Last Updated on April 8, 2023 by Chin Yi Xuan

So, 2022 marks my 3rd year working with my financial planner, Stev.

Engaging a financial planner has been a major decision in my adulthood.

Stev is a licensed financial planner from Wealth Vantage Advisory (WVA). With Stev’s help, my finances have never been more organized and this allows me to focus on important priorities in my life (eg. family, career).

So, what is it like to do comprehensive financial planning in Malaysia, and is it really useful?

In this post, let me walk you through my 2022 financial planning experience with you – check it out!

—

Note: Before we proceed with my journey in 2022, please note that this is my 3rd year working alongside Stev in my finances. Feel free to follow my journey from my very first year so you’ll have a better picture of my journey:

- My initial experience engaging a financial planner

- 2020: My 1st year engaging a financial planner

- 2021: My 2-year experience with a financial planner

p.

Table of Contents

Quick recap: What is a financial planner

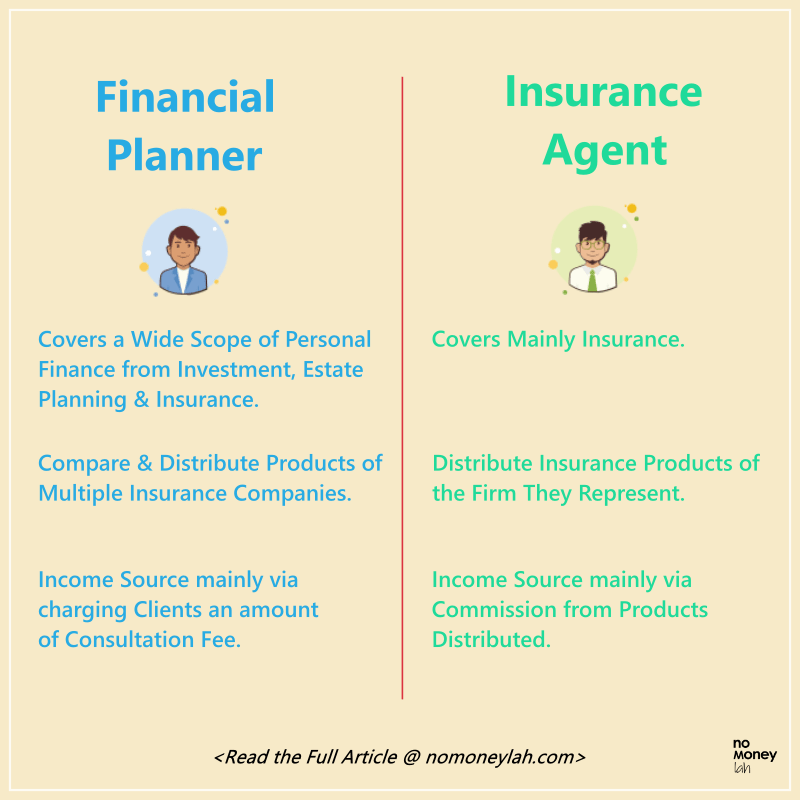

So, what is a licensed financial planner, and who is qualified to be called a licensed financial planner?

Essentially, a licensed financial planner has in-depth qualifications, namely:

- Capital Market Service Representative License:

Issued by the Securities Commission (SC): To conduct licensed financial planning in Malaysia – as such, be called a ‘financial planner’.

- Financial Adviser Representative (FAR) License:

Issued by Bank Negara Malaysia (BNM): Allows a financial planner to recommend insurance products from any insurance company.

On the other hand, the qualification of most insurance agents would stop at the Pre-Contract Examination for Insurance Agents (PCEIA) & Certificate Examination in Investment-linked Life Insurance (CEILI) papers.

These are the papers that insurance agents have to take in order to start offering insurance solutions for one particular insurance company.

In essence, a financial planner offers a holistic & comprehensive service in all aspects of personal finance relative to an insurance agent.

