Last Updated on March 16, 2024 by Chin Yi Xuan

Interactive Brokers (IBKR) is one of the most complete global brokers that I’ve used in my investing journey.

It offers users access to over 150 markets in 33 countries at a highly competitive commission. Moreover, IBKR users gain access to a huge variety of products/instruments such as stocks, bonds, ETFs, FX, futures.

As an IBKR user, I find Wise and Instarem to be 2 of the best methods to deposit funds to my IBKR account.

However, which one should you choose?

In this post, let me compare Wise and Instarem deposit methods, and see which is a more ideal IBKR deposit method!

RELATED:

—

p.s. A word to fellow readers:

Dear friends, if you find this post helpful, I’d appreciate it if you can click on the button below to learn about IBKR via IBKR’s official site.

Doing so will help the earn the blog a small fee at no extra cost to you.

This will help supporting the blog in creating more useful content – thanks in advance my friends!

Table of Contents

#1 Fees & Exchange Rate Comparison

Firstly, let’s compare the fees and exchange rate if we were to use Wise and Instarem to fund our IBKR account.

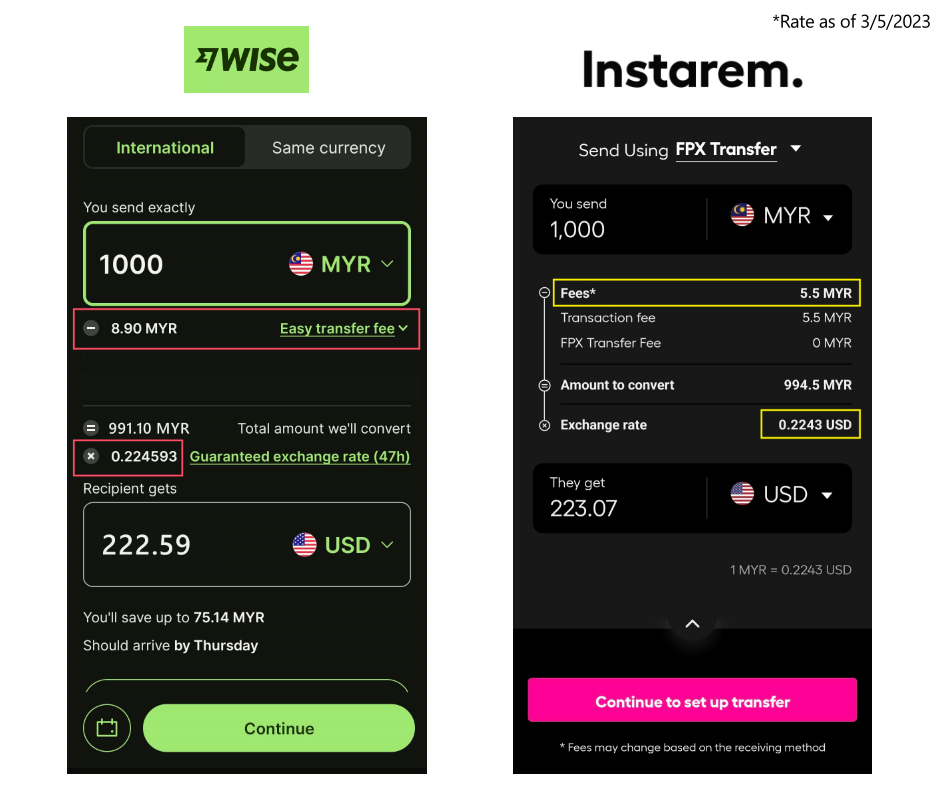

Scenario #1: RM1,000 MYR-USD transfer

For this, I take similar RM1,000 MYR-USD transfers and see how much we have to pay in fees, as well as the exchange rate for both platforms:

Putting the info side-by-side, we can see that:

| Wise | Instarem | |

| Fee for RM1,000 MYR-USD transfer | RM8.90 | RM5.50 |

| Exchange Rate (as of 3/5/2023) | 0.224593 | 0.2243 |

| Final amount in USD | USD 222.59 | USD 223.07 |

- Instarem offers a cheaper fee of RM5.50 for my RM1,000 MYR-USD transfer.

