Last Updated on March 7, 2024 by Chin Yi Xuan

Gold is one of the most precious commodities in the world.

Not only gold is rare, but it is also very durable. It doesn’t rust, it doesn’t tarnish, and you can bury your gold and come back in 50 years (or 5,000 years) and it would still be unchanged.

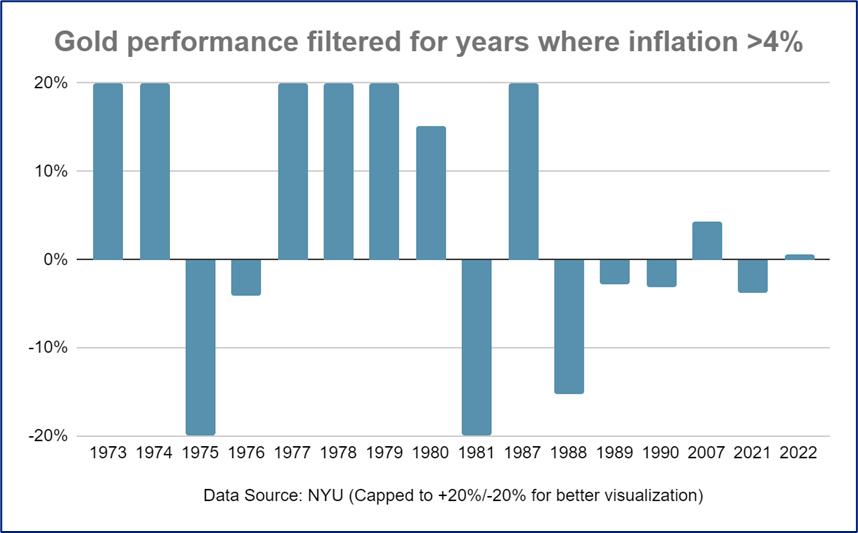

However, in my previous post, I used past data to prove that gold is not an ideal hedge against inflation, nor it is a stable investment:

That said, gold is an excellent insurance within an investment portfolio when major asset classes like stocks and bonds are tumbling. In other words, gold tends to hold up well when the market gets tough – just look at 2022:

In this post, I want to answer an important question:

If inflation has minimal impact on gold’s performance, what actually moves gold price?

If you are looking to invest in gold, this will give you a solid insight into why gold price behaves the way it does!

RELATED POST: Part 1 – Why you need to buy gold (not inflation)

Table of Contents

2 underrated indicators that drive gold price

The market is a complex place and there are many reasons that drive the price of gold.

In this post, I want to break down 2 less-talked-about (yet crucial) indicators that move the price of this precious metal:

#1 The health of the banking sector

Banks are an important part of the economy, as they create capital (eg. loans) and provide liquidity to the market.

Therefore, a healthy banking sector indicates a healthy economy.

In this case, the banking sector has an inverse correlation with gold prices. This is because investors tend to flock to gold when there is a negative perception towards the economy.

Check out how gold price has a tendency to move in the opposite direction against the banking sector:

Whenever the banking sector suffers, it has had a positive impact on gold prices as investors are prepared for economic weaknesses.

The health of the banking sector is, therefore, a leading indicator of gold prices.

Try this on your own:

Using my preferred charting platform TradingView:

- Firstly, search for the ticker for gold ‘GLD’.

- Next, click the ‘+’ symbol, and search for the ticker ‘BANK’ which represents the banking sector in the US.

- Right-click the price axis and change it from ‘Regular’ to ‘Percent’.

RELATED POST: TradingView beginner’s guide – my favourite charting platform!