My financial planning progress in 2022

Engaging a financial planner is a process that involves 3 key stages: (A) Fact-finding, (B) Implementation, and (C) Follow-Up Review Meetings.

This is also how I begin my financial planning journey every year with my financial planner, Stev, for the past 3 years.

(A) Engagement/Fact-Finding phase (September – December 2021):

My 2022 financial planning journey actually started in Q3 2021, when I sat down with Stev to review my year and plan for the year ahead.

This is where we come together to learn my overall financial status such as my cashflow, income, investments, insurance, and so on.

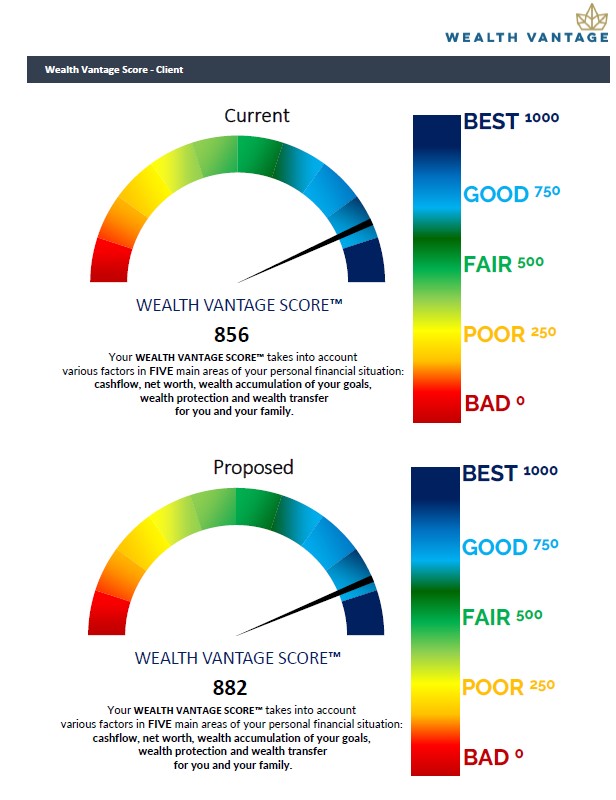

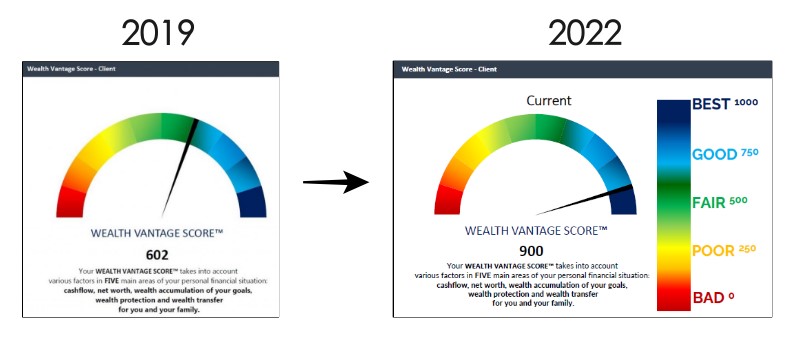

I am also shown my Wealth Vantage Score, a visual gauge of my financial state, and target progress for the year:

Then, Stev and I will discuss my goals for the new year, and if there are any changes required in my financial routine to adjust to my goals.

With guidance from Stev, here are some examples of adjustments made to my financial routine include:

- Increasing my EPF contribution for tax relief

- Switching my PRS fund to a better-performing fund

- Reducing my exposure to REIT (real estate investment trust) and channel to other sectors/asset classes (based on my risk profile)