- Wise offers a more competitive exchange rate of 0.224593 compared to 0.2243 from Instarem. (Rate as of 3/5/2023)

- That said, taking into account of fee + exchange rate, I’d still get slightly more USD from Instarem for my transfer.

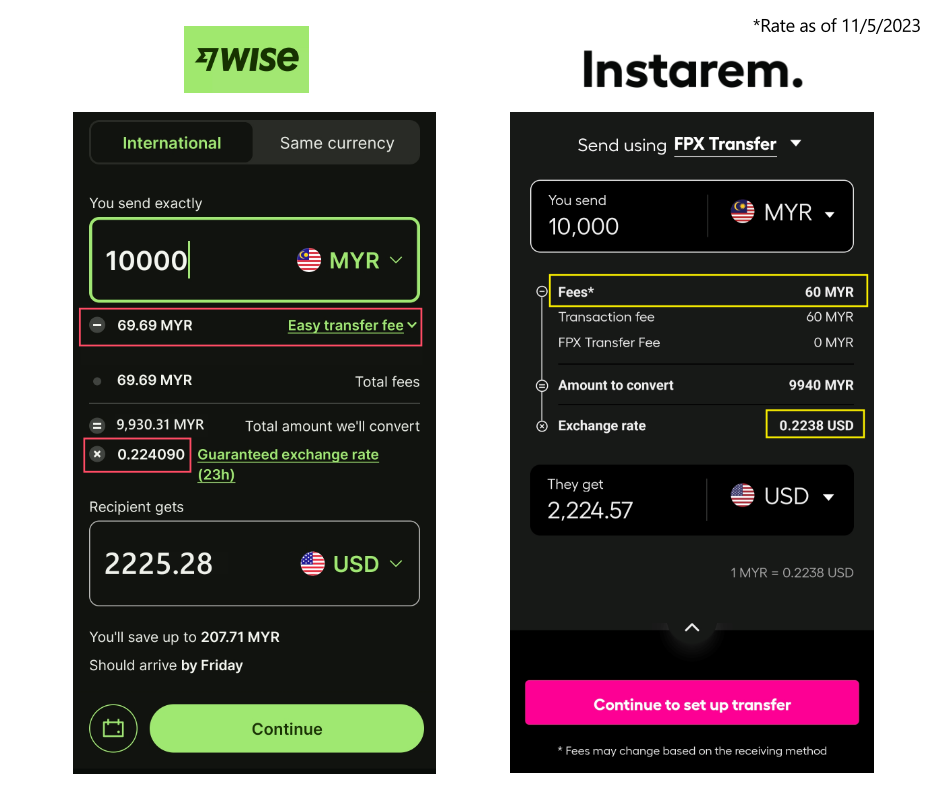

Scenario #2: RM10,000 MYR-USD transfer

Let’s see if a larger transfer amount of RM10,000 MYR-USD transfer would make any difference:

Does a larger transfer amount make any difference for the fees?

Putting the info side-by-side, we can see that:

| Wise | Instarem | |

| Fee for RM10,000 MYR-USD transfer | RM69.69 | RM60 |

| Exchange Rate (as of 11/5/2023) | 0.224090 | 0.2238 |

| Final amount in USD | USD 2225.28 | USD 2224.57 |

- Instarem still offers a cheaper fee of RM60 for my RM10,000 MYR-USD transfer.

- Wise still offers a more competitive exchange rate of 0.224090 compared to 0.2238 from Instarem. (Rate as of 11/5/2023)

- However, this time around, Wise is able to transfer slightly more USD in my RM10,000 MYR-USD transfer.

Summary: Use Instarem for smaller amount transfer, Wise for larger amount transfer

In essence, when you make a transfer in a small amount, Instarem’s lower fee structure makes it up to a slightly high exchange rate.

On the other hand, in a bigger transfer, Wise’s lower exchange rate is a better deal despite a higher fee.

