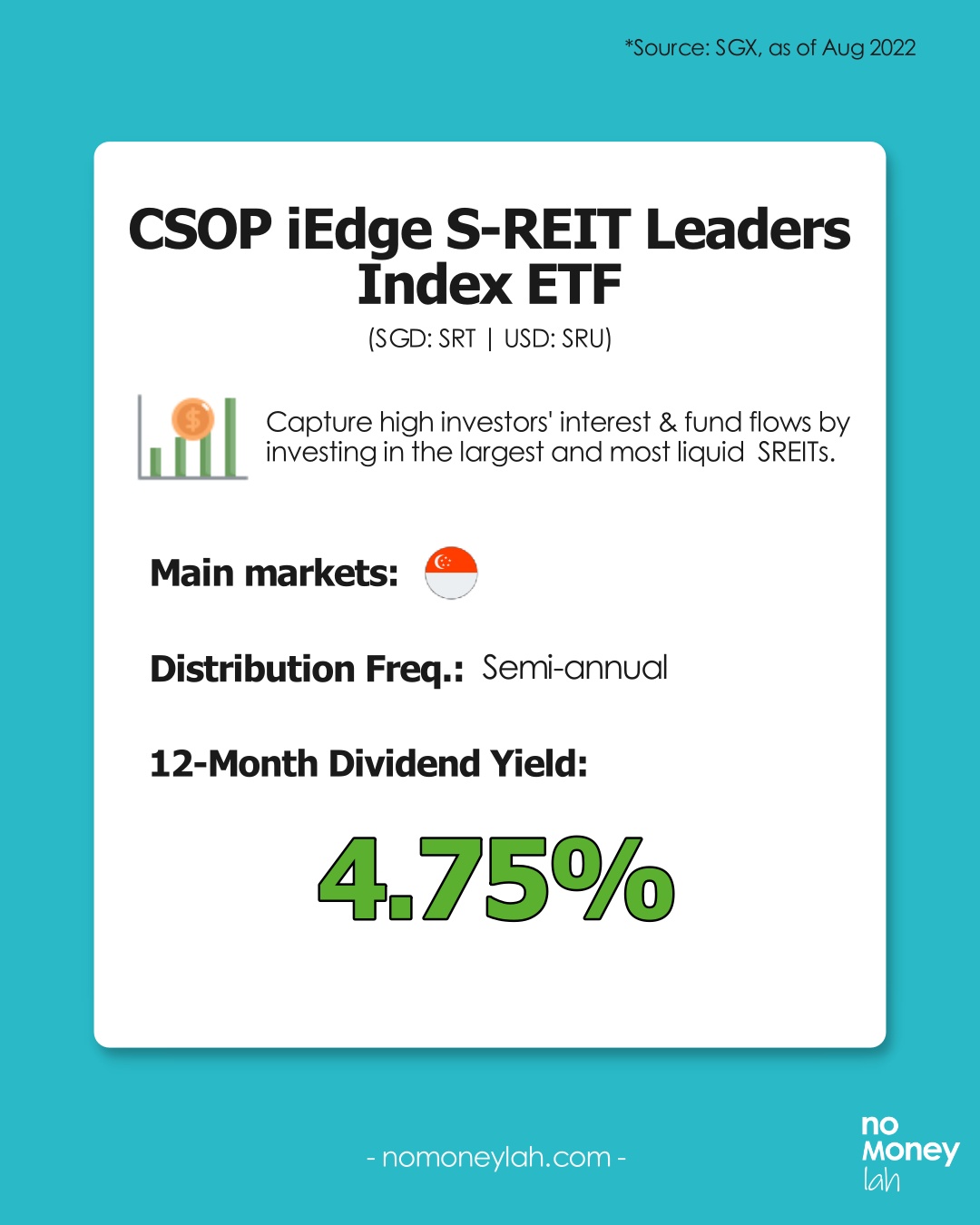

CSOP iEdge S-REIT Leaders Index ETF (SGD: SRT | USD: SRU)

12-Month Dividend Yield: 4.75%

CSOP iEdge S-REIT Leaders Index ETF is a S-REIT ETF that tracks the iEdge S-REIT Leaders Index.

It tracks the performance of the largest and most liquid REITs listed on the Singapore Stock Exchange (SGX).

