Last Updated on October 17, 2022 by Chin Yi Xuan

No Money Lah turns 5 this year!

If you were to tell me that someone you know is making a living running a blog many years ago, I’d be rolling my eyes in front of you.

In fact, this was what actually happened when my mom told me about the son of her colleague that makes his living through blogging.

“This is absurd. Is it sustainable? Why not go get a proper job?”

But fast forward to the present: I’ve been self-employed running my blog, No Money Lah for close to 5 years, writing all things personal finance and investing.

In this post, I want to share some reflections on the career & life lessons that I’ve learned in the past 5 years.

I hope you find this a good read as much as it is a good reflection for me!

p.s. If you like what you read, consider subscribing to my free weekly newsletter as I will cover more quality content on personal finance and investing!

p.

Table of Contents

How are you doing?

“Can you make money blogging?”

When it comes to making a living, I consider myself very fortunate & lucky as I actually managed to make a relatively okay (not a lot, but OK) living out of my blogging income.

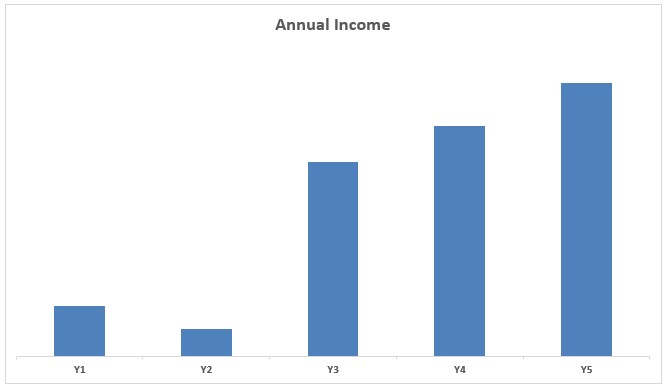

That said, the first 2 years of my self-employed journey were challenging.

I left my first full-time job which paid me RM4.5k/month. I wasn’t able to earn much from blogging (I wasn’t even sure how). I had to become a part-time table tennis coach on the side to supplement my income.

But with time, with strokes of luck, and by actually staying long enough in the game (+ learning along the way), breakthroughs & opportunities finally came in my 3rd year:

So, for friends that are curious, I am doing alright. Not wealth-breaking, but good enough for me to sustain my investment and savings routine while having extra left to spend on people and things that matter to me in life.

Now, on to the lessons that I’ve learned (and still learning) in the past 5 years:

On business & career

- Instead of tell, show. If you are good at something, show the world your work instead of spending time telling people how good you are. Most can talk, few can execute.

- Pursue curiosity, not passion. The ability to be intrigued and curious is what makes life interesting. Screw finding your passion – start with what makes you curious. What are some problems in your life that you are intrigued to solve?

- Don’t be shy, show your work (and progress). Your first few projects will suck and it is alright. No one gets it perfect at the start. One B+ article is always better than the A+ idea that stays in your head. (reminder to self)

- Be a specialist – you win nothing when you try to get everyone as your customer.

- Ethics above everything else. Be honest + transparent upfront. Be clear on what you can or cannot deliver.

- Good read: Linchpin by Seth Godin.

On falling behind in life

- Define your self-worth or the society (eg. Instagram, friends & colleagues, bosses, family members) will do it for you.

- What we see on social media is the curated version of people’s lives, not the whole of them. The more you want your life to resemble what others are showing on social media, the more miserable you are in real life.

- When overwhelmed, spend less time on social media. The mental peace you gain from a social media diet is massive.

- It’s never about catching up in life because there is nothing to catch up on. It’s about finding peace with where you are now, and the thrill of pursuing your full potential as a person. Changing how we look at life is so important.

On money & wealth

- Can you be happy with less? The ability to find satisfaction in simple, little things in life is a superpower to sustainable happiness that many do not have.

- Having the foresight to plan ahead in life is crucial. From buying your first car, planning for a family & kids, aging parents, and your own retirement, to unexpected incidents such as retrenchment – there are so many expenses in life that’d catch you off guard if you are not prepared ahead.

- One of the worst feelings in life is to be at the mercy of others. The best feeling in life is knowing that you have choices. Proper financial planning can give you both dignity and freedom in life.

- The biggest measure of wealth is not having luxury cars or watches. It is the ability to do what you want, when you want, with who you want, for as long as you want. It is the highest dividend money pays.

- Good read: The Psychology of Money by Morgan Housel.

On time & priority

- Time is more precious than money. We all know this, but isn’t it crazy how we think twice (and thrice) when people try to borrow money from us, yet be so generous when people ask us for ’10 minutes of our time’? Definitely something to ponder about.

- When we say ‘Yes’ to someone’s agenda, we closed up the doors to something else. Likewise, when we say ‘No’, we opened up the doors for us to explore something else. Set your priorities right in life (eg. family, health, career, relationship, etc) so you have a clearer guide on what to and what not to dedicate time to.

- Good read: Atomic Habits by James Clear

On the biggest challenges that I face

- With everything written above, let me be clear that I am still internalizing these lessons and I still mess up every now and then.

- (Bad) Routine & Habit: In my self-employed journey, I find it the hardest to maintain a disciplined routine. I still find it difficult to sleep early at night which always causes me to become unproductive in the morning. I don’t like my overreliance on binging Youtube as an escape whenever I am stressed or faced with problems at work.

- Feeling guilty for not working: As a self-employed, I always feel guilty whenever I am not spending time on work. Ironically, I get burnout a lot whenever I overwork and this causes my productivity to go down as I use Youtube as an escape during work.

No Money Lah’s Verdict

So there you have it – the lessons I learned & the challenges that I face in my self-employed journey.

I hope you find this post helpful as I did while reflecting on my journey!

If you like what you read, consider subscribing to my free weekly newsletter as I will cover more things on personal finance and investing!

p.

Related Posts

September 27, 2020

How to Become Indispensable in Your Career and Life

September 23, 2020

Lessons I Learned In Search of Perfection (2nd Anniversary Special)

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.