#2 Deposit Process Comparison

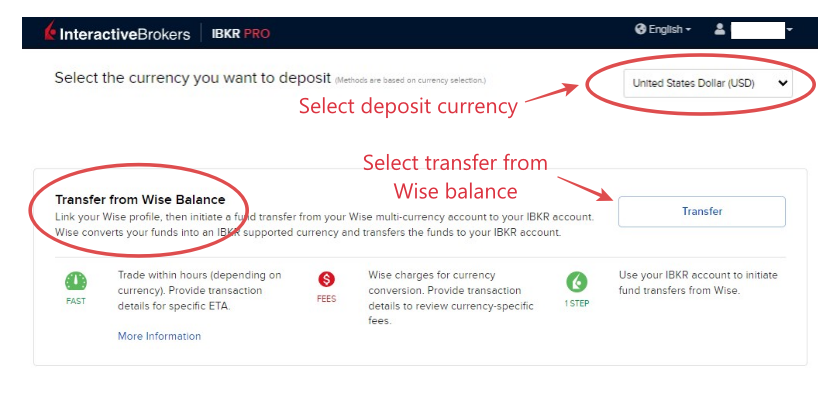

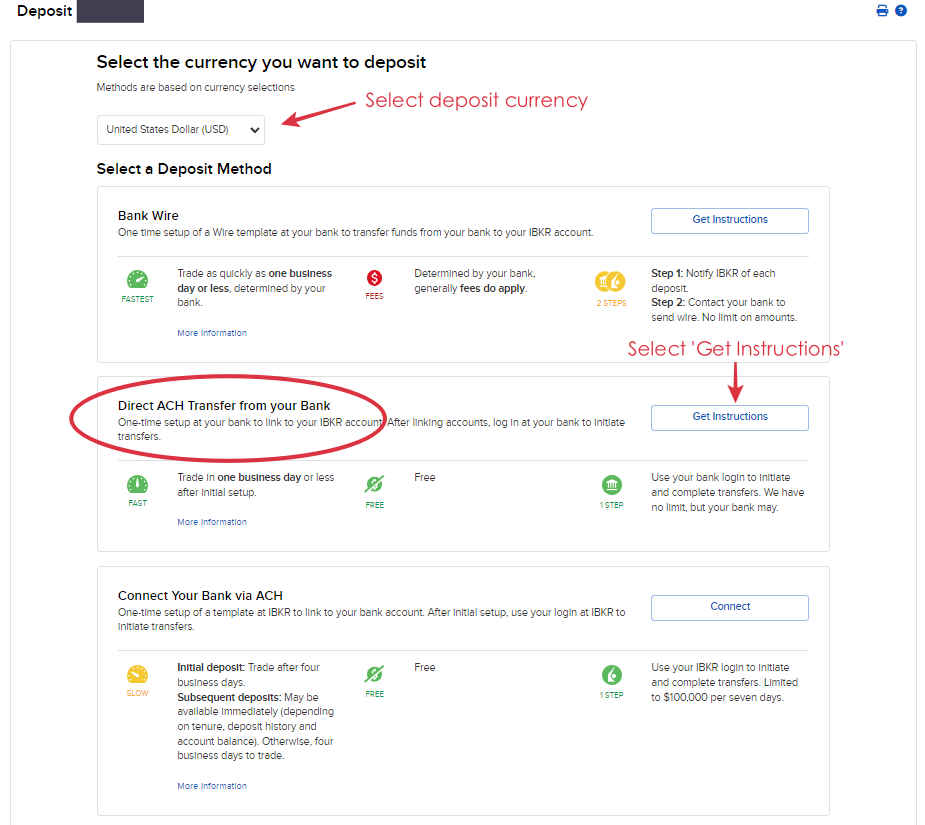

There is a slight difference between Wise and Instarem when it comes to the deposit process to IBKR:

| Wise | Instarem | |

| Deposit Process | Transfer directly from Wise balance (easier) | ACH funding via Instarem |

Essentially, the biggest difference is when it comes to setting up the initial transfer.

