Last Updated on August 8, 2023 by Chin Yi Xuan

Fixed Deposit (FD) has always been the go-to place for many Malaysians to save their cash.

However, most FDs require a high deposit, and they lock in your money for a long time (+charges a penalty on early withdrawal).

That said, over the past year, we are seeing the emergence of more money market funds, which is a flexible alternative to FD over the past year.

In this article, let’s compare my top 5 Fixed Deposit (FD) killers: StashAway Simple, Versa Cash (and Versa Cash-i), KDI Save, and TNG GOinvest!

p.s. This is a comprehensive comparison, so feel free to use the menu below to skip to the part you are interested in reading, enjoy!

Table of Contents

Overview:

- StashAway Simple is a cash management offering from well-known robo-advisor, StashAway. It is part of the offering within the StashAway app. Check out my in-depth review of StashAway Simple.

- Versa Cash was launched in 2021 and it offers a return on-par with FDs. In April 2023, Versa Cash-i, the Shariah-compliant version of Versa Cash is launched. Check out my detailed review of Versa Cash HERE.

- KDI Save is a cash management offering. It is part of the offering within the latest Kenanga Digital Investing (KDI) robo-advisor app.

- GOinvest is a newly introduced cash management feature within the Touch ‘n Go e-Wallet in 2022. GOinvest allows users to save and get attractive returns easily within the app.

What is a Money Market Fund?

All the products we are comparing today achieve returns on-par or higher than FD by investing in Money Market Fund (MMF).

Money market funds (MMF) are funds that invest in a mix of (i) Fixed Deposits, (ii) bonds, and highly liquid, short-term cash equivalent instruments called (iii) Money Market Instruments.

Quick Intro: Money Market Instruments

Essentially, Money Market Instruments are short-term debts issued by banks in order to accumulate short-term cash-pile to make up for the shortfall in their daily deposit reserve.

- Simply put, MMFs are lending money to banks when they buy these Money Market Instruments.

- These instruments are relatively low-risk as they are backed by banks. Moreover, they are highly liquid with short maturity periods.

- Through regular redemption of matured Money Market Instruments, it allows MMF to provide a similar rate to FDs without having to lock up users’ capital.

In short, through StashAwaySimple, Versa Cash & Cash-i, KDI Save, and GOinvest, you can earn a similar rate to FD through low-risk MMF without having to lock up your funds, unlike typical FDs.

They are great options if you are looking for a competitive and flexible alternative to FDs.

Similarities: StashAway Simple, Versa Cash & Versa Cash-i, KDI Save & GOinvest

What are the similarities or common traits when you place your money with these apps?

1. Regulated

All StashAway, Versa, KDI, and GOinvest are regulated by the Securities Commission (SC) of Malaysia. This ensures that these services are always operating in Malaysia as per the guideline from the local authority.

2. Flexible & Low barrier of entry

Generally, most FDs require a high minimum deposit to get started. Moreover, FDs lock in our funds for a period of time and charge a penalty for early withdrawal.

In contrast, every app in this article has a low minimum deposit of RM0 (Simple) and RM10 (Versa, KDI Save, GOinvest).

Furthermore, they do not lock in your funds as FD does. Meaning, you are free to deposit and withdraw anytime without penalty.

In short, with a small capital, anyone can start saving flexibly and enjoy rates that are on par with FD.

3. Competitive returns to FD

As a whole, all apps provide returns that are similar and/or competitive to traditional Fixed Deposits (FDs).

I will go through a detailed comparison in the next section, but safe to say they are all great alternatives to FDs.

One thing to be aware of, is none of them guarantee returns. Even though they invest in low-risk MMF, returns are still subjected to market fluctuation.

4. Not protected by PIDM

Another thing to note is that none of the apps are protected under Perbadanan Insurans Deposit Malaysia (PIDM).

PIDM is an organization that protects deposits kept in banks and financial institutions that are a member of PIDM. Conventional FDs are usually protected by PIDM.