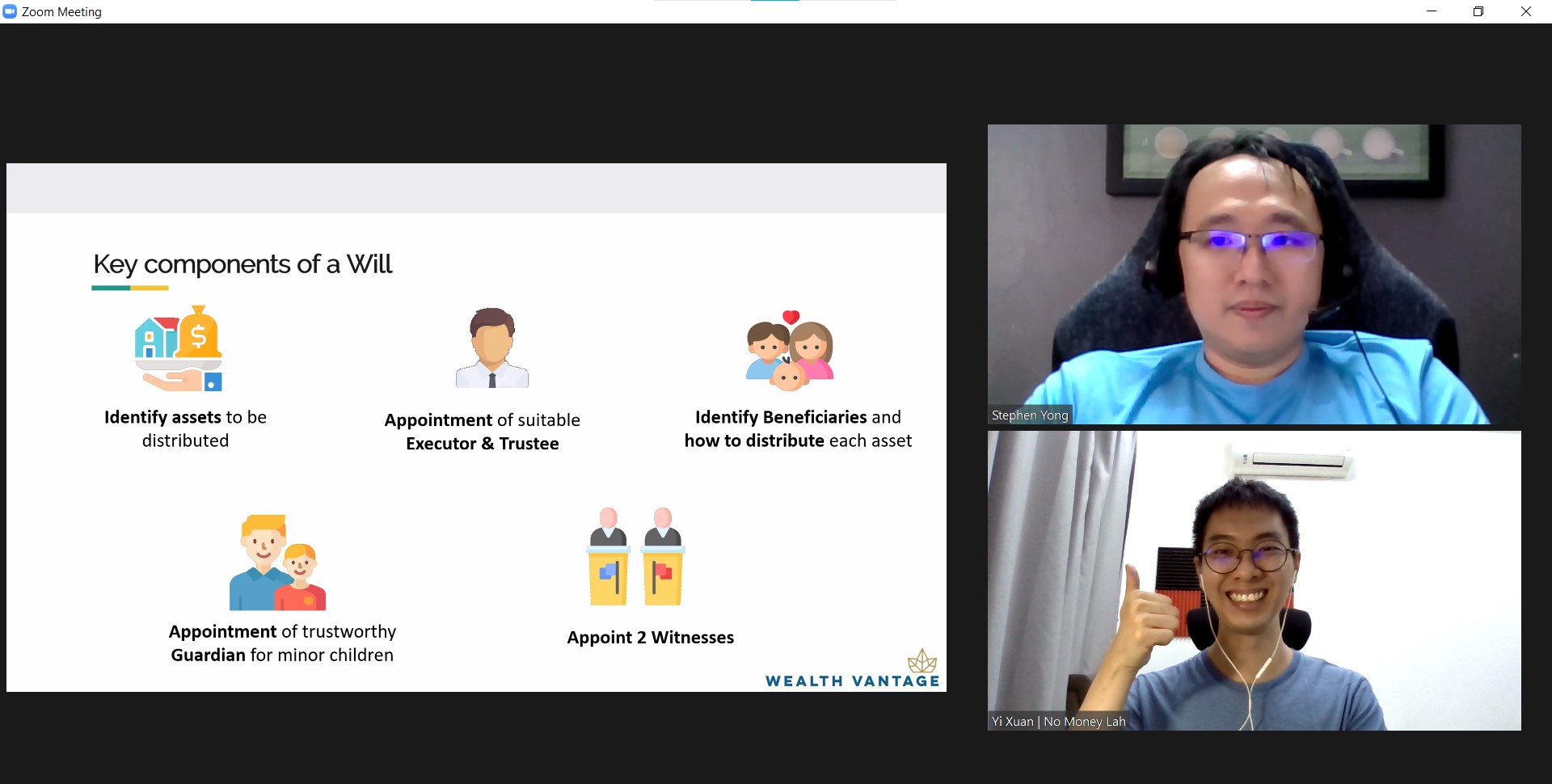

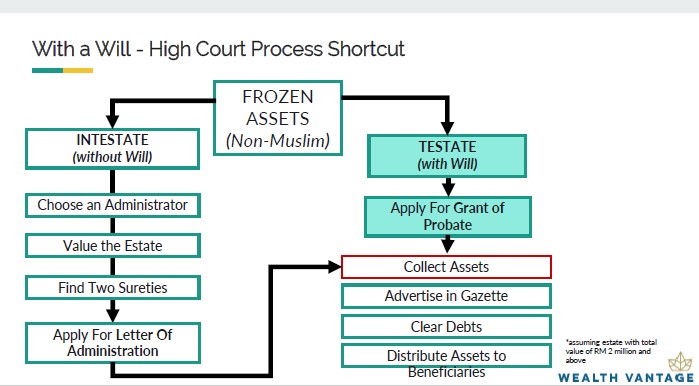

An important goal that we set back then for 2022 is to establish a will as a legal asset distribution document should anything happen to me.

(B) Implementation of financial plan (Throughout 2022)

Then, throughout the year, Stev guided me with the implementation of my plan, especially on a few things:

-

Writing my will

Writing a will is my main financial planning goal in 2022, and we spent about 8 – 9 months getting it done.

Throughout the year, Stev introduced me to will-writing and guided me through the whole process (eg. what assets to include, drafting).

Since the cost of will-writing is not transparent online, Stev used his expertise as a financial planner to help me to filter and select the best-value-for-money service.

After comparing different providers (eg. Rockwills, RHB Trustee), we ended up going with RHB Trustee.

Getting my will done is certainly a key milestone in my financial planning process. Now, I know my assets will be distributed legally as per my wish should something happens to me.

LEARN MORE: My will-writing experience + how much I spent.

-

Navigating a challenging 2022 bear market

2022 has been a challenging time for most investors.

As we entered a bear market – triggered by various factors such as war, and inflation spike followed by interest rate hikes, it is a mentally tough time to invest.

Fortunately, Stev as my mentor has kept my worries at bay by constantly reminding me of the benefits of investing long-term.

(C) Follow-Ups

-

Tax Planning

Stev also helped me look through how I can best optimize my taxes (very helpful especially for me as a self-employed)

-

Investment planning + market outlook

We also have constant chats and discussions about the market outlook throughout the year and how we can best adapt to the market.

As WVA’s financial planning client, I also had the chance to attend Wealth Vantage Advisory’s inaugural financial planning symposium.

p.

(D) Annual Review (September – November 2022)