- It is easier to set up a Wise transfer as IBKR users can make a transfer directly from their Wise account. Read about my full Wise-IBKR transfer guide HERE.

- As for Instarem, IBKR users will need to key in some additional details in order to set up an initial transfer. (though it is pretty simple as well) Read about my full Instarem-IBKR transfer guide HERE.

Summary: Wise provides an easier initial setup

Once the setup is done, all future transfers are very simple for both methods.

RELATED: Guide – How to fund your IBKR using Wise, Instarem, and SG bank account

#3 Deposit Speed Comparison

Fees aside, it is also important that my funds reach my IBKR account ASAP whenever I make my deposit.

So, how long does it take for my funds to reach my IBKR account with Wise and Instarem?

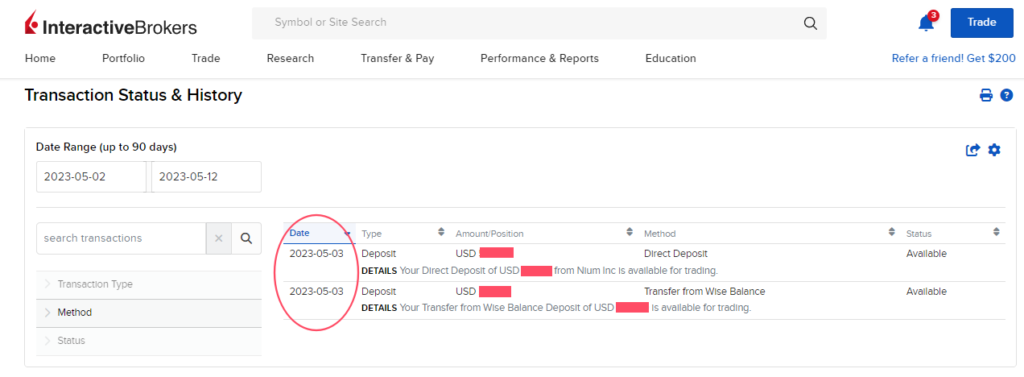

For this example, I did a transfer on both Wise and Instarem on the same day (3/5/2023), first with Wise, then Instarem a few hours later.

Let’s look at the result:

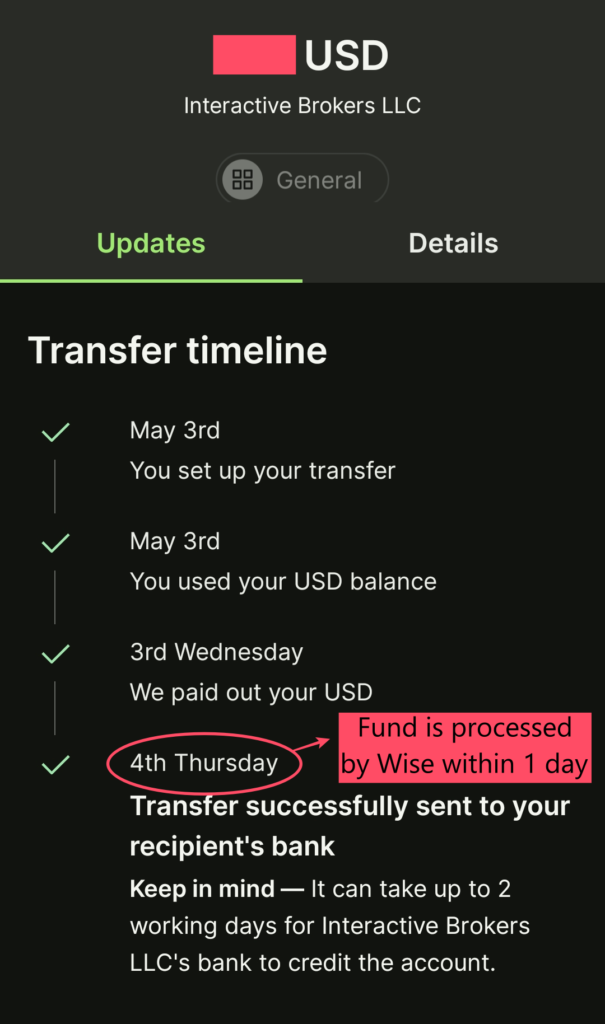

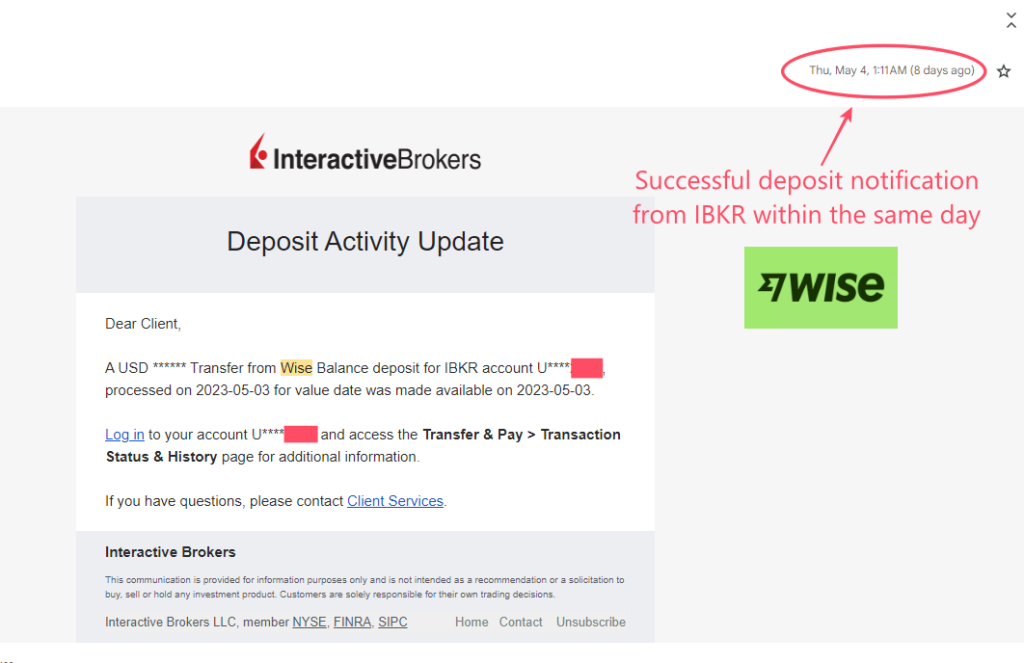

(i) Wise-IBKR transfer: About 13 hours (<1 day)

I initiated my Wise transfer on 3/5/2023 after lunch and I receive my successful deposit notification from IBKR at 1:11am the next day (4/5/2023).