Comparison Part 1: Returns & Fees

In this section, let’s compare the returns and fees of these apps. I will assign a winner at the end of each section:

Each app has an underlying money market fund, namely:

- Eastspring Investment Islamic Income Fund for StashAway Simple

- Affin Hwang Enhanced Deposit Fund for Versa Cash

- Affin Hwang Aiiman Enhanced i-Profit Fund for Versa Cash-i

- Proprietary Money Market Instruments from Kenanga for KDI Save

- Principal Islamic Money Market Fund for TNG GOinvest

Below, let’s compare the returns of these funds:

| StashAway Simple | Versa Cash | Versa Cash-i | KDI Save | TNG GOinvest | |

|---|---|---|---|---|---|

| Return | 3.8% p.a. Projected Return (AFTER fees) | 4.3% (AFTER fees) | 4.3% (AFTER fees) | 4% Effective Annual Rate (NO fees) | 3.28%** p.a. Projected Return (AFTER fees) |

| Total Annual Fees* | 0.115% | 0.35% | 0.52% | FREE | 0.42% |

Note: Info accurate as of June 2023 (*Annual Management + Trustee Fee)

(**GOinvest markets its projected return to be 3.7% p.a. BEFORE fees, so I took 3.7% – 0.42% fee to get 3.28% of projected annual return AFTER fee)

From this comparison above, I think the difference in returns between each app is minimal.

However, some of these apps have their own ongoing promo:

| Promo | Versa Cash & Cash-i | KDI Save | TNG GOinvest |

| Returns | 4.3% p.a. promotional rate for the first RM30k + maintain RM1,000 in Versa Cash and/or Cash-i | 4% Effective Annual Rate is for the first RM50k only. Then, 3.5% thereafter until RM200k and 3% thereafter. | – |

Winner: Versa Cash & Cash-i

In my opinion, Versa’s 4.3% projected annual return still makes it the best offering among the others.

In the next sections, we’ll explore an equally important aspect of these apps: User Experience.

Comparison Part 2: User Experience

In this section, we’ll explore the overall user experience of these apps, from fees, how long it takes to deposit and withdraw, and so on:

(A) Interest Payout Frequency, Minimum Deposit

As for interest payout, KDI Save pays out users’ interest on a daily basis. Meaning, you’ll receive your interest payout daily from KDI Save.

This is followed by StashAway Simple, Versa Cash & Cash-i, and TNG GOinvest (monthly).

| StashAway Simple | Versa Cash & Cash-i | KDI Save | TNG GOinvest | |

| Interest Payout Frequency | Monthly | Monthly | Daily (W) | Monthly |

(B) Deposits & Withdrawals

All 4 apps do not charge any fees on deposits and withdrawals. In addition, all of them have a low barrier for deposits, of which I think the differences are negligible.

As such, an important discussion here would be how fast we can receive our money in our bank account during a withdrawal.

Of course, the earlier we can receive our funds, the better:

| StashAway Simple | Versa Cash | Versa Cash-i | KDI Save | TNG GOinvest | |

| Min. Deposit | No min. deposit | RM10 | RM10 | RM100 initial deposit (RM10 thereafter) | RM10 |

| Deposit Speed | 2-3 business days | 2-3 business days | 2-3 business days | 1-2 business days | 2 business days |

| Withdrawal fee & Speed | No. 3-4 business days | No. 1-2 business days | No. 0-1 business day | No. 1-2 business days | No. 2 business days |