-

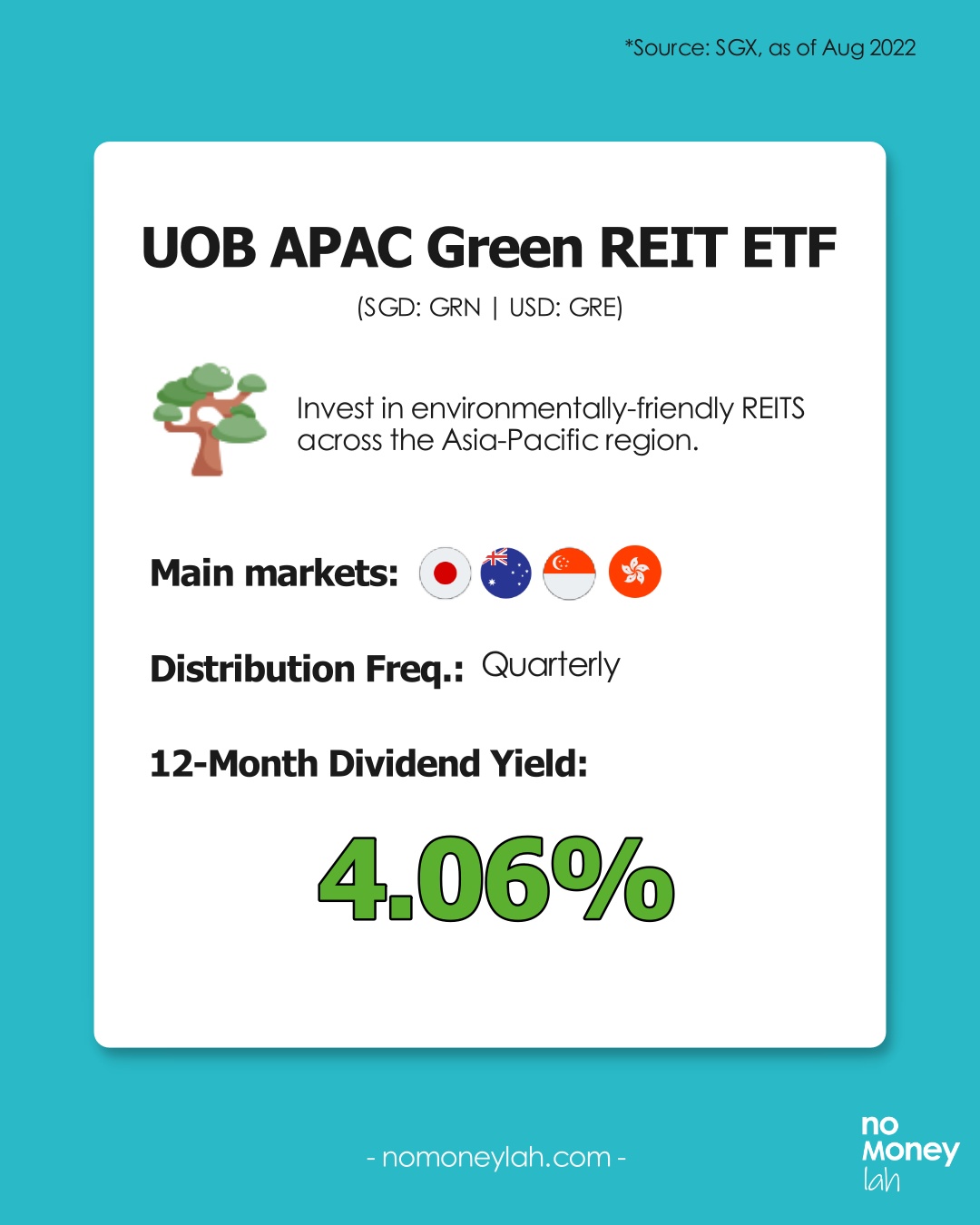

UOB APAC Green REIT ETF (SGD: GRN | USD: GRE)

12-Month Dividend Yield: 4.06%

The UOB APAC Green REIT ETF mirrors the iEdge-UOB APAC Yield Focus Green REIT index, which aims to allow investors to invest in environmentally-friendly REITs.

Risks of investing in S-REITs

Risk #1: Interest Rate Risk

Since REITs distribute over 90% of their income as dividends to investors, most REITs will usually take up loans to finance their property acquisitions.

As such, REITs are generally sensitive to interest rate fluctuation.

Simply put, any rise in interest rates will increase the operating cost of REITs as their interest repayment will become higher.

Risk #2: Subject to market fluctuation

Just like other stocks, the price of REITs is also affected by the overall market fluctuation – though S-REITs are usually less volatile.

Are S-REITs for you?

Investing in S-REITs can be a solid choice if:

- You are looking to build a reliable dividend income stream.

- You are seeking to diversify your stock portfolio to assets that are less volatile.

- You are looking to expand your dividend portfolio to earn dividends in SGD.

Best broker to invest in S-REIT: ProsperUs by CGS-CIMB

This educational post is sponsored by ProsperUs by CGS-CIMB.

ProsperUs by CGS-CIMB is a regulated broker from Singapore that gives investors access to 30+ exchanges in more than 8 countries (US, Hong Kong, China, Japan, UK, Singapore, Malaysia, Europe, and more)!

In fact, from just 0.06% – 0.10%/trade (no min. trade value required), ProsperUs offers the most affordable brokerage fee for investors to invest in the Singapore stock exchange!

Exclusive ProsperUs Referral Code – MONEY20

If you are thinking to give ProsperUs a try, here’s something exclusive to No Money Lah readers – you will not find this anywhere else!

From today till 30/6/2024, key in my exclusive promo code ‘MONEY20’ while you register, and get FREE cash credits up to SGD100 when you open a ProsperUs account:

p

| Tier | Initial funding within 30 days of account set up | Trades Executed | Cash Credits |

|---|---|---|---|

| 1 | Minimum SGD500 – SGD2,999 | Minimum 3 trades executed | SGD10 |

| 2 | Minimum SGD3,000 – SGD14,999 | Minimum 3 trades executed | SGD20 (Deposit SGD3000 or more), OR SGD20 + SGD30 (Deposit SGD3000 or more + Min. trades fulfilled) |

| 3 | SGD15,000 or more | Minimum 3 trades executed | SGD20 (Deposit SGD3000 or more), OR SGD20 + SGD100 (Deposit SGD15,000 or more + Min. trades fulfilled) |

Click HERE to view the full T&C of this referral reward.

Open a ProsperUs Account Today!

No Money Lah Verdict

So there you have it – an in-depth guide to invest in S-REIT!

I hope this guide has been useful and if you have any questions, feel free to leave your comment in the comment section below!

Disclaimers

This article is brought to you in collaboration with ProsperUs by CGS-CIMB.

Any of the information above is produced with my own best effort and research.

This post is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

This post may contain promo code(s) that afford No Money Lah a small amount of commission (and help support the blog) should you sign up through my referral link.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.