September is when we begin our annual review as me and Stev sat down to review my progress for the year.

It is at this time (Q3) that Gabriel, the firm’s new up-and-coming rising star financial planner, joined Stev to guide me in my finances.

This is where we talk about my goals for the new year and if there are any adjustments required to my financial routine.

3 lessons I learned from my financial planner & Results

-

Focus on the big picture and think long term

2022 has been a challenging year for most investors. That said, Stev has taught me to focus on the big picture and keep a long-term view of my wealth-building journey.

In fact, my overall financial health (cashflow, net worth, protection) has made a major improvement in 2022 compared to late 2019, when I first started working with Stev.

Check out my WVA Score – a visual of how Stev measures my overall financial wealth in 2019 vs 2022:

-

Consistency is key

As a mentor, Stev also reminded me of the importance of being patient and consistent in my journey.

There was a short period in 2022 where I was discouraged about my wealth-building journey and Stev let me see what was possible if I stay consistent in my journey.

-

Good defense always comes before strong offense

In my 3 years working with a financial planner, I realized the importance of building a solid foundation before anything else.

This means having the proper defense in place, such as insurance protection, savings & emergency fund so I can focus on pursuing my priorities in life without worries.

How it works (Financial Planning Packages & Pricing)

Depending on your needs, there are 3 ways you can work with a licensed financial planner from WVA, namely:

-

Package #1: Comprehensive Financial Health Check (FHC)* [RM300]

Financial Health Check offers a comprehensive report on your financial state with action plans for improvement.

You’ll go through a comprehensive fact-finding process with your financial planner.

Then, you’ll be presented with an analysis and report of your overall financial state with recommendations for improvement.