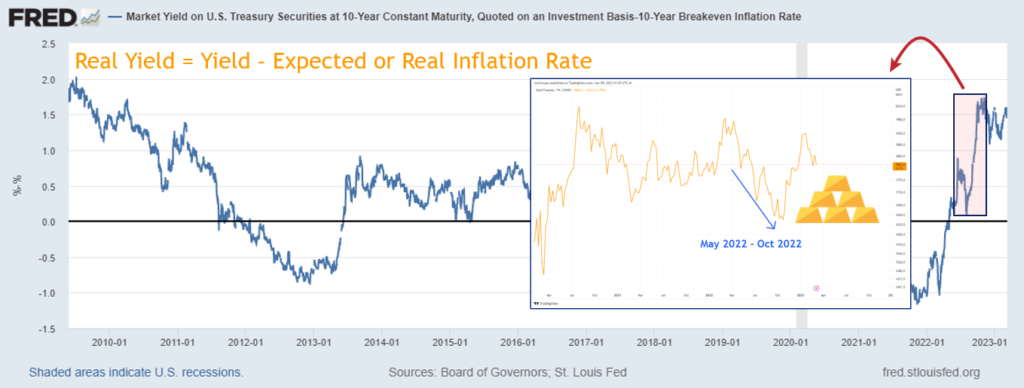

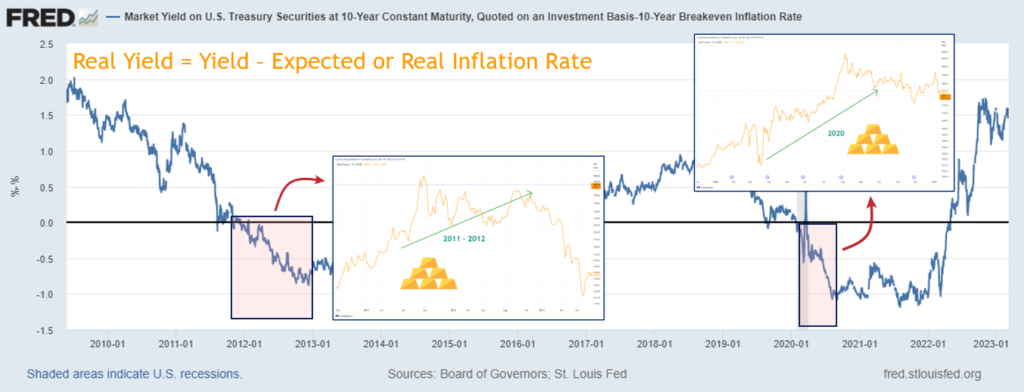

#2 Real Yield

Real yield refers to the interest that government bonds pay to investors, minus the expected/actual inflation rate:

Real Yield = Interest from government bonds – Expected or Actual Inflation Rate

A positive real yield means the interest from bonds beats inflation. A negative real yield implies that the interest from bonds is not able to cover inflation.

In this case, real yield tends to have an inverse relationship to gold.

Why so?

- Because when real yield is rising, there is an opportunity cost to investing in anything other than interest-paying assets like bonds.

- Since gold DOES NOT pay interest, that makes the opportunity cost of holding gold much higher, thus suppressing the price of gold.

- Meanwhile, when real yield is dropping, the returns from bonds become less attractive.

- As such, investors will be inclined to take more risks by investing in assets that do not pay interest, such as gold. This will usually push the price of gold in a positive direction.

Try this on your own:

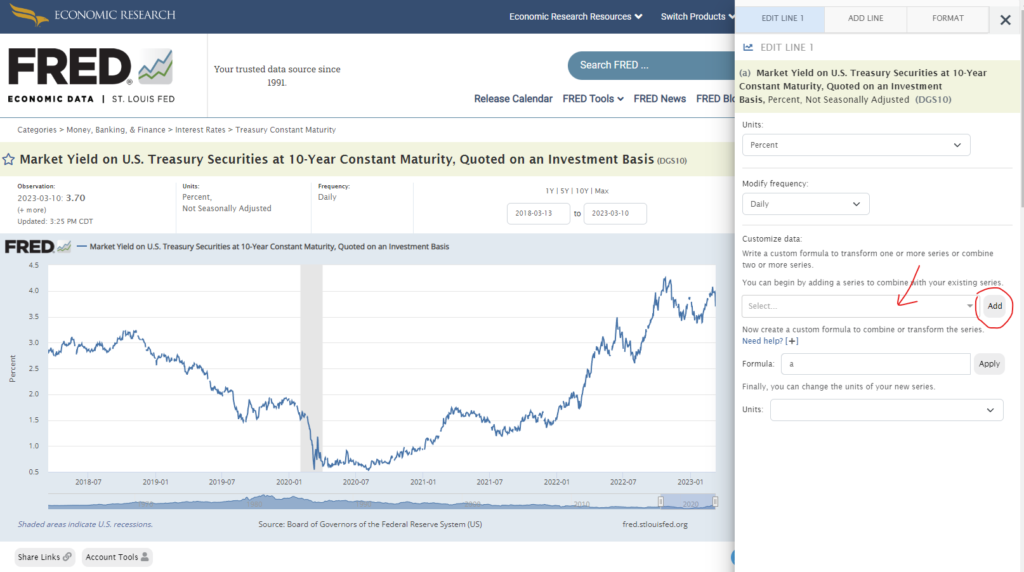

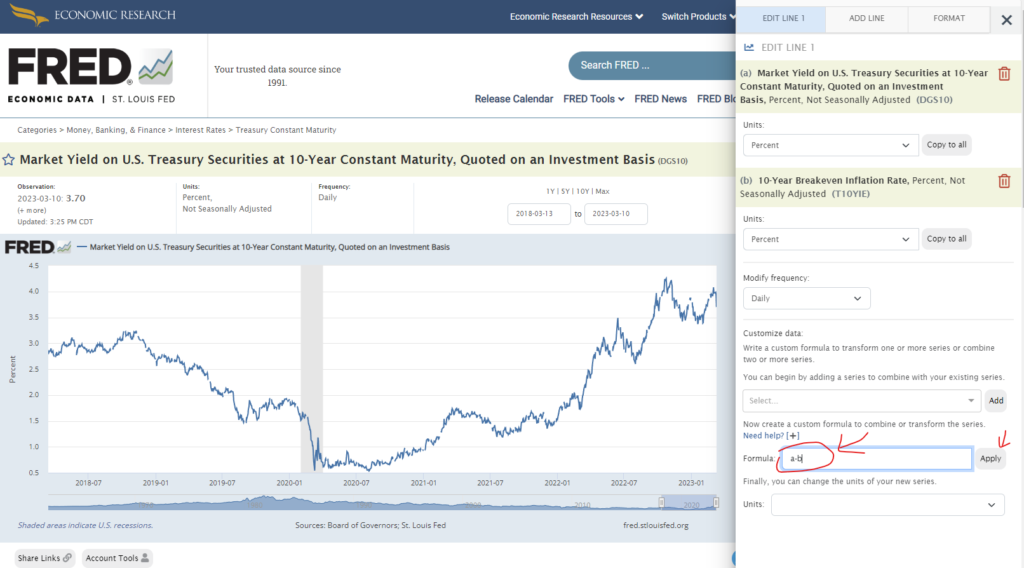

- To start, click HERE to access data for the 10-year US treasury yield graph.

- Select ‘Edit Graph’

- Under ‘Customize Data’, select ’10-Year Breakeven Inflation Rate’, then click ‘Add’.

- Under ‘Formula’, type ‘a-b’. Then, click ‘Apply’. You will get the graph I used in this post.

3 recommended ways to invest in gold

Below, let me recommend 3 ways to invest in gold without having to store physical gold:

Method 1: Invest in local gold ETF via Rakuten Trade

The TradePlus Shariah Gold Tracker (code: 0828EA) is a Malaysia-listed Exchange-Traded Fund (ETF) that tracks gold price.

This gold ETF is shariah-compliant and is backed by physical gold bars, ensuring that it tracks the price of gold with precision.

At a low annual fee of 0.56% (trustee, management, custody fees), it is one of the most convenient ways for Malaysians to invest in gold without having to store physical gold!

You can start investing in the TradePlus Shariah Gold Tracker (code: 0828EA) via Rakuten Trade.

RELATED: Rakuten Trade long-term review

—

p.s. You can also invest in US gold ETF (Method 2) via Rakuten Trade as they also offer access to the US stock market!

—

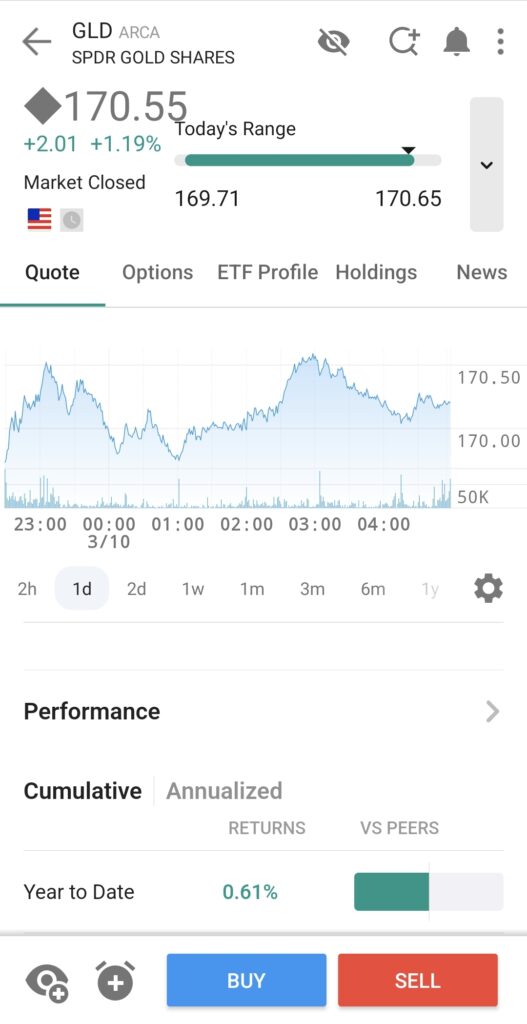

Method 2: Invest in US gold ETF via Interactive Brokers (IBKR)

You can also invest in gold ETF that is listed in the US, such as the SPDR Gold Shares ETF (ticker: GLD).