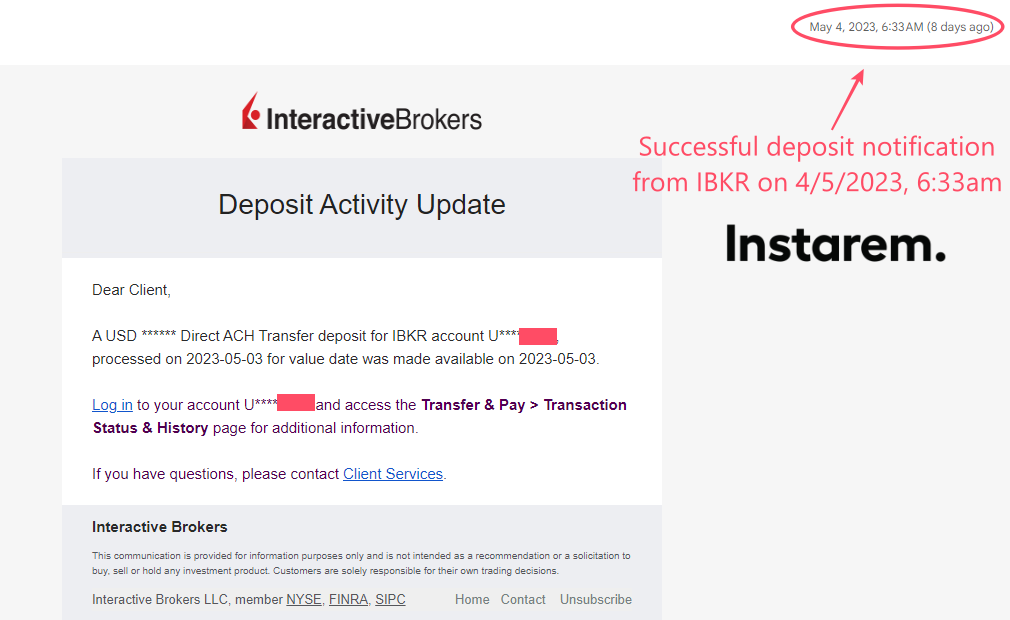

(ii) Instarem-IBKR transfer: About 14 hours (<1 day)

Meanwhile, I initiated my Instarem-IBKR transfer at late noon (4:38pm) on 3/5/2023. I received my successful deposit notification from IBKR at 6:33am the next day (4/5/2023).

Summary: Deposit speed is pretty much the same for Wise and Instarem

In essence, from my experience, there is no significant difference between the deposit speed of Wise and Instarem transfers.

I find both transfer experiences smooth and reliable.

Promotions for new Wise & Instarem users

(i) Wise: Get a free transfer on your first 500 GBP (~RM2600) transfer!

Use my Wise referral link below and get a free transfer on your first 500 GBP (~RM2600) transfer!

(ii) Instarem: Get 200 InstaPoints (worth RM12) for your money transfer!

Open an Instarem account via my referral link by clicking on the button below, and get 200 InstaPoints (worth RM12) which can be redeemed for your money transfer (no min. transaction amount required)!

Verdict: Use Wise and Instarem to save on your IBKR deposit fee!

To summarize, for small amount transfers, Instarem-IBKR makes up for better value thanks to its lower fee structure. For bigger amount transfers, Wise-IBKR is better thanks to Wise’s more competitive exchange rates.

Be it Wise or Instarem, both IBKR deposit methods allow users to save massively on fees & exchange rates compared to traditional foreign bank telegraphic transfer.

For new users of Wise and Instarem, I recommend taking advantage of the promotions so you can get more value out of your IBKR transfers!

Do you have any other tips on how to fund your IBKR account? Feel free to leave your tips and thoughts in the comment section below!

Disclaimer:

This review is purely based on my personal experience and is updated as of the time of writing.

This article may contain affiliate links that will earn the blog a small fee if you click on them. This comes at no extra cost to you as a reader.

Promotional Relationship Disclosure:

This content is provided by a paid Influencer of Interactive Brokers. Influencer is not employed by, partnered with, or otherwise affiliated with Interactive Brokers in any additional fashion. This content represents the opinions of Influencer, which are not necessarily shared by Interactive Brokers. The experiences of the Influencer may not be representative of other customers, and nothing within this content is a guarantee of future performance or success.

None of the information contained herein constitutes a recommendation, promotion, offer, or solicitation of an offer by Interactive Brokers to buy, sell or hold any security, financial product or instrument or to engage in any specific investment strategy. Investment involves risks. Investors should obtain their own independent financial advice and understand the risks associated with investment products and services before making investment decisions. Risk disclosure statements can be found on the Interactive Brokers website.

Interactive Brokers is a FINRA registered broker and SIPC member, as well as a National Futures Association registered Futures Commission Merchant. Interactive Brokers provides execution and clearing services to its customers. For more information regarding Interactive Brokers or any Interactive Brokers products or services referred to in this video, please visit www.interactivebrokers.com.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Hi Yi Xuan, great article as usual! Have you tried withdrawing money from IBKR and is Wise the best method to withdraw money from this broker?

Hi Devan,

Per my experience, Wise is the most seamless way to withdraw money from IBKR.

Regards,

Yi Xuan