[*Note: FHC package is only offered to readers that signed up through my exclusive Free Financial Consultation session link]

-

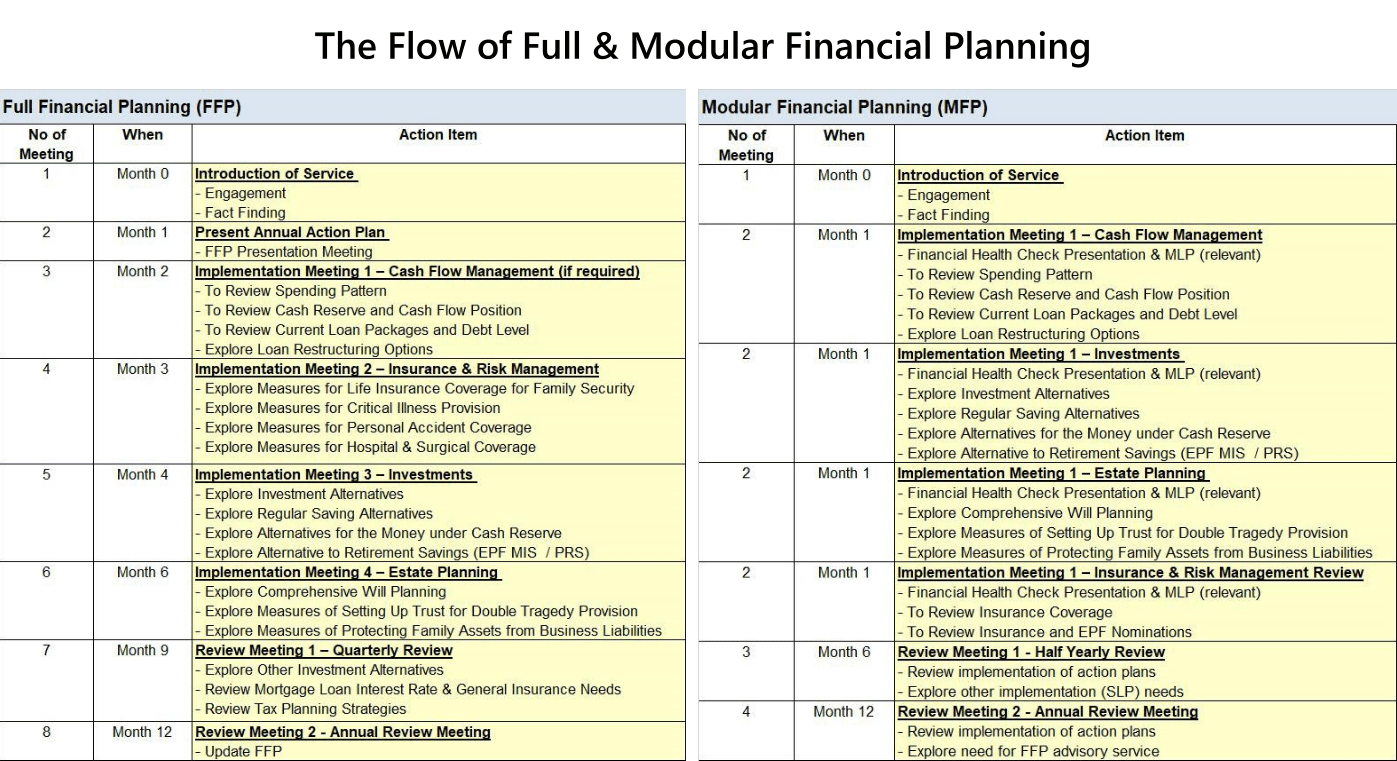

Package #2: Modular Financial Planning (MFP) [RM1,500]

Modular Financial Planning is essentially a combination of comprehensive Financial Health Check (FHC) + your financial planner will support you in the implementation of ONE aspect of your finance (insurance, investment, estate planning) for 1 full year.