| Min. Withdrawal Amount | No. | RM50 | RM50 | RM10 | RM10 |

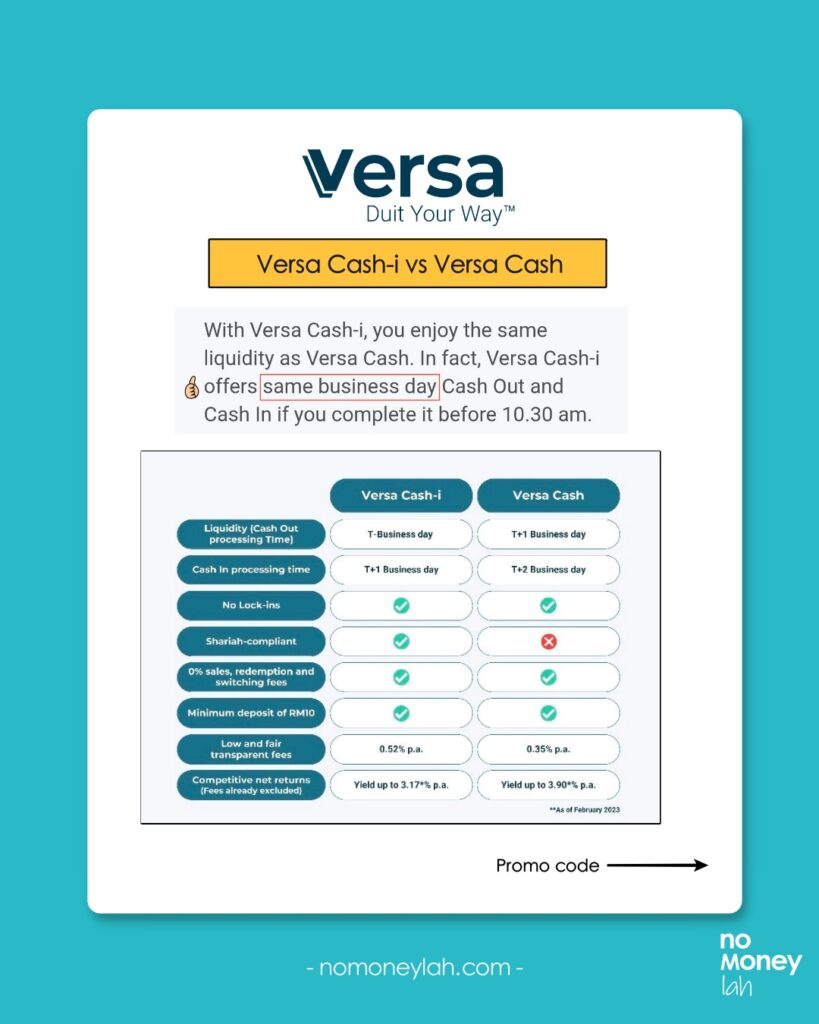

When it comes to speed, Versa Cash-i leads with same-day withdrawal if it is done before 10:30am.

Another less-talked-about comparison would be the minimum withdrawal amount. Versa has the highest minimum withdrawal amount of RM50, followed by KDI Save and GOinvest (RM10). Meanwhile, Simple does not have such restrictions in place.

In my opinion, there is no clear edge for either app in this comparison. That said, if you prefer that have access to your cash faster, Versa Cash-i is the way to go.

2d. User-Friendliness

I enjoy using well-designed apps. For me, I genuinely enjoy using Versa and StashAway Simple as their navigation is straightforward and works as intended.

In particular, for cash management & saving purposes, Versa nailed it in terms of simplicity as it is a pure cash management app.

2e. Others (Shariah-Compliance)

In this comparison, StashAway Simple, Versa Cash-i, and TNG GOinvest are shariah-compliant while KDI Save and Versa Cash do not come with such compliance.

Winner: Versa Cash-i

Versa Cash-i wins in its fast withdrawal speed, shariah-compliancy, and superior user experience.

Comparison Part 3: Special features/promo

- Limited-Time Promo: Get up to 4% on your savings (KDI Save)

For a limited time only, get 4% Effective Annual Rate (EAR) when you save with KDI Save!

Do note that the promotional rate of 4% EAR is tiered, as of below:

| Deposit amount | Rate |

| First RM50,000 | 4% EAR |

| > RM50k – 200k | 3.5% EAR |

| > RM200k | 3% EAR |

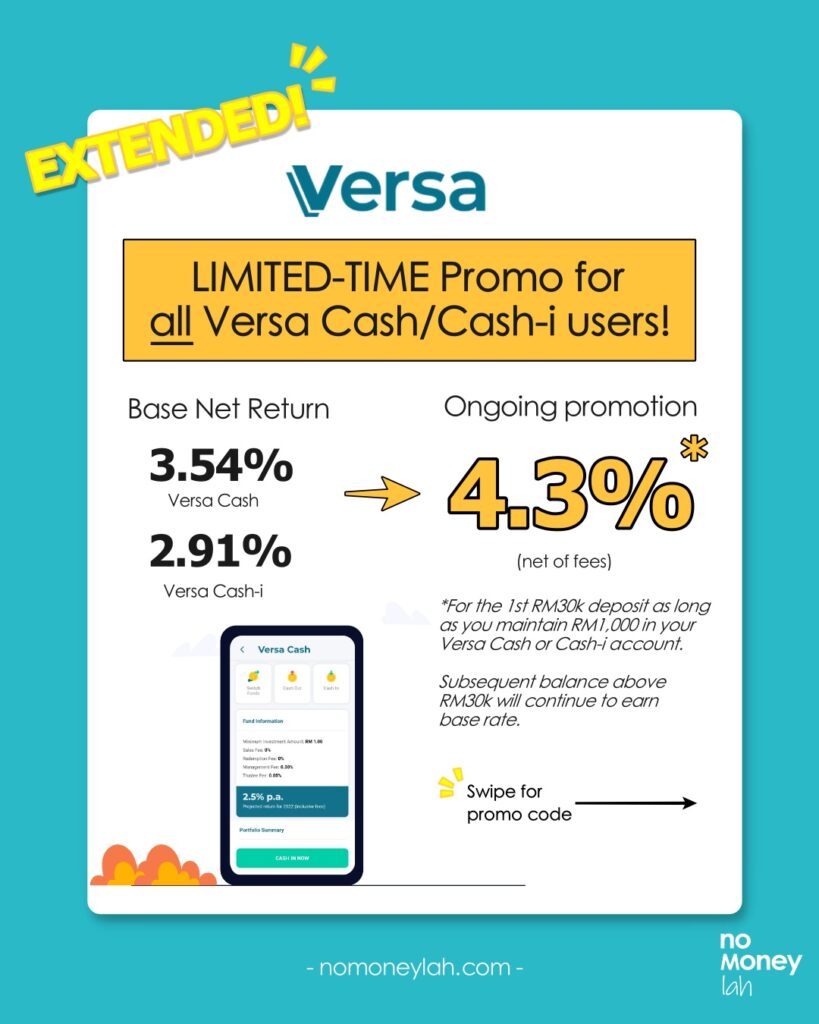

- Limited-Time Promo: Get up to 4.3% on your savings! (Versa Cash & Versa Cash-i)

Looking to get more out of your cash? For a limited time, all Versa users are eligible for a promotional rate of 4.3% on their cash!

How it works:

- Versa Cash and Cash-i’s 4.3% promotional rate is applicable to all new & existing Versa users.

- Maintain RM1,000 in your Versa Cash or Cash-i account, and the promotional rate is automatically applied to the first RM30,000 in your Versa Cash & Cash-i account. Any subsequent balance above RM30,000 will continue to earn Versa Cash’s base net return rate of 3.95% p.a., and Versa Cash-i’s base net return of 3.08% respectively.

- Promotional period: Ongoing until further notice

- Refer to the full T&C for more info.

I think this is GREAT news if you are looking for a higher rate for your savings! Remember, there is no lock-in period for Versa Cash and you are free to withdraw your funds anytime!