GLD is also backed by physical gold so it can reflect the gold price in the closest precision.

Compared to Malaysia-listed gold ETF, GLD is quoted in USD and has a lower annual estimated fee of 0.4%.

If you prefer to have your gold investments in USD, GLD is the way to go.

You can invest in GLD via Interactive Brokers, my preferred platform to buy global stocks:

READ MORE: Interactive Brokers Long-Term Review

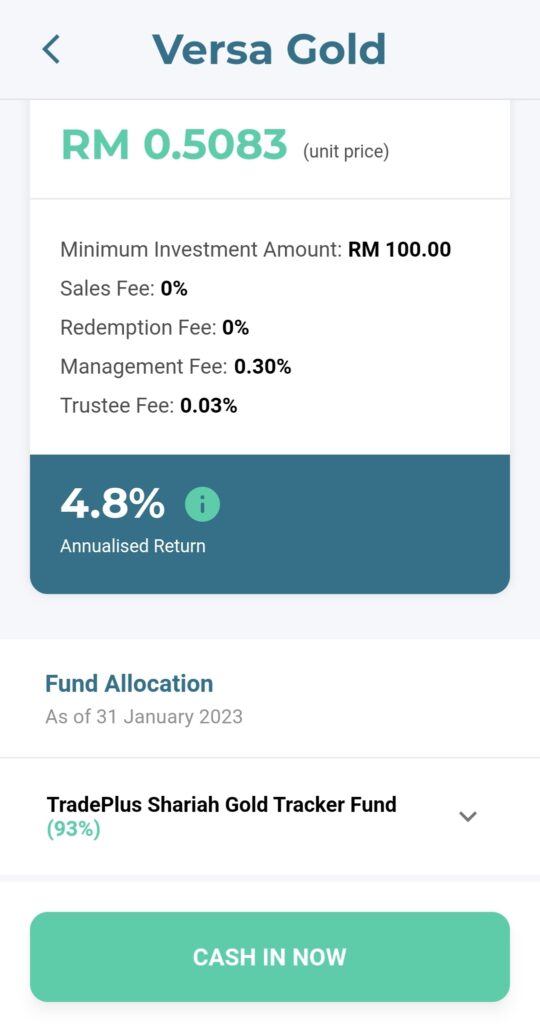

Method 3: Invest in gold ETF via Versa Gold

If opening a stock brokerage account overwhelms you, and you want a simple-to-use platform to buy gold, you can consider checking out Versa Gold from Versa.

With Versa Gold, you are essentially investing in TradePlus Shariah Gold Tracker from Method 1 above, but at a much simpler to use Versa app.

In addition, Versa Gold requires a low minimum investment amount of RM100, which is very beginner-friendly if you want to try investing in gold.

No Money Lah Verdict + Takeaways

I hope this post is helpful in showing you what kind of fundamental indication tends to move gold price!

Having this knowledge can help you understand why gold moves and responds the way it does – and it is highly insightful as an investor.

So, would you consider investing in gold? Why or why not?

Feel free to share with me your thoughts in the comment section below!

Disclaimers

Any of the information above is produced with my own best effort and research.

This post is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

This post may contain promo code(s) that afford No Money Lah a small amount of commission (and help support the blog) should you sign up through my referral link.

Promotional Relationship Disclosure:

This content is provided by a paid Influencer of Interactive Brokers. Influencer is not employed by, partnered with, or otherwise affiliated with Interactive Brokers in any additional fashion. This content represents the opinions of Influencer, which are not necessarily shared by Interactive Brokers. The experiences of the Influencer may not be representative of other customers, and nothing within this content is a guarantee of future performance or success.

None of the information contained herein constitutes a recommendation, promotion, offer, or solicitation of an offer by Interactive Brokers to buy, sell or hold any security, financial product or instrument or to engage in any specific investment strategy. Investment involves risks. Investors should obtain their own independent financial advice and understand the risks associated with investment products and services before making investment decisions. Risk disclosure statements can be found on the Interactive Brokers website.

Interactive Brokers is a FINRA registered broker and SIPC member, as well as a National Futures Association registered Futures Commission Merchant. Interactive Brokers provides execution and clearing services to its customers. For more information regarding Interactive Brokers or any Interactive Brokers products or services referred to in this video, please visit www.interactivebrokers.com.

Related Posts

January 13, 2022

Malaysian’s Guide to Invest in ETF

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.