-

Package #3: Full Financial Planning (FFP) [RM3,000]

Full Financial Planning is a combination of comprehensive Financial Health Check (FHC) + your financial planner will support you in the implementation of ALL aspects of your finances (insurance, investment, estate planning) for 1 full year.

Below, you can find the whole flow of MFP and FFP:

Personally, I’ve opted for the Modular Financial Planning (MFP) package (investment) back in 2020.

Since 2021, I have been on the Full Financial Planning (FFP) package. This is where my financial planner, Stev has guided me in all aspects of my finances (investment, insurance, and estate planning).

You can read about my experiences below:

- 2020: My 1st year engaging a financial planner (Modular Financial Planning – MFP)

- 2021: My 2-year experience with a financial planner (Full Financial Planning – FFP)

Sign Up for a FREE Consultation Session Here!

Should you engage a financial planner in Malaysia?

For me, engaging a financial planner like Stev gives me a sense of security.

With Stev as a mentor & guide, I can go on to pursue different life goals without worries – as there is always someone looking over my shoulder when it comes to my finances.

So, here’s a question for you:

Do you have important priorities in life that you want to pursue or dedicate time to without having to always worry about your financial status:

“Do I have enough insurance coverage?”

“Am I investing right?”

“Can I retire with what I am earning now?”

If yes, engaging a financial planner can bring massive benefits to your life.

Specifically, I am confident that a financial planner will add massive value to you if:

- You have tried to DIY your finances but still feel overwhelmed.

- You want to prepare your finances for the next phase in life (eg. marriage, retirement), but not sure how.

- You need help to organize your finances in place but you are unsure how or too busy to begin (investments, insurance, estate planning etc).

Yes, there are charges to engage a financial planner. But trust me, this will be an investment that’ll give you returns and peace of mind in multiple folds.

3 tips on how to get maximum value while engaging a financial planner:

#1 Be open with your financial planner:

Financial planners are licensed to guide you in your finances. They can only help if you are willing to be open and honest about your financial conditions/challenges, and goals.

#2 Know your goal/intention:

Engaging a financial planner can be massively helpful if you have a clear financial goal (eg. Retirement/Building a family). This gives your financial planner a direction to design a financial plan that is best fit for you.

#3 Keep your financial routine in check:

It is also helpful if you have the habit of tracking + updating your finances on a routine basis. This help in reducing the time that your financial planner has to spend on gathering the information required to devise your financial plan.

[EXCLUSIVE] Get Your First Financial Consultation Session – FREE OF CHARGE!

If you are keen to explore how a licensed financial planner can help with your finances, this is for you:

I am working together with Wealth Vantage Advisory to bring a FREE Financial Consultation Session to all No Money Lah’s readers!

- When you sign up for this FREE consultation session, you will learn more about your overall financial state.

- Not only that, you can gauge if a Financial Planner is going to add value in the pursuit of your financial goals.

Regardless, it is 100% FREE and you have zero obligations to take up the service if it is not suitable for you. Plus, you are doing your finances a favor for the year to come!

You can sign up for your FREE financial consultation session by clicking on the button below.

Sign Up for Your FREE Consultation Session Here!

No Money Lah’s Verdict

And there you go – my personal long-term experience engaging a financial planner!

For me, engaging a financial planner helped me put my finances in place. As a result, it allows me to pursue my career and life priorities without worries.

Having Stev and Gabriel as my financial planner, friend, and mentor is one of the best decisions I’ve made in my financial planning journey.

Are you in a position in life where you want to pursue your priorities without being held back by money matters?

In this case, I am sure engaging a financial planner can yield massive benefits for you.

Sign Up for Your FREE Consultation Session Here!

Disclaimer

This article is made possible through a collaboration with Wealth Vantage Advisory. Special thanks to Stev and the team for making this collaboration such an impactful one.

Wealth Vantage Advisory did not receive copy approval rights on this article – that means they are reading this article for the first time, right alongside you. 🙂

p.s. This post contains affiliate links, which afford No Money Lah a small referral if you sign up for any paid services.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.