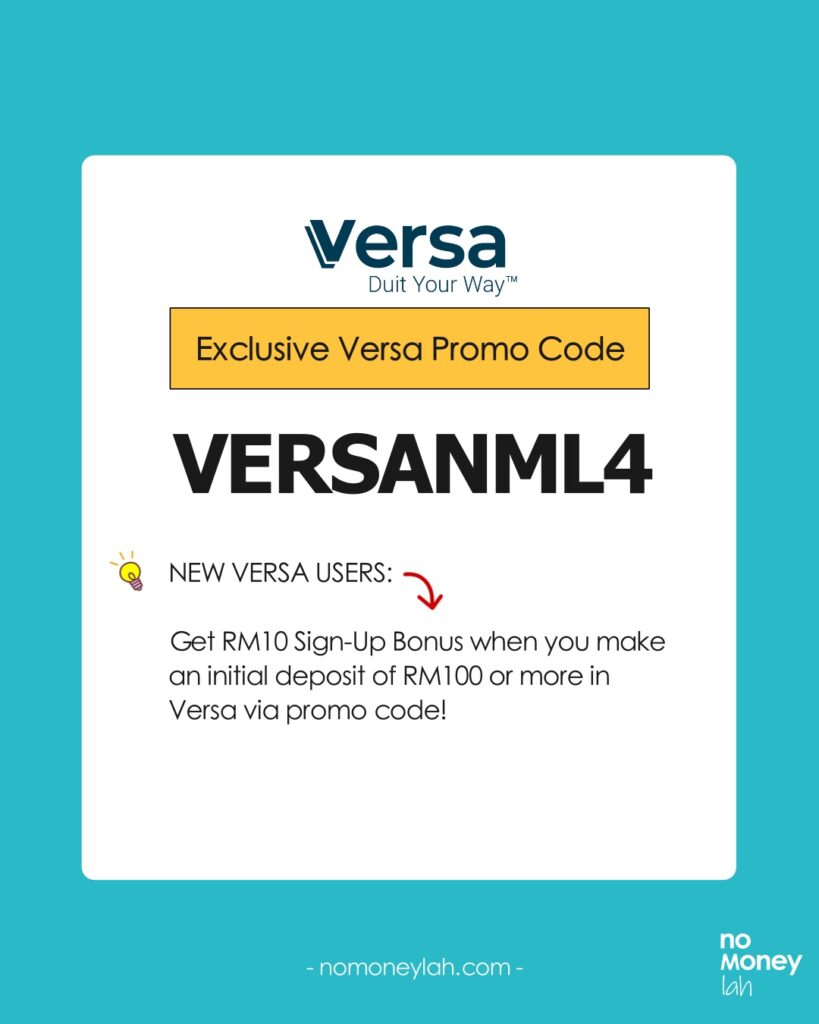

Use my dedicated Versa referral code – VERSANML4, and you will get RM10 credited into your account* when you successfully make a minimum deposit of RM100 or more. That’s an instant 10% return on your investment.

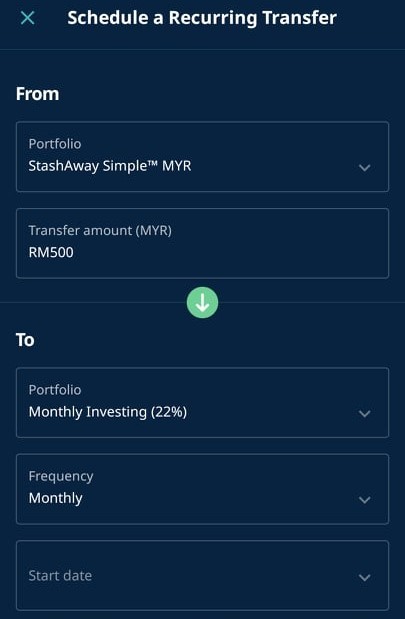

- Investment integration (StashAway)

One thing I love with StashAway is its seamless savings (StashAway Simple) and investment (StashAway) integration.

So, let’s say you have RM50,000 in cash and would like to invest them. However, you do not want to invest the whole RM50,000 at once and would like to spread it over time (dollar-cost average).

Through the StashAway app, you can place your funds in Simple (low-risk + earn stable interest), then automate a weekly or monthly transfer from Simple to your main StashAway investment portfolio.

I think this is a brilliant feature from StashAway, which is one of the reasons why it is my favorite go-to robo-advisor at the moment.

Verdict: Which FD alternative should you choose?

Personally, I’ve been using all Versa Cash & Cash-i, Simple, KDI Save, and GOinvest. All platforms are unique in their own way. Question is, which one should you use?

#1 Versa Cash & Versa Cash-i: For pure savings purposes

Versa as a pure cash management app offers a straightforward user experience. Its underlying low-risk money market fund is also a fantastic alternative to FD.

As a whole, if you are looking for a low-risk way to save your cash, I highly recommend Versa.

p

#2 KDI Save & StashAway Simple: For savings & investing

StashAway and KDI are robo-advisors that offer both cash management (Simple & KDI Save) and investment services (StashAway & KDI Invest).

Within both app, users can easily transfer money from their savings to investments, which is really convenient.

Furthermore, I think both KDI Save and StashAway Simple are equally capable alternatives to FD for savings purposes.

p

#4 StashAway Simple & Versa Cash-i : If you need shariah-compliancy

Muslim friends looking for alternatives to FD can consider StashAway Simple and Versa Cash- i as they are shariah-compliant.

EXCLUSIVE Promo codes/referral link (KDI Save, Versa Cash & Cash-i, StashAway)

If you find this post useful, do consider using my promo codes/referral links to open your account(s)!

This will greatly help me in sustaining my blog and keep on working on quality content like this one:

- KDI Referral Code: 101183

Use my dedicated KDI referral code – 101183, and you will get RM10 credited into your KDI Invest portfolio* when you successfully make a minimum deposit of RM250 on KDI Invest!

*Note: RM10 credit will be made within 60 days upon successful verification & deposit.

Open Your KDI Account HERE.

- Versa Referral Code: VERSANML4

In collaboration with Versa, No Money Lah is bringing an exclusive deal for new users that are keen to start saving or investing with Versa!

Use my dedicated Versa referral code – VERSANML4, and you will get RM10 credited into your account* when you successfully make a minimum deposit of RM100 or more. That’s an instant 10% return on your investment.

Open Your Versa Account HERE.

- StashAway Referral Link & Code: P-NOMONEYLAH-MY

No Money Lah is working with StashAway to bring new users an exclusive 50% off your fees for the first RM100,000 invested for 6 months.

To be eligible for this deal, sign up for your account through my StashAway referral link HERE (or apply code ‘P-NOMONEYLAH-MY‘). (or HERE if you are from Singapore)

Disclaimers:

Investment in a money market fund is not the same as placement in a deposit with a financial institution. There are risks involved and investors should consult a financial planner before making any investment decisions.

This post contains affiliate links/codes that afford No Money Lah a small amount of commission (and help support the blog) should you sign up through my affiliate link/code.

Related Posts

November 23, 2020

Simple vs Easy

April 20, 2023

StashAway Simple Review: The Fixed Deposit (FD) Killer?

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Hi there, first of all great write-ups and thorough comparisons about these locally famous MMF platforms, you literally nailed every single pros and cons and now thanks to you I’ve fully understood Versa!

Just wanna point out there was an update to the GO+ as it’s now shariah-compliant (for those who need it)

Btw I’m using your referral code to sign up for a Versa account after reading this, but an urgent question here: is the RM10 account sign-up promo still available?

Hi Tale!

Thanks for your kind words and glad that you like the article!

I have updated the shariah compliance part on Go+ as well!

Yes the RM10 sign up promo is still available!

Regards,

Yi Xuan

Woahh your response was damn prompt I’m instantly sold!!

Apps are so well-designed indeed. I wonder why there are only a few people knowing this platform at this point but, lucky for me to still be qualified as an early bird then xD

Keep writing, man, so I can milk some more good stuff from you next time!

Haha appreciate the support Tale!!

Regards,

Yi Xuan

Hi, wonder if any of these, other than TNG, could allow depositing via ewallet balance such as Boost and Grabpay?

Hi Moon,

Nope so far you can only deposit via a bank acc under your name.

Regards,

Yi Xuan

Thanks for the wonderful sharing. I have no idea about this apps until I found your page. Thanks for the comparison as it really gave me a good knowledge and understanding. Hats off to the admin!!!!!!!

Glad that you find this helpful Thanish!

Regards,

Yi Xuan

Yi Xuan,

You did the comparison on the “saving” of each platform. Do you mind share more about the pro & con of the “invest” part of each platform. Thanks.

Hi KH,

Thanks for the comment and yes I did cover the investment part of most of the platforms:

1. StashAway Review: https://nomoneylah.com/2021/09/27/stashaway-review/

2. Versa Invest Review: https://nomoneylah.com/2022/05/30/versa-invest-review/

3. KDI Invest Review (coming soon either this